AbbVie Inc

Latest AbbVie Inc News and Updates

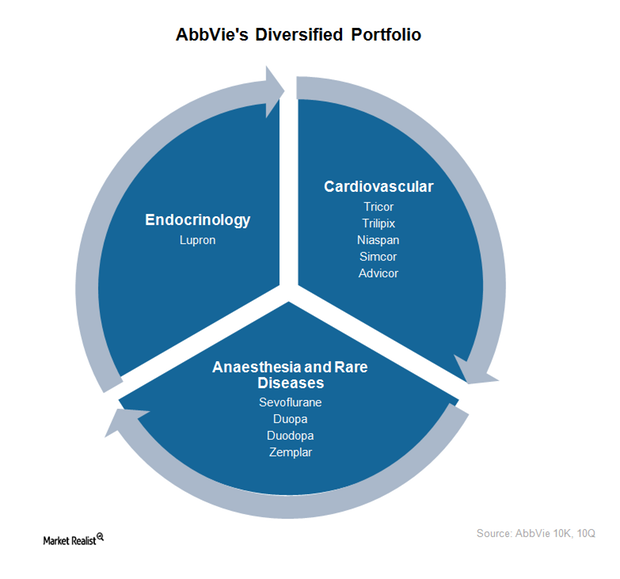

AbbVie’s Endocrinology, Cardiovascular, and Rare Disease Segments

AbbVie has a diversified offering of drugs for the treatment of conditions related to endocrinology, cardiovascular, and rare disease.

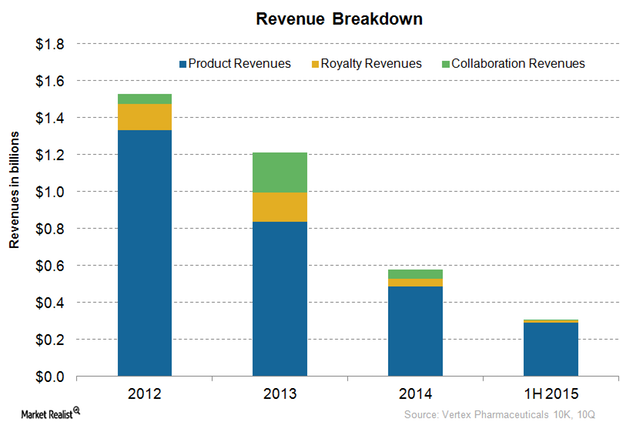

Vertex Pharmaceuticals’ 3-Pronged Business Model

Vertex Pharmaceuticals’ (VRTX) business model includes revenues in three areas: products, royalties, and collaboration. There’s significant variability in royalty and collaboration revenues.

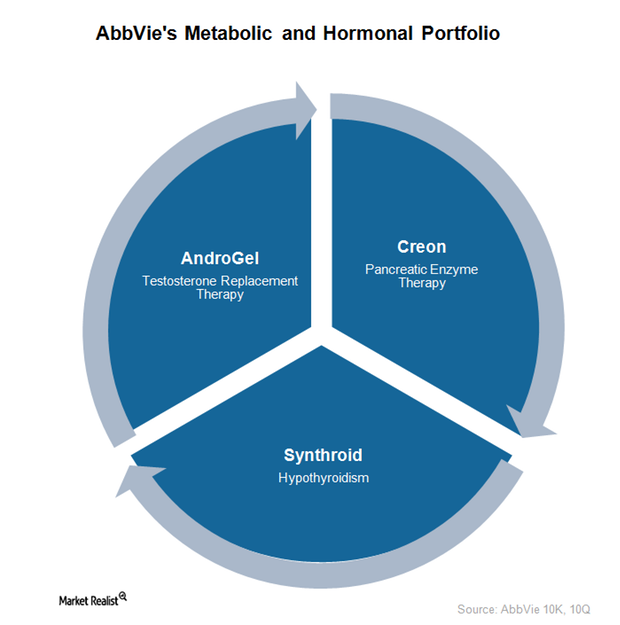

AbbVie Has a Strong Metabolic and Hormonal Portfolio

AbbVie’s metabolic and hormonal portfolio offers drugs such as AndroGel, Creon, and Synthroid to address various medical conditions.

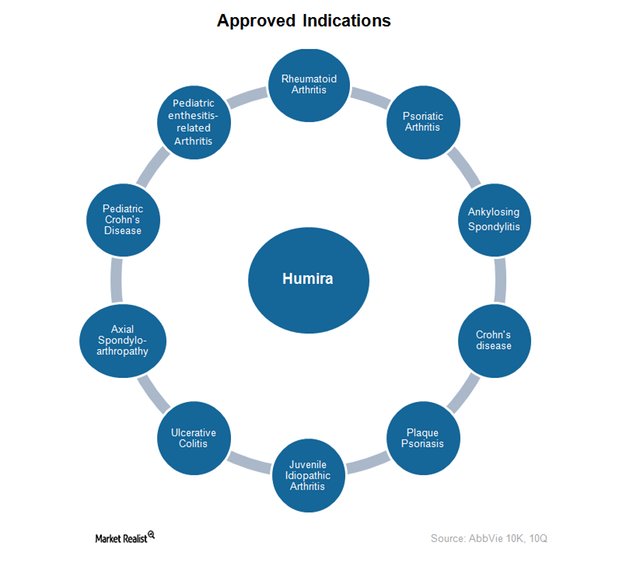

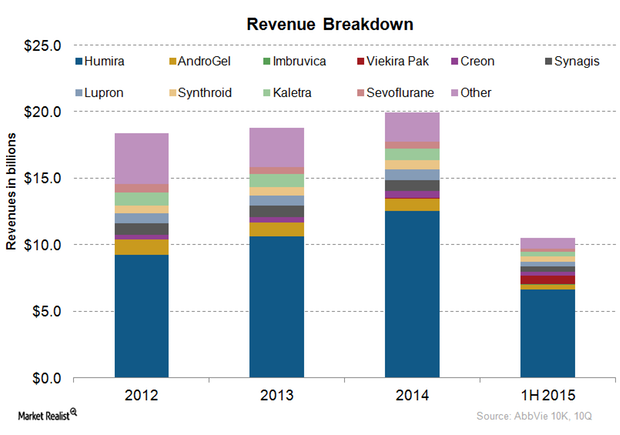

Humira Continues to Dominate AbbVie’s Revenues

Since Humira’s launch in the US market in 2002, Abbott Laboratories and its spin-off AbbVie have aggressively expanded the drug’s approved indications.

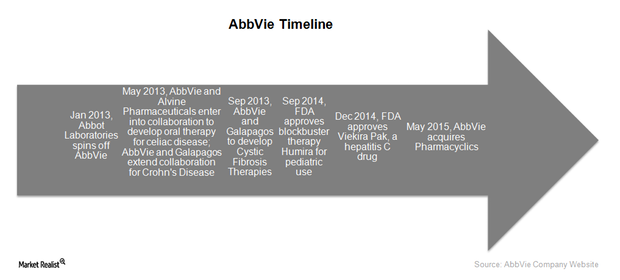

An Overview of AbbVie’s Business Model

AbbVie’s business model involves generating revenues through the sale of pharmaceutical products, which target some of the world’s most serious diseases.

AbbVie: An Investor’s Look at a Leading Biotechnology Company

With a market capitalization of $100.7 billion, AbbVie is a major US biopharmaceutical company. AbbVie competes with Amgen, Gilead Sciences, and Bristol-Myers Squibb .

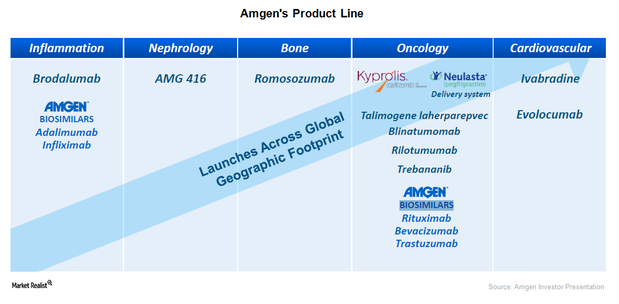

Amgen’s Presence in the Biosimilar Market

As it is still relatively difficult to introduce biosimilars, Amgen plans to enter the US market by leveraging experience of biosimilars in the European market.

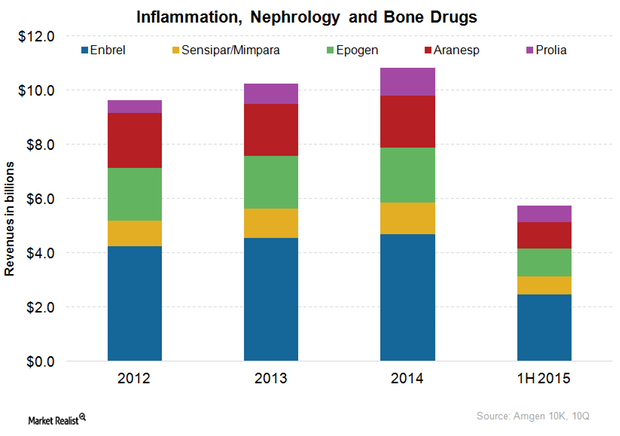

Amgen’s Presence in Inflammation, Nephrology, and Bone Segments

Amgen offers various nephrology drugs such as Epogen, Aranesp, Sensipar, and Mimpara. Both Epogen and Aranesp have been facing squeezed profits from tight competition.

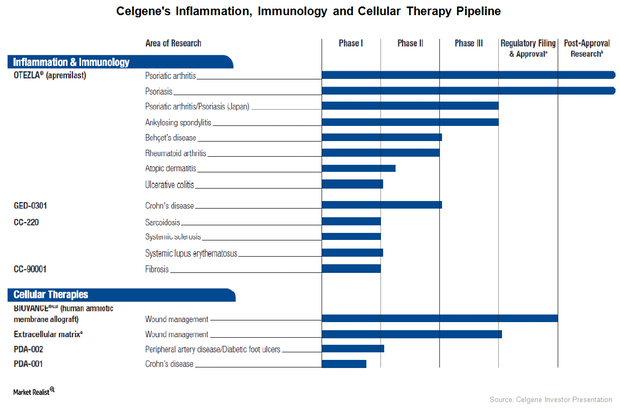

Celgene’s Growing Inflammation and Immunology Pipeline

Celgene has entered the inflammation and immunology drug market, as well as the cell therapies market, in order to be less dependent on MM drugs.

Sanofi’s Position Compared to Its Peers

The forward PE ratio for Sanofi is ~15.1x for 2015, and ~18.1x for the industry.

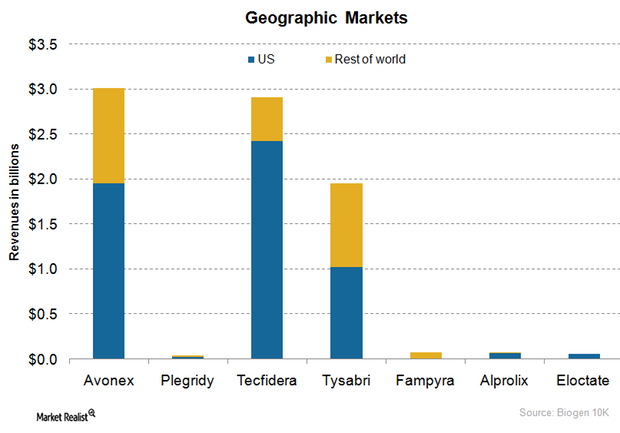

Biogen’s Geographic Market Strategy

In 2014, Biogen earned about 27% of its total revenues from international markets such as Canada, Europe, and emerging economies.

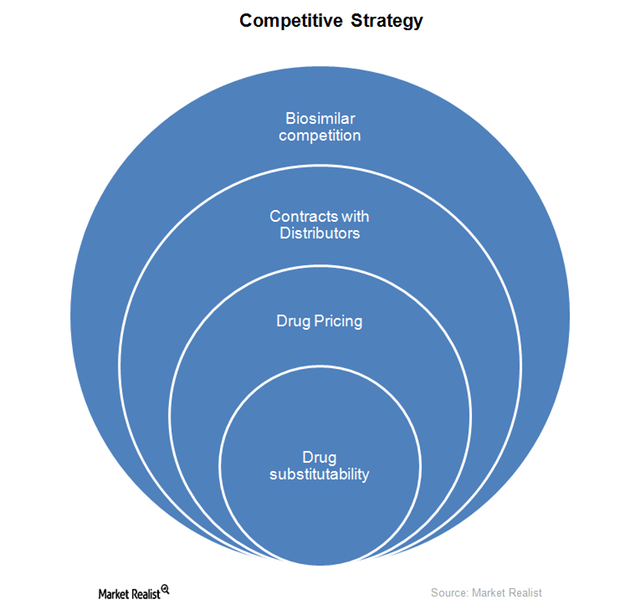

How Does Competition Impact the Biotechnology Industry?

The biotechnology sector is witnessing intense competition with big pharmaceutical companies entering into collaborations and mergers and acquisitions with biotechnology companies.

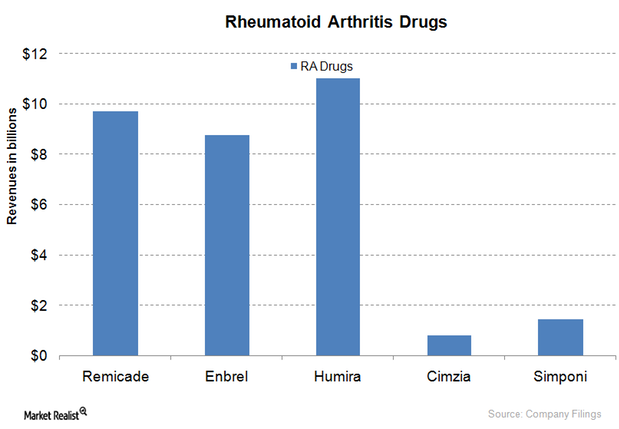

Humira Takes Top Spot for Rheumatoid Arthritis Drugs

There’s no complete cure for rheumatoid arthritis, so most RA drugs are part of disease-management therapy. Humira accounts for 23.5% of the RA market share.

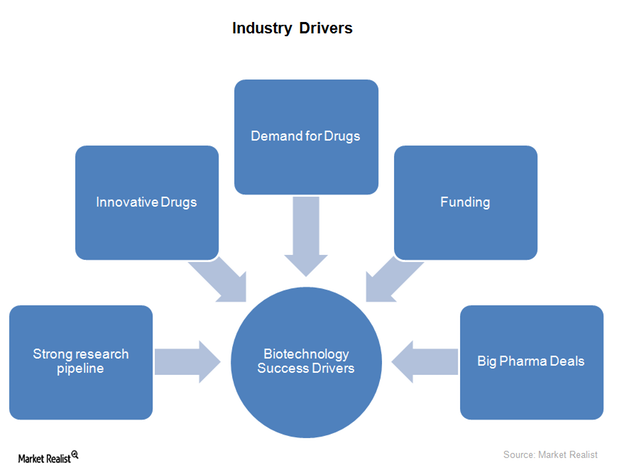

Commercial Growth Drivers of the Biotechnology Industry

After 2012, the biotechnology industry (IBB) had a period of solid growth, mainly driven by novel scientific inventions and aggressive commercial distribution.

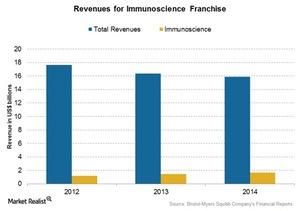

Bristol-Myers Squibb’s Immunoscience Franchise

Bristol-Myers Squibb’s (BMY) immunoscience franchise deals with medicines that help defend the body against invading pathogens like bacteria, viruses, and cancer cells.

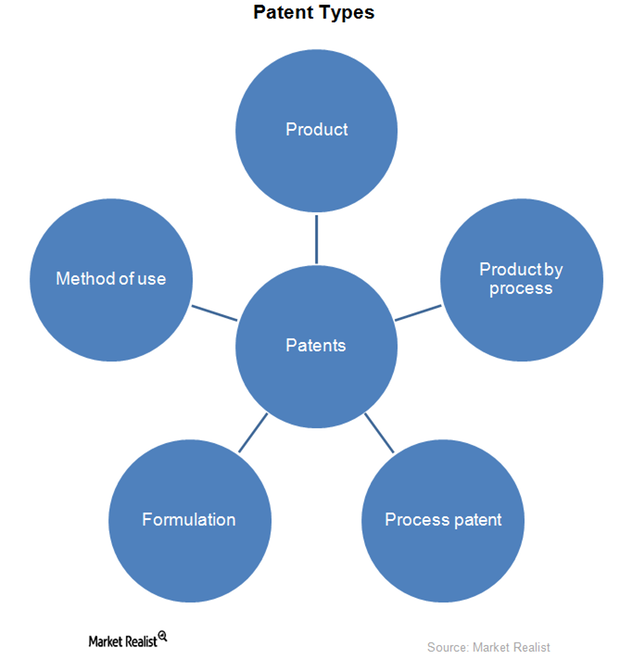

Patents and the Biotechnology Sector

The biotechnology industry will witness 12 blockbuster drugs worth $67 billion in annual revenues lose their patents by 2020. This is the so-called patent cliff.

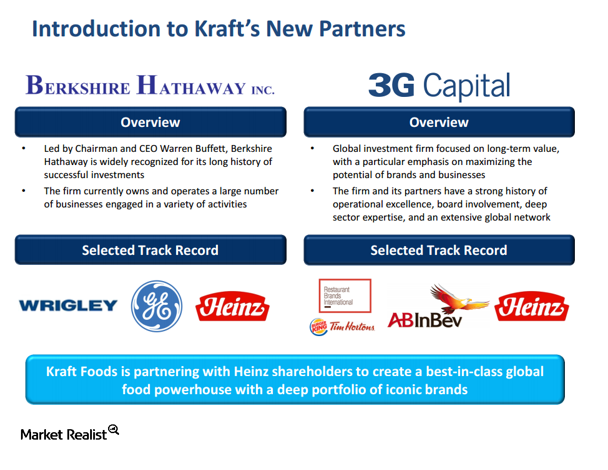

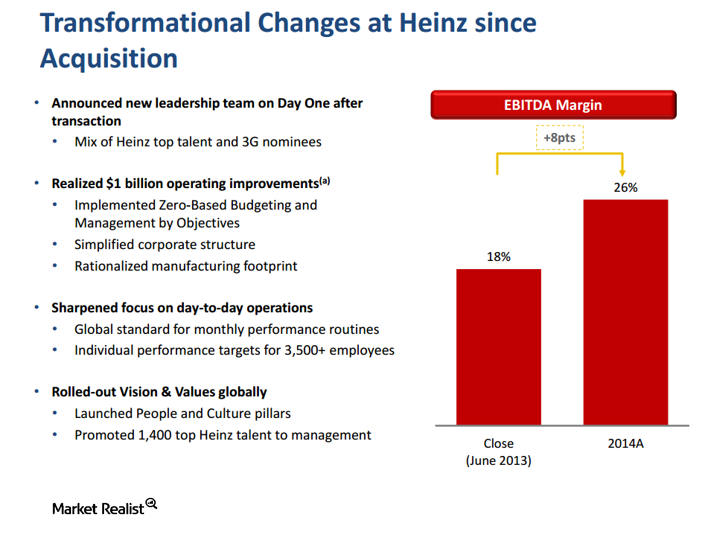

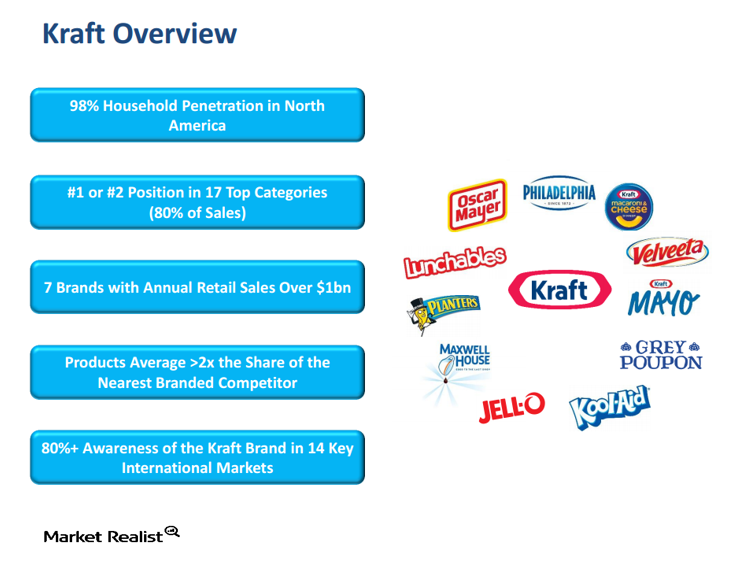

The Kraft–Heinz merger: Overview of Heinz

Kraft’s (KRFT) and Heinz’s portfolio of brands are highly complementary, which is a big reason for the Kraft–Heinz merger.

The Kraft–Heinz Merger: What If the Deal Breaks?

The Kraft–Heinz merger isn’t a typical risk arbitrage deal because you can’t arbitrage a spread. Before the deal, Kraft was trading at $62.40 a share.

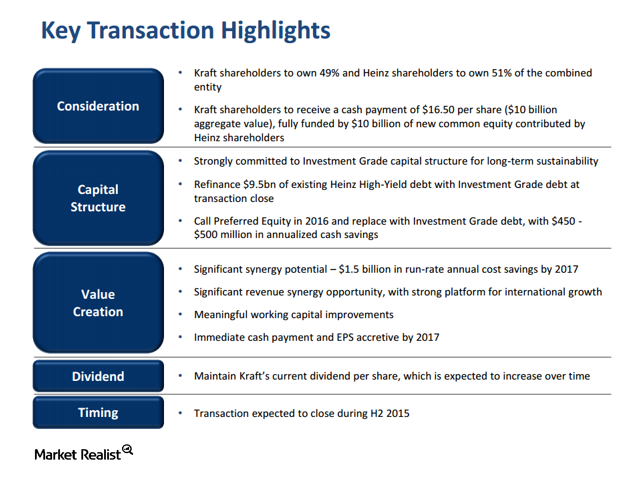

The Kraft–Heinz Merger: Transaction Rationale

The Kraft–Heinz merger entity will maintain Kraft’s current dividend, and management anticipates it will grow.

Is Antitrust an Issue in the Kraft–Heinz Merger?

The first place arbitrageurs look to get a handle on antitrust risk is the 10-K, where companies often disclose the names of competitors.

The Kraft–Heinz Merger and Material Adverse Change, Part 3

Other important merger spreads include the deal between Time Warner Cable and Comcast as well as the merger between Pharmacyclics and AbbVie.

The Kraft–Heinz Merger: Transaction Benefits for Kraft Investors

Kraft has a non-solicitation agreement with a fiduciary out. This means that Kraft could discuss another merger if approached by another suitor.