Samuel Prince

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Samuel Prince

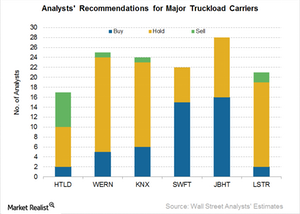

The Word on the Street: What Analysts Are Saying about Truckload Carriers

Swift Transportation has a consensus rating of 4.36 or “strong buy” among truckload carriers. Out of 22 analysts, 15 gave it a “buy” recommendation.

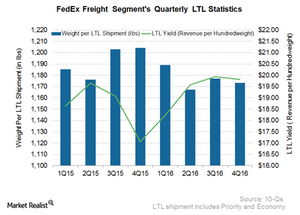

FedEx Freight: Higher Demand from Large Customers

FedEx expects FedEx Freight revenues to rise in fiscal 2017.

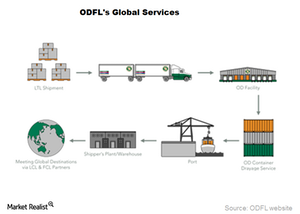

Inside Old Dominion Freight Line’s Global Services

Old Dominion unloads its less-than-truckload shipments dispatched by vendors onto an ocean container unit and onto the client’s steamship of choice.

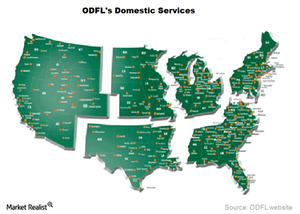

Understanding Old Dominion Freight Line’s Domestic Services

Old Dominion Freight Line has 224 shipping service centers and 32 transfer points. ODFL serves nine major regions and thousands of direct points in the US.

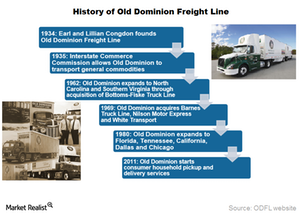

How Did Old Dominion Evolve as a Major US Trucking Company?

Old Dominion offers access, through agents or strategic alliances, to services in international locations including Canada, Mexico, Europe, and China.

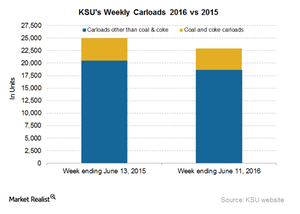

Kansas City Southern’s Carloads, and What They Have to Do with Mexico

In the week ending June 11, 2016, Kansas City Southern’s (KSU) total railcars declined by 8.1% YoY (year-over-year).

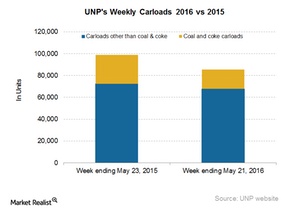

The Next Chapter in Union Pacific’s Carload Slump

In the week ending May 21, Union Pacific’s total railcars declined by 13.5% YoY to ~86,000 units, which was down from ~99,000 units one year previously.

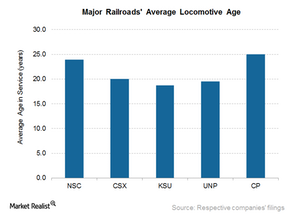

A Quick Glance at Major US Railroads’ Fleet Age

The fleet of railroads includes railcars and locomotives. In this part, we’ll compare the average locomotive fleet age of US Class I railroads.

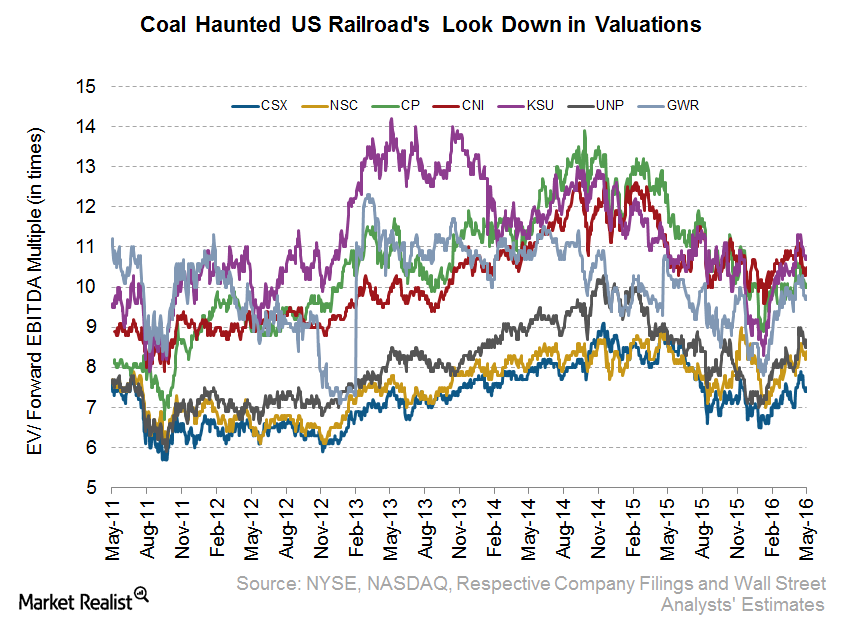

How Does the Market Value Major US Railroads?

The EV-to-forward EBITDA ratio denotes how a railroad is valued for each dollar of EBITDA that it’s anticipated to earn.

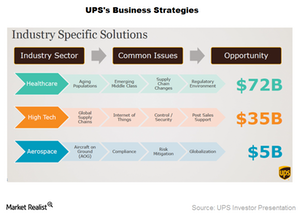

United Parcel Service: Key Growth Focus Areas

Recently, United Parcel Service has broadened the service offering of UPS My Choice to 15 more countries and territories in the Americas and Europe.

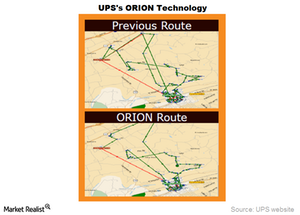

ORION: A Star in United Parcel Service’s Technology Crown

United Parcel Service, through 10,000 routes optimized with ORION, saves up to 1.5 million gallons of fuel per year.

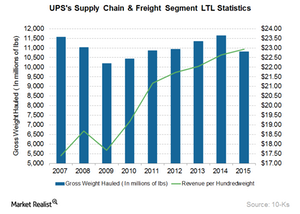

A Deep Dive into UPS’s Supply Chain and Freight Segment

United Parcel Service’s (UPS) Supply Chain and Freight segment includes forwarding and logistics services, UPS Freight, truckload freight brokerage, and financial services through UPS Capital.

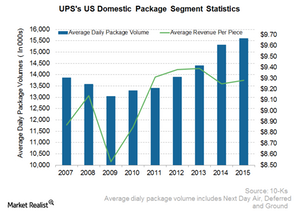

UPS Domestic Package Segment: Largest Courier Service in the US

UPS’s US Domestic Package segment consists of the time-sensitive delivery of letters, documents, and packages across the US. As the jewel in the company’s crown, this segment’s share averaged 61.1% of the total revenues in the last six years.

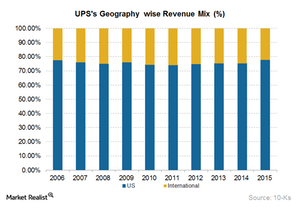

United Parcel Service: A Company Overview

In 2015, United Parcel Service reported total revenues of $58.4 billion. The company’s primary competitor in the US is the Memphis-headquartered FedEx Corporation.

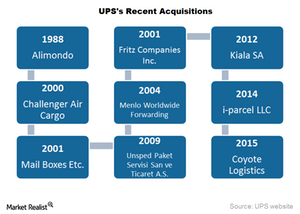

United Parcel Service: Fostering Business through Acquisitions

In 1988, United Parcel Service (UPS) bought its Italian partner, Alimondo, a move aimed at expansion in Europe. In the same year, UPS went on an acquisition spree.

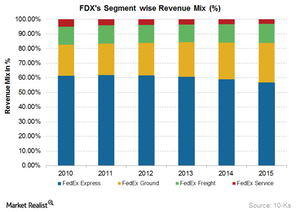

Analyzing FedEx’s Revenue Streams

In fiscal 2015, FDX increased its revenues by $1.9 billion. Its total revenue was a $47.4 billion for the year.

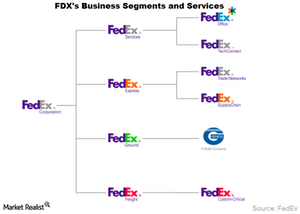

What Is FedEx’s Business Model?

FedEx provides a portfolio of transportation, e-commerce, and business services through wholly owned subsidiaries.

J.B. Hunt 360: J.B. Hunt Transport’s Technological Innovation

JHBT calls J.B. Hunt 360 an intuitive transportation management system. The company claims to realize improved workflows, tighter integration, and mobile tools.

Who Competes with J.B. Hunt Transport Services?

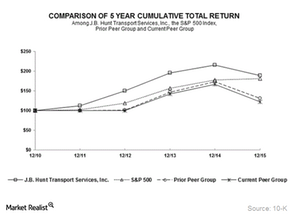

J.B. Hunt Transport’s (JBHT) peer group includes trucking companies that compete in the national marketplace and some of the US Class I railroads. The company updates its peer group every year.

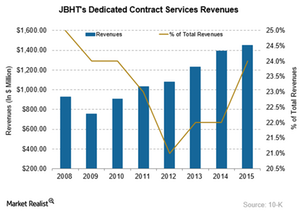

J.B. Hunt Transport’s Dedicated Contract Services Division

J.B. Hunt Transport (JBHT) has a network of roughly 89 cross-dock locations throughout the US to support the company’s final-mile, or last-mile, delivery services.

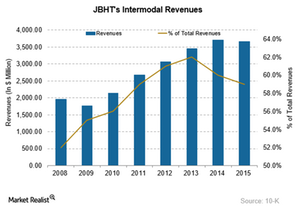

Why J.B. Hunt Transport Leads the Trucking Intermodal Space

Intermodal transportation involves the movement of freight in an intermodal container using multiple transportation modes such as rail, ship, and truck. It doesn’t involve the handling of freight when the modes are changed.

J.B. Hunt Transport Services: America’s Largest Trucking Company

One of the largest road transport companies in North America, J.B. Hunt Transport (JBHT) has transportation arrangements with all major US Class I railroads. Its operating revenues grew from $2.2 billion in 2002 to $6.1 billion in 2015.

Assessing Canadian National through Porter’s Five Forces

In this part, we’ll do a Porter’s Five Forces check for Canadian National (CNI). The threat of new entrants is relatively low for CNI. The railroad industry is extensively capital intensive, with maintenance capital spending accounting for the highest share.

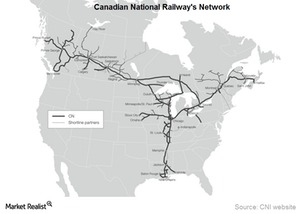

Canadian National Railway: Class I Railroad with a Robust Network

A Class I railroad in the US, or a Class I railway in Canada, is one of the largest freight railroads based on operating revenue. US Class I Railroads are line haul freight railroads with 2014 operating revenues of ~$475.75 million.

Porter’s 5 Forces: KSU’s Position in the US Freight Rail Industry

Competition with other railroads and other modes of transportation is subject to service rates, routes, service reliability, and quality. KSU faces the stiffest competition among the Class I railroads due to its relatively small size.

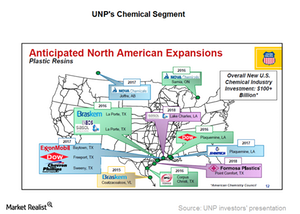

Union Pacific’s Chemical Freight Revenues: An Anticipated Mixed Bag in 2016

Union Pacific’s chemical freight carloads were down by 4% in 4Q15 compared to 4Q14. Petroleum products carloads were down by 18% during the same period.

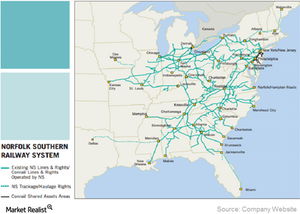

Norfolk Southern: A Class I Railroad Carrier

Norfolk Southern Corporation operates ~20,000 route miles in 22 states and the District of Columbia. The company mainly transports coal and general merchandise.