AbbVie Inc

Latest AbbVie Inc News and Updates

Analyzing AbbVie’s Financial Performance

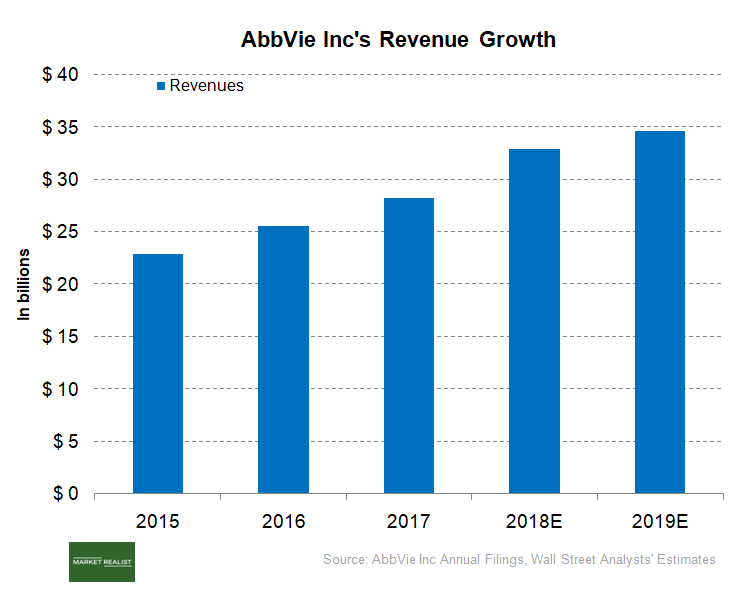

AbbVie (ABBV) generated net revenue of $7.9 billion in 1Q18 compared to $6.5 billion in 1Q17.

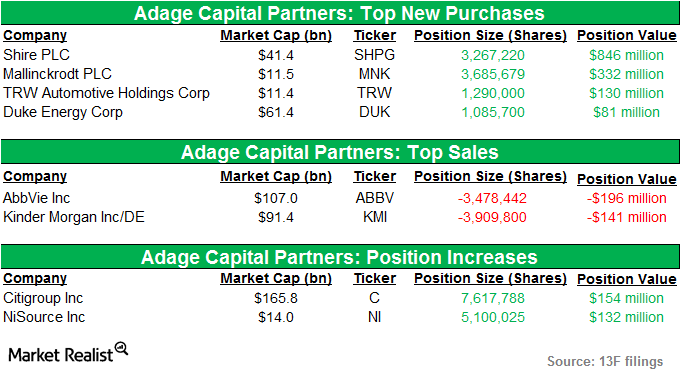

Adage Capital adds a new position in Mallinckrodt

Adage Capital added a new position in Mallinckrodt Plc (MNK) in the third quarter of 2014. The position accounted for 0.82% of the fund’s total portfolio.

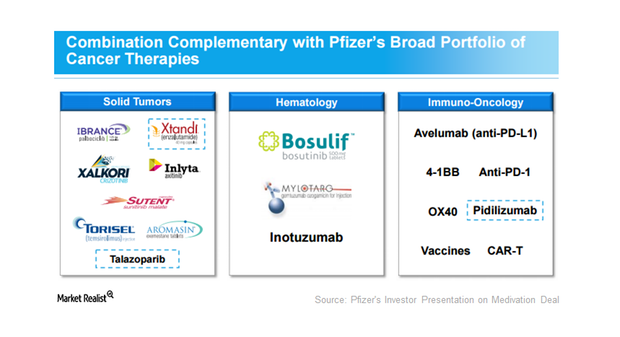

What’s the Story behind the Pfizer-Medivation Deal?

Medivation’s portfolio complements Pfizer’s existing oncology portfolio that includes solid tumors, hematology, and immunology-oncology.

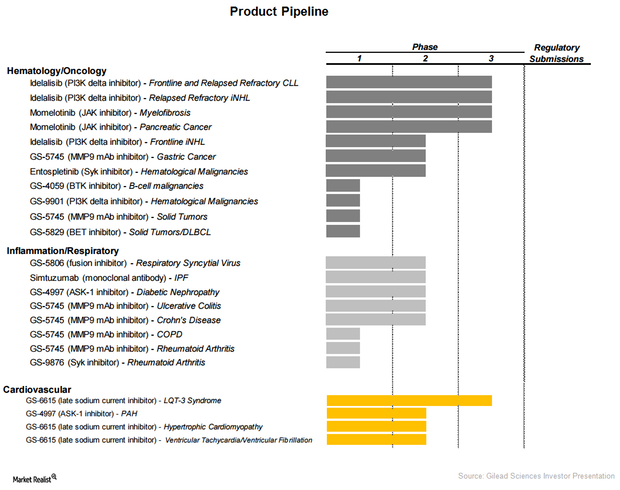

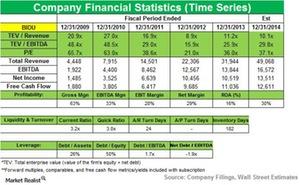

Gilead Sciences’ Product Line Extension

As part of its significant product line extension, Gilead Sciences (GILD) is entering therapeutic areas such as oncology, pulmonology, and cardiology.

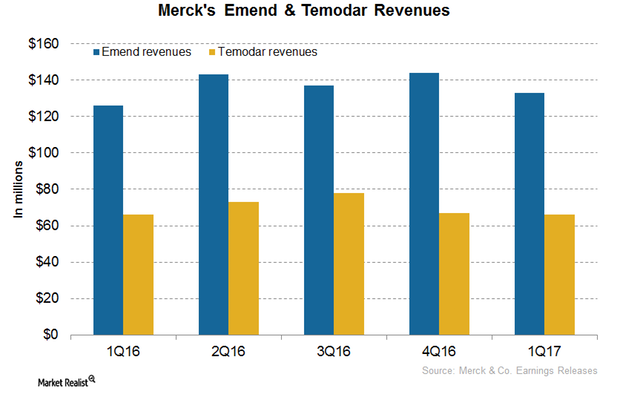

How Merck’s Oncology Drugs Emend and Temodar Could Perform in 2017

In 2016, Merck’s (MRK) Emend reported revenues of around $549 million, which reflected 3% year-over-year growth.

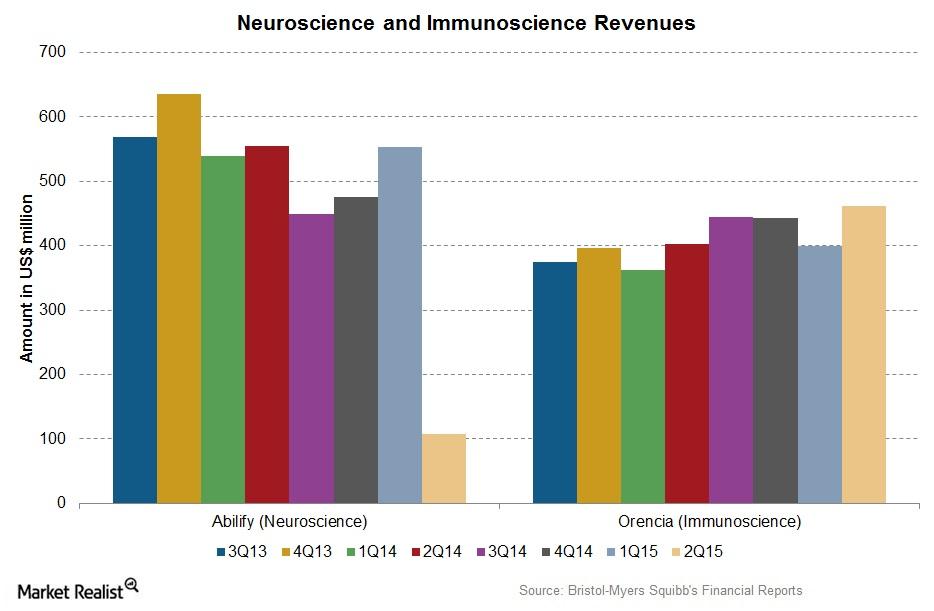

Bristol-Myers Squibb’s Neuroscience and Immunoscience Segments

Sales for Bristol-Myers Squibb’s (BMY) neuroscience segment declined over 80% in 2Q15, while the immunoscience segment’s sales improved ~15% in 2Q15 as compared to 2Q14.

Understanding Bristol-Myers Squibb’s Other Segments

Sales from Bristol-Myers Squibb’s Neuroscience segment declined by 94% in 1Q16. Sales from the Immunoscience segment improved by ~18.7% in 1Q16 over 1Q15.

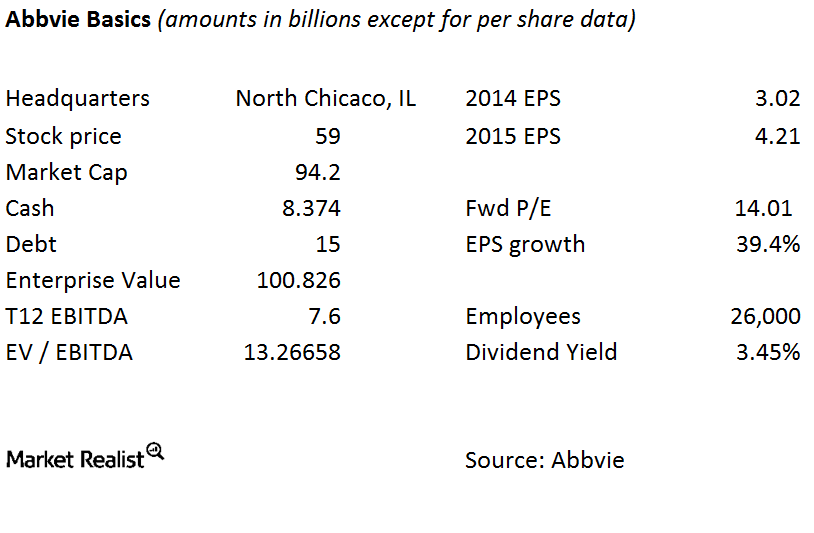

The Pharmacyclics–AbbVie Merger: The Basics of AbbVie

A major reason for the Pharmacyclics–AbbVie merger is to diversify AbbVie away from its reliance on a single product, Humira, and boost its pipeline.

Humira May Continue to Drive AbbVie’s Revenue Growth

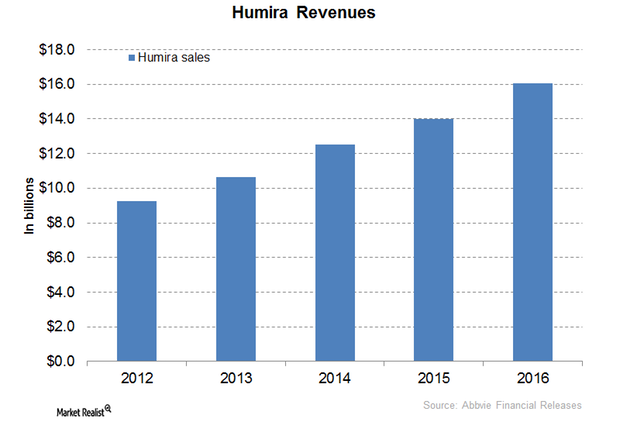

In 2016, AbbVie’s (ABBV) drug Humira reported revenue of ~$16.0 billion, which reflected a ~15% year-over-year (or YoY) rise.

Overview of BioMarin: History and Product Portfolio

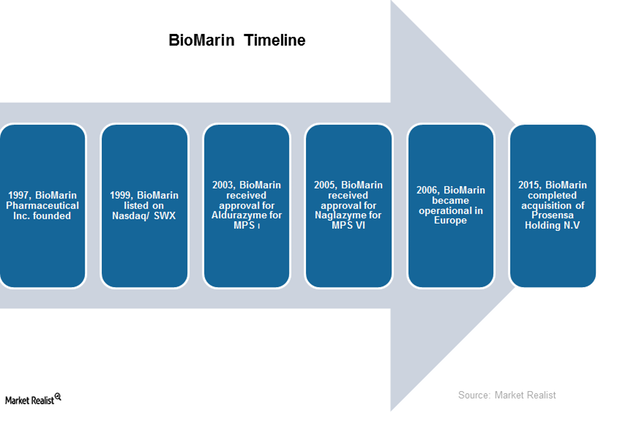

Here we present an overview of BioMarin. It’s based in California and was founded in 1997. It focuses on therapies for life-threatening rare genetic diseases.

AbbVie Strengthens Its Position in the Virology Segment

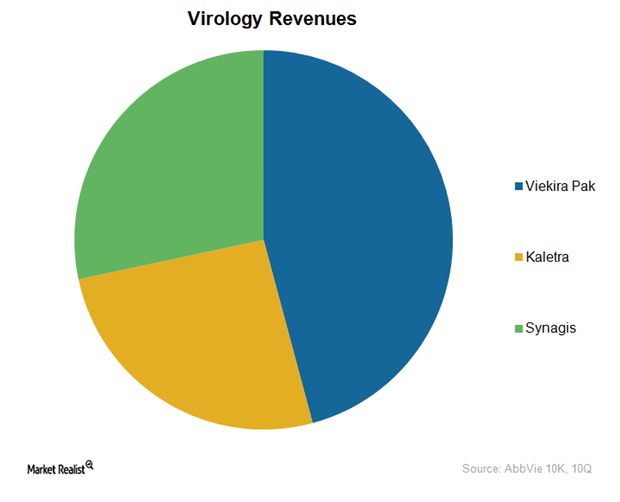

In addition to Humira, AbbVie also offers several virology drugs targeting diseases such as hepatitis C, HIV, and respiratory syncytial virus.

Mylan’s Humira Biosimilar Opportunity in Europe

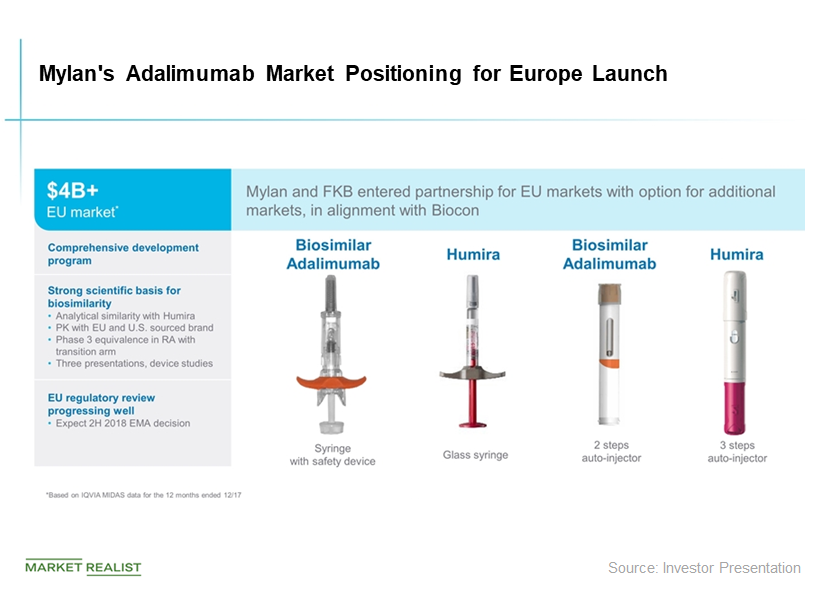

On September 20, Mylan and its partner, Fujifilm Kyowa Kirin Biologics, received the marketing authorization from the European Commission for Hulio.

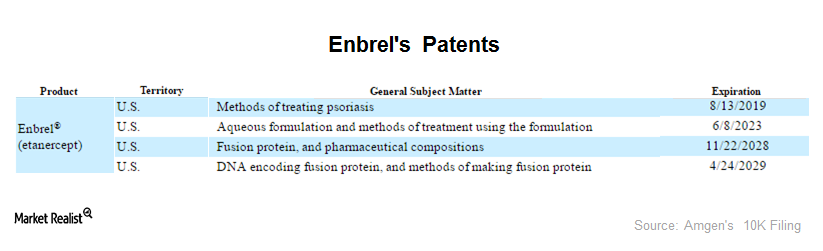

Why Is Enbrel So Important for Amgen?

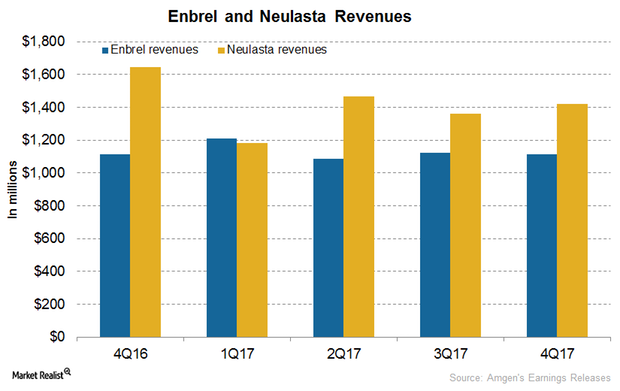

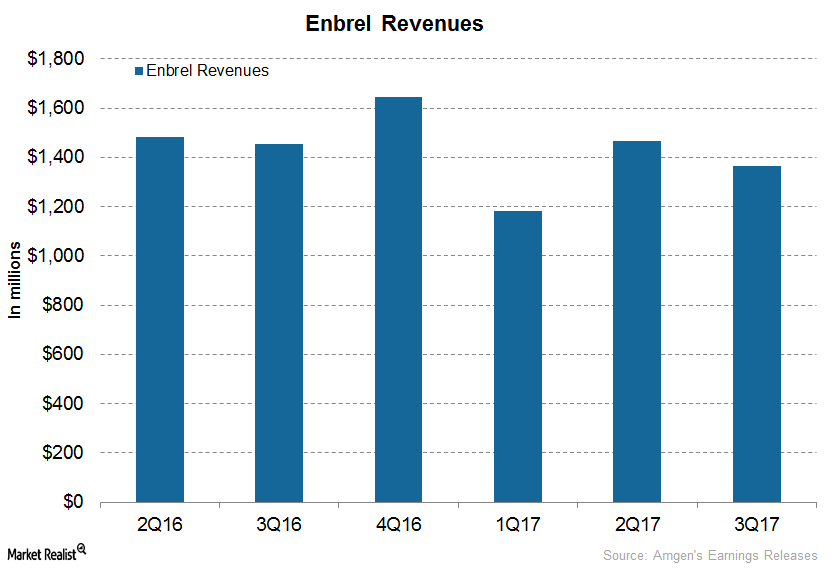

YTD, Amgen’s (AMGN) stock has already fallen 9%. Perhaps the pressure that Enbrel (etanercept) is seeing is to blame for the negative investor sentiment.

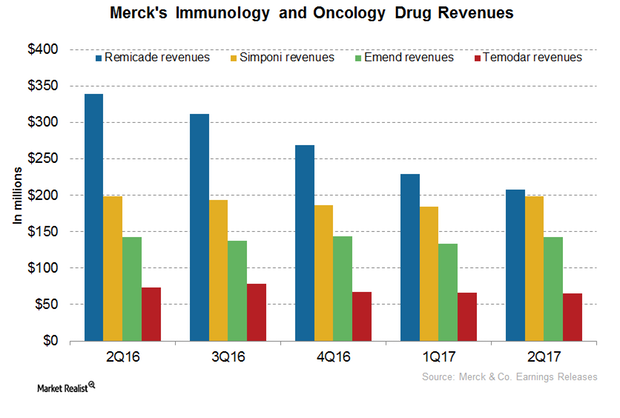

A Look into Merck’s Immunology and Oncology Portfolio

In 1H17, Remicade generated revenues of around $437 million, which is a 37% decline year-over-year.

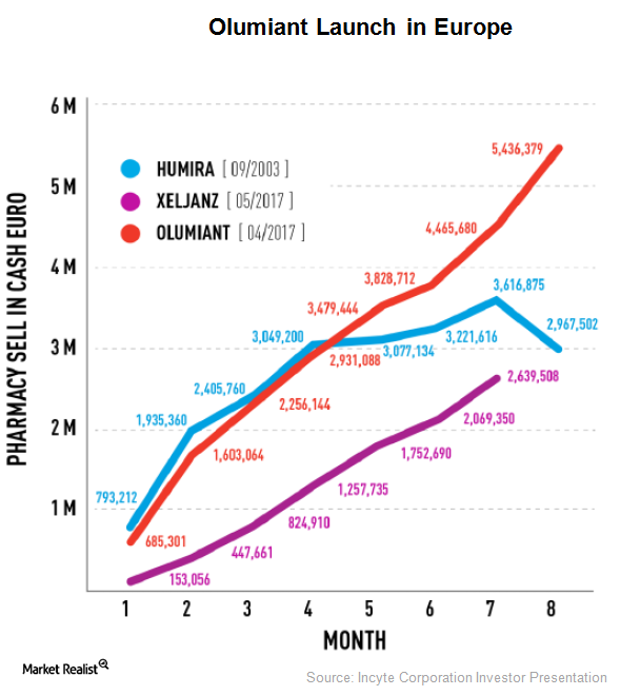

Olumiant Could Boost Incyte’s Revenues

In February 2017, Eli Lilly (LLY) secured approval for Olumiant (baricitinib) from the European Medicines Agency (or EMA) for patients suffering from moderate-to-severe rheumatoid arthritis.

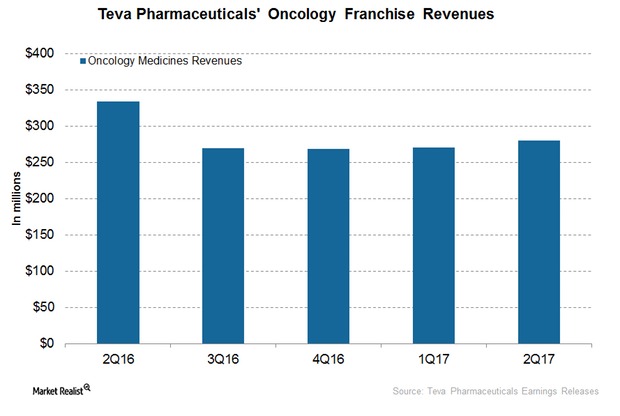

The Latest on TEVA’s Oncology Business

In 1H17, Teva Pharmaceutical’s (TEVA) oncology business generated revenues of ~$550 million, or ~9% lower YoY (year-over-year).

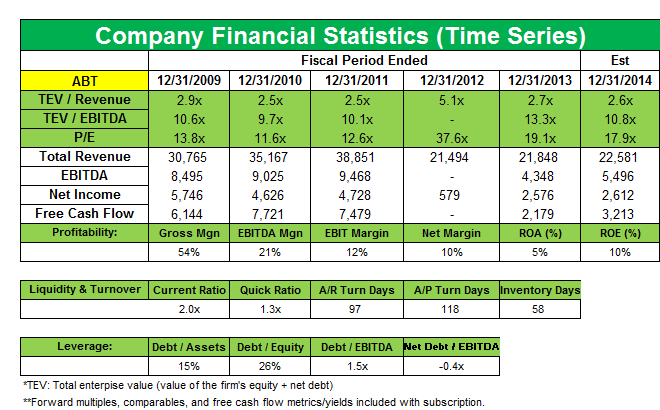

Chilton opens a new position in Abbott Laboratories in 4Q13

Abbott Laboratories (ABT) is a brand new position that accounts for 1.19% of Chilton’s fourth quarter 2013 portfolio.

A key overview of Adage Capital’s holdings in 3Q14

Adage Capital’s US long portfolio grew from $38.69 billion in 2Q14 to $40.2 billion in 3Q14. The portfolio comprised around 699 stocks.

Maverick Capital lowers position in Baidu, Inc.

Maverick Capital lowered its position in Baidu, Inc. in 3Q14. The position accounts for 0.36% of the fund’s total portfolio in the third quarter.

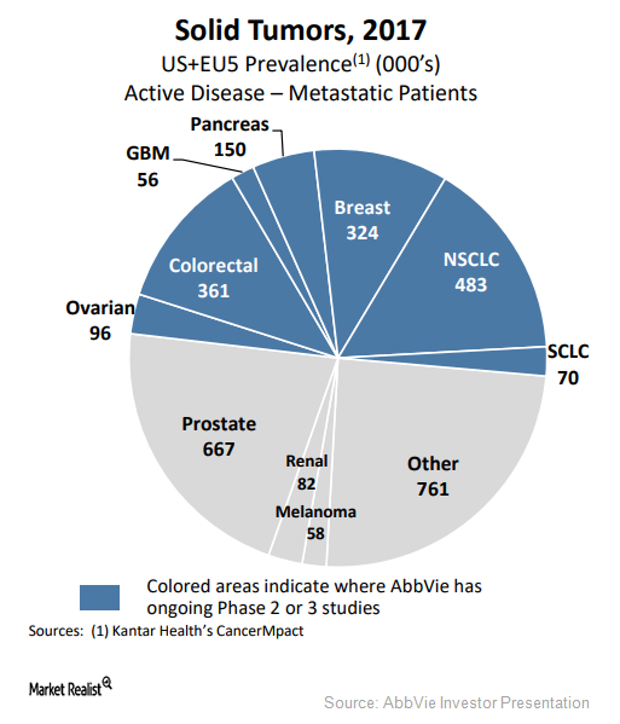

AbbVie Rapidly Advancing Its 2018 Solid Tumor Portfolio

AbbVie (ABBV) is currently evaluating more than 20 investigational therapies targeting solid tumors. Seventeen of them are in Phase 1 trials.

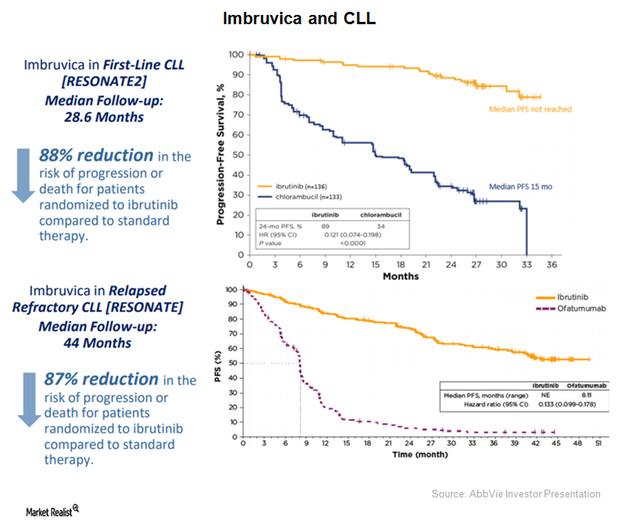

AbbVie Expects Peak Sales of $7 Billion for Imbruvica

AbbVie (ABBV) has projected Imbruvica’s annual revenues to be $5 billion by 2020. That would be driven by a rapid uptake in the first line chronic lymphocytic leukemia (or CLL) segment.

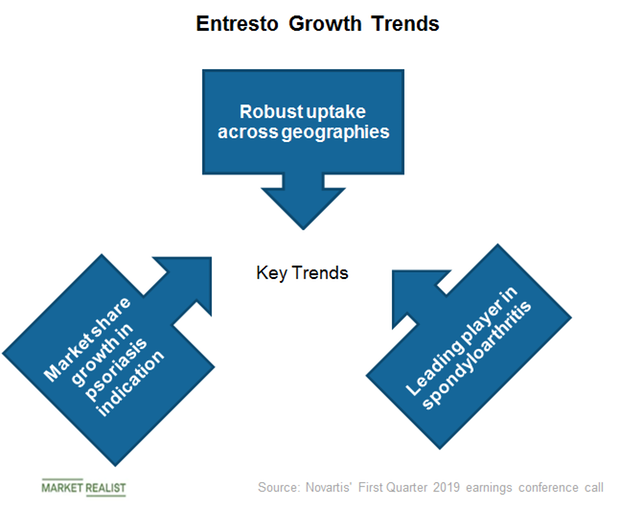

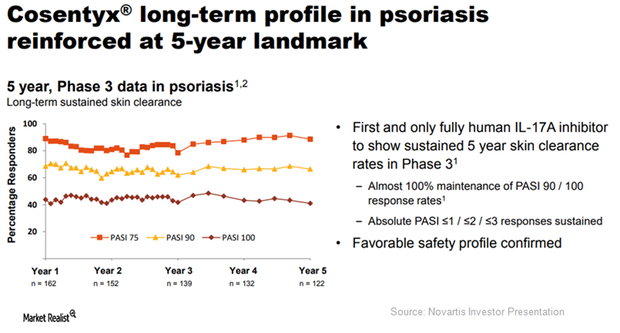

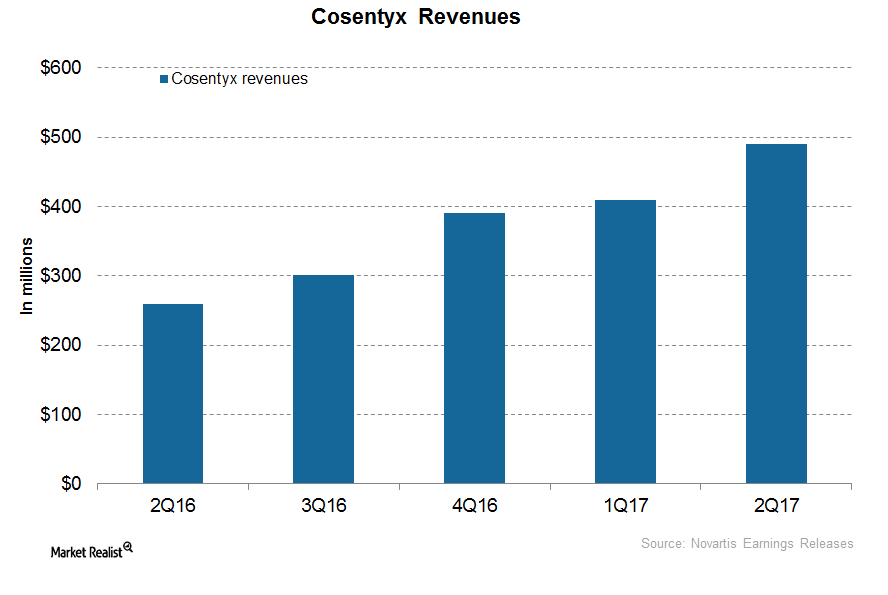

A Look at Cosentyx, Novartis’s Fast-Growing Immunology Drug

In the first quarter, Novartis’s (NVS) Cosentyx reported net sales of $791 million, a YoY (year-over-year) rise of 41% on a constant currency basis.

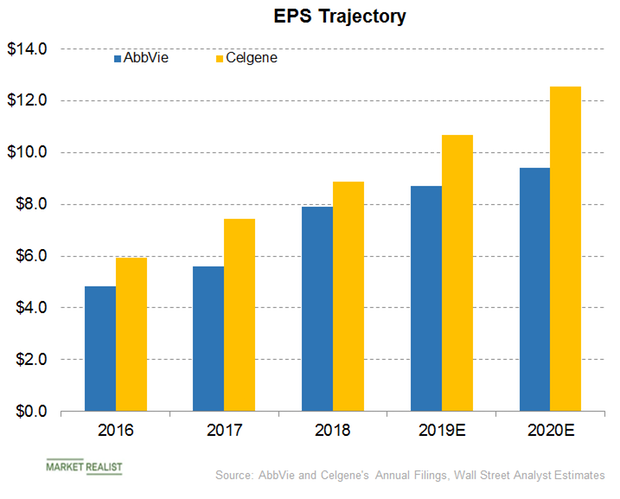

AbbVie or Celgene: Which Is Expected to Report Faster EPS Growth?

On its fourth-quarter earnings conference call, AbbVie (ABBV) guided for an adjusted gross margin of 82.5% in 2019.

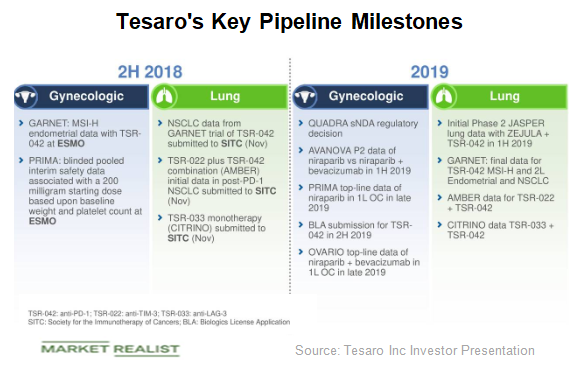

Here’s What Tesaro’s Valuation Trend Indicates

Tesaro stock has been on a downward trajectory for the past 52 weeks. From a high of $135 on September 5, 2017, it has corrected to $27 in August.

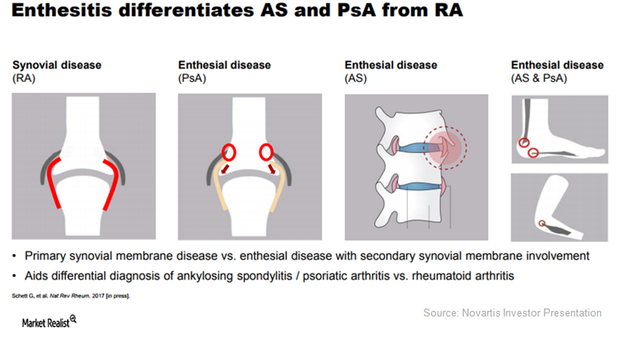

How Cosentyx Resolves Enthesitis in Psoriatic Arthritis Patients

Only 525,000 patients (or 55% of the diagnosed psoriatic arthritis patients) were eligible for treatment with biologics.

Novartis’s Cosentyx May Emerge as a Leading Psoriasis Drug

According to Novartis’s estimates for the US biologics market in 2016, there were ~8.4 million patients with moderate to severe psoriasis in the US.

Amgen’s Neulasta and Enbrel in 4Q17 and 2017

In 4Q17, Amgen’s (AMGN) Neulasta generated revenues of $1.1 billion, which reflected a 1% decline on a quarter-over-quarter basis.

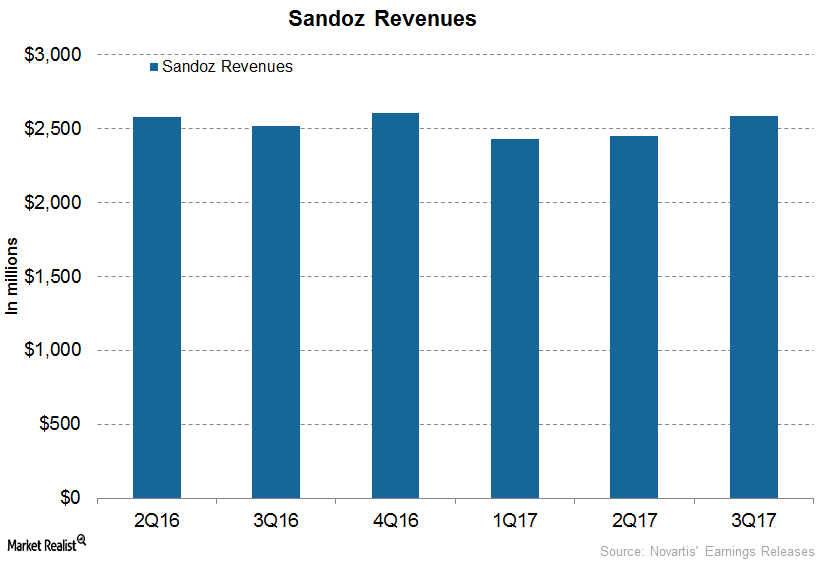

How Is Novartis’s Subsidiary Sandoz Positioned for 2018?

In 1Q17, 2Q17, and 3Q17, Novartis’s (NVS) subsidiary Sandoz generated revenues of $2.4 billion, $2.5 billion, and $2.6 billion, respectively.

Vermont Legalizes Recreational Marijuana on January 22, 2018

On January 22, Vermont decriminalized the possession of marijuana for adults 21 and older. Vermont became the ninth state to legalize marijuana for recreational purposes.

The Marijuana Ecosystem’s Potential Business Opportunities

Given that legislative approval is the strongest driving factor behind the boost in the marijuana industry, companies have rushed to capitalize on the wave.

Is Investment in the Marijuana Space Picking Up?

In the previous part of this series, we saw that the alcohol industry could expect marijuana legalization for recreational purposes as an extension to their growth strategy.

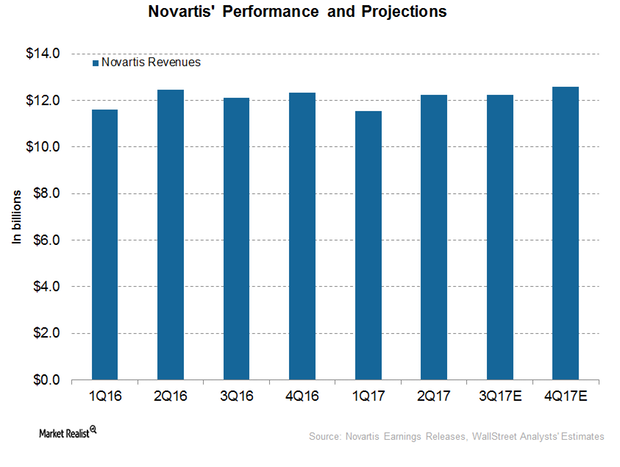

Behind Novartis’s 4Q17 Earnings: Why Some Expect Revenue Growth

Analysts expect Novartis’s revenues to rise ~3.9% to $12.8 billion in 4Q17, driven by growth in operating revenues across all three segments.

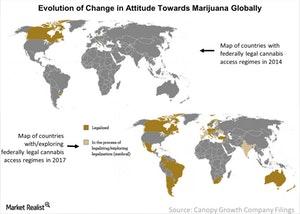

How Marijuana Acceptance Is Evolving Globally

It’s fascinating to see how the marijuana landscape around the world has evolved in the last three years. According to Canopy Growth (WEED.TO), Canada, Israel, the Czech Republic, Uruguay, and the Netherlands “established federally legal cannabis access regimes” in 2014.

How Amgen’s Enbrel and Nplate Are Positioned for 2018

In 1Q17, 2Q17, and 3Q17, Amgen’s (AMGN) Enbrel generated revenues of ~$1.2 billion, ~$1.5 billion, and ~$1.4 billion, respectively.

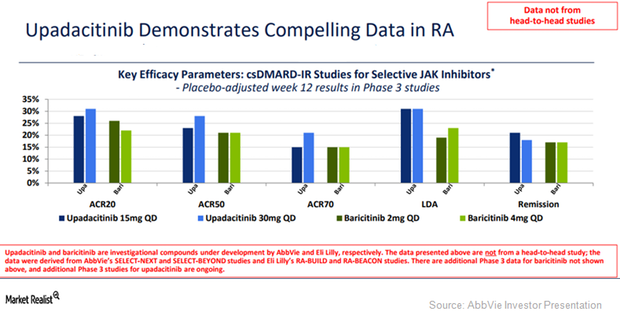

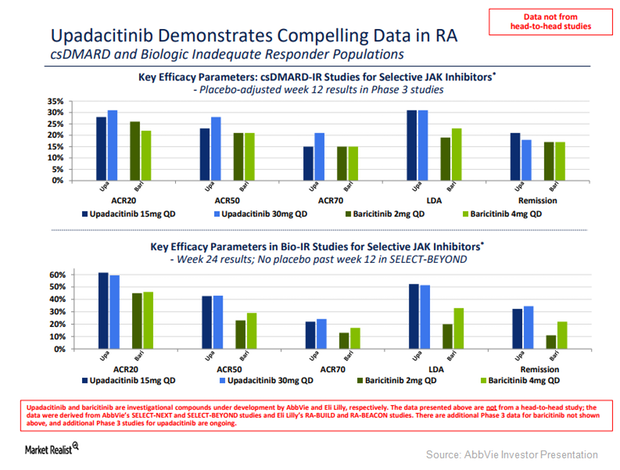

Why AbbVie’s Upadacitinib Keeps Posting Strong Data for Rheumatoid Arthritis

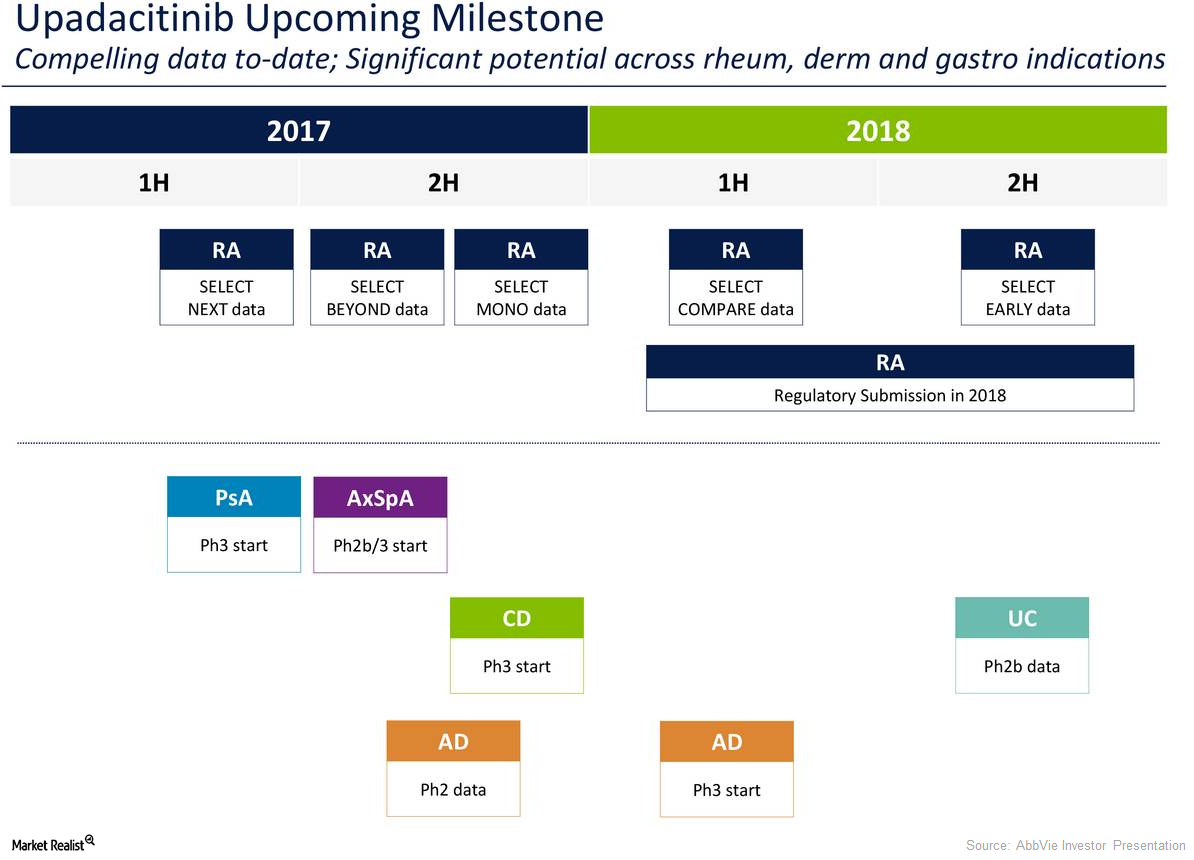

On December 20, 2017, AbbVie (ABBV) reported positive top-line results from its phase-3 trial Select-Monotherapy.

What Upadacitinib Did for AbbVie in 2017

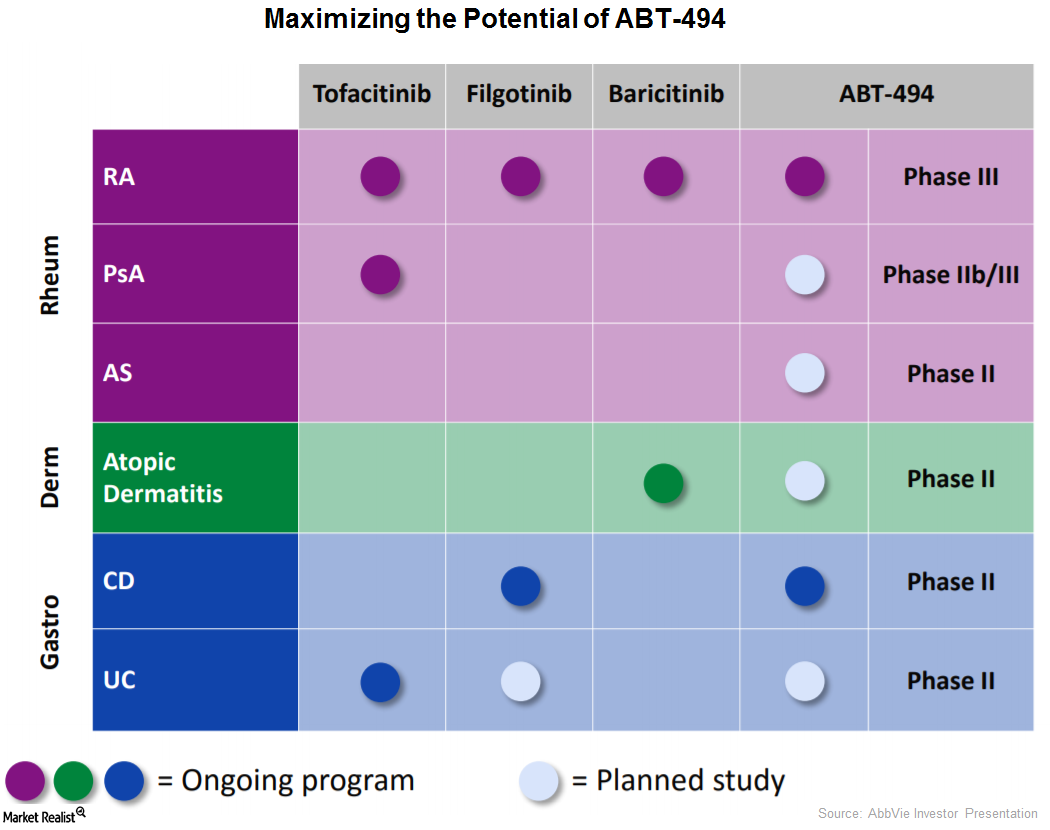

In September 2017, AbbVie’s (ABBV) investigational immunology drug, Upadacitinib (ABT-494), managed to demonstrate its clinical potential.

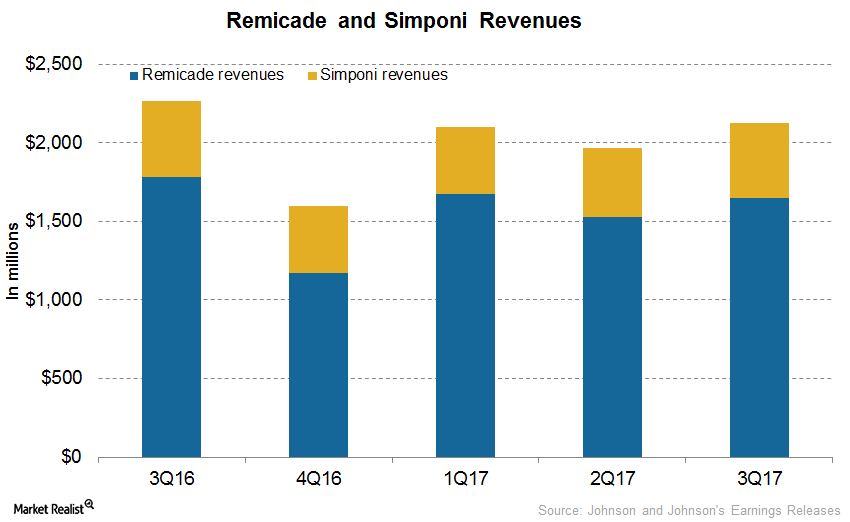

How Johnson & Johnson’s Remicade and Simponi Performed in 3Q17

In 3Q17, Johnson & Johnson’s (JNJ) Remicade generated revenues of $1.6 billion, which reflected a ~8% decline on a year-over-year (or YoY) basis and 8% growth on a quarter-over-quarter basis.

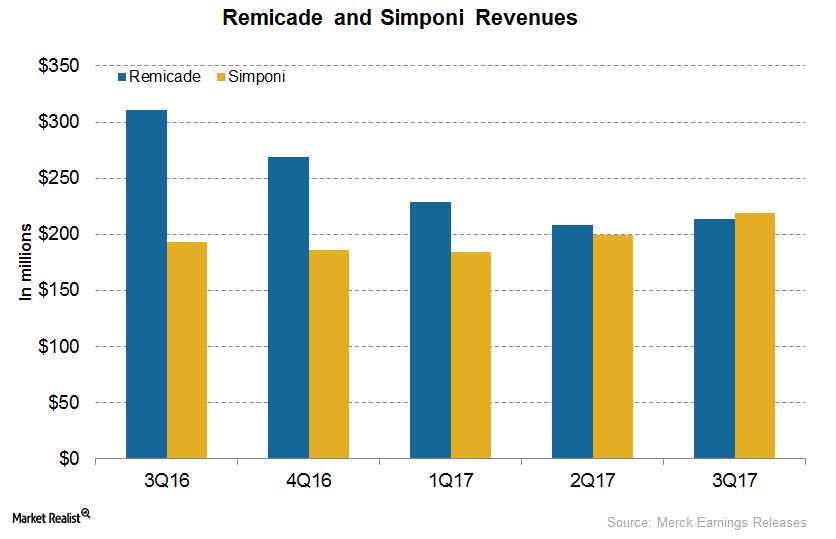

Merck’s Immunology and Oncology Drugs, Post-3Q17

Immunology drug revenue In 3Q17, Remicade generated revenue of $214 million, a ~31% fall YoY (year-over-year) and 3% growth QoQ (quarter-over-quarter). During the first nine months of 2017, Remicade reported revenue of $651 million, which reflected a ~35% fall YoY. Foreign exchange had a 3% favorable effect towards 3Q17 Remicade revenue. In 3Q17, Simponi reported revenue of […]

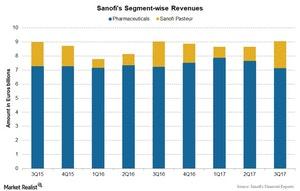

Understanding Sanofi’s Revenues by Segment in 3Q17

Sanofi reports its business in two segments: Human Pharmaceuticals and Sanofi Pasteur, or the Human Vaccines segment.

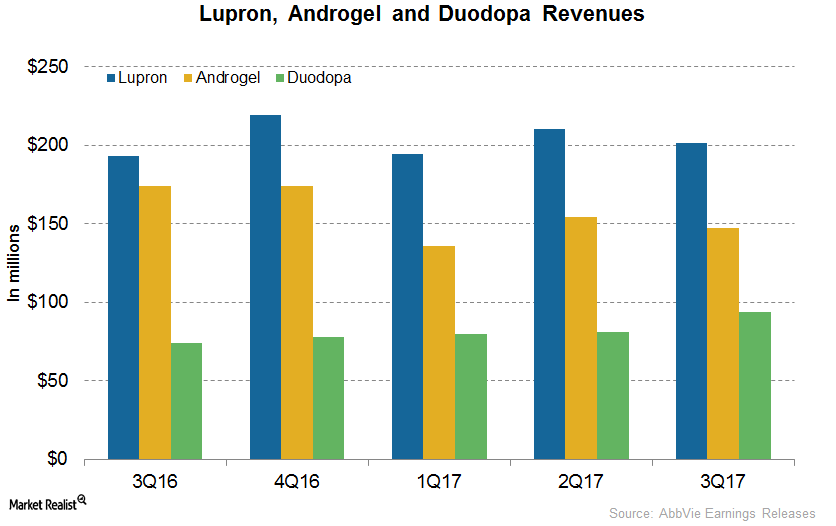

How AbbVie’s Drugs Performed in 3Q17

In 3Q17, AbbVie’s (ABBV) Lupron generated revenues of around $201 million, which reflected ~4% growth on a year-over-year (or YoY) basis.

Why Upadacitinib Could Be AbbVie’s Long-Term Growth Driver

In September 2017, AbbVie (ABBV) presented successful results from its phase 3 SELECT-BEYOND trial.

Why Upadacitinib Could Drive AbbVie’s Long-term Growth

In September 2017, AbbVie (ABBV) presented the results from a phase 2B trial of upadacitinib (ABT-494) for the treatment of adult individuals with moderate to severe atopic dermatitis.

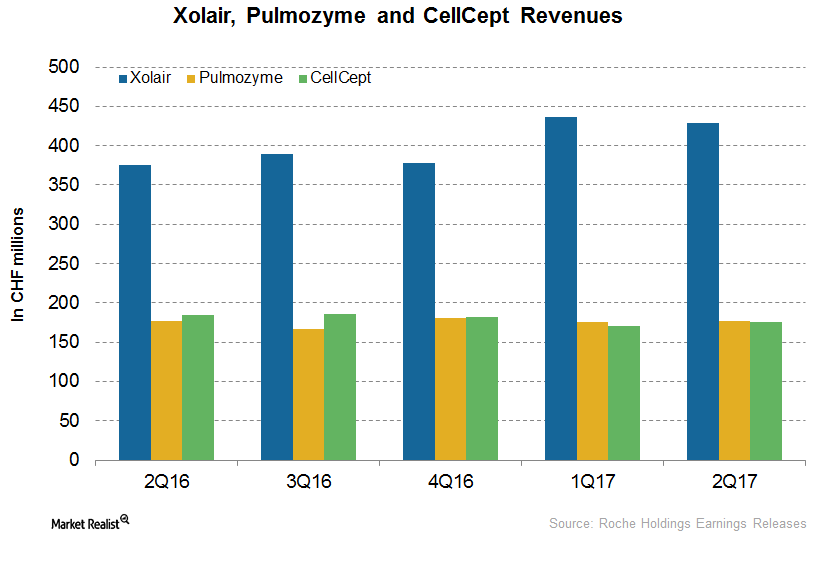

Roche’s Immunology Drugs Xolair, Pulmozyme, and CellCept

In the first half of 2017, Roche’s (RHHBY) Xolair reported revenues of CHF 866.0 million, which is a 17.0% rise on a YoY (year-over-year) basis.

Why Cosentyx Could Significantly Drive Novartis’s Revenue Growth

In 1H17, Novartis’s (NVS) Cosentyx generated revenues of around $900 million compared to $436 million in 1H16.

How Did Novartis Perform in 1H17?

In 1H17, Novartis (NVS) reported revenues of around $23.8 billion, a ~1% decline on a year-over-year (or YoY) basis.

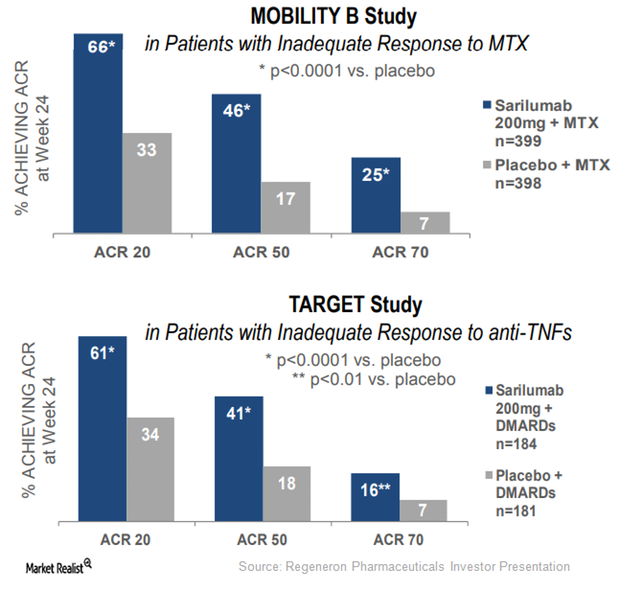

Kevzara May Emerge as a Prominent Rheumatoid Arthritis Drug in 2017

Regeneron and Sanofi have submitted an application seeking regulatory approval for Kevzara in Japan.

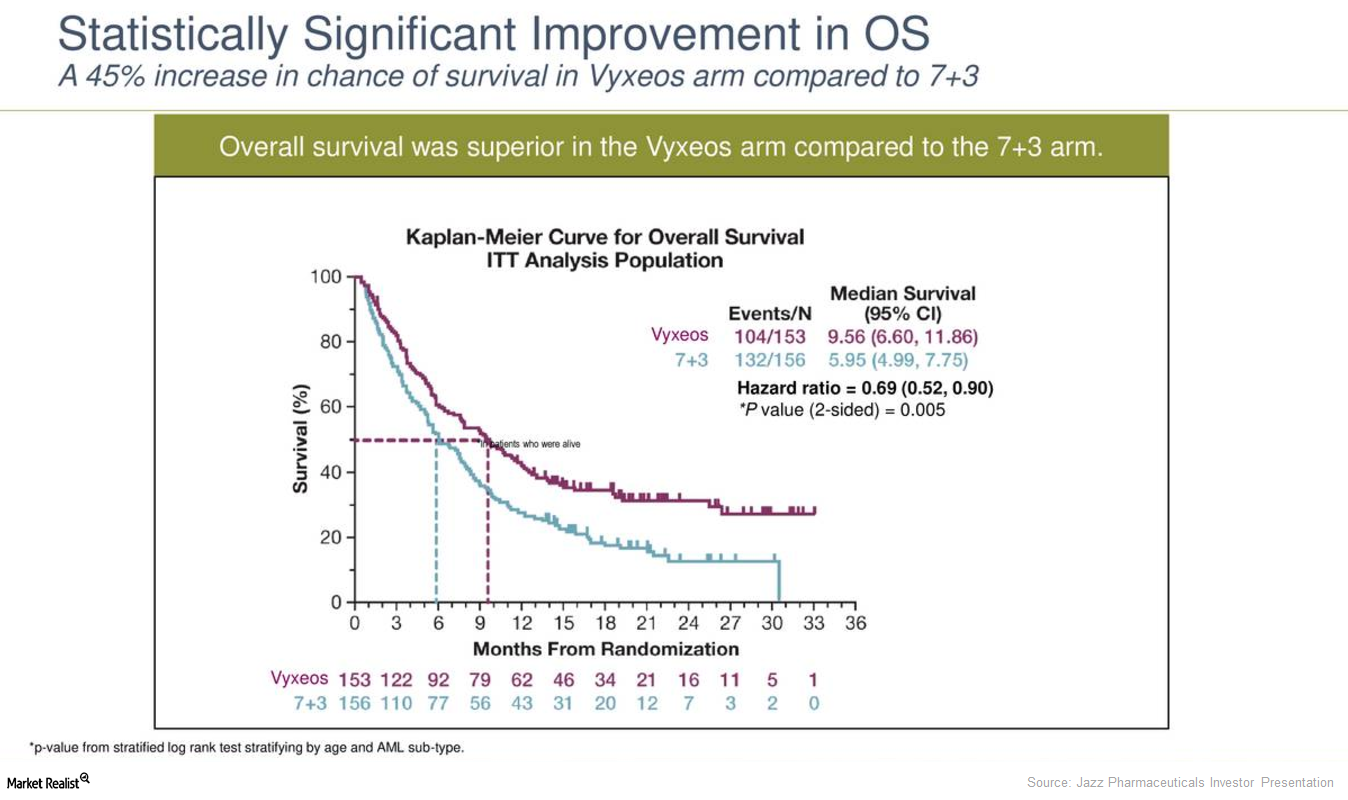

Why Jazz Pharmaceuticals’ Vyxeos Could Boost Revenue Growth in 2018

In August 2017, JAZZ’s Vyxeos liposome injection for the treatment of adult individuals with rapidly progressing or life t-AML received FDA approval.

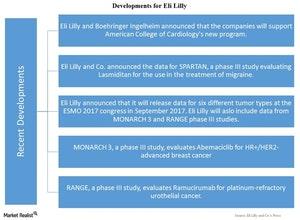

Eli Lilly & Co.’s Recent Developments after Its 2Q17 Earnings

On July 31, 2017, Eli Lilly and Boehringer Ingelheim announced that the companies would support one of the new programs by the American College of Cardiology.

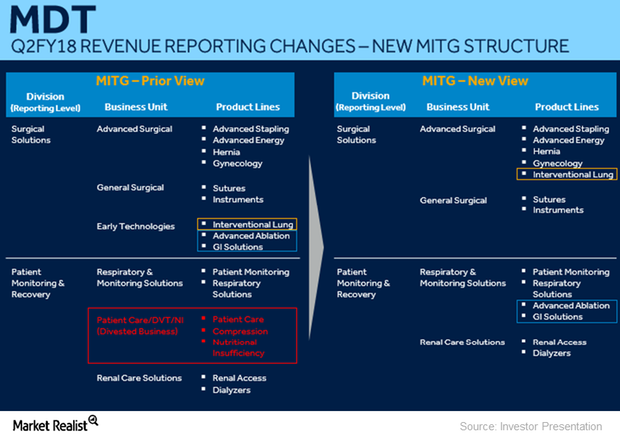

Divestiture of a Part of Medtronic’s PMR Business to Cardinal Health

Medtronics’ MITG (Minimally Invasive Therapies Group) business is expected to grow 3.5%–4.5%.

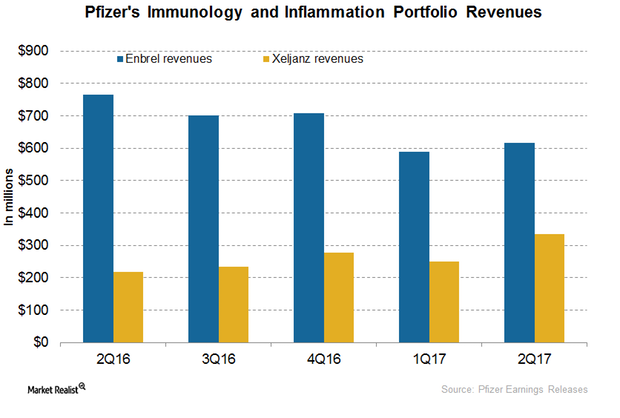

How Pfizer’s Enbrel and Xeljanz Are Positioned after 2Q17

In August 2017, the Arthritis Advisory Committee of the FDA recommended a positive opinion for the proposed dose of Xeljanz for the treatment of individuals with active psoriatic arthritis.