Understanding Integrated Energy Stocks’ Betas in April 2017

Royal Dutch Shell’s (RDS.A) 90-day daily beta fell from 0.96 on April 3, 2017, to 0.85 on April 11, 2017.

April 17 2017, Updated 7:36 a.m. ET

Integrated energy stocks’ betas

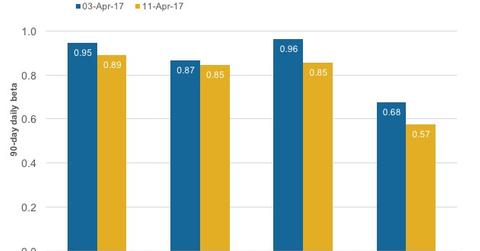

Royal Dutch Shell’s (RDS.A) 90-day daily beta fell from 0.96 on April 3, 2017, to 0.85 on April 11, 2017. In this part of our series, we have considered the 90-day daily beta, which represents how much a stock changes for a given change in the market, on a daily basis for 90 days.

So far in April, integrated energy betas have generally fallen, while the stocks’ correlations with WTI (West Texas Intermediate) crude oil have generally risen. This trend is reflected in the stock price performance of these companies. XOM, CVX, Shell, and BP’s stock prices rose in line with WTI prices, despite the marginal fall in the broader market.

Specific betas

Specifically, the fall in Shell’s beta was the steepest among peers ExxonMobil (XOM), Chevron (CVX), and BP (BP). BP and XOM’s 90-day daily betas fell 0.10 and 0.06, respectively, between April 3 and April 11.

CVX had the lowest fall of 0.02 in its beta value, while in absolute terms, XOM’s beta stood highest at 0.89. Shell’s and CVX’s betas each stood at 0.85, and BP had lower beta standing at 0.57.

For exposure to integrated energy stocks, investors can consider the iShares US Energy ETF (IYE), which has ~40% exposure to integrated energy sector stocks.

Continue to the next part for a look at the institutional holding levels in integrated energy stocks in April 2017.