Why Bunge Might Report a Drop in Revenue in 1Q16

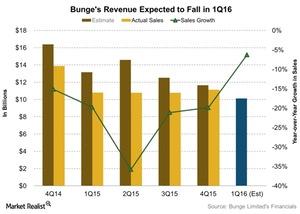

Analysts are expecting revenue to be $10.1 billion for fiscal 1Q16. This represents a fall of 6% compared to 1Q15 revenue of $10.8 billion.

Nov. 20 2020, Updated 3:42 p.m. ET

Bunge’s segmental contribution

Bunge Limited (BG) earns its revenue through its five segments: Agribusiness, Edible Oil Products, Milling Products, Sugar and Bioenergy, and Fertilizer. The Agribusiness segment accounts for approximately 70%–75% of Bunge’s revenue every quarter. In the guidance provided for the Agribusiness segment in the last earnings call, the company stated it expects South American operations to drive results in the oilseeds and grains businesses. However, the company expects the results to be seasonally weak in the first half of 2016.

Revenue expectations for upcoming quarters

Analysts are expecting revenue to be $10.1 billion for fiscal 1Q16. This represents a fall of 6% compared to 1Q15 revenue of $10.8 billion. The company has missed estimates in the past eight quarters, with the exception of 2Q14.

For fiscal 2Q16, analysts expect revenue to fall by 3%. However, revenue is projected to rise by 1% in both 3Q16 and 4Q16. In 2016, analysts expect revenue to come in around $42.9 billion, a fall of 1% compared to 2015. Bunge ended 2015 with a 25% drop in revenue, with revenue falling in all four quarters of 2015.

How are Bunge’s segments expected to perform?

Bunge anticipates its results will be seasonally weak in the first half of 2016. In the Agribusiness segment, the company expects the Northern Hemisphere grain exports and oilseed processing margins, mainly in the European rapeseed business, will be challenged until global supply and demand are balanced. The USDA (U.S. Department of Agriculture) forecasts that global soybean meal and oil will see demand increase by 7% and 5%, respectively, in 2016.

The company also projects the acquisition of Moinho Pacífico, a wheat mill in Santos, Brazil, will contribute to the company’s Milling Products segment. In the Food & Ingredients business, the company anticipates higher results driven by ~$50 million of performance improvements. Recent acquisitions are also expected to contribute to results throughout 2016.

The Fertilizer segment should see an increase in the purchase of crop inputs. The company expects to achieve this through improved farmer economics in Argentina and the removal of export taxes on grains. In the Sugar & Bioenergy segment, Bunge expects 2016 to be a year of earnings and cash flow growth. The company expects to benefit from Brazilian ethanol pricing and hedged sugar investments.

Revenue estimates for peers

Bunge’s peers in the industry include Archer Daniels Midland (ADM), Campbell Soup (CPB), and Ingredion (INGR).

- Archer Daniels Midland’s revenue for its fiscal 1Q16 is expected to fall by 3%.

- Campbell Soup’s revenue for its fiscal 3Q16 is projected to be in line with 3Q15 revenue.

- Ingredion’s revenue for its fiscal 1Q16 is expected to increase by 1%.

To gain exposure to INGR, you can invest in the PowerShares DWA Consumer Staples Momentum Portfolio (PSL) and the PowerShares S&P MidCap Low Volatility Portfolio (XMLV), which invest 2.8% and 1.1% of their respective holdings in INGR.