Biogen Inc

Latest Biogen Inc News and Updates

Biogen CEO Michel Vounatsos Is Stepping Down, Company Look to the Future

On May 3, Biogen announced that CEO Michel Vounatsos is stepping down from his role. His net worth is estimated to be over $32 million.

Best Stocks to Invest in Alzheimer's Research in 2021

Given how coveted advancements in Alzheimer's research are, these publicly traded stocks can help you impact science and reap returns.

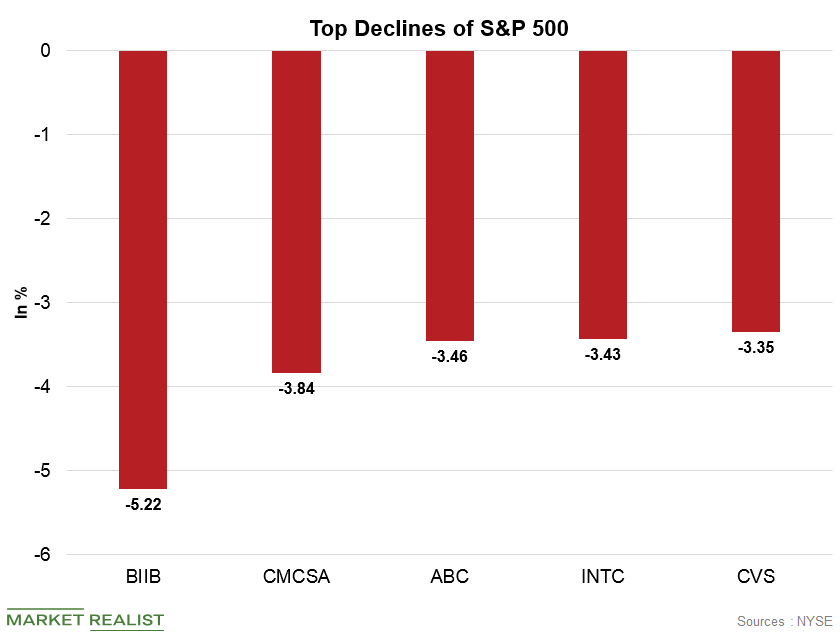

S&P 500’s Top Losses: Why Biogen Declined

Biogen, which is an American multinational biotechnology company, was the S&P 500’s top loss on June 18.

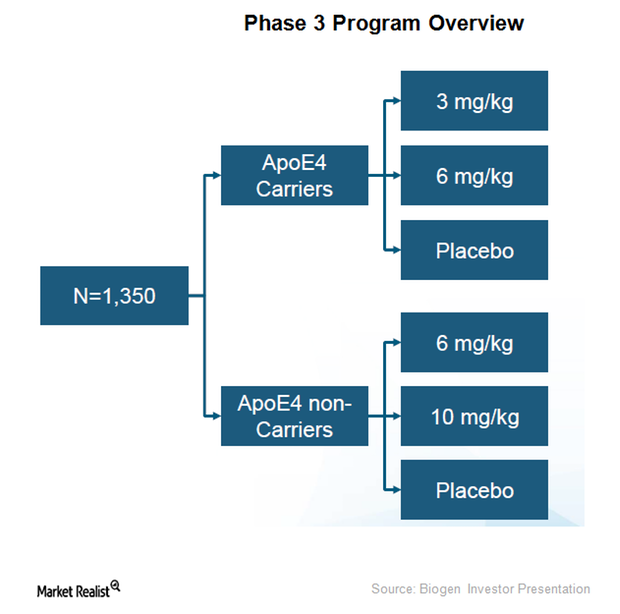

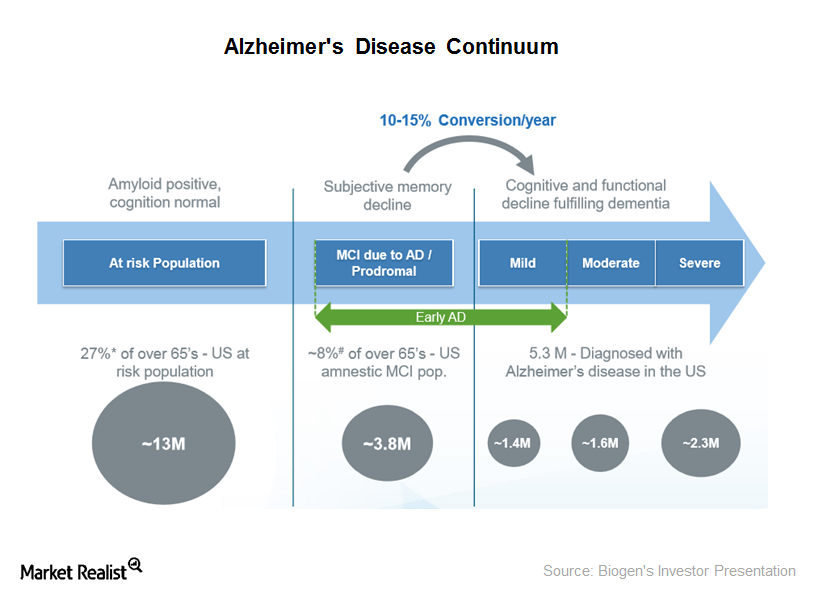

Biogen’s Experimental Alzheimer Therapy: Limited 2Q15 Success

On July 22, 2015, Biogen (BIIB) released data from a Phase 1b study, also called the PRIME Study, that looked at the effectiveness of its investigational Alzheimer’s drug, BIIB037.

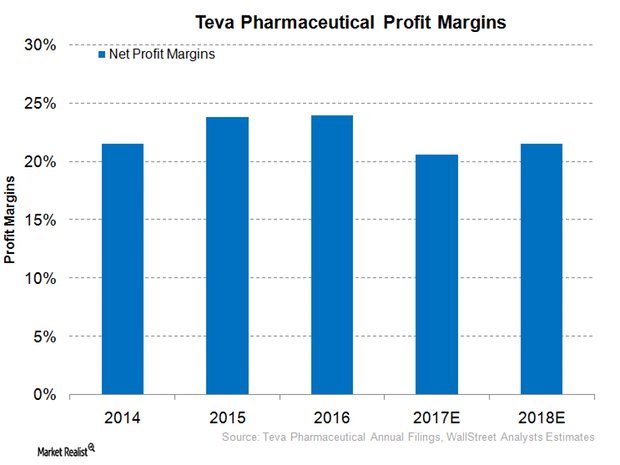

Teva Is Expected to See a Fall in Its Profit Margins in 2017

Teva Pharmaceutical (TEVA) expects its 2017 non-generally accepted accounting principles (non-GAAP) earnings per share (or EPS) to fall in the range of $4.9–$5.3.

What’s behind Biogen Buyout Rumors?

Since early August 2016, there have been rumors of a likely buyout of Biogen (BIIB) by one of the many interested suitors in the biotechnology industry.

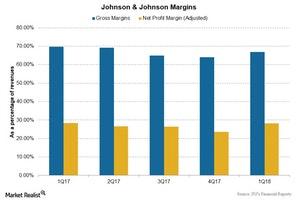

Analyzing Johnson & Johnson’s 1Q18 Profitability

Johnson & Johnson (JNJ) reported revenues of $20.0 billion during 1Q18, 12.6% growth as compared to revenues of $17.8 billion during 1Q17.

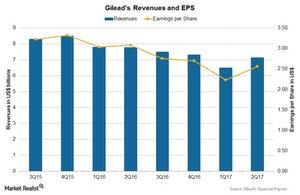

What’s Gilead Sciences’ Valuation?

Gilead’s stock price has risen ~8.9% in the last 12 months. Wall Street analysts estimate that the stock price will fall ~4.5% over the next 12 months.

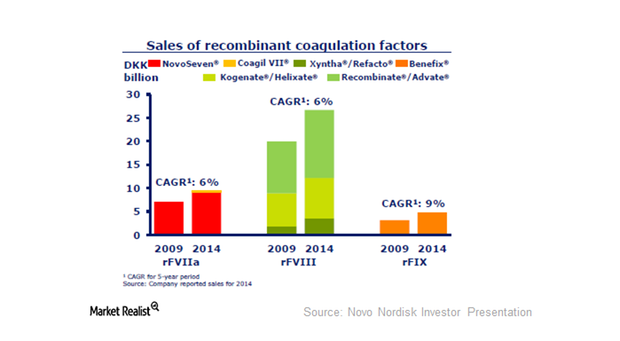

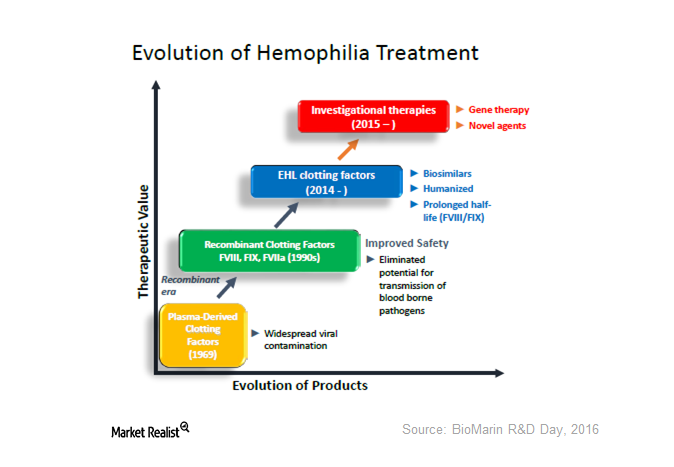

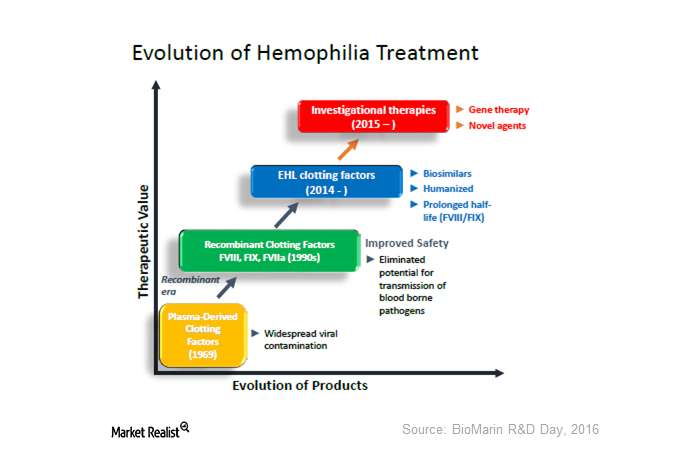

What Are the Current Treatment Options for Hemophilia?

Hemophilia treatment primarily includes factor replacement therapy and prolonged half-life therapy such as factor VIII or factor IX infusion.

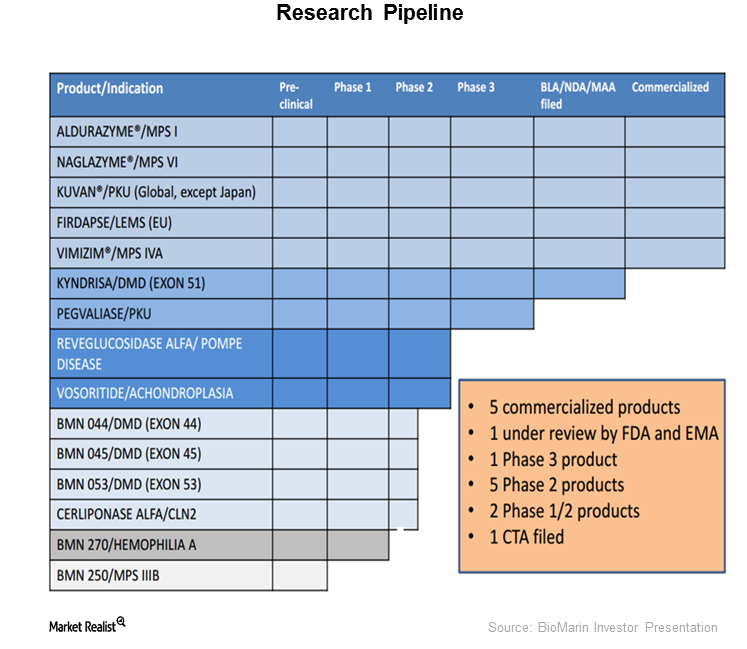

BMN 270: A Big Valuation Catalyst for BioMarin

On March 1, 2016, BioMarin received orphan drug designation for BMN 270 from the FDA. BioMarin’s stock jumped by about 6.96% the same day.

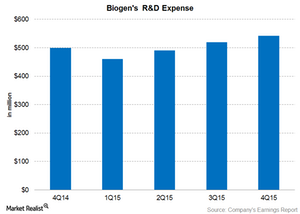

How Much Does Biogen Spend on Research and Development?

Biogen’s (BIIB) R&D expenses for 4Q15 were $542 million, or 19% of its total revenue, including a $60 million payment to Mitsubishi Tanabe.

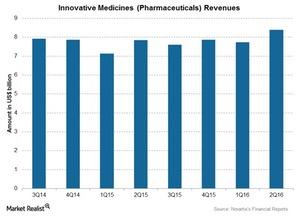

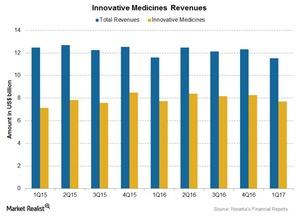

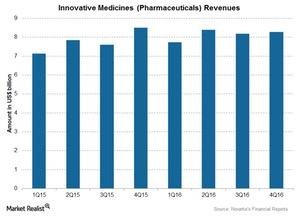

Novartis’s 3Q16 Estimates: Innovative Medicines Segment

Novartis’s Innovative Medicines segment, formerly referred to as the Pharmaceutical segment, consists of products for a variety of therapeutic areas.

Novartis’s 4Q16 Estimates: Innovative Medicines Segment

The overall contribution of the Innovative Medicines segment is ~67% of Novartis’s total revenues.

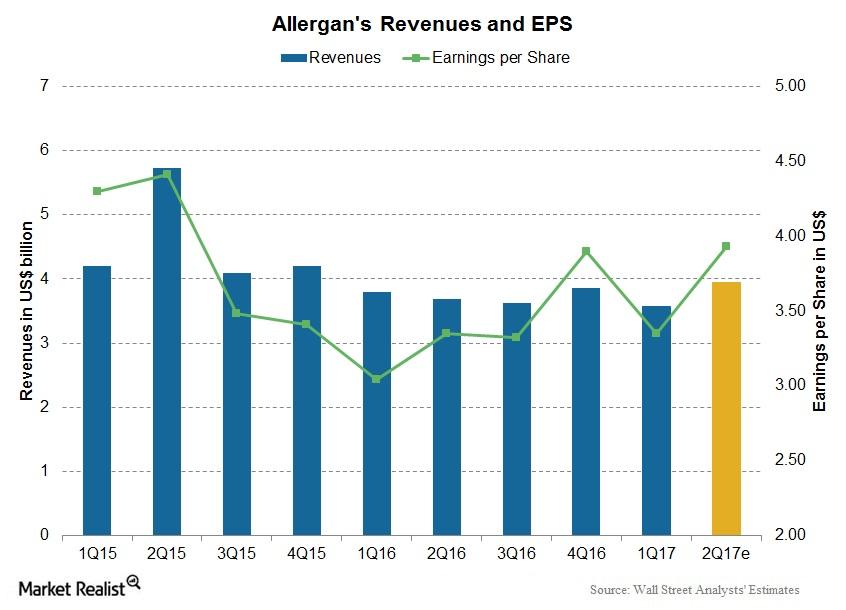

Allergan’s 1Q18 Earnings: Analysts’ Estimates

Allergan (AGN) plans to release its 1Q18 earnings on April 30. Wall Street expect AGN’s earnings per share to reach $3.36.

BIIB Stock Tumbles as Alzheimer Drug BAN2401 Data Failed to Impress Investors

Today, Biogen (BIIB) and partner Eisai presented highly anticipated detailed study data for their investigational Alzheimer’s drug BAN2401.

Why the US Moat Index Beat the S&P 500 Index in July

Domestic moat companies, as represented by the Morningstar® Wide Moat Focus IndexSM (MWMFTR, or “U.S. Moat Index”), once again posted strong results in July.

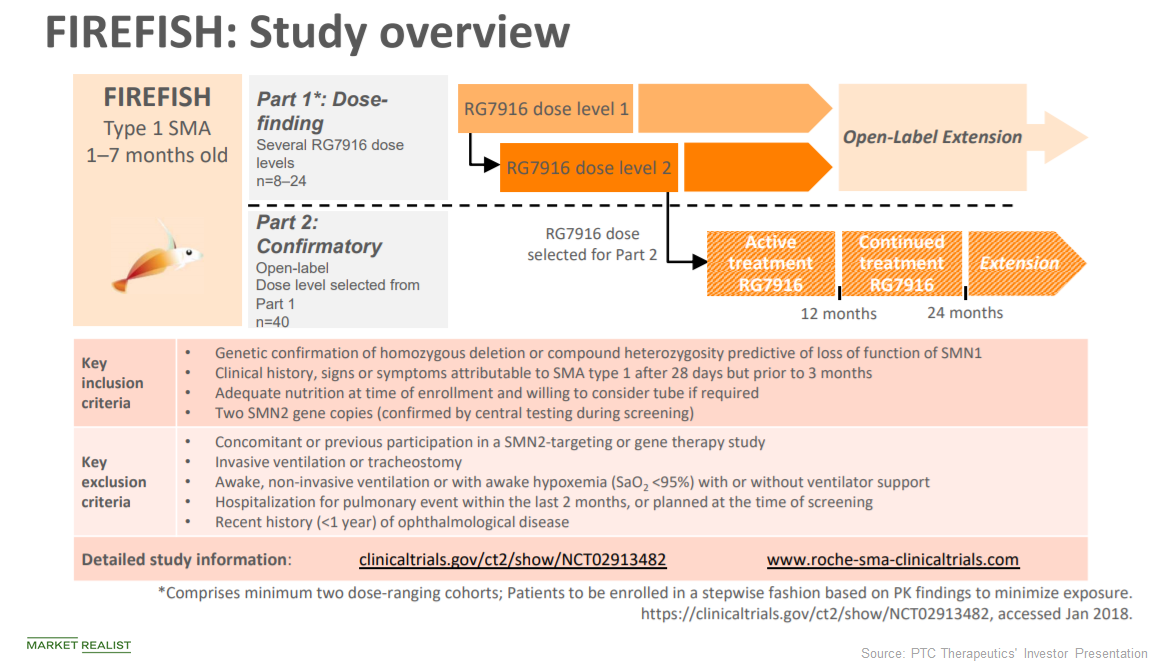

Risdiplam: Could It Be PTC Therapeutics’ Future Growth Driver?

In June, PTC Therapeutics (PTCT) presented its updated interim clinical data from the Phase 1 FIREFISH trial.

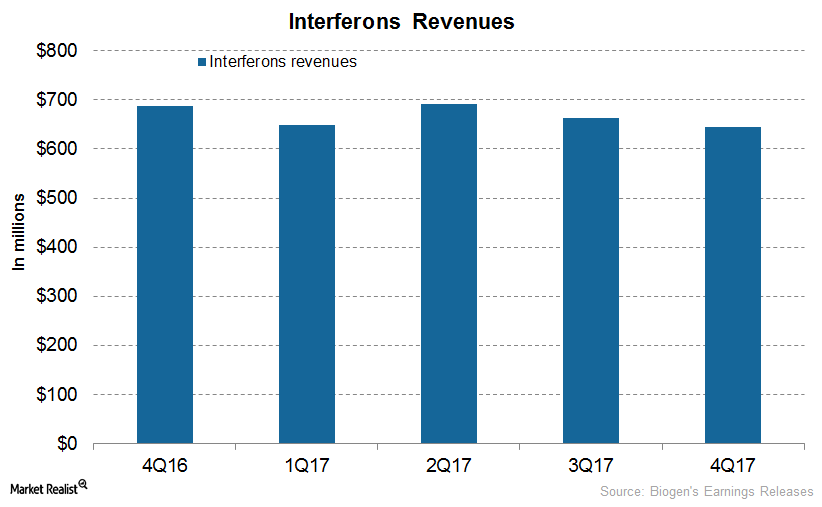

How Biogen’s Biosimilars and Interferons Performed in 4Q17

In 4Q17, Biogen’s (BIIB) interferons generated revenues of $645 million, which reflected a 6% decline YoY and a 3% decline on a quarter-over-quarter basis.

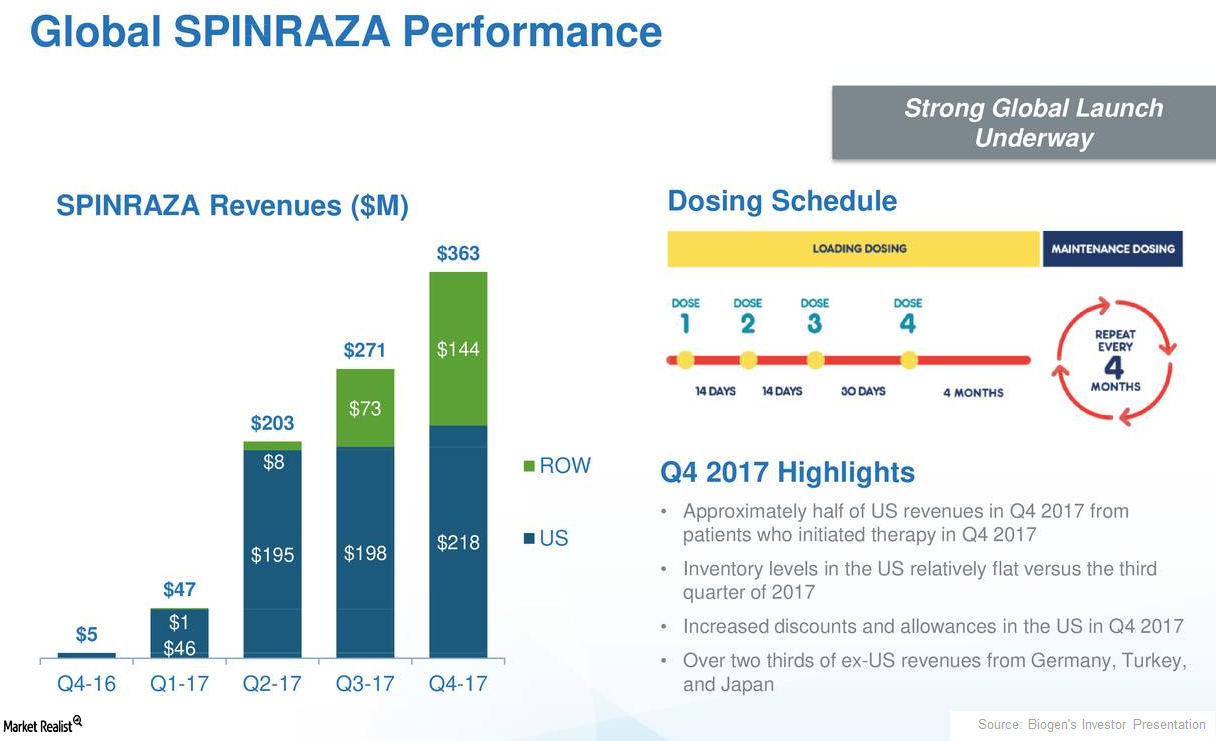

How Biogen’s Spinraza Is Positioned for 2018

In 4Q17, Biogen’s (BIIB) Spinraza generated revenues of $363 million, which reflected 34% quarter-over-quarter growth.

Efficient Scale Offers a Narrow Moat

Across the five moat sources (network effect, intangible assets, cost advantage, switching costs, and efficient scale), efficient scale is the most likely to drive a “narrow moat” rating from Morningstar.

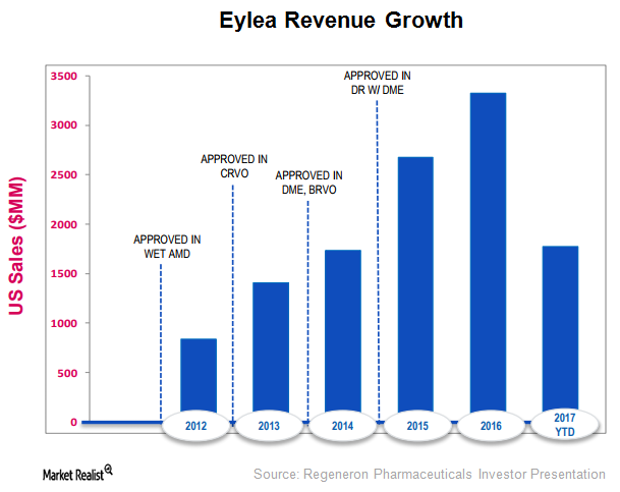

Eylea Leads the Retinal Diseases Sector

In 1H17, Eylea’s total sales rose 10% on a year-over-year basis.

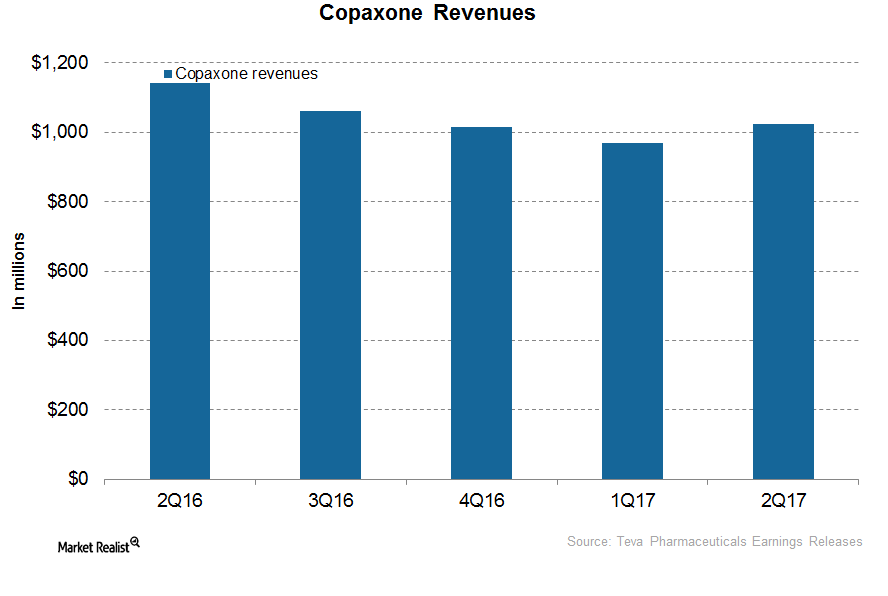

TEVA Depends on This for Revenue Growth

In 1H17, Teva Pharmaceutical’s (TEVA) Copaxone reported revenues of ~$2.1 billion, or ~7% lower YoY (year-over-year).

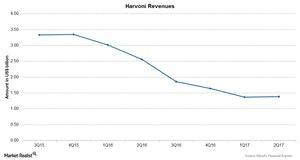

How Did Gilead’s Blockbuster Drug Harvoni Perform in 2Q17?

Harvoni is the top-selling drug in Gilead Sciences’ (GILD) portfolio. The drug is used for the treatment of genotype-1 hepatitis C virus (or HCV) infection.

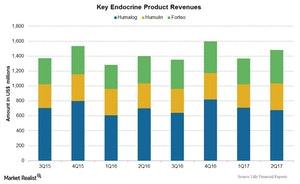

Performance of Eli Lilly’s Endocrine Franchise in 2Q17

Forteo is used for the treatment of osteoporosis. Forteo’s sales totaled $446.7 million during 2Q17, a 22.0% increase compared to $367.6 million in 2Q16.

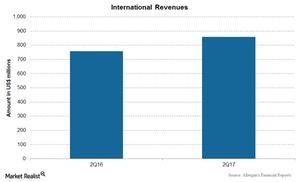

How Allergan’s International Segment Performed in 2Q17

Allergan’s (AGN) international business includes total revenues from the sales of branded products as well as aesthetics products outside the US markets.

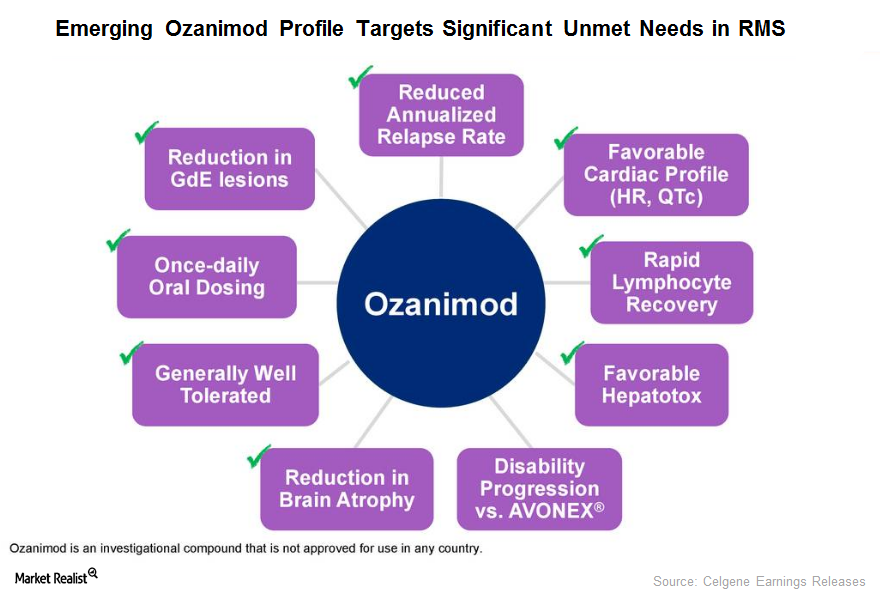

Ozanimod Could Drive Celgene’s Long-Term Growth

The Phase 3 RADIANCE trial enrolled 1,313 RMS patients and conducted the trial in 21 countries.

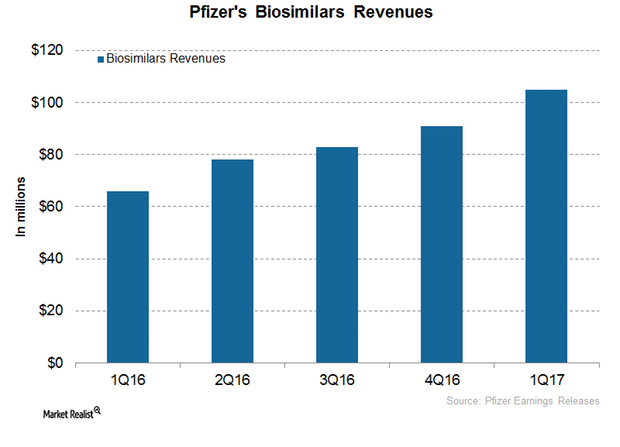

Pfizer Sees a Significant Opportunity in This for Revenue Growth

In 2016, Pfizer’s (PFE) biosimilar business reported revenues of ~$319 million, compared with $63 million in 2015.

Behind Allergan’s Business Segments and Revenues

Allergan’s (AGN) business has undergone several changes over the past few years due to acquisitions and divestitures.

A Look at Allergan’s Performance in 2Q17

Allergan Headquartered in Dublin, Ireland, Allergan (AGN) is a leading pharmaceutical company focused on generic and specialty pharmaceutical products. The company has divided its business into three segments: US Specialized Therapeutics, US General Medicine, and International. Stock price performance Allergan’s stock price has risen ~1.4% in 2Q17, and 15.0% year-to-date as of July 7, 2017. […]

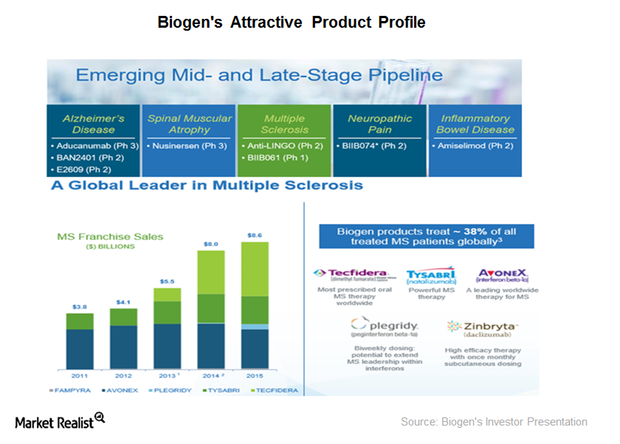

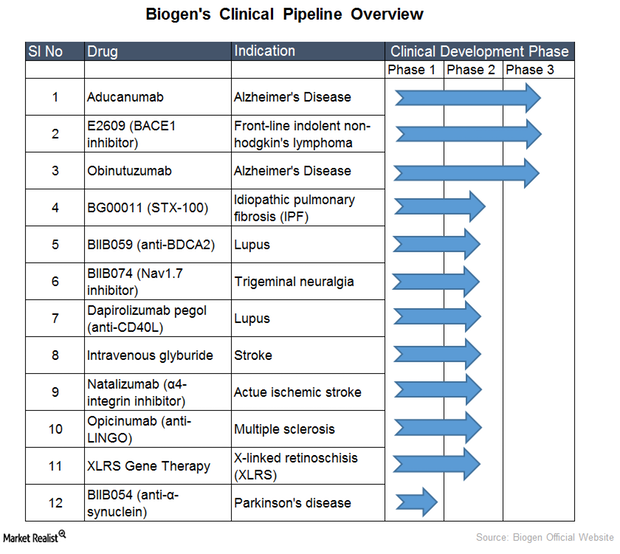

What’s in Biogen’s Clinical Pipeline?

Currently, Biogen is conducting 13 clinical studies in early phases and expects promising results from those trials.

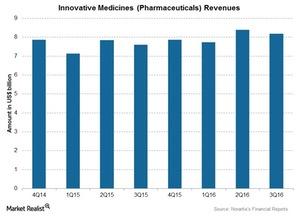

Inside Novartis’s Innovative Medicines Segment in 1Q17

Novartis’s (NVS) Innovative Medicines segment contributed ~67% of NVS’s total revenues in 1Q17.

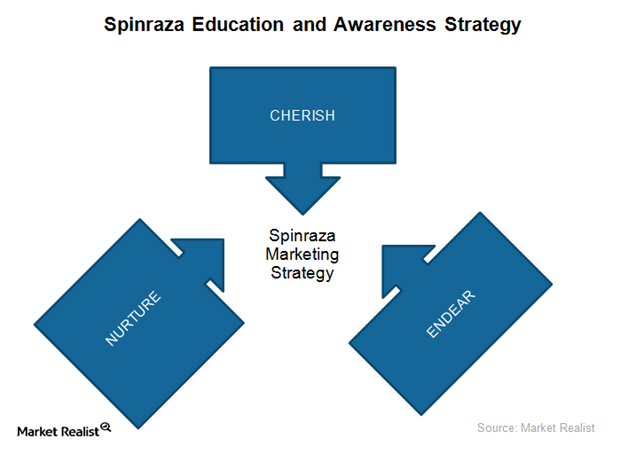

Biogen’s Targeted Marketing Strategy for Spinraza in 1Q17

To promote the use of Spinraza for SMA, Biogen (BIIB) has been actively educating and creating awareness for the drug among physician and patient communities.

Novartis’s 1Q17 Earnings: Innovative Medicines Segment

Novartis’s (NVS) Innovative Medicines segment contributed ~66.6% to overall 1Q17 revenue, or $7.7 billion.

Novartis’s 1Q17 Estimates: Innovative Medicines Segment

Novartis’s (NVS) Innovative Medicines segment includes products for therapeutic areas such as oncology, cardiometabolic, immunology, and dermatology.

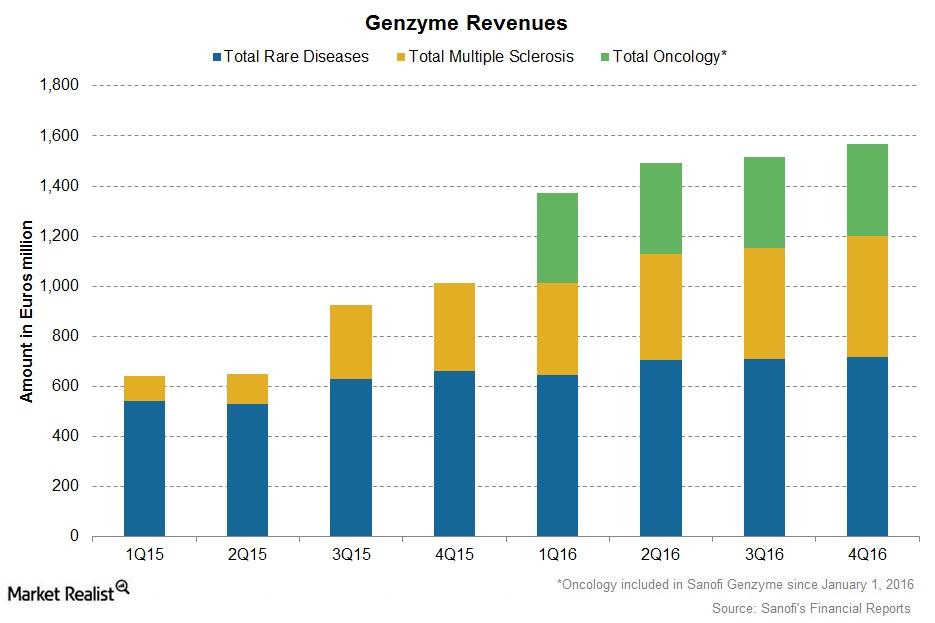

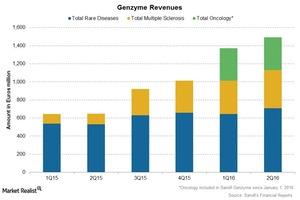

Sanofi Genzyme Continued Growth in 2016

Sanofi’s (SNY) 2016 revenues were mainly driven by Sanofi Genzyme and Sanofi Pasteur.

Novartis’s Innovative Medicines Segment in 2016

Novartis’s Innovative Medicines segment, formerly referred to as its Pharmaceuticals segment, consists of products for therapeutic areas including oncology, respiratory, and established medicines.

This Keeps Driving Sanofi’s Growth

Sanofi’s (SNY) 4Q16 revenues were mainly driven by Genzyme and Sanofi Pasteur.

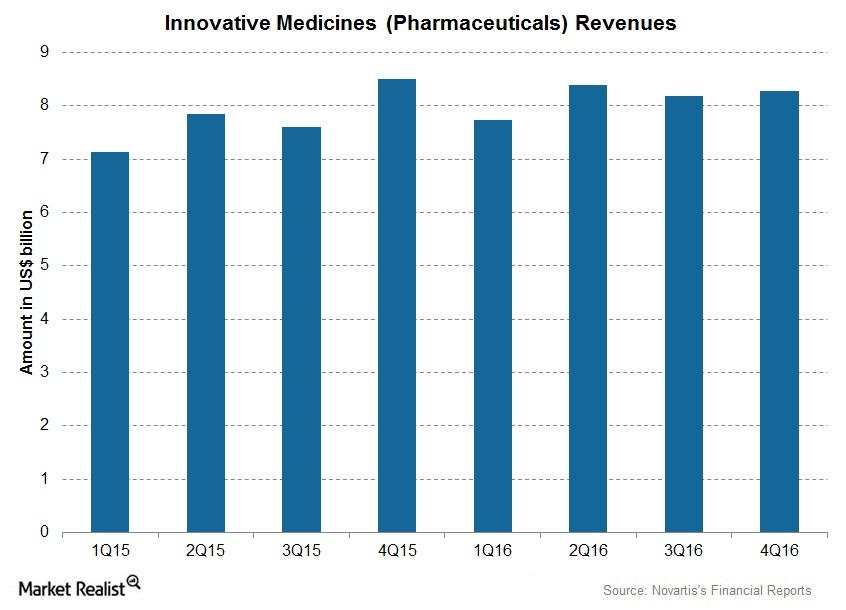

Novartis’s Innovative Medicines Segment in 4Q16

The overall contribution from NVS’s Innovative Medicines segment was ~67%, reaching $8.3 billion in 4Q16.

How Did Novartis’s Innovative Medicines Segment Perform?

The overall contribution of the innovative medicines segment was ~67% at $8,173 million for 3Q16.

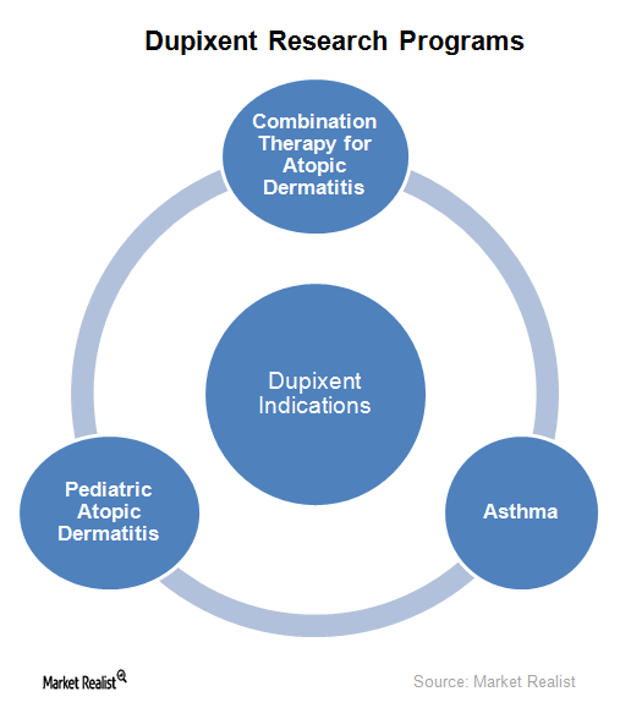

Dupixent Is Being Explored for Multiple Indications in 2016

In addition to being explored as a monotherapy for AD (atopic dermatitis), Regeneron and Sanofi are also researching Dupixent for other indications.

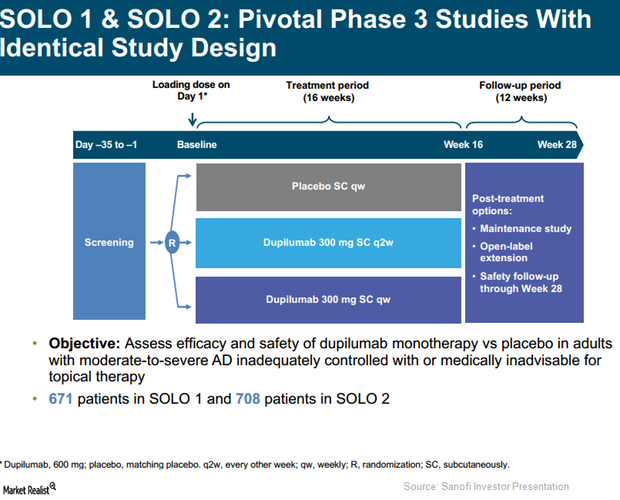

SOLO 1 and SOLO 2 Trials Could Strengthen Dupixent’s Label

In Phase 3 trials, SOLO 1 and SOLO 2, Regeneron (REGN) and Sanofi (SNY) tested the efficacy of an investigational therapy, Dupixent, compared to a placebo.

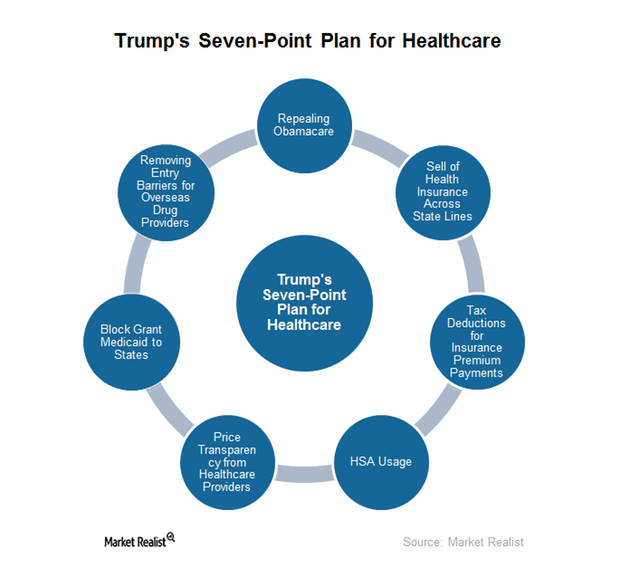

What Is Donald Trump’s Seven-Point Health Plan?

Trump’s healthcare agenda During his campaign, Trump came up with a seven-point plan for the healthcare industry. In this plan, he proposed to repeal the Affordable Care Act. Although a complete repeal doesn’t seem feasible, if applied, it would definitely take a toll on hospitals and insurance companies. In the next article, we’ll discuss the severity of […]

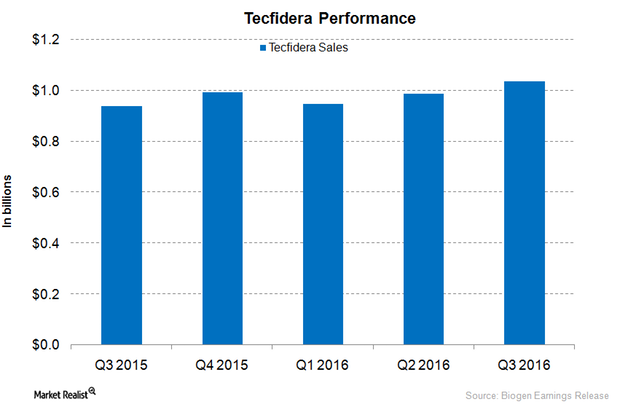

Tecfidera Continued to Lead in the Oral Multiple Sclerosis Market

In 3Q16, Biogen’s (BIIB) oral multiple sclerosis (or MS) drug, Tecfidera, managed to increase its global market share to ~15%, a year-over-year (or YoY) rise of about 1 point.

Market Cheers FDA’s Fast Tracking of BIIB’s Alzheimer’s Treatment

The U.S. Food and Drug Administration (or FDA) recently awarded the fast track status to aducanumab following the positive results of Biogen’s pre-clinical research.

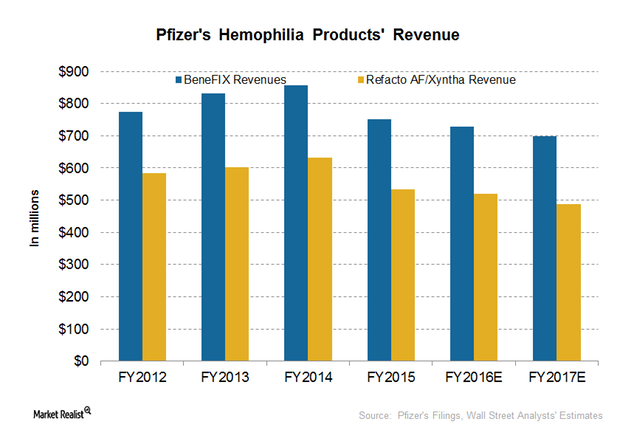

Why Are Revenues from Pfizer’s Rare Disease Portfolio Falling?

BeneFIX, the major contributor to Pfizer’s (PFE) Rare Disease portfolio, is indicated for hemophilia B. During the first six months, the drug earned $367 million.

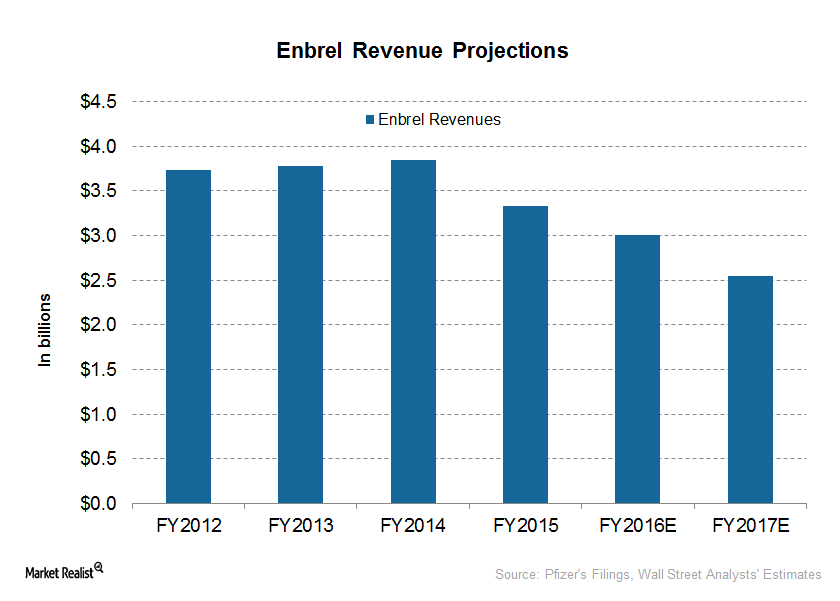

Why Pfizer’s Enbrel Faces a Sales Decline

Wall Street analysts expect Enbrel to earn $3 billion and $2.5 billion from the sale outside US and Canada in fiscal 2016 and 2017, respectively.

Genzyme Continued to Boost Growth for Sanofi in 2Q16

After Sanofi’s reorganization, Genzyme now includes products for multiple sclerosis, rare diseases, and oncology. Genzyme’s sales increased ~19.5% in 2Q16.

The Evolution of Hemophilia Treatment—And What It Means for BioMarin

BioMarin’s BMN 270 is a gene therapy being investigated for hemophilia A. On April 20, it announced early data of the phase-1 and phase-2 study of BMN 270.

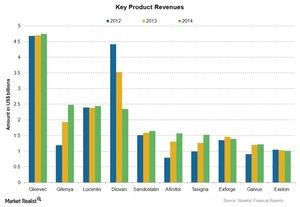

Which Products Contribute the Most to Novartis’s Revenues?

Novartis (NVS) has recorded direct product sales of over $1 billion for each of its ten pharmaceutical products in the last year.

Could Gene Therapy Be a Next-Generation Treatment for Hemophilia?

Gene therapy is the emerging platform for hemophilia care. If approved, it would be a paradigm.