Manu Milan

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Manu Milan

Why Did RBOB Gasoline Outperform Heating Oil?

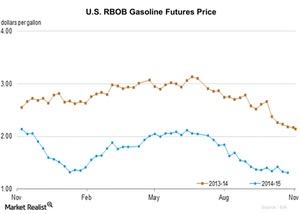

The EIA reported RBOB gasoline futures contract 1 prices at $1.30 per gallon on November 23, representing a fall of ~1.8% from $1.32 per gallon on October 16.

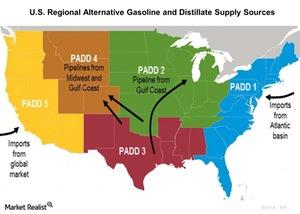

Why Are Gasoline Prices So High in the West Coast Region?

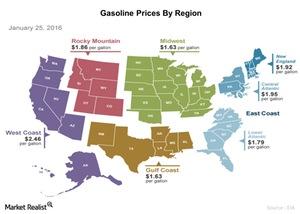

Gasoline prices in the West Coast region were at $2.45 per gallon on January 25, 2016—around $0.60 per gallon higher than the average US gasoline prices.

US Households Prefer Electricity and Natural Gas for Home Heating

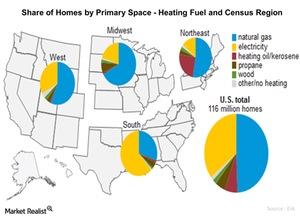

Natural gas is used as heating fuel in 48% of the homes across the country, electricity is used for heat in 38% of homes, and the rest of the fuels are used for heat in the remaining 14% of homes.

Crude Oil Demand Expected to Grow from Road Transportation

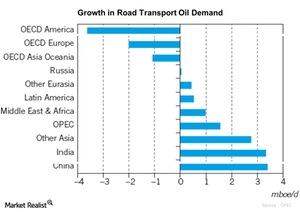

OPEC has estimated that the road transportation sector will account for one-third of the global crude oil demand growth between 2014 and 2040.

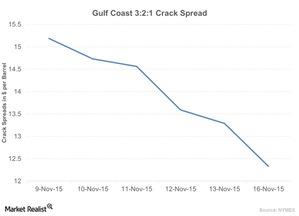

Crack Spread Narrowed: Is There Less Demand for Crude Oil?

The benchmark US Gulf Coast 3:2:1 crack spread fell ~12.50% last week. It hit ~$13.28 per barrel on Friday, November 13, 2015.

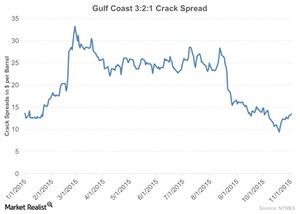

Wider Crack Spread: Its Impact on Refiners

The recent rise in the crack spread is driven by factors like low crude oil prices, a rise in demand for gasoline, and a sharp rise in demand for propane.

Can Outages Be Overcome by Alternate Sources of Gasoline Supply?

According to the EIA, since the Torrance outage, imported supplies of gasoline have been arriving in Southern California from all over the world.