PowerShares DWA Consumer Staples Mom ETF

Latest PowerShares DWA Consumer Staples Mom ETF News and Updates

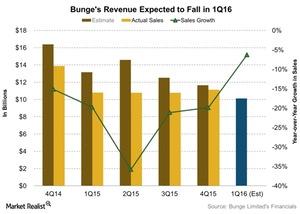

Why Bunge Might Report a Drop in Revenue in 1Q16

Analysts are expecting revenue to be $10.1 billion for fiscal 1Q16. This represents a fall of 6% compared to 1Q15 revenue of $10.8 billion.

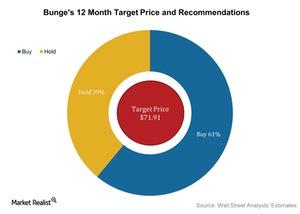

Wall Street Analysts’ Take on Bunge before Its 2Q16 Earnings

Around 61% of analysts now rate Bunge as a “buy” and 39% rate it as a “hold.” No analysts rate it as a “sell.”

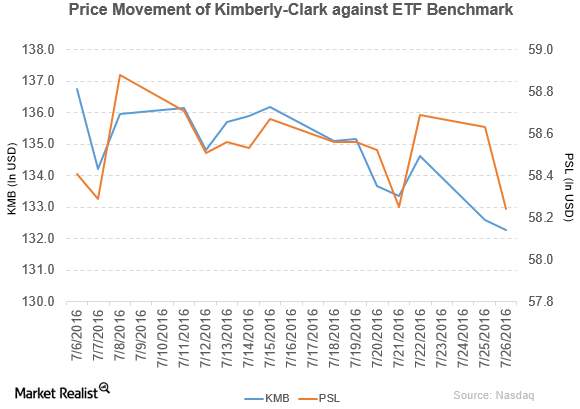

Kimberly-Clark Saw Sales for Personal Care Items Fall in 2Q

Kimberly-Clark (KMB) has a market cap of $47.7 billion. It fell by 0.23% to close at $132.28 per share on July 26, 2016.

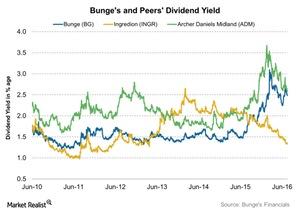

Bunge Consistently Returns Value to Shareholders

On May 24, Bunge announced that its board of directors approved a 10.5% increase in the company’s regular quarterly common share cash dividend.

Cal-Maine Plans to Increase Its Value-Added Specialty Egg Business

Cal-Maine Foods (CALM) plans to grow its specialty egg business by meeting consumer demand in the rapidly growing segment.

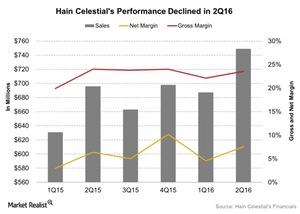

How Did Hain Celestial Perform in Fiscal 2Q16?

Hain Celestial Group’s (HAIN) fiscal 2Q16 had the strongest revenue performance in its history. The net sales for 2Q16 were $752.6 million.

Campbell Soup’s New Segments Impacted the Operating Profit

The Americas Simple Meals and Beverages segment reported operating earnings of $290 million—a rise of 22% compared to fiscal 2Q15.