Exxon Mobil Corporation

Latest Exxon Mobil Corporation News and Updates

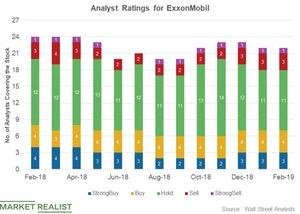

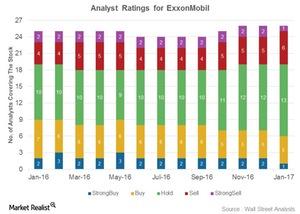

ExxonMobil: Analysts’ Recommendations

In the fourth quarter, ExxonMobil’s earnings rose and beat the estimates. ExxonMobil continued to take advantage of its integrated business model.

Chevron: Analysts Expect Higher Q3 Earnings

Chevron (CVX) is expected to post its third-quarter results on November 2. Chevron is expected to post an EPS of $2.1 in the third quarter.

Integrated Energy Stocks: The Top Eight Dividend Yielders

In this series, we’ll look at eight integrated energy stocks and rank them on dividend yields. Royal Dutch Shell (RDS.A) holds the top spot.

ExxonMobil’s Potential in Downstream and Chemicals

ExxonMobil expects its downstream earnings to double by 2025 over 2017.

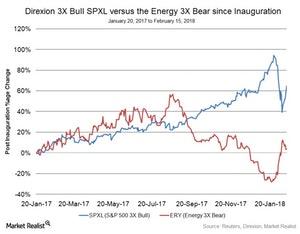

Could Energy Continue Its Wild Ride in 2018?

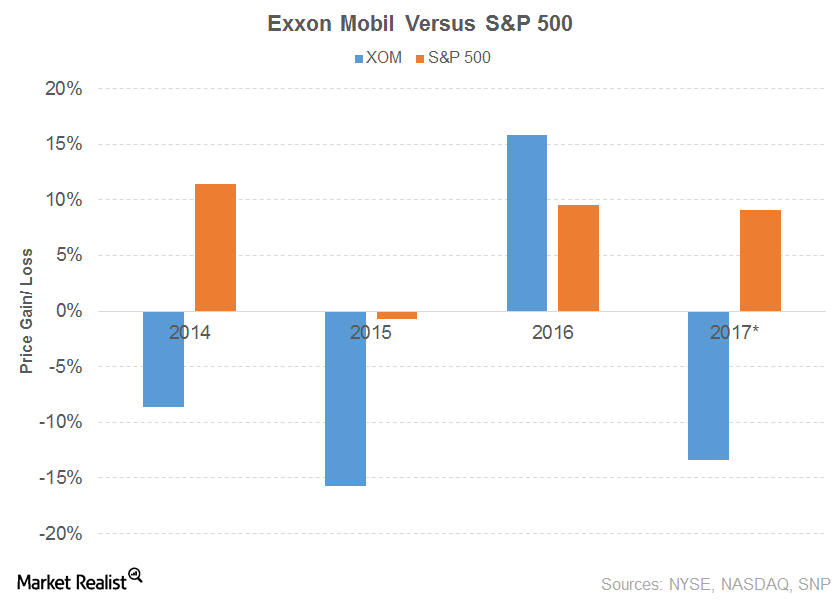

From the presidential election in November 2016 through August 2017, the energy sector saw its worst time.

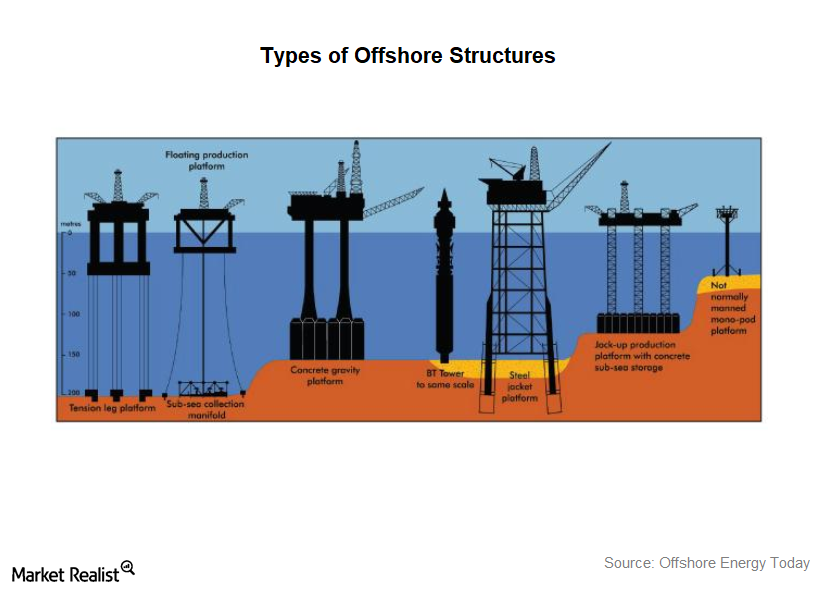

A Look at KBR’s Subsidiaries

Primary subsidiaries Previously, we discussed various acquisitions completed by KBR (KBR). Let’s now take a look at some of KBR’s subsidiaries and how they fit into the big picture for the company. Energy and construction Granherne, a KBR technology and engineering subsidiary, operates in the oil and gas industry. Granherne provides front-end engineering and design services […]

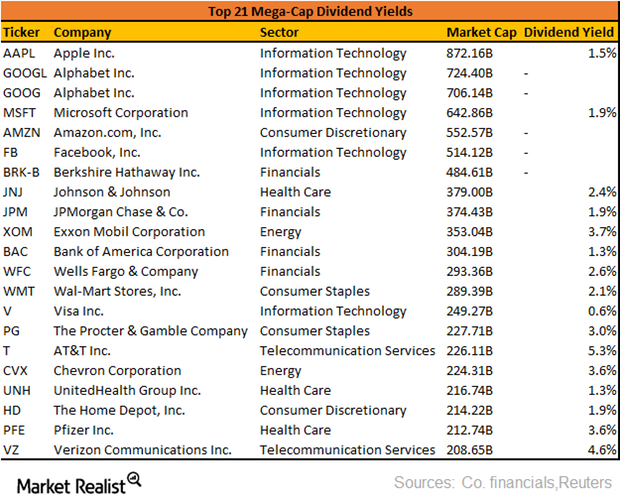

What Are the Dividend Yields of the Top 10 Mega-Cap Stocks?

Donald Trump’s promises of financial deregulation, infrastructure spending, and tax cuts played a major role in the stock market rally this year.

How Tropical Storm Harvey Impacts US Crude Oil and Gasoline Prices

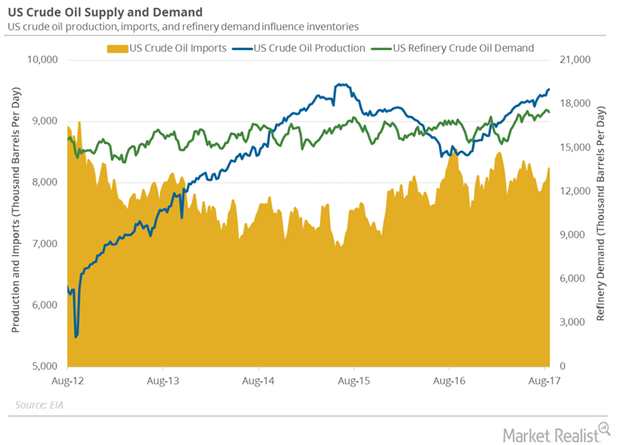

WTI (West Texas Intermediate) crude oil (SCO)(BNO)(PXI) futures contracts for October delivery rose 0.4% and were trading at $46.8 per barrel in electronic trading at 2:05 AM EST on August 29.

ExxonMobil’s Journey as a Dividend Aristocrat

ExxonMobil’s (XOM) story is similar to Chevron’s. The company’s sales and other operating revenue for 2016 fell 16.0%.

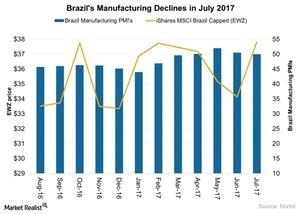

Why Manufacturing Activity in Brazil Is on a Decline

Manufacturing activity in Brazil In July 2017, the manufacturing PMI (purchasing managers’ index) in Brazil (BRZU) continued to decline, falling to 50 from 50.5 in June 2017. July 2017 brought a slowdown in both output and new business. US companies doing business in Brazil include Walmart (WMT), ExxonMobil (XOM), Chevron (CVX), and Apple (AAPL). Brazil (EWZ) […]

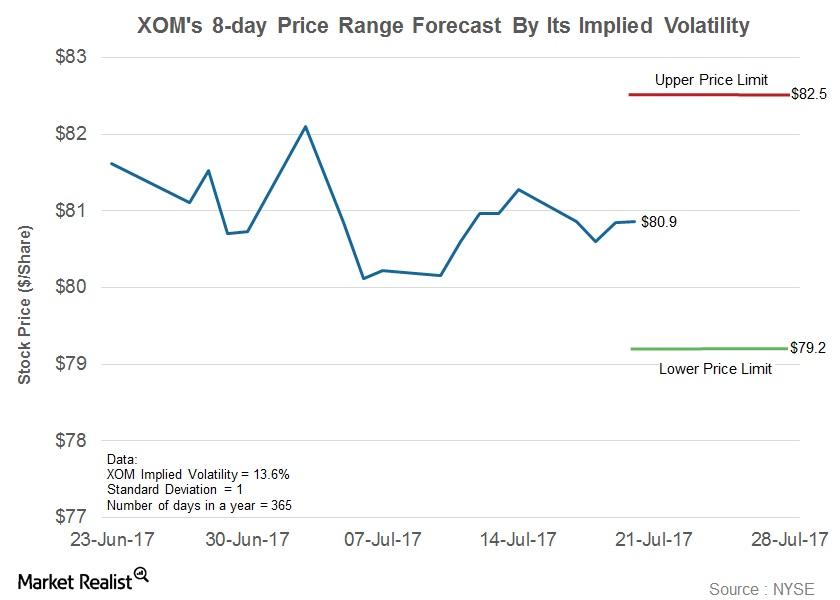

What’s the Forecast for ExxonMobil’s Stock Price?

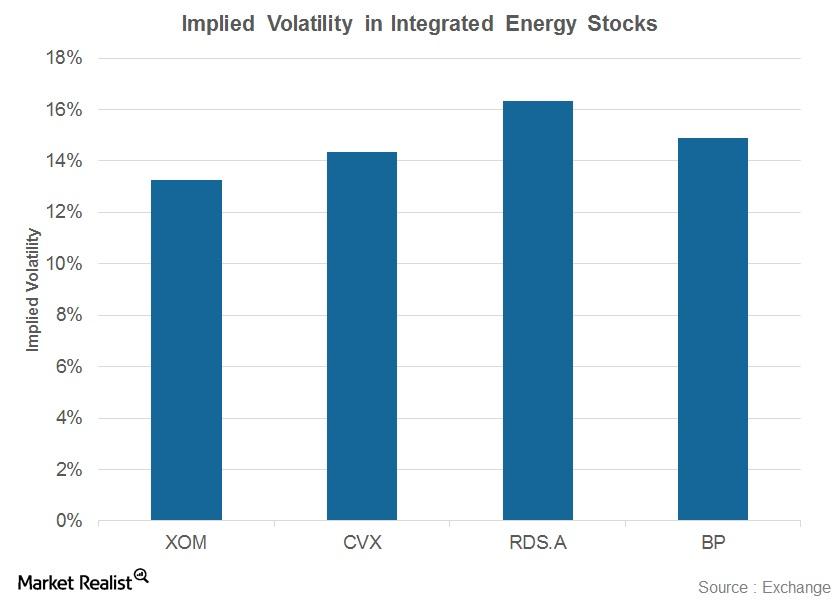

Implied volatility in ExxonMobil has fallen from 14.9% on April 3, 2017, to 13.6% to date.

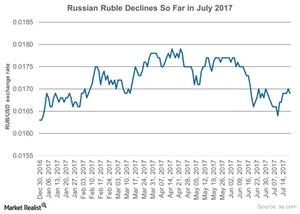

How Has the Ruble Performed in July 2017?

The Russian ruble (ERUS) tends to move in line with crude oil prices (USO) (UCO).

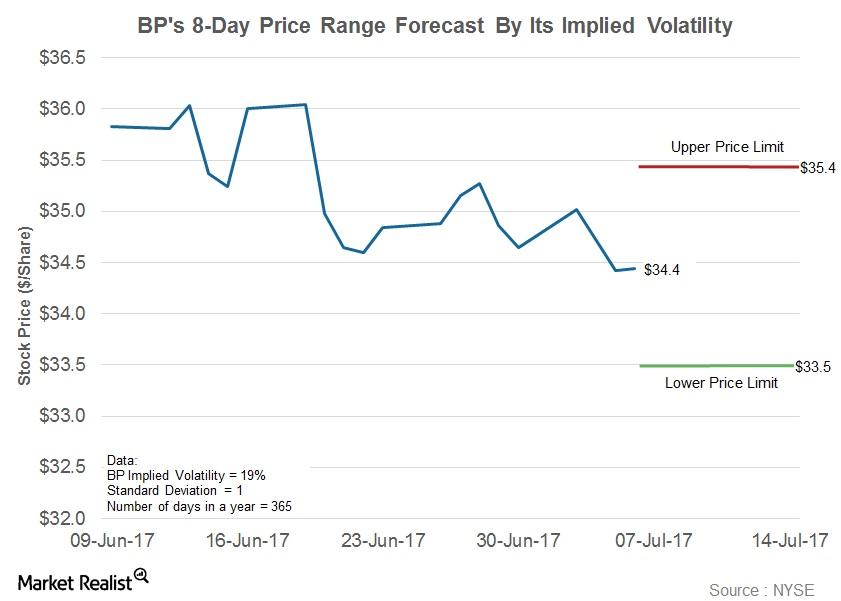

Estimating BP’s Stock Price Using Implied Volatility

What is implied volatility? Volatility gauges changes in a stock’s return over a period. When estimated based on historical stock prices, it is called historical volatility. We can estimate the future volatility, or implied volatility, of security using an option pricing model. A high implied volatility would indicate that a stock price is expected to move […]

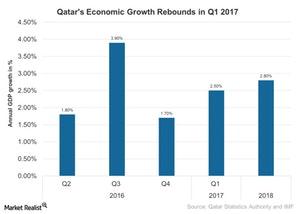

Understanding Qatar’s Resilience amid Sanctions

Qatar’s (QAT) economy continued to grow in 1Q17 amid improved oil prices since 2Q16. But more recently, oil prices have hit a downtrend.

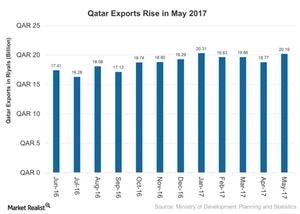

Qatar’s Exports Could Rise despite the Crisis in 2017

Qatar’s exports stood at 20.2 billion riyals in May 2017—an increase of 8% compared to a fall of 5% in the previous month.

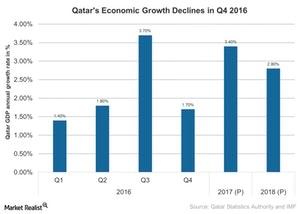

Will Qatar’s Economic Growth Continue to Fall amid the Crisis?

Qatar was expected to grow at a faster pace in 2017. However, economic sanctions by its neighbors are expected to impact its economic activity in 2017.

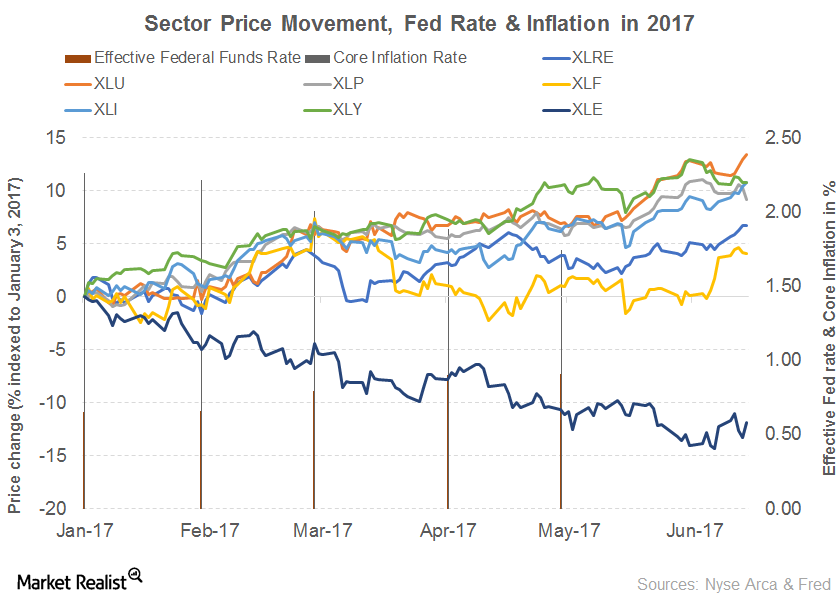

Comparing Growth and Value Stock Sectors

The SPDR S&P 500 Growth ETF (SPYG) has generated a YTD return of 13.3% versus 4.3% from the SPDR S&P 500 Value ETF (SPYV).

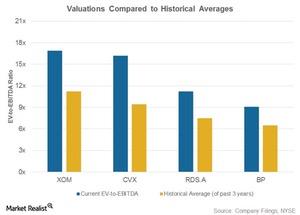

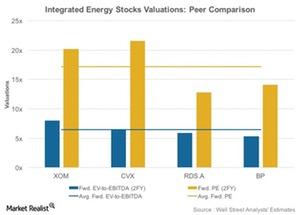

Energy Stock Valuations and Their Historical Averages

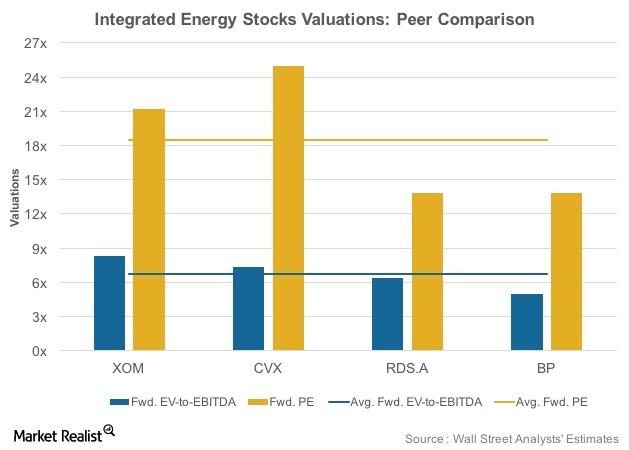

EV-to-EBITDA multiples in 1Q17 for ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) were above their historical averages.

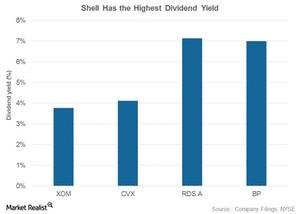

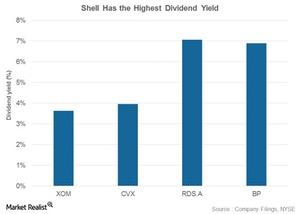

Who Has Higher Dividend Yields: RDS.A, XOM, CVX, or BP?

Shell has the highest dividend yield of 7.1% among the integrated energy stocks we’re covering in this series.

Inside Integrated Energy’s Dividend Yields: Comparing XOM, CVX, RDS.A, and BP

ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have consistently given returns to shareholders in the form of dividends.

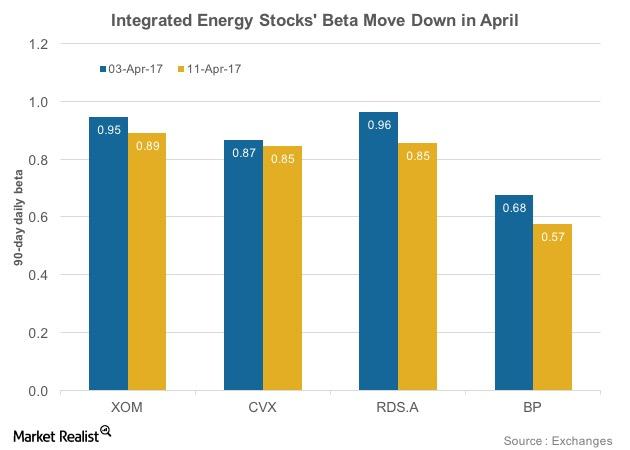

Understanding Integrated Energy Stocks’ Betas in April 2017

Royal Dutch Shell’s (RDS.A) 90-day daily beta fell from 0.96 on April 3, 2017, to 0.85 on April 11, 2017.

Integrated Energy Stocks: Who Stands Tall in Dividend Yield?

Shell’s dividend yield is 7.1%, the highest among the integrated energy stocks in this series.

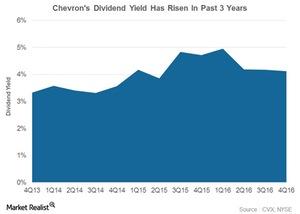

How Chevron’s Dividend Yield Has Trended

Chevron’s dividend yield Chevron (CVX) has consistently given returns to shareholders in the form of dividends. Therefore, we have evaluated its dividend yields. Yield is calculated as a ratio of the annualized dividend to stock price. Chevron’s dividend yield rose from 3.3% in 4Q13 to 4.1% in 4Q16, due to a dividend increase coupled with […]

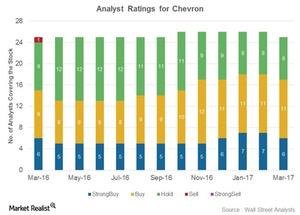

Why Most Analysts Rate Chevron a ‘Buy’

Analyst ratings for Chevron Chevron (CVX) has been rated by 25 analysts. Of the total, 17 analysts have given “buy” or “strong buy” ratings, eight have given “hold” ratings, and none have given “sell” or “strong sell” ratings on the stock. These ratings have improved from March 2016, when Chevron had fewer “buy” ratings, more […]

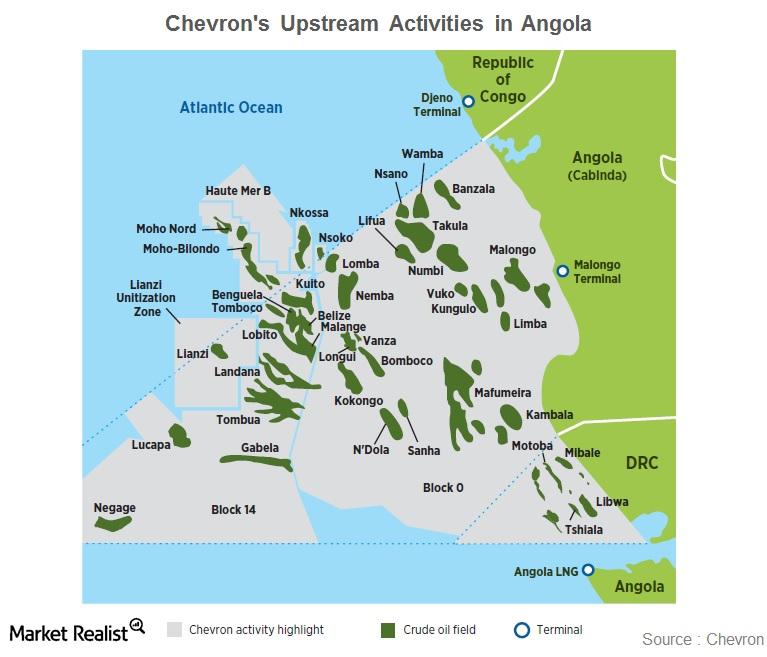

Chevron’s Mafumeira Sul Project Kick-Starts Production

In this series, we’ll provide updates on Chevron’s market performance. We’ll examine CVX’s latest stock performance, analyst ratings, dividend yield, PEG (price-to-earnings-to-growth) ratio, beta, short interest position, institutional ownership status, and implied volatility movement.

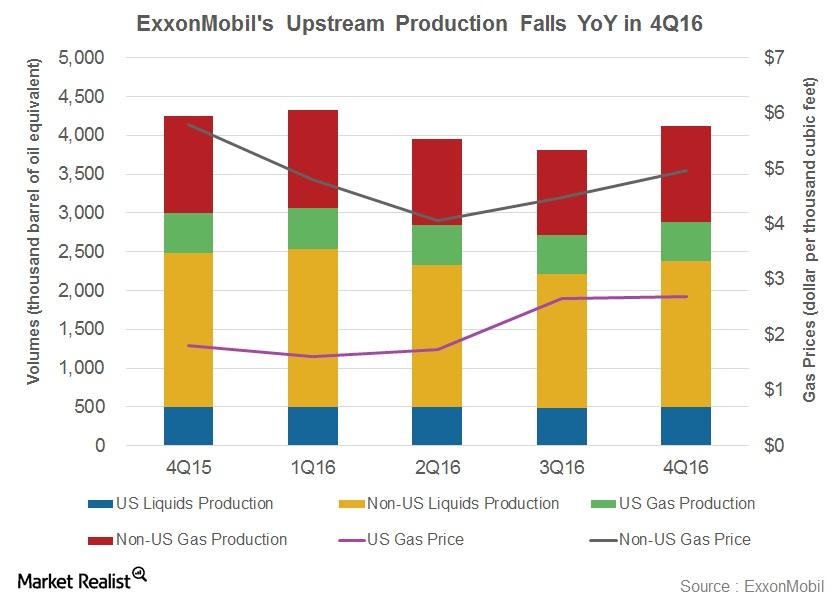

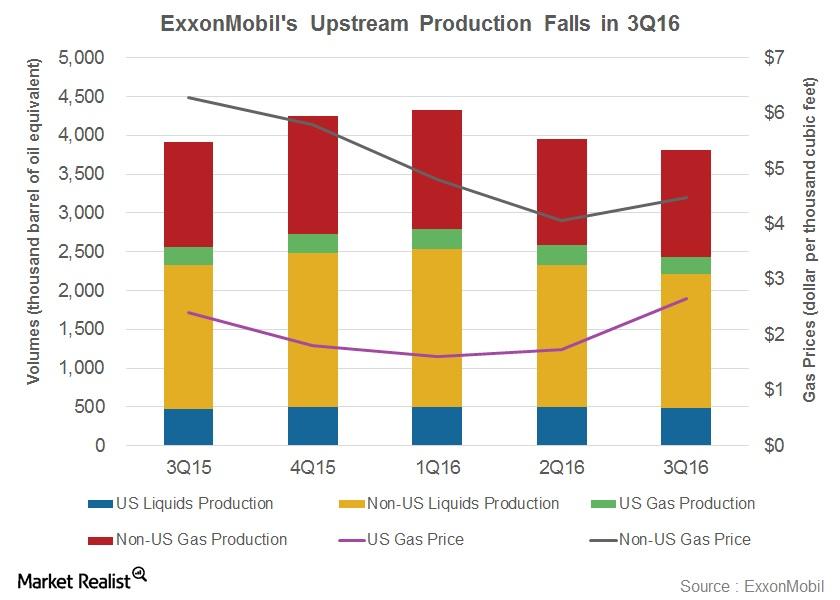

ExxonMobil’s Robust Upstream Portfolio: Poised for Growth

ExxonMobil (XOM) produced 4.1 MMboepd (million barrels of oil equivalent per day) from its worldwide operations in 4Q16.

ExxonMobil Focuses on Integrated Growth, Reveals the Path Forward

In its latest analyst meeting, ExxonMobil (XOM) announced that it had plans to concentrate on an integrated earnings model, capturing value at every stage of the energy chain.

Where Do Implied Volatilities in Integrated Energy Stocks Stand?

Implied volatility in Royal Dutch Shell (RDS.A) currently stands at 16%, which is the highest compared to peers ExxonMobil (XOM), Chevron (CVX), and BP (BP).

Analysts’ Ratings for ExxonMobil after Its Earnings

Six analysts gave ExxonMobil a “buy” rating, 13 analysts gave it a “hold” rating, and seven analysts gave it a “sell” rating after its 4Q16 earnings.

How Has ExxonMobil’s Upstream Production Trended?

ExxonMobil (XOM) produced 3.8 MMboepd (million barrels of oil equivalent per day) from its worldwide operations in 3Q16.

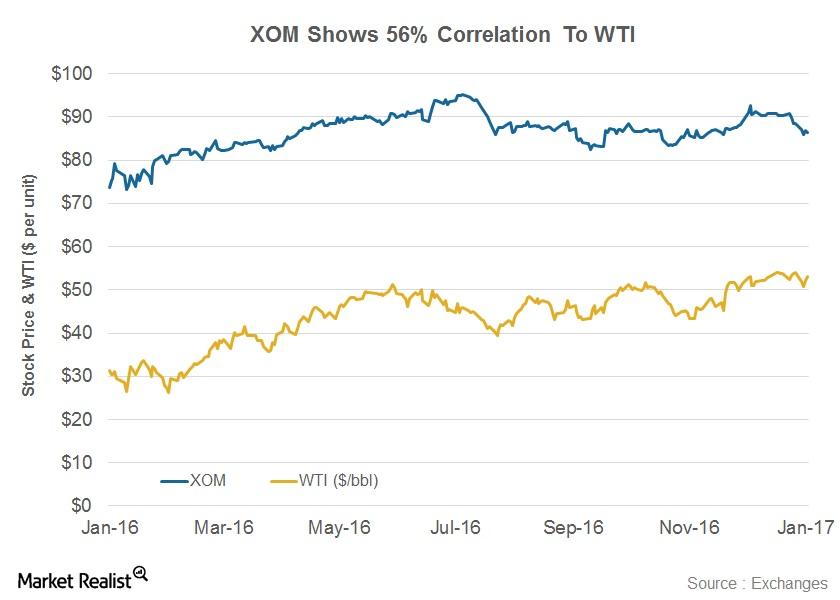

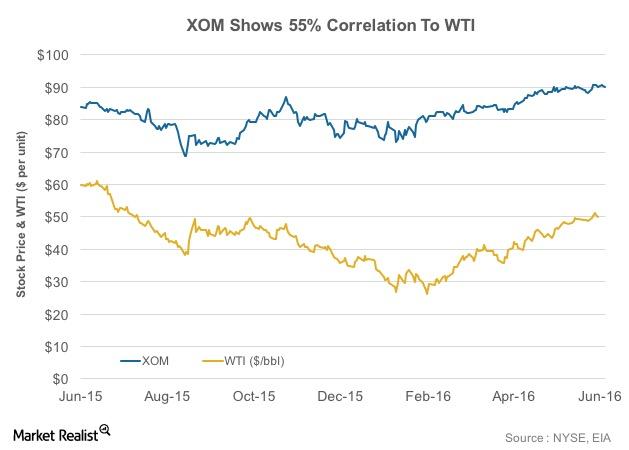

What’s the Correlation Between XOM and WTI?

Integrated energy companies such as ExxonMobil are affected to varying degrees by volatility in crude oil prices. XOM’s correlation coefficient with WTI stands at 0.56.

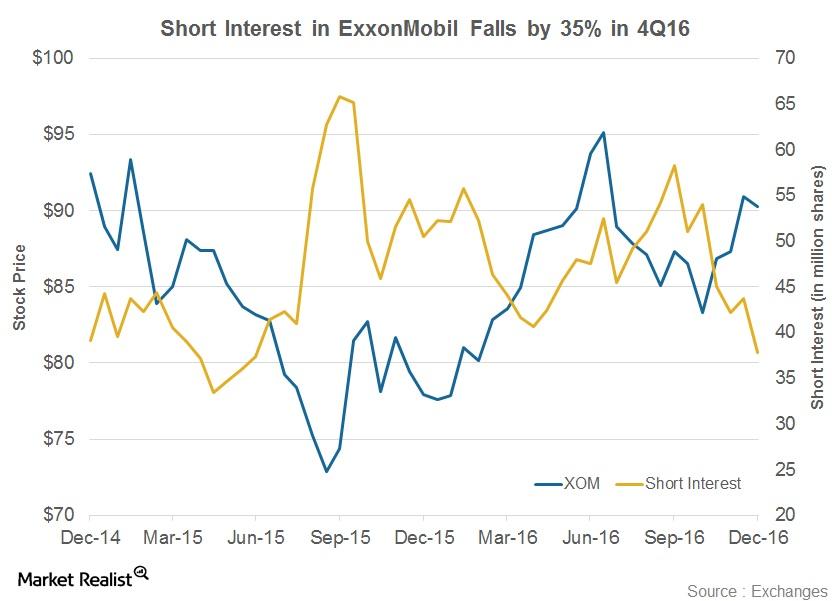

Has Short Interest in ExxonMobil Fallen?

ExxonMobil (XOM) has witnessed a 35% fall in its short interest volumes since September’s end 2016.

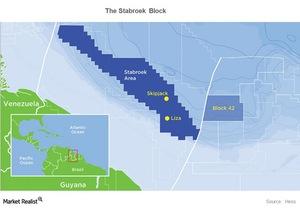

Once Again, ExxonMobil Discovers Oil in Guyana

ExxonMobil (XOM) has found oil in the Payara-1 Well in the Stabroek Block, positioned 120 miles offshore Guyana. This is the company’s second discovery in the block.

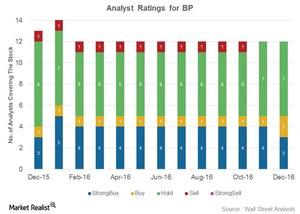

Why Do a Majority of Analysts Rate BP as a ‘Hold’?

BP (BP) plans to rebalance its sources and uses of cash by 2017 at an oil price level of $50–$55 per barrel.

Integrated Energy Stocks’ Post-3Q16 Forward Valuations

XOM trades at 8.3x forward EV-to-EBITDA and 21.2x forward price-to-earnings, both above its peer averages.

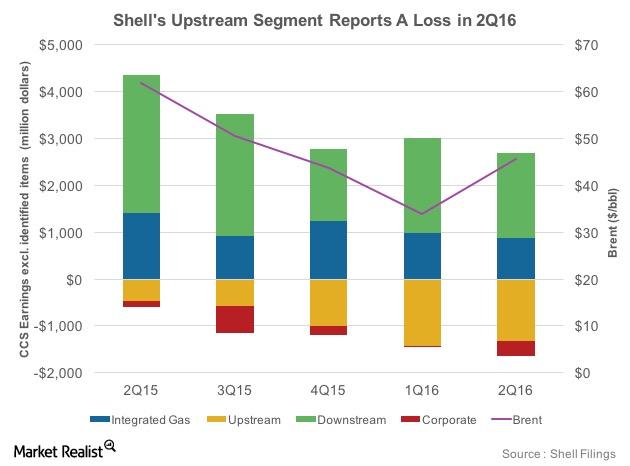

Shell’s Segments: Upstream Continues to Report Losses

Falling crude oil prices have changed the segmental dynamics within integrated energy companies such as Royal Dutch Shell (RDS.A).

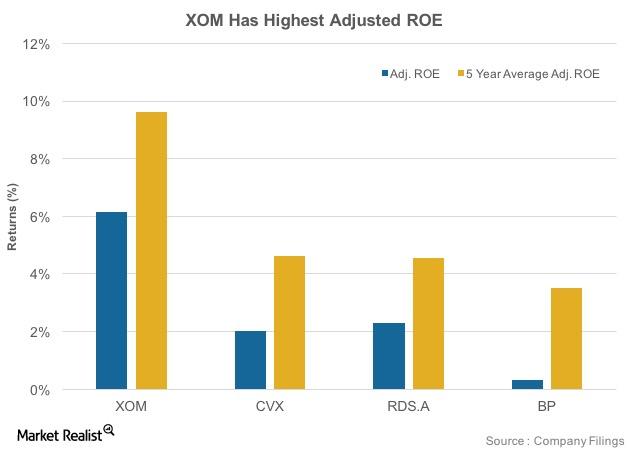

Look to This Energy Company for the Best ROE

Battered by falling oil prices, the 2Q16 ROE numbers for ExxonMobil (XOM), Chevron, Royal Dutch Shell, and BP were lower than their five-year average historical ROE figures.

Looking 2 Years Out, Energy Stocks Trade at Respectable PEs

ExxonMobil (XOM) trades at an 8.1x EV-to-EBITDA multiple and a 20.2x price-to-earnings ratio, both above its peers’ averages.

What Does Suncor’s Short Interest Analysis Reveal?

Suncor Energy (SU) has witnessed a 34% rise in its short interest since April 2016.

What’s the Correlation between XOM’s Stock and Crude Oil?

Integrated energy companies such as ExxonMobil (XOM) are affected by volatility in crude oil prices. To what degree? This varies from company to company.

What Does a Fall in Shell’s Short Interest Mean?

Shell has witnessed a 49% fall in its short interest volumes since February 10, 2016. This indicates that the bearish sentiment for the stock is weakening.

Why ExxonMobil’s Valuations Are Higher Than Historical Averages

ExxonMobil’s price-to-earnings (or PE) ratio has generally shown an uptrend in the past two years. In 1Q16, the stock traded at a PE of 26.4x.

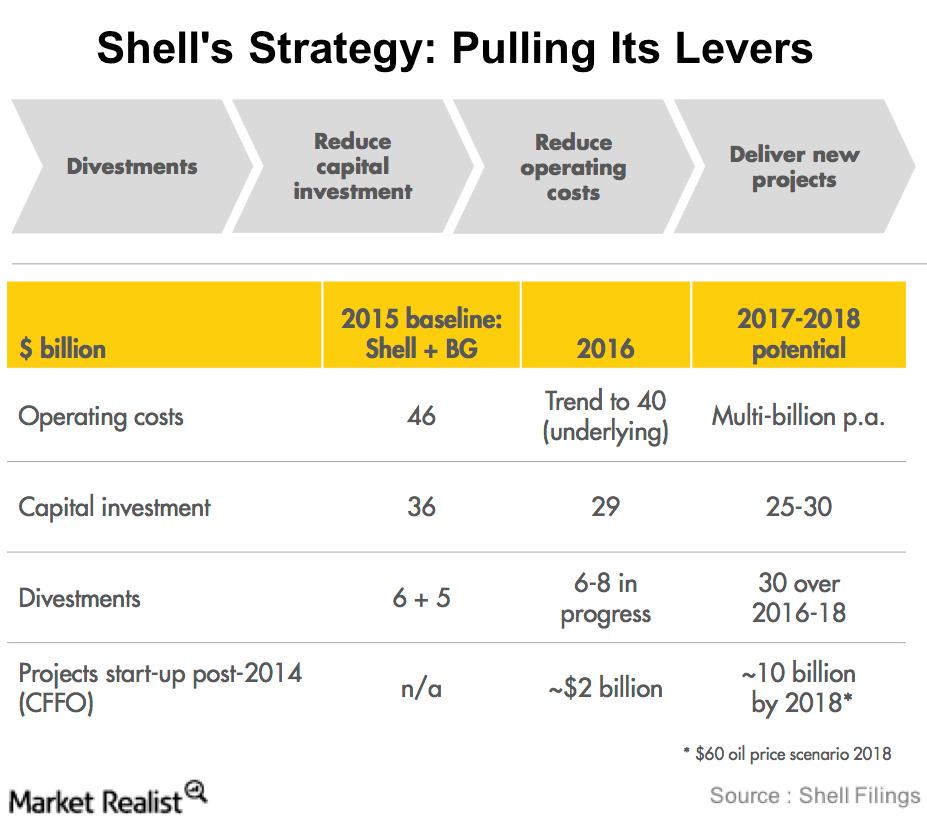

Shell’s Strategy: Pulling Its Levers

Shell plans to restructure itself to become more resilient to lower oil prices and more focused in terms of assets. To do this, it plans to use four levers.

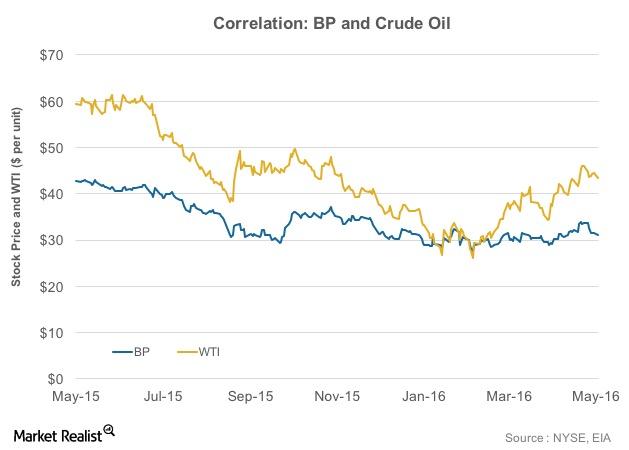

How Do BP’s Stock and Crude Oil Prices Correlate?

To what degree are integrated energy companies such as BP affected by volatility in crude oil prices? This varies from company to company.

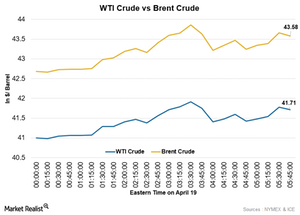

Why Did Oil Prices Rise This Morning?

Oil prices rose early today because of the oil workers’ strike in Kuwait. Here’s what you need to know.

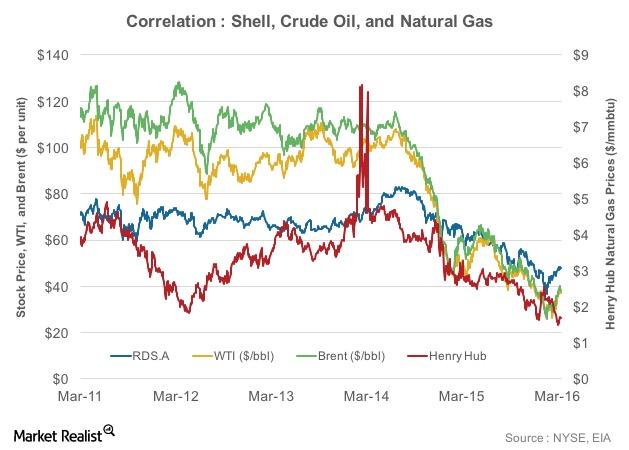

Correlation Analysis: Shell and Oil Price

Shell’s stock price has largely moved in-line with crude oil prices. This is reflected in the results of a correlation test.

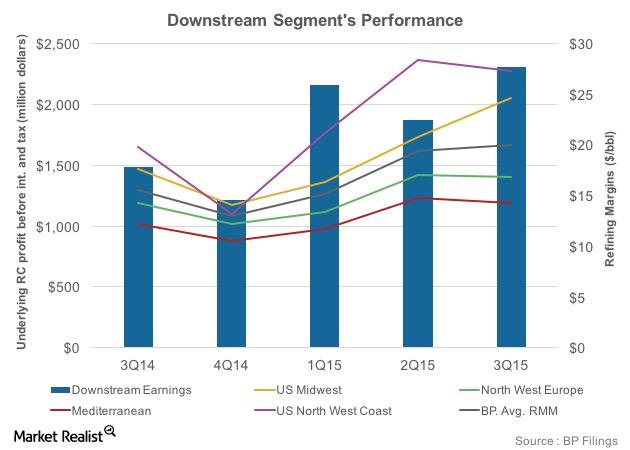

Overview of BP’s Refining Segment and Margins

BP’s refining segment has 2.0 million barrels per day of refining capacity worldwide. In the United States, it has around 0.74 MMbpd of refining capacity.

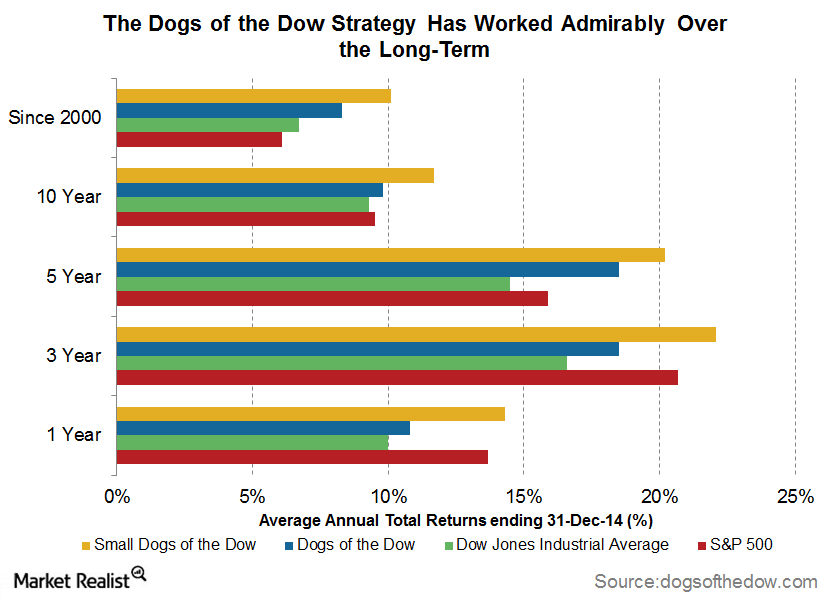

Dogs of the Dow: A Classic Investment Strategy

The Dogs of the Dow strategy involves ranking the 30 stocks comprising the Dow Jones Industrial Average index on the basis of their dividend yields and selecting the top ten.

Fall in Crude Oil Demand Could Impact Saudi Arabia the Most

Crude exports account for more than 85% of Saudi Arabia’s revenue. The economy still isn’t diversified. Saudi Arabia is already experiencing high fiscal deficit.

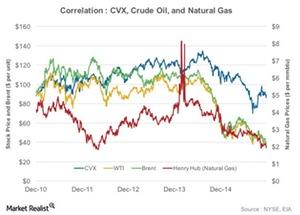

The Correlation of Chevron’s Stock to Oil and Natural Gas Prices

The integrated energy model provides Chevron’s insulation from oil and natural gas price volatility. This is reflected in the results of the correlation test.