What Are the Threats for Emerging Markets?

The major threat to emerging markets is tightening in the US. While the Fed will likely leave rates unchanged in September, a hike is possible in December.

Aug. 16 2016, Published 1:29 p.m. ET

Expectations for Federal Reserve (Fed) rate hikes slumped further after the Brexit vote. Uncertainties around the health of the global economy and the upcoming U.S. election are expected to keep the Fed on hold. Oil prices have recovered, leveling off at around $45 to $50 per barrel. Lastly, growth in China appears to be stabilizing. We do not expect an impending Brexit to derail recent “green shoots,” or signs of economic recovery, in some EM economies following two years of subpar growth. There are risks to our outlook, such as a U.S. inflation pickup leading to higher yields. We’re also paying close attention to market liquidity conditions, global funding stresses and capital flows in China. The attempted coup in Turkey on Friday underscores the political risks in the emerging world.

Market Realist – Abundant tailwinds drive emerging markets’ bond market

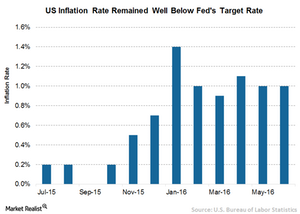

US (IVV) retail sales remained flat in July—compared to a 0.4% increase expected by economists. Weak consumption data underscores the fact that a sharp pickup in economic growth likely won’t occur in the third quarter. Inflation is consistently running much lower than the Fed’s target inflation rate of 2% due to lower oil prices and a strong dollar. According to the US Department of Labor, the producer price index fell 0.4% in July—the first decline since March and the largest in a year.

As a result, despite a strong labor market, the Fed may not raise interest rates in the near future due to cooling inflation, declining discretionary spending, and global uncertainty. In the past, the Fed expressed concern about lower inflation.

Abundant tailwinds

The rising energy prices and stabilizing Chinese (FXI) economy are providing support to the emerging market debt (EMB) (LEMB) story. Oil prices are up almost 65% from the lows recorded in February this year. On the other hand, the Brexit vote hasn’t had a severe impact on emerging markets. Recovering commodity prices (GSG) will likely improve economic fundamentals of commodity-driven emerging economies while easing political tensions in Brazil and Russia (Crimea). This makes matters easy for their respective governments.

Risk factors

As the emerging market growth story continues, it’s important to discuss risks that would halt their growth momentum. The major threat to the emerging market story is tightening in the US. While the Fed will likely leave rates unchanged during its next policy meeting, a hike in December can’t be ruled out. The Fed tightening could unnerve many emerging markets because funds could see outflows back to the US (IWD). This could result in weakness in emerging market currencies.