Samuel Prince

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Samuel Prince

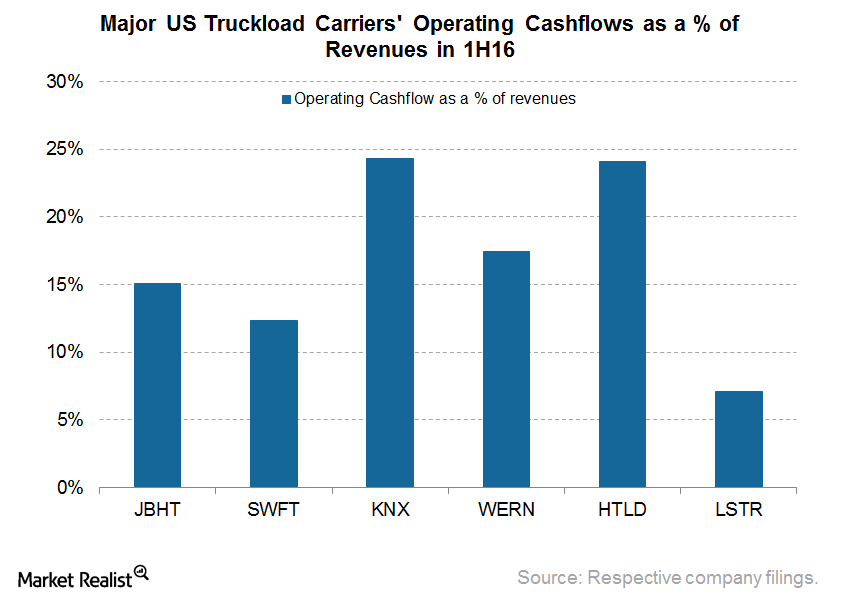

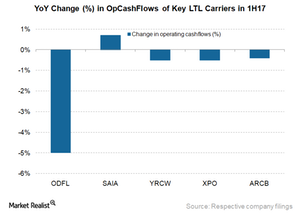

Which US Trucking Carrier Has the Best Operating Cash Flow?

Operating cash flow is a vital parameter for judging the health of a transportation company because it points to efficiency in operating assets and liabilities.

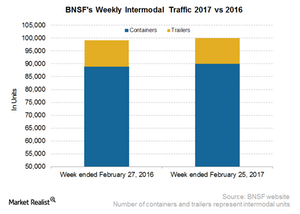

BNSF Railway’s Intermodal Volumes Matter

In the eighth week of 2017, BNSF’s overall intermodal traffic rose slightly by 0.8% YoY to ~100,000 containers and trailers.

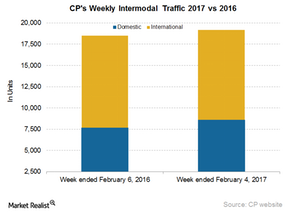

Canadian Pacific versus Canadian National: A Key Intermodal Comparison

Canadian Pacific’s (CP) intermodal volumes have been on roll for the past few weeks. It reported a 3.6% YoY rise for the week ended February 4.

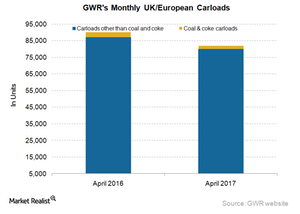

Reviewing GWR’s European Carloads in April 2017

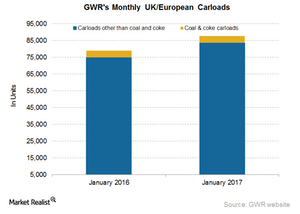

Genesee & Wyoming’s (GWR) European carloads fell 9.1% YoY (year-over-year) in April 2017. GWR’s other-than-coal carloads fell 8.2% on a YoY basis in April 2017.

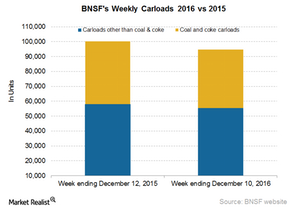

How BNSF’s Carloads Compared to Rival Union Pacific

BNSF Railway’s (BRK-B) total railcars for the week ended December 10, 2016, fell 5.5% to ~95,000 units, compared to ~100,000 units on a year-over-year basis.

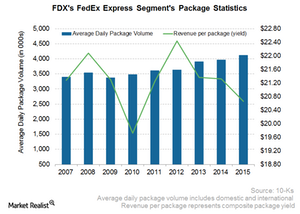

FedEx Express Is One of the Largest Express Networks in the World

FedEx Express offers three US overnight package delivery services: FedEx First Overnight, FedEx Priority Overnight, and FedEx Standard Overnight.

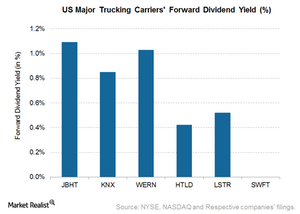

Which Trucking Company Tops in Dividend Growth?

In the second quarter 2016, Werner Enterprises (WERN) declared a dividend of $0.06 per share. That’s an increase of 20% from the corresponding period last year.

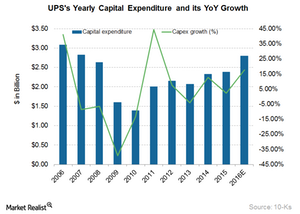

Where Is UPS Making Its Next Set of Capital Investments?

For 2016, UPS has anticipated an investment of $2.8 billion in the procurement of capital assets.

Behind Kansas City Southern’s Intermodal Growth amid Weak Trailers

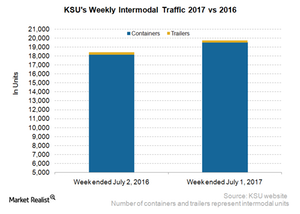

Kansas City Southern (KSU) reported a 7.2% rise in its overall intermodal volumes of containers and trailers in the week ended July 1, 2017.

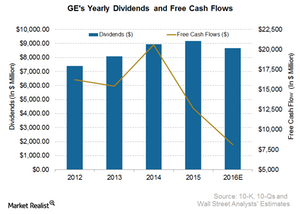

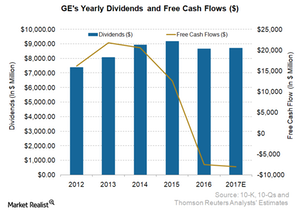

Does GE Have Enough Free Cash Flow to Support Dividend Growth?

General Electric’s dividend compound annual growth rate in the last seven years ended in 2015 was 7.1%. This single-digit growth wasn’t that impressive.

Inside GWR’s European Carload Rise in January

Genesee & Wyoming’s (GWR) European carloads rose 11.2% YoY in January 2017.

Who Are Old Dominion’s Biggest LTL Competitors Today?

Old Dominion’s peer group includes LTL companies that compete in the national and regional marketplace. The company also competes with some US railroads.

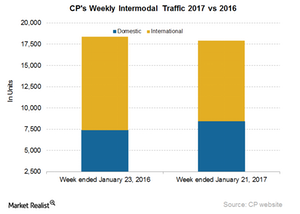

What Led to the Fall in Canadian Pacific’s Intermodal Volumes?

Canadian Pacific’s intermodal volumes Although Canadian Pacific’s (CP) intermodal volumes have been marching forward for the past few quarters, for the week ended January 21, 2017, CP reported a fall of 2.5% in overall intermodal traffic. Intermodal data indicates that the fall was due to a drop in its international intermodal business, where volumes fell […]

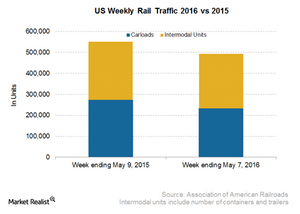

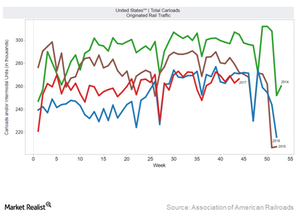

US and Canadian Rail Traffic Fell

In the week ended May 7, 2016, total US railcars went down by ~233,000, a double-digit fall of 15%.

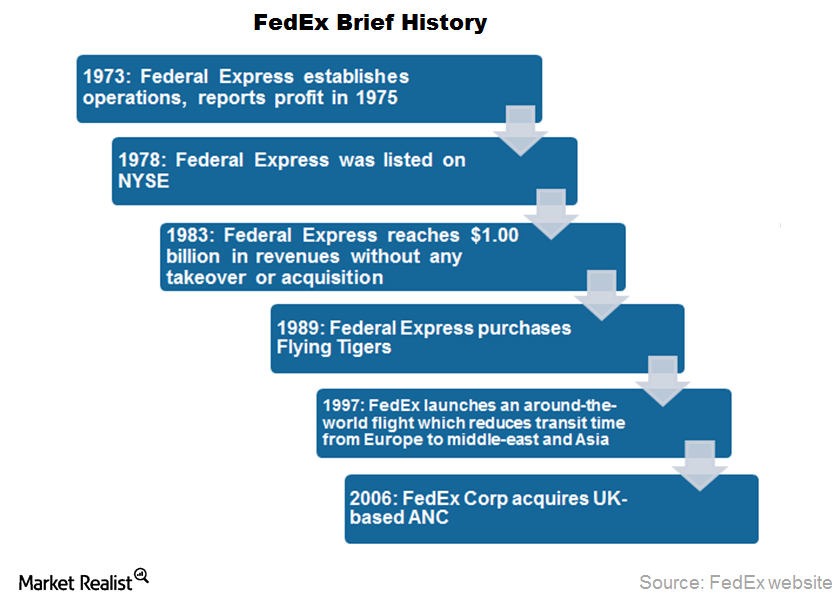

FedEx: A Concept that Blossomed into an Industry

FedEx achieved the distinction of being the first US company to reach $1.0 billion in revenues within the first ten years of operations without a single merger or acquisition.

BNSF: The Largest US Class I Railroad

Burlington Northern Santa Fe (or BNSF) owns and operates the largest rail network in North America. The company manages ~32,500 route miles of track.

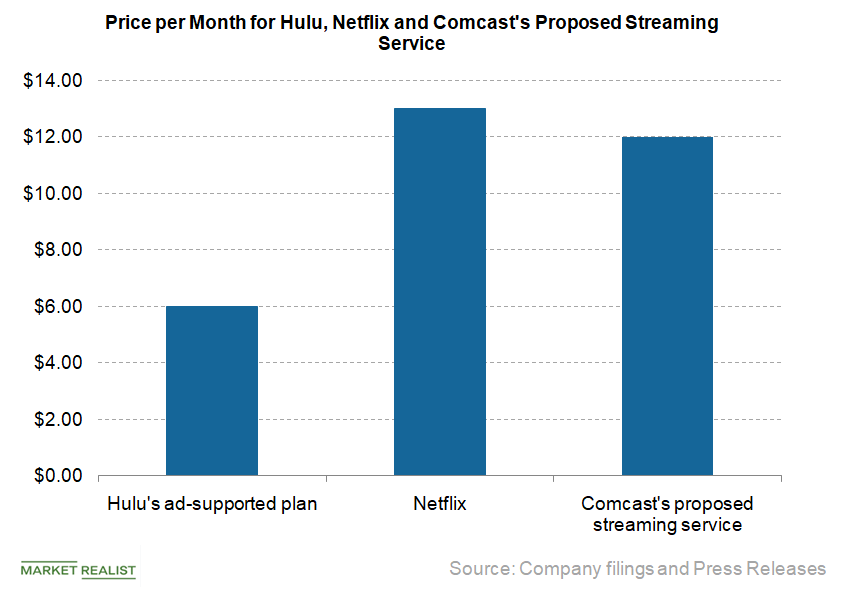

Why Hulu Changed Its Pricing Strategy

According to a Variety report from January 23, Hulu lowered the price of its ad-supported streaming plan from $7.99 per month to $5.99 per month.

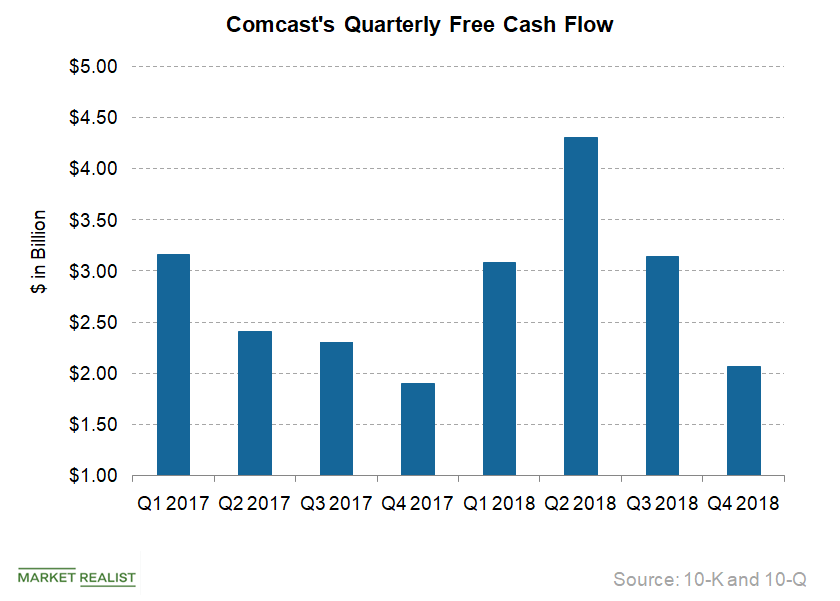

What’s Driving the Success of Comcast’s NBCUniversal Businesses?

Comcast’s (CMCSA) NBCUniversal business segment consists of filmed entertainment, theme parks, broadcast television, and cable networks divisions.

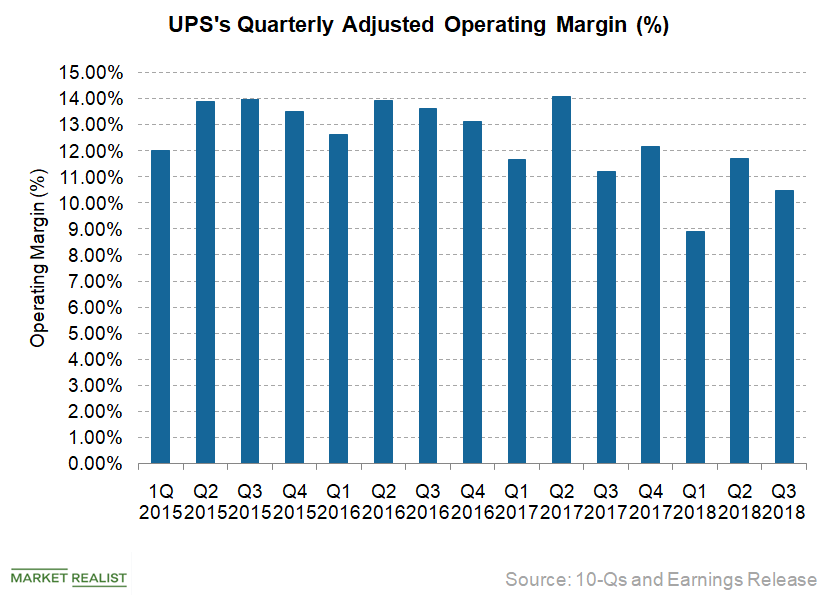

Why United Parcel Service’s Operating Margin Declined in Q3 2018

UPS’s operating profit declined 4.7% to $1.7 billion in the third quarter from $1.8 billion in the third quarter of 2017.

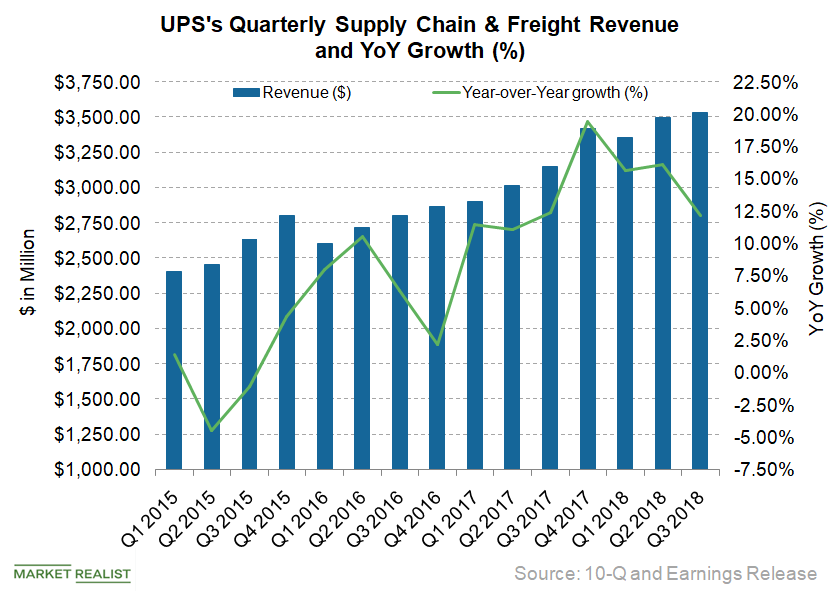

UPS: What Led Its Supply Chain and Freight Growth in Q3 2018?

United Parcel Service’s (UPS) Supply Chain & Freight vertical accounts for ~20% of its total revenues.

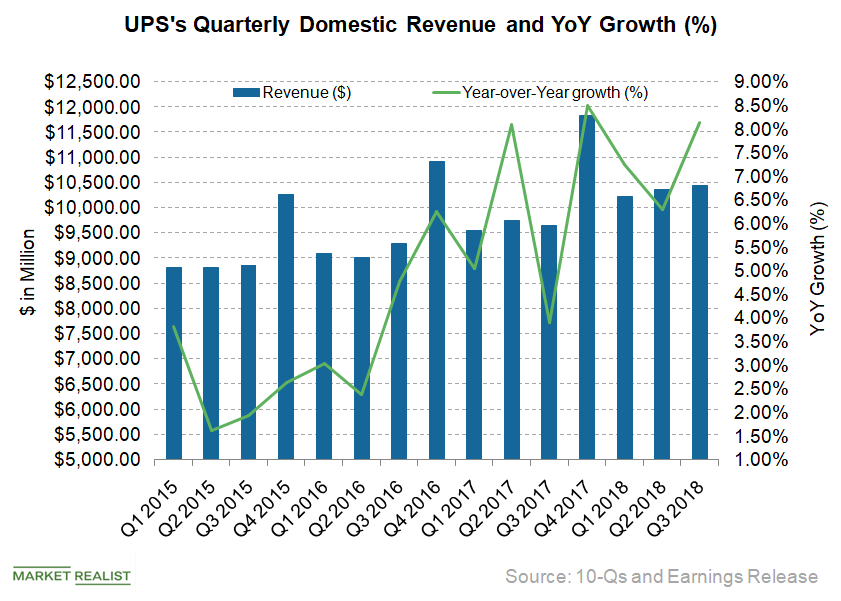

UPS: Decoding Its Domestic Segment’s Q3 Revenue Growth

In the third quarter, the US Domestic Package segment’s revenues jumped 8.1% YoY to $10.4 billion from $9.6 billion in the third quarter of 2017.

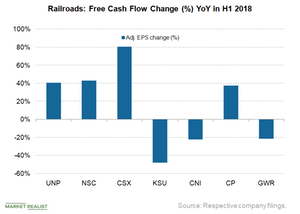

How Railroads’ Free Cash Flow Stacks Up

Free cash flow (or FCF) is an important metric in the railroad (FXR) industry.

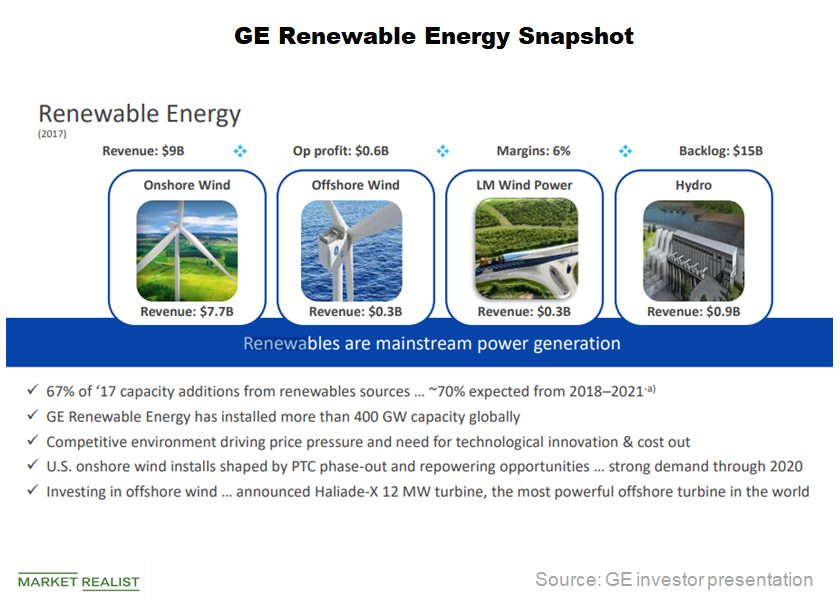

General Electric’s Renewable Energy Business

On September 24, General Electric’s (GE) Renewable Energy division launched its new onshore turbine platform named “Cypress.”

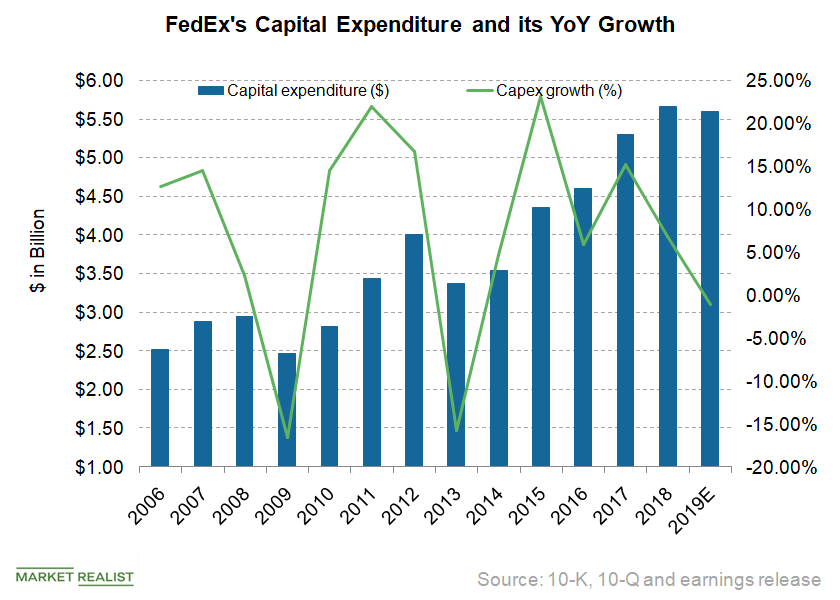

A Look at FedEx’s Capital Expenditure in Q1 2019

FedEx (FDX) incurred capital expenditure of $1.17 billion in the first quarter compared to $1.0 billion in the comparable period of fiscal 2018.

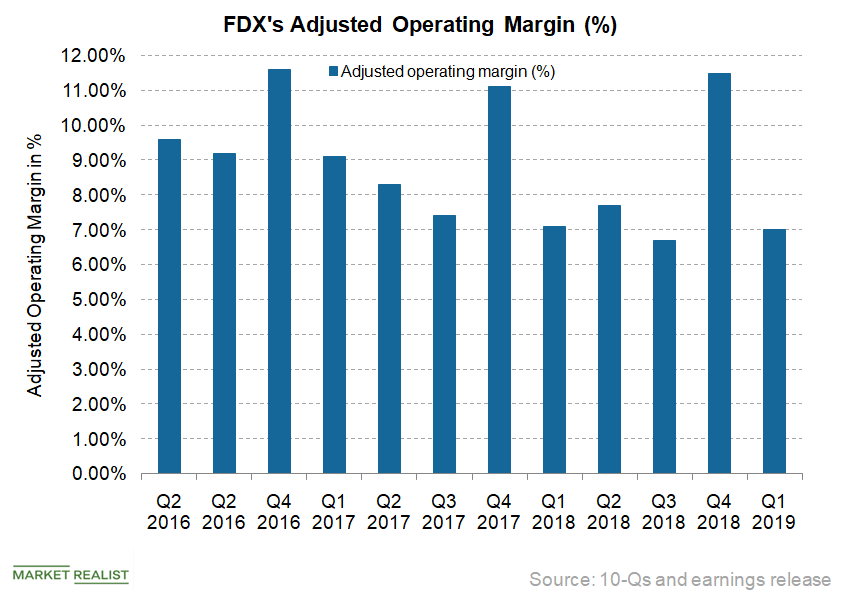

Did FedEx Deliver on Operating Margins in the First Quarter?

FedEx’s adjusted operating margin contracted by ten basis points to 7% in Q1 2019 from 7.1% in the first quarter of 2018.

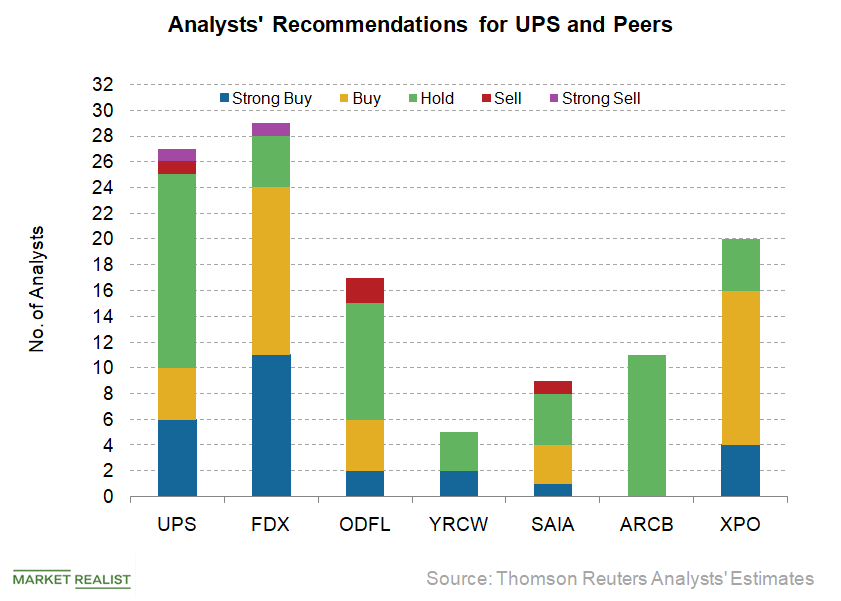

Inside Analysts’ Recommendations on United Parcel Service

Of the 27 analysts covering United Parcel Service (UPS), six analysts (22%) have a “strong buy” recommendation on the stock.

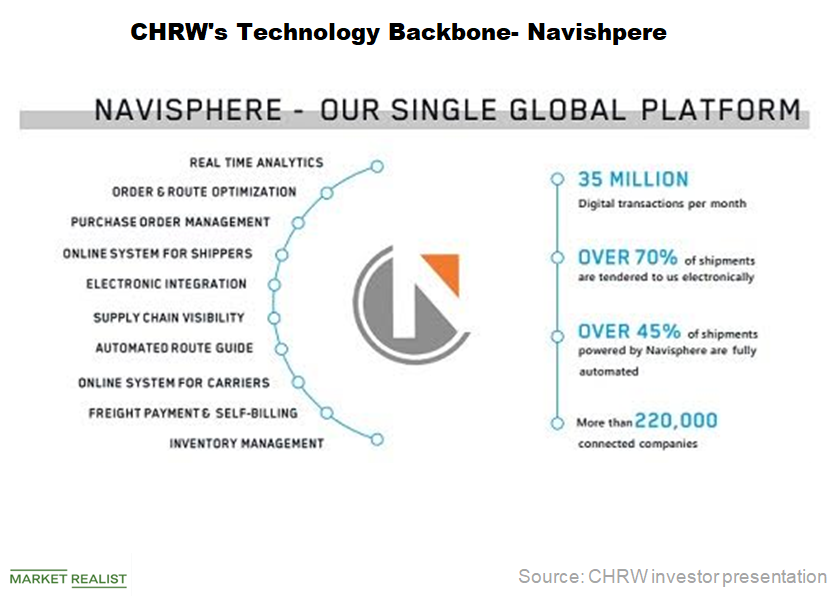

Navisphere: C.H. Robinson’s Technology Backbone

C.H. Robinson Worldwide’s (CHRW) Navisphere is a proprietary global technology platform that matches customer requirements with supplier capabilities to fit customers’ needs.

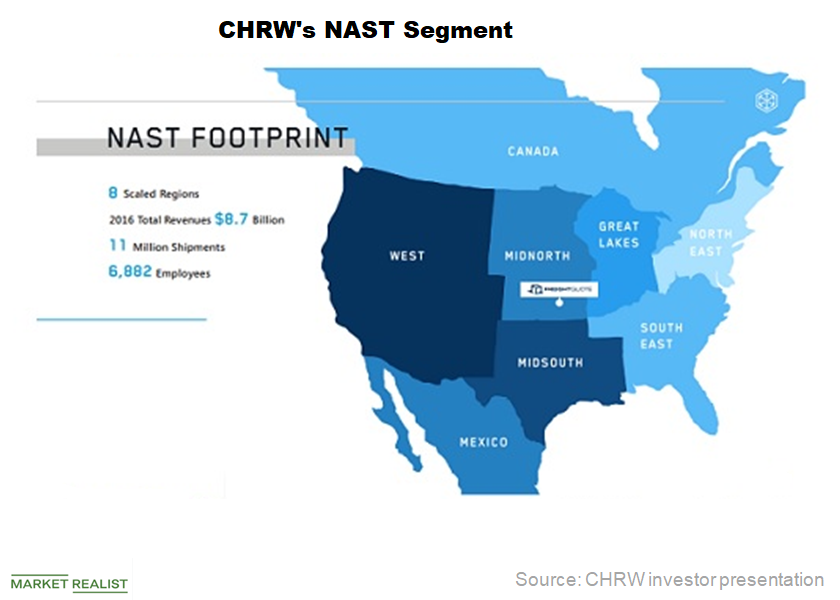

C.H. Robinson’s North American Surface Transport Segment

C.H. Robinson Worldwide’s (CHRW) NAST (North American Surface Transport) segment provides truckload, LTL (less-than-truckload), and intermodal freight transportation services across North America.

Inside C.H. Robinson’s Competition and Growth Strategy

C.H. Robinson Worldwide (CHRW) is the largest third-party logistics provider in the world.

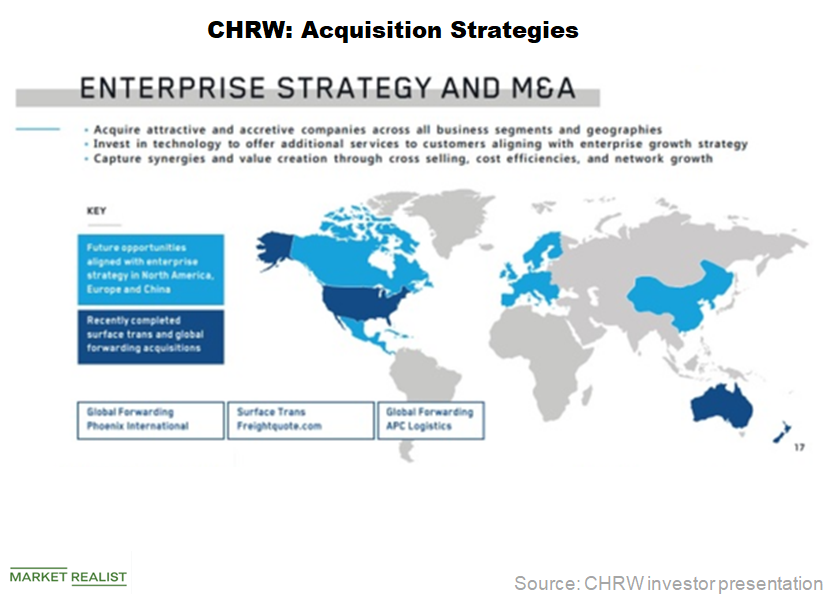

C.H. Robinson: Solid Business Growth through Acquisitions

C.H. Robinson Worldwide (CHRW) went public in 1997. Soon after, the company went on an acquisition spree to further its business interests in new geographies.

Boeing Unveils New Hypersonic Jet Concept

On June 26, Boeing (BA) announced it has joined the race to make the next-generation version of the Concorde, a hypersonic jet.

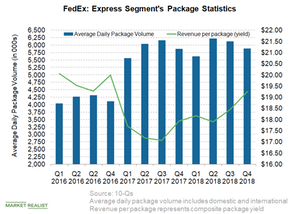

What’s behind FedEx Express’s Revenue Growth?

In this article, we’ll consider FedEx’s (FDX) Express segment’s performance in the fourth quarter.

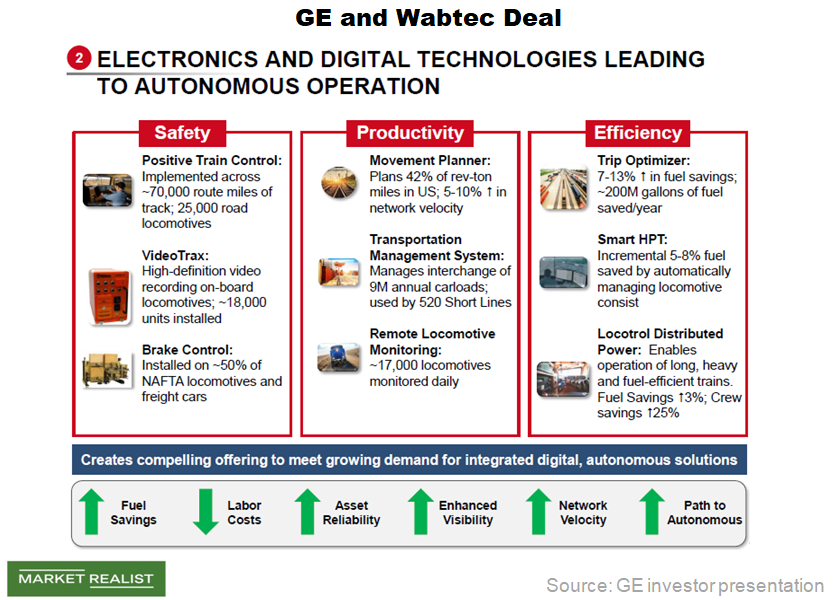

Synergies of the GE Transportation and Wabtec Deal

The deal between General Electric (GE) and Wabtec (WAB) is expected to generate annual run-rate synergies of $250 million by 2022.

How Union Pacific’s Dividend Has Varied Historically

On May 10, Western US rail freight giant Union Pacific (UNP) declared a quarterly cash dividend of $0.73 per share on its common stock.

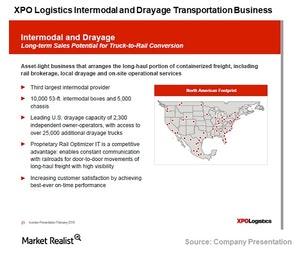

Decoding XPO Logistics’ Intermodal and Drayage Business

XPO uses a proprietary technology called Rail Optimizer for its intermodal services.

XPO Logistics: A Brief Company Overview

XPO Logistics (XPO) stock closed at $98.66 on March 27, 2018, which was lower than its 52-week high of $106.20.

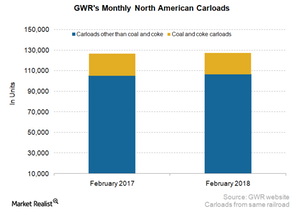

How GWR’s North American Carloads Trended in February

In February 2018, Genesee & Wyoming’s (GWR) North American carloads expanded 0.3% YoY (year-over-year) on a reported basis.

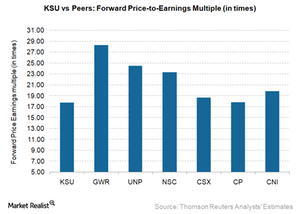

How Kansas City Southern Is Valued among Peers after 4Q17

KSU has the lowest PE ratio of 17.7x in the peer group, most likely due to the uncertainty of the NAFTA renegotiations.

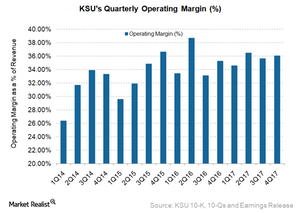

How Kansas City Southern Delivered on 4Q17 Operating Margins

In 4Q17, Kansas City Southern (KSU) reported an improvement of 80 basis points in its operating margin, which rose to 36% from 35.2% in 4Q16.

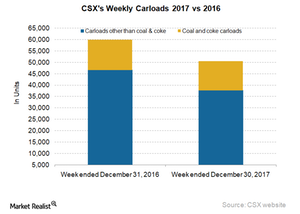

Commodities that Pulled Down CSX’s Carload Traffic in Week 52

Rail giant CSX (CSX) reported double-digit carload traffic loss in the 52nd week of 2017. The company’s carload traffic slumped 15.7% that week.

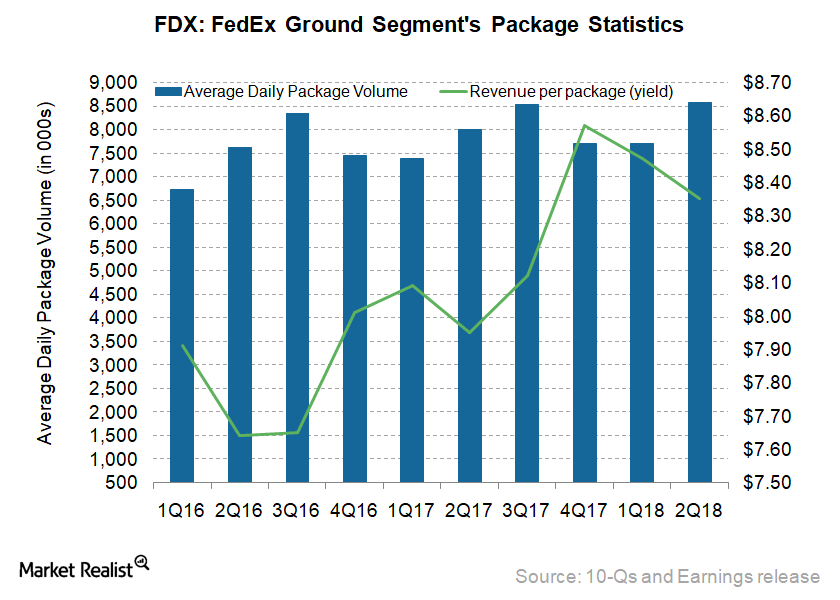

FedEx Ground’s Revenues in Fiscal 2Q18: What’s behind the Growth?

FedEx Ground’s (FDX) revenues rose 11.5% to $4.9 billion in fiscal 2Q18, from $4.4 billion in fiscal 2Q17.

Week 44 Failed to Lift US Rail Freight Volumes

In the 44th week of 2017, total rail freight traffic in the United States recorded a ~0.9% fall. Overall volumes, including intermodal, decreased to ~539,000 units.

Which Less-than-Truckload Carrier Saw Highest Operating Cashflows?

In this article, we’ll analyze the operating cash flows of these LTL (less-than-truckload) carriers in 1H17.

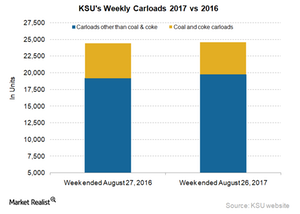

How Harvey Affected Kansas City Southern

Kansas City Southern’s network Kansas City Southern’s (KSU) US subsidiary caters to ten US states in the Midwest and Southeast. It also runs a rail route between Kansas City, Missouri, and multiple ports along the Gulf of Mexico in Texas, Louisiana, Alabama, and Mississippi. Among the major US Class I railroads, Kansas City remains hugely […]

Will Free Cash Flow Halt Dividend Growth for General Electric?

In the last ten years, GE has raised its cash dividends to common for seven of those years. The annualized $0.96 per share dividend results in a dividend payout ratio of 61.1%.

Kansas City Southern: What Led Volume Rise in Week 34?

Kansas City Southern (KSU), the smallest Class I railroad, reported a marginal volume gain in the week ended August 26, 2017.

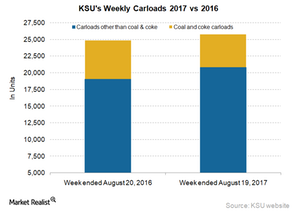

Kansas City Southern: Behind the Freight Volume Rise in Week 33

Kansas City Southern hauled ~26,000 railcars in the same week compared with close to 25,000 units in the week ended August 20, 2016.

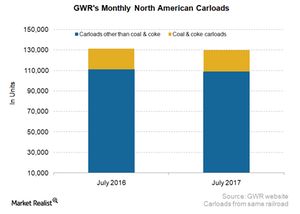

How Genesee and Wyoming’s Volumes Trended in July 2017

In July 2017, Genesee and Wyoming recorded a slight decline in its North American traffic YoY (year-over-year).

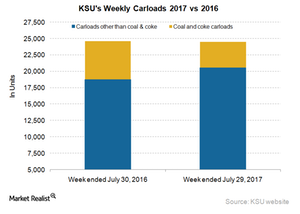

A Deep Dive into Kansas City Southern’s Shipments in Week 30

Kansas City Southern (KSU), the smallest Class I railroad in the US, also operates in Mexico.

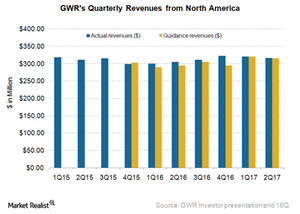

Genesee & Wyoming’s North American Revenues in 2Q17

In 2Q17, GWR’s North American revenues were $315.7 million, a 3.6% rise from $304.6 million in the same quarter last year.