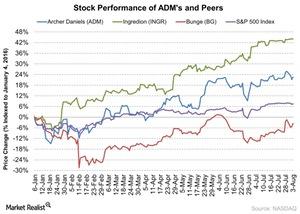

Archer Daniels Midland Co.

Latest Archer Daniels Midland Co. News and Updates

Archer Daniels Stock Is a Buy Amid Price Dip and Big Announcement

Archer-Daniels-Midland has revealed plans for a $350 million soybean crushing plant. The stock looks like a good buy for investors.

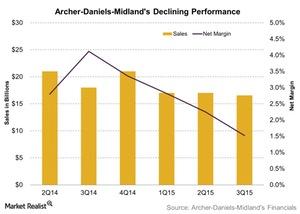

Archer Daniels Midland Reports Another Disappointing Quarter

In 3Q15, Archer Daniels Midland earned $684 million in operating profit, down $257 million from 3Q14. Its net revenue for the quarter was $16.6 billion.

How’s ADM Advancing with Its Portfolio Management Strategy?

As part of its portfolio management strategy, Archer Daniels Midland (ADM) sold its Brazilian sugar cane ethanol operations.

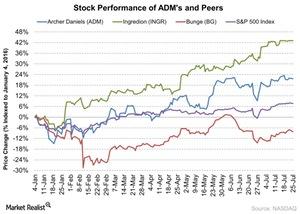

Archer Daniels Midland Stock Gained since Its 1Q16 Earnings

Archer Daniels Midland (ADM) is slated to report its 2Q16 results on August 2 before the market opens. The stock has gained 12% since its last quarter results.

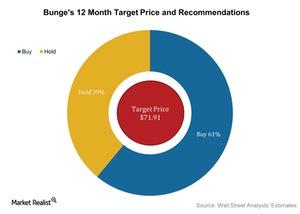

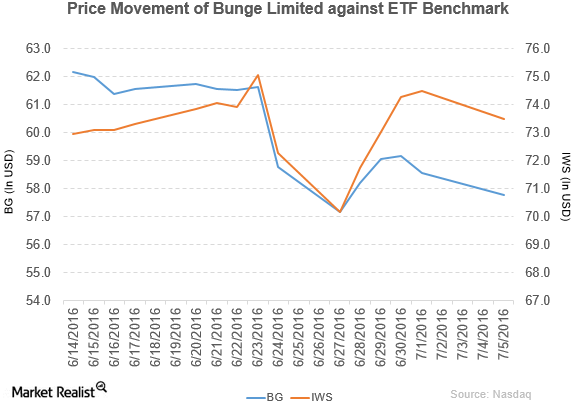

Wall Street Analysts’ Take on Bunge before Its 2Q16 Earnings

Around 61% of analysts now rate Bunge as a “buy” and 39% rate it as a “hold.” No analysts rate it as a “sell.”

What Are Analysts’ Target Prices before ADM’s 2Q16 Results?

Around 77% of the analysts rate Archer Daniels Midland a “hold” and 23% gave it a “buy” rating. No analysts rated it as a “sell.”

How Is Bunge Expanding Oilseed Segment’s Global Presence?

In the Oilseeds segment, Bunge’s focus has been to enhance its footprint in the major growth regions.

Why Ingredion Acquired Sun Flour’s Rice Starch and Rice Flour Business

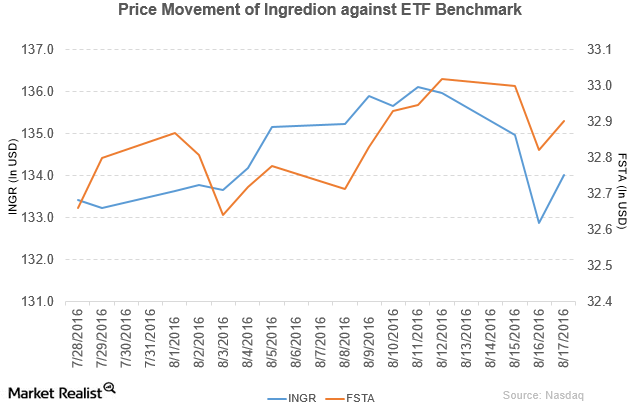

Ingredion (INGR) has a market cap of $9.7 billion. It rose by 0.87% to close at $134.02 per share on August 17, 2016.

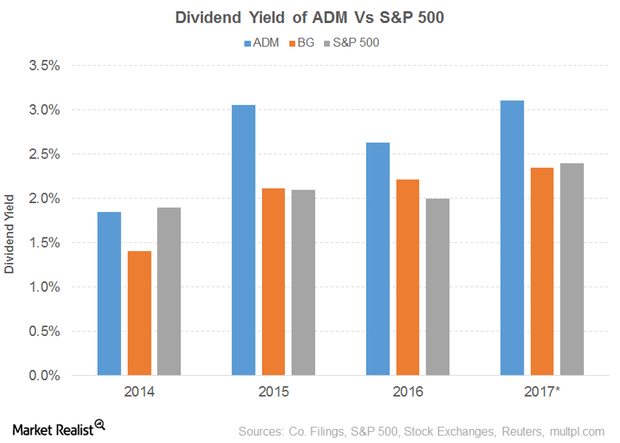

Dividend Yield of Archer-Daniels Midland

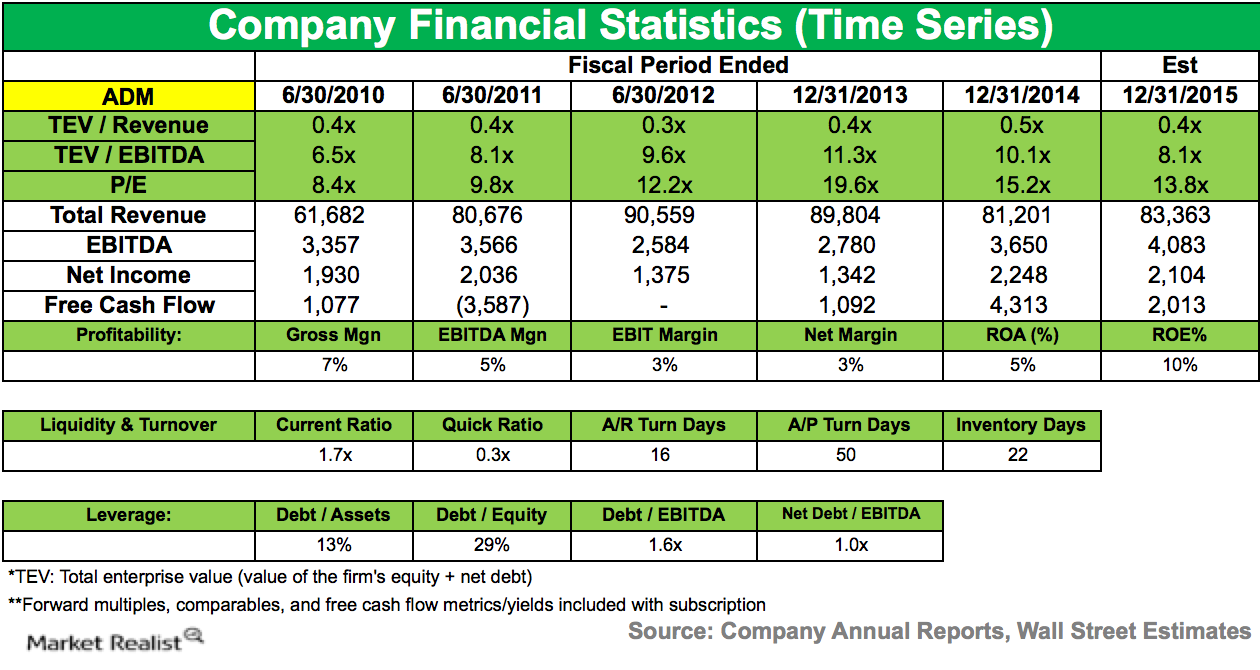

Archer-Daniels Midland’s (ADM) PE ratio of 19.1x compares to a sector average of 23.8x. The dividend yield of 3.1% compares to a sector average of 2.4%.

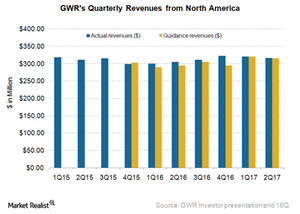

Genesee & Wyoming’s North American Revenues in 2Q17

In 2Q17, GWR’s North American revenues were $315.7 million, a 3.6% rise from $304.6 million in the same quarter last year.

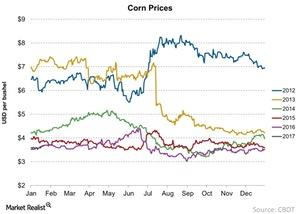

Why Corn Prices Moved Higher in January

Global corn prices are significantly lower than they’ve been for the past four years, considering the high global corn stock-to-use ratio last year.

Northcoast Downgrades BorgWarner to ‘Neutral’

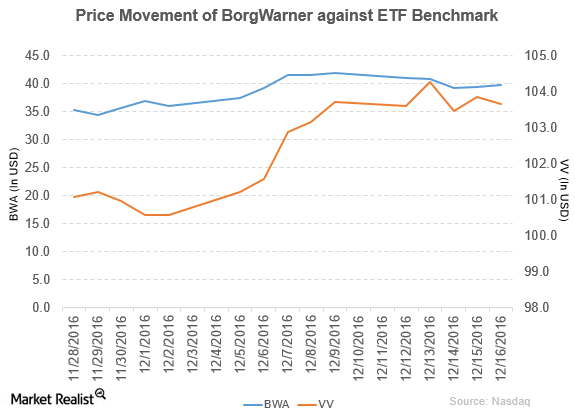

Price movement BorgWarner (BWA) fell 5.1% to close at $39.74 per share during the second week of December 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -5.1%, 15.7%, and -6.6%, respectively, as of December 16. BWA is trading 5.4% above its 20-day moving average, 10.5% above its 50-day moving average, and […]

Bunge Limited Has Declared Dividends

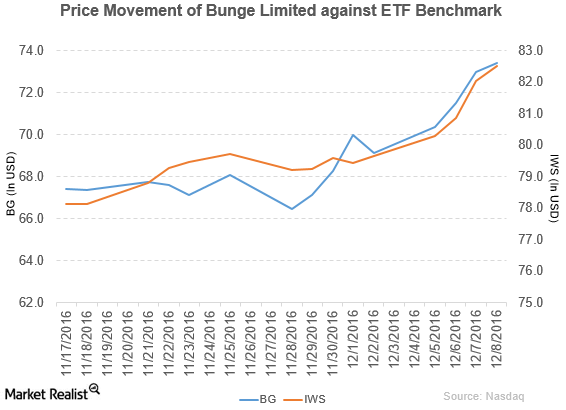

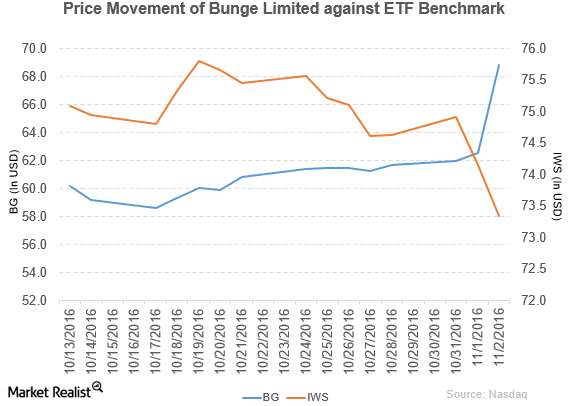

Price movement Bunge Limited (BG) has a market cap of $10.4 billion. It rose 0.55% to close at $73.40 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.9%, 5.4%, and 10.4%, respectively, on the same day. BG is trading 7.8% above its 20-day moving average, 14.4% […]

PVH Corporation and Grupo Axo Close Their Joint Venture

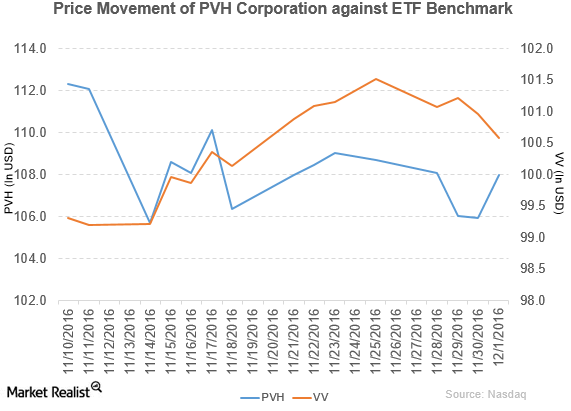

PVH Corporation (PVH) has a market cap of $8.7 billion. It rose 1.9% and closed at $107.99 per share on December 1, 2016.

Why Did Bunge Limited Issue Senior Notes?

Bunge Limited (BG) has declared a regular quarterly cash dividend of $0.42 per share on its common stock. The dividend will be paid on December 2, 2016, to shareholders of record on November 18, 2016.

How Did Bunge Perform in 3Q16?

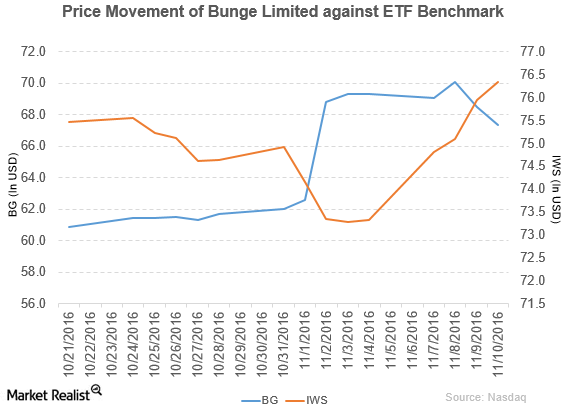

Bunge (BG) has a market cap of $9.6 billion. It rose 10.0% to close at $68.81 per share on November 2, 2016.

Bunge to Partner with Oleo-Fats

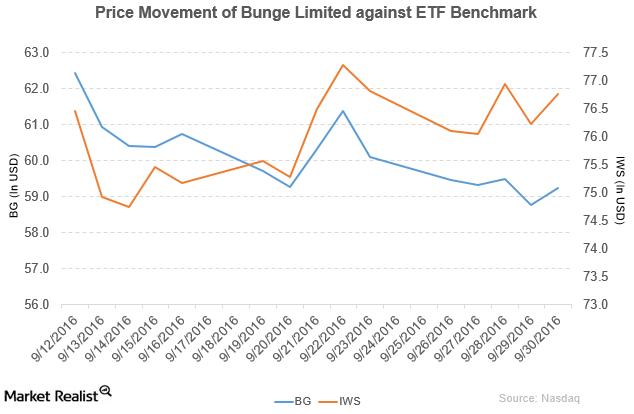

Bunge (BG) has a market cap of $8.3 billion. It rose 0.80% to close at $59.23 per share on September 30, 2016.

Bunge’s New Investment to Increase the Value of Its Business

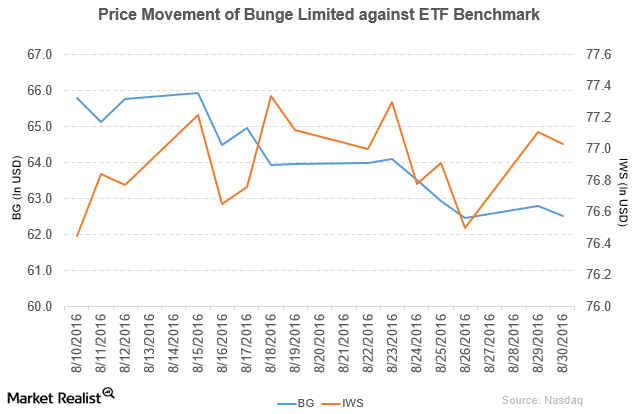

Bunge (BG) has a market cap of $8.8 billion. It fell by 0.45% to close at $62.52 per share on August 30, 2016.

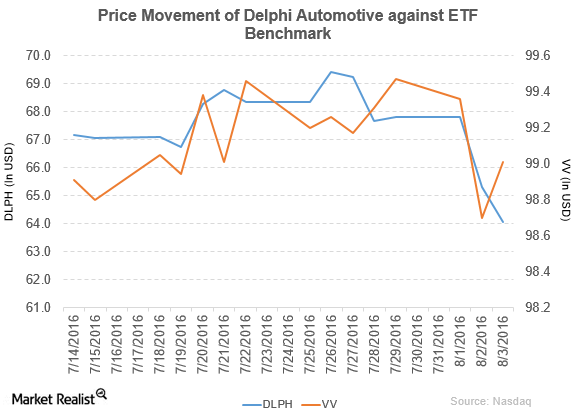

ADM’s Stock Fell 2% Due to Weaker Performance in 2Q16

Archer Daniels Midland (ADM) reported its 2Q16 results on August 2. The stock didn’t react well to the results. It fell 2% on the same day.

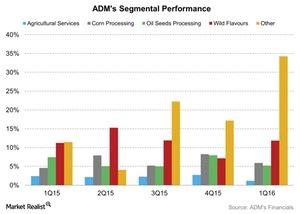

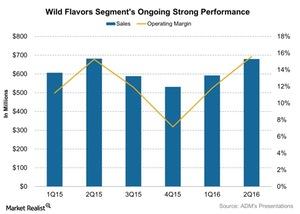

What Benefited ADM’s WILD Flavors and Specialty Ingredients in 2Q16?

Archer Daniels Midland’s management mentioned that the WILD Flavors and Specialty Ingredients’ results were in line with the same quarter last year.

Archer Daniels Midland Declares Dividend of $0.30 Per Share

Archer Daniels Midland (ADM) has a market cap of $25.7 billion. It rose by 1.1% to close at $43.93 per share on August 3, 2016.

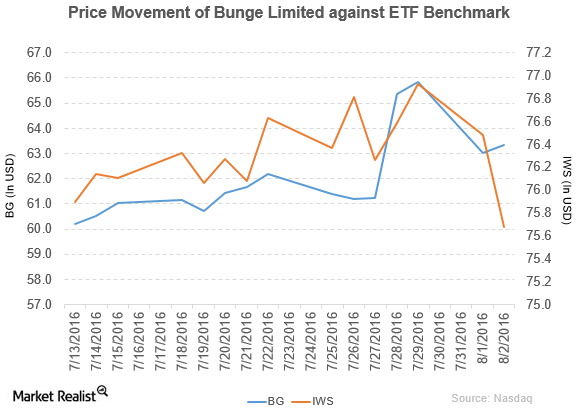

Bank of America/Merrill Lynch Upgraded Bunge Limited to a ‘Buy’

Bunge Limited (BG) has a market cap of $8.8 billion. It rose by 0.48% to close at $63.33 per share on August 2, 2016.

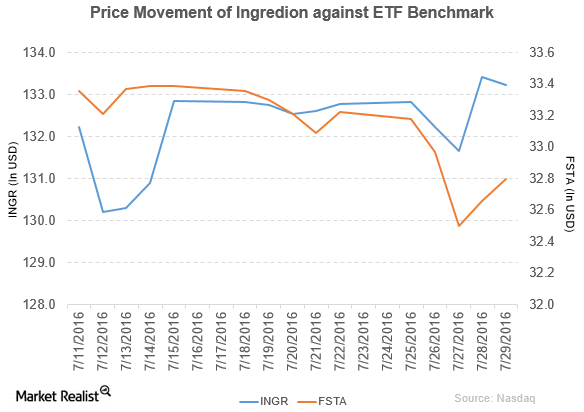

Ingredion’s Top and Bottom Lines Rose in 2Q16

Ingredion’s (INGR) stock price rose by 0.35% to close at $133.24 per share during the fourth week of July 2016.

Why Bunge’s Limited Bottom Line Rose in 2Q16

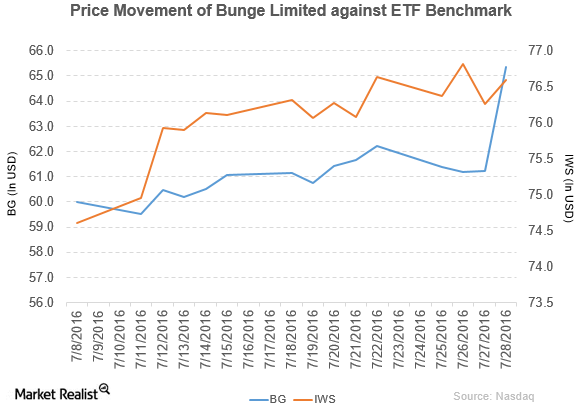

Bunge Limited (BG) has a market cap of $9.1 billion. It rose by 6.7% to close at $65.35 per share on July 28, 2016.

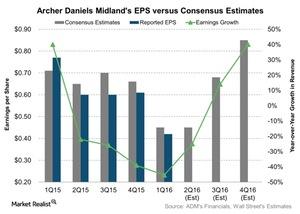

What Could Cast a Shadow over Archer Daniels Midland’s 2Q16 EPS?

Analysts expect Archer Daniels Midland’s adjusted EPS in 2Q16 to be $0.45—compared to $0.60 in 2Q15. It represents a massive decline of 25%.

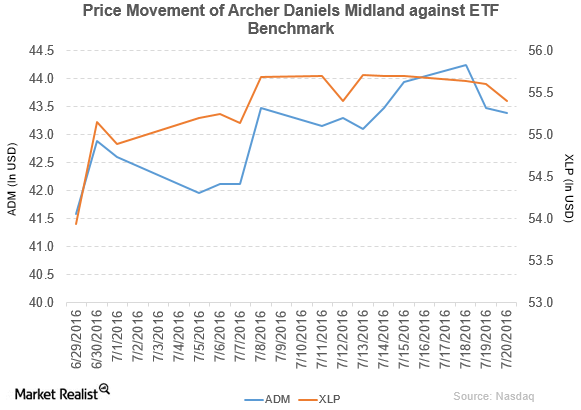

Why Horse Owners Are Suing Archer-Daniels Midland

Archer-Daniels Midland (ADM) has a market cap of $25.2 billion. It fell by 0.21% to close at $43.39 per share on July 20, 2016.

What’s behind Ingredion’s Impressive 2016 Stock Prices?

Ingredion (INGR) is set to report its fiscal 2Q16 results before the Market opens on July 28, 2016. So far in 2016, Ingredion stock has risen 43%.

BB&T Capital Rated Bunge a ‘Buy’

Bunge reported 1Q16 net sales of $8.9 billion, a decline of 17.5% compared to net sales of $10.8 billion in 1Q15.

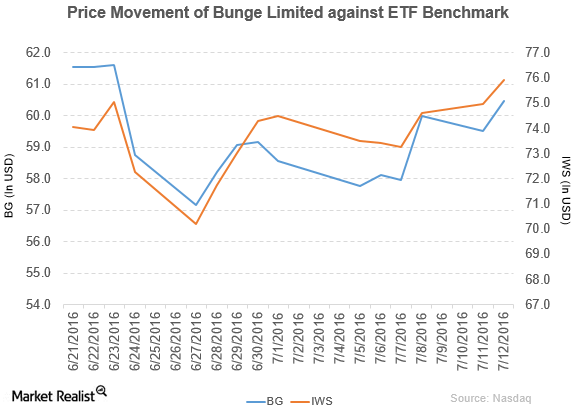

Bunge and Wilmar Form Joint Venture to Increase Market Share

Bunge Limited (BG) has a market cap of $8.2 billion. Its stock fell by 1.4% to close at $57.76 per share on July 5, 2016.

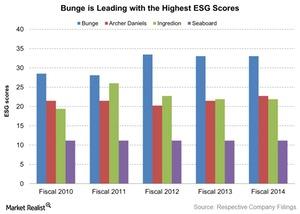

How Is Bunge’s Environmental, Social, and Governance Score?

Bunge (BG) has had the highest ESG score among its peers for the last five years.

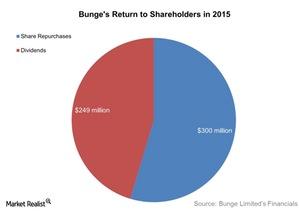

How Bunge Returns Value to Shareholders

Bunge (BG) paid $549 million to shareholders through dividends and share repurchases in 2015.

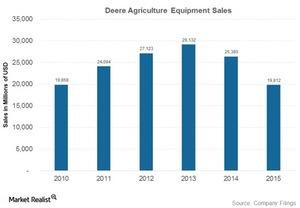

Why Did Deere & Company Consolidate Its Dealer Network?

Despite relying on dealers to sell its iconic tractors for almost a 100 years, Deere & Company (DE) began consolidating its dealer network in the mid-2000s.

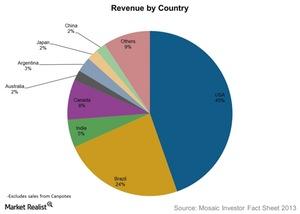

Who Are Mosaic’s Customers and How Does It Reach Them?

Mosaic doesn’t sell directly to farmers. Its customers include cooperatives, wholesale distributors, retail chains, and independent retailers.

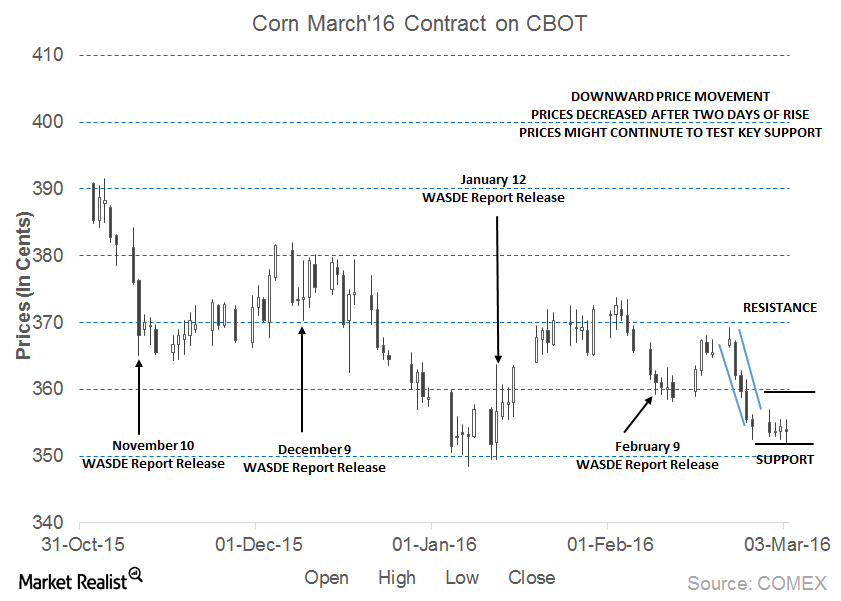

Corn Prices Could Continue to Test Crucial Support

March 2016 corn futures prices were trading near the support level of 355 cents per bushel on March 3, 2016. Prices declined after two days of rising by 0.28%.

Will Corn Prices Be Range-Bound before WASDE Report Release?

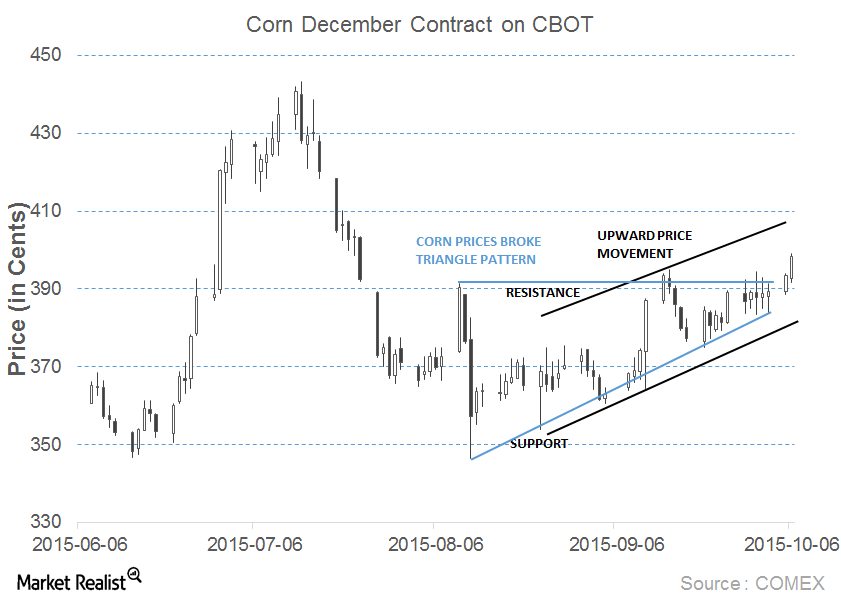

On October 6, 2015, CBOT (Chicago Board of Trade) December expiry of corn futures contracts rose, breaking the resistance level.

Citadel Advisors Reduces Position in Archer Daniels Midland

The Archer Daniels Midland Company is a processor of oilseeds, corn, wheat, cocoa, and other agricultural commodities.