Century Aluminum Co

Latest Century Aluminum Co News and Updates

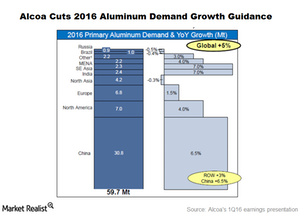

Why It’s No Surprise that Alcoa Cut Aluminum Demand Guidance

Alcoa has revised down its 2016 global aluminum demand growth projection to 5%.

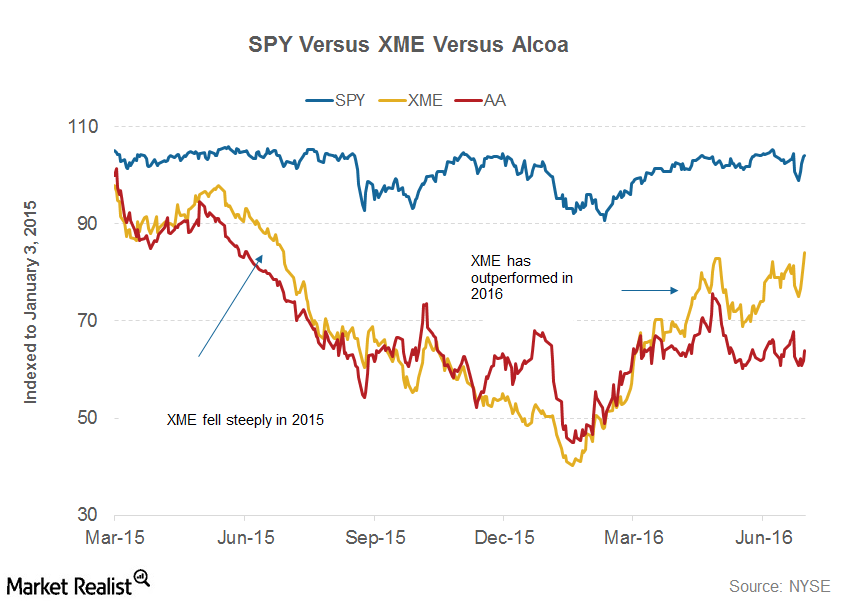

Alcoa’s 2Q16 Earnings: What Can Investors Expect?

Alcoa (AA) is expected to release its 2Q16 earnings on July 11. The company is in the final stages of its split, which will create two new entities.Materials Why Alcoa is improving its competitive position

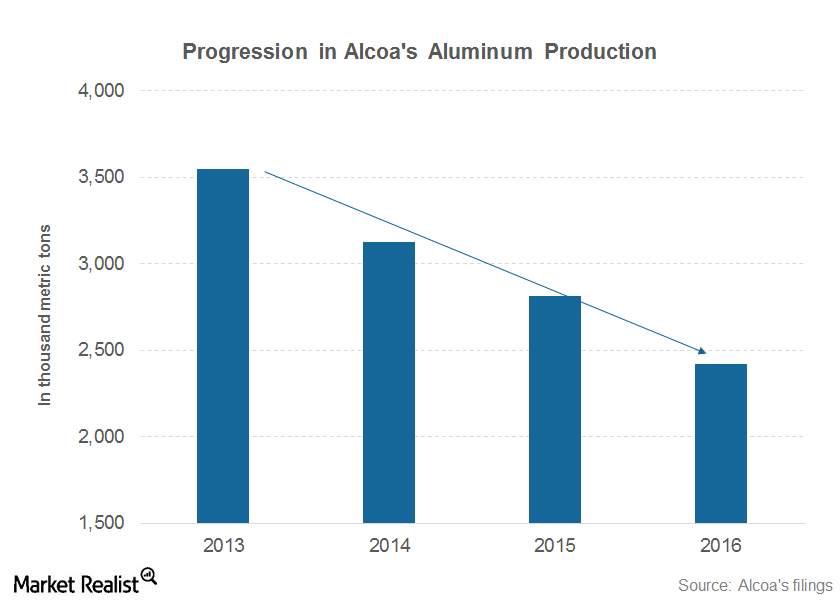

Alcoa idled several smelting plants since 2007. Its aluminum smelting capacity has come down by 28% over the period. Most of these smelters had high unit production costs.

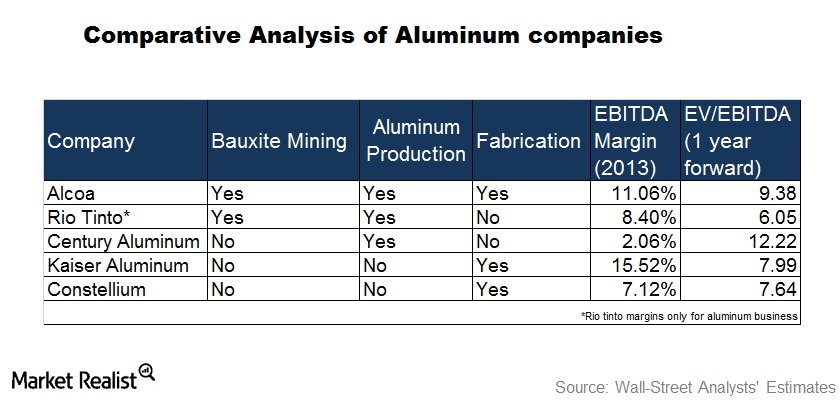

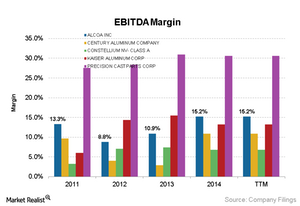

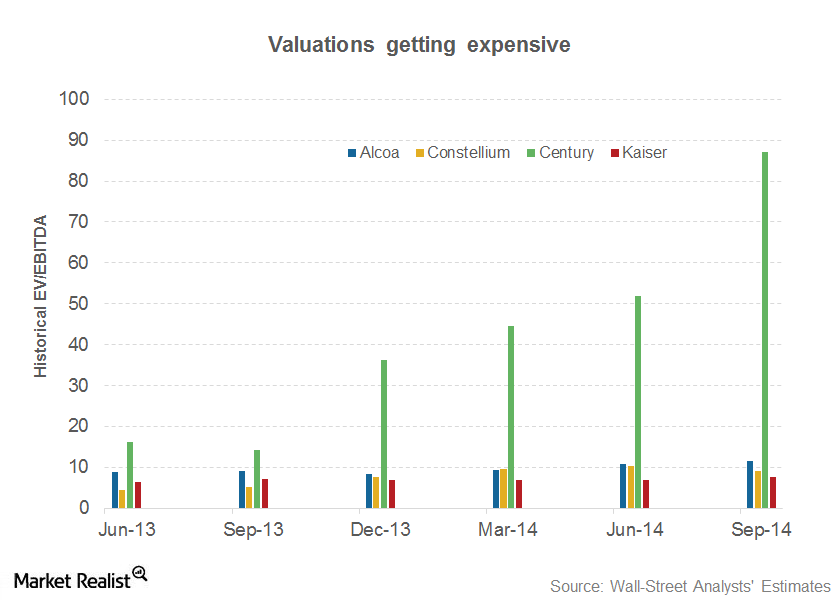

Aluminum company metrics compared

Trading on the London metal exchange determines the price for primary aluminum. Any increase in the price of aluminum benefits companies that produce primary aluminum.

Must-know: Alcoa is placed better than other aluminum companies

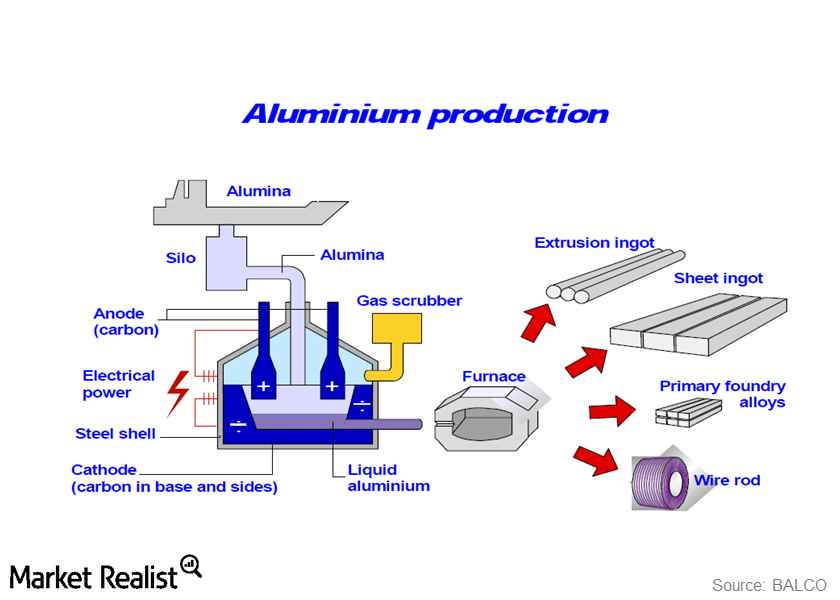

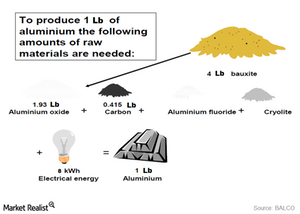

The aluminum process starts by extracting bauxite from the Earth’s crust. The bauxite is refined into alumina. Alumina is a key raw material—along with carbon and electricity.

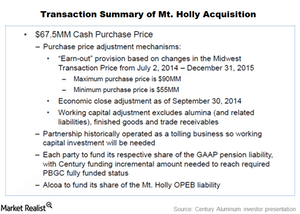

Was Alcoa Smart to Sell Mt. Holly Smelter to Century Aluminum?

In 2014, Alcoa (AA) sold its stake in the Mt. Holly smelter to Century Aluminum (CENX).

Alcoa Is Optimistic about Aluminum’s 2018 Outlook

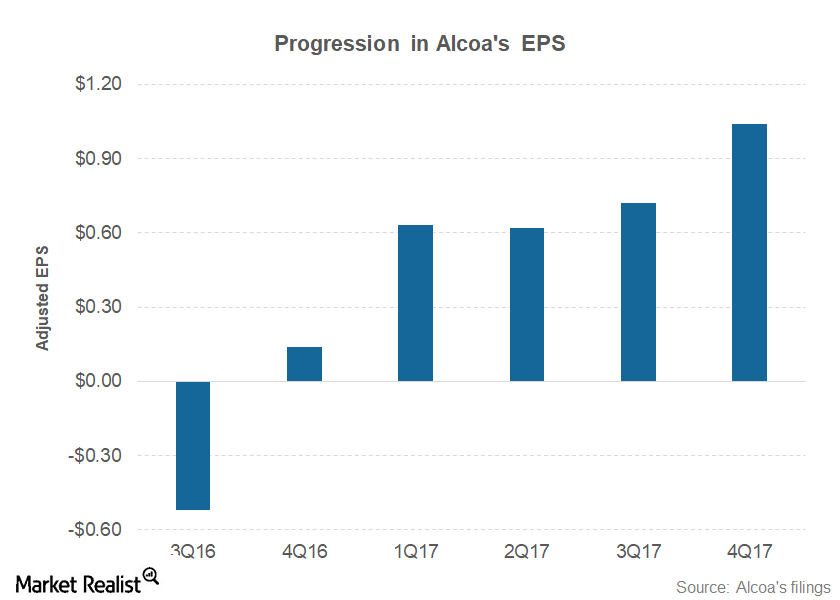

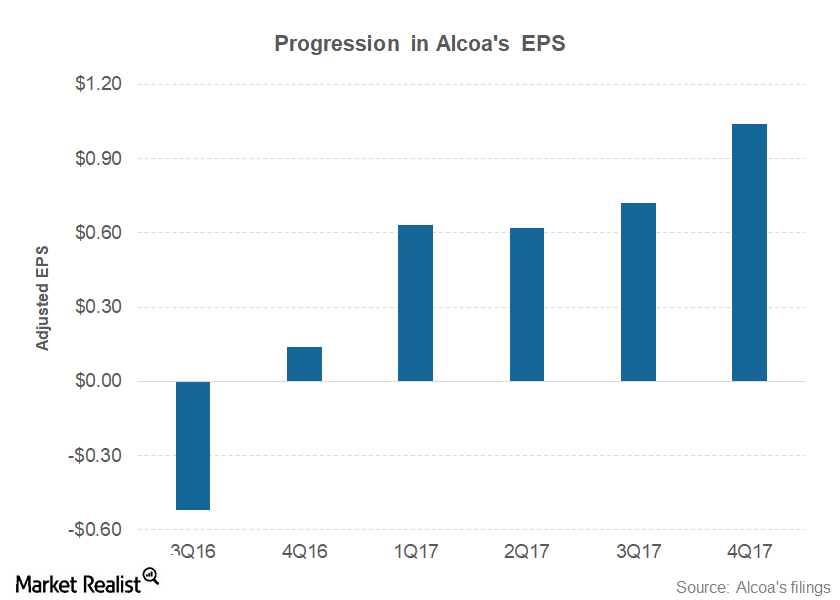

Alcoa (AA) reported its 4Q17 earnings on January 17, 2018, after the markets closed. The company posted an adjusted EPS of $1.04 in 4Q17.

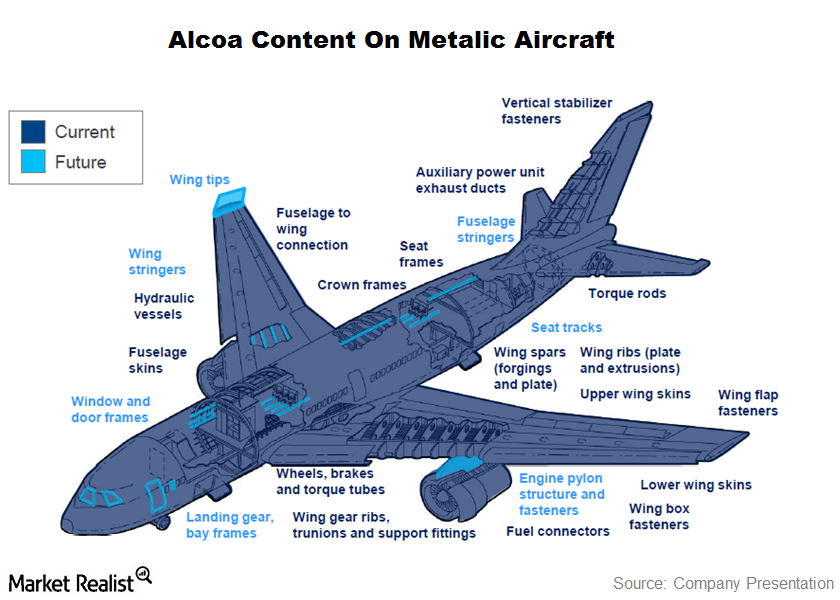

Must-know: Alcoa’s Aerospace Segment Is Important

The aerospace segment is the one of the biggest aluminum consumers in the world. Alcoa (AA) got $4 billion in revenue from aerospace companies last year.

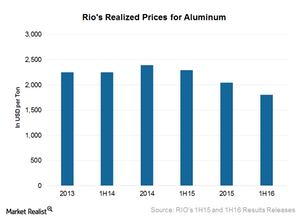

Rio’s Aluminum Division Didn’t Bow to Commodity Price Pressures

Rio Tinto’s (RIO) Aluminum division contributed 19% of its 1H16 underlying EBITDA (or earnings before interest, tax, depreciation, and amortization).

How Alcoa Looked In 2014

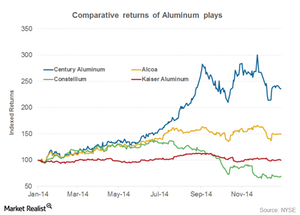

In this series, we’ll pay special attention to Alcoa’s 2014 performance and to how investors can play Alcoa and other aluminum companies in 2015.

Why Profit Margins Vary across the Aluminum Value Chain

The profit margins vary across the aluminum value chain. Upstream aluminum producers’ earnings depend on their position on the cost curve.Materials Must-know: Playing the aluminum value chain

Bauxite is the most abundant metal in the earth’s crust. Because of the many impurities in bauxite, it must be refined to produce alumina.Materials Why investors need to understand the cost curve

Primary aluminum and alumina are commodity products. Producers don’t have much control over their pricing. The prices are decided by market dynamics.

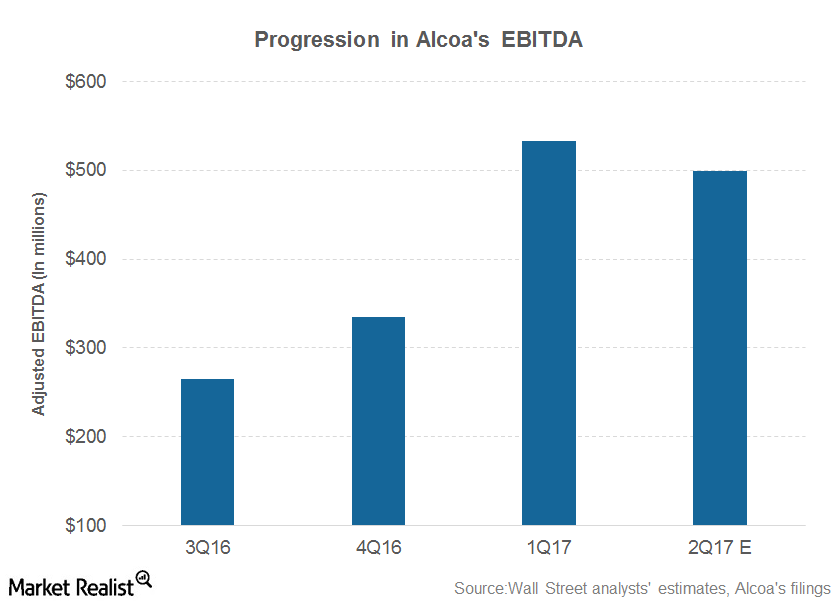

Markets Will Await These Updates from Alcoa’s 1Q17 Earnings Call

In 1Q17, there were rumors that Rio Tinto (RIO) could acquire Alcoa.

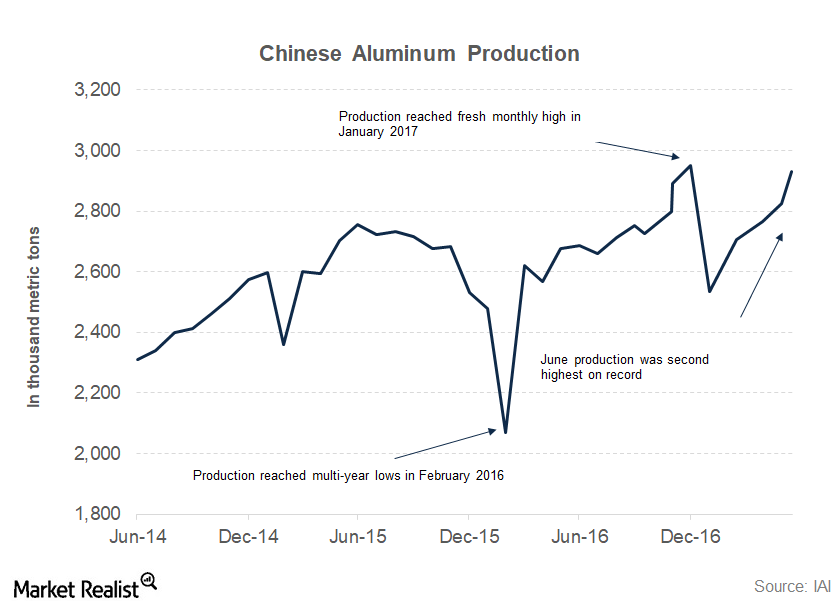

China’s Supply-Side Reforms Could Impact Aluminum in 2018

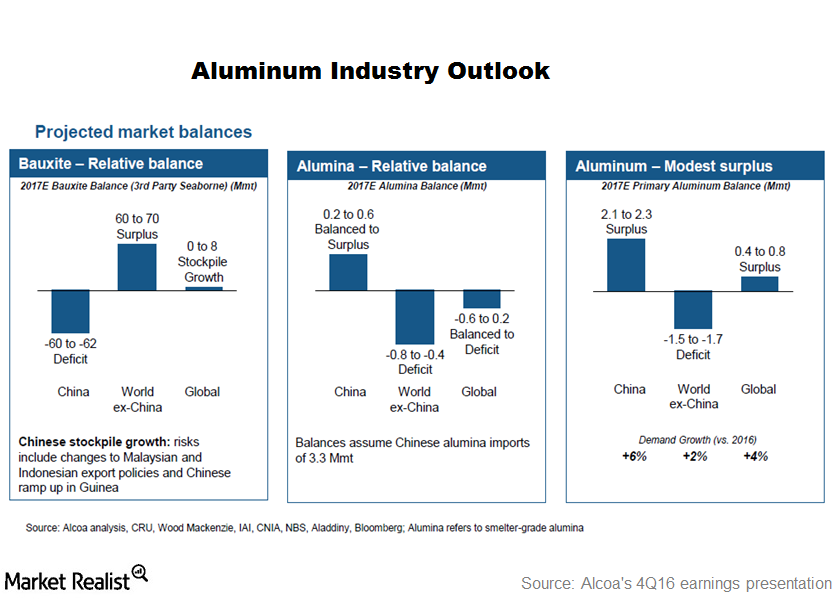

Alcoa (AA) expects global aluminum demand to exceed supply in 2018 on China’s supply-side reforms.

Alcoa’s 1Q17 Earnings: What Investors Need to Know

Alcoa (AA) released its 1Q17 earnings on April 24 after the markets (MDY) (MID-INDEX) closed. It held the conference call the same day.

Must-know: 3 risks that aluminum company investors face

Litigations can be a big blow for aluminum producers. Litigations are expected to decrease aluminum prices and premiums. This will be negative for aluminum companies like Alcoa Inc. (AA), Century Aluminum (CENX), Kaiser Aluminum Corp. (KALU), and Constellium (CSTM).

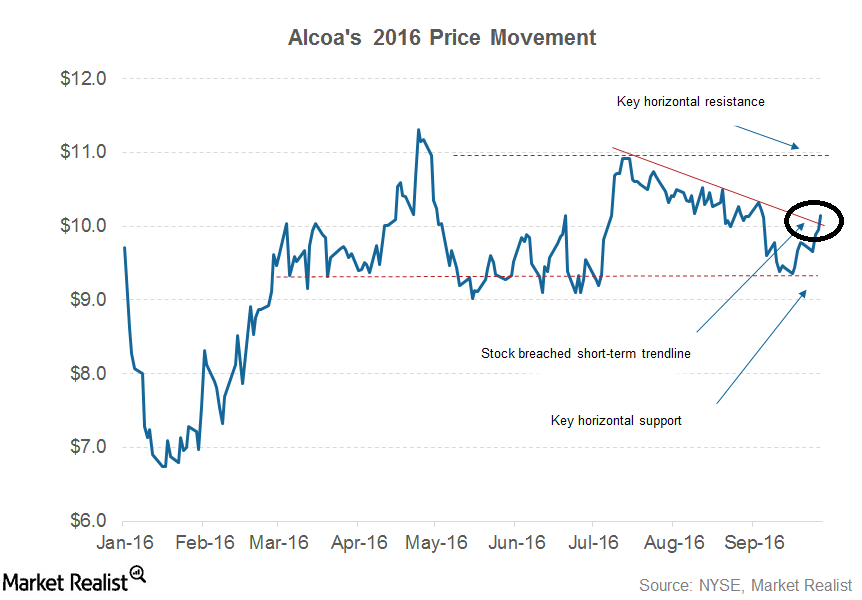

A Look at Alcoa’s Technical Indicators before Its 3Q16 Release

Alcoa’s technical indicators To make market entry and exit decisions, traders and investors analyze technical indicators. Resistance and support levels are among the most commonly used technical indicators. Resistance level Support levels typically act as a floor for stock prices. As a stock approaches its support levels, more buyers emerge while selling pressure generally subsides. […]

Should Alcoa Bears Like Their Chances in 2017?

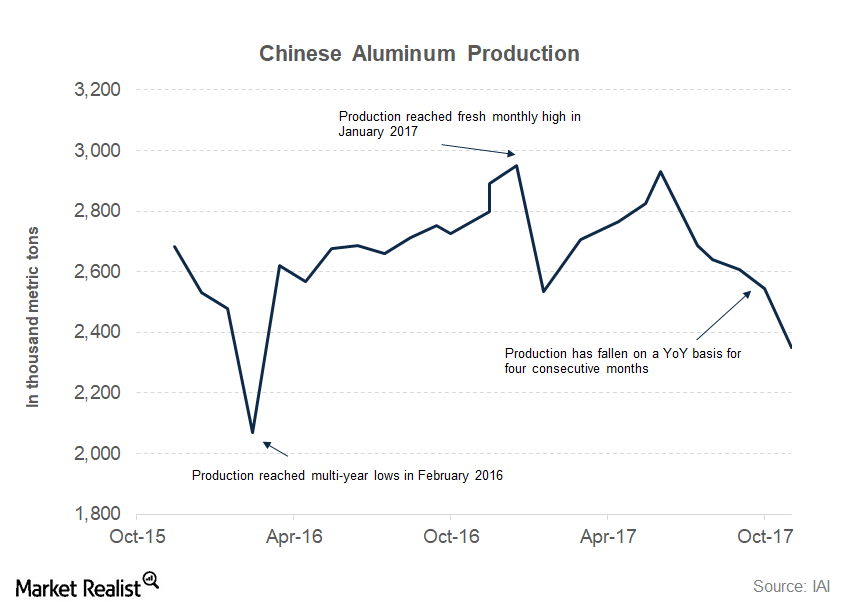

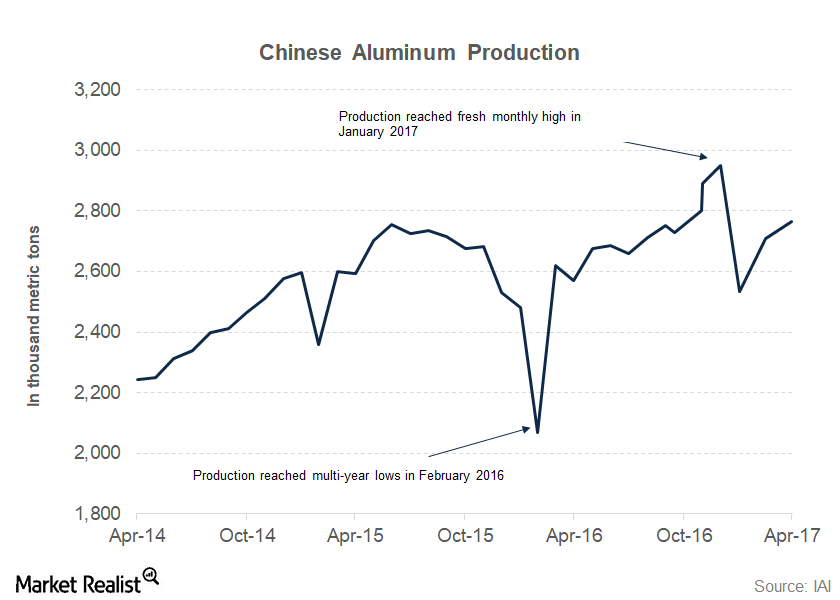

Higher Chinese aluminum production could spoil the party that companies such as Alcoa and Century Aluminum (CENX) are currently enjoying.Materials Why Alcoa is positioned well to serve the automotive industry

Alcoa is working to expand its capacity in Tennessee. It’s a $275 million investment. Alcoa expects that the facility will be operational by mid-2015.

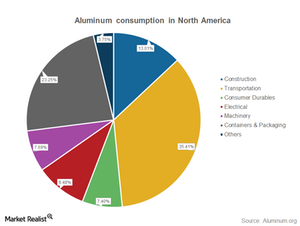

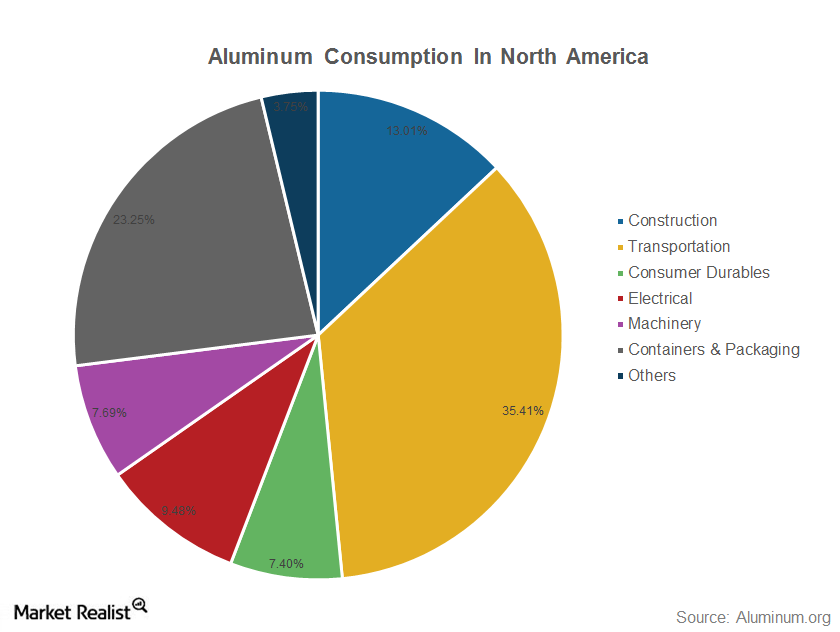

Why Aluminum Is An Important Metal For Investors

Investors like aluminum. They can play the aluminum industry by trading aluminum on commodity exchanges. Investors can also investment in aluminum plays.

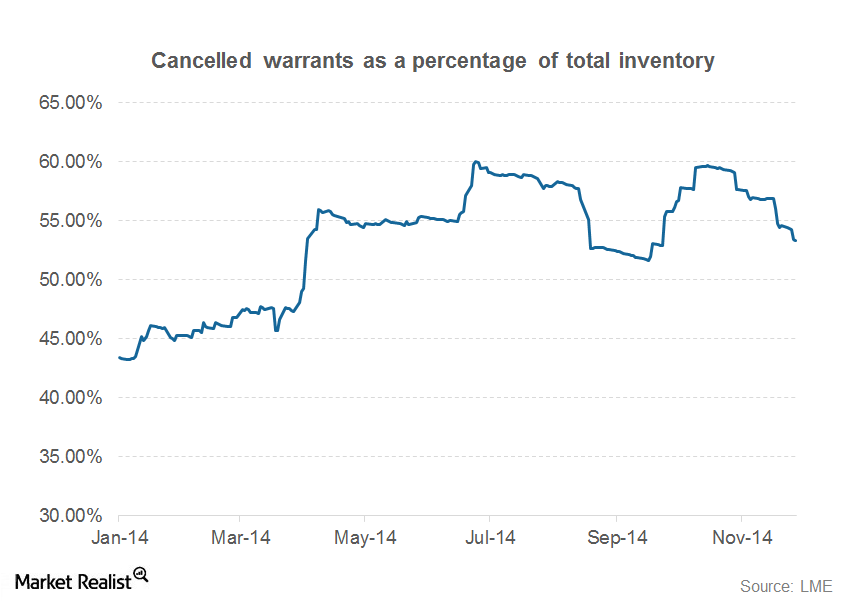

What Investors Need to Know About Aluminum Warrants

Analysts expect that most of the metal has been moving away from LME registered warehouses to non-LME registered warehouses, which typically charge less rent than registered warehouses.Materials Why investors should understand Alcoa’s business model

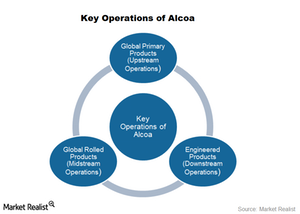

Alcoa is an integrated player in the aluminum value chain. This means its operations extend from bauxite refining to aluminum fabrication.

Overview: An investor’s guide to the aluminum industry

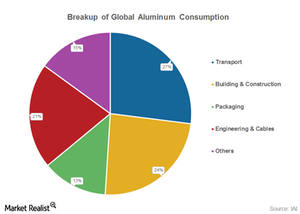

Aluminum is the most abundant metal found in the earth’s crust. It’s soft, lightweight, and durable in nature. Its low density and resistance to corrosion make it a very important metal that a lot of industries use.

Must-know: Understanding aluminum’s value chain

The aluminum industry has a value chain that consists of both upstream and downstream companies. Upstream companies are engaged in the mining and refining operations.

Trump Tariffs: Why Alcoa’s Fears Are Coming True

Last year, President Trump slapped a 10% tariff on US aluminum imports. Alcoa didn’t support the tariffs in the first place.

Analyzing Alcoa’s 2019 Outlook

On paper, aluminum’s fundamentals look strong. Aluminum markets were expected to be in a deficit of 1.5 million metric tons last year.

How Alcoa Fared in 4Q17

While Alcoa’s 4Q17 earnings rose sharply as compared to previous quarters, the quarterly results fell short of expectations.

Aluminum Supply: What Investors Should Watch in 2018

After its split, Alcoa (AA) became a pure-play aluminum producer (S32) (CENX). Like other aluminum producers, Alcoa’s fortunes are tied to metal prices.

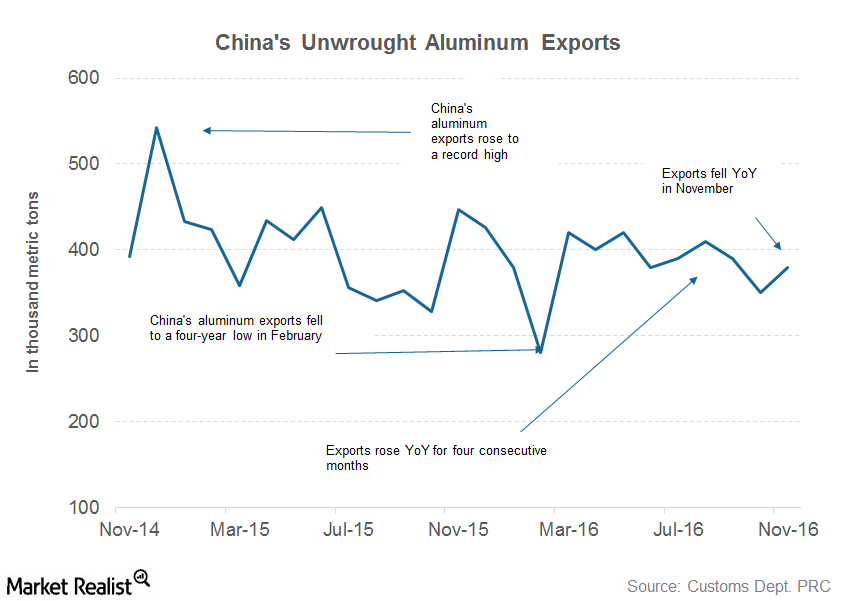

Alcoa Continues Its Rally as China Keeps Its Commitment

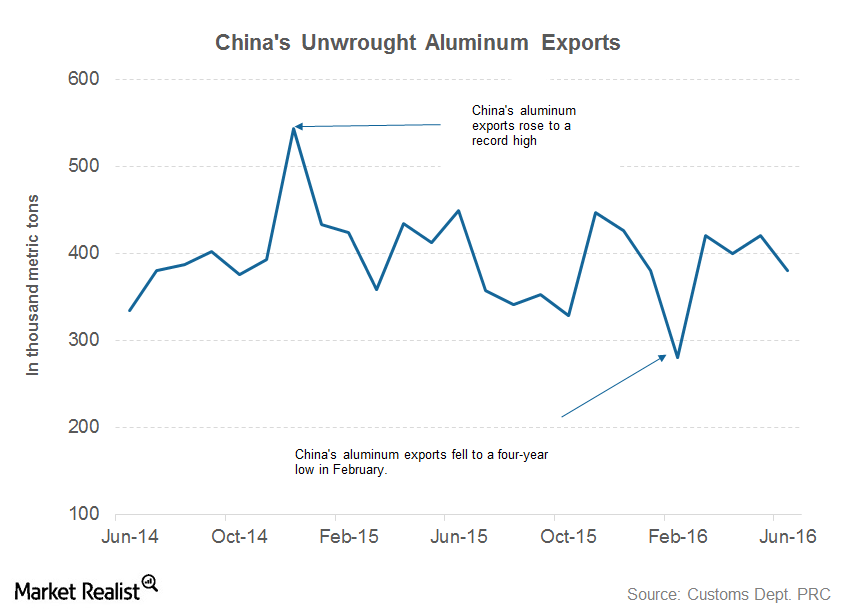

China exported 370,000 metric tons of unwrought aluminum in September, compared to 410,000 metric tons in August.

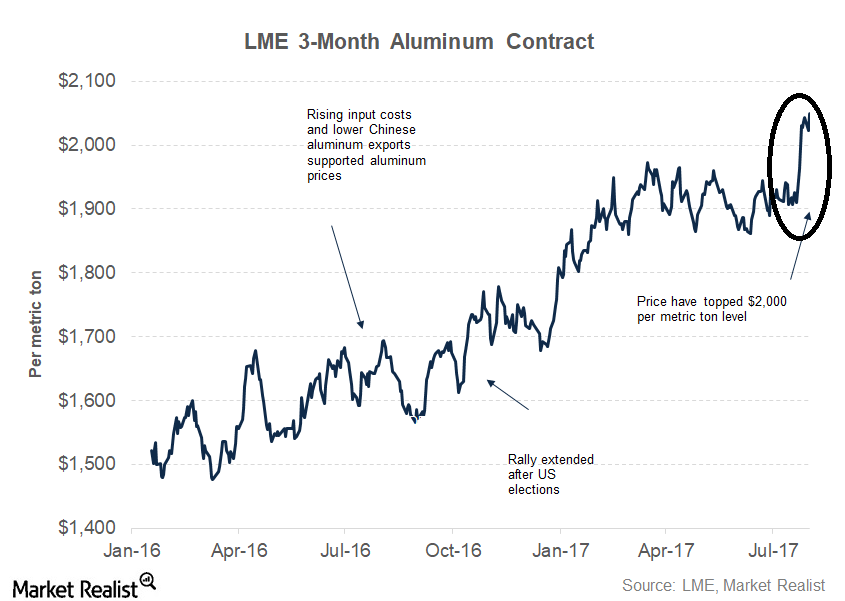

Aluminum’s Outlook: What Investors Can Expect

Aluminum prices have been strong in 2017 and have built on last year’s gains. The entire industrial metals space has come a long way since 1Q16.

Aluminum Prices Defy Gravity and Maintain the $2,000 Level

Aluminum prices have gained more than 22% so far in 2017. This trend was preceded by a 13.6% rise in 2016.

Is China Cutting Aluminum Capacity? Analyzing Producers’ Views

As we noted previously, aluminum prices have been strong this year. Strength has been driven by positive supply and demand dynamics.

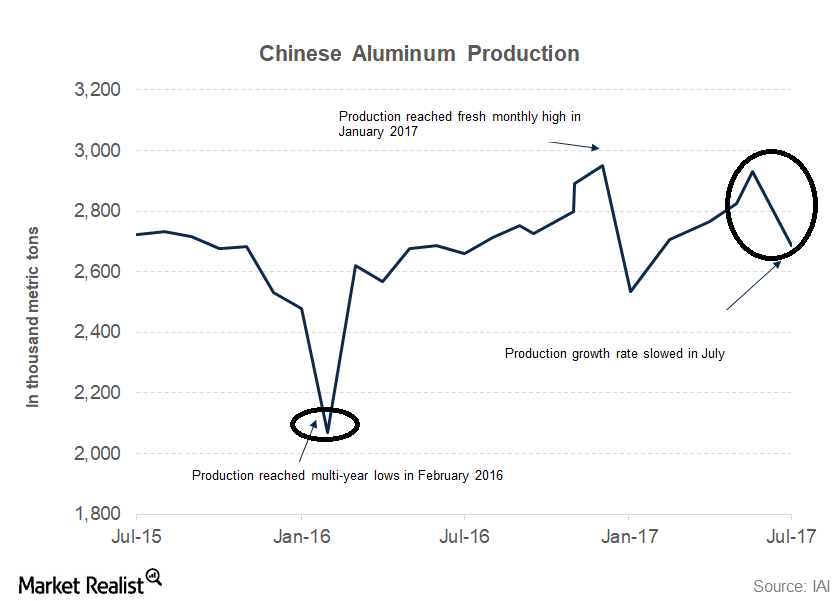

Analyzing China’s Aluminum Production Data

China produced ~2.76 million metric tons of aluminum in April—a YoY increase of 7.6%. Its production has risen 12.0% YoY in the first four months of 2017.

Could Wilbur Ross and Donald Trump Be Alcoa’s Saviors?

Alcoa and Century Aluminum (CENX) survives the commodity price slump by closing their high-cost capacities and negotiating better power deals for several operating plants.

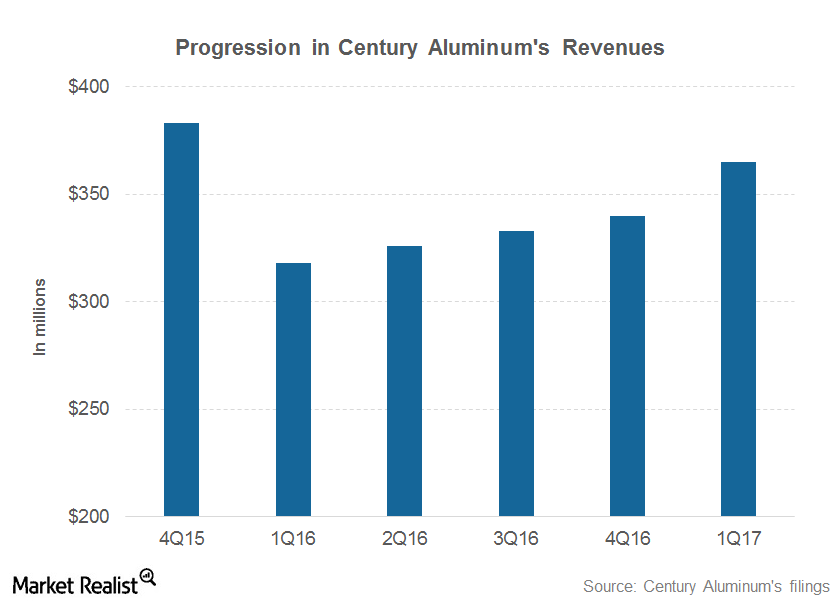

What Investors Should Know about Century Aluminum’s 1Q17 Results

Century Aluminum (CENX) was among the best-performing aluminum stocks (NHYDY) (ACH) (SOUHY) last year with gains of 94%.

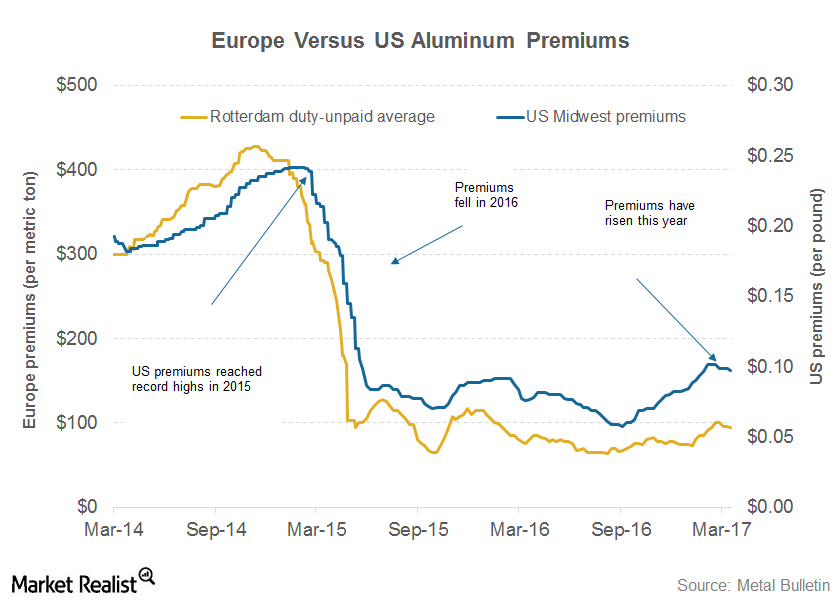

What Should Alcoa Investors Make of Aluminum Premiums?

Aluminum premiums are key indicators that investors in primary producers such as Century Aluminum (CENX), Norsk Hydro (NHYDY), and Rio Tinto (RIO) should track.

Alcoa’s 2017 Guidance: Everything You Need to Know

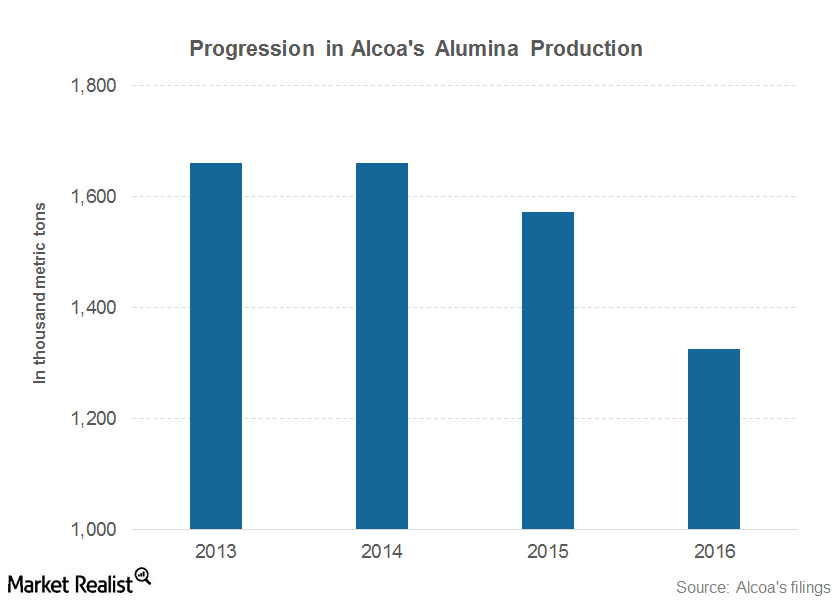

Alcoa (AA) expects its alumina shipments to range from 13.8 million–13.9 million metric tons in fiscal 2017 compared to 13.2 million metric tons in fiscal 2016.

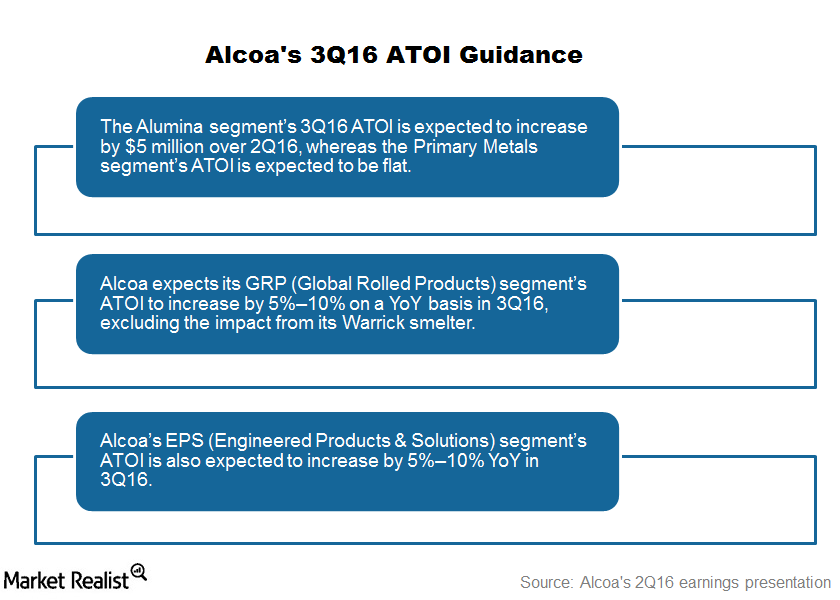

Alcoa’s 3Q16 Guidance: Everything You Need to Know

Alcoa’s 3Q16 guidance Previously, we looked at factors that could impact Alcoa’s (AA) 3Q16 revenues. In this part, we’ll look at the company’s profitability metrics. Note that there are several metrics you can use to measure an enterprise’s profitability. Alcoa releases a non-GAAP (generally accepted accounting principles) measure, the ATOI (after tax operating income). In […]

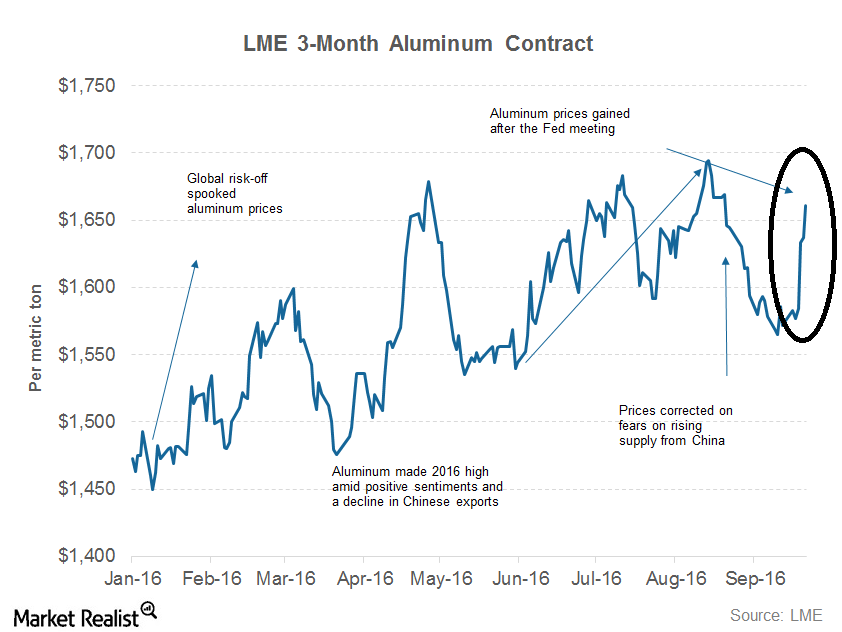

What’s Driving Aluminum Prices in 2016?

Aluminum prices have shown resilience this year. However, aluminum has been facing stiff resistance at $1,700 per metric ton.

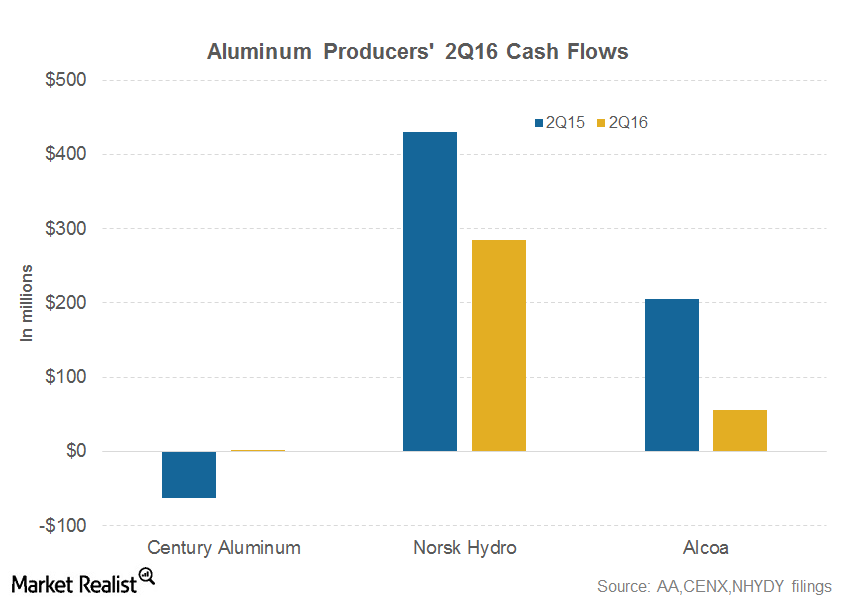

Can Alcoa Generate Positive Free Cash Flows in 2016?

Alcoa (AA) generated free cash flows of $55 million in 2Q16—compared to $205 million in the same quarter last year.

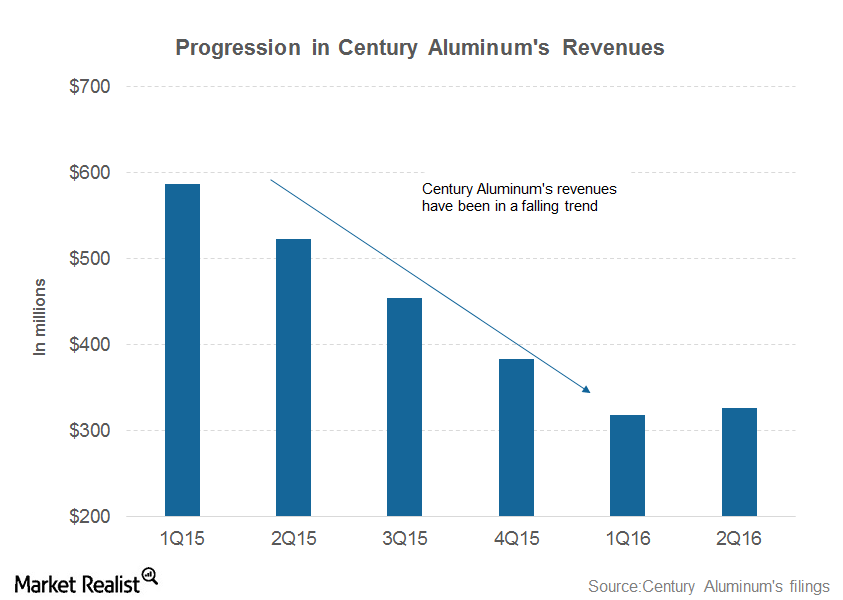

Century Aluminum Misses 2Q16 Revenues: Should You Be Concerned?

Century Aluminum reported revenues of $326 million in 2Q16. The revenue miss shouldn’t be a major concern given its performance on other metrics.

Can Higher Commodity Prices Boost Alcoa’s 3Q16 Earnings?

Alcoa expects its fiscal 2016 net income to rise by $160 million for every $100 per metric ton rise in aluminum prices.

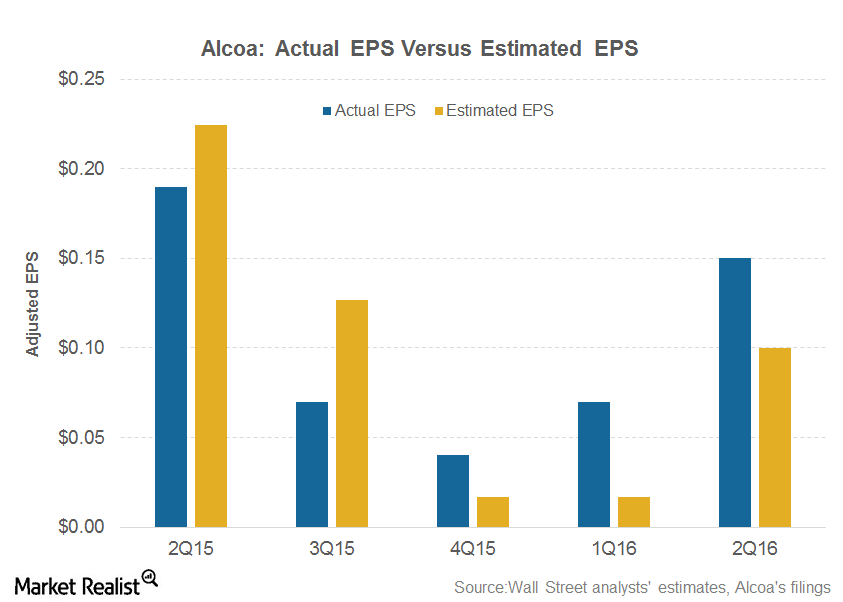

Alcoa’s 2Q16 Earnings: Everything You Need to Know

Alcoa (AA) reported its 2Q16 earnings yesterday after the market closed. Here’s what you should know.

Will Aluminum Demand Grow 6% as Alcoa Is Projecting?

There are valid reasons for aluminum producers to feel upbeat about aluminum demand growth.

Why Are Alumina Prices a Key Driver for Aluminum Companies?

It can take almost two pounds of alumina to produce one pound of aluminum. Naturally, changes in alumina prices would impact aluminum’s production cost.

What’s Driving Alcoa’s Stock?

Alcoa’s stock has witnessed a decent upwards move over the last few trading sessions, gaining more than 16% since November 12.

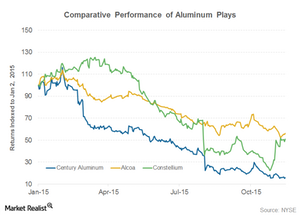

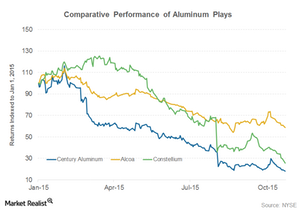

Will Century Aluminum Post a Larger-Than-Expected Loss in 3Q15?

Analysts expect Century Aluminum (CENX) to post a loss when it releases its 3Q15 results on October 29, 2015. Earnings season for the aluminum industry has started on a dull note.

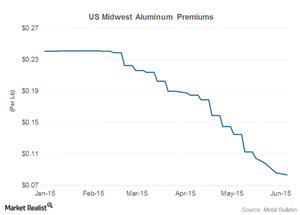

US Midwest Aluminum Premiums Are Still Caught in a Downtrend

Year-to-date, aluminum prices have lost ~9%, while physical aluminum premiums in the US have lost almost 60%.

Key Takeaways from Alcoa’s 1Q 2015 Earnings

Alcoa (AA) reported its 1Q 2015 earnings on April 8. It reported net income of $195 million on revenues of $5.8 billion.