Shannon Black

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Shannon Black

Dover Corporation: Growing by Acquiring

Since its inception, Dover Corporation (DOV) has followed an acquisition-based growth strategy. The company has acquired over 100 manufacturing companies since 1955, and it currently manages close to 30 independently operating companies under its umbrella.

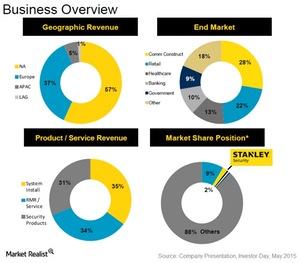

What You Should Know about Stanley Security’s Business Mix

The Stanley Security business saw a steady decline in the last four years with sales falling from $2.4 billion in 2012 to ~$2.1 billion in 2015.

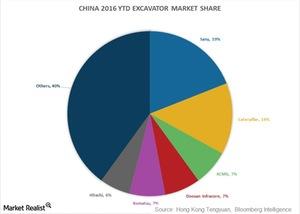

Caterpillar Doubles Its Market Share in China’s Shrinking Market

In 2012, Caterpillar (CAT) had a market share of 7% in the excavator manufacturing industry. Its share doubled to 14% YTD in 2016.

Dover Refrigeration & Food Equipment: Keeping It Cool

The Dover Refrigeration & Food Equipment unit is a major provider of refrigerated display cases and kitchen equipment such as cookers, mixers, braising pans, and packaging and processing solutions for the meat and poultry business.

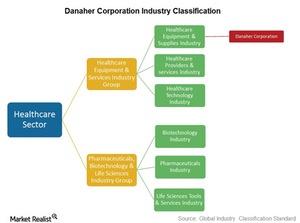

Introducing Danaher: A Diversified Healthcare Company

Danaher is a diversified conglomerate with a market cap of ~$56 billion. Its customers are mostly professionals and organizations rather than retail consumers.

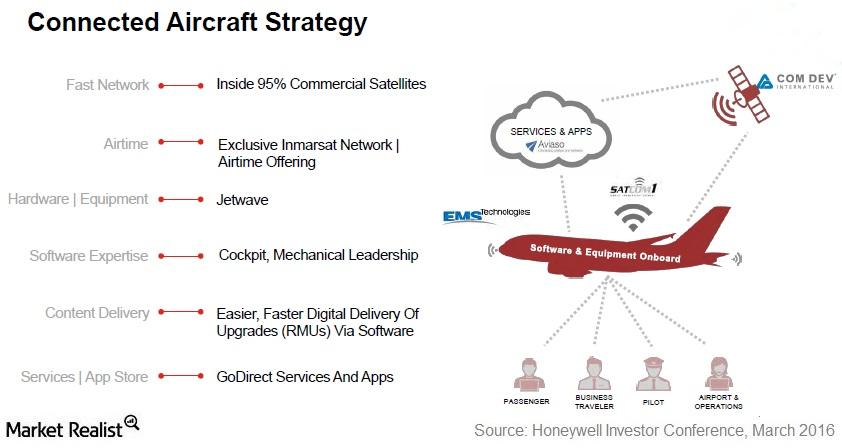

Honeywell Aerospace’s Recent Developments in Connectivity

In September 2015, Honeywell acquired Aviaso Software, a privately held aviation software company based in Switzerland. Aviaso develops and provides fuel efficiency and emission-saving software to the airline industry.

What’s Stanley Black & Decker’s Market Position?

Stanley Black & Decker (SWK) has a stupendous record of launching at least 1,000 products every year at an average of three products a day.

A Brief Overview of Honeywell Automation and Control Solutions

Honeywell (HON) provides control solutions for various residential and industrial applications through the Honeywell Automation and Control Solutions–ACS unit.

Dover Fluids: A Brief Overview

Dover Corporation’s (DOV) Fluids businesses include the Pump Solutions Group (or PSG), which provides pumping solutions to several end markets.

What Are Stanley Black & Decker’s Business Segments?

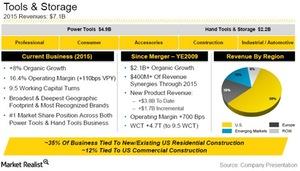

Stanley Black & Decker (SWK) markets its products through three business segments: Global Tools & Storage, Security, and Industrials.

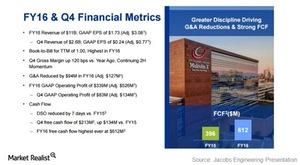

Jacobs Engineering Posts the Highest Annual Free Cash Flows

Jacobs Engineering Group declared its 4Q16 and fiscal 2016 results on November 22. It reported adjusted EPS (earnings per share) of $0.77.

After 3 Years, Rockwell Could See Sales Growth in Fiscal 2017

Rockwell Automation maintains that oil prices have recovered since the beginning of 2016, and most of its business in the heavy industries end market is expected to stabilize.

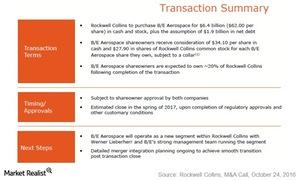

Rockwell Collins Acquires B/E Aerospace in a Deal-Making Weekend

On October 23, Rockwell Collins (COL) announced that it intends to acquire B/E Aerospace (BEAV) for a total consideration of $8.3 billion. Within Rockwell Collins, B/E Aerospace will operate as its new Aircraft Interior Systems segment.

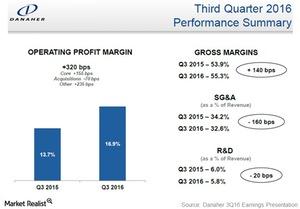

With Phenomenex, Danaher Has an Attractive Consumables Asset

On October 12, Danaher announced its an agreement to acquire Phenomenex, a privately held manufacturer of separation and purification consumables.

Caterpillar’s 3Q16 Earnings Bring ‘Inflection’ Back into Focus

Caterpillar, the world’s largest manufacturer of construction and mining equipment, will declare its 3Q16 earnings before the market opens on October 25.

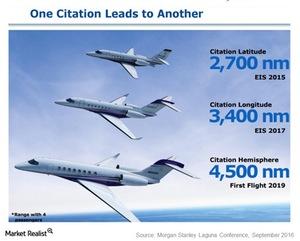

NetJets Orders Secure Textron Aviation amid Business Jet Weakness

Textron Aviation increase its sales in the last two quarters after gaining traction for its new Latitude business jets. It has secured 150 orders from NetJets.

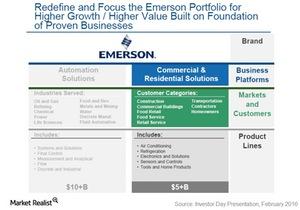

How This Emerson Sales Strategy Is Reeling in Big Box Retailers

Emerson Electric’s (EMR) omnichannel sales strategy is a multichannel approach that provides an integrated shopping experience.

How Emerson Process Management Stacks Up to Competitors

Revenues for Emerson’s (EMR) Process Management segment have risen from $7.0 billion in 2011 to $8.5 billion in 2015 at a compound annual growth rate of 4%.

What Are Emerson Electric’s Core Business Areas?

This is the second series in our company overview of Emerson Electric (EMR). The company recently realigned its business after finding buyers for its Network Power segment.

Higher Productivity and Lower Sales Highlight Clarcor’s 3Q Results

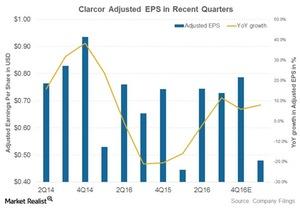

Clarcor beat Wall Street estimates by four cents with 3Q16 adjusted earnings per share (or EPS) of $0.73.

What Made Cepheid Attractive to Danaher?

On September 6, 2016, Danaher (DHR) announced that it has entered into a definitive agreement to acquire Cepheid (CPHD) for $4 billion.

Digging around to Find Drivers in Danaher’s Environmental Segment

Danaher’s Environmental & Applied Solutions (or, EAS) segment represented 25% of company sales in 2015, or $3.5 billion in value terms.

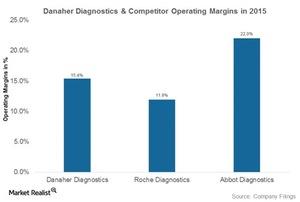

How Danaher Diagnostics Fares against Its Competition

Danaher’s Diagnostics unit had operating margins of 15.4% in 2015 and 17.2% in 1H16.

The Key Product Lines That Make Up Danaher’s Diagnostics Business

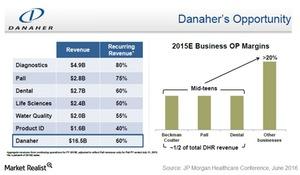

Danaher’s (DHR) Diagnostics unit, established through the acquisition of Radiometer in 2004, earned $4.9 billion in sales in 2015.

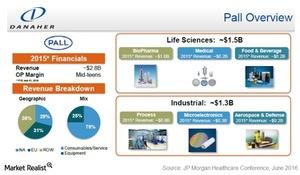

Pall Acquisition Gave Birth to Danaher’s Filtration Business

Danaher’s filtration business came into existence through the acquisition of Pall in 2015.

Understanding the Skeleton of Danaher’s Life Sciences Business

Customers in the Danaher life sciences business generally look at how the technology offered by a company can fit into their workflows.

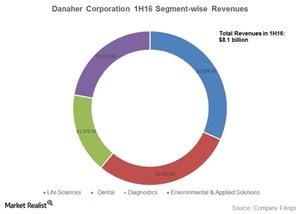

How Danaher’s Business Segments Are Structured

Each segment of Danaher is made up of roughly about 50 independent operating companies that Danaher has acquired over the years.

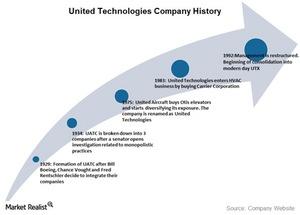

How United Technologies Has Evolved over the Years

The origins of United Technologies (UTX) lie in the creation of the United Aircraft and Transportation Company (or UATC) in 1929.

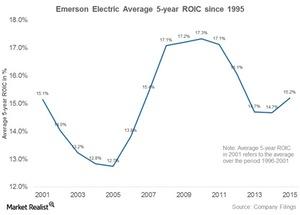

Does Emerson Have a Competitive Advantage?

An analysis of Emerson Electric’s (EMR) ROIC between 1995 and 2015 shows that 2001–2003 were the only years when ROIC fell below 13%.

More Losses? Caterpillar Puts Part of Its Mining Business on Sale

Caterpillar logged four consecutive quarters of operating losses in the Resource Industries segment—it houses the mining equipment business.

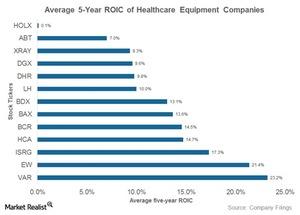

How Are Danaher’s Returns Compared to Its Industry Peers’?

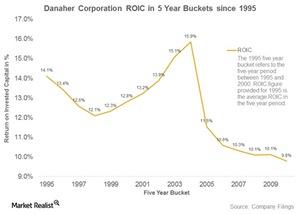

Danaher’s ROIC fell steadily from 15.5% in 2006 to 8.5% in 2015, indicating that it has probably had fewer high return reinvestment opportunities since then.

Investors Shouldn’t Expect Near-Term Optimism from Caterpillar

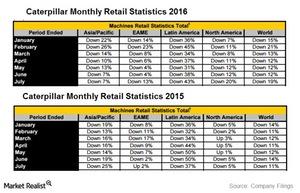

Caterpillar (CAT) released its retail statistics for July on a three-month rolling basis on August 18. However, Caterpillar’s retail sales fell in July.

Is Danaher Losing Its Competitive Advantage?

We analyzed Danaher’s (DHR) ROIC in the 20-year period between 1995 and 2015 and classified the period of study into 16 buckets of five years each.

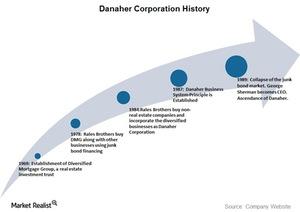

Danaher’s Journey from Corporate Raider to Corporate Statesman

Danaher (DHR) was the brainchild of brothers Steven and Mitchell Rales. It was incorporated as a holding company in 1984.

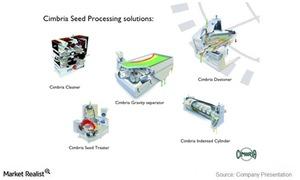

AGCO Acquires Cimbria, Expands in Seed and Grain Handling

On June 29, AGCO (AGCO) announced that it acquired Cimbria Holdings from Silverfleet Capital for 310 million euros ($340 million).

Parker-Hannifin’s 2017 Guidance Suggests Slowdown in Industrials

Parker-Hannifin has guided its fiscal 2017 adjusted EPS at $6.40–$7.10. The midpoint of this range is roughly 4.5% higher than $6.46 in fiscal 2016.

How 3M Company’s Acquisition Strategy Has Changed

3M Company’s (MMM) acquisition strategy for the last ten years can be classified as “BI” (before Inge) and “AI” (after Inge).

What Are the Financial Objectives of 3M Company’s 5-Year Plan?

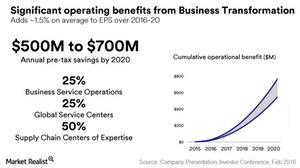

In February 2016, 3M Company (MMM) set financial objectives for the five-year period from 2016 to 2020 that were slightly below its previous expectations.

What Strategy Is 3M Company Using to Increase Cost Savings?

Realizing that its capital structure was sub-optimal and was leading to a high cost of capital, 3M Company started adding leverage.

How Good Is the Quality of 3M Company’s Earnings?

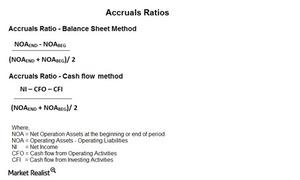

3M Company’s (MMM) accruals ratios using the balance sheet and the cash flow methods rose considerably in 2015.

3M Consumer Products: Your Everyday Kitchen and Office Companions

3M Company’s (MMM) Consumer Solutions segment is made up of four diverse businesses, which garnered a combined annual revenue of $4.4 billion in 2015.

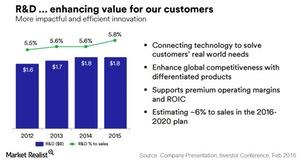

What Strengths Differentiate 3M Company from the Competition?

3M Company is generating a massive 30%–32% of its annual revenue from products it’s introduced in the last five years.

How 3M Company Differs from Other Industrial Conglomerates

While 3M’s peer group includes industrial conglomerates such as Honeywell and General Electric, these companies hardly share any similarities with 3M.

How the 15% Rule Became a Stepping Stone for 3M’s Innovation

3M company owes much of its innovative culture to William McKnight, who became the General Manager of the company in 1914.

Introducing 3M Company: A Jack of All Trades

Few companies have the kind of ubiquitous presence that 3M Company (MMM) likely does in your everyday life.

How Deere’s Margins Differ across Key Geographical Markets

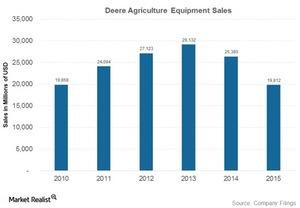

The US and Canada regions were responsible for 63.9%, 63%, and 66.1% of Deere & Company’s (DE) total revenues in 2013, 2014, and 2015, respectively.

Why Did Deere & Company Consolidate Its Dealer Network?

Despite relying on dealers to sell its iconic tractors for almost a 100 years, Deere & Company (DE) began consolidating its dealer network in the mid-2000s.

How Did Deere & Company Become the Brand It Is Today?

John Deere, who began his career as a blacksmith, founded the eponymous Deere & Company (DE) in 1837.

Honeywell Completes Acquisition of Com Dev International

Honeywell (HON) purchased Com Dev for $345 million net of debt and cash, which was equivalent to ten times the EBITDA of the target.

Essentials of the SaaS Business Model in Honeywell’s ACS Unit

Honeywell’s ACS unit uses the software-as-a-service (or SaaS) business model. In the SaaS model, software is licensed on a subscription basis to users.