iShares S&P Mid-Cap 400 Value

Latest iShares S&P Mid-Cap 400 Value News and Updates

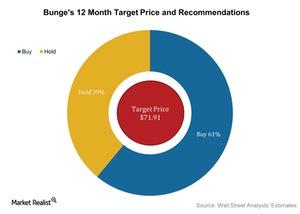

Wall Street Analysts’ Take on Bunge before Its 2Q16 Earnings

Around 61% of analysts now rate Bunge as a “buy” and 39% rate it as a “hold.” No analysts rate it as a “sell.”

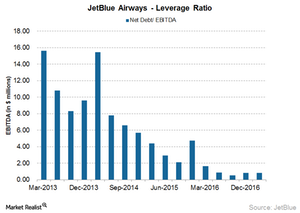

What Investors Should Know about JetBlue’s Debt

The airline industry is very capital-intensive, so airlines generally have huge debt numbers on their balance sheets.

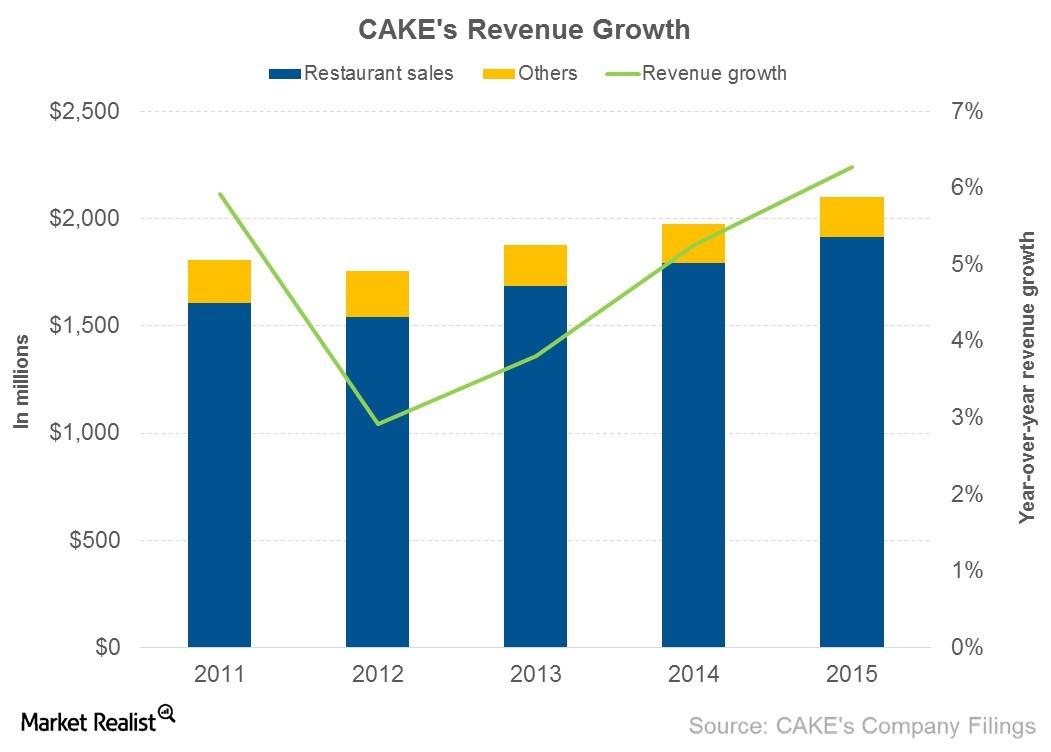

What’s Driving The Cheesecake Factory’s Revenue Growth?

The Cheesecake Factory earns its revenue from its company-owned restaurant sales, franchisee fees and royalties, and its bakery operations.