Shell’s Strategy: Pulling Its Levers

Shell plans to restructure itself to become more resilient to lower oil prices and more focused in terms of assets. To do this, it plans to use four levers.

June 14 2016, Published 3:17 p.m. ET

Series outline

Royal Dutch Shell (RDS.A) is restructuring itself by pulling some powerful levers. Before discussing these levers, let’s quickly examine an outline of this series.

In this series, we’ll provide you with an update on Shell’s strategy. In the next few parts, we’ll examine Shell’s strategic levers in detail. This will be followed by discussions of Shell’s recent stock price rise and why the majority of analysts rate the company as a “buy.”

We’ll also evaluate Shell’s business segment dynamics. We’ll examine Shell’s leverage and cash flow position followed by its valuations, and we’ll make a peer comparison. We’ll also conduct correlation analysis of Shell’s stock and oil prices. Finally, we’ll make an analysis of short interest in Shell’s stock.

Now, let’s begin by discussing Shell’s strategy.

Shell’s strategy

Shell plans to restructure itself to become more resilient to lower oil prices and more focused in terms of assets. To do this, the company plans to use four levers: cash flows, costs, capital expenditure, and divestments.

On one hand, Shell plans to increase its free cash flow. On the other hand, it plans to reduce its operating costs, optimize its capital spending, and exit non-strategic assets or positions.

To improve its cash flows, Shell plans to deliver new projects on time and within budget. The company will also focus on strengthening its cash engines, namely oil products, conventional oil and gas, integrated gas, and oil sands mining assets. The company expects to earn the majority of its cash flows from these assets until 2018. We’ll discuss this in detail in the next part.

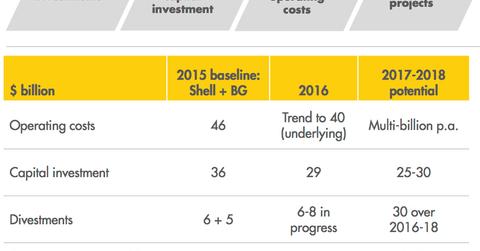

Shell acquired BG Group in 1Q16. On the operating cost front, Shell plans to reduce its operating costs as a merged entity by 15% over 2015 to $40 billion in 2016. Shell saved $4 billion on a stand-alone basis in 2015 over 2014.

The company plans to reduce its capital spending from $36 billion in 2015 to $25 billion–$30 billion in 2017–2018. Shell also plans to sell assets to the tune of $30 billion by 2018, of which $6 billion–$8 billion is expected in 2016. We’ll discuss each of these levers in detail in the next few articles.

Shell’s peers BP (BP), Chevron (CVX), and ExxonMobil (XOM) have also taken steps such as portfolio rechurning, lowering costs, and reducing capital expenditure to battle lower oil prices. For exposure to integrated energy sector stocks, you can consider the Vanguard Energy ETF (VDE). The ETF has ~36% exposure to the sector.