iShares Core S&P 500

Latest iShares Core S&P 500 News and Updates

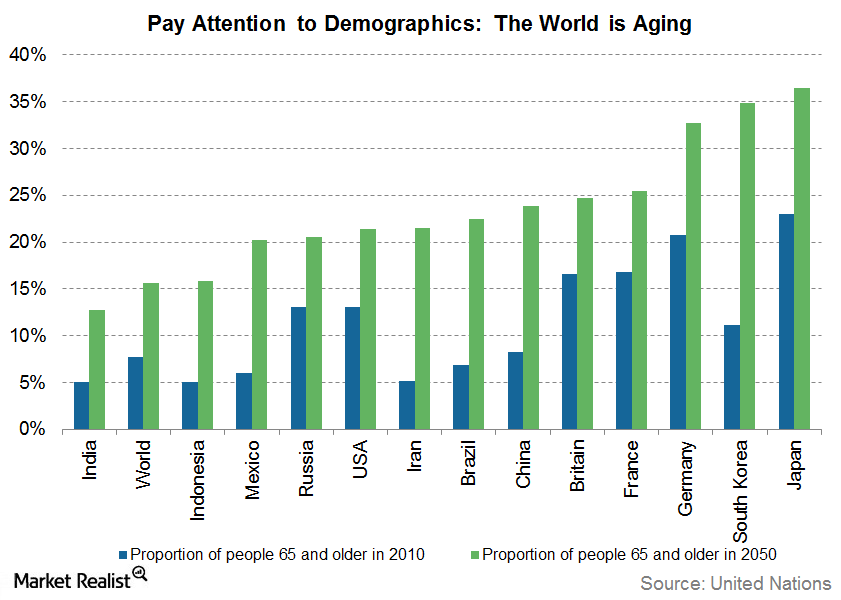

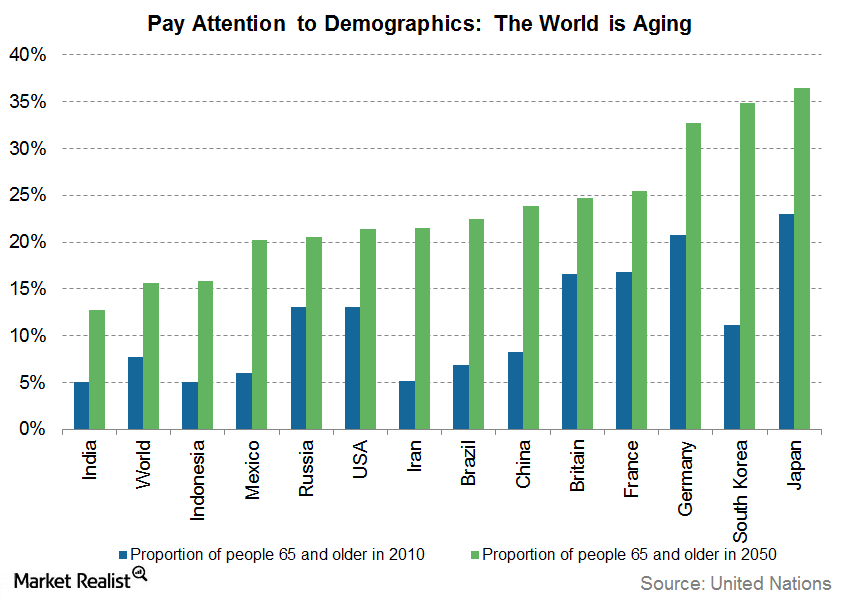

The Longevity Phenomenon: Impact on the World

The longevity phenomenon has given rise to a unique problem. The world’s population is aging rapidly, which could have a negative impact on productivity and growth rates.

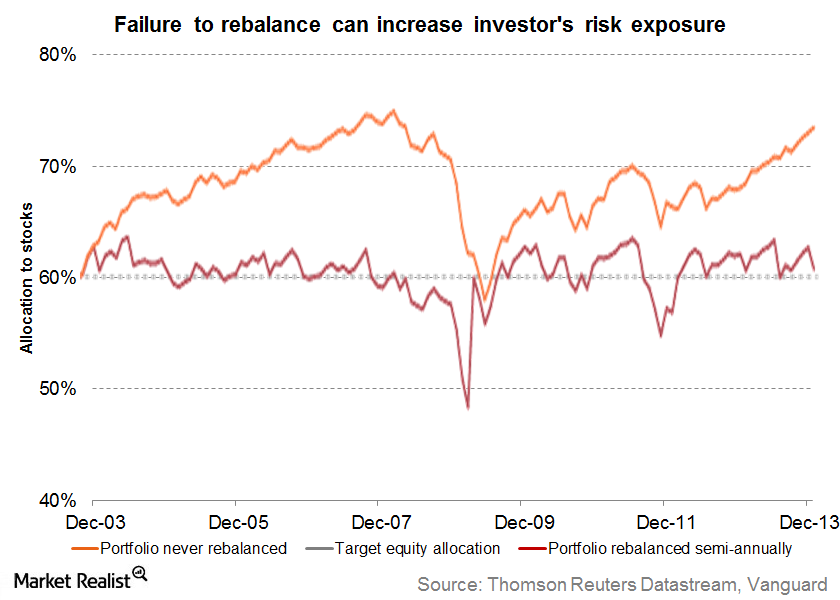

The Importance of Rebalancing Your Portfolio

Rebalancing your portfolio means bringing the portfolio back to the asset allocation levels specified in the financial plan. Not rebalancing can expose you to higher risk.

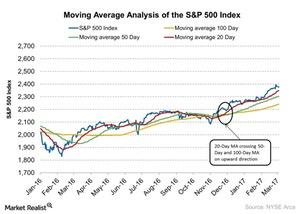

What S&P 500 Index Moving Averages Could Indicate

The S&P 500 Index is trading 1.2% above its 20-day moving average and 6% above its 100-day moving average.

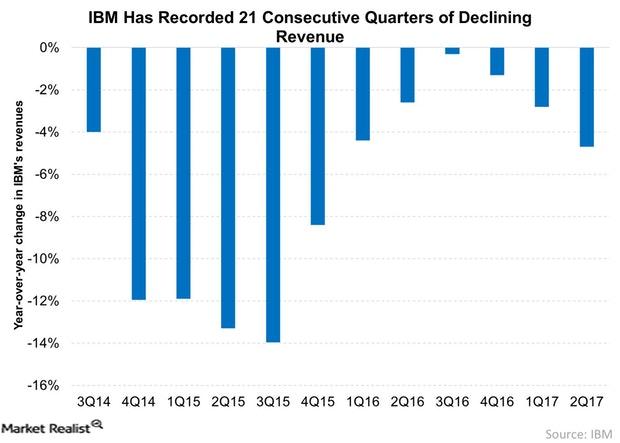

Why IBM’s Earnings Could Fall Going Forward

International Business Machines (IBM) reported its 2Q17 results on Tuesday, July 18. The company reported falling quarterly profits and sales yet again.

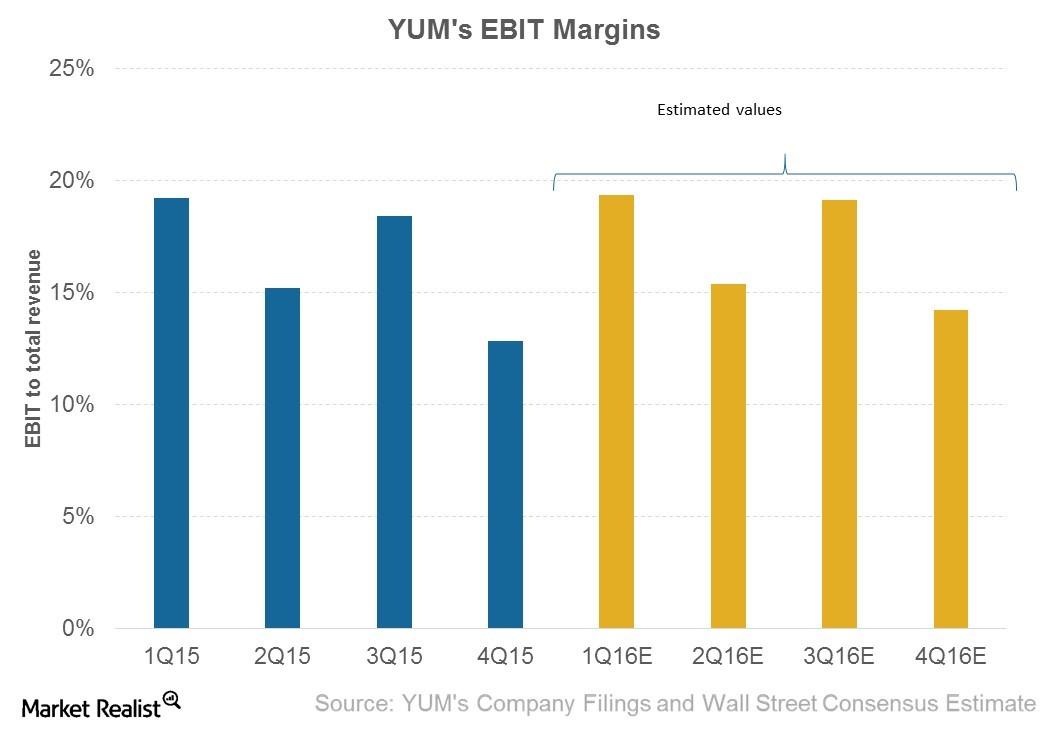

Could Yum! Brands’ Margins Increase in 1Q16?

With positive same-store sales growth expected in all three of YUM’s divisions, analysts are expecting the leverage to improve the company’s margins.

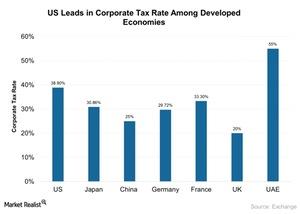

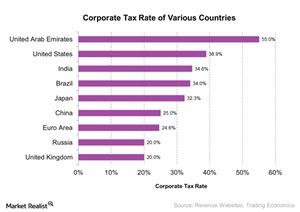

Inside the Market’s View of Corporate Tax Cuts

Are markets upbeat on potential tax reforms? The markets (SPY) (IVV) surged last week with the announcement of a phenomenal update on the corporate tax cut. The S&P and Nasdaq Comp gained ~2% in the week ended February 10, 2017. The Trump administration’s proposed tax cut is likely to boost the economy, though analysts have […]

Will We See a Recession within the Next 2 Years?

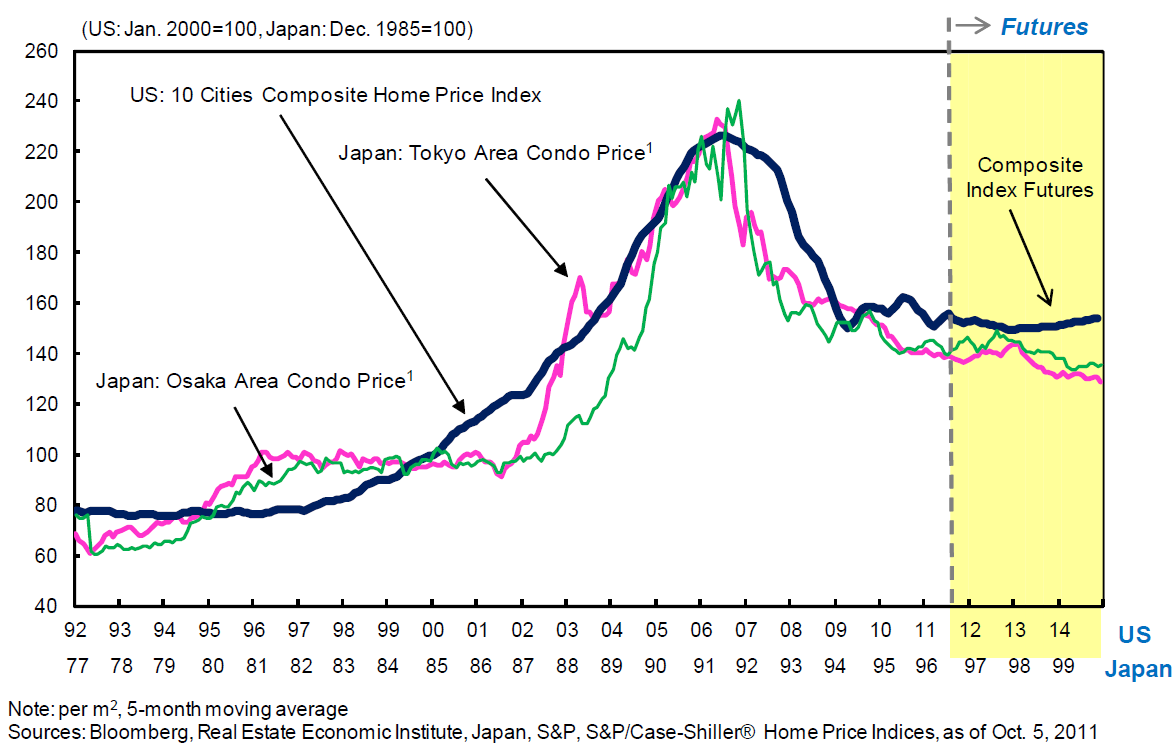

In a recent interview, Jim Rogers said, “I’m on record as saying that we’re going to have a recession certainly within a year or two.”Real Estate Why the housing market impacts consumption and equity investors

This article considers the importance of investment, including residential investment, in the support of U.S. consumption data and the implications for investors.

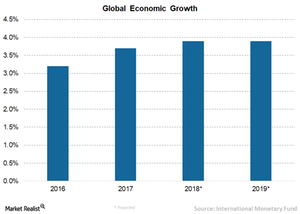

Are Tougher Days ahead for Global Equities?

The IMF revealed that emerging Asia is expected to grow ~6.5% in 2018 and 2019.

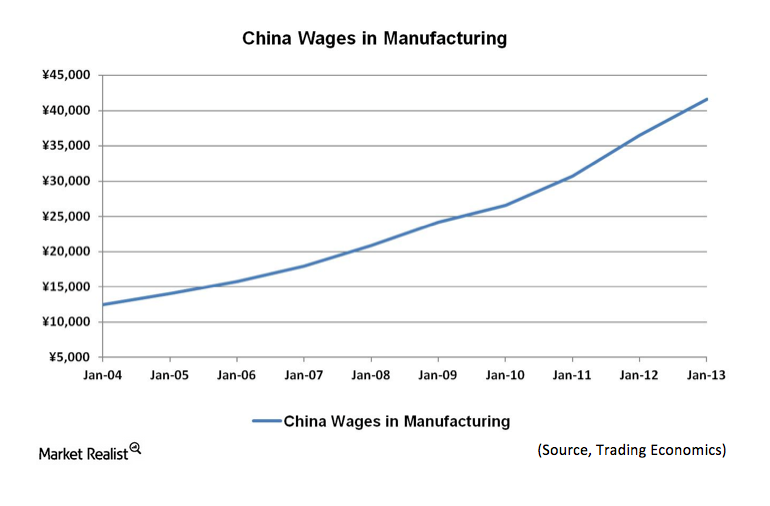

China’s wage inflation: Bad news for corporate profits and banks

Wage inflation in Chinese manufacturing With an appreciating currency and growing economy, Chinese manufacturers have experienced wage inflation. The cost of Chinese labor is simply becoming more expensive, as the below graph indicates. Private sector wage growth in China was 14% in 2012, while GDP growth is slowing to around 7.5% per annum. Wages are […]

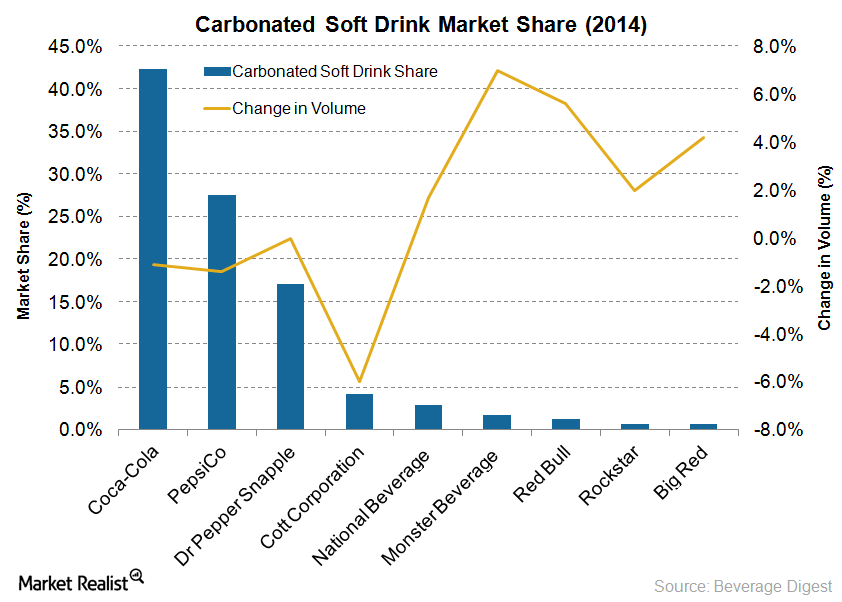

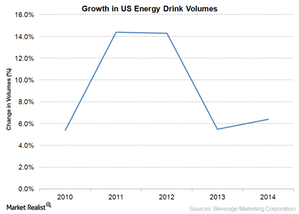

Energy Drinks Outperform Soda Drinks in Case-Volume Growth

An interesting development in the energy drinks industry is Monster Beverage’s strategic deal with Coca-Cola. The deal will expand Monster Beverage’s product line-up.

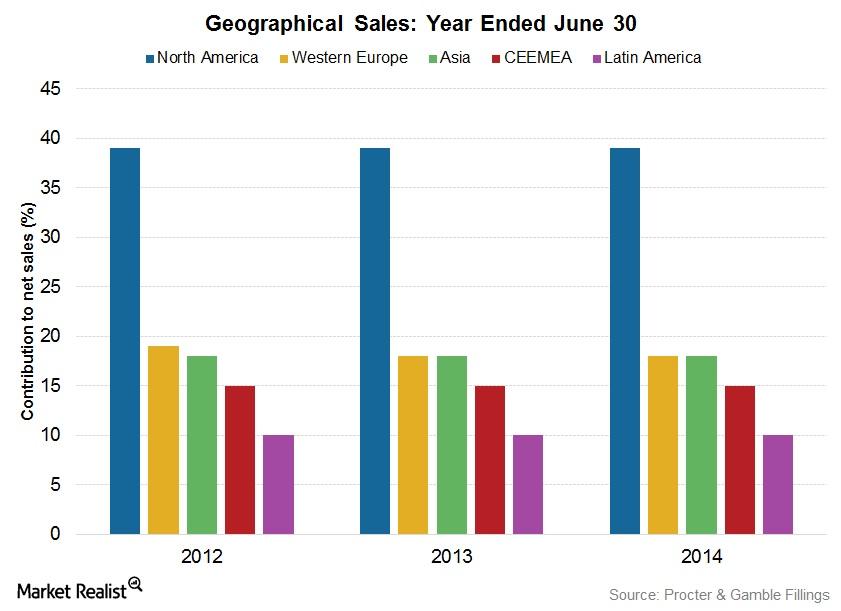

Procter & Gamble: Global Giant in Household, Personal Products

The Procter & Gamble Company, or P&G, is the largest household and personal products company in the world. It was established in 1837 by William Procter and James Gamble.

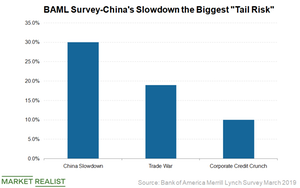

Markets Look at US-China Trade Talks as Slowdown Concerns Multiply

Today, another round of trade talks started in Beijing.

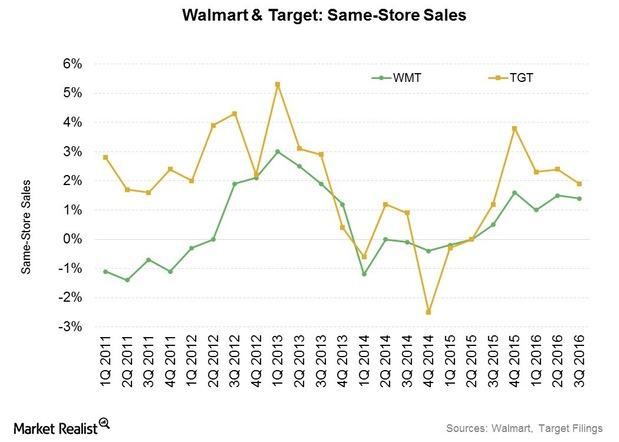

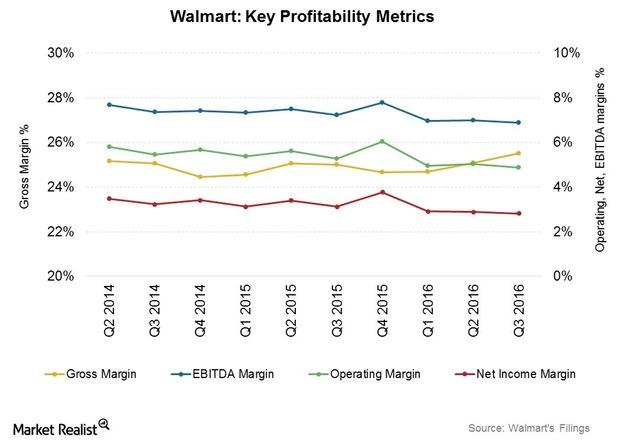

Why Walmart and Target Saw Same-Store Sales Growth in 3Q16

Same-store sales growth came in at 1.5% in 3Q16 for Walmart US compared to 0.4% in 3Q15. Target’s (TGT) same-store sales grew 1.9% in 3Q16, driven by both higher traffic and transaction size.

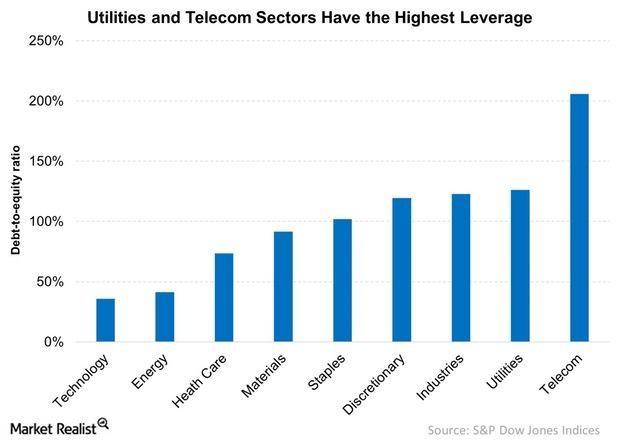

How a Rate Hike Could Affect High-Leverage Sectors

Industrials, utilities, and telecommunications have much higher leverage, as these sectors have massive capital needs.

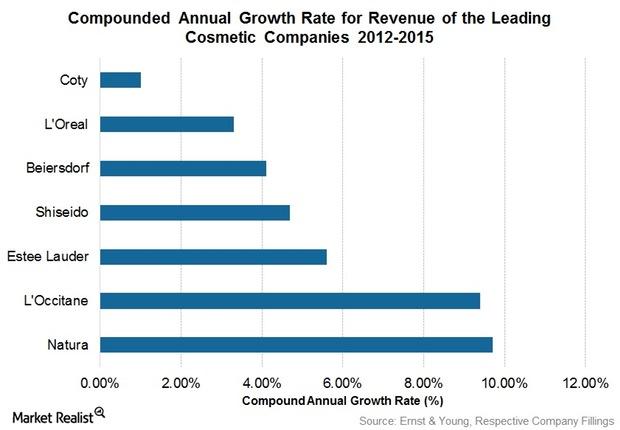

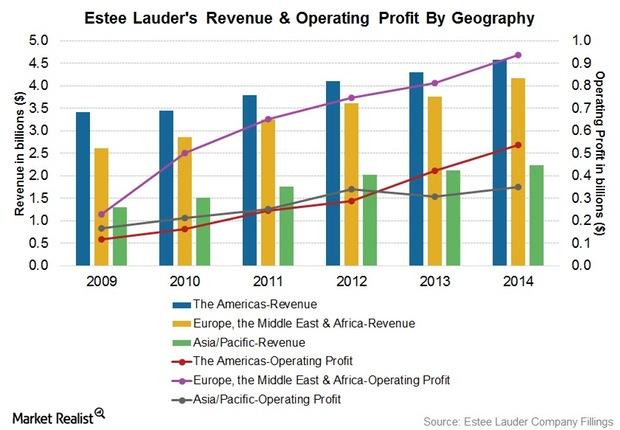

Why Estée Lauder’s Margins and Profitability Are Rising

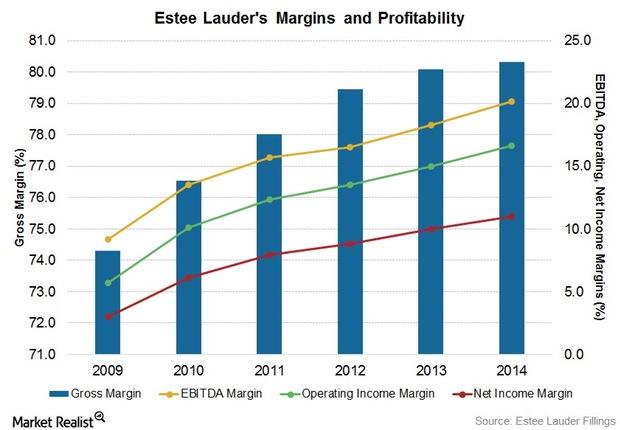

Despite currency headwinds, Estée Lauder’s (EL) worldwide gross profit margin increased to 80.3% in fiscal 2014 from 80.1% in fiscal 2013.

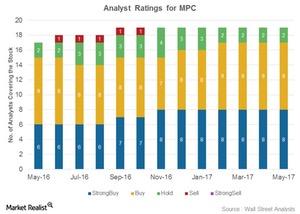

Why Most Analysts Are Calling Marathon Petroleum a ‘Buy’

Marathon Petroleum (MPC) has been rated by 19 Wall Street analysts. Seventeen analysts (or 89%) have rated it as a “buy” so far in May 2017.

Mead Johnson Plans to Focus on R&D to Support Innovations

Mead Johnson follows a strategy of investments in innovation, having expanded its liquids portfolio and rolled out its key specialty formulas across Asia.

Mintel Forecasts Strong Growth in the US Energy Drink Market

The US energy drink and shots market grew by 56% between 2009 and 2014, even though the category was entangled in litigation and had negative publicity.

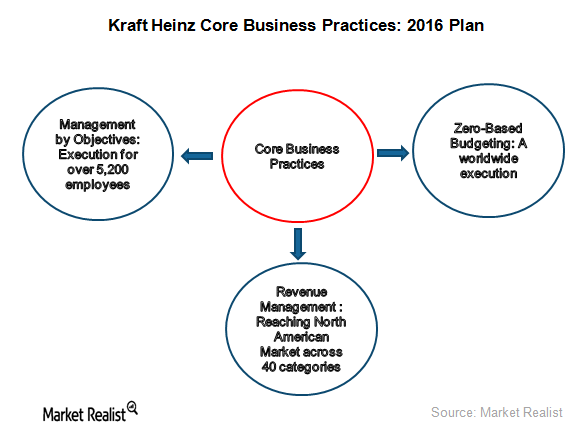

Evaluating Kraft Heinz’s Core Business Strategies

Kraft Heinz is focusing on core business practices, including ZBB (zero-based budgeting), revenue management, and MBO (management by objectives).

Beyond the Ephemeral: Pay Attention to Demographics

Lost in all the chatter about interest rates is a structural phenomenon that may be of far greater significance: demographics.

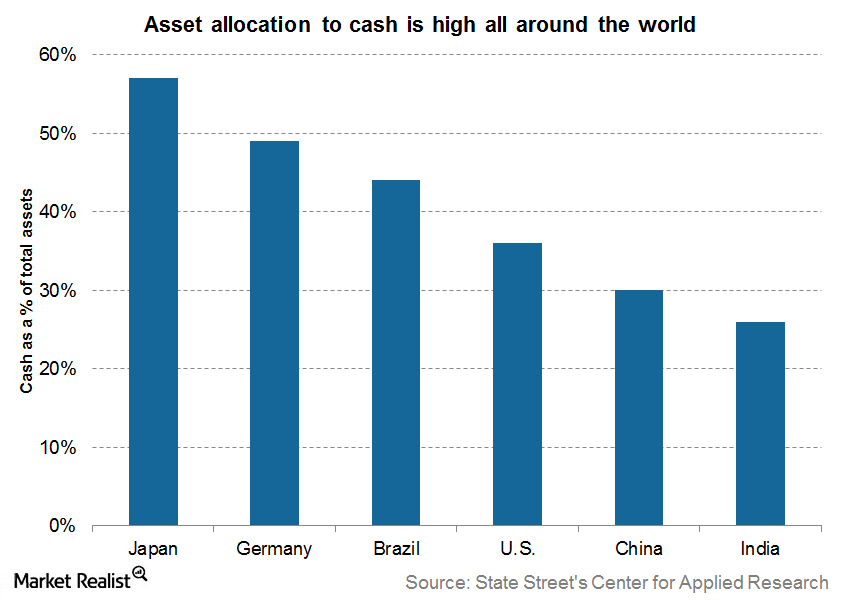

What Should Be The “Right Amount” of Cash Allocation?

If you’re preparing your portfolio for the short term, the allocation to cash should be high. As the horizon increases, allocation to cash should go down.Technology & Communications Why you should know the key differences between job reports

Few economic releases elicit as much reaction from both the stock (IVV) and bond (BND) markets as the employment reports issued by Automatic Data Processing (ADP) and the Bureau of Labor Statistics (the BLS).

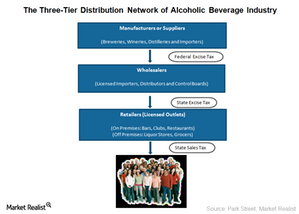

Alcoholic Beverage Industry Is Reluctant to Embrace E-Commerce

Manufacturers in the alcoholic beverage industry can’t sell directly to consumers due to a three-tier distribution system. This discourages them from having their own e-commerce channels.

Business Overview of Estée Lauder

Estée Lauder’s sales growth was ranked third-highest globally among leading cosmetic companies between the years 2012 to 2015, with net revenue of $11 billion in fiscal year 2014.

When Can You Expect Walmart’s Profitability Margins to Stabilize?

Despite the revenue headwinds we discussed in the previous part of this series, Walmart (WMT) expanded its gross margin by 21 basis points to 24.6% in the first three quarters of fiscal 2016.

Why we’re seeing a brand new housing bubble—Japan style

Residential investments in Japan The below graph reflects the ongoing decline in the rate at which residential investments are being made in Japan. As with other forms of fixed investment noted earlier in this series, Japan has seen a long-term decline in the housing market since the peak of the economic bubble, which was accompanied […]

Estée Lauder’s Efforts to Expand Its Geographical Presence

Estée Lauder aims to expand its geographical market share in China, the Middle East, Eastern Europe, Brazil, and South Africa by focusing on consumers who purchase in travel retail channels.Financials Financial intermediation, systemic risks, and “too big to fail”

When financial intermediaries allocate funds, they assess the risks and returns that come from various risky claims. Intermediaries help allocate resources and risks throughout the economy. Financial intermediation can result in concentrated risks. The risks increase the financial system’s fragile state. These risks are called systemic risks.

We’re in ‘an Environment of Abnormally Slow Growth,’ Says Dalio

This isn’t a normal business cycle Billionaire hedge fund manager Seth Klarman said, “the stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” Ray Dalio believes that this isn’t a normal business cycle. In our April 2015 series Business Cycle Investing: What Should You Look […]

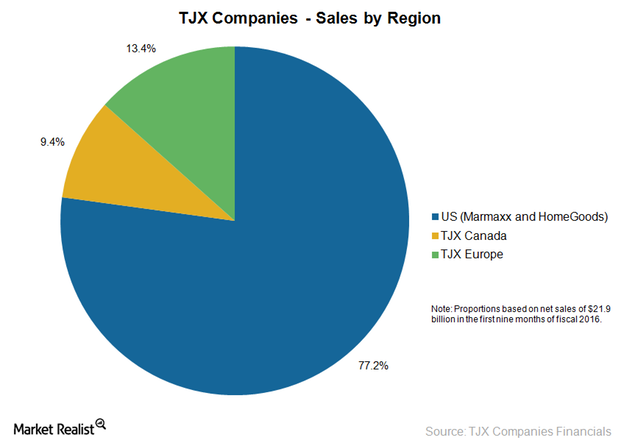

TJX Companies’ HomeGoods Segment Impressed in Fiscal 3Q16

TJX Companies’ HomeGoods segment reported strong same-store sales growth of 6%. The segment’s net sales grew by 12.8% to $959.8 million in 3Q16.

Nike’s Outlook: Category Offense All the Way

Consensus Wall Street analyst estimates project Nike’s adjusted diluted EPS to be $3.58 in fiscal 2015, an increase of 19.7% over the previous year.

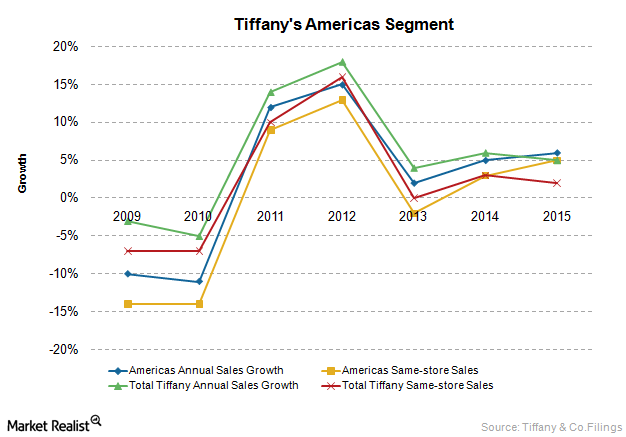

Analyzing Tiffany’s Largest Segment: The Americas

Tiffany & Co.’s Americas segment includes sales from company-operated retail stores in the United States, Canada, Mexico, and Brazil.

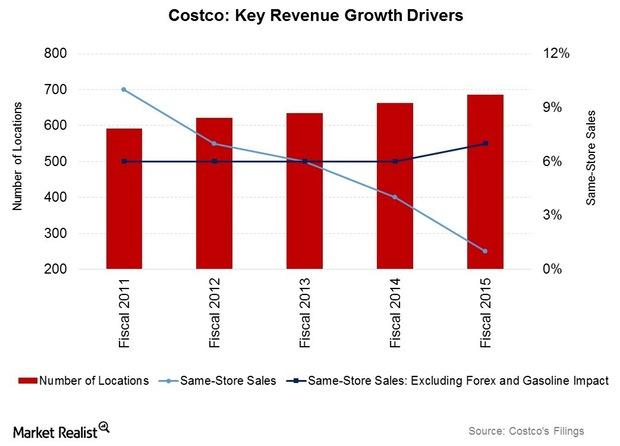

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.Financials Key differences between PCE and CPI as inflation measures

The CPI and PCE are both important indicators of U.S. inflation. CPI is more important from an individual perspective, while PCE is more important for monetary policy.

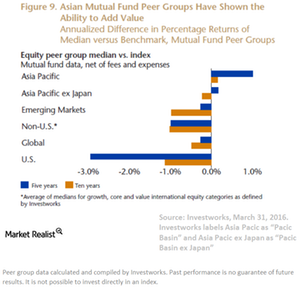

Asian Markets Could Generate Higher Returns

In the short term, Asian benchmarks and ETFs have also performed better than US-focused funds.

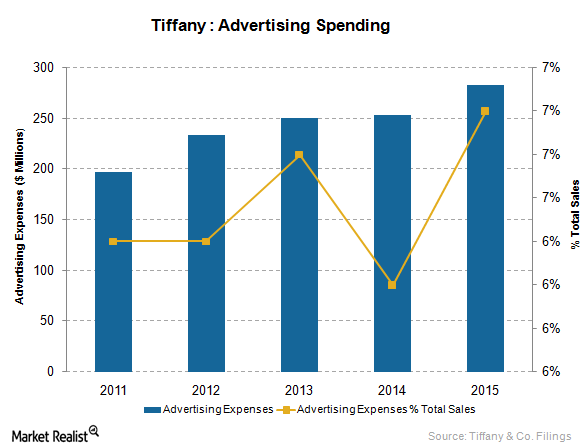

Why Tiffany Is Spending More on Marketing

Tiffany has been increasing its advertising expenses. In fiscal 2015, it spent $284 million on advertising, marketing, and public and media relations.

Which International Opportunities Is Lowe’s Betting On?

Lowe’s (LOW) operates stores in the select international markets of Canada and Mexico.

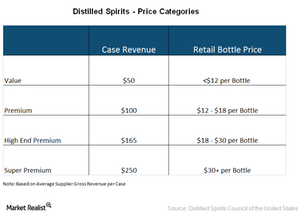

Demand for Expensive Liquor Is Growing

The performance of liquor business in 2014 reflects the premiumization trend, or a preference for better, premium, or expensive liquor brands.

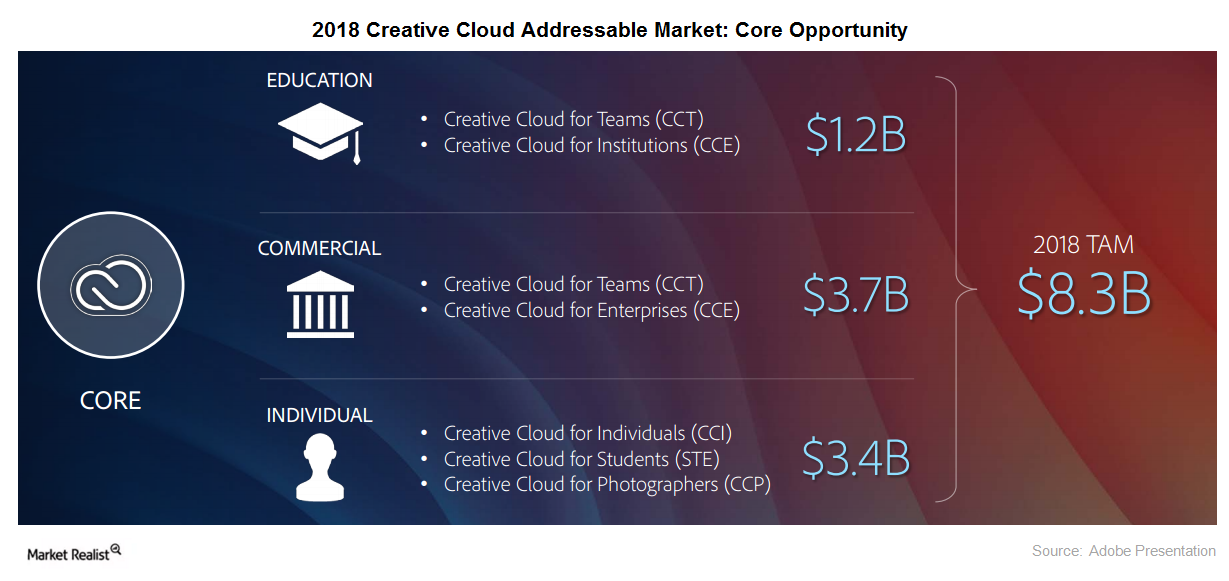

What Enabled Adobe to Raise Its Digital Media ARR?

The continued migration of Creative Suite and the addition of new Creative Cloud subscriptions contributed towards Adobe’s subscription growth.

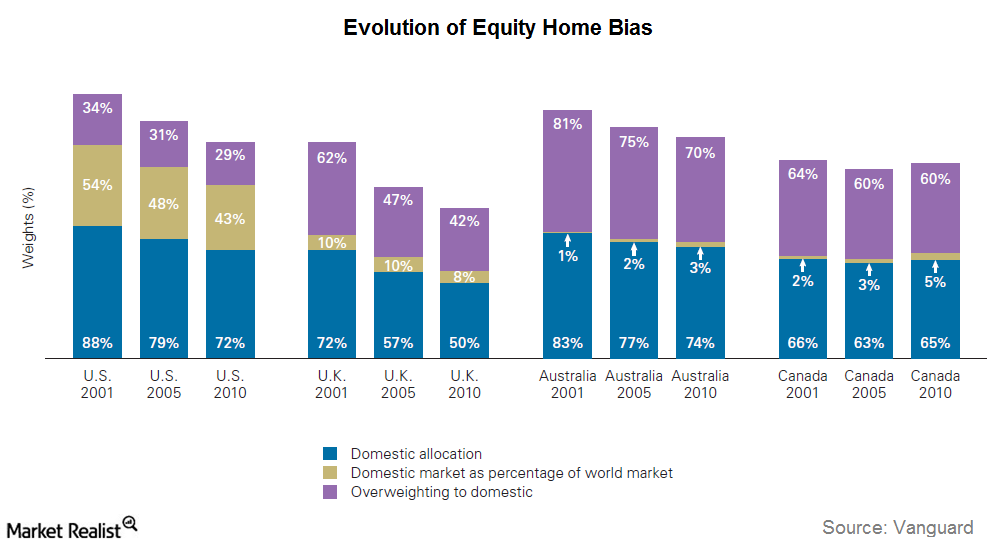

The Equity Home Bias Puzzle

In this series, we’ll look at the prevalence of home bias, the disadvantages of favoring home bias, and the benefits of international diversification.

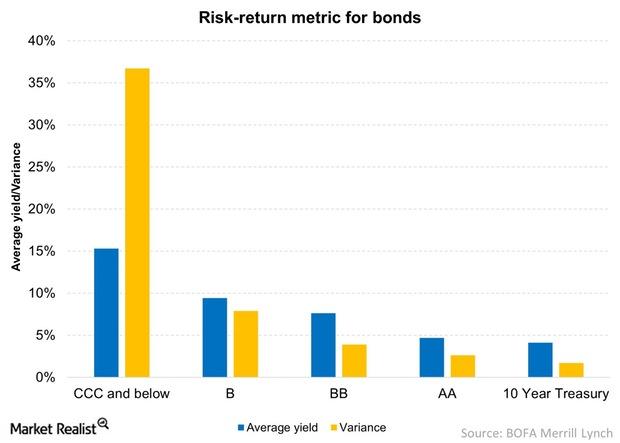

How Various Asset Classes Compare Using The Risk-Return Metric

The risk-return metric for ten-year Treasuries (IEF) are lowest, but also the safest, with a paltry 1.3% volatility and with an average yield of 4.1%.

Will Fox’s ‘Biggest Story of 2016’ Be Important Driver for 2017?

On Friday, December 30, 2016, Fox Business Network’s David Asman, Dagen McDowell, and Lauren Simonetti talked about the “biggest business story of 2016.”

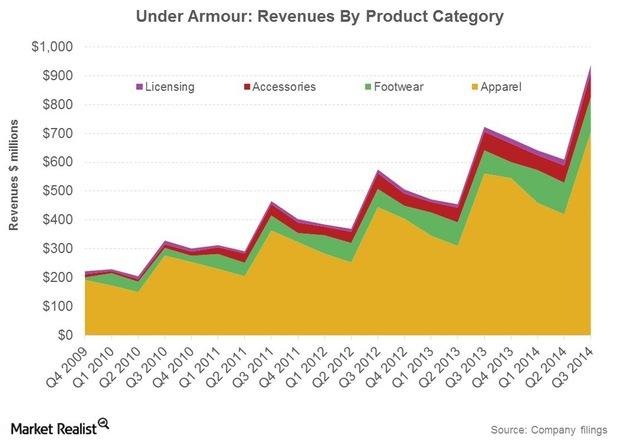

Under Armour: The Nature Of Its Business, Product Portfolio

UA’s product, marketing, and sales teams each play an active role in the design process. This collaboration helps control brand and product consistency.

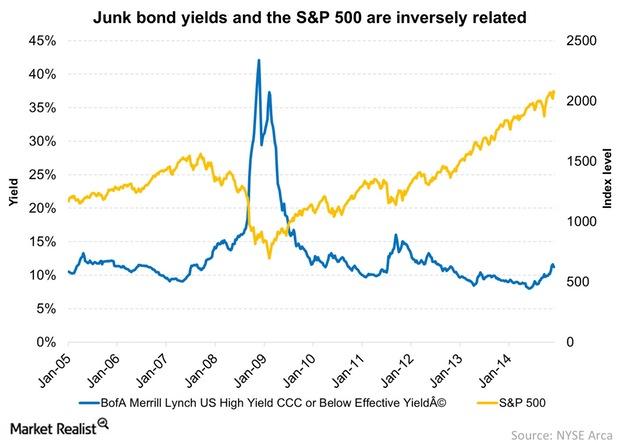

Connection Between Equities And High Yield Bonds

Equities and high yield bonds perform well when the economy is improving, and both underperform when the economy is slumping.Financials How close is the FOMC to achieving its dual mandate?

We’ve talked about the dual mandate and factors constraining the Federal Reserve from achieving this mandate. Let’s now assess how close the Fed has come to achieving its macroeconomic objectives.Materials Is gold no longer an inflation hedge?

Gold certainly can be an inflation hedge, and it has worked in the past. Obviously, one of the reasons gold has been weak of late is that people are becoming less concerned about inflation.Financials Key drivers affecting investment-grade bond funds flows

Bond yields and prices move in opposite directions. As a result, returns on high-quality corporate bonds were positive. This year, demand for U.S. investment-grade debt benefited from geopolitical tensions overseas and economic growth fears in the first quarter. This raised prices and lowered yields on high-quality corporate bonds.Financials Why you should pay attention to Scottish referendum opinion polls

As I write in my new weekly commentary, over the past two weeks, several polls have suggested a realistic chance that the people of Scotland will vote for independence in this week’s referendum.Financials Why Treasury auctions impact investors and financial markets

The purpose of Treasury auctions is to obtain financing from markets at the most competitive cost. The yield on these securities is determined through a public auction process. These yields affect the secondary market for U.S. Treasuries. Yields and bond prices move in opposite directions.