Vanguard Short-Term Infl-Prot Secs ETF

Latest Vanguard Short-Term Infl-Prot Secs ETF News and Updates

FOMC’s Review of Economic Situation Signals Strong US Economy

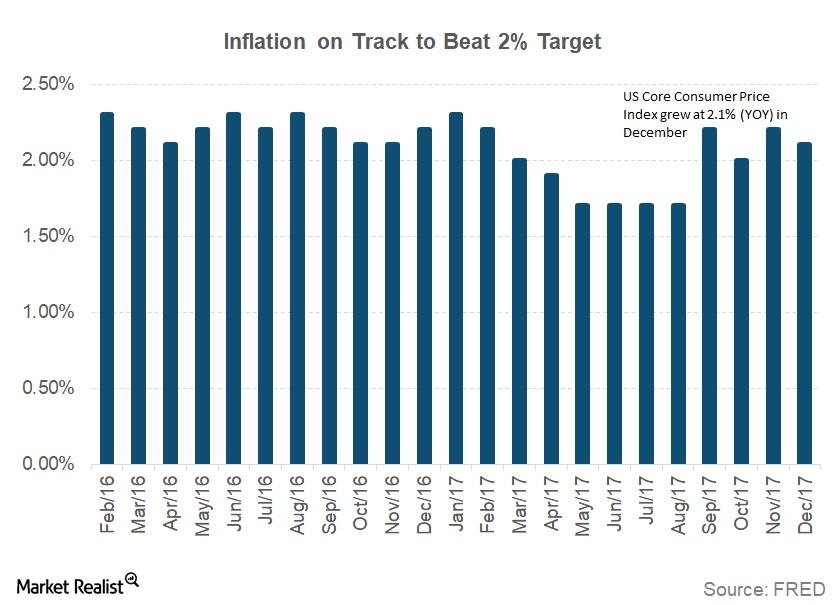

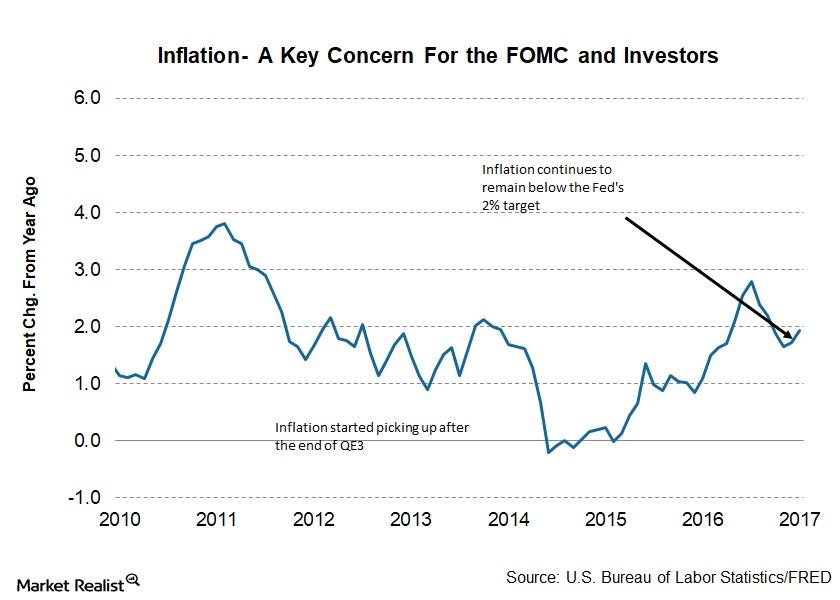

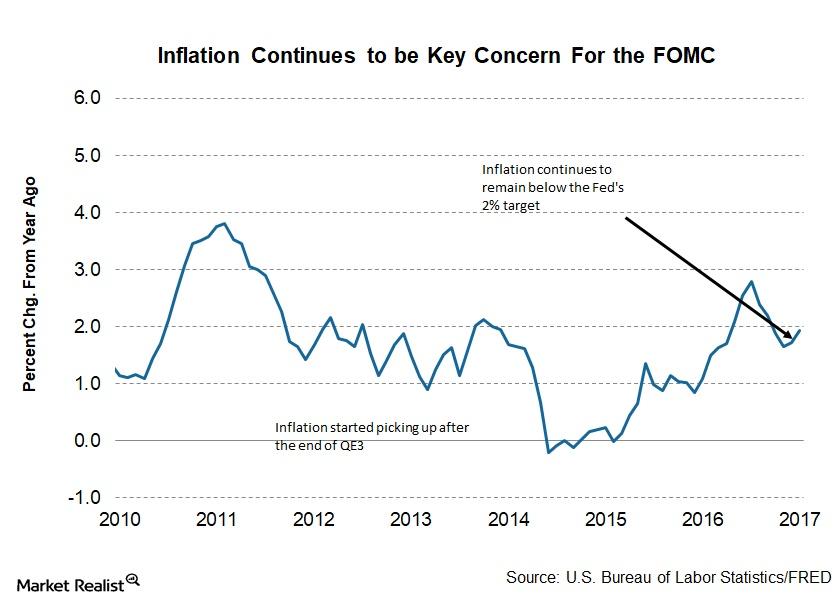

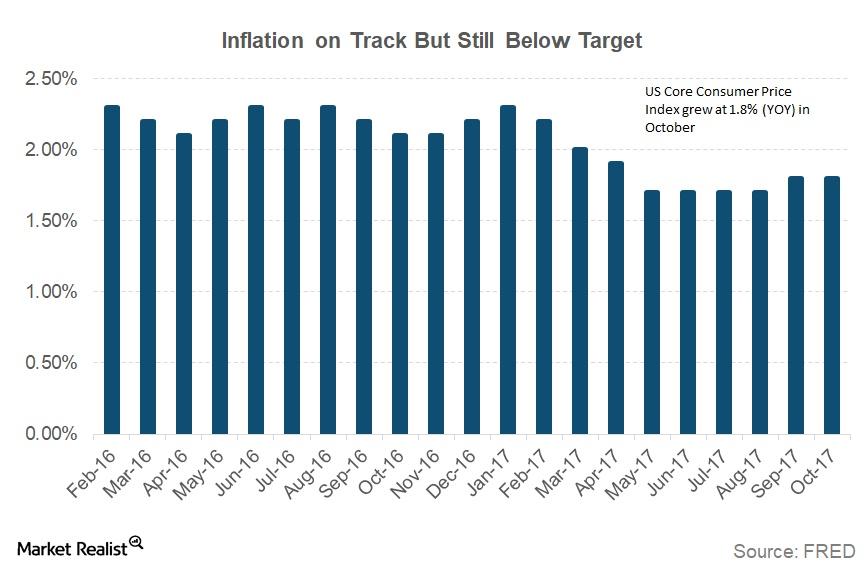

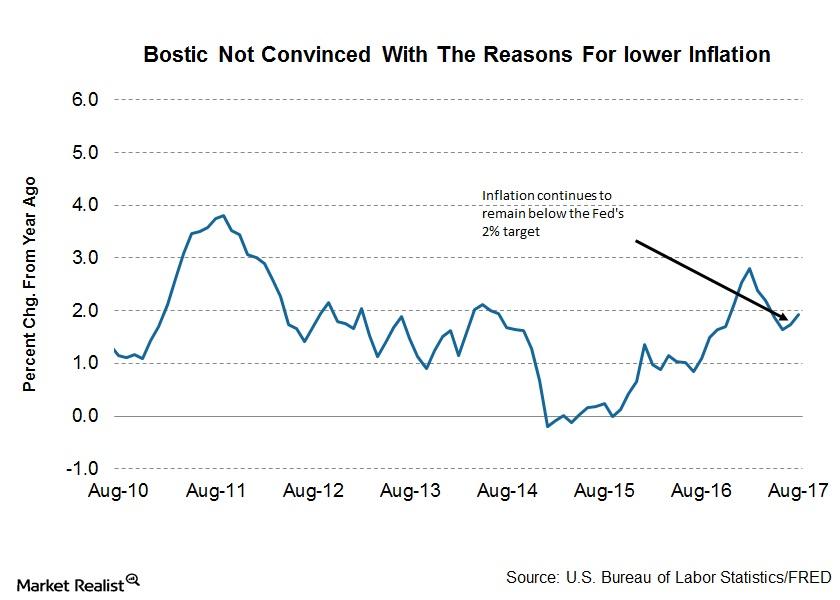

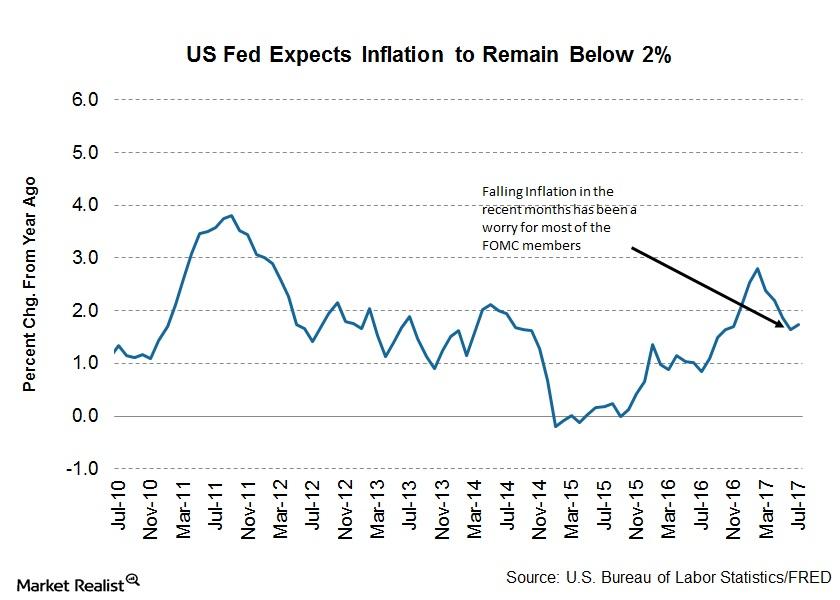

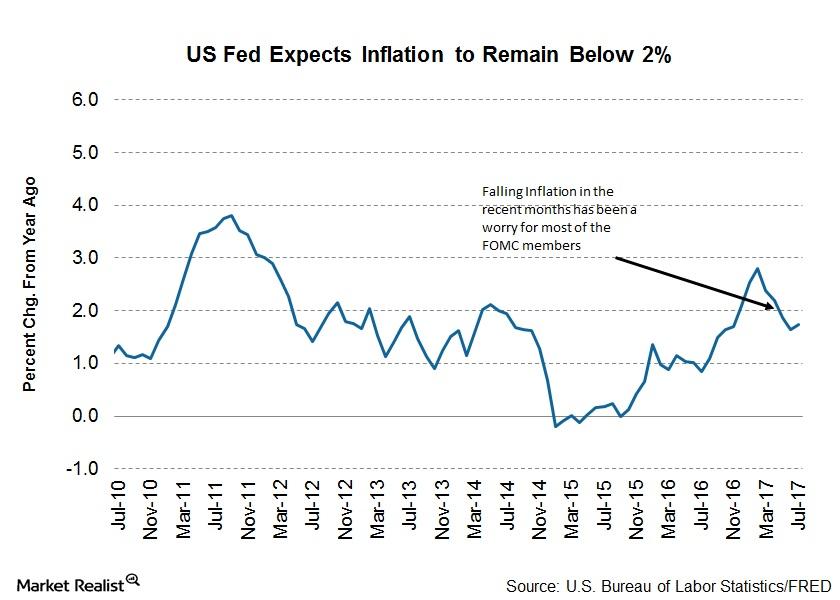

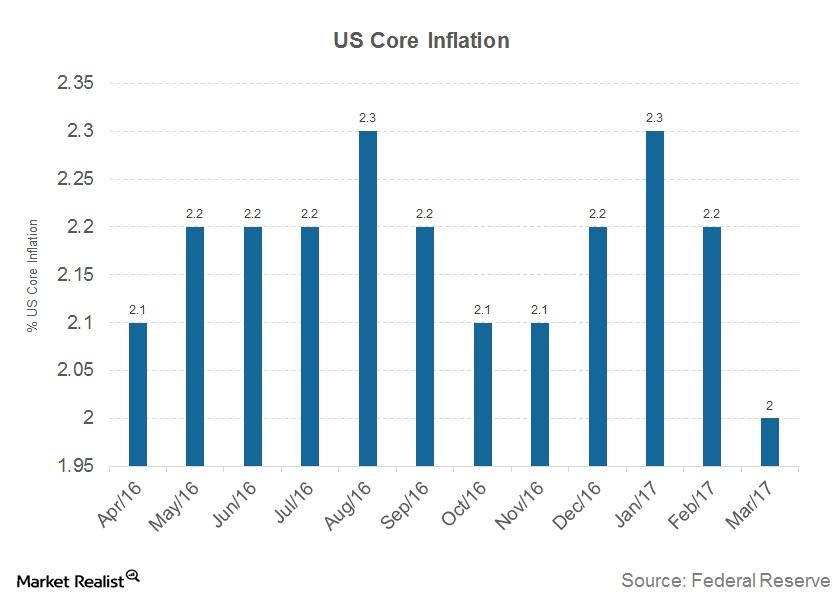

As per the FOMC staff report, inflation (TIP) in the US remained below the 2% target.

Why Did the Consumer Price Index Rise in December?

According to the December CPI report released by the U.S. Bureau of Labor Statistics on January 12, consumer prices in December increased 0.1%.

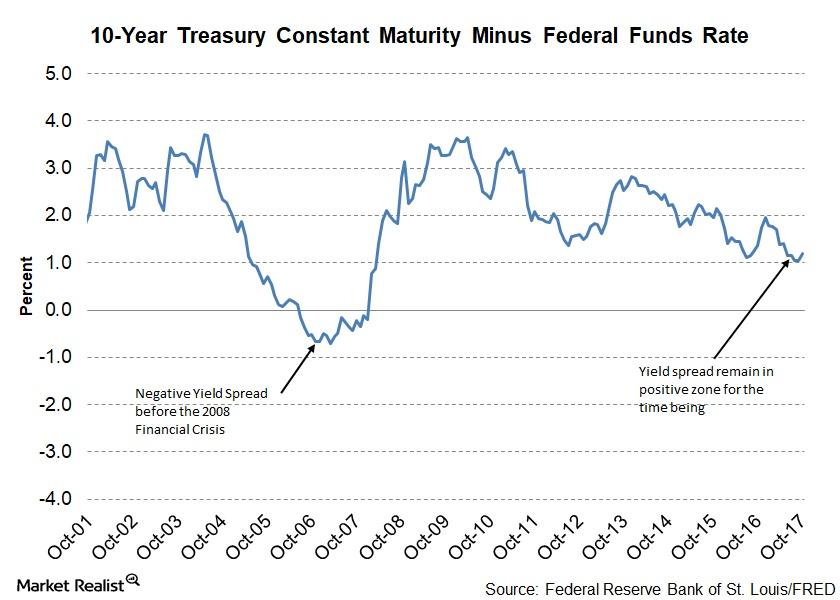

Analyzing the Yield Curve’s Ongoing Flatness

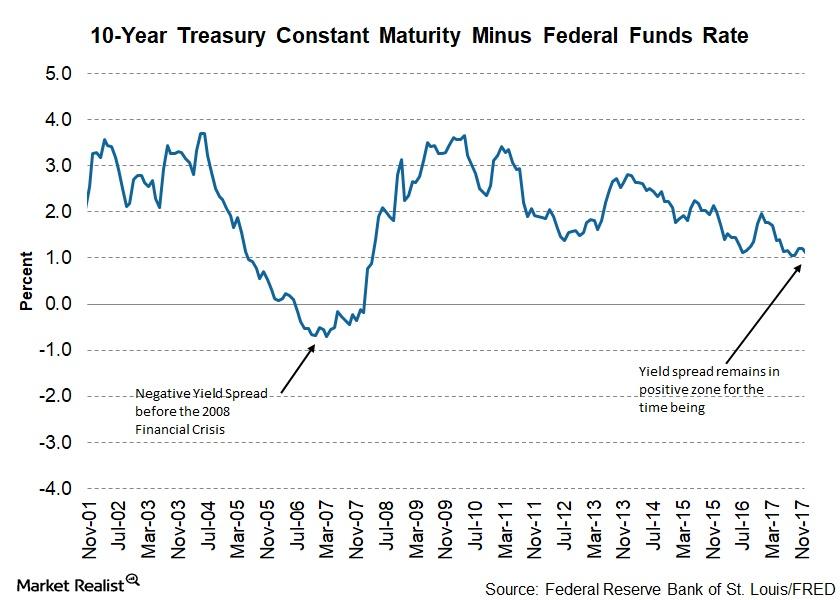

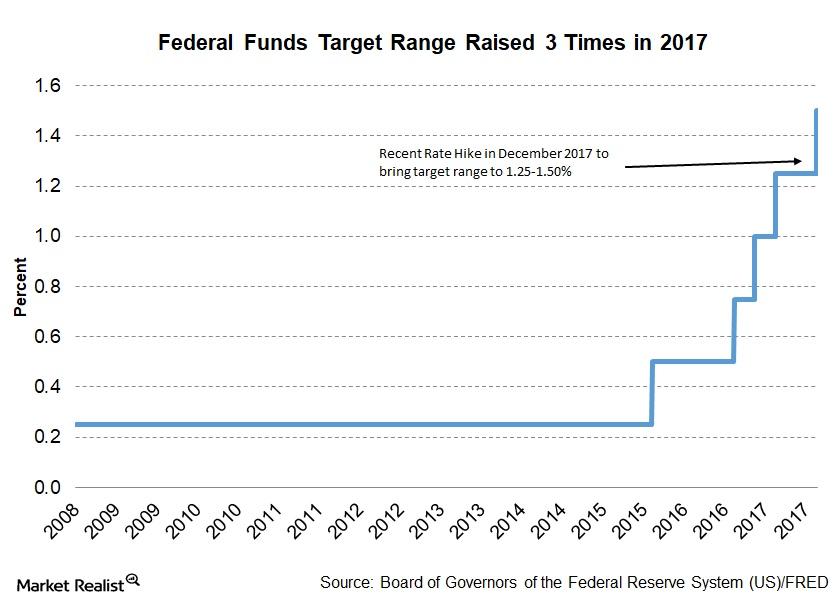

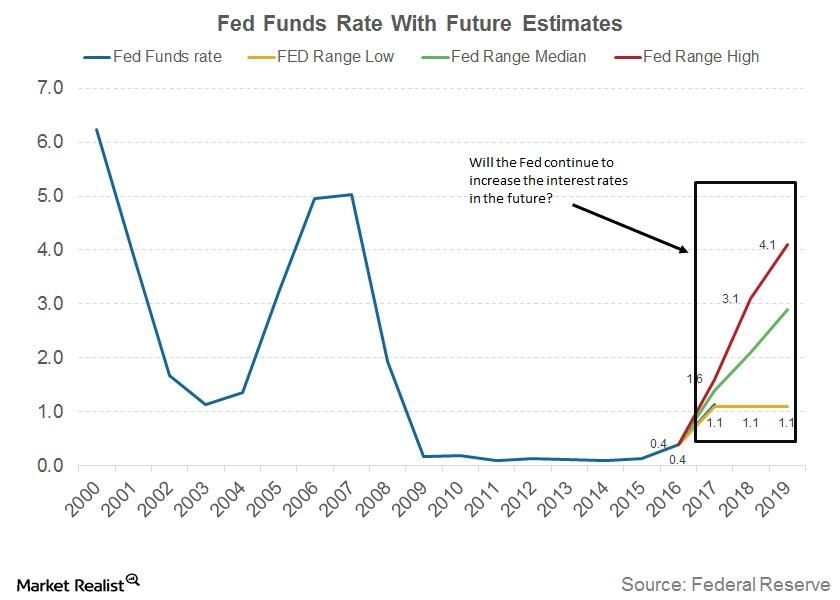

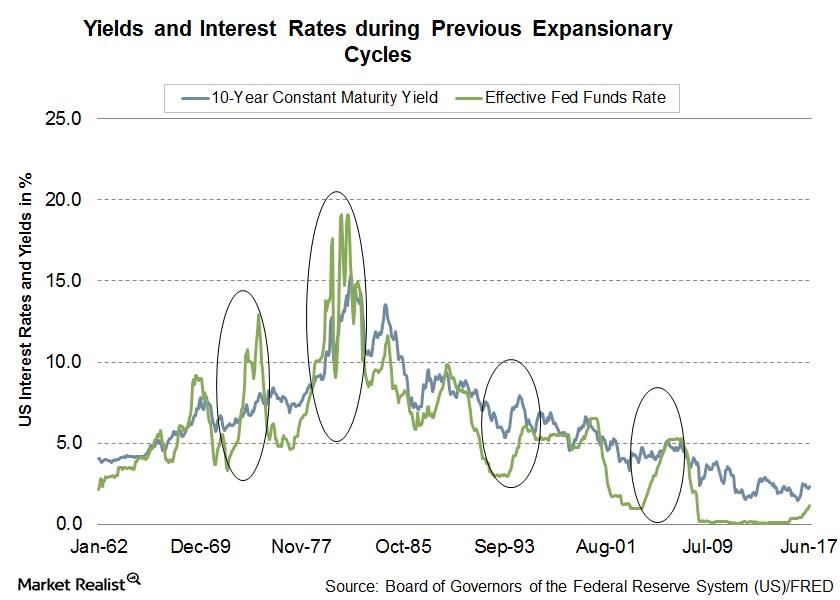

A December rate hike and a flattening yield curve The Fed rolled out another rate hike at its final meeting of 2017. The target range for the federal funds rate was increased by 0.25% to 1.25%–1.50%, and the Fed has signaled three more rate hikes in 2018. Two members dissented to the rate hike due to lower […]

The Curious Case of Low Inflation in 2017

The last statement from the US Fed, which was released with its recent rate hike decision, cited lower levels of inflation but hopes that the inflation target could be achieved in 2018.

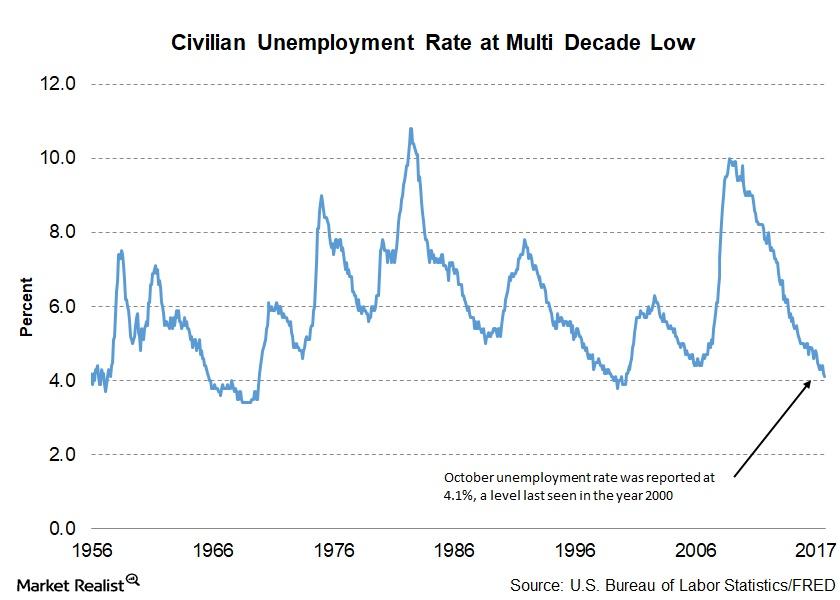

Will US Unemployment Rate Fall below 4% in 2017?

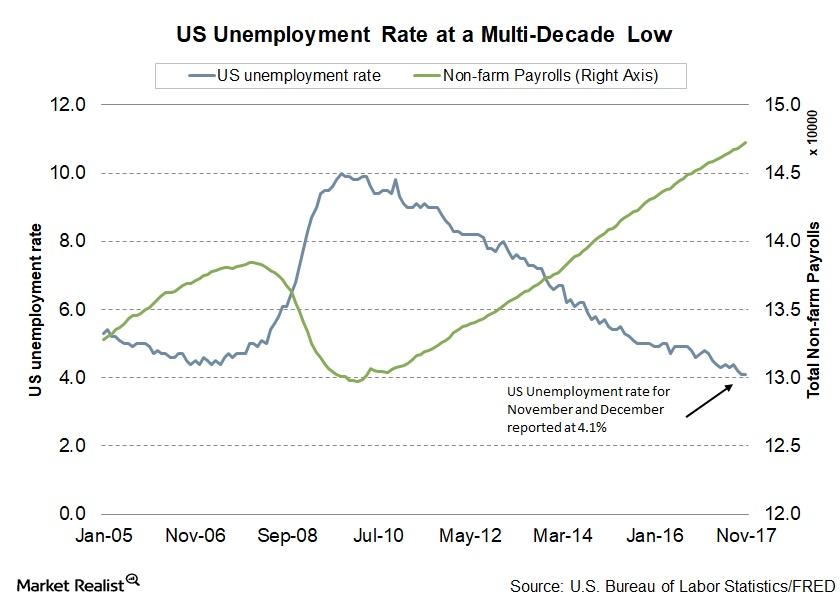

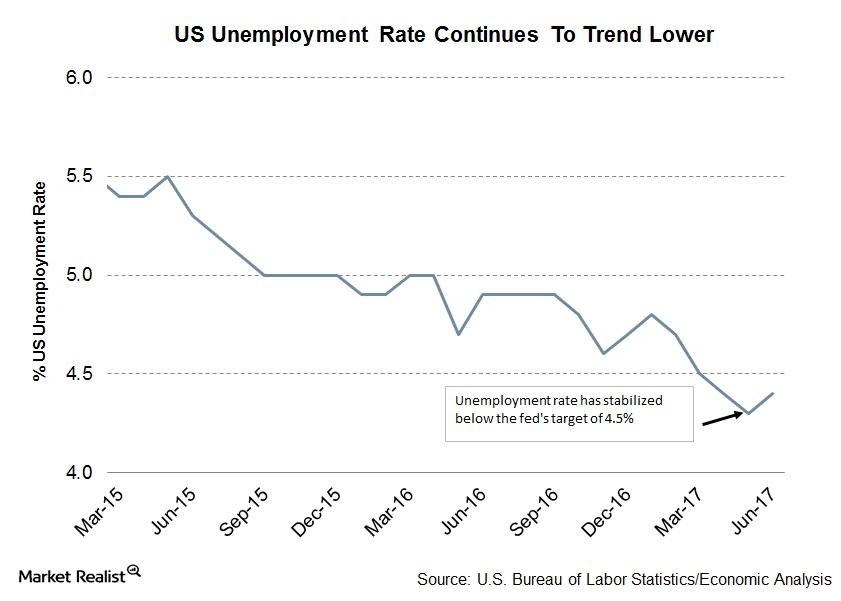

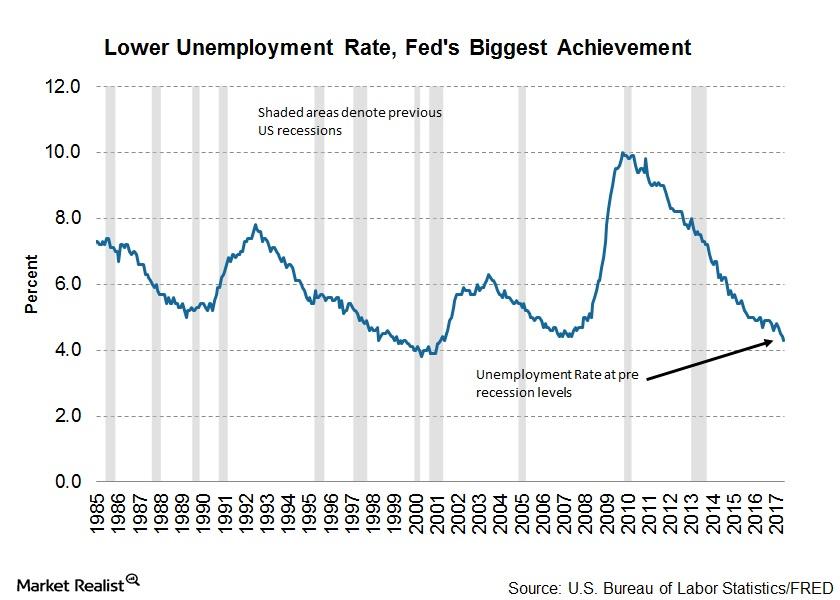

A lower unemployment rate is one of the key objectives of the Fed. In 2017, the unemployment rate fell, reaching 4.1% in its latest November reading.

A Double Dose of Tightening from the Fed in 2017

In its December monetary policy statement, the Fed projected three interest rate hikes in 2018 and three in 2019, depending on the incoming economic data.

The Primary Cause of Yield Curve Flattening

Interest rates and inflation The pace of interest rate hikes and inflation rate growth have a profound influence on the US yield curve. The US Fed has been communicating its intent to increase interest rates from the current ultra-low level to a target rate of 2.5% over the next few years. The conditions required for […]

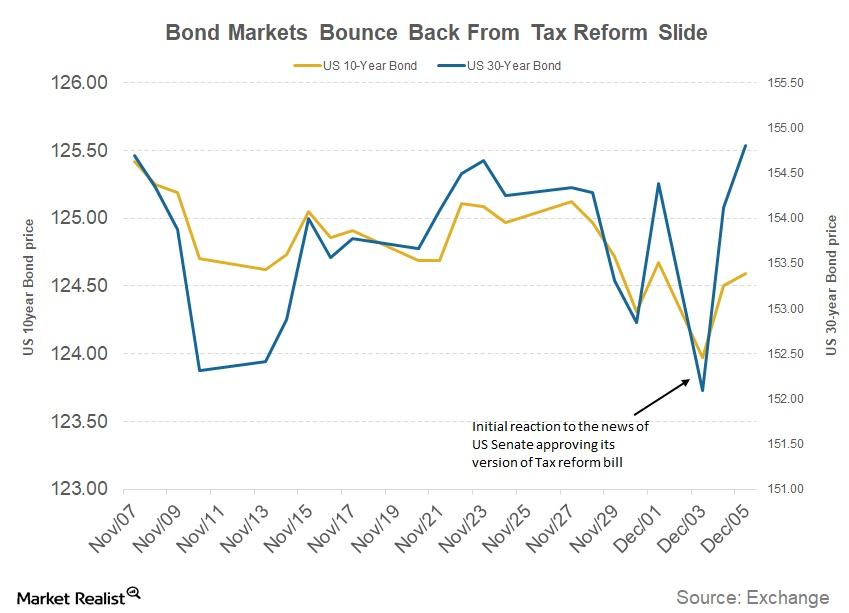

Tax Cuts and Rate Hikes Could Impact the Fed

The proposed tax cuts and the resulting increase in the federal deficit are expected to impact bond markets. It’s important to consider the Fed’s stance.

Fed’s November Beige Book and Restrained Hiring Plans

The inability of employers to find suitable workers is leading to wage increases, especially in the professional, technical (XLK), and production (XLI) sectors.

Why Decreasing Credit Spreads Are a Cause for Concern

The November Conference Board report, which takes October data into account, reported the credit spread at ~1.2—an improvement from the September reading of ~1.1.

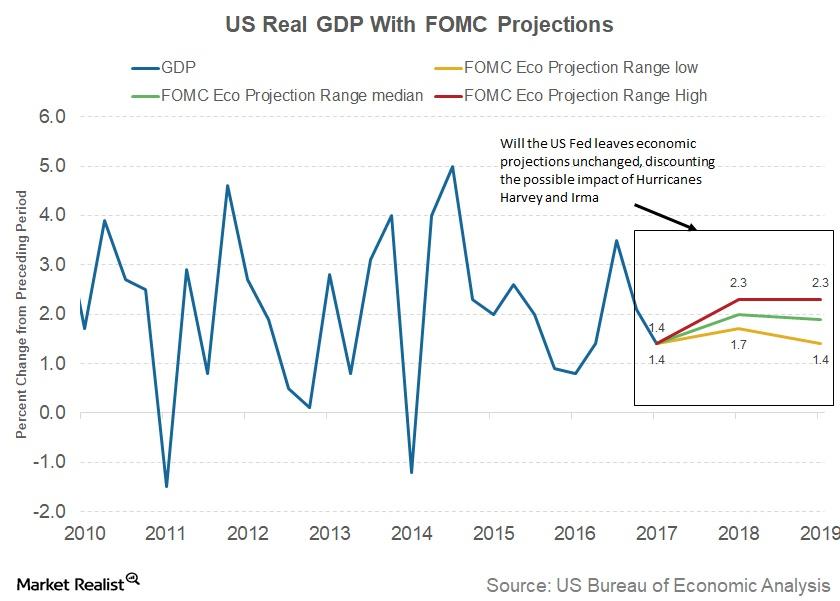

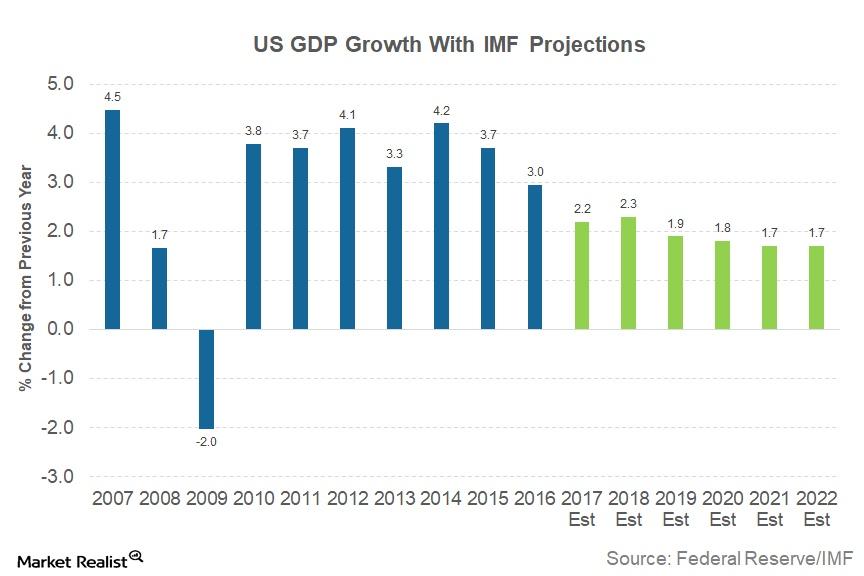

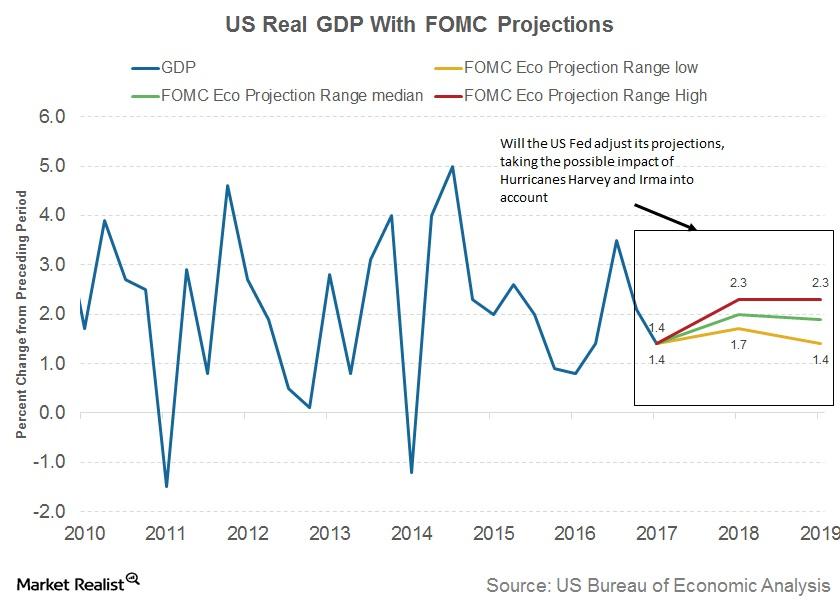

The FOMC’s Outlook for the US Economy

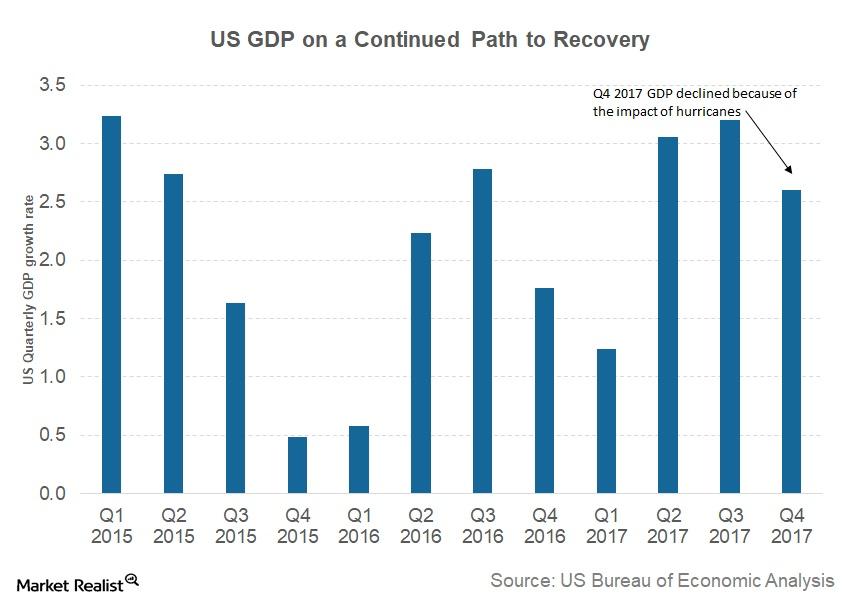

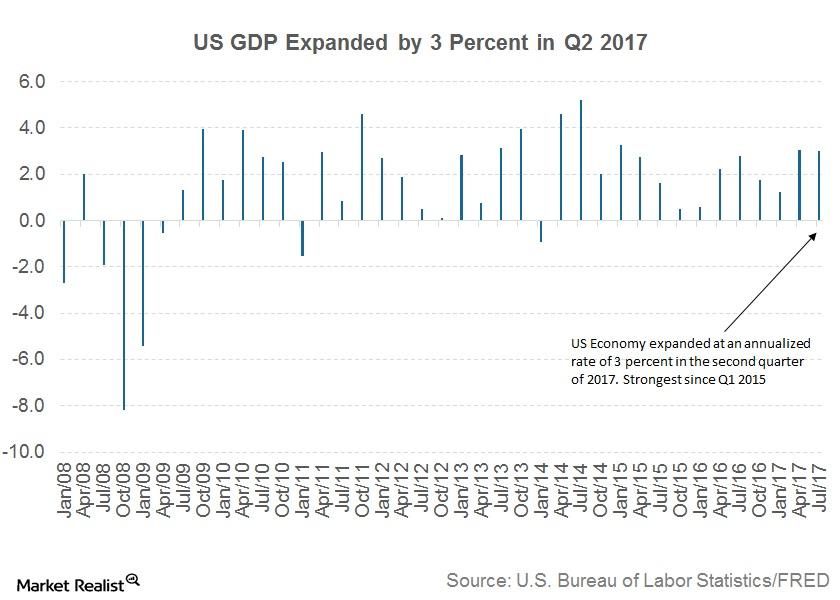

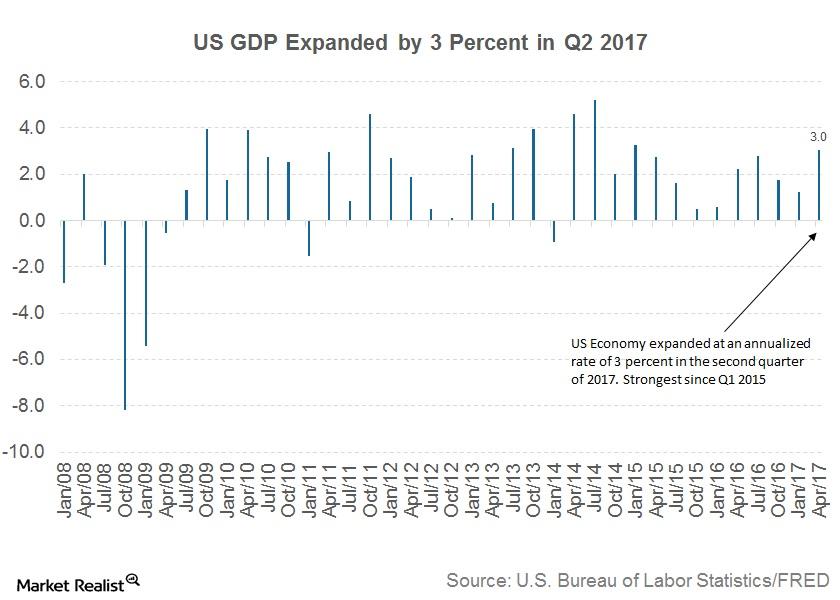

As per economic projections prepared by the FOMC, US real GDP is expected to improve in the final quarter of this year.

The FOMC’s View on the US Economy

At the November meeting, the FOMC staff review indicated that US labor market conditions continued to strengthen and that the US economy continued to expand at a solid pace.

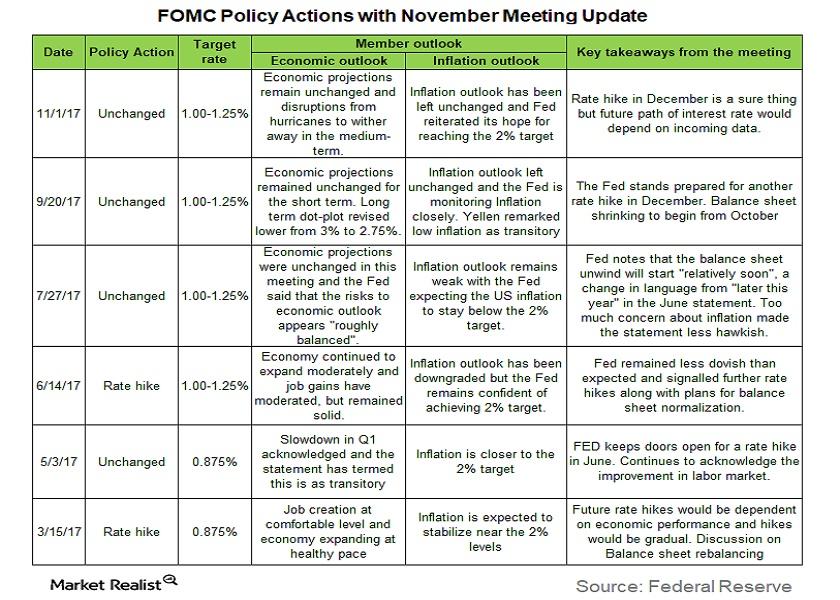

The November FOMC Meeting Minutes: Must-Knows

The last Federal Open Market Committee (or FOMC) meeting took place on October 31–November 1. The target range for the federal funds rate stayed unchanged at 1%–1.25%.

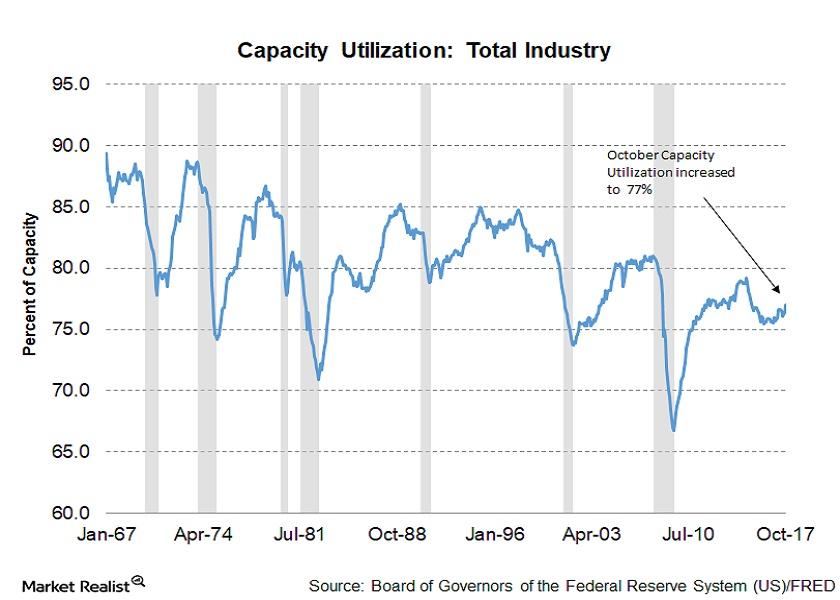

Reading the Trends in Capacity Utilization across US Industries in October

Among the key macroeconomic indicators published by the Fed, capacity utilization in US industries helps investors forecast business cycle changes.

Chart in Focus: The Consumer Price Index Rose in October

The Fed is expected to increase the target funds rate by 0.25% at its December meeting.

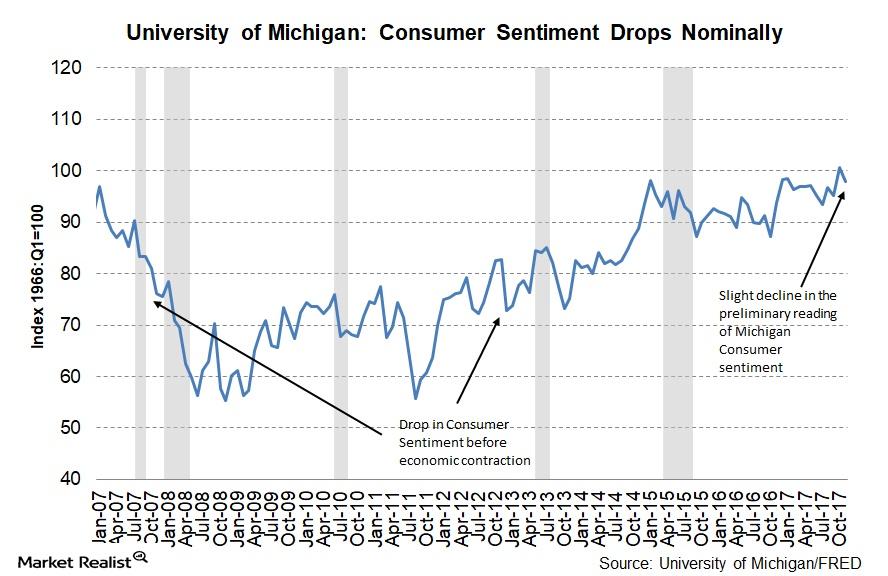

Here’s What Drove Consumer Expectations Lower in November

The University of Michigan Preliminary Consumer Sentiment for November was reported at 97.8, which was 2.9 lower than the final October reading of 100.7.

IMF: Why US Economic Growth Could Slow

The International Monetary Fund (or IMF), in its “World Economic Outlook” (or WEO) released in October, upgraded the economic forecast for the United Statess for 2017.

Why a December Rate Hike Shouldn’t Be Taken for Granted

Not all members of the FOMC, according to the minutes of the meeting, were on the same page with respect to a December interest rate hike.

Why FOMC’s Raphael Bostic Is Not Happy with Low Inflation Explanations

Bostic dealt with various reasons that have been cited as reasons for the lower level of inflation—even questioning the common ones.

FOMC’s James Bullard Has Three Questions for US Monetary Policy

Bullard said that the current growth rate in the US economy is likely to remain consistent with recent quarterly growth—near the 2% mark.

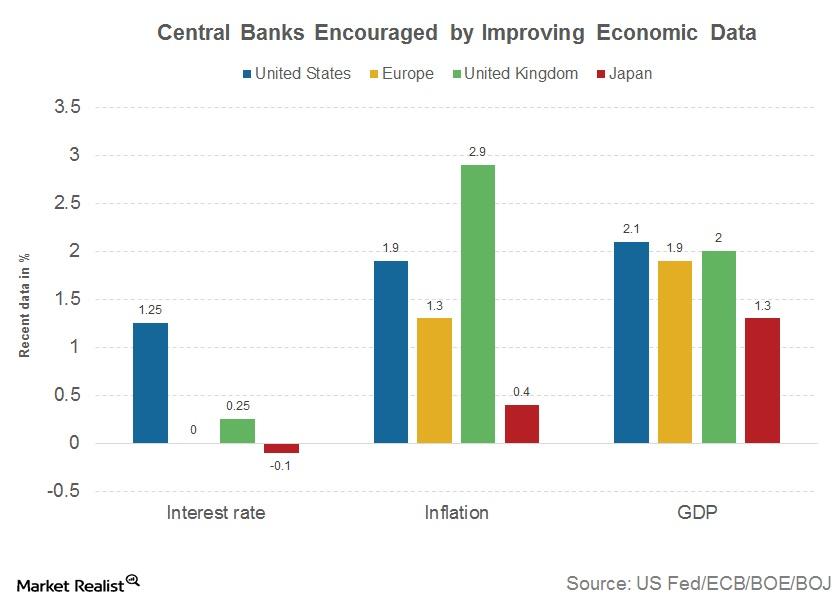

Would Markets Be Prepared for a Central Bank Surprise?

Three central banks on a path to tightening After years of ultra-loose monetary policy, global markets are beginning to realize they may have to wave goodbye to easy money. In their efforts to save the global system from the 2007 financial crisis, and to revive economic growth, US, EU, UK, and Japanese central banks resorted […]

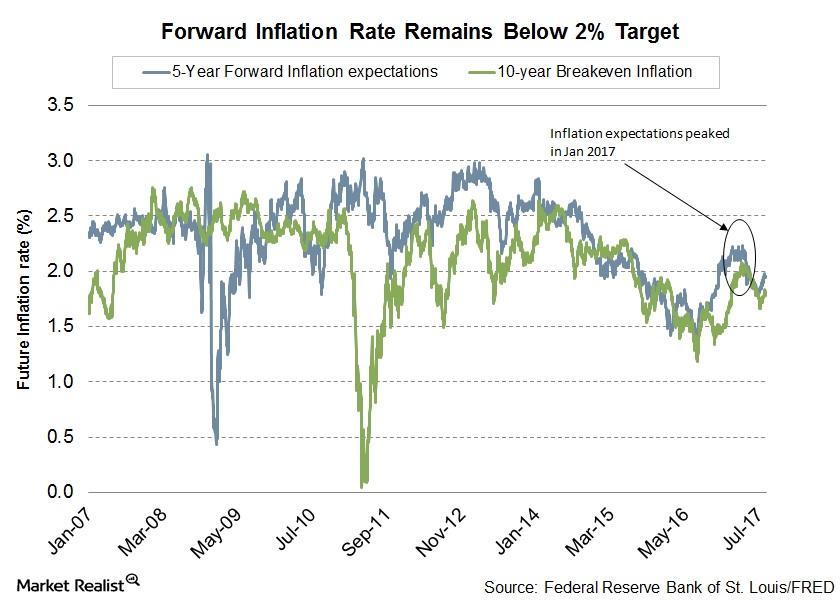

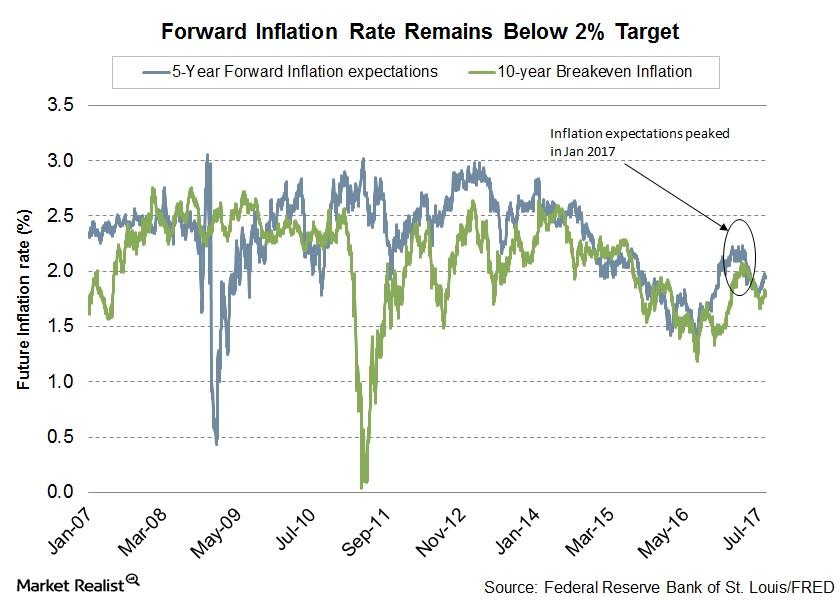

Do Markets Agree with Janet Yellen on Low Inflation?

In her post-meeting press conference, US Federal Reserve Chair Janet Yellen seemed less worried than expected about the current state of US inflation.

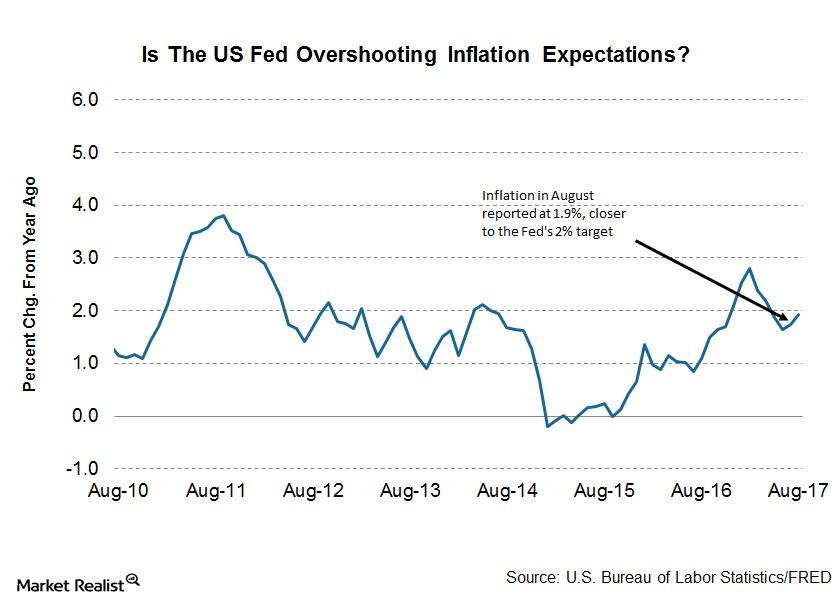

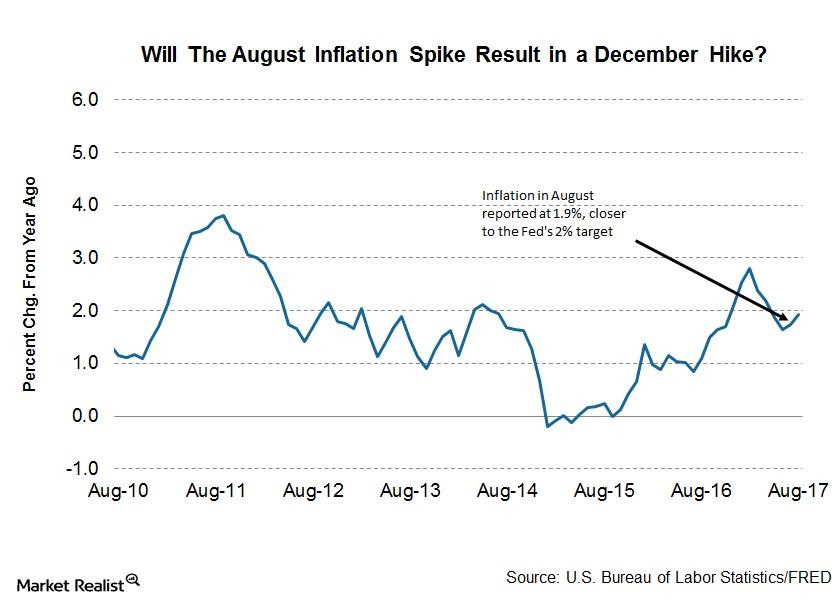

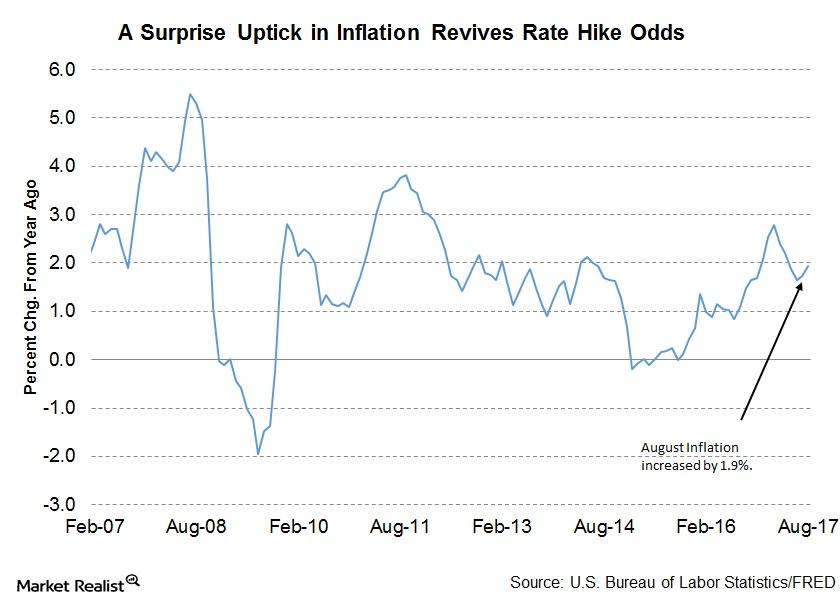

Is the Uptick in August Inflation Enough for a Fed Hike in December?

Slow US inflation growth has been a concern for the US Fed and was one of the key reasons that the Fed raised interest rates only twice in 2017.

How Has the US Economy Fared since the Last FOMC Meeting?

Since the last FOMC meeting in July, economic conditions in the US have continued to improve.

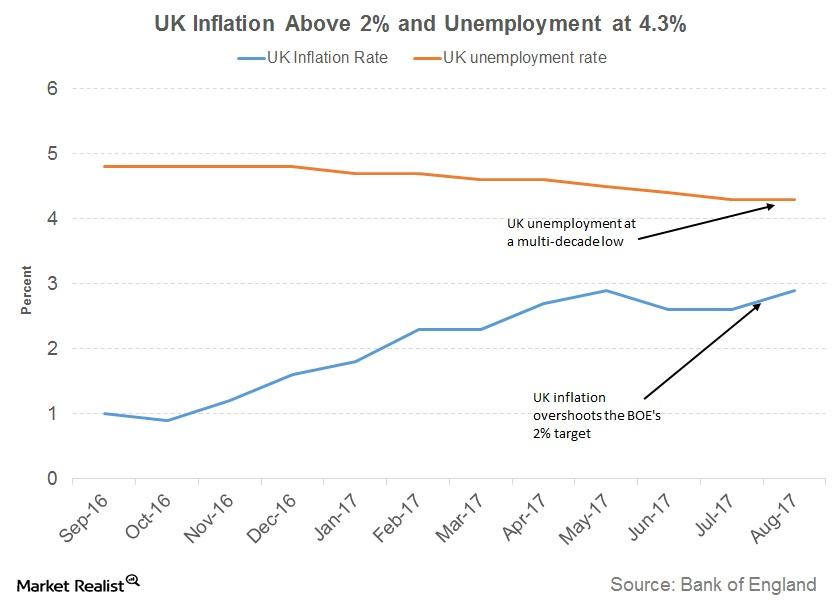

Will Inflation and Unemployment Push the BOE to Raise Rates?

Inflation in the United Kingdom has been on a higher trajectory with consumer prices in the United Kingdom rising 2.9% in August year-over-year.

Will the Sudden Rise in Inflation Change the US Fed’s Outlook?

The consumer price inflation (CPI) data reported on Thursday indicated an increase of 0.4% in August. The year-over-year rate improved from 1.7% to 1.9% for August.

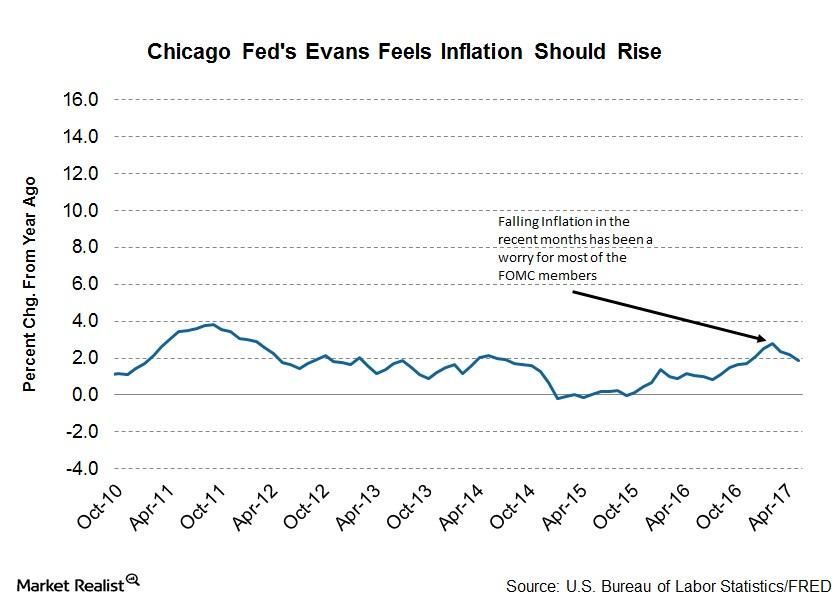

Here’s Why the US Inflation Rate Is Troubling the Fed

In its latest monetary policy statement, the Fed admitted it would take longer than expected for inflation to reach its 2.0% target.

Why Improving Economic Conditions Aren’t Enough for the FED

In the last few months, the performance of the US economy has been impressive. The unemployment rate fell to 4.3% in August.

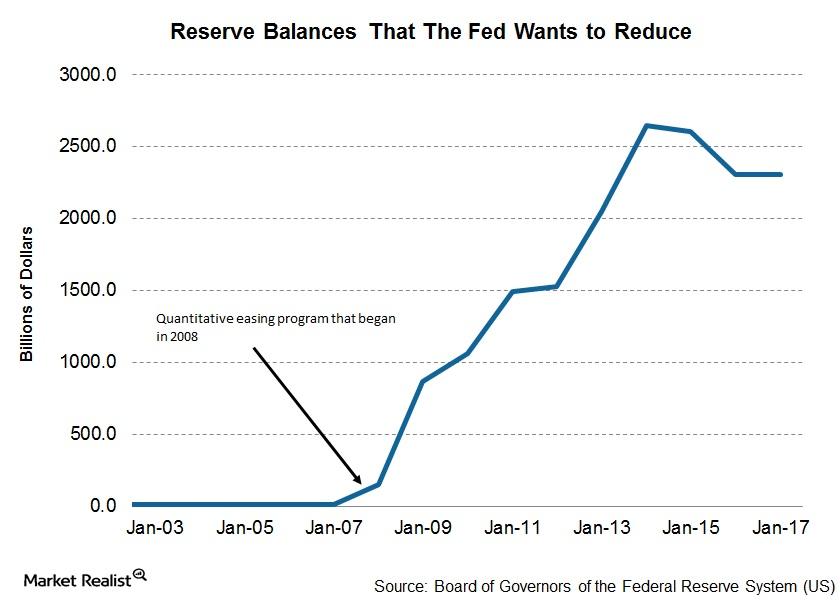

Will the Fed Repeat Its Taper Tantrum Mistakes?

In this cycle of expansion after the great recession, the Fed has started the process of monetary tightening.

Why Inflation Remains a Huge Concern for FOMC Members

Members of the FOMC (Federal Open Market Committee) attributed the recent slowdown in inflation growth to idiosyncratic factors.

New York Fed President William Dudley Discussed Inflation

In his speech on August 10, New York Fed President William Dudley joined the group of FOMC members to ease concerns about slowing inflation (TIP).

Can There Really Be a Bubble in the Bond Market?

Fundamentally, bonds (AGG) are a discount instrument and are generally never expected to be in a bubble. Let’s see why that’s the case.

US Unemployment: The Fed’s Favorite Metric Continues to Improve

In a statement following the conclusion of its two-day monetary policy meeting, the FOMC stated that US labor market growth was solid.

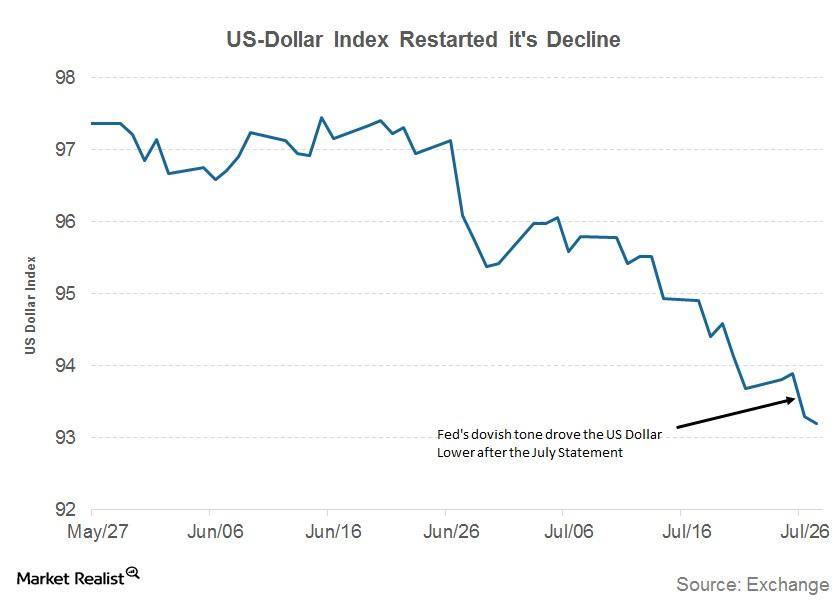

Why the US Dollar Took a Hit after the FOMC’s July Statement

Most of the statement released by the Federal Open Market Committee (or FOMC) following its two-day monetary policy meeting was in line with the market’s expectations.

Why the Fed Isn’t Satisfied with Labor Market Conditions

Despite the strong growth in employment numbers, the Fed’s latest monetary policy report had some comments about slow wage growth.

Why Minneapolis’s Fed President Voted Against a Rate Hike

In an essay published by Minneapolis’s Federal Reserve president, Neel Kashkari, after he voted against a rate hike in the Federal Open Market Committee’s (or FOMC) June 2017 meeting, he explained why he dissented.

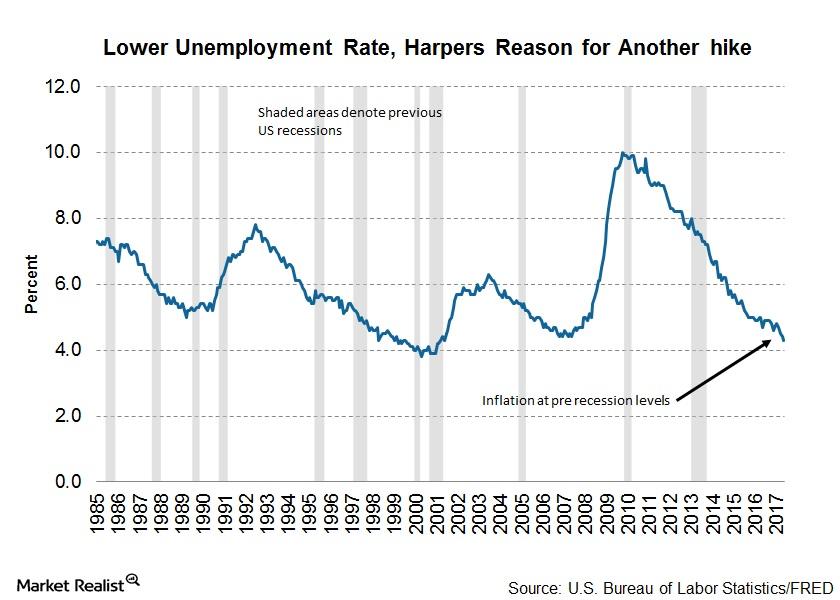

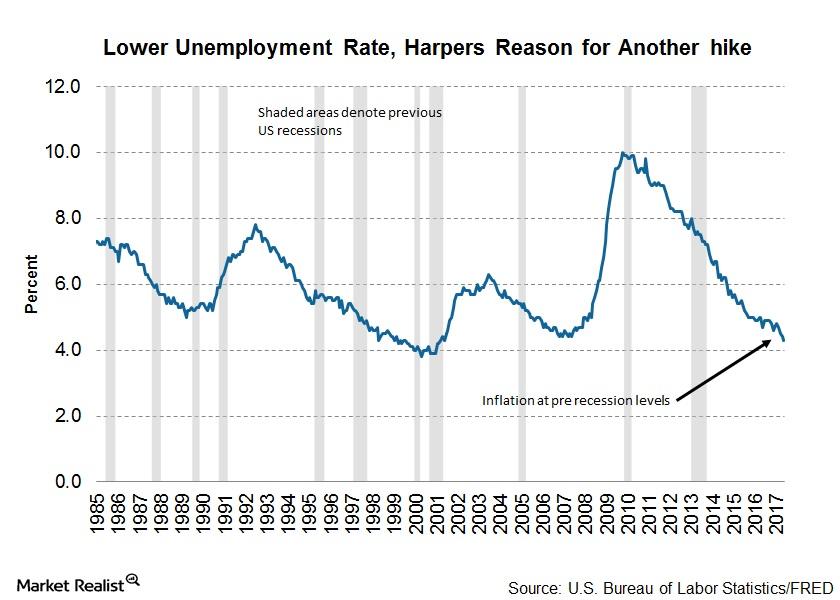

Why Philadelphia’s Fed President Supports Another Rate Hike

In a recent interview with The Financial Times, the hawkish president of the Philadelphia Federal Reserve said that the Fed’s balance sheet’s unwinding could begin in September 2017.

Why Chicago’s Evans Sees Moderate Risks to Financial Stability

Chicago’s Federal Reserve president, Charles L. Evans, recently spoke at a Money Marketeers of New York University event about monetary policy challenges in a new inflation environment.

St. Louis’s Bullard Thinks Rebalancing Will Take 5 Years

At the Illinois Bankers Association’s annual conference in Nashville, organized on June 23, 2017, St. Louis’s Federal Reserve president, James Bullard, sounded dovish about the US economy.

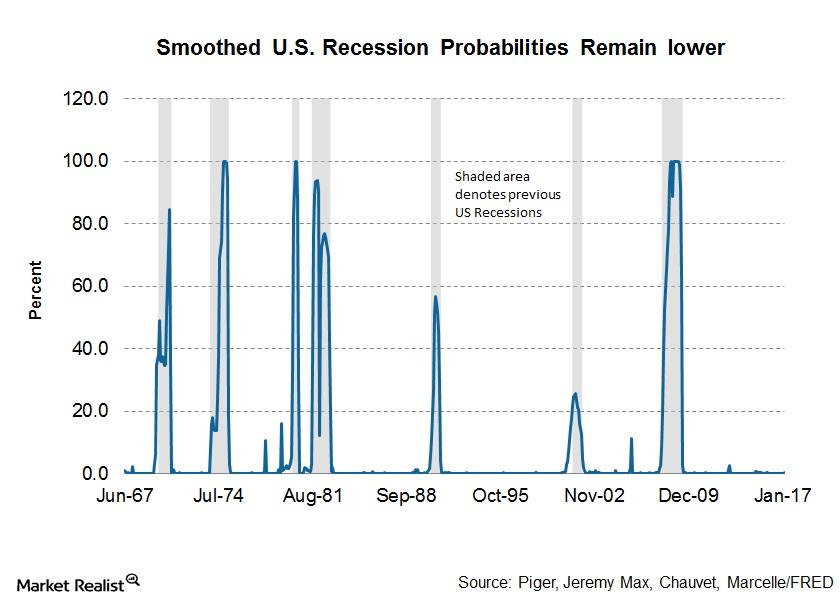

Why Cleveland’s Fed President Worries about Another Recession

Loretta J. Mester, the president and CEO of the Cleveland Federal Reserve, spoke at the 2017 Policy Summit on Housing, Human Capital, and Inequality held on June 23, 2017.

Why Charles Evans Thinks It’s Important to Reach Inflation Goals

Charles L. Evans, president of the Federal Reserve Bank of Chicago, said it’s extremely important that the Fed reach its inflation (VTIP) goal.

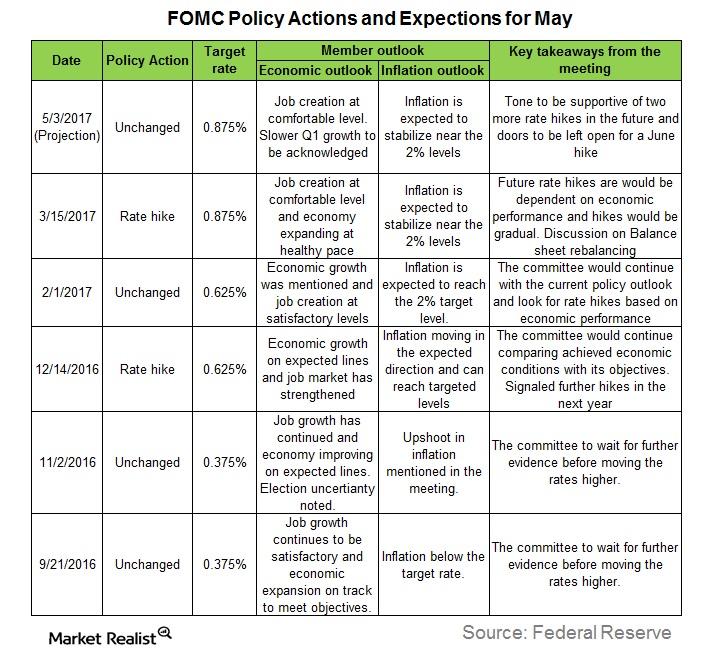

Will the FOMC Remain Hawkish?

In its last meeting in March, the Fed increased interest rates (SCHZ) by 0.25% and sounded hawkish about the US economy.

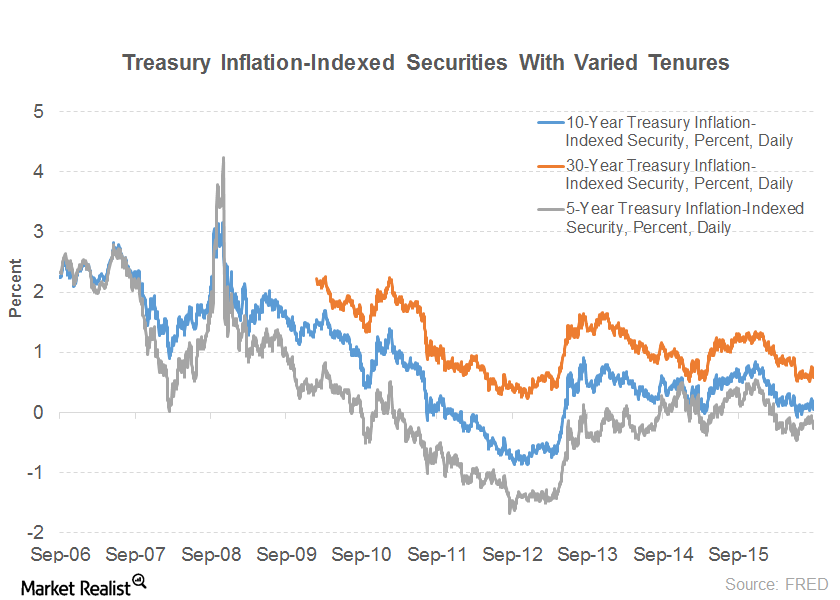

Will Treasury Inflation-Protected Securities Be a Game-Changer?

According to Bloomberg, Treasury Inflation-Protected Securities (or TIPS) have generated a year-to-date return of 6.3% compared to 4.7% by the broad Treasury market.

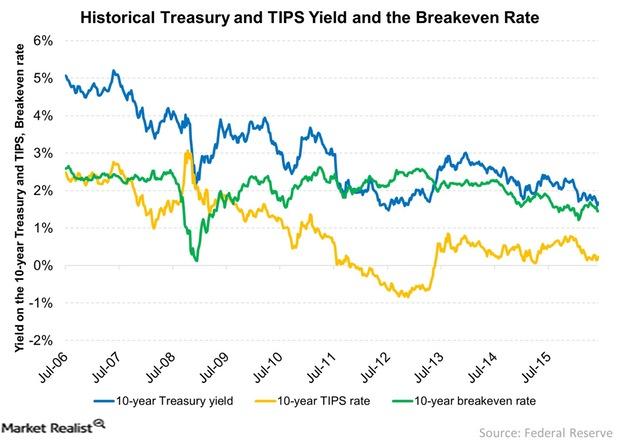

What Does the Break-Even Rate Suggest?

The break-even rate is the difference between the yields of ten-year Treasuries (IEF) (TLH) and ten-year TIPS (VTIP).