Bunge Ltd

Latest Bunge Ltd News and Updates

What Do Analysts Recommend for Archer Daniels Midland?

Now, ~8% gave Archer Daniels Midland a “buy” rating. No analysts rated it a “sell.” The average target price for the company fell to $36.60 as of April 26.

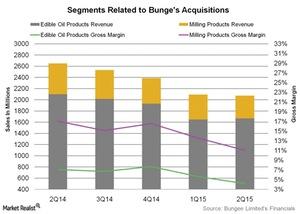

Will Bunge’s Acquisitions Help Revive Its Segment Margins?

Bunge North America, the North American operating segment of Bunge Limited (BG), announced that it had acquired Whole Harvest Foods.

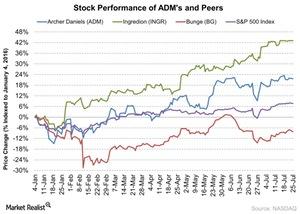

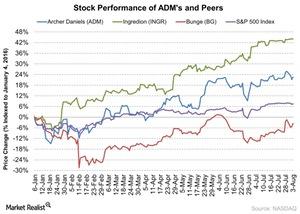

Archer Daniels Midland Stock Gained since Its 1Q16 Earnings

Archer Daniels Midland (ADM) is slated to report its 2Q16 results on August 2 before the market opens. The stock has gained 12% since its last quarter results.

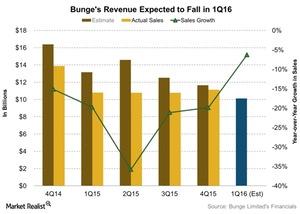

Why Bunge Might Report a Drop in Revenue in 1Q16

Analysts are expecting revenue to be $10.1 billion for fiscal 1Q16. This represents a fall of 6% compared to 1Q15 revenue of $10.8 billion.

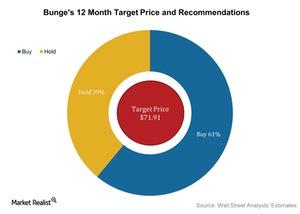

Wall Street Analysts’ Take on Bunge before Its 2Q16 Earnings

Around 61% of analysts now rate Bunge as a “buy” and 39% rate it as a “hold.” No analysts rate it as a “sell.”

How Is Bunge Expanding Oilseed Segment’s Global Presence?

In the Oilseeds segment, Bunge’s focus has been to enhance its footprint in the major growth regions.

Why Ingredion Acquired Sun Flour’s Rice Starch and Rice Flour Business

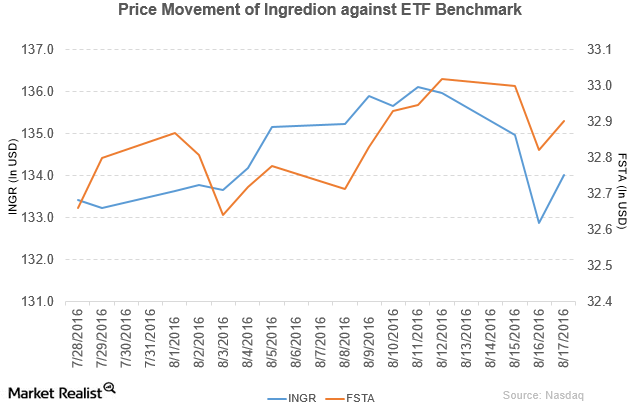

Ingredion (INGR) has a market cap of $9.7 billion. It rose by 0.87% to close at $134.02 per share on August 17, 2016.

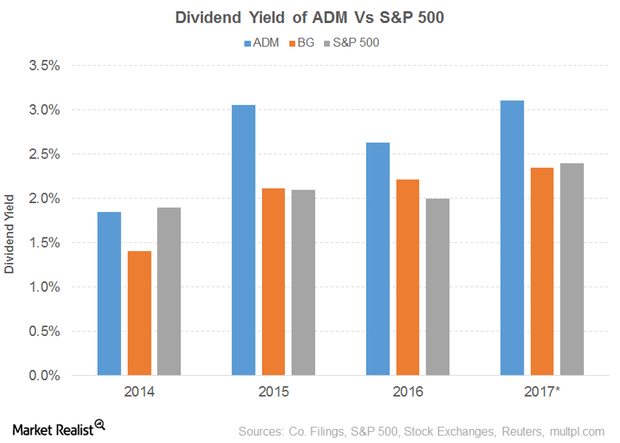

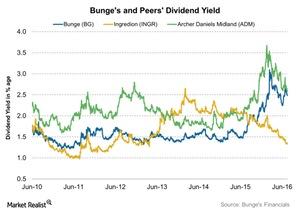

Dividend Yield of Archer-Daniels Midland

Archer-Daniels Midland’s (ADM) PE ratio of 19.1x compares to a sector average of 23.8x. The dividend yield of 3.1% compares to a sector average of 2.4%.

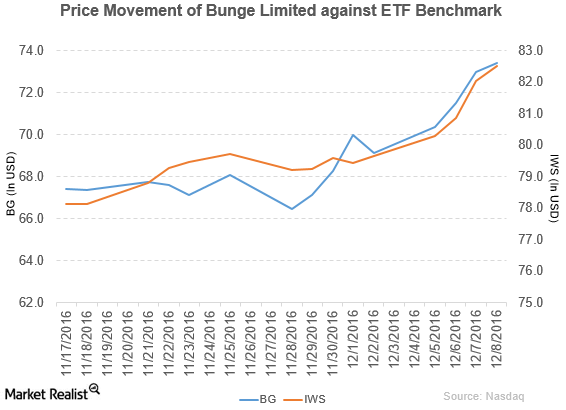

Bunge Limited Has Declared Dividends

Price movement Bunge Limited (BG) has a market cap of $10.4 billion. It rose 0.55% to close at $73.40 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.9%, 5.4%, and 10.4%, respectively, on the same day. BG is trading 7.8% above its 20-day moving average, 14.4% […]

Why Did Bunge Limited Issue Senior Notes?

Bunge Limited (BG) has declared a regular quarterly cash dividend of $0.42 per share on its common stock. The dividend will be paid on December 2, 2016, to shareholders of record on November 18, 2016.

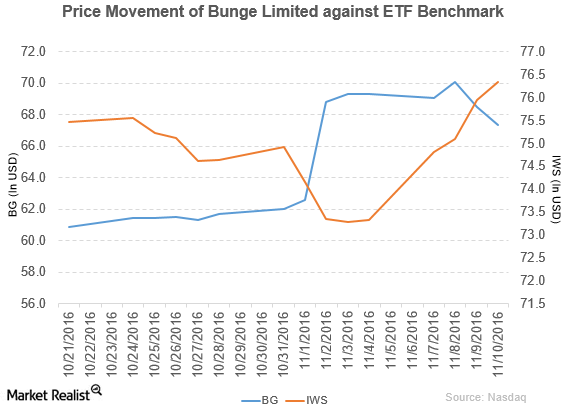

How Did Bunge Perform in 3Q16?

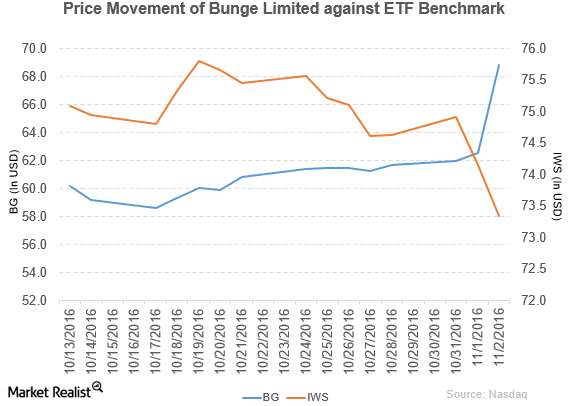

Bunge (BG) has a market cap of $9.6 billion. It rose 10.0% to close at $68.81 per share on November 2, 2016.

Bunge to Partner with Oleo-Fats

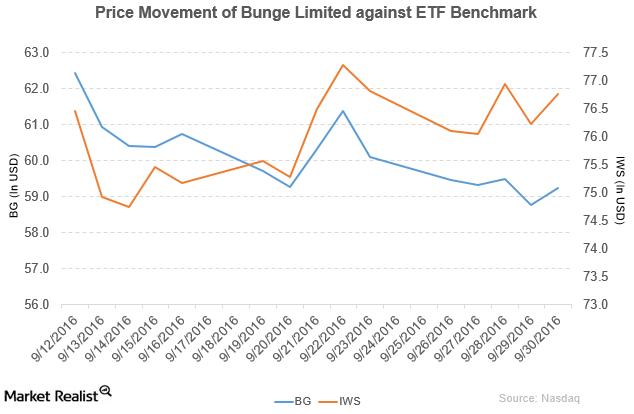

Bunge (BG) has a market cap of $8.3 billion. It rose 0.80% to close at $59.23 per share on September 30, 2016.

Bunge’s New Investment to Increase the Value of Its Business

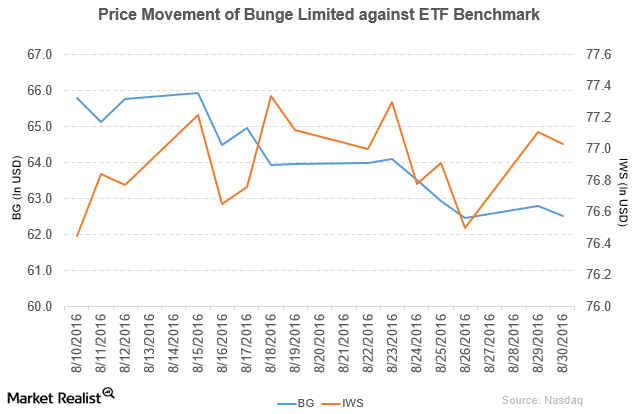

Bunge (BG) has a market cap of $8.8 billion. It fell by 0.45% to close at $62.52 per share on August 30, 2016.

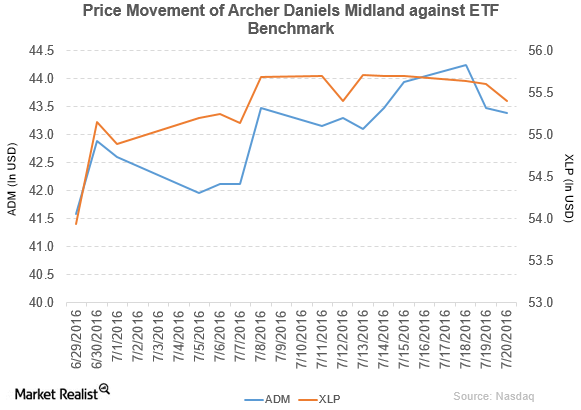

ADM’s Stock Fell 2% Due to Weaker Performance in 2Q16

Archer Daniels Midland (ADM) reported its 2Q16 results on August 2. The stock didn’t react well to the results. It fell 2% on the same day.

Archer Daniels Midland Declares Dividend of $0.30 Per Share

Archer Daniels Midland (ADM) has a market cap of $25.7 billion. It rose by 1.1% to close at $43.93 per share on August 3, 2016.

Bank of America/Merrill Lynch Upgraded Bunge Limited to a ‘Buy’

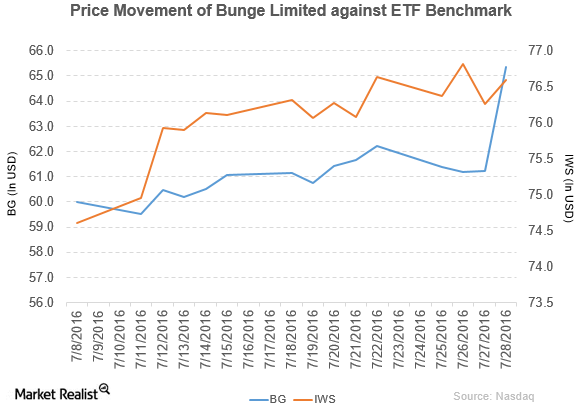

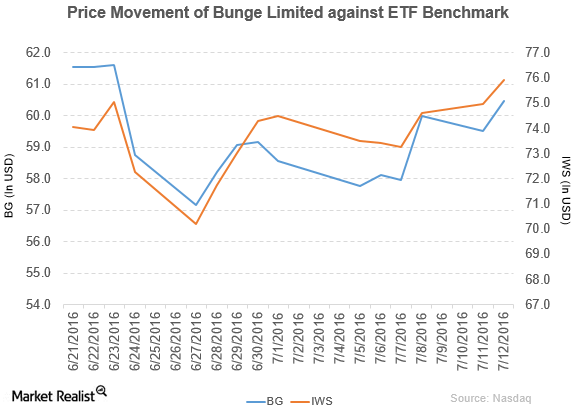

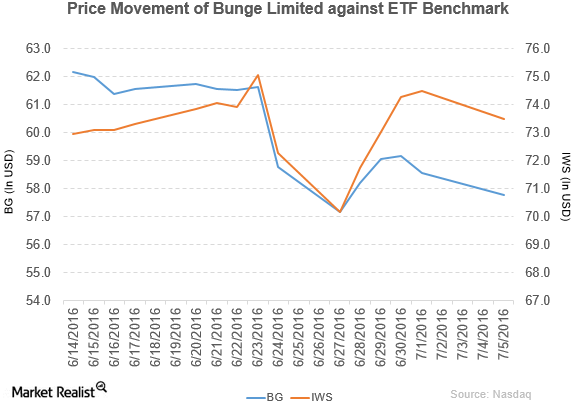

Bunge Limited (BG) has a market cap of $8.8 billion. It rose by 0.48% to close at $63.33 per share on August 2, 2016.

Ingredion’s Top and Bottom Lines Rose in 2Q16

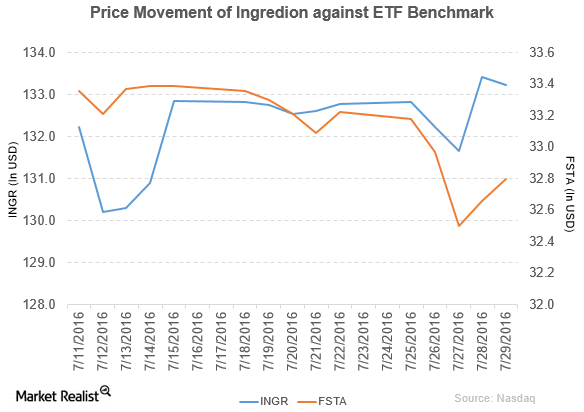

Ingredion’s (INGR) stock price rose by 0.35% to close at $133.24 per share during the fourth week of July 2016.

Why Bunge’s Limited Bottom Line Rose in 2Q16

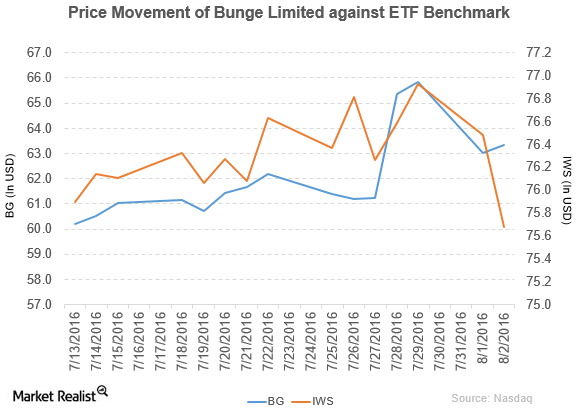

Bunge Limited (BG) has a market cap of $9.1 billion. It rose by 6.7% to close at $65.35 per share on July 28, 2016.

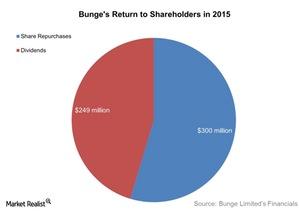

Bunge Consistently Returns Value to Shareholders

On May 24, Bunge announced that its board of directors approved a 10.5% increase in the company’s regular quarterly common share cash dividend.

Why Horse Owners Are Suing Archer-Daniels Midland

Archer-Daniels Midland (ADM) has a market cap of $25.2 billion. It fell by 0.21% to close at $43.39 per share on July 20, 2016.

What’s behind Ingredion’s Impressive 2016 Stock Prices?

Ingredion (INGR) is set to report its fiscal 2Q16 results before the Market opens on July 28, 2016. So far in 2016, Ingredion stock has risen 43%.

BB&T Capital Rated Bunge a ‘Buy’

Bunge reported 1Q16 net sales of $8.9 billion, a decline of 17.5% compared to net sales of $10.8 billion in 1Q15.

Bunge and Wilmar Form Joint Venture to Increase Market Share

Bunge Limited (BG) has a market cap of $8.2 billion. Its stock fell by 1.4% to close at $57.76 per share on July 5, 2016.

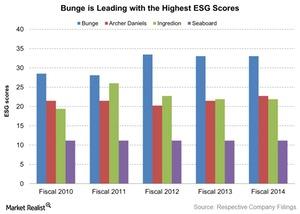

How Is Bunge’s Environmental, Social, and Governance Score?

Bunge (BG) has had the highest ESG score among its peers for the last five years.

How Bunge Returns Value to Shareholders

Bunge (BG) paid $549 million to shareholders through dividends and share repurchases in 2015.

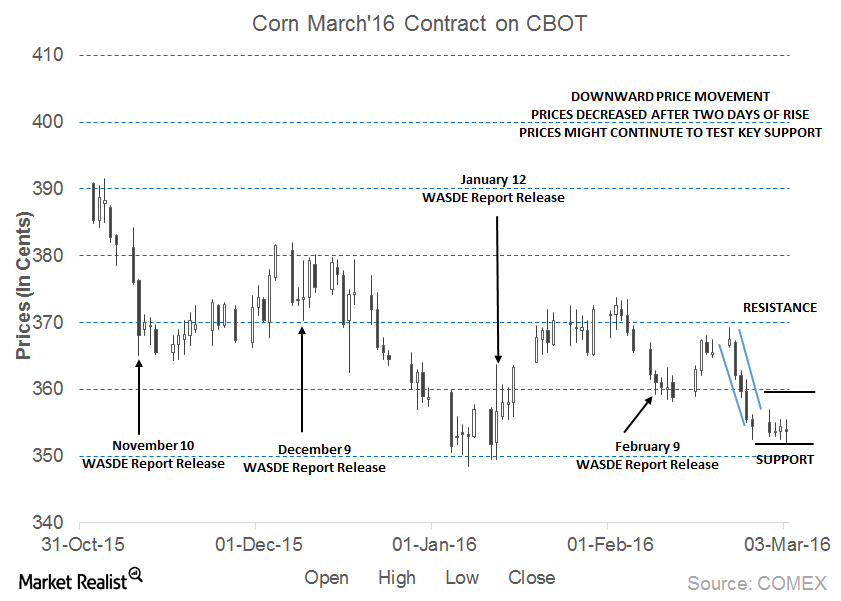

Corn Prices Could Continue to Test Crucial Support

March 2016 corn futures prices were trading near the support level of 355 cents per bushel on March 3, 2016. Prices declined after two days of rising by 0.28%.