BTC iShares S&P GSCI Commodity-Indexed Trust

Latest BTC iShares S&P GSCI Commodity-Indexed Trust News and Updates

Energy Sector and Crude Oil Prices Helped the S&P 500

The S&P 500 rose ~0.7% to 2,733.01 on May 21 due to the rise in industrial stocks and crude oil prices—the highest level in more than two months.

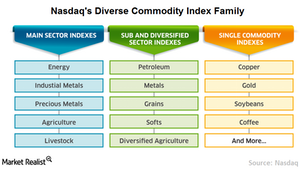

Nasdaq Commodity Index: Reflecting the Global Commodity Market

On the commodities side, we have broad-based commodity benchmark, the Nasdaq Commodity Index, aptly named.

What Are the Threats for Emerging Markets?

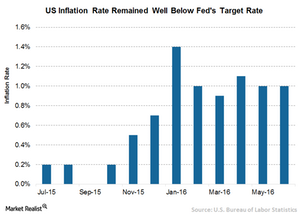

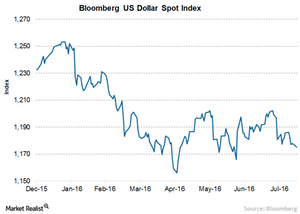

The major threat to emerging markets is tightening in the US. While the Fed will likely leave rates unchanged in September, a hike is possible in December.

Fading Risks Are Working in Favor of Emerging Markets

Low commodity (GSG) prices in the first quarter of the year impacted commodity-driven emerging markets like Russia, Brazil (EWZ), Indonesia, and Venezuela.

How Fallen Angels Could Reward Investors

Fallen angel bonds—high-yield bonds originally issued with investment grade credit ratings—are generally known for offering potential value. A big source of this value has been the tendency of fallen angels to be oversold below what may be considered fair value, leading to a downgrade to high yield. A less obvious source of value for fallen angels […]

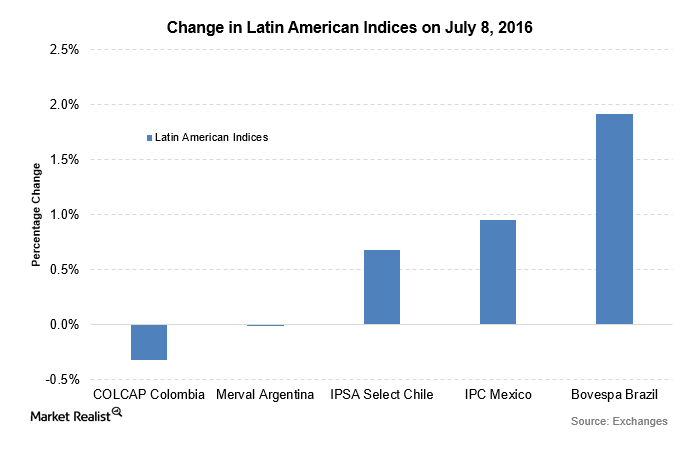

Latin American Markets Rise as Inflation Levels Ease in Brazil

Latin American markets were trading higher on July 9—taking cues from other emerging markets. Brazil’s inflation rate was released lower at 8.8% in June.

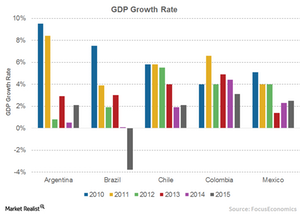

How Can Latin America Keep Up Inclusive Growth?

The Latin American (ILF) (EWW) economy contracted in the second half of 2015. The fourth quarter registered the biggest fall in six years.

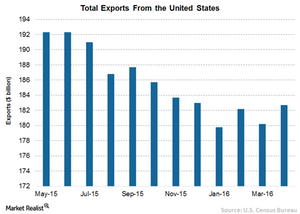

How to Navigate Uneven Economic Growth

A number of factors have contributed to the slowdown, including soft overseas growth and a sharp drop in capital spending by energy and mining companies.

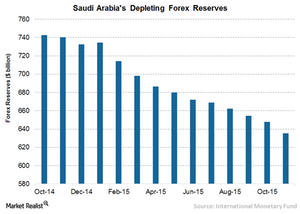

Saudi Arabia Is Depleting Its Foreign Exchange Reserves

It’s been more than a year since Saudi Arabia has had a new king, and what an eventful year for the country under his leadership!