Exxon Mobil Corporation

Latest Exxon Mobil Corporation News and Updates

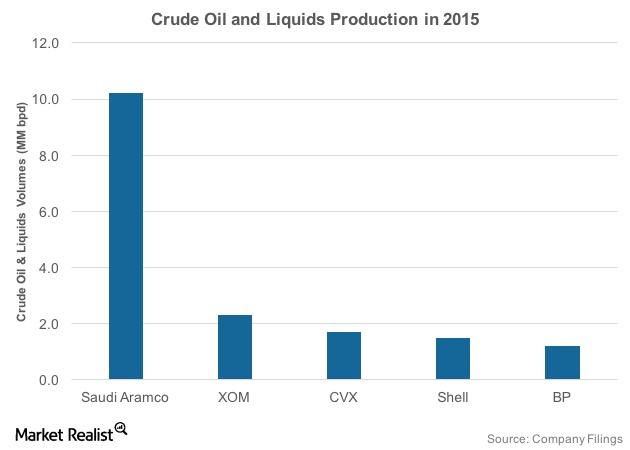

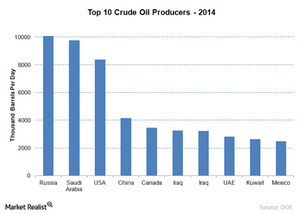

How Does Saudi Aramco’s Production Compare to Its Peers?

Saudi Aramco’s production accounted for 27% of OPEC’s average production in 2015. After Saudi Arabia, Iraq and Iran have the highest production in OPEC.

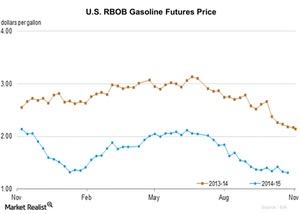

Why Did RBOB Gasoline Outperform Heating Oil?

The EIA reported RBOB gasoline futures contract 1 prices at $1.30 per gallon on November 23, representing a fall of ~1.8% from $1.32 per gallon on October 16.

Net Exports: Why They Matter and What Drives Them

A country’s net exports measure the value of total exports less the value of its total imports. It’s positive if exports are larger in value than imports.

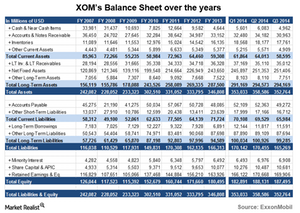

An essential analysis of ExxonMobil’s balance sheet

On a combination of several factors such as its earnings, share buybacks, and XTO acquisition, XOM’s balance sheet has grown.

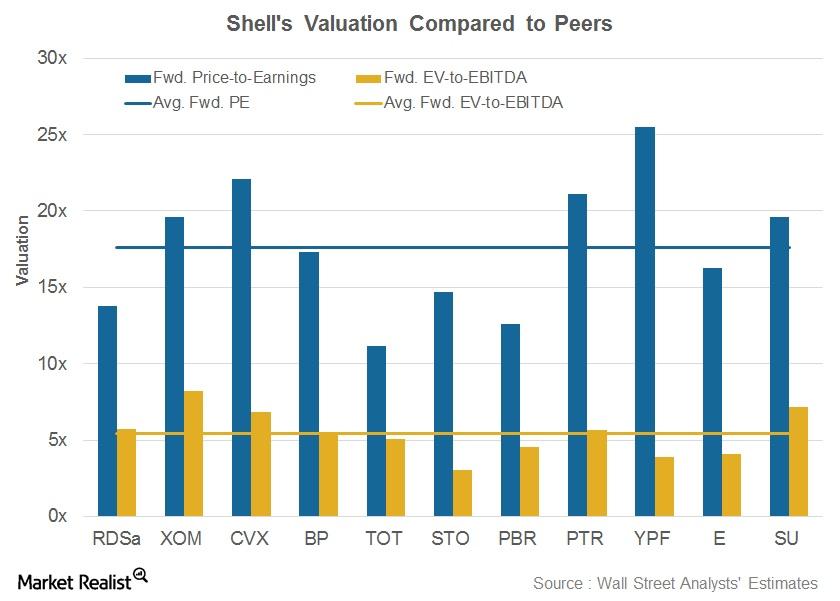

Shell’s Valuation Compared to Its Peers

Shell is trading at a forward PE of 13.8x, below its peer average of 17.6x.

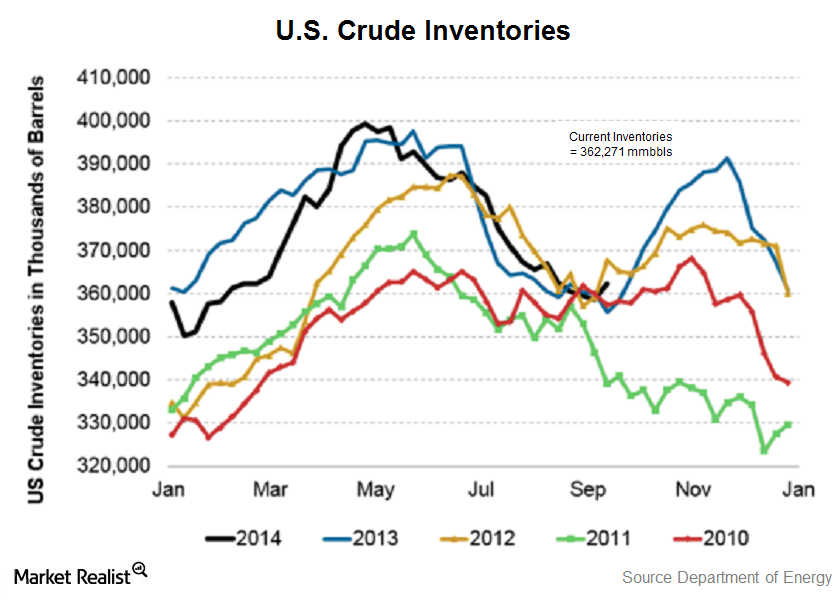

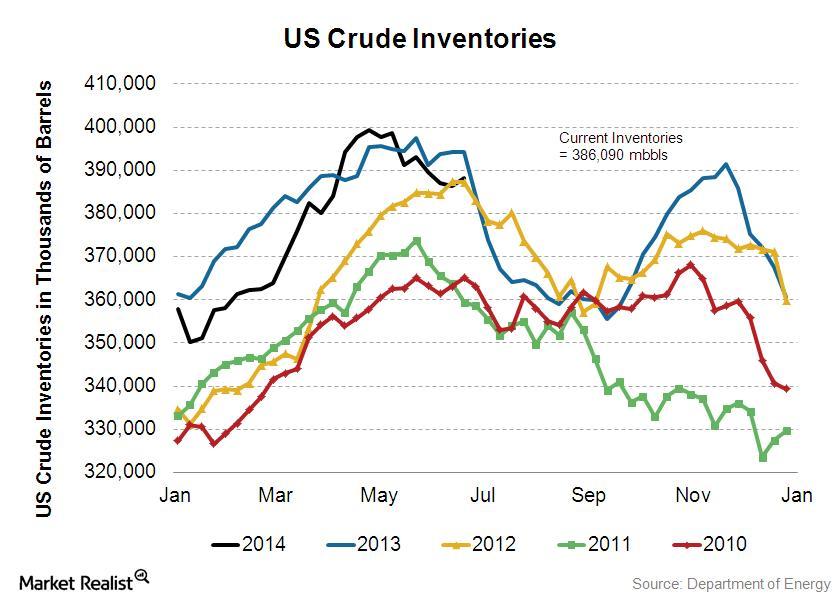

Must-know: Why energy investors monitor crude oil inventories

Analysts had expected a drop of 1.5 million barrels (mmbbls) in crude inventories last week. The following parts will cover actual changes in inventories.

Why Was Exxon Mobil Dropped by the Dow?

Exxon Mobil, which joined the Dow Jones Industrial Average in 1928, was removed from the index following a rough year for the company.

The World’s Top Oil-Producing Countries

These are the countries who produce the most oil in the world as well how much they produce

Top Oil-Producing Companies’ Stock Prices Fall

Looking at the top US-listed oil-producing companies’ stock prices, ExxonMobil, BP, and Chevron have fallen by 40.5%, 41.6%, and 31.5% in 2020.

Do Technical Indicators Hint at Strength for BP Stock?

BP stock has had almost flat returns in 2019, and its stock is up 0.3% year-to-date. Lower oil prices have impacted the stock’s performance.

2019 Oil and Gas Bankruptcies Paint Bleak Outlook

Haynes and Boone reported that 50 energy companies filed for bankruptcy in the first nine months of 2019, including 33 oil and gas producers.

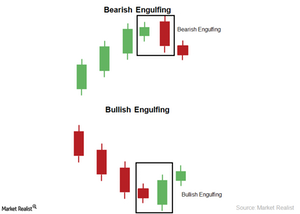

The Bearish Engulfing and Bullish Engulfing Candlestick Pattern

The Bullish Engulfing candlestick pattern is a reversal pattern. The pattern has two candles. The first candle is small and bearish. The second candle is long and bullish.

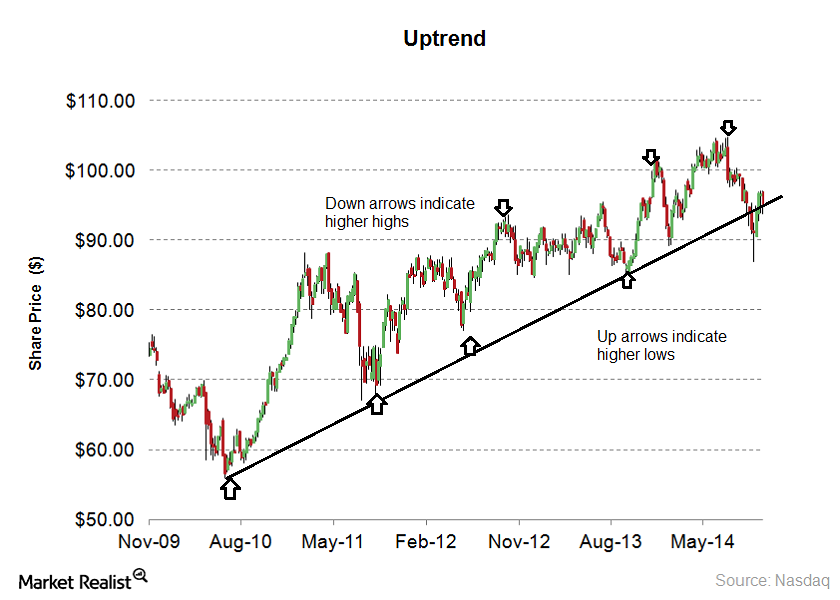

Why investors should buy stocks during an uptrend

Stocks are in an uptrend when they’re making higher highs and higher lows. An uptrend forms when psychological or fundamental factors are improving.

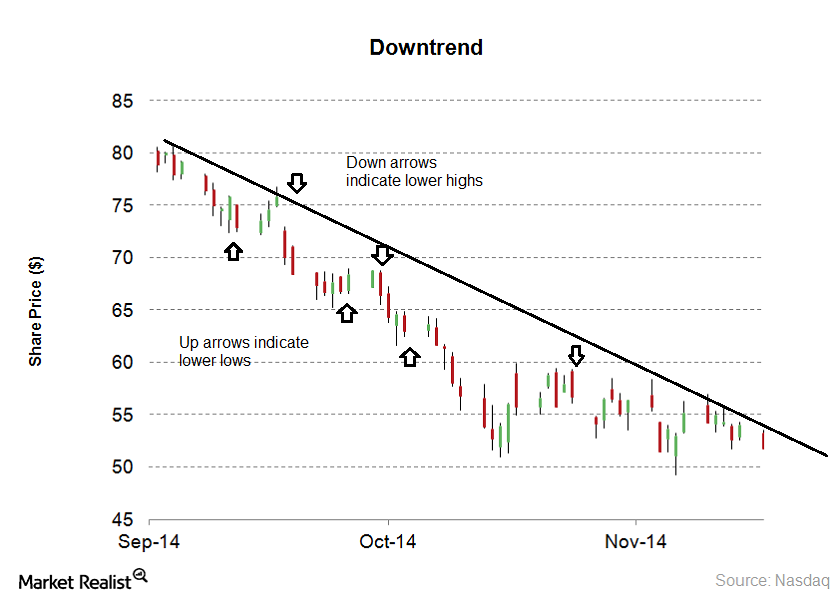

Why downtrends and sideways trends impact investors

It’s advisable to sell stocks on bounces when the stock is in a downtrend. In a sideways trend, it’s advisable to buy stock at support levels and sell at resistance levels.

Chevron: Is It a Good Time to Invest in the Stock?

Currently, Chevron stock trades at 18.5x its 2019 forward EPS and at 17.2x its 2020 forward EPS. The stock is higher than most of its peers.

Oil Prices and ExxonMobil Stock: What’s the Correlation?

ExxonMobil stock and oil prices have a strong correlation. The one-year correlation coefficient between the stock and WTI crude oil prices stood at 0.54.

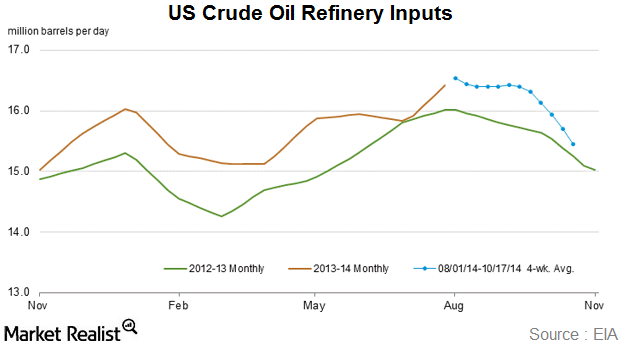

Why peak refinery maintenance season affects crude inventory

U.S. crude oil refinery inputs averaged 15.2 million barrels per day during the week ending October 17. Input levels were 113,000 bpd less than the previous week’s average.

Which Country Has the Most Oil?

Let’s take a look at the countries that own the most proven oil reserves and see why that matters for investors. You might find some surprises!

Must-know: Why crude oil inventories can affect prices

Every week, the U.S. Energy Information Administration (or EIA) reports figures on crude inventories, or the amount of crude oil stored in facilities across the United States.

Why is OPEC important to the price of crude oil?

High market share gives OPEC bargaining power to price oil above a competitive market. It can sway crude oil prices by increasing or decreasing production.

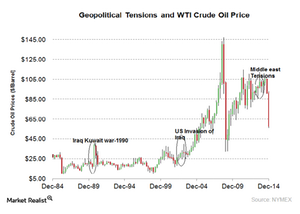

The crude oil market: An overview

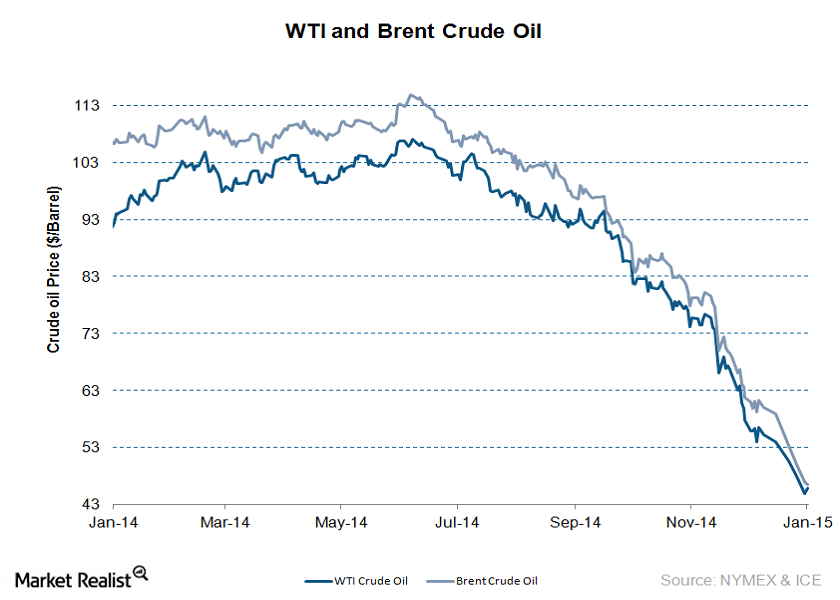

Crude oil prices have been on a roller coaster ride in 2014. This series will help crude oil investors recognize key factors that are impacting oil prices.

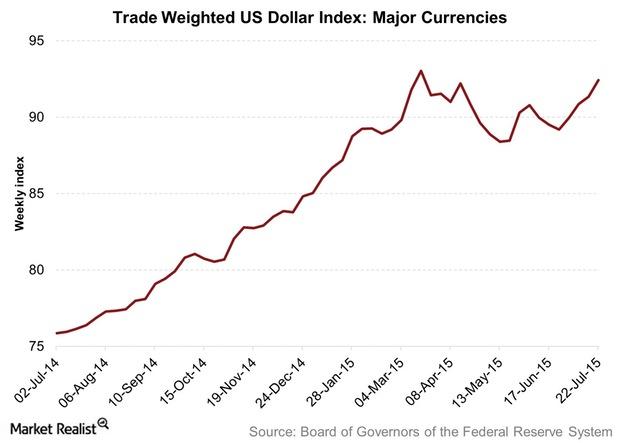

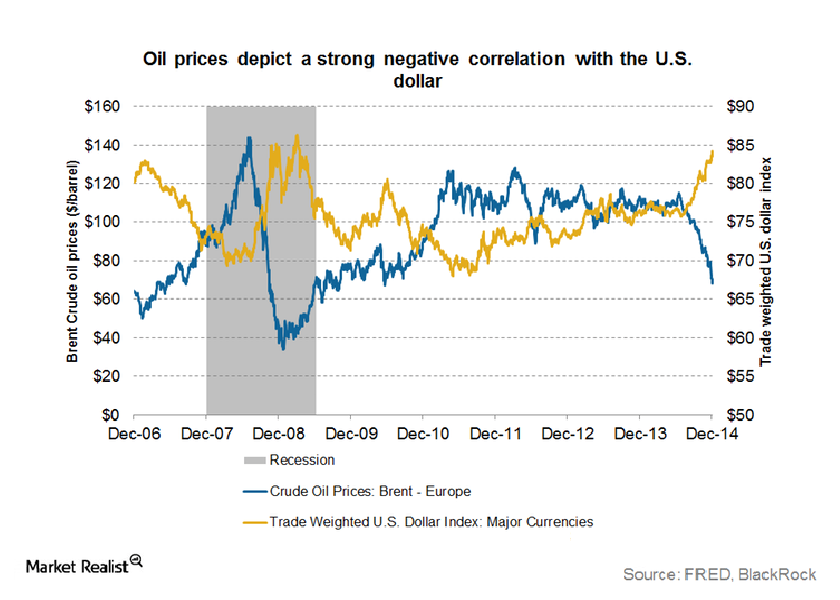

How the strengthening US dollar is impacting crude oil prices

The US dollar plays a major role in the price movements of commodities such as gold and crude oil. A strengthening US dollar is often seen as negative.

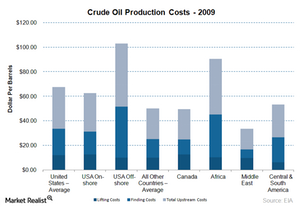

How does the production cost of crude oil affect oil prices?

Recent consensus says the production cost of crude oil could range from $20 to $25 per barrel.

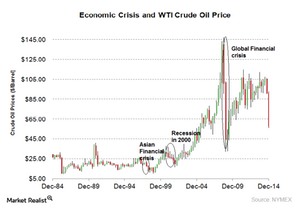

How an economic crisis affects the price of crude oil

The common factor during an economic crisis is that economic growth slows down. Demand declines, which has a negative impact on oil prices.

Must know: Geopolitical tensions impact oil prices

A glut in crude oil supply could mean that political tensions in the near term may not impact oil prices.

Get Real: From Huawei’s Reprieve to the Future of HP

Respite for Huawei is big news for tech stocks, but China’s facing other problems. Plus, one company’s fight for survival and much more.

Get Real: Roller Coaster Continues This Earnings Season

AT&T stock is prospering, while Netflix’s problems could be rising. We also have the latest earnings including U.S. Steel and Chevron today.

Chevron Stock Could Enter the ‘Buy’ Zone Soon

Chevron stock (XOM) closely relates to oil prices, so investors sometimes use this highly liquid, well-regarded stock as a trading vehicle for oil.

Get Real: Warren Buffett’s Next Elephant

In today’s Get Real, we saw that California Governor Gavin Newsom has ideas about Warren Buffett’s next elephant. Plus, earnings takeaways, the Fed, oil risk, and more.

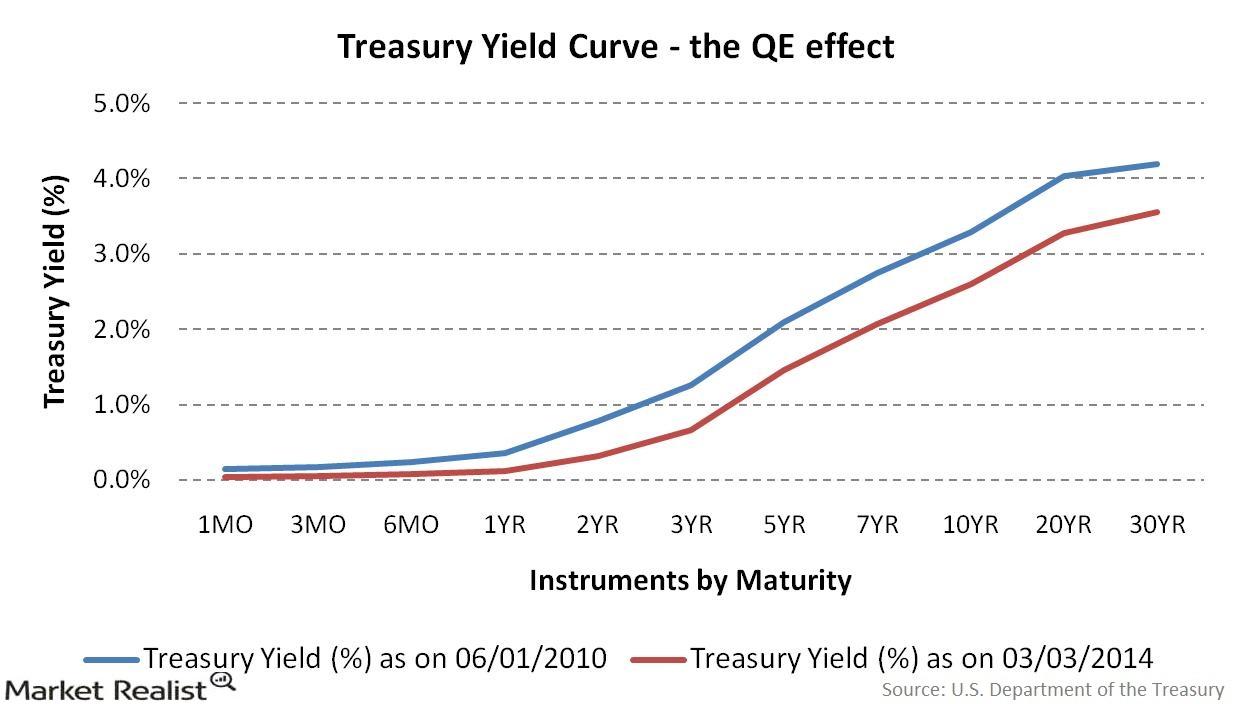

The Fed taper: How quantitative easing affects the yield curve

QE is an unconventional form of monetary easing—the Fed’s way of putting in more money into circulation in the economy.

These 5 Refiners Make Half the Crude Oil in the US

The total refiners capacity in the US is around 18.8 million barrels per calendar day. The refinery utilization rate in 2018 was 93%.

Must-Know: The Top 10 Refineries in the US

US crude oil production has more than doubled since 2009 and grew by 1.1% over the last year. Currently, there are 133 operable refineries in the US.

ExxonMobil and Chevron: Do Moving Averages Show a Breakout?

Leading energy stocks like ExxonMobil (XOM) and Chevron (CVX) are facing bleak business conditions. Oil prices have been weaker in the third quarter.

ExxonMobil and Chevron: Upstream Portfolio Positioning

Integrated oil companies ExxonMobil and Chevron have strong upstream portfolios, which play a vital role in determining their profitabilities.

BP Stock: Should You Buy It Now?

BP (BP) stock rose 3.9% on Monday due to higher oil prices. The drone attack on Saudi Arabia’s oilfield increased WTI crude oil by about 13%.

Dow Jones Index Falls after Rising for Eight Days

The Dow Jones Industrial Average Index has fallen 0.4% or by 115 points today. The index is trading lower after rising for eight consecutive trading sessions.

The US Energy Sector: An Overview

To understand the US energy sector, it’s essential first to understand the country’s energy needs. The US uses various energy sources to meet its energy needs.

ExxonMobil or Chevron: Which Is the Better Buy?

ExxonMobil and Chevron slumped 7.9% and 4.9%, respectively, in August. The stocks took a beating due to weaker markets and tumbling crude oil prices.

Energy Stocks Fall: Right Time to Invest?

The recent slump in energy stocks provides investors with an opportunity to invest in well-placed stocks. Shell looks like an attractive investment option.

Can the US-China Trade War Spiral into a Crude Oil War?

Although the US doesn’t export much crude oil to China, the additional supply of cheap Iranian oil could pressure both Brent and WTI crude prices.

ExxonMobil Stock: JPMorgan Chase Cut Its Target Price

ExxonMobil’s (XOM) earnings fell in the second quarter. After the earnings, JPMorgan Chase cut its target price on ExxonMobil stock from $85 to $83.

BP’s Earnings Beat Analysts’ Expectations

BP (BP) reported its second-quarter results today. Its earnings per American depositary share of $0.84 beat analysts’ estimate by about 7%.

Total SA Stock Fell Marginally After Q2 Earnings

Total SA stock fell 0.9% on Thursday—its earnings release day. The stock was impacted by a 20% YoY fall in its earnings.

Suncor’s Earnings Rise but Miss Estimate in Q2

Suncor Energy (SU) posted its second-quarter earnings results on July 24. In the quarter, its revenue missed Wall Street’s estimate by 4%.

ExxonMobil Tops the Charts with Strong Financials

ExxonMobil (XOM) has the lowest percentage of debt in its capital structure compared to its peers. In the first quarter, ExxonMobil’s total debt-to-capital ratio stood at 17%.

How Strong is ExxonMobil’s Debt Position?

ExxonMobil’s (XOM) net debt-to-adjusted EBITDA ratio was 1.0x in the first quarter—below the industry average of 1.2x.

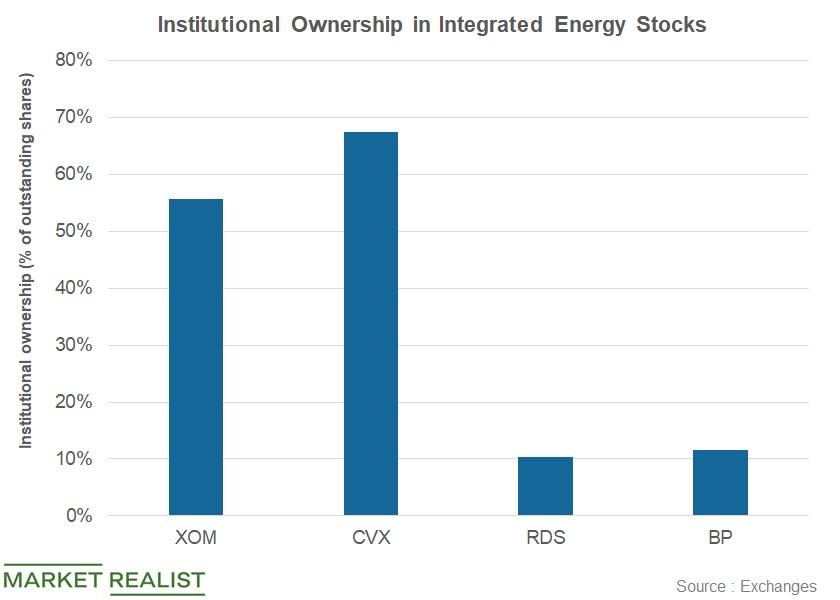

Which Institutions Raised Holdings in Integrated Stocks?

Institutional ownership in ExxonMobil and BP stands at ~56% and ~12%, respectively.

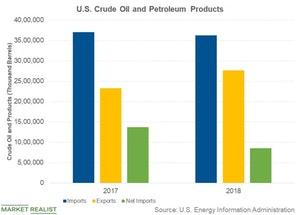

Why the United States Imports Oil

Several factors contributed to the rising crude oil exports in 2018.

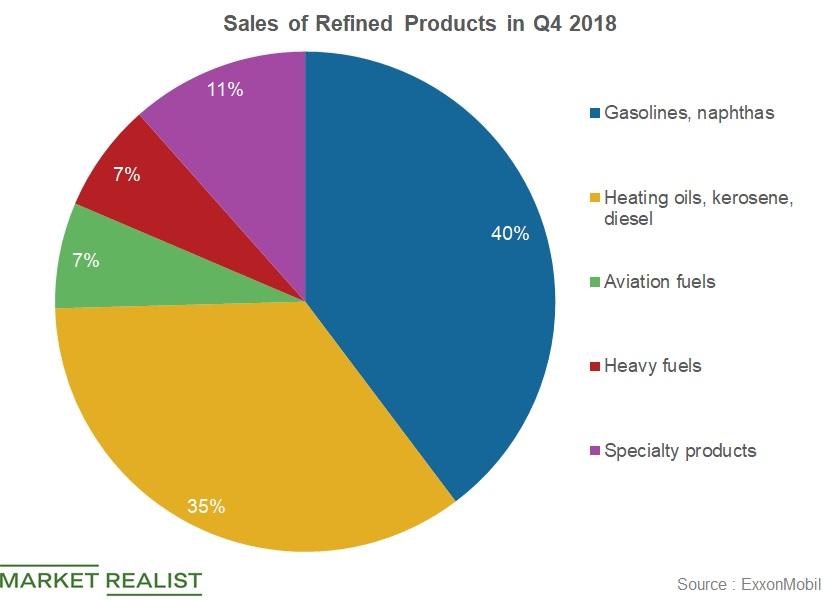

How’s ExxonMobil’s Downstream Segment Positioned?

In the fourth quarter, ExxonMobil’s refined products sales fell 2.3% YoY to 5.5 MMbpd. The company’s gasoline sales fell 7.2% YoY.

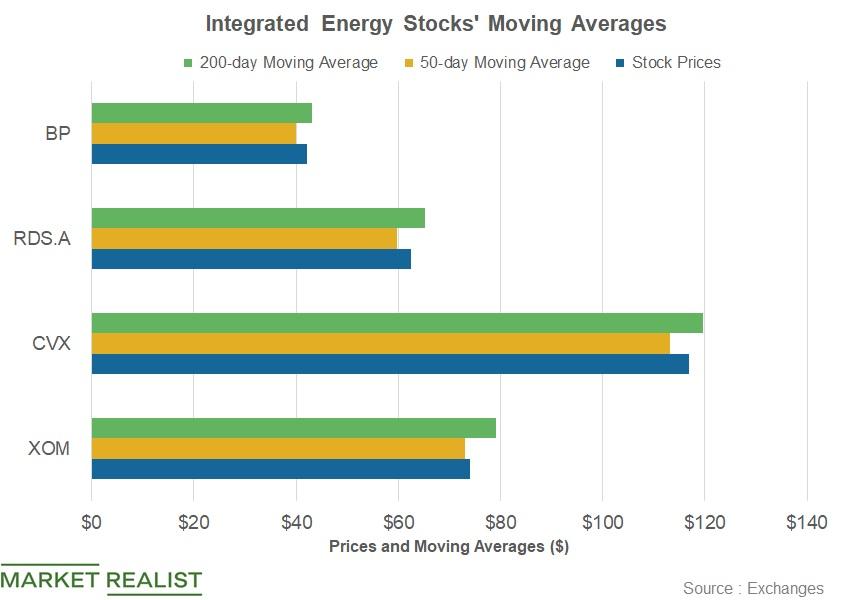

XOM, CVX, Shell, BP: What Do Moving Averages Suggest?

In the first quarter so far, integrated energy stocks ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have risen due to the rise in oil prices.