PowerShares S&P MidCap Low Volatil ETF

Latest PowerShares S&P MidCap Low Volatil ETF News and Updates

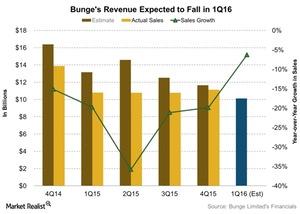

Why Bunge Might Report a Drop in Revenue in 1Q16

Analysts are expecting revenue to be $10.1 billion for fiscal 1Q16. This represents a fall of 6% compared to 1Q15 revenue of $10.8 billion.

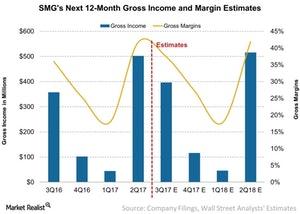

Scotts Miracle-Gro: Gross Margins Are Expected to Expand in 3Q17

Wall Street analysts expect gross income of $396 million in 3Q17, which will deliver a gross margin of 37% on 3Q17 sales estimates of $1.06 billion.

Campbell Soup’s New Segments Impacted the Operating Profit

The Americas Simple Meals and Beverages segment reported operating earnings of $290 million—a rise of 22% compared to fiscal 2Q15.