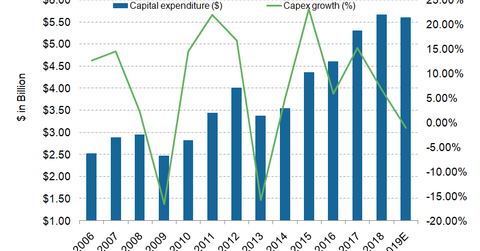

A Look at FedEx’s Capital Expenditure in Q1 2019

FedEx (FDX) incurred capital expenditure of $1.17 billion in the first quarter compared to $1.0 billion in the comparable period of fiscal 2018.

Sept. 24 2018, Updated 7:30 a.m. ET

FedEx’s capital expenditure in 2019

FedEx (FDX) incurred capital expenditure of $1.17 billion in the first quarter compared to $1.0 billion in the comparable period of fiscal 2018. The increase in capex was due to aircraft purchases, higher IT spending in FedEx Services segment, and increased vehicle purchases in the FedEx Freight and Express segment. For fiscal 2019, FedEx has slightly lowered its 2019 capex forecast to $5.6 billion, or ~8% of its projected revenue.

FedEx’s segment-wise capital expenditure

The Express segment’s capex jumped 31% YoY (year-over-year) to $760.0 million in the first quarter compared to $581.0 million in Q1 2018. In terms of assets, FedEx’s investment in aircraft and related equipment expanded 15% YoY to $472.0 million in the first quarter from $410.0 million. The segment’s share in the first-quarter capex was 64.5% compared to 55.7% in the same period of fiscal 2018.

FedEx’s Ground segment’s share in the first-quarter total capital expenditure was 14.9%, down from 29.3% in Q1 2018. In the quarter, the vertical’s capex was $176.0 million, down 42% from $306.0 million in the same period of fiscal 2018. Asset wise, FedEx spent $193.0 million on package handling and ground support equipment in the quarter compared to $197.0 million in Q1 2018.

Management outlook

FedEx mentioned that it has benefitted from the Tax Cuts and Jobs Act provision of 100% expensing of capital expenditure in the year incurred. The parcel delivery company has invested more in vehicles to support its Express and Freight segment. Plus, it has increased its capital investment in IT spending. The company’s IT-related capital spending went up 39% YoY to $175.0 million in the quarter from $126.0 million in Q1 2018. Although FedEx has curtailed its capex for 2019, it foresees a significant rise in the Express segment’s capital investment in 2020 and 2021.

ETF investment

The iShares Transportation Average ETF (IYT) has a 12.87% weight in FedEx stock. Major transportation and logistics companies included in IYT’s holdings are Norfolk Southern (NSC) with a weight of 9.73%, Union Pacific (UNP) with a weight of 8.60%, and JB Hunt Transport Services (JBHT) with a weight of 6.44%.

In the next part, we’ll discuss in detail FedEx’s bet on its Ground segment operation expansion.