How Does GE’s Aviation Segment Look Pre-3Q16 Results?

General Electric’s Aviation segment General Electric’s (GE) Aviation segment is the second-largest contributor to the company’s overall revenues. This segment’s 22.5% operating margins in 1H16 were the largest among all eight segments reported under GE Industrial. Commercial aviation According to the International Air Transport Association (or IATA), global air traffic is expected to fall to […]

Oct. 7 2016, Updated 4:25 p.m. ET

General Electric’s Aviation segment

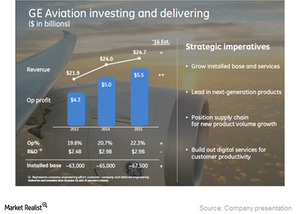

General Electric’s (GE) Aviation segment is the second-largest contributor to the company’s overall revenues. This segment’s 22.5% operating margins in 1H16 were the largest among all eight segments reported under GE Industrial.

Commercial aviation

According to the International Air Transport Association (or IATA), global air traffic is expected to fall to 6.2% in 2016, compared with 7.4% the year prior. The passenger load factor (or PLF) is expected to remain at 80% in 2016. The year-over-year freight traffic growth is anticipated to be 2.1% in 2016, compared with 3% in 2015.

However, the same agency expects passenger departures to rise to 36.8 million in 2016, compared with 34.8 million a year ago. The average cost of jet fuel cost is anticipated to be $55 per barrel in 2016, compared with $67 per barrel in 2015. It expects the airline’s overall profits to touch $39.0 billion in 2016, compared with $35.0 billion a year ago.

GE Aviation’s order book position

General Electric expects the US defense budget to remain flat through 2017 at $580.0 billion. The company’s intelligence suggests that international defense spending rose 4% in 1H16. The spares growth has been nearly 6% in 1H16, compared with 9% in 2015. The company expects the in-service fleet of engines to grow by 15% to 31,000 units in 2020 from 27,000 in 2015. Contracts won by GE Aviation so far in 2016 are as follows:

- USAF (United States Air Force) adaptive technology – $1.0 billion

- F414 Korea indigenous fighter – $2.0 billion

- T700 UK Apache re-engine – $200.0 million

- USAF F110 service agreement – $100.0 million

- T408 Heavy lift helo production and F414 for Sab Gripen rollout – $7.5 billion

The total backlog for GE Aviation stands at $156.0 billion, of which $46.0 billion pertains to orders placed more than three years ago. Plus, the company expects services growth due to the expected installation of 44,000 commercial engines by 2020. The aviation segment is expected to ship about 110 engines in 2016 and targets 1,900 by 2019.

ETF investment

Investors interested in GE could opt for the iShares Global Industrials ETF (EXI). GE makes up 7.4% of EXI’s portfolio. Other major industrial names included in this ETF are 3M (MMM), Honeywell International (HON), United Technologies (UTX), Union Pacific (UNP), and United Parcel Service (UPS). In the next part, we’ll look at analysts’ expectations for General Electric’s operating margins in the coming quarters.