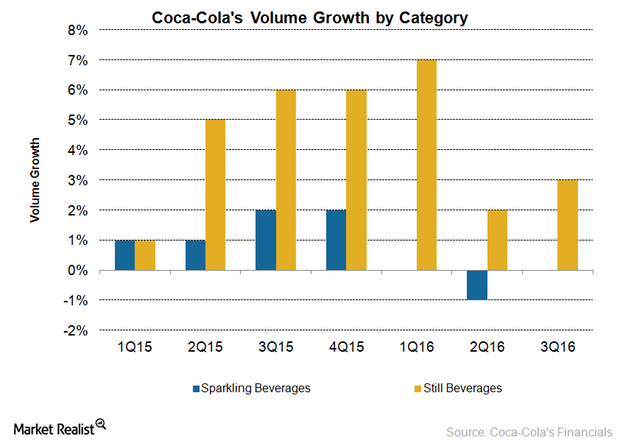

Coca-Cola’s Growth Strategy for Soda and Still Beverages

Coca-Cola’s (KO) overall unit case volume rose 1% in 3Q16. The company’s soda or sparkling beverage unit case volumes were flat in 3Q16 on a YoY basis.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.