Why Did GE Part Ways with Its Appliance Division?

In addition to the sale of its Financial Assets business, General Electric (GE) bid farewell to its Appliance business in July 2016.

Nov. 8 2016, Updated 3:04 p.m. ET

General Electric’s sale of its Appliance division

In addition to the sale of its Financial Assets business, General Electric (GE) bid farewell to its Appliance business in July 2016. In focusing on the core competencies of the Industrial business, the Appliance business was a no-value proposition of the company.

In January 2016, GE disclosed that it would sell its Appliance business to Haier, a Chinese major in home appliances, for $5.4 billion.

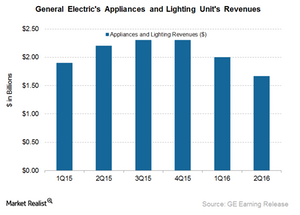

GE’s major products include lighting products and services such as industrial-scale lighting solutions and major home appliances like refrigerators, cooktops, dishwashers, and hybrid water heaters. The appliances and lighting business generated roughly 6% of GE’s Industrial segment’s revenues in 2Q16 but accounted for only 2.3% of the segment’s operating profit.

GE’s Lighting has two sub-businesses—its current business and the legacy core Lighting business. In a 3Q16 conference call, GE stated it is in the process of restructuring its legacy core lighting business. The current business includes professional lighting sales for North America, energy management, and control systems.

For more details on GE’s 3Q16 earnings, please read Market Realist’s GE Lowers Its 2016 Guidance as Orders Fall on Weak Oil and Gas.

The headquarters shift

The new GE wants to be known as a digital industrial technology giant. In an attempt to woo skilled young talent, the company temporarily moved its headquarters from Fairfield, Connecticut, to Boston.

Although the move hardly represents GE’s ~360,000 employees in percentage terms, the shift gives the company a new look. GE’s aggressive recruiting of software developers reiterates its focus on the digital side of its industrial business.

ETF investment

GE is a part of the Industrial Select Sector SPDR ETF (XLI) and accounts for 10.3% of XLI’s total holdings. The other major industrial companies included in XLI in the order of holdings are 3M (MMM), Honeywell International (HON), and Boeing (BA).

Investors wishing to know more about GE’s business model can read Market Realist’s General Electric Is Pivoting Back to Industrials—But Why?