Lancaster Colony Corp

Latest Lancaster Colony Corp News and Updates

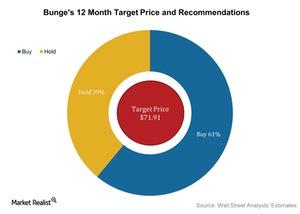

Wall Street Analysts’ Take on Bunge before Its 2Q16 Earnings

Around 61% of analysts now rate Bunge as a “buy” and 39% rate it as a “hold.” No analysts rate it as a “sell.”

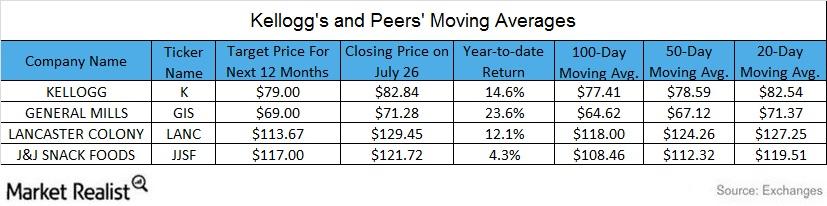

Key Moving Averages: Analyzing Kellogg versus Its Peers

Kellogg closed at $82.84 on July 26. It’s trading 7.0%, 5.4%, and 0.4% above its 100-day, 50-day, and 20-day moving averages. It has appreciated ~15% in 2016.

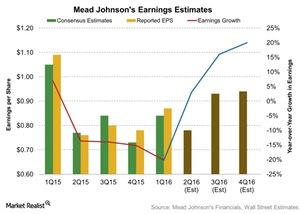

What Could Help Mead Johnson’s Earnings in 2Q16?

Analysts are expecting Mead Johnson’s adjusted EPS to be $0.78 compared to $0.76 in 2Q15.

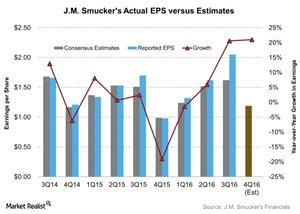

What Could Benefit J.M. Smucker’s 4Q16 Earnings?

Analysts are expecting J.M. Smucker’s adjusted EPS to be $1.19 in fiscal 4Q16—compared to 4Q15 EPS of $0.98. It represents a tremendous rise of 21%.

Campbell Soup’s New Segments Impacted the Operating Profit

The Americas Simple Meals and Beverages segment reported operating earnings of $290 million—a rise of 22% compared to fiscal 2Q15.