Richard Turnill

Richard Turnill, Managing Director, is Global Chief Investment Strategist for BlackRock, leading the Investment Strategy Function within the BlackRock Investment Institute (BII).

Disclosure: The content Market Realist publishes should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of Blackrock.

More From Richard Turnill

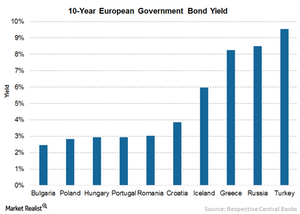

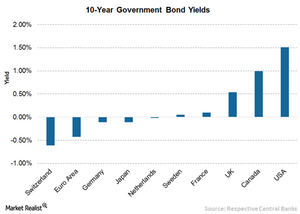

Why Does Fixed Income Look Promising?

Under the current uncertain economic circumstances, investors searching for higher yield might turn to fixed income.

Why Emerging Markets Are Rebounding

Emerging markets (IEMG) (AAXJ) are expected to grow at a healthy pace of 4% in 2016 and see even higher growth in 2017.

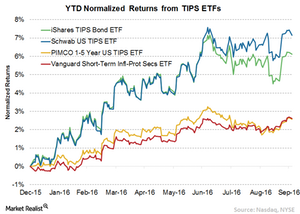

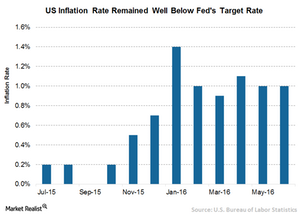

How to Beat Inflation?

We see inflation-linked bonds such as US Treasury Inflation-Protected Securities (TIPS) as a valuable hedge against inflation. We also like inflation-linked debt in the Eurozone and Japan as a potential substitute for nominal bonds. Market Realist: inflation-linked bonds could turn out to be a better choice Inflation-linked bonds (TIP) provide a hedge against inflation by […]

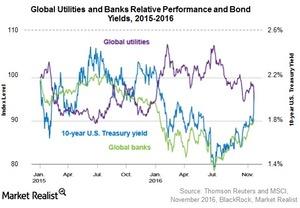

Which Assets Find Support in a Reflationary Environment?

The focus can now shift to the assets that are more cyclical, like financials (XLF) (IYF), utilities (XLU) (IGF), and dividend growers.

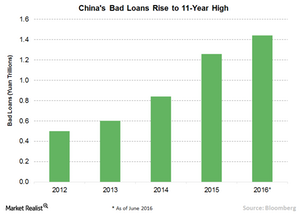

Why Has China’s Risk Ranking Fallen?

Movers and shakers…and losers The biggest movers in our latest quarterly update? China posted the biggest rankings decline, with a three-notch fall to the 32nd place. This was mostly a result of shuffles of its close neighbors in the index. China’s Financial Sector Health score slumped against a backdrop of rapid credit growth. Norway was […]

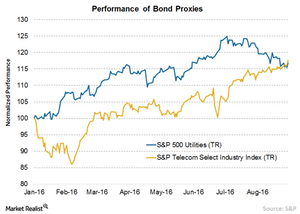

Why Some Popular Positions Become Risky

According to Factset data, around 93% of companies in the utilities (JXI) sector and 80% in the telecom (IXP) sector reported revenues below estimates in the second quarter of 2016.

Why Caution Holds the Key

The UK has taken over other countries as the most sought-after bond market destination, especially after the Brexit vote.

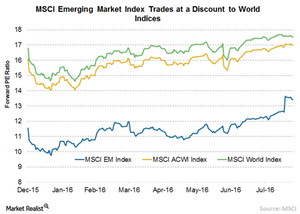

Why Investors Are Upbeat about Emerging Markets

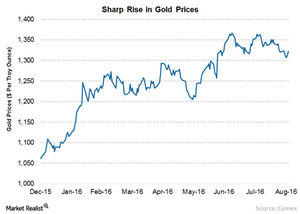

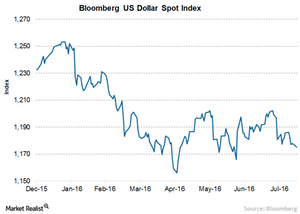

The sharp rise in global liquidity conditions has been channeled mainly into emerging market (EEM) economies.

Why Does Emerging Market Debt Still Look Attractive?

Emerging market debt (EMB) offers plenty of opportunities to investors. Markets are expected to continue their outperformance for the next few quarters.

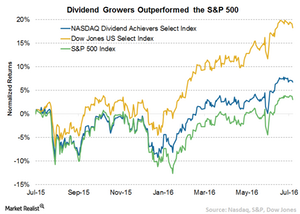

Do Dividend Growers Look Appealing?

Historically, dividend growers have often performed better than the S&P 500 (IVV) and provided higher income during Market volatility.

What Are the Threats for Emerging Markets?

The major threat to emerging markets is tightening in the US. While the Fed will likely leave rates unchanged in September, a hike is possible in December.

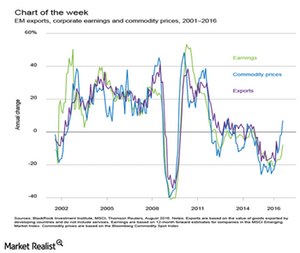

Fading Risks Are Working in Favor of Emerging Markets

Low commodity (GSG) prices in the first quarter of the year impacted commodity-driven emerging markets like Russia, Brazil (EWZ), Indonesia, and Venezuela.

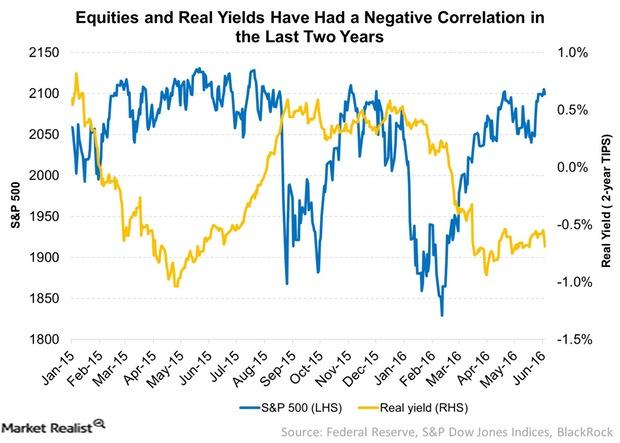

How Rising Real Yields Could Affect Equities

Since the start of 2015, the S&P 500 and real yields have had a high negative correlation. Falling real yields have encouraged investors to take more risk in search of higher returns.

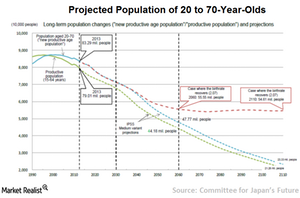

Why Structural Reforms Are Needed to Spur the Japanese Economy

Market participants believe that the BoJ (Bank of Japan) needs to do more to beat deflation and propel the Japanese economy to sustainable long-term growth.

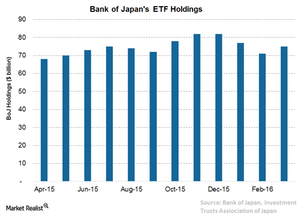

Why Monetary Policy Isn’t Enough to Boost the Japanese Economy

The BoJ is the one of the largest holders of Japanese (DFJ) government bonds and also a major player in equity markets.