Wall Street Analysts’ Take on Bunge before Its 2Q16 Earnings

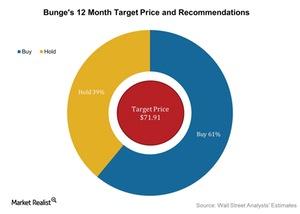

Around 61% of analysts now rate Bunge as a “buy” and 39% rate it as a “hold.” No analysts rate it as a “sell.”

Nov. 20 2020, Updated 3:34 p.m. ET

Target prices

Since we last discussed Bunge’s (BG) joint venture announcement on July 7, Wall Street analysts have updated their target prices for the next 12 months. Their recommendations have also changed. Around 61% of analysts now rate Bunge as a “buy” and 39% rate it as a “hold.” No analysts rate it as a “sell.”

Analysts’ target prices for Bunge

The average broker target price for Bunge has risen slightly to $71.91 from $71.60. This represents an increase of 17% from the stock’s closing price of $61.15 on July 18, 2016. Its peers’ target prices and return potentials as of July 18 are as follows:

- Archer Daniels Midland (ADM) has a target price of $43.33. It surpassed estimates by 2%.

- Ingredion (INGR) has a target price of $125.33. It surpassed estimates by 6%.

- Lancaster Colony (LANC) has a target price of $113.7. It surpassed estimates by 12%.

The PowerShares DWA Consumer Staples Momentum ETF (PSL) and the iShares S&P MidCap 400 Value ETF (IJJ) invest a combined total of 4.4% in Ingredion.

Recommendations for Bunge

Goldman Sachs has given Bunge the highest target price of $86. This implies a potential rise of 40% compared to the current trading price of $61.15. It rates it a “strong buy.” Credit Suisse also rates Bunge a “strong buy.” It gave it a target price of $78.

BB&T Capital Markets and Stephens have each given Bunge a target price of $75, respectively. This target price implies a rise of 23%, respectively, from the company’s closing price of $61.15 on July 18, 2016. They both rate Bunge a “strong buy.”

Other companies that rate Bunge as a “strong buy” are BMO Capital Markets, Piper Jaffray, and Macquarie. JPMorgan Chase downgraded the stock from “overweight” to “neutral” before the company’s 1Q16 earnings release. Later, it increased its target price to $60. It was consistent with a “hold” rating.

Next, we’ll discuss the company’s moving averages.