Samuel Prince

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Samuel Prince

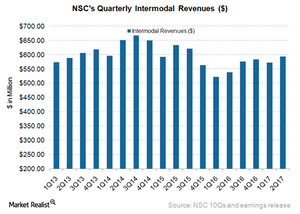

Norfolk Southern: International Pushed Intermodal Revenues in 2Q17

NSC’s Intermodal segment’s revenues rose 10% to $593.0 million from $538.0 million in 2Q16.

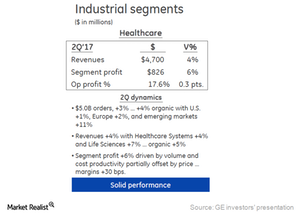

What Led the Rise in GE’s Healthcare Revenue in 2Q17?

GE’s Healthcare segment remained a top performer in 2Q17. Revenue-wise, this segment remained the third-largest contributor to GE’s total operating revenue of $28.0 billion.

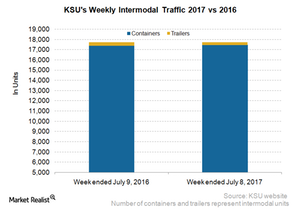

Inside Kansas City Southern’s Trailer Decline Last Week

In the week ended July 8, 2017, Kansas City Southern (KSU) reported a marginal loss in its total intermodal volumes (containers and trailers).

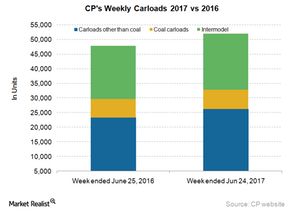

A Freight Growth Summary for Canadian Pacific Railway in Week 25

In this article, we’ll take a look at Canadian Pacific Railway’s (CP) overall traffic. The company’s overall freight traffic also consists of its intermodal volumes.

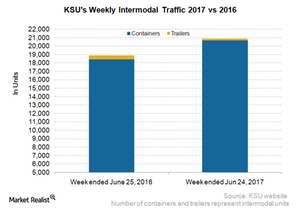

Diving into Kansas City Southern’s Week 25 Intermodal Data

Kansas City Southern’s (KSU) total intermodal traffic in terms of containers and trailers rose 10.6% in the week ended June 24, 2017.

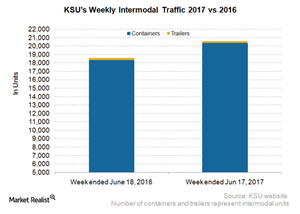

Kansas City Southern’s Containers Rose, Trailers Fell in Week 24

In week 24 of 2017, Kansas City Southern (KSU) saw its overall intermodal volumes rise 10.6%, unlike in the previous two weeks.

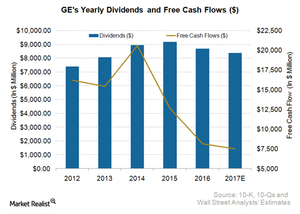

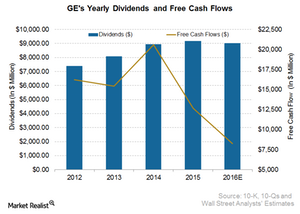

Do General Electric’s Free Cash Flows Support Dividend Payments?

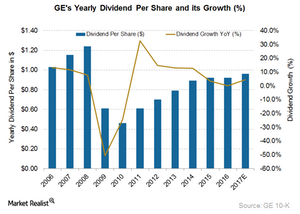

General Electric’s (GE) dividend CAGR (compound annual growth rate) for the last seven years was ~7%.

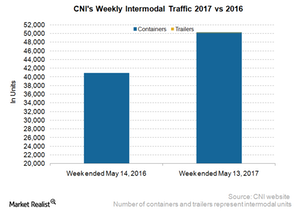

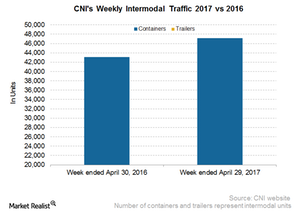

CNI’s Intermodal Growth Continued in Week 19

Canadian National Railway moved more than 50,100 containers in the 19th week of 2017, compared to the nearly 40,900 containers it moved in the corresponding week of 2016.

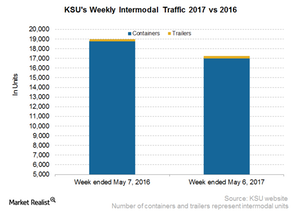

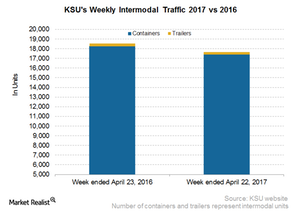

Kansas City Southern: Unfolding Its Intermodal Traffic in Week 18

In the week ended May 6, 2017, Kansas City Southern reported a year-over-year fall of 9.1% in its overall intermodal traffic.

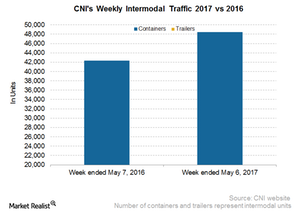

Canadian National Railway: Intermodal Growth Continues in Week 18

Canadian National Railway moved more than 48,400 containers in the 18th week of 2017, compared with nearly 42,300 containers in the corresponding week of 2016.

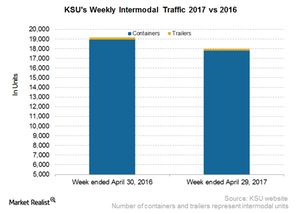

Kansas City Southern: A Look at Its Intermodal Traffic

Kansas City Southern’s intermodal traffic In the past few weeks, Kansas City Southern (Kansas City Southern), the smallest Class I railroad company in the United States, has seen its intermodal traffic slow. In the week ended April 29, 2017, Kansas City Southern reported a YoY (year-over-year) fall of 6.1% in its overall intermodal traffic. Kansas City […]

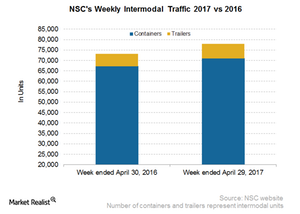

Comparing Norfolk Southern’s Intermodal Traffic with CSX’s

Norfolk Southern’s intermodal traffic Norfolk Southern’s (NSC) total intermodal traffic rose 6.5% in the week ended April 29, 2017. Its volumes reached ~78,000 containers. Norfolk’s container traffic rose 5.6%, and its trailer traffic rose 15.6% YoY (year-over-year) to nearly 6,900 units, compared with 5,900 units in the week ended April 30, 2016. Since the beginning of […]

Analyzing Canadian National Railway’s Intermodal Volumes

Canadian National Railway’s intermodal volumes In the 17th week of 2017, Canadian National Railway’s (CNI) overall intermodal volumes rose 9.4%. There was no trailer movement in the week. The company moved more than 47,000 containers in the 17th week of 2017, compared with more than 43,000 containers in the corresponding week of 2016. The rise […]

Trailers Hurt Kansas City Southern’s Intermodal Volume in Week 16

In the past few weeks, Kansas City Southern (KSU), the smallest Class I railroad company in the United States, has seen its intermodal traffic slow.

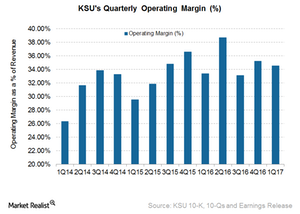

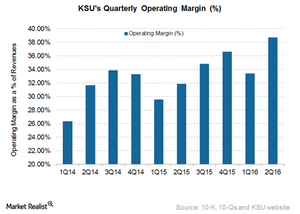

Kansas City Southern’s Operating Margin Rose in 1Q17

Kansas City Southern (KSU) reported a 120-basis-point rise in its 1Q17 operating margin. KSU recorded 34.6% operating margin in 1Q17, compared to a 33.4% in 1Q16.

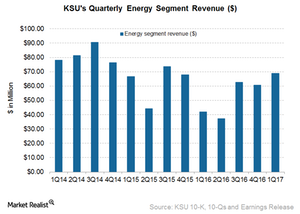

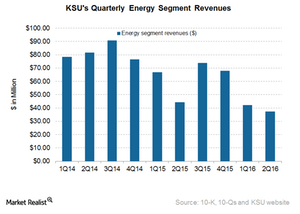

Why Kansas City Southern’s Energy Revenue Rose 64% in 1Q17

In this article, we’ll examine Kansas City Southern’s (KSU) Energy freight revenue in 1Q17. In the quarter, KSU’s Energy freight revenue was $69.0 million.

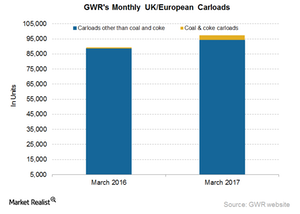

Analyzing Genesee & Wyoming’s European Carloads in March 2017

Genesee & Wyoming’s (GWR) European carloads rose to 9.0% YoY (year-over-year) in March 2017.

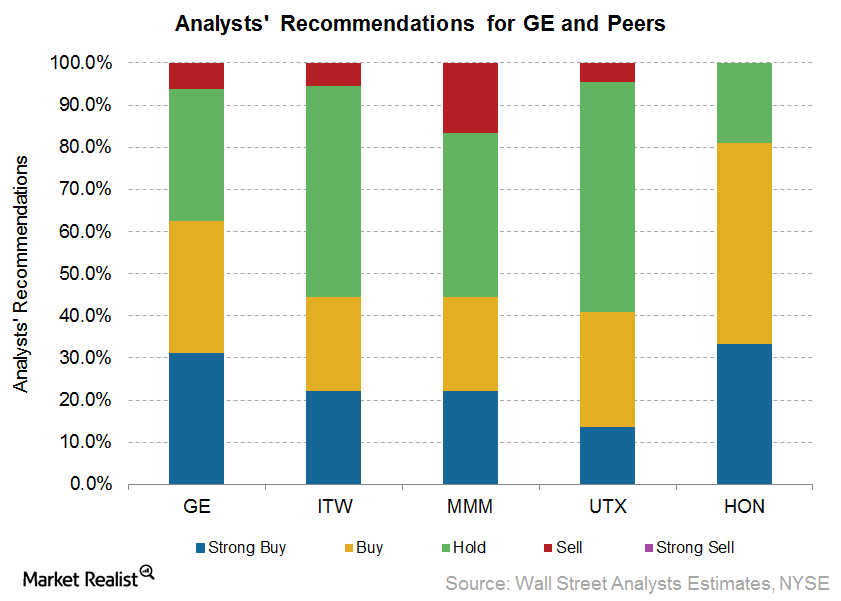

How Analysts View General Electric Leading Up to 1Q17

In this article, we’ll review analysts’ recommendations for General Electric (GE) ahead of its 1Q17 earnings release on April 21, 2017. Wall Street analysts seem to be divided over GE.

Should We Expect General Electric to Raise Dividends in 2017?

For a long time, General Electric (GE) has remained a decent dividend distributor in the S&P 500 space. The company raised its dividend per share by $0.01 to $0.24 in January 2017.

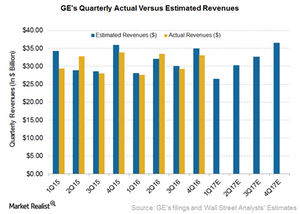

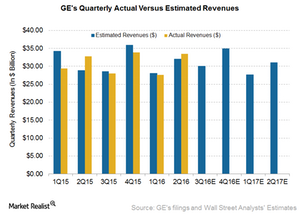

General Electric’s 1Q17: Are Analysts’ Revenue Estimates Right?

Analysts expect General Electric (GE) to achieve revenue of $26.4 billion in 1Q17. On a year-over-year (or YoY) basis, this represents a fall of 5.8%.

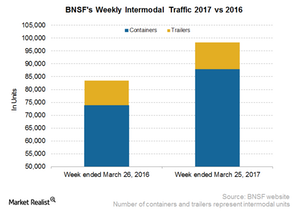

How BNSF’s Intermodal Volumes Compare in the 12th Week

In the 12th week of 2017, BNSF Railway’s (BRK-B) overall intermodal traffic rose 17.6% YoY to more than 98,000 containers and trailers.

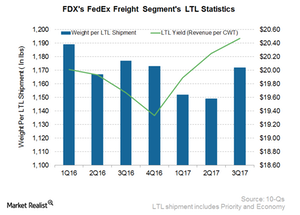

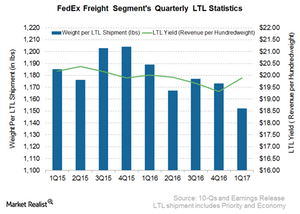

Better LTL Pricing Drove FedEx’s 3Q17 Freight Revenue

The FedEx Freight segment revenues rose 3.1% from $1.4 billion in 3Q16 to $1.5 billion in fiscal 3Q17.

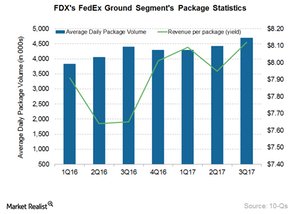

Better SmartPost and Ground Yield Pushed Up FedEx Ground’s Revenue

The FedEx Ground segment’s revenues rose 6% from $4.4 billion in 3Q16 to $4.7 billion in fiscal 3Q17.

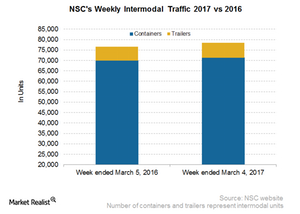

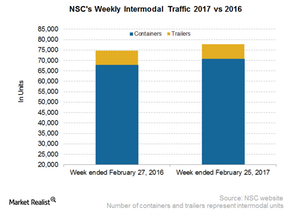

How Norfolk Southern’s Intermodal Volumes Compare to Peers

Norfolk Southern’s (NSC) total intermodal traffic rose 2.7% in the week ended March 4, 2017.

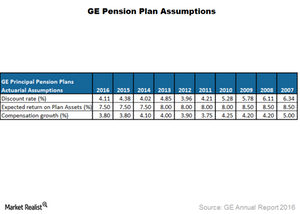

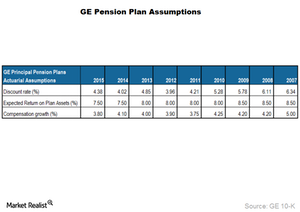

Analyzing General Electric’s Pension Plan Assumptions

General Electric’s (GE) projected benefit obligation (or PBO) calculation takes into account the average years of service, salary growth, and the discount rate.

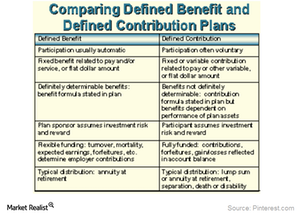

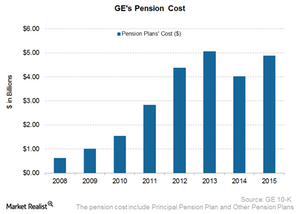

What Does General Electric’s Pension Plan Entail?

Under a defined contribution plan, the employer contributes a fixed amount to the fund on behalf of the employee.

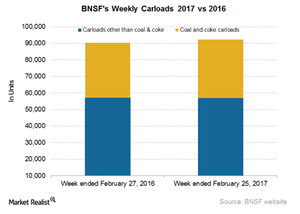

Your Guide to BNSF Railway’s Latest Carload Data

BNSF’s total railcars for the week ended February 25, 2017, rose 2.3% YoY to more than 92,000 units.

Behind Norfolk Southern’s Intermodal Volumes in the 8th Week

NSC’s total intermodal traffic rose 4.3% in the week ended February 25, 2017, reaching ~78,000 containers and trailers.

In Focus: General Electric’s Pension Plan Assumptions

General Electric’s (GE) projected benefit obligation (or PBO) calculation takes into account the average years of service, the salary growth, and the discount rate.

A Deep Dive into General Electric’s Pension Plan

After the financial crisis of 2008, many companies shifted toward defined contribution pension plans.

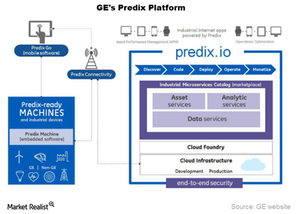

GE Digital Sticks Another Feather in Its Industrial Internet Cap

On November 14, industrial heavyweight General Electric acquired ServiceMax, a global provider of field service management software based in California.

How Useful Will ServiceMax Be in GE Digital’s Industrial Internet Vision?

ServiceMax’s complementary capabilities would help GE Digital develop and expedite the commercialization of its Predix applications.

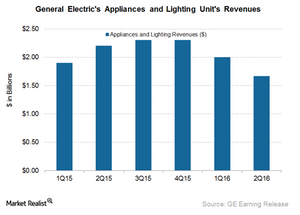

Why Did GE Part Ways with Its Appliance Division?

In addition to the sale of its Financial Assets business, General Electric (GE) bid farewell to its Appliance business in July 2016.

What’s the Rationale behind GE’s Proposed Acquisition?

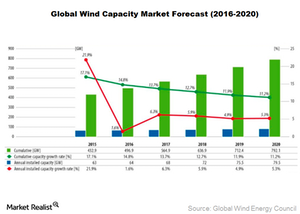

In this article, we’ll go through the rationale behind GE’s planned acquisition of LM Wind Power. According to the GWEC, worldwide wind capacity is expected to nearly double in the next five years.

GE’s Acquisition Spree Continues with LM Wind Power

On October 11, 2016, General Electric (GE), an industrial behemoth, said that it was set to acquire LM Wind Power for $1.7 billion.

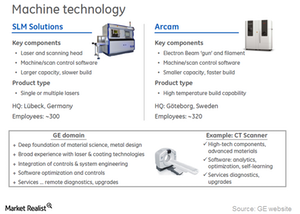

Why Is General Electric Focused on Additive Manufacturing?

General Electric’s focus on 3D printing Earlier in this series, we looked at General Electric’s (GE) expected operating margins and profit in 3Q16. In this part, we’ll look at GE’s plans in the additive manufacturing space. On September 6, 2016, GE acquired two 3D printing companies, Arcam and SLM, for $1.4 billion in cash. General […]

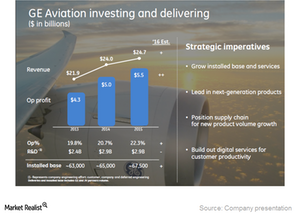

How Does GE’s Aviation Segment Look Pre-3Q16 Results?

General Electric’s Aviation segment General Electric’s (GE) Aviation segment is the second-largest contributor to the company’s overall revenues. This segment’s 22.5% operating margins in 1H16 were the largest among all eight segments reported under GE Industrial. Commercial aviation According to the International Air Transport Association (or IATA), global air traffic is expected to fall to […]

Why Do Analysts Expect General Electric’s 3Q16 Revenues to Rise?

Analysts’ estimates Analysts estimate that General Electric’s 3Q16 revenues will total $30.0 billion, up by 7.3% on a year-over-year basis. Even though energy markets are acting as a deterrent to General Electric’s (GE) overall revenues, the favorable business environment in power, aviation, and healthcare will jack up the revenues. Analysts expect the next four quarters’ revenue to […]

Why FedEx Sees Volume Growth in the Future of Its Freight Segment

FedEx’s (FDX) Freight segment revenues rose 4% from $1.6 billion in fiscal 1Q16 to ~$1.7 billion in fiscal 1Q17.

How TNT Acquisition Is Driving FedEx’s European Growth

On May 25, 2016, FedEx (FDX) completed the 4.4 billion euro acquisition of the Netherlands-based TNT Express NV.

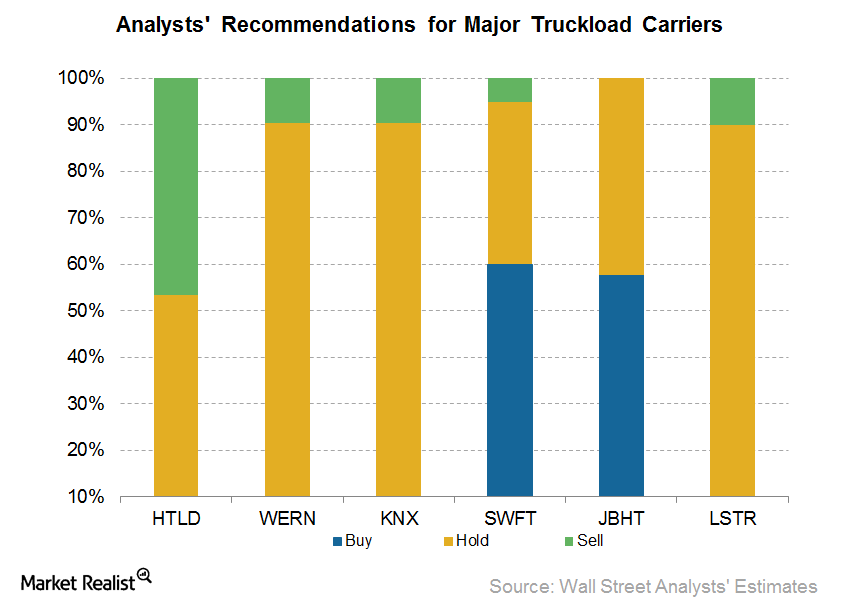

Looking at US Truckload Carriers through Analysts’ Eyes

In this part of the series, we’ll take a look at what Wall Street analysts are saying about US truckload carriers and how they’re rating the stocks.

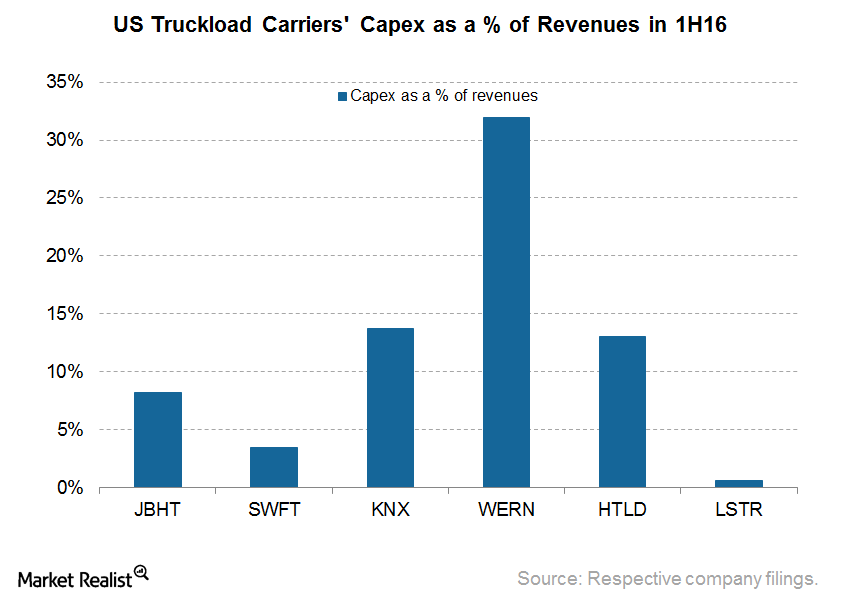

This Truckload Carrier’s Capital Expenditure Bucks the Trend

In the current weak freight regime, the extent of capital expenditure throws light on the growth prospects of these trucking carriers.

Are GE’s Free Cash Flows Sufficient for Dividend Growth?

General Electric’s 2016 free cash flows are expected to remain at $8.2 billion. This is mainly due to free cash flows of -$6.0 billion generated in 1H16.

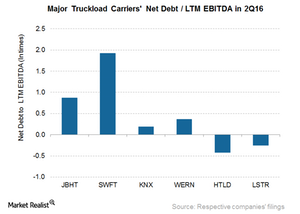

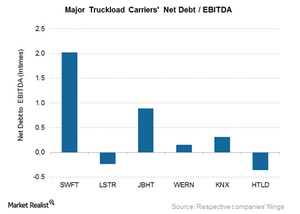

Which Truckload Carrier Posted the Most Debt in 2Q16?

Landstar System (LSTR) and Heartland Express (HTLD) have higher available cash on their balance sheets than total debt.

Why Kansas City Southern’s Operating Margin Rose in 2Q16

Kansas City Southern (KSU) reported a 3% decline in 2Q16 revenues to $568.5 million on a YoY (year-over-year) basis.

Kansas City Southern’s Energy Segment Lost Its Sheen in 2Q16

Kansas City Southern’s Energy segment Previously, we discussed the revenue of Kansas City Southern’s (KSU) Agriculture & Minerals segment in 2Q16. Now, we’ll examine KSU’s Energy freight revenues in 2Q16. In the reported quarter, KSU’s Energy freight revenues came in at $37.2 million, down by 16% from $44.2 million in the same period last year. […]

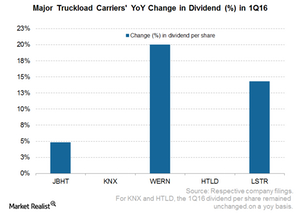

Which US Truckload Carrier Holds First Place in Dividend Growth?

Among major truckload companies, in 1Q16, Werner Enterprises (WERN) declared the highest dividend growth, at $0.06 per share, which is a 20% YoY increase.

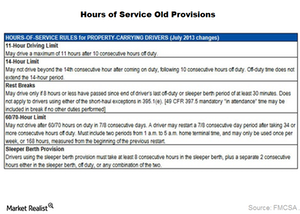

Understanding the Impact of Hours-of-Service Rules on Truckload Carriers

In July 2013, the FMCSA of the US Department of Transportation extended safety regulations regarding truckload drivers’ hours of service.

Which Is the Least Leveraged Truckload Carrier among Major Peers?

Among truckload companies, Landstar and Heartland have a lot of available cash compared to total debt. Swift and J.B. Hunt have high net debt-to-EBITDAs.

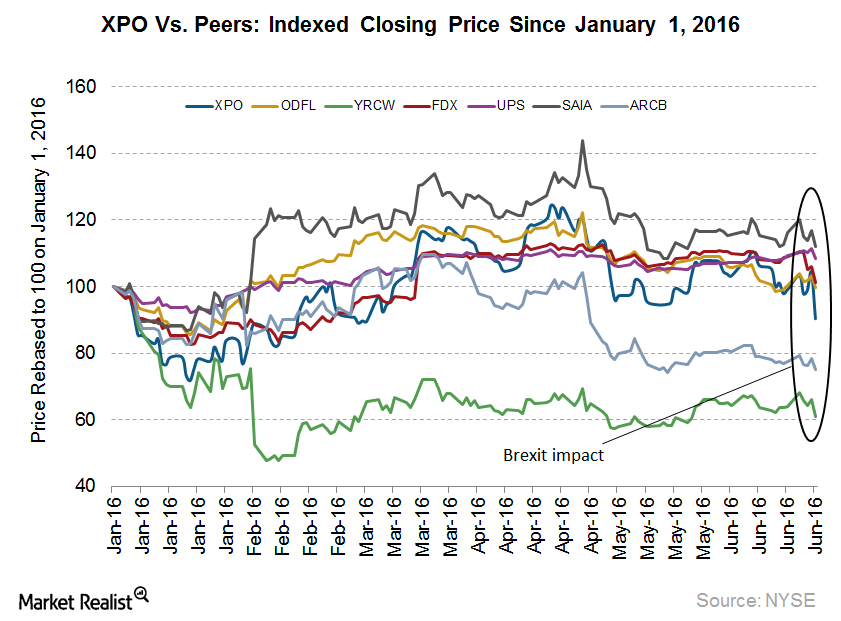

Will Brexit Continue to Impact XPO Logistics?

Following the United Kingdom’s decision to exit the European Union, XPO Logistic’s (XPO) stock fell 13.4% on June 24.