Vanguard FTSE Europe ETF

Latest Vanguard FTSE Europe ETF News and Updates

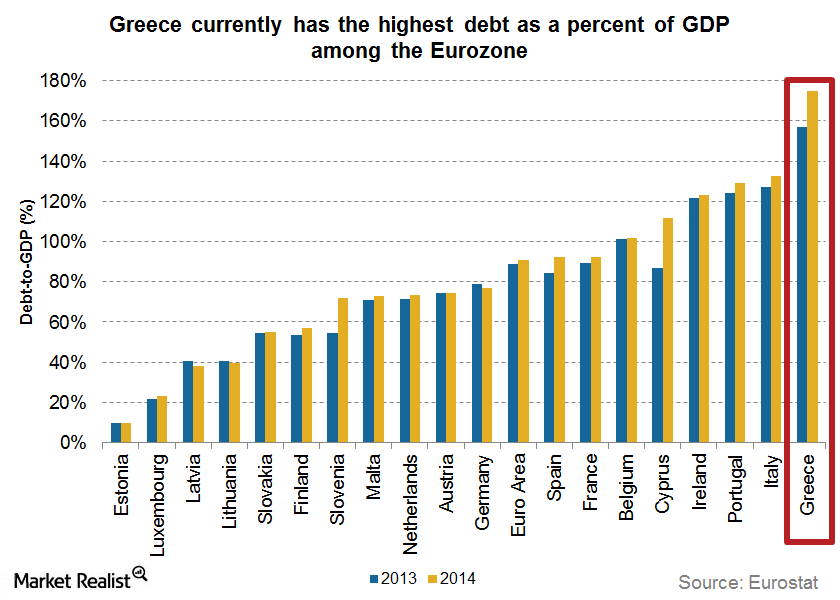

Greek Debt Crisis 101: Getting To The Crux Of The Matter

According to estimates by EuroStat, Greek debt stood at more than 315 billion euros at the end of September 2014.

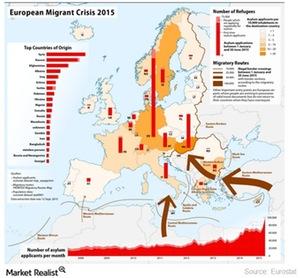

What Does the UK Really Have to Gain from Exiting the EU?

The EU’s light immigration laws allow young talent to work across the EU, but with more immigrants entering the UK, local citizens have less access to jobs.

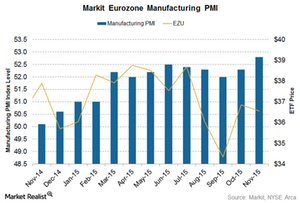

Credit Suisse and Barclays Are Bullish on European Equity for 2016

Credit Suisse (CS) strategists forecast 10% earnings growth in Europe versus a 6.8% growth expected from the US.

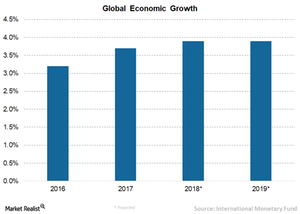

Are Tougher Days ahead for Global Equities?

The IMF revealed that emerging Asia is expected to grow ~6.5% in 2018 and 2019.

Once Again, Soros Makes Money off the UK’s Woes

Four days before the UK (EWU) decided to leave the European Union (VGK), Soros warned the markets of a “Black Friday” and a crash in the pound.

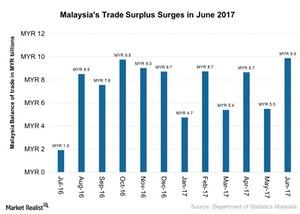

What’s behind Malaysia’s Large Trade Surplus in June 2017?

Malaysia’s trade surplus jumped to 9.9 billion Malaysian ringgit (MYR) (about $2.3 billion as of August 11, 2017) in June 2017—an 80% rise YoY.

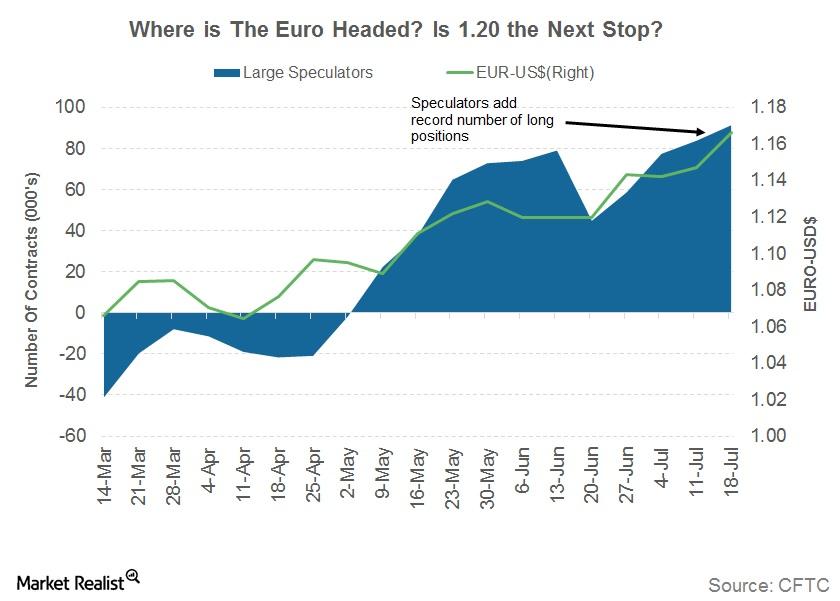

Euro Reaches 23-Month Peak: Could It Climb Higher?

Euro rallies to a 23-month peak Last week, the euro (FXE) closed at 1.17, appreciating by 1.7% against the US dollar (UUP). The currency has appreciated by more than 10% against the US dollar this year, making it one of the strongest developed market currencies. Improving economic conditions and a stable political climate turned the […]

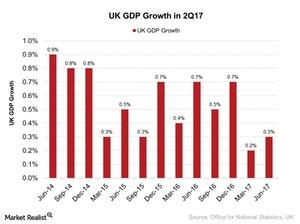

Will UK’s 2Q17 Growth Strengthen Investor Sentiment?

The UK’s 2Q17 economic growth surprised the market with a rise of 0.3% as compared to a 0.2% rise in the first quarter of 2017.

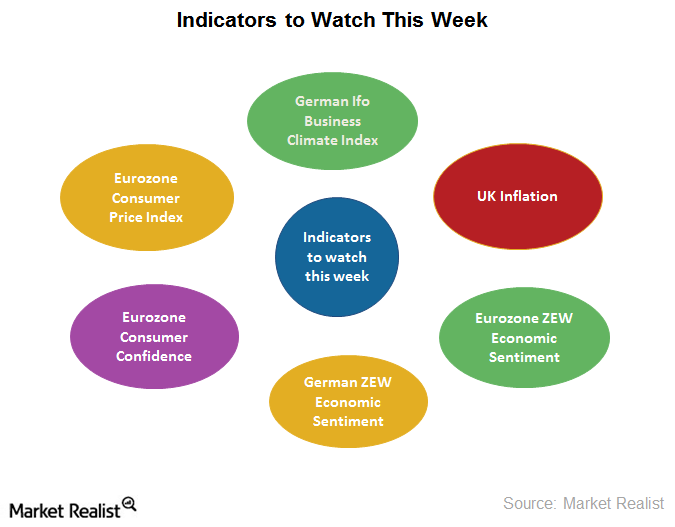

Economic Indicators Investors Should Watch This Week

If major Eurozone economic indicators improve in the coming months, we could expect those economies to regain some strength.

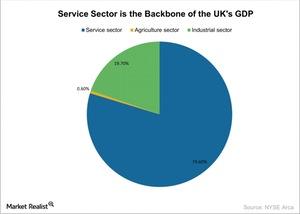

Which Sectors in the UK Will the ‘Brexit’ Decision Affect Most?

The financial sector has contributed heavily to the UK economy. Financial institutions like HSBC and Barclays will face challenges doing business in the EU.

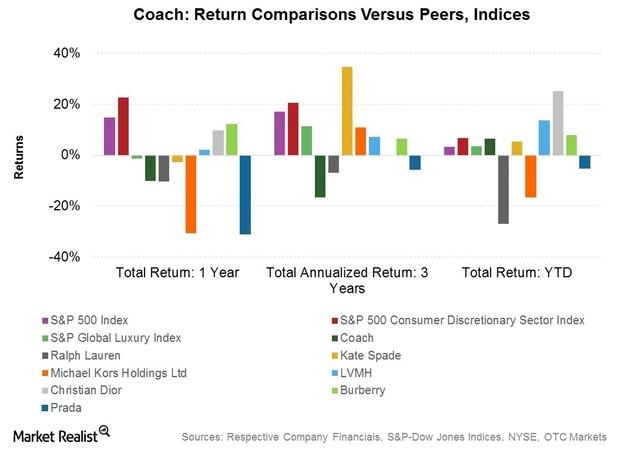

Opportunities and Challenges for Coach

Coach expects to realize $160 million in annual savings due to its restructuring initiatives from fiscal 2016 onward. It also expects to maintain its annual dividend of $1.35 per share.

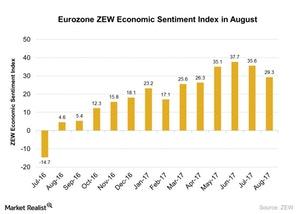

How the Eurozone ZEW Economic Sentiment Index Looked in October

According to a report by the Centre for European Economic Research (ZEW), the Eurozone ZEW Economic Sentiment Index fell to 26.7 so far in October compared to 31.7 in September.

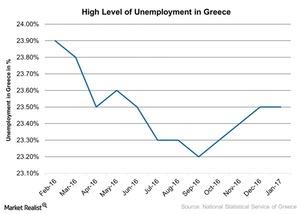

Greece’s Unemployment Falls, but Still the Highest Among Peers

Europe’s average unemployment has fallen to a four-year low of 9.8% as of 2016. Greece’s seasonally adjusted unemployment rate was 23.5% in January 2017.

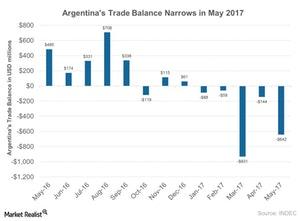

Surge in Imports Increases Argentina’s Trade Deficit in May 2017

Argentina (ARGT) posted a higher trade deficit for May 2017 at $642 million, mainly due to increasing imports as compared to its exports.

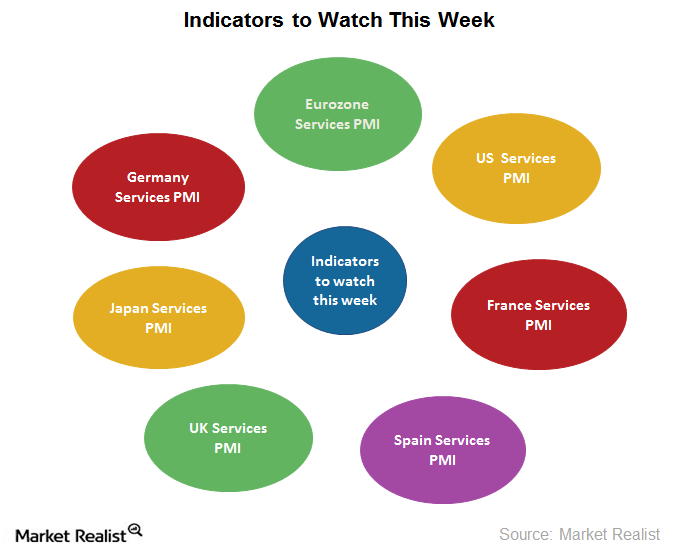

Economic Indicators Investors Should Watch for This Week

Economic indicators Key economic indicators investors should watch for this week are: US (SPY) services PMI data UK (EWU) services PMI data Eurozone (IEV) (VGK) services PMI data German (EWG) services PMI data Spanish services PMI data French (EWQ) services PMI data Japanese services PMI data US ADP employment data US non-farm payroll data Wrapping up […]

Eurozone ZEW Economic Sentiment Fell after a Year

According to a report by the Centre for European Economic Research (ZEW), the Eurozone ZEW Economic Sentiment Index fell to 29.3 in August.

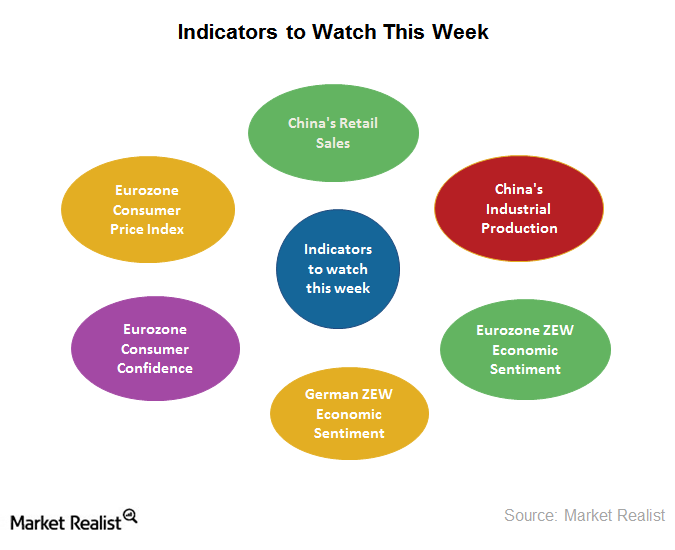

What Indicators Should Investors Watch This Week?

As China is one of the important emerging economies, investors should keep an eye on its important indicators.

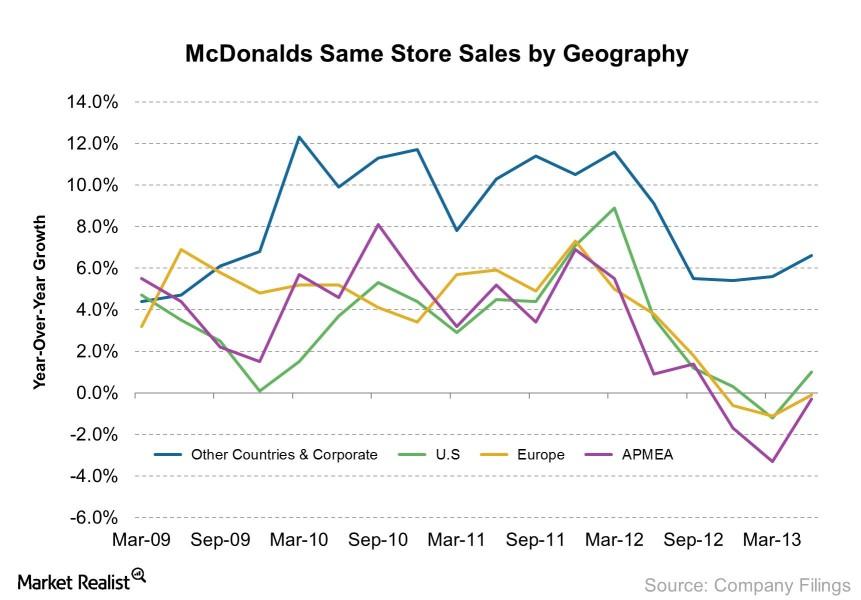

Are McDonald’s higher sales in Europe part of a larger trend?

In this series, we uncover the key indicators investors should know to help them stay calm and position themselves correctly in the restaurant market. Investing is an art and a science. There is no secret formula.Financials The key arguments of the Yes campaign of the Scottish referendum

The voting result of the Scottish Referendum, due September 18, will have a direct bearing on Scotland, the United Kingdom, and the 28-member European Union as a whole.

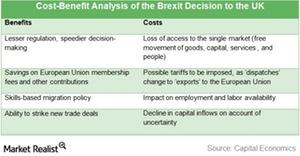

A Cost-Benefit Analysis of the Brexit Decision

To understand how the Brexit result stands to impact your portfolio or your willingness to invest in the United Kingdom, a cost-benefit analysis is pertinent.

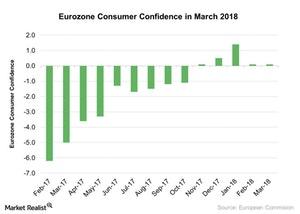

Eurozone Consumer Confidence Weakens

According to the European Commission, the Eurozone consumer confidence index has remained at 0.1 in March 2018, unchanged from February 2018.

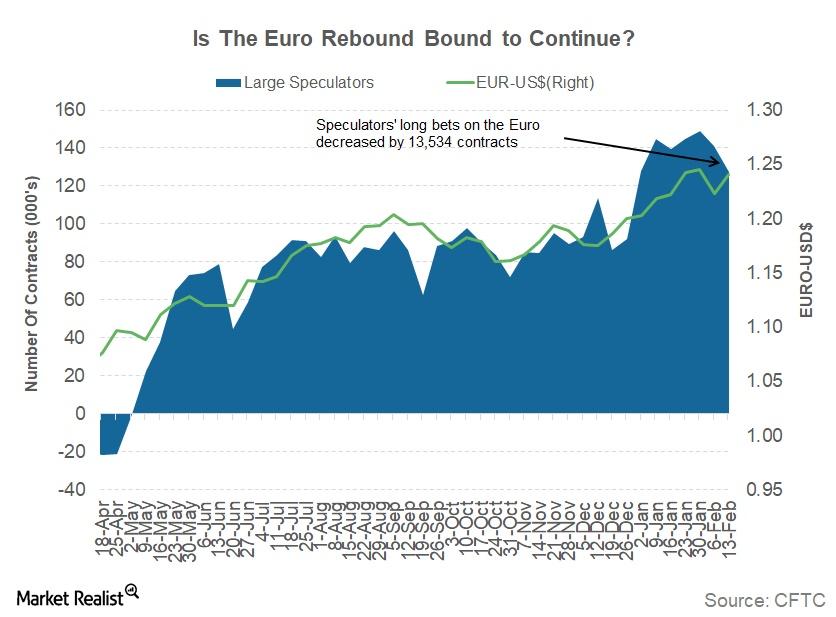

What to Expect from the Euro This Week

The euro-dollar (FXE) exchange rate closed the week ending February 16 at 1.24, an appreciation of 1.4% against the US dollar (UUP).

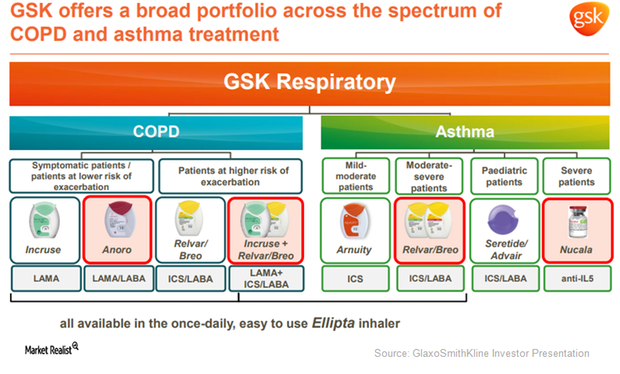

GlaxoSmithKline Has Developed a Broad Respiratory Portfolio

In 3Q17, GlaxoSmithKline (GSK) reported revenues close to 1.6 billion pounds from the sale of its respiratory products, which is year-over-year (or YoY) growth of 1% on a reported basis.

Politics and Central Bank Comments Could Drive the Euro Higher

The Eurozone’s inflation data published on January 17 indicated that prices increased 1.4% in December 2017, which is still below the long-term average.

Eurozone Investor Confidence Improved: Will It Help Equity Market?

Eurozone (FEZ) (VGK) investor confidence has shown strong improvement in December 2017.

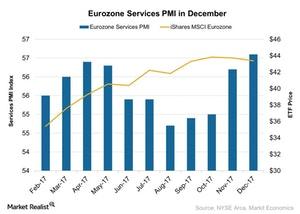

Eurozone Services Activity Reached 6-Year High in December

According to a report by Markit Economics, the final Eurozone services PMI (purchasing managers’ index) showed a strong improvement in December 2017.

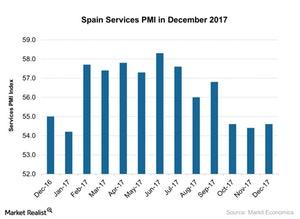

How Did Spain’s Services PMI Perform in December 2017?

According to a report by Markit Economics, the final Spain services PMI stood at 54.6 in December 2017 as compared to 54.4 in November.

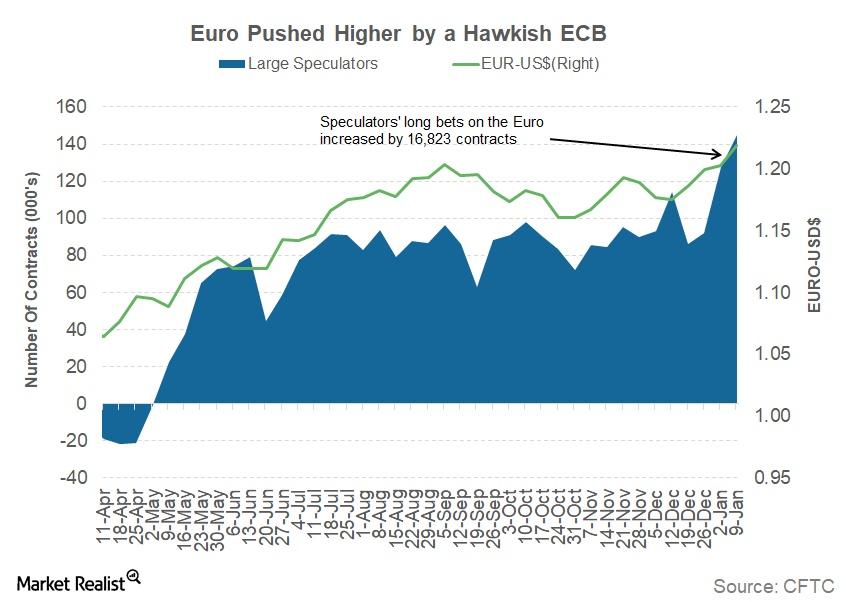

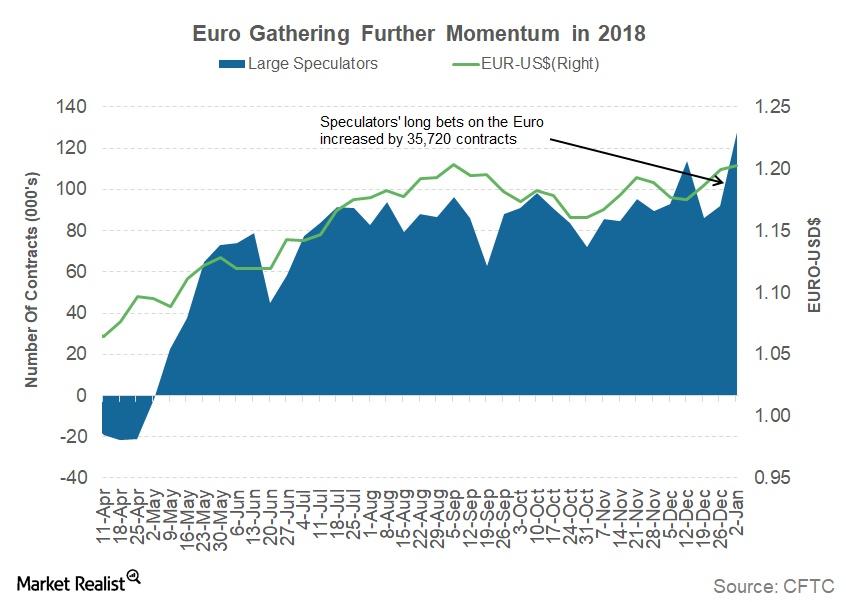

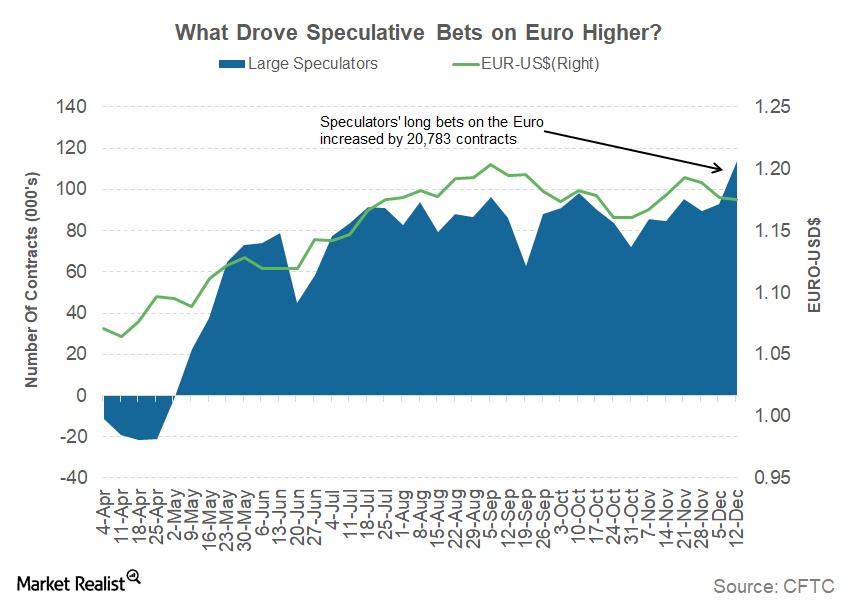

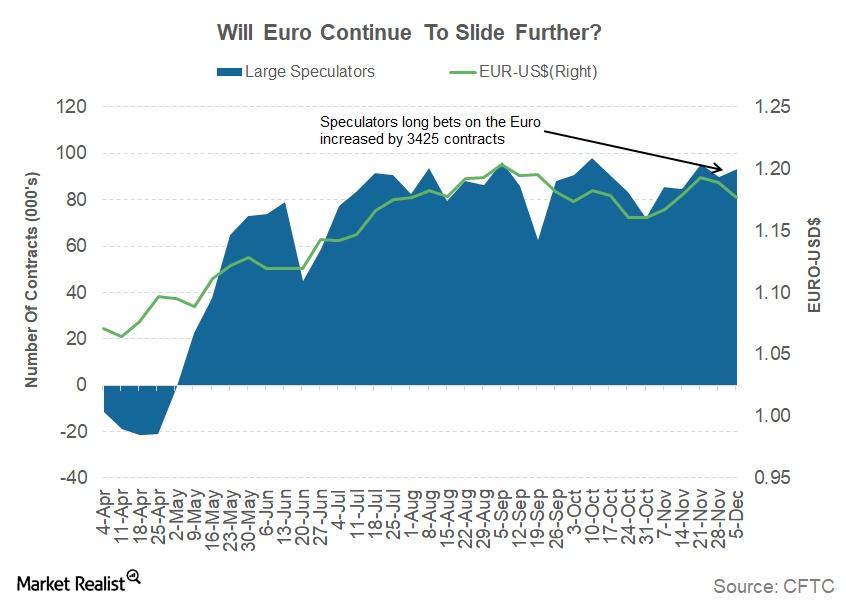

What Factors Are Driving the Euro Higher?

According to the January 12 Commitment of Traders report, speculators increased their long euro positions by 16,823 contracts last week.

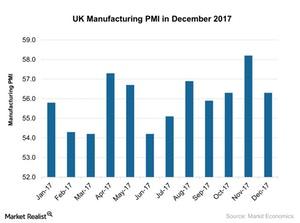

What UK Manufacturing Activity Indicates for the Economy

UK manufacturing activity in December Between November and December 2017, the UK manufacturing PMI (purchasing managers’ index) fell to 56.3 from 58.2 and missed the market expectation of 58. The index was mainly affected by the following: production output and volume improved at a slower rate new and export orders rose at a slower pace employment in the manufacturing sector slowed In […]

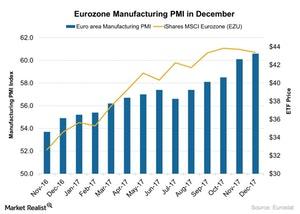

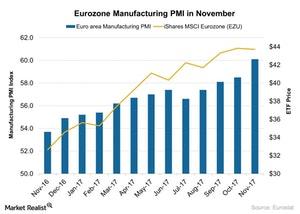

Eurozone Manufacturing Activity Reaches a High in December 2017

Eurozone manufacturing activity in December According to Markit Economics, the Eurozone’s manufacturing PMI (purchasing managers’ index) rose strongly in December 2017, to 60.6 from 60.1 in November 2017. It beat the market expectation of 60.4 and marked the strongest expansion in manufacturing activity since 1997. Major Eurozone members Germany (EWG) (DAX-INDEX), France (EWQ), Spain (EWP), and Italy […]

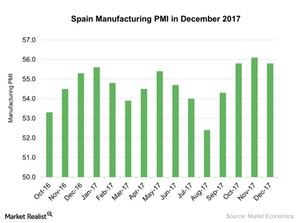

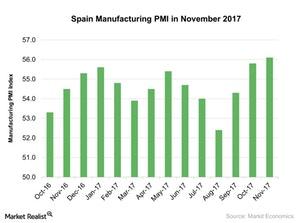

A Look at Spain’s Manufacturing Activity in December 2017

Spain’s manufacturing activity in December According to Markit Economics, Spain’s manufacturing PMI (purchasing managers’ index) rose to 55.8 in December 2017 from 56.1 in November. Whereas the index had reached an 11-year high in November, in December, it missed the market estimate of 56.4. Despite the lower PMI figure, manufacturing activity remained strong. Spain’s manufacturing PMI performance in […]

Factors That Are Driving the Euro Higher

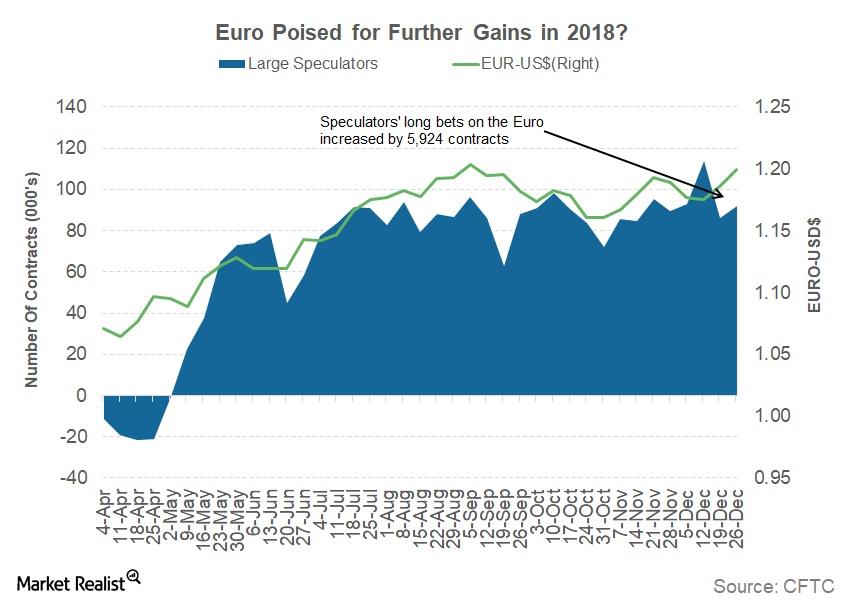

The euro appreciated 0.27% against the US dollar (UUP) after posting double-digit gains against the US dollar in 2017.

What to Make of the Surprising Gains in the Euro in 2017

The euro–dollar (FXE) pair closed 2017 at 1.1998. It appreciated by 13% against the US dollar and posted close to 10% gains against the other major global currencies.

How Is Novo Nordisk’s New Generation Insulin Segment Positioned after 3Q17?

In 3Q17, Novo Nordisk’s (NVO) new generation insulin generated revenues of 2.1 billion Danish krone (or DKK), which reflected ~93% growth on a year-over-year (or YoY) basis.

Germany ZEW Economic Sentiment Index in December 2017

According to the Centre for European Economic Research (or ZEW), the Germany ZEW Economic Sentiment Index is at 17.4 so far in December 2017.

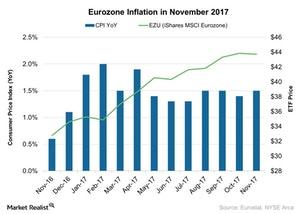

Can Rising Eurozone Inflation Make European Central Bank Hawkish?

According to Eurostat, on a year-over-year basis, inflation in the Eurozone (VGK) (IEV) (EZU) was 1.5% in November 2017 compared to 1.4% in October 2017.

Here’s What Drove the Euro Higher Last Week

The euro (FXE) closed the week ended December 22, 2017, at 1.1864, appreciating 0.94% against the dollar (UUP).

What Drove the Euro Higher Last Week?

The total net speculative bullish positions on the euro (EUFX) increased from 93,106 contracts to 113,889 contracts in the previous week.

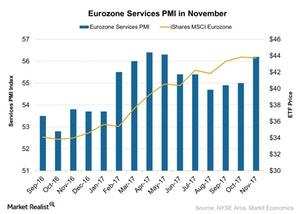

Eurozone Services PMI: Why It Strengthened in November

The final Eurozone Services PMI stood at 56.2 in November compared to 55.0 in October. It met the preliminary market estimate of 56.2.

France Services PMI: Solid Expansion in November 2017

The final France Services PMI stood at 60.4 in November compared to 57.3 in October. It beat the initial estimate of 60.2.

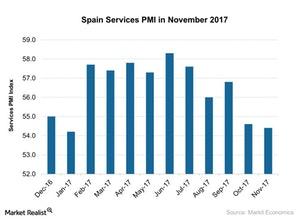

Insights into the Spain Services PMI for November 2017

The final Spain Services PMI stood at 56.1 in November compared to 55.8 in October. It didn’t beat the preliminary market estimate of 56.5.

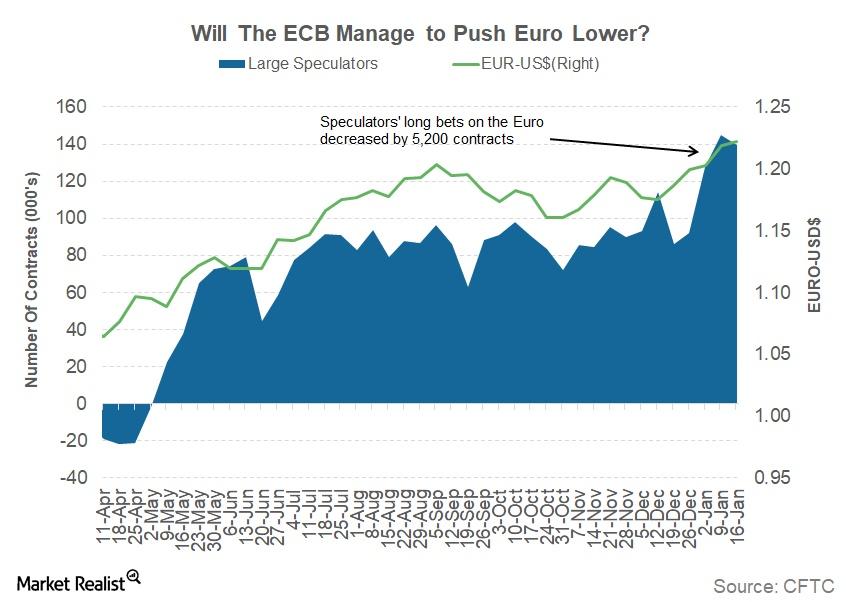

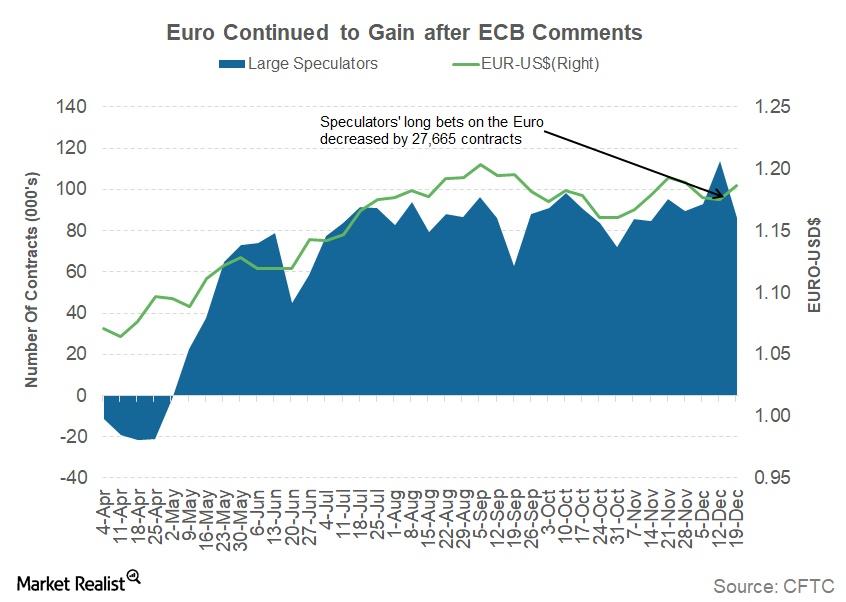

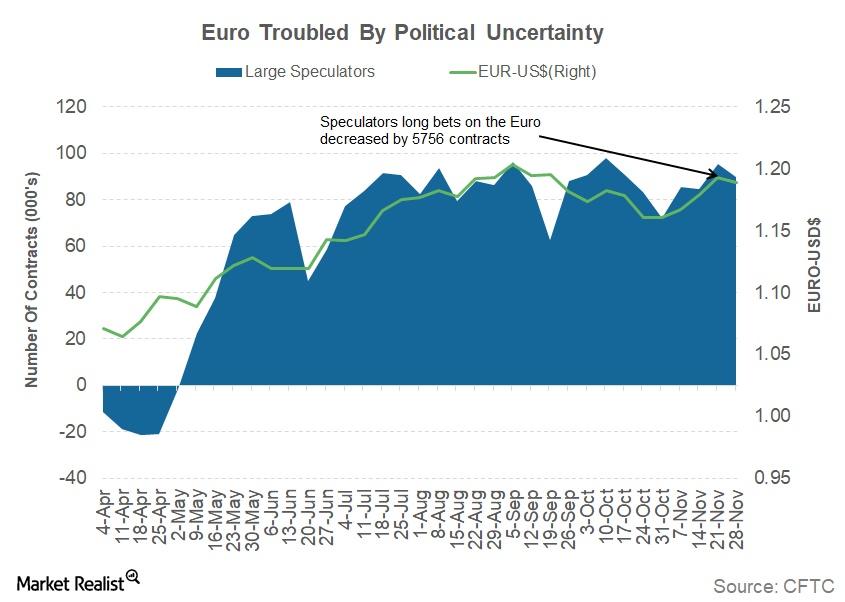

Why the Euro Continued to Fall Last Week

The euro-dollar (FXE) closed the week ending December 8 at 1.18, depreciating by 1.1% against the US dollar (UUP).

Spain’s Manufacturing Activity Recovers

Spain’s manufacturing data According to Markit Economics, Spain’s manufacturing PMI (purchasing managers’ index) score rose to 56.1 in November 2017 from 55.8 in October 2017. Although the PMI figure didn’t beat the preliminary estimate of 56.5, it marked the fastest expansion seen since February 2007. Spain’s stronger manufacturing PMI performance was mainly due to increases in the following: improved […]

Eurozone Manufacturing Rises at a Higher Rate in November

Eurozone manufacturing data The Eurozone’s manufacturing PMI (purchasing managers’ index) stood at 60.1 in November, compared with 58.5 in October 2017, according to Markit Economics. The reading met the preliminary estimate of 60. Eurozone manufacturing activity rose due to increases in the following: production output new orders and export orders employment Production output and new order levels reached […]

France’s Manufacturing Data Shows Robust Growth in November

France’s manufacturing purchasing managers’ index According to IHS Markit, France’s final manufacturing PMI (purchasing managers’ index) stood at 57.7 in November 2017, compared with 56.1 in October 2017. The preliminary market expectation was 57.5. Factory activity was at its highest in seven years. Why manufacturing activity rose France’s manufacturing PMI score rose due to the following […]

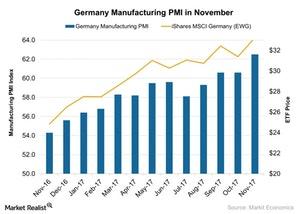

Germany’s Manufacturing Growth Signals Stronger Business Climate

Germany’s manufacturing data in November Germany’s final manufacturing PMI (purchasing managers’ index) stood at 62.5 in November, compared with 60.6 in October 2017, according to Markit Economics. The November reading met the preliminary estimate of 62.5, and was the second-highest score since February 2011. Germany’s (DAX-INDEX) manufacturing PMI score improved due to increases in the following: new orders exports employment […]

Are Politics Holding the Euro Back?

The euro-dollar (FXE) closed the week ending December 1 at 1.19, depreciating by 0.33% against the US dollar (UUP).

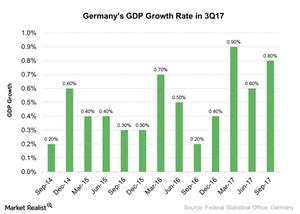

Germany’s GDP at 0.8% in 3Q17: Will It Raise Investor Sentiment?

According to a report by the Federal Statistical Office, Germany’s GDP growth rate was 0.8% in the third quarter of 2017 compared to 0.6% growth in the second quarter of 2017.

Is Improving Eurozone Inflation Minimizing Deflation Risk?

On a year-over-year basis, the Eurozone inflation index was 1.4% in October compared to 1.5% in September 2017, according to data provided by Eurostat.

A Look at Key Economic Indicators Released Last Week

In this series, we’ll take a look at US inflation, US retail sales, and China’s retail sales for October 2017. We’ll also analyze some economic indexes and the Eurozone’s consumer confidence in November 2017.