iShares Core S&P 500

Latest iShares Core S&P 500 News and Updates

Financials Why the banking sector is better, but with room for improvement

Russ explains the good news behind his upgrade of the global financial sector as well as the bad news keeping his sector outlook somewhat subdued.

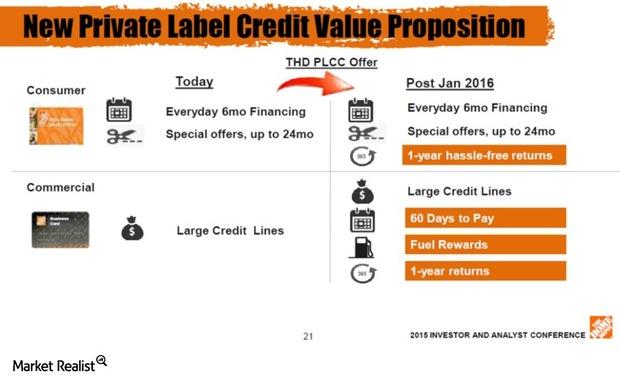

How Home Depot Drives Membership Loyalty With Pro Customers

The Home Depot’s (HD) focus on the pro customer allows the retailer to compete in the installations market and the product demand the services create.

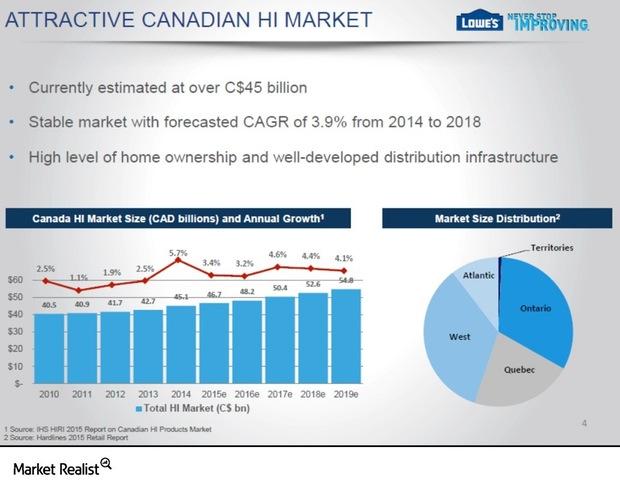

Market Share Play: Lowe’s Bid to Gain Scale in Canada with Rona

The Rona (RON.TO) acquisition should give Lowe’s (LOW) a market-leading position in Canada’s home improvement market, estimated at over $45 billion Canadian.

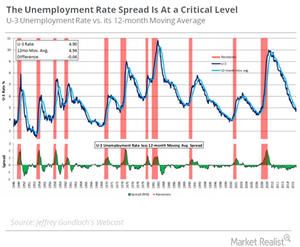

Gundlach Says This Chart Is ‘Early Warning Indicator’ of Recession

Jeffrey Gundlach seems quite bearish in his views about the US economy (IWM) (QQQ).

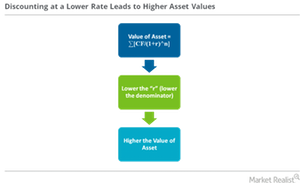

Ray Dalio: ‘Risks Are Asymmetric on the Downside’

“Risks are asymmetric on the downside” On the economy, Ray Dalio stated that “the risks are asymmetric on the downside, because asset prices are comparatively high at the same time there’s not an ability to ease.” Courtesy of the current global monetary policy’s low interest rates, asset prices are artificially inflated—so much so that they’ve […]

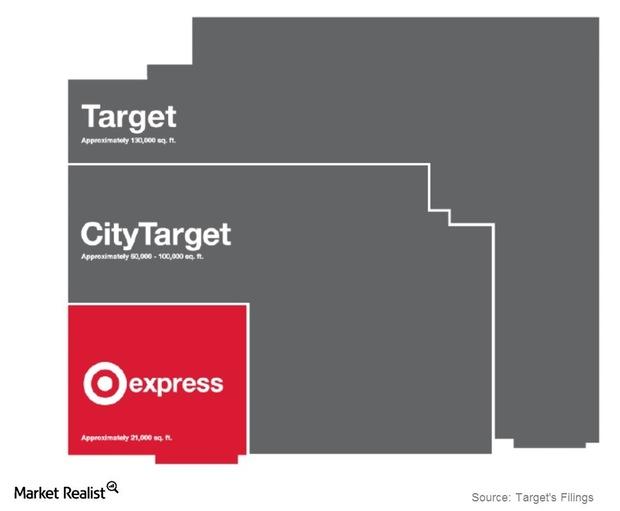

Why Target Is Looking at Flexible Format Stores in the US Market

Target operates 1,792 stores in the United States under multiple store formats. Its merchandise assortment differs by store, store location, and store size.

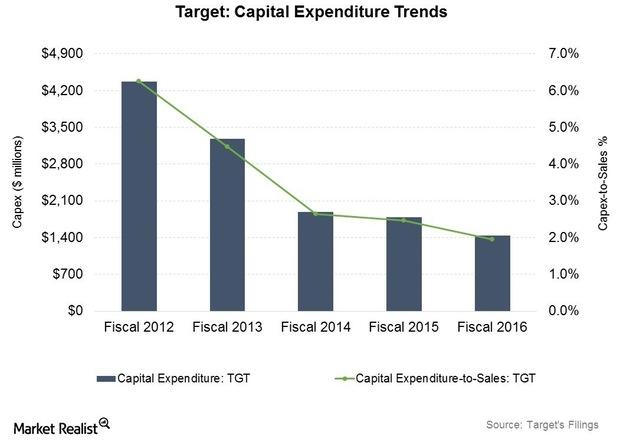

Where Is Target Spending the Bulk of Its Capital Expenditure?

Target (TGT) spent $1.4 billion on capital expenditure in fiscal 2016, representing about 2% of sales.

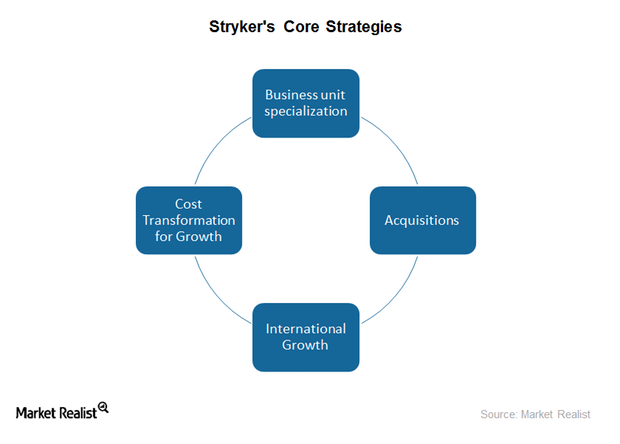

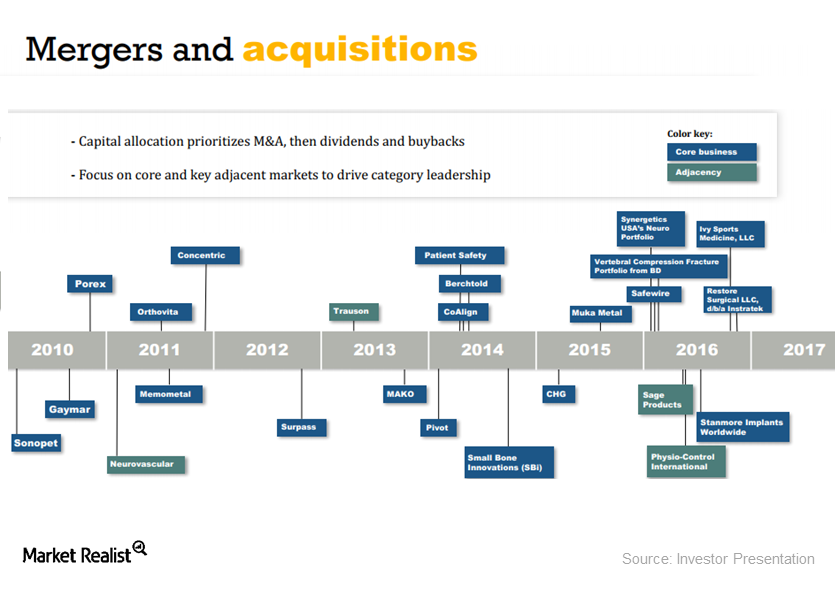

How Stryker’s Margins Are Driven by Its CTG Program

Cost transformation for growth (or CTG) is Stryker’s program that focuses on driving leveraged growth by structural cost optimization.

How Do Gold Miners’ Leverage Ratios Look?

Barrick has reduced its debt more than 57% in the last four years from $13.4 billion at the end of 2014 to $5.7 billion at the end of 2018.

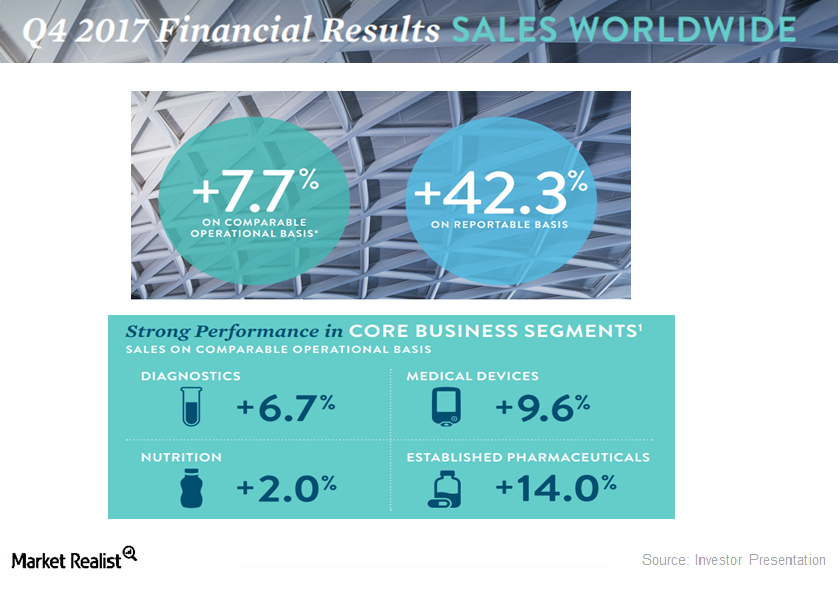

Inside Abbott Laboratories’ 4Q17 Earnings Results: Key Highlights

Abbott Laboratories (ABT) reported sales of $7.6 billion and adjusted diluted EPS (earnings per share) of $0.74 for fiscal 4Q17.

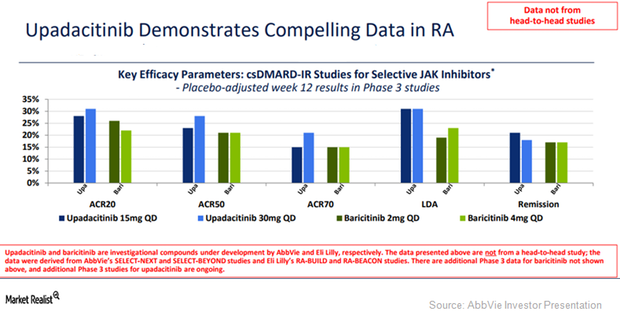

Why AbbVie’s Upadacitinib Keeps Posting Strong Data for Rheumatoid Arthritis

On December 20, 2017, AbbVie (ABBV) reported positive top-line results from its phase-3 trial Select-Monotherapy.

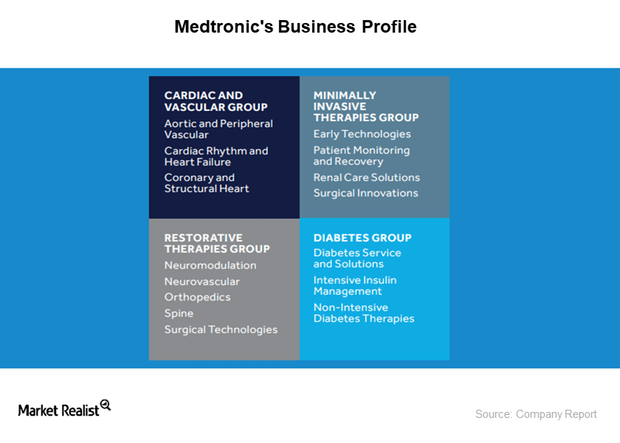

Discussing the Recent Management Changes at Medtronic

On December 20, 12 of 24 analysts surveyed by Reuters rated Medtronic (MDT) stock as a “buy,” and the remaining 12 analysts recommended a “hold.” There were no “sell” ratings given to MDT stock.

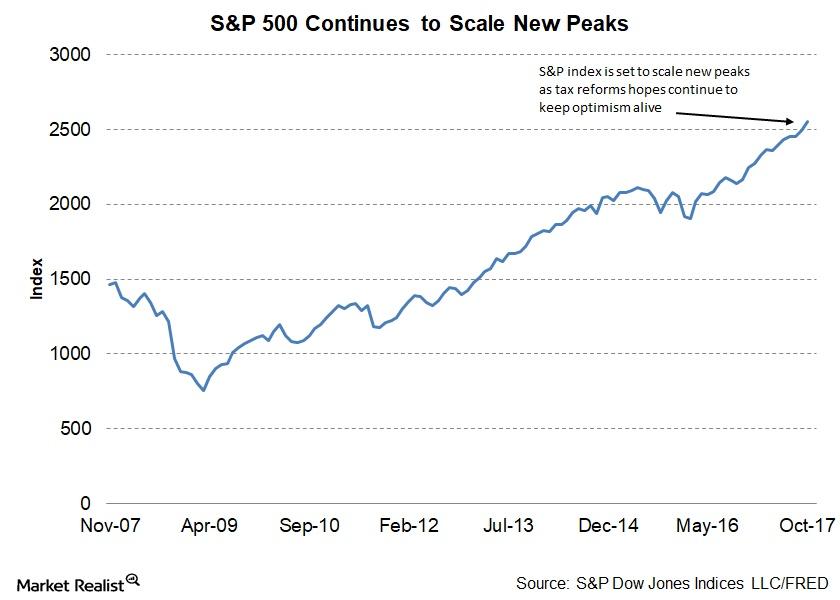

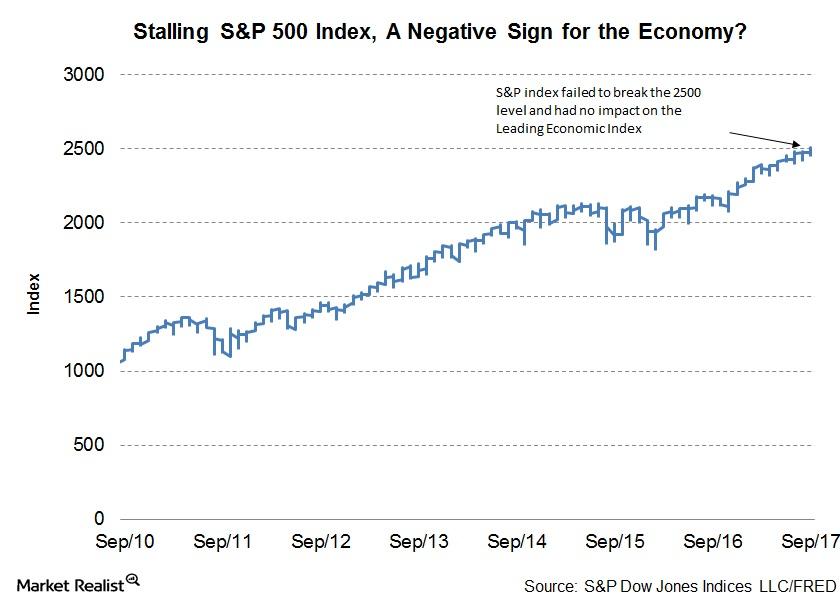

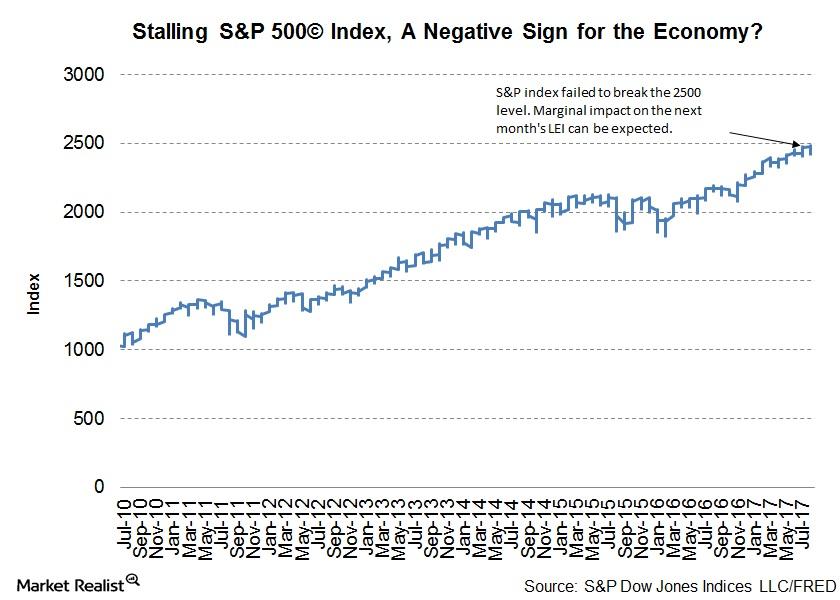

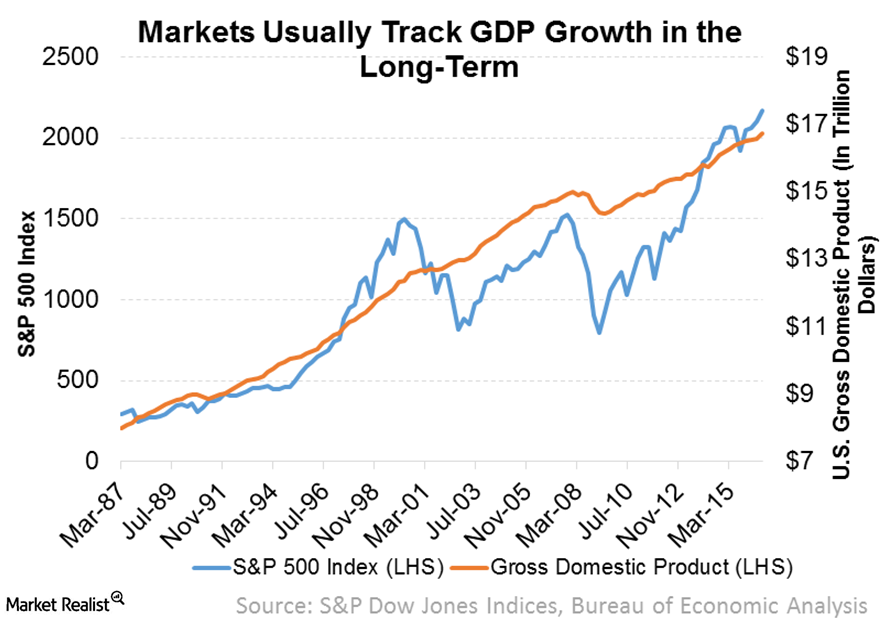

Why the S&P 500 Index Is Considered a Leading Indicator

The S&P 500 Index has risen 2.2% in October and is en route to its eighth straight positive monthly close.

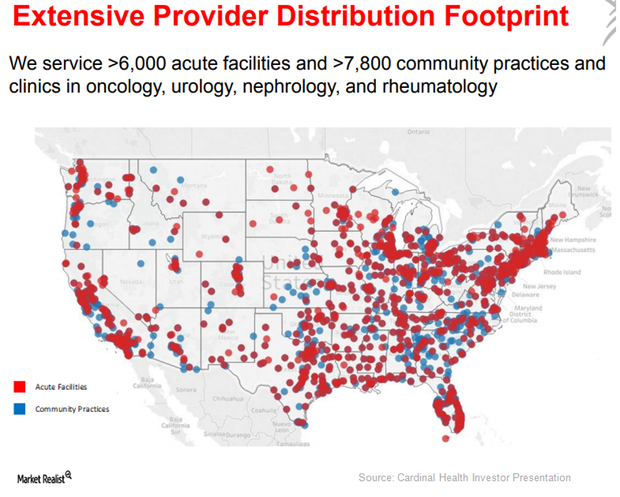

Robust Growth Expected for Cardinal Health’s Specialty Solutions

Cardinal Health’s (CAH) Specialty Solutions segment provides two types of services: upstream to pharmaceutical and biopharmaceutical manufacturers and downstream to healthcare providers.

The Link between the S&P 500 and the Leading Economic Index

The S&P 500 is stuck The S&P 500 (IVV) index has been stuck near the 2,500 level for more than a month now. The recent war of words between US president Donald Trump and North Korean foreign minister Ri Yong Ho has increased risk aversion. However, the index has been resilient despite the rise in volatility. […]

Stryker Stock Falls Due to the Impact of the Sage Products Recall

On August 23, Stryker (SYK) announced a voluntary product recall of specific lots of oral care products that form part of the company’s Sage business unit.

Could the S&P 500’s Stalled Ascent Derail Economic Expansion?

The risk scenario The S&P 500’s rally has stalled just shy of 2,500. Investors are drawn to to riskier assets such as equities when they expect further expansion in the economy. The S&P 500 (SPY), which comprises the 500 largest stocks in the United States, is a constituent of the Conference Board Leading Economic Index […]

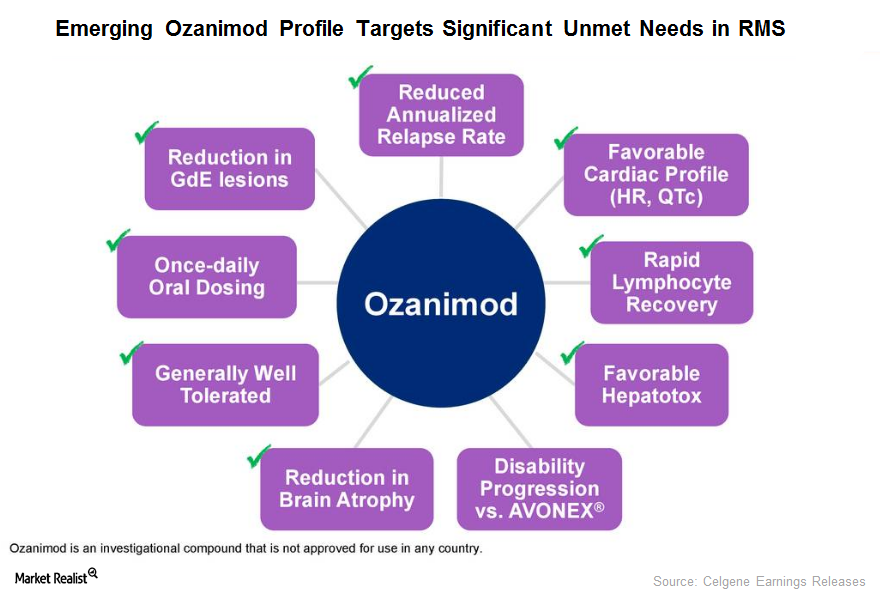

Ozanimod Could Drive Celgene’s Long-Term Growth

The Phase 3 RADIANCE trial enrolled 1,313 RMS patients and conducted the trial in 21 countries.

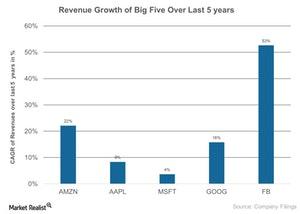

Why Big Five Tech Companies Could Keep Dominating Markets

The big technology companies (XLK) are expected to continue dominating the markets (SPY) (QQQ) thanks to their size, innovations, acquisitions, and investments in 2017.

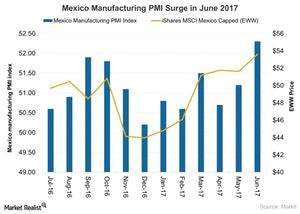

What Drove the Rise in Mexico’s Manufacturing Activity in June?

Mexico’s manufacturing activity posted a strong performance after its output, new orders, and employment picked up the pace in June 2017.

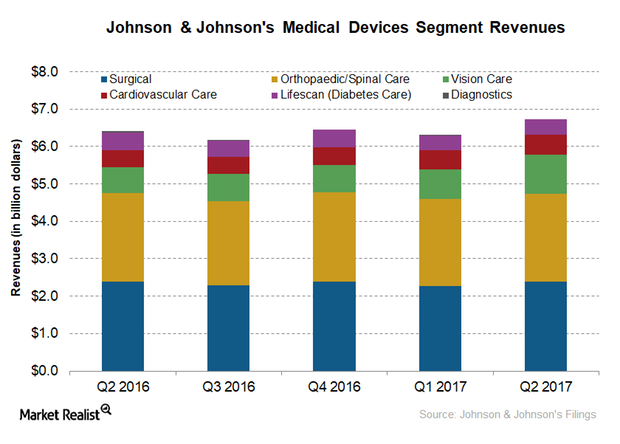

Behind the Major Drivers of JNJ’s Medical Device Growth

Johnson & Johnson (JNJ) reported Medical Devices segment sales of ~$6.7 billion in 2Q17, compared with $6.4 billion in 2Q16.

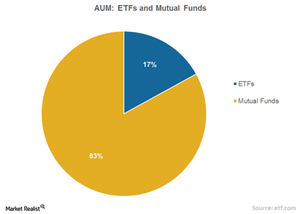

Why ETFs Are Seeing Increased Popularity

Mutual fund ownership of equities is at the lowest level in ~13 years, while ETFs (SPY) (IVV) are gradually increasing their share in the stock market.

Using Asian Markets’ Low Correlation with US Markets

The correlation between US and international markets varies depending on market cycles.

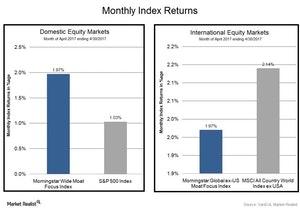

How Does Moat Investing Provide a Competitive Advantage?

Morningstar helps investors choose companies with economic moats. “Economic moats” refers to companies’ ability to obtain an advantage over competitors.

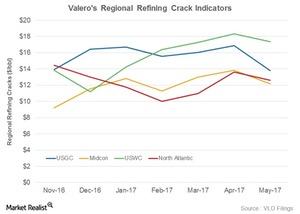

What Valero Needs to Soar in 2Q17

Valero’s crack indicators have fallen in all of these areas in May 2017 (as of May 23) as compared to April 2017.

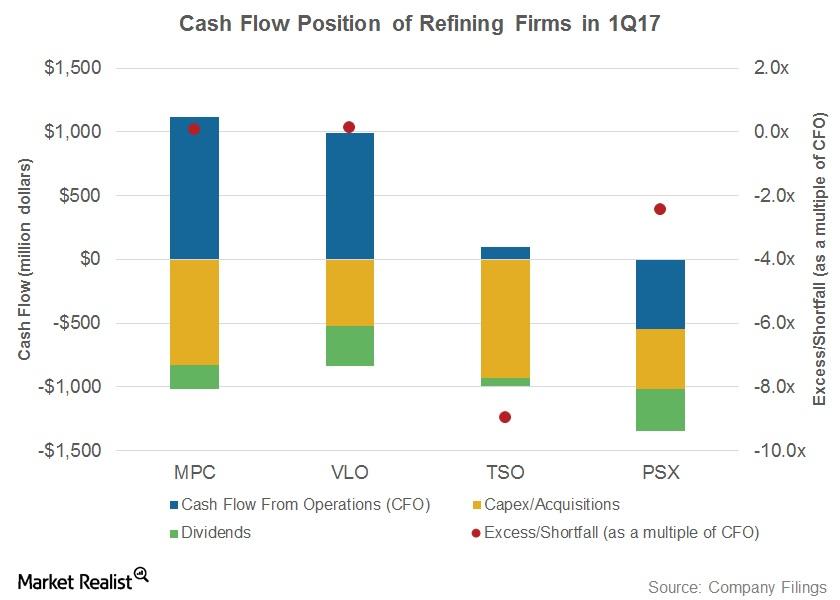

How Major Refiners’ Cash Flows Fared in 1Q17

Refiners’ cash flows have turned volatile over the past few quarters due to volatile refining earnings.

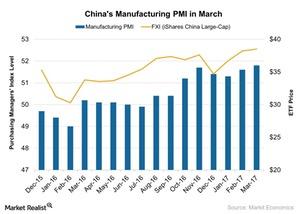

China’s Manufacturing PMI Improved: How It Could Drive Investor Sentiment

China’s final manufacturing PMI (purchasing managers’ index) stood at 51.8 in March 2017 compared to 51.6 in February, beating market expectations of 51.6.

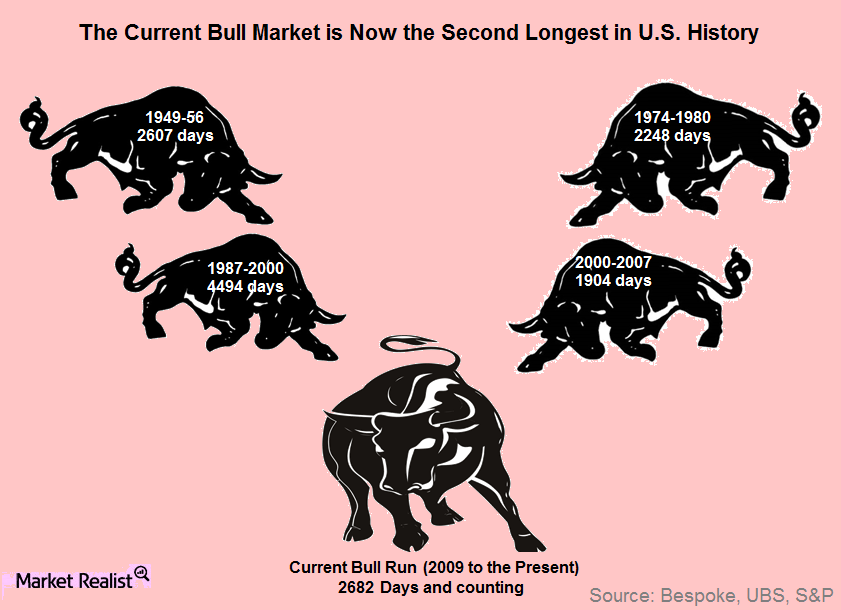

The Cycle Continues, but the Risks Are Rising

OppenheimerFunds In response to accusations of flip-flopping, John Maynard Keynes purportedly quipped, “When the facts change, I change my mind. What do you do, sir?” With 2017 in full swing, the facts have changed. Since the financial crisis, the global economy has been mired in a slow growth, disinflationary world. We argued that the weak […]

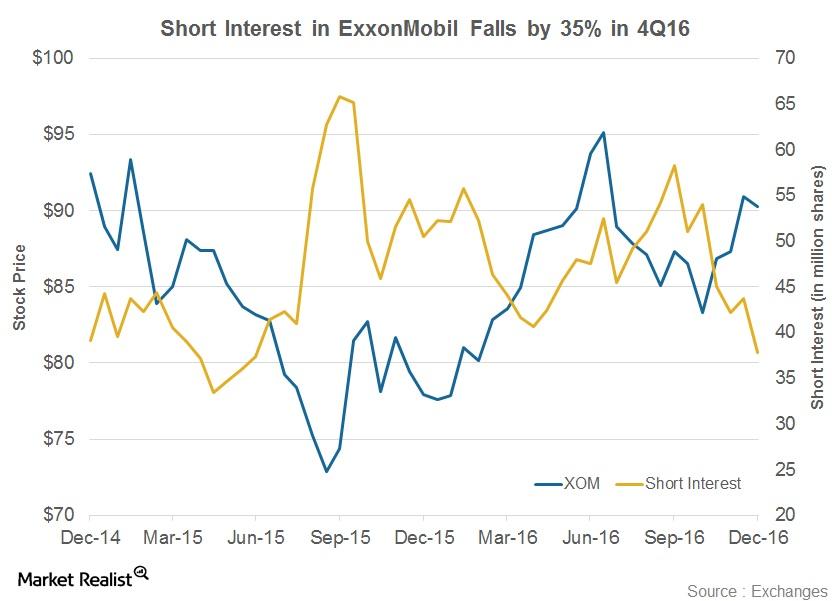

Has Short Interest in ExxonMobil Fallen?

ExxonMobil (XOM) has witnessed a 35% fall in its short interest volumes since September’s end 2016.

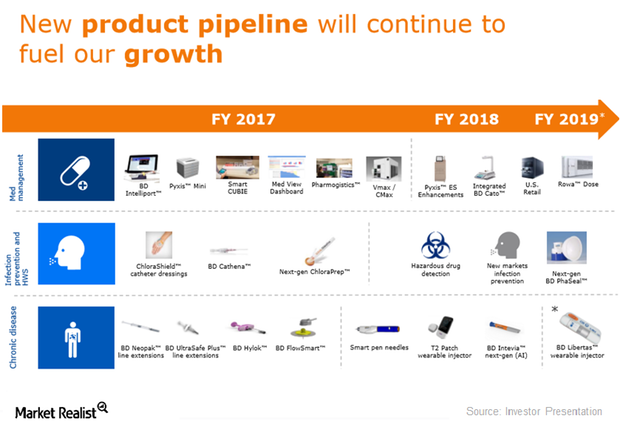

Analyzing the BD Medical Segment’s Product Pipeline

Becton, Dickinson and Company (BDX) generates ~$1 billion from its Infection Prevention business.

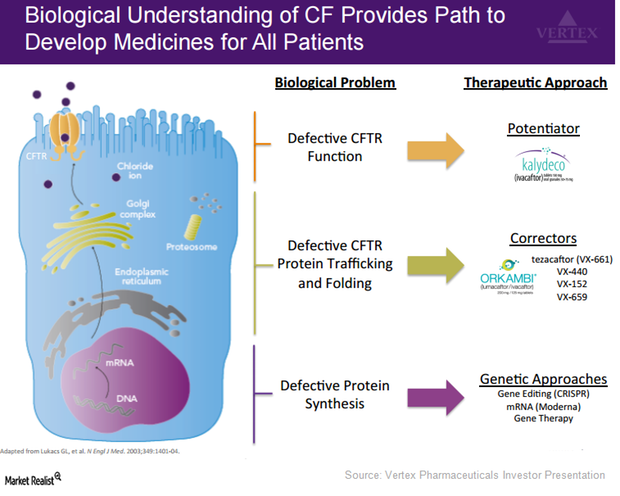

Vertex Has Adopted Multiple Approaches to Treat Cystic Fibrosis

Vertex Pharmaceuticals (VRTX) is aiming to increase the number of patients eligible to be treated with its drugs to include the entire CF patient population.

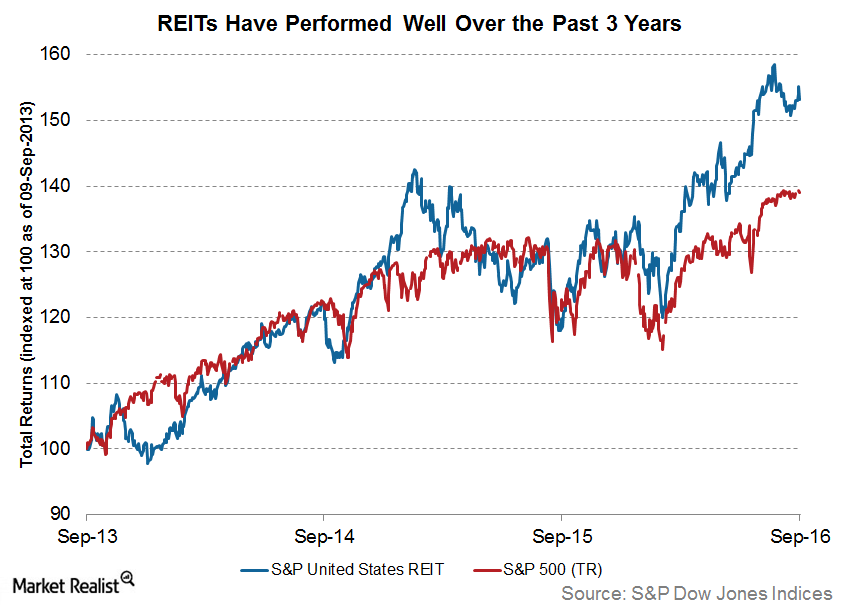

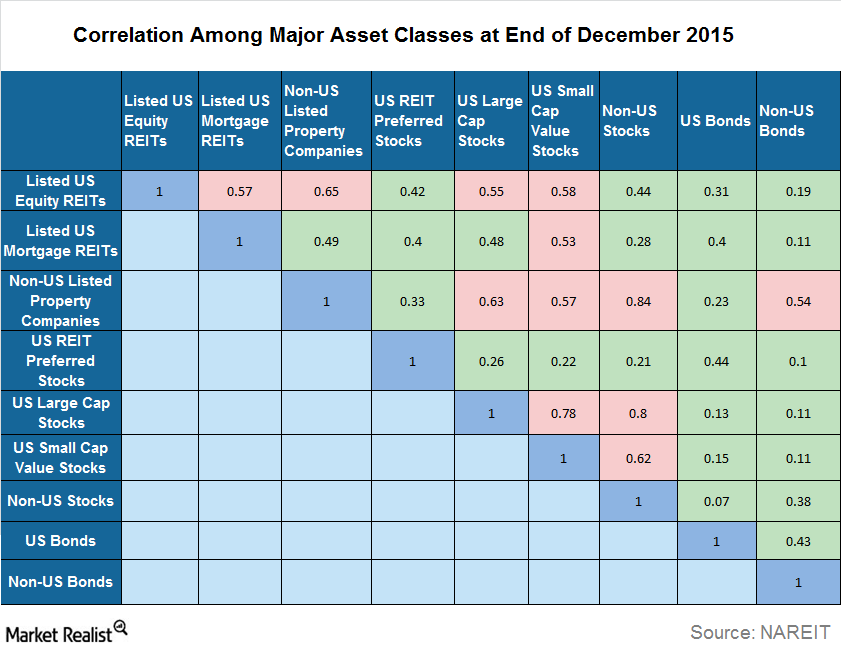

The REIT Advantage: High Return, Low Correlation

RETURNS AND RISKS OF REITS REIT and property stock performance has been relatively strong over the long term, especially when compared with traditional bond and equity indices. Since 1992, the Dow Jones Global Ex-U.S. Select RESI has had an average total return close to 9%, while the Dow Jones U.S. Select REIT Index has had […]

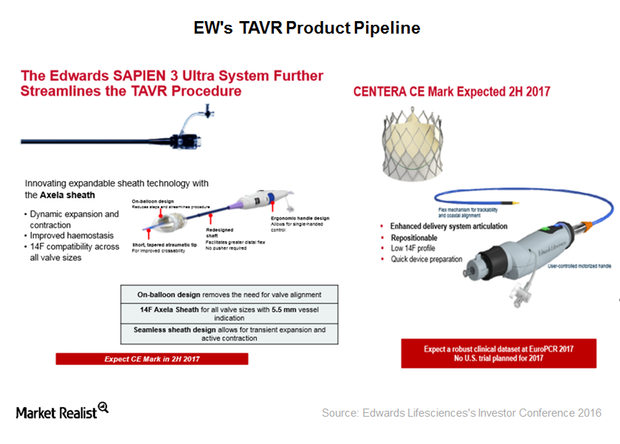

Inside Edwards Lifesciences’ THV Product Pipeline and Future Growth Estimates

Edwards Lifesciences (EW) has a robust product pipeline in its THV (transcatheter heart valve) segment, with Sapien 3 as the segment’s leading product.

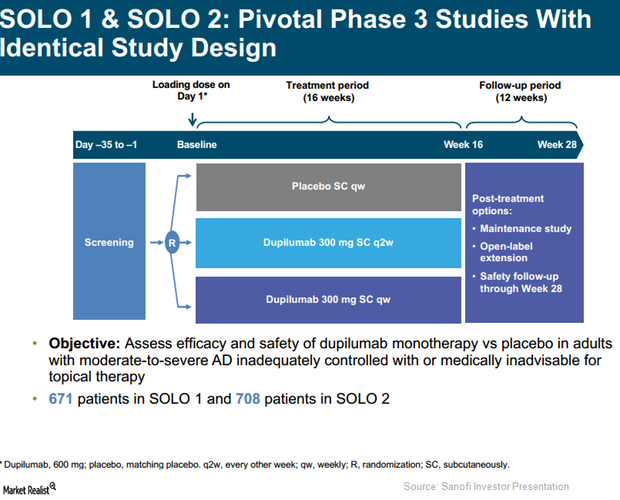

SOLO 1 and SOLO 2 Trials Could Strengthen Dupixent’s Label

In Phase 3 trials, SOLO 1 and SOLO 2, Regeneron (REGN) and Sanofi (SNY) tested the efficacy of an investigational therapy, Dupixent, compared to a placebo.

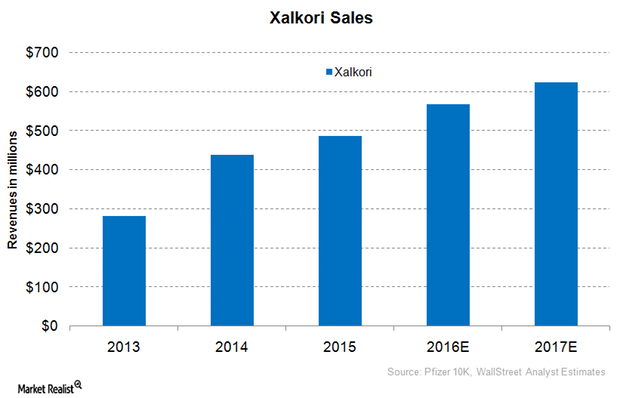

Xalkori Label Expansion May Boost Pfizer’s Sales in 2016

On August 26, 2011, the FDA approved Pfizer’s (PFE) Xalkori for patients suffering from late-stage NSCLC and who express abnormal ALK gene.

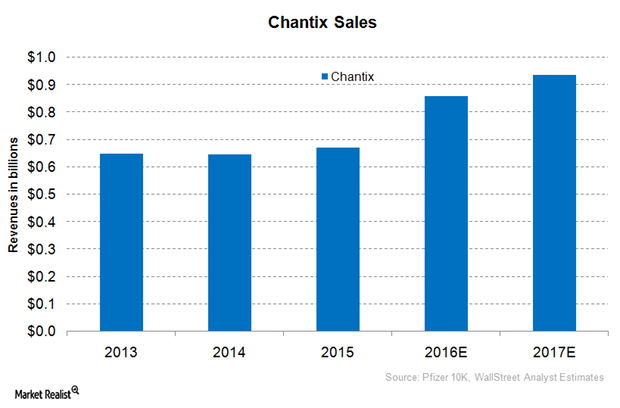

Pfizer Has a Revenue-Boosting Treatment to Help Smokers Quit

Approved by the FDA on May 11, 2006, Chantix, also known as Champix, is used as an aid to help cigarette smokers quit the habit of smoking.

Policymakers Are Getting Vocal about the Fed’s Credibility

The issue of the Fed’s credibility is not a new one. The effectiveness of the prolonged monetary accommodation has sparked a lot of debate in the past.

Behind the Risks Affecting Global Economic Growth

The IMF cited the “fraying consensus about the benefits of cross-border economic integration” visible in the UK’s Brexit vote as a slowdown factor.

The REIT Advantage: High Returns, Low Correlation

Not only do REITs tend to provide steady and stable returns over the long term, but they also help in diversifying investor portfolios effectively.

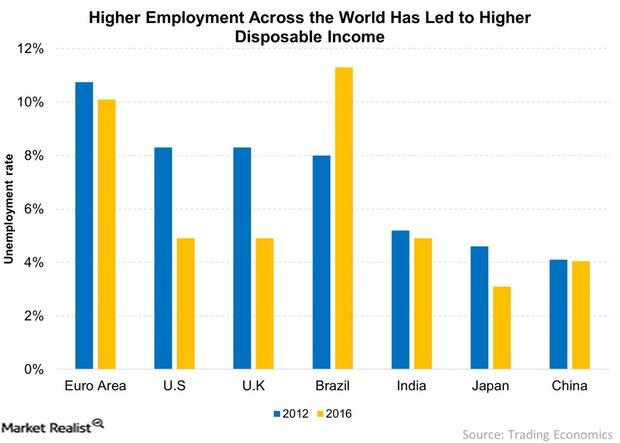

Positive Long-Term Macro Trends Can Grow the Restaurant Industry

Lower oil prices and unemployment rates globally could support the restaurant industry.

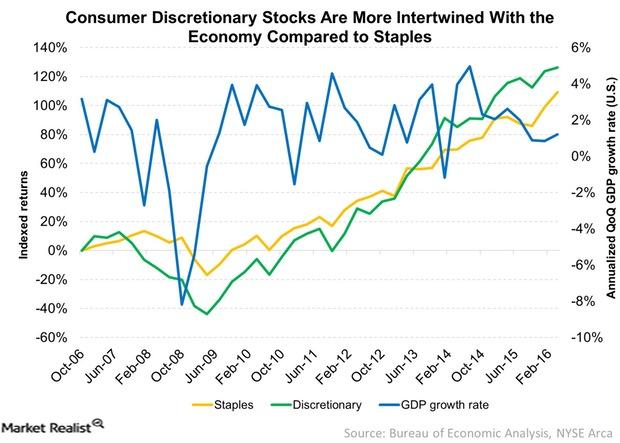

Difference Between Consumer Discretionary and Consumer Staples

GDP growth has explained 30% of returns in the consumer discretionary sector in the last ten years. This compares to only 20% for the consumer staples sector.

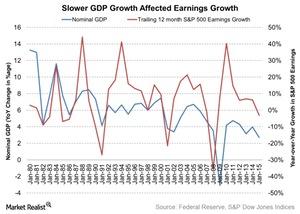

What’s the Primary Driver of Corporate Earnings?

Nominal gross domestic product in the United States is strongly correlated with the trailing-12-month earnings growth of the S&P 500.

Investors Are Worried about an Impending Squall

Inverse ETFs can help protect against a squall US stocks bumped up against all-time highs again this year. After hitting a new intraday high of 2,178 on August 1, the S&P 500 was unable to hold onto the gains. Sector performances offer a glimpse of where we are in the market cycle. The top performing […]

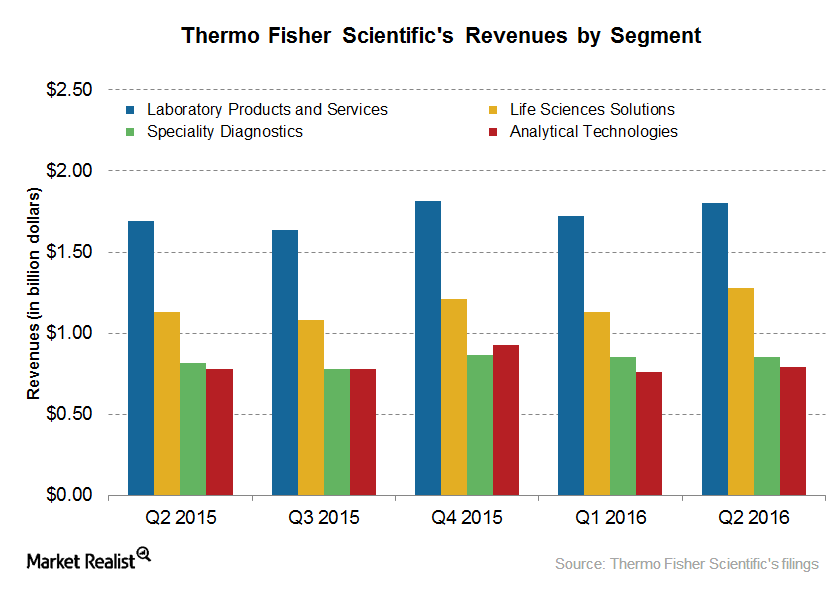

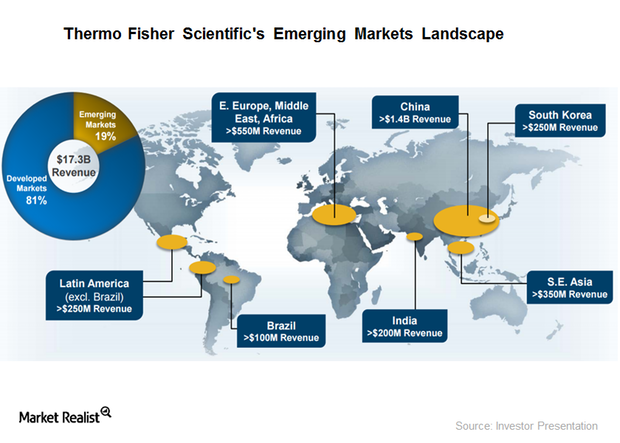

Thermo Fisher Scientific’s Key Growth Strategy

Thermo Fisher Scientific reported ~$4.5 billion in revenues in 2Q16, representing YoY (year-over-year) growth of ~6%.

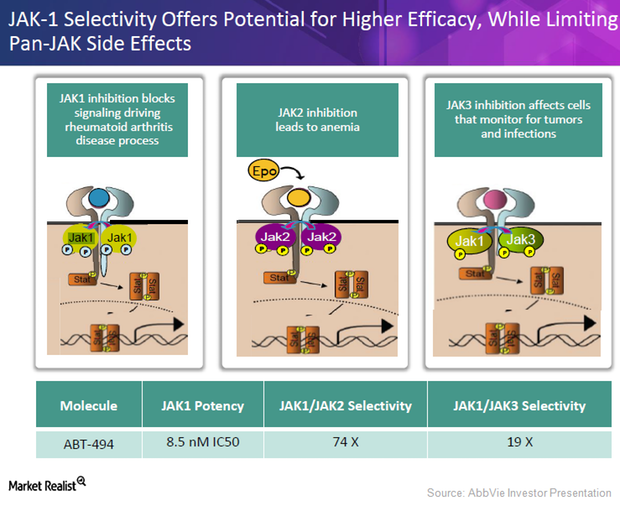

AbbVie Expects to Commercialize Selective JAK1 Inhibitor ABT-494

Currently being tested in six Phase 3 trials, ABT-494 is expected to be a significant improvement in the standard of care for rheumatoid arthritis.

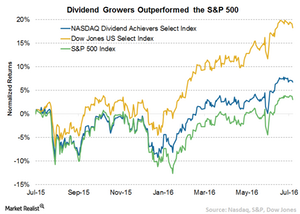

Do Dividend Growers Look Appealing?

Historically, dividend growers have often performed better than the S&P 500 (IVV) and provided higher income during Market volatility.

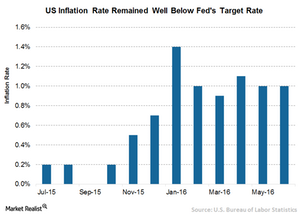

What Are the Threats for Emerging Markets?

The major threat to emerging markets is tightening in the US. While the Fed will likely leave rates unchanged in September, a hike is possible in December.

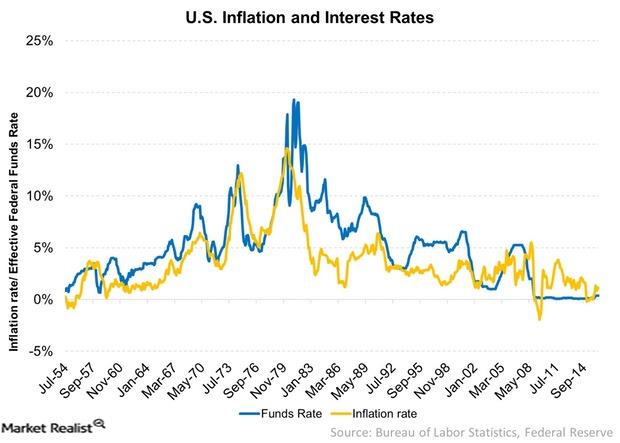

How Are Inflation and Interest Rates Related?

If inflation rises more quickly than the Fed’s estimate, the Fed could be forced to hike rates, which could stifle the economy and the Markets.

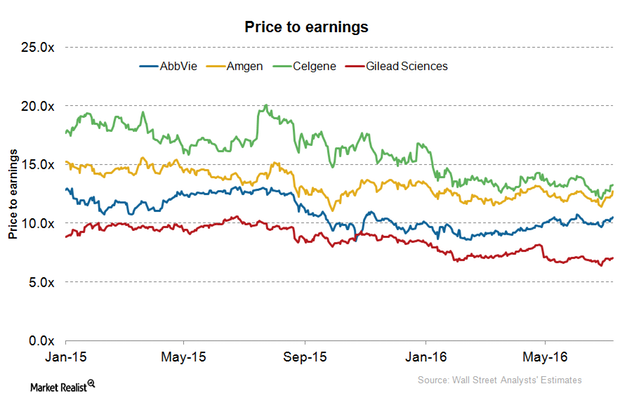

Why Is AbbVie’s Valuation Multiple Rising in July?

AbbVie believes that the Market has misunderstood the growth potential of Rova-T, which is expected to earn $1.5 billion–$2 billion in peak sales even under extremely conservative assumptions.

Inside Thermo Fisher Scientific’s Emerging Markets Strategy

Thermo Fisher has a presence in more than 50 countries. It generates ~19% of its revenues from emerging markets and the rest from developed markets.