How Are Inflation and Interest Rates Related?

If inflation rises more quickly than the Fed’s estimate, the Fed could be forced to hike rates, which could stifle the economy and the Markets.

July 25 2016, Published 10:05 a.m. ET

What Is Inflation?

Inflation is the rate at which prices for goods and services increase. At first, this sounds like a simple concept, but in actuality it is rather complex. Inflation affects numerous aspects of the market and many factors influence it. If prices go up, the current value of the currency is eroded. What could have been purchased a year prior for USD 1.00 might now cost USD 1.03, and if salaries had not risen in tandem with this inflation, the public would have lost purchasing power. From this vantage point, some may see inflation as a bad thing. However, the right balance of inflation and economic growth is important for a healthy economy. An economy that grows too fast can cause high rates of inflation and an economy with slow or no growth can cause low levels of inflation or even deflation (when prices decline). Inflation is one of several key factors that are considered when interest rates are set by the U.S. Federal Reserve. Interest rates determine the cost of borrowing and dictate savings, mortgage, and car loan rates, among others.

How are inflation and interest rates related, and what’s the Fed’s dual mandate? Market Realist’s View

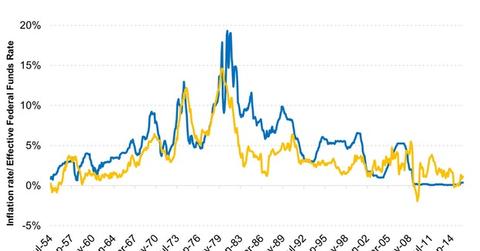

The graph above shows the federal funds rate, which influences interest rates and inflation in the United States. As you can see, the two tend to move in the same direction. The Federal Reserve has a dual mandate of stabilizing prices and maximizing employment.

In order to maximize employment, the Fed cuts interest rates, which encourages companies to expand and, in turn, hire more employees. Higher credit availability thus stimulates growth. However, as mentioned above, growth usually leads to higher inflation levels as demand levels rise.

This is where the second mandate comes into play. If the inflation level crosses a certain threshold, the Fed will hike rates in order to curb inflation. This discourages spending and thus cools down the economy.

So the Fed’s dual mandate is a balancing act. Currently, the federal funds rate is 0.25%–0.5%. However, the current state of the economy doesn’t warrant such low rates. If inflation rises more quickly than the Fed’s estimate, the Fed could be forced to hike rates, which could stifle the economy and the Markets (VTI) (IVV). The impact would be like shifting from first gear right into fourth.