S&P500 Index

Latest S&P500 Index News and Updates

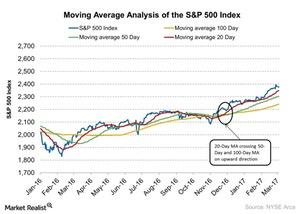

What S&P 500 Index Moving Averages Could Indicate

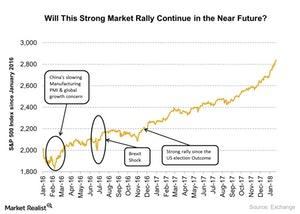

The S&P 500 Index is trading 1.2% above its 20-day moving average and 6% above its 100-day moving average.

These Key Economic Indicators Were Released Last Week

In this series, we’ll take a look at the global final manufacturing PMIs and services PMIs for March 2017. These indicators help us understand the business condition of an economy.

Will President Trump’s Pressure Tactics Work Out?

In March 2018, President Donald Trump imposed a tariff of 25% on steel imports. What’s happened since?

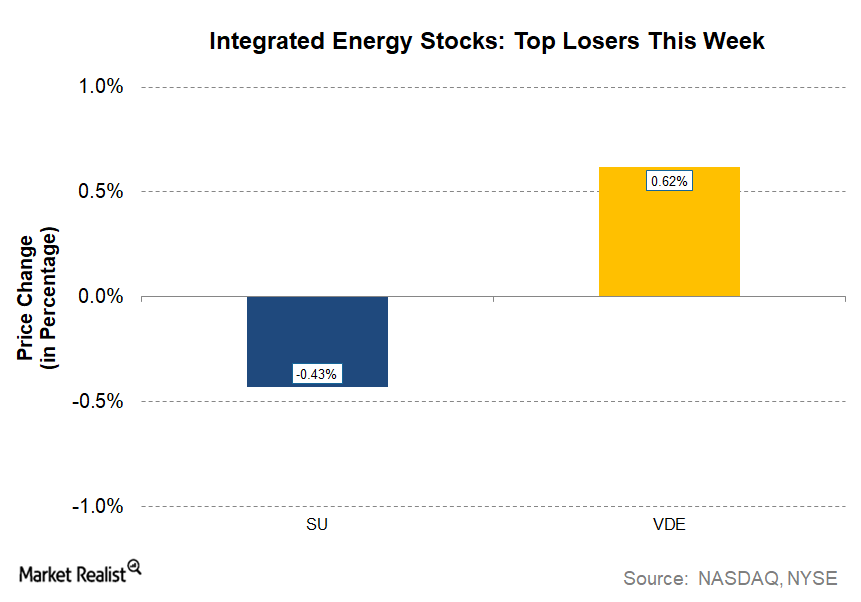

Suncor Energy: The Only Integrated Energy Loser This Week

Suncor Energy (SU) is the only losing stock in the current week from the integrated energy sector. It fell from last week’s close of $34.67 to $34.52 on October 11, 2017.

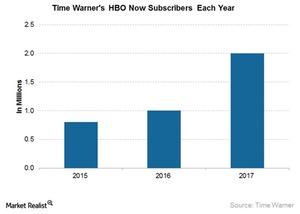

Why Time Warner Intends to Pull Its HBO Programming from Amazon

Time Warner announced at its fiscal 1Q17 earnings call that it most likely won’t extend its agreement with Amazon beyond 2018.

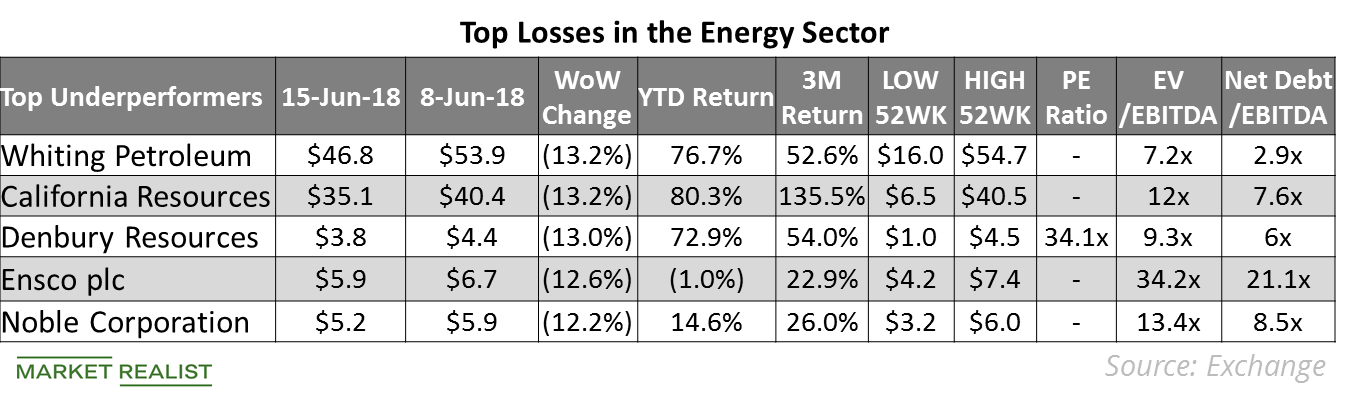

Top Energy Losses Last Week

On June 8–15, Whiting Petroleum (WLL) and California Resources (CRC) fell the most on our list of energy stocks.

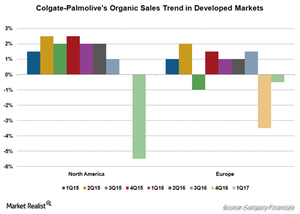

Colgate-Palmolive’s Developed Markets Remained a Drag in 1Q17

Net sales in North America fell 5.0% in 1Q17, reflecting a strong decline in volumes coupled with lower pricing.

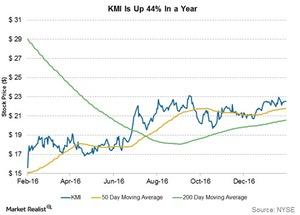

Will Kinder Morgan Stock Continue to Surge in 2017?

Kinder Morgan stock has risen 44% in the past year, as compared to Enterprise Products Partners’ 32% rise and ONEOK’s 162% rise.

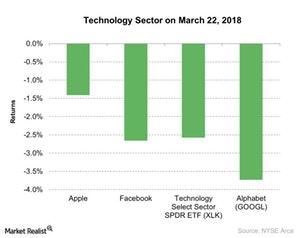

Facebook Stock Is Dragging the Tech Sector Down

The Technology Select Sector SPDR ETF (XLK) fell ~2.6% on March 22, 2018.

Why Larry Fink Thinks Markets Could See Some Setbacks

In a recent interview with CNBC, Larry Fink, CEO of BlackRock (BLK), shared his views on market movement, the US economy, and the dangerous impact of the lower interest rates.

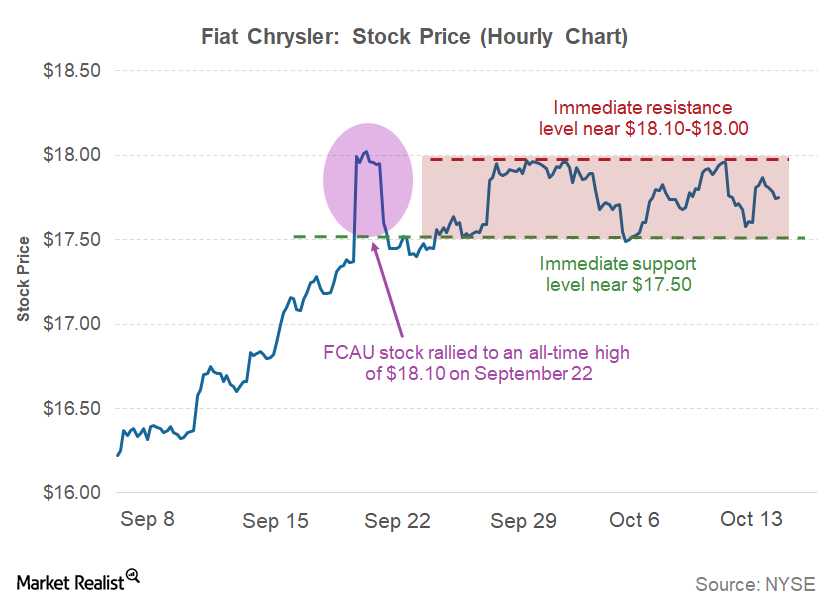

Why Fiat Chrysler Stock Is Trading in a Narrow Range

Last week, which ended October 13, 2017, Fiat Chrysler (FCAU) stock remained mixed and witnessed a minor rise of 0.90%.

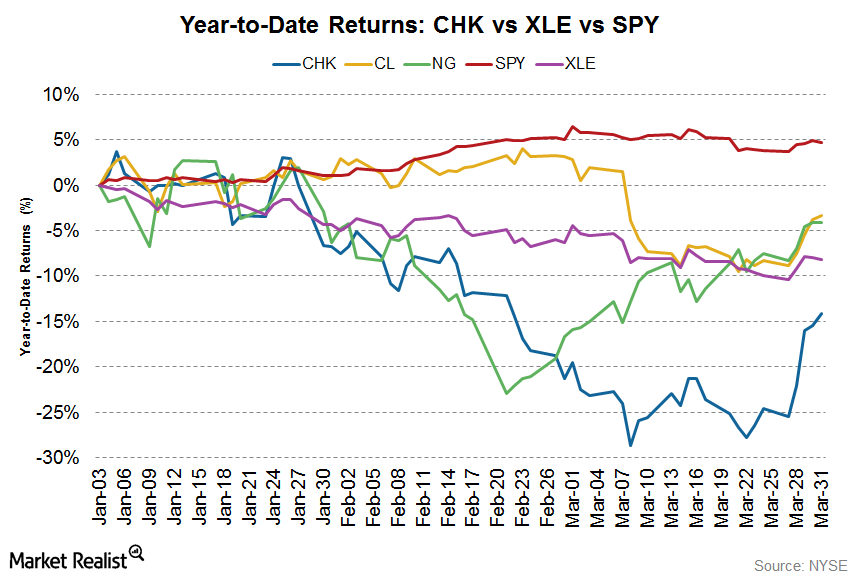

Natural Gas Prices Driving Chesapeake Energy Stock in 2017

Chesapeake Energy’s (CHK) 2016 debt management efforts included a combination of debt exchanges, open market repurchases, and equity-for-debt exchanges.

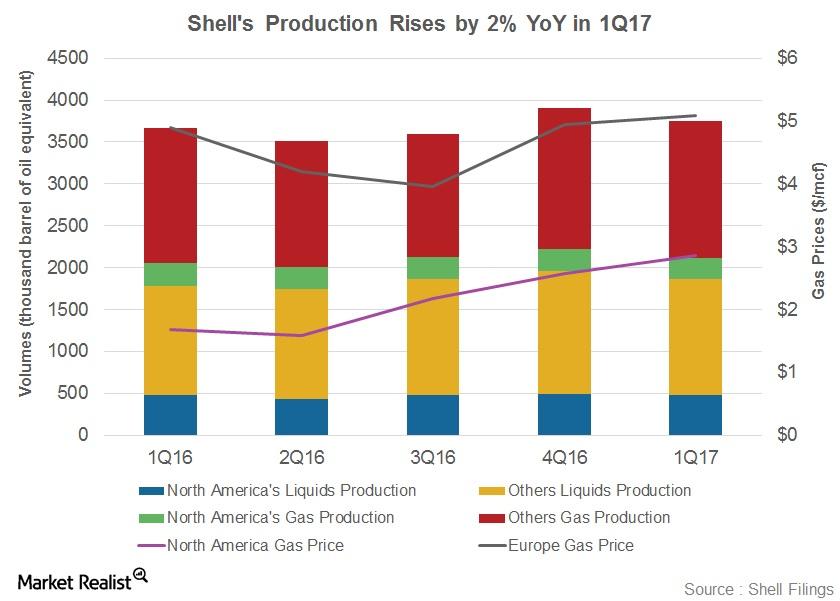

Shell’s Upstream Portfolio: Is it Poised to Grow?

Royal Dutch Shell (RDS.A) produced 3.8 MMboepd in 1Q17 from its worldwide operations, compared to 3.7 MMboepd in 1Q16.

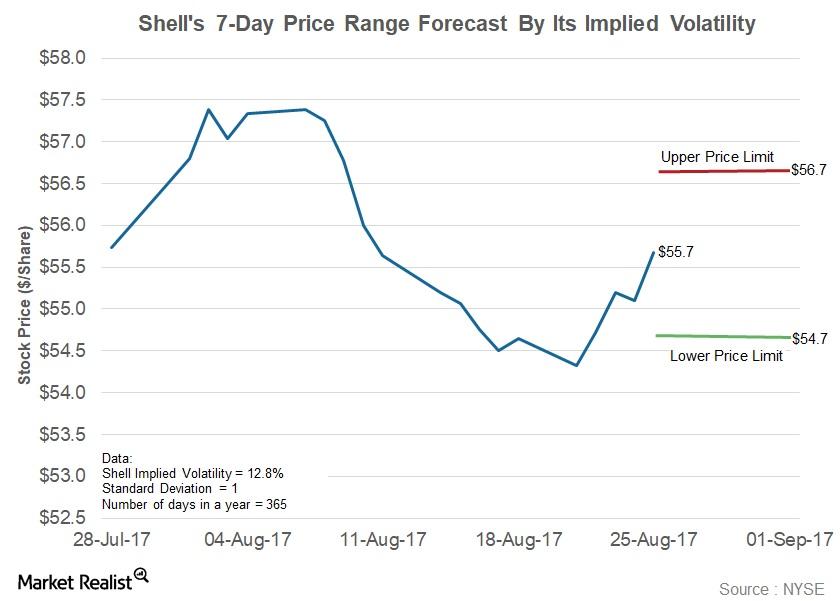

What’s the Forecast for Shell Stock for the Next 7 Days?

Implied volatility in Royal Dutch Shell (RDS.A) has fallen 4.9% since July 3, 2017, to the current level of 12.8%.

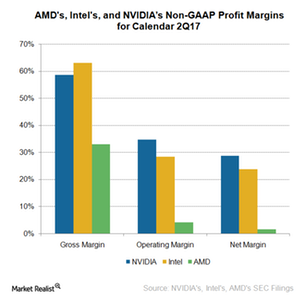

Where NVIDIA’s Margins Stand next to Those of Intel and AMD

NVIDIA’s profit margins NVIDIA (NVDA) has been increasing its revenue while controlling its expenses, resulting in improved profitability and a high free cash flow of up to 20% of its total revenues. Gross margin NVIDIA’s non-GAAP (generally accepted accounting principles) gross margin fell 90 basis points from 59.7% in fiscal 1Q18 to 58.6% in fiscal 2Q18 […]

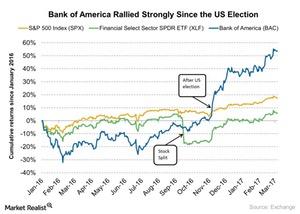

What Goldman Sachs Thinks about Bank of America

Bank of America (BAC) is currently trading at $25.26. Its 52-week high is $25.80 and 52-week low is $12.05.

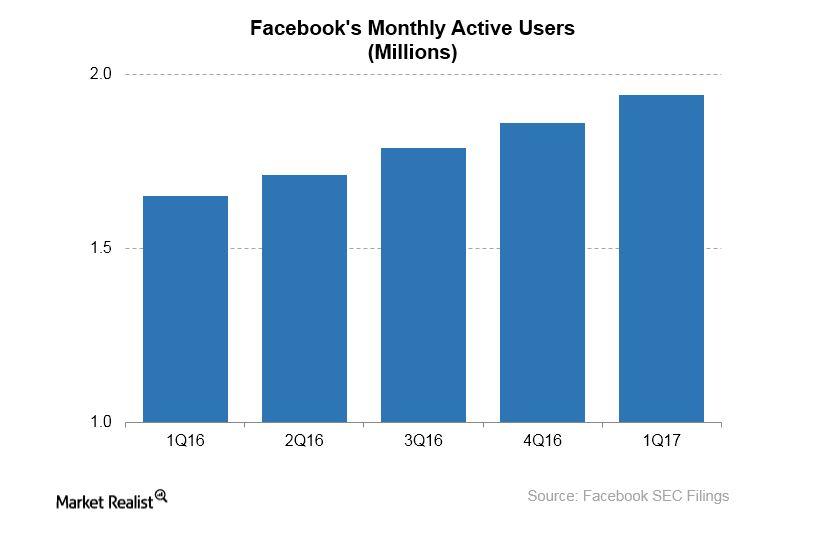

Facebook’s Efforts to Appease Media Companies

Facebook (FB) is building a paywall tool that would allow publishers to charge for access to stories they publish on Instant Articles, according to the Wall Street Journal.

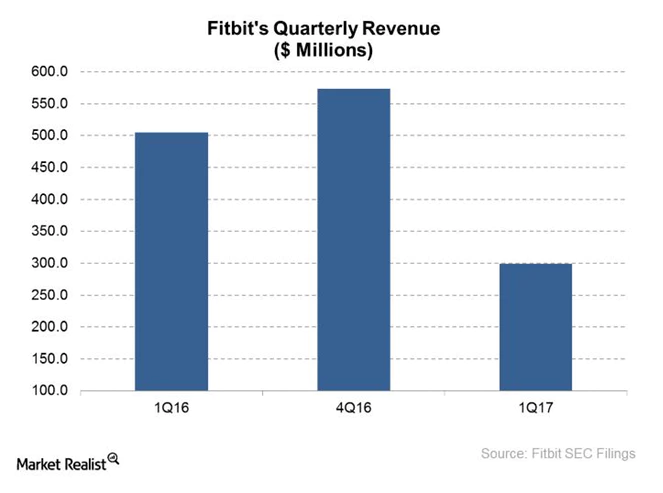

The 2% Fall in Fitbit Stock since May 1

Despite a 40.0% YoY fall in sales in 1Q17, Fitbit stock rose 12.0% on May 4, 2017, since it beat analysts’ revenue estimate.

Why Marc Faber Thinks These Stocks Are Vulnerable

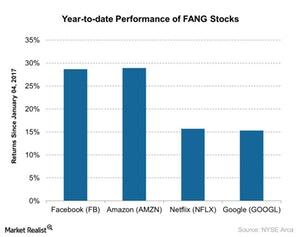

Facebook, Amazon, Netflix, and Google returned nearly 388%, 345%, 1,157%, and 217%, respectively, in the last five years.

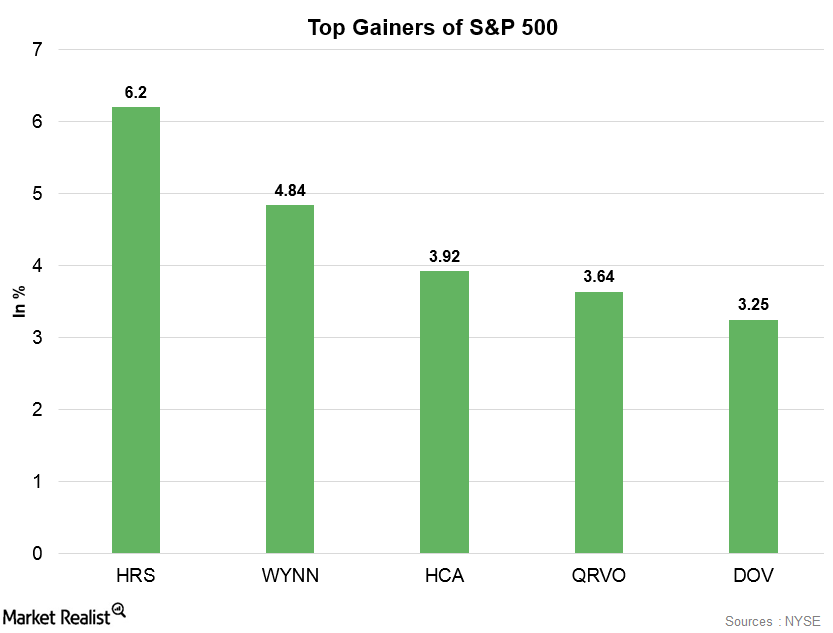

Harris Corporation: S&P 500’s Top Gainer on January 30

Harris Corporation was the S&P 500’s top gainer on January 30. On January 30, Harris Corporation gained 6.2% and closed the day at $156.31.

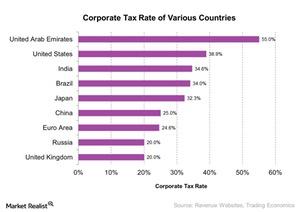

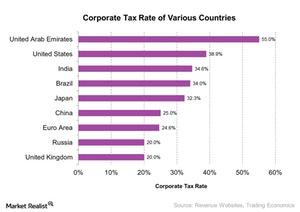

Why Buffett Believes US Businesses Aren’t Really Hurting from the US Corporate Tax

The US economy has been improving gradually, but some businesses in the US have suffered a lot over the years.

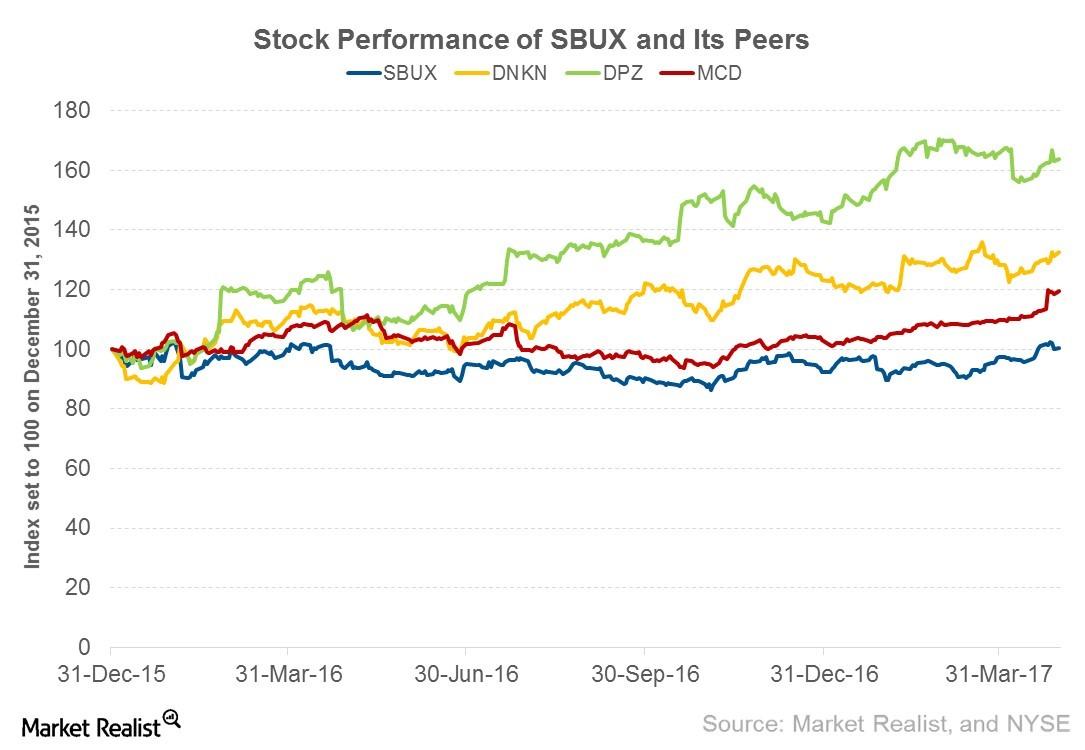

Why Investors Weren’t Impressed by Starbucks’s Fiscal 2Q17

Starbucks (SBUX) posted its fiscal 2Q17 earnings after the market closed on April 27, 2017. Its EPS was $0.45 on revenues of $5.3 billion.

Miller: Bond Bear Market to ‘Propel Stocks Significantly Higher’

Legendary value investor Bill Miller has an optimistic view on the equity market.

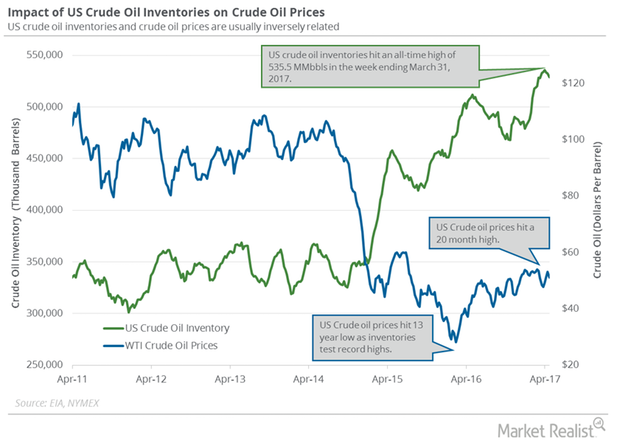

Backwardation: What It Could Mean for Crude Oil Prices

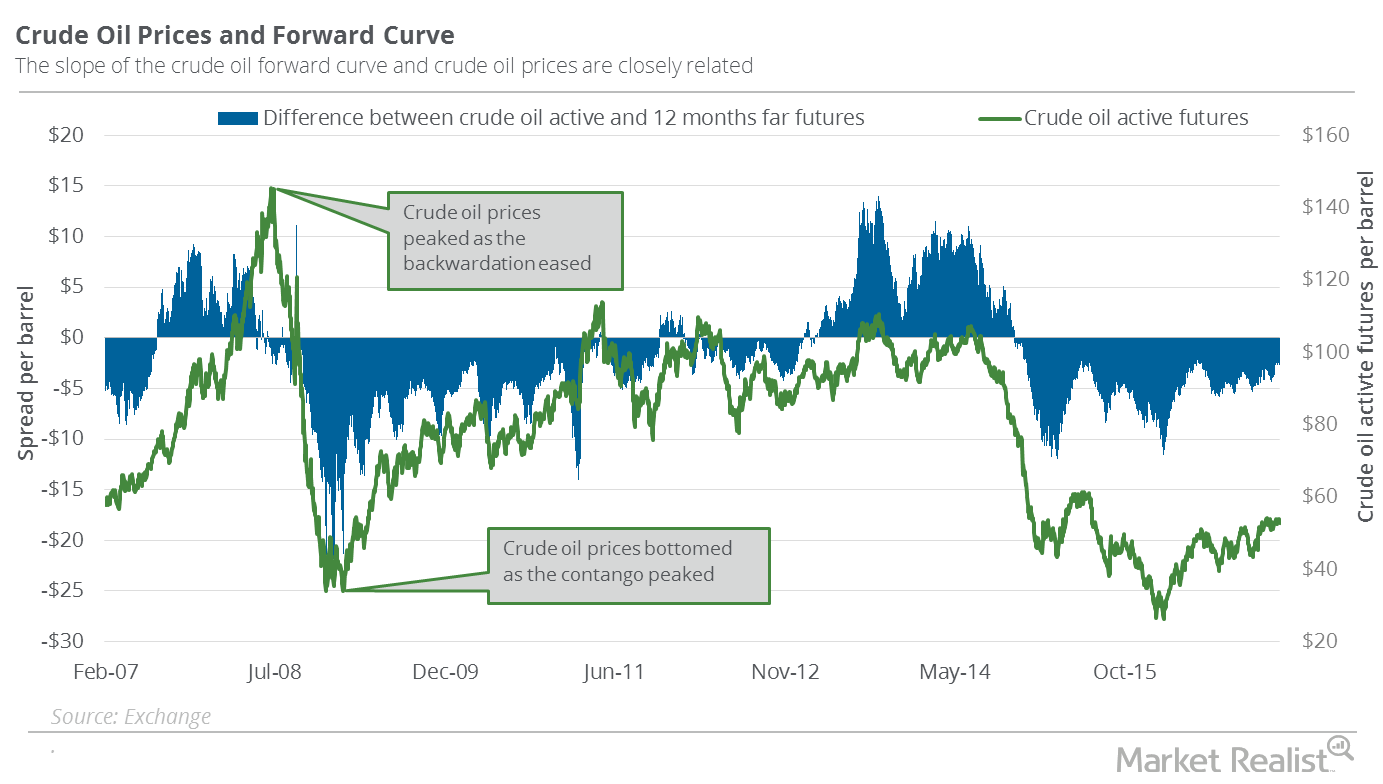

When the crude oil futures forward curve to slopes downwards, the situation in the crude oil futures market is called “backwardation.”

Why Oil Prices Could Increase More

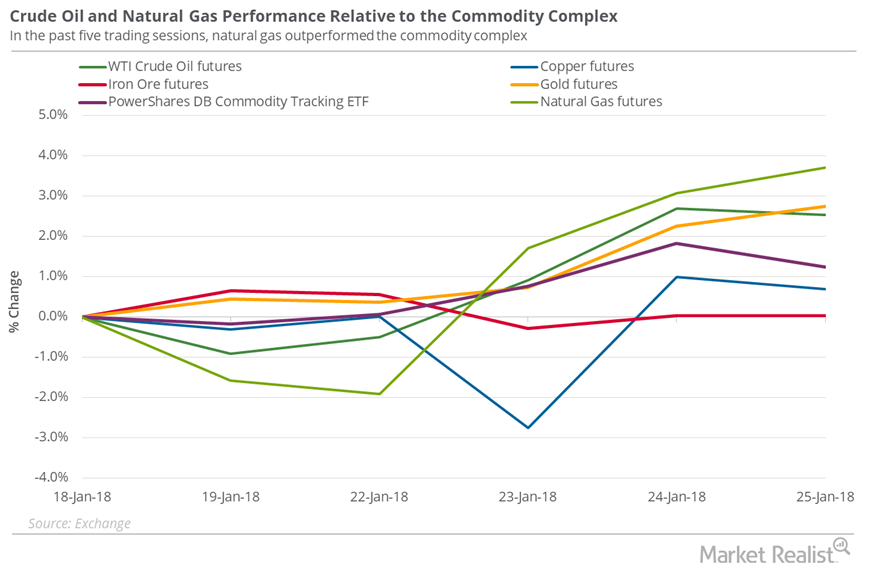

On January 22, 2018, US crude oil active futures were 3.1%, 7.8%, 15.8%, and 23.7% above their 20-day, 50-day, 100-day, and 200-day moving averages.

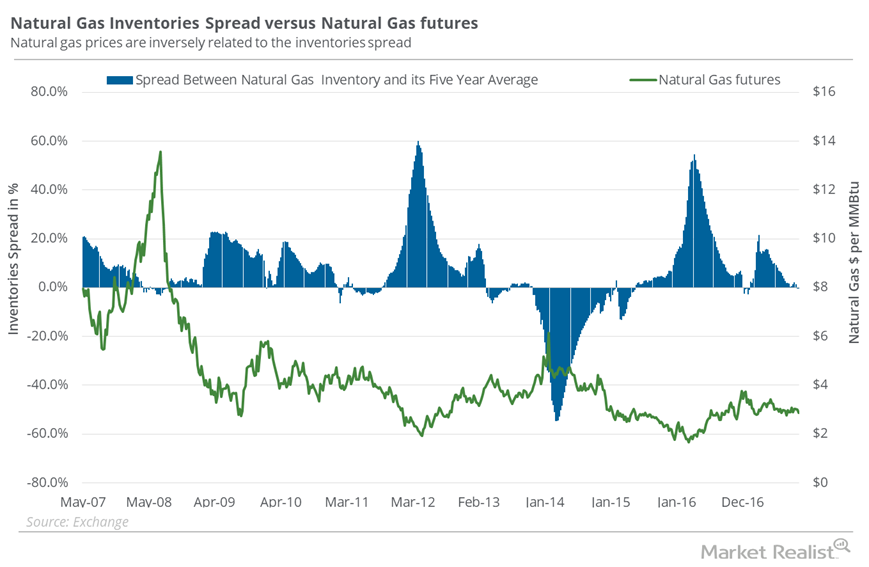

How the Inventory Spread Could Boost Natural Gas Prices

In the week ended October 6, natural gas inventories rose by 87 Bcf (billion cubic feet) to 3,595 Bcf—13 Bcf more than the market expected inventories to rise.

China’s Economic Data Might Drag Oil Prices

On December 14, China reported the November industrial output growth at 5.4% on a year-over-year basis—the lowest growth since early 2016.

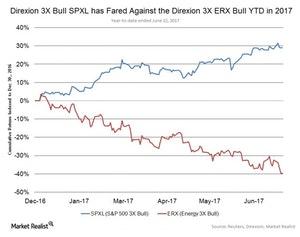

Is this Summer a Good Time to Invest in Energy?

So far this year, the S&P 500 energy sector has struggled mightily, down 12% versus an almost 9.5% gain in the S&P500 this year.

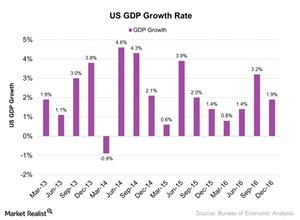

What Does Jack Bogle Predict for US Real GDP?

In 4Q16, US (SPY) (QQQ) (IVV) (VFINX) real GDP grew at an annual rate of 1.9% compared to a 3.5% rise in 3Q16.

Natural Gas Prices: What Could Happen on January 24?

On January 24, at 5:39 AM EST, natural gas prices have risen 1.7% from the last closing level.

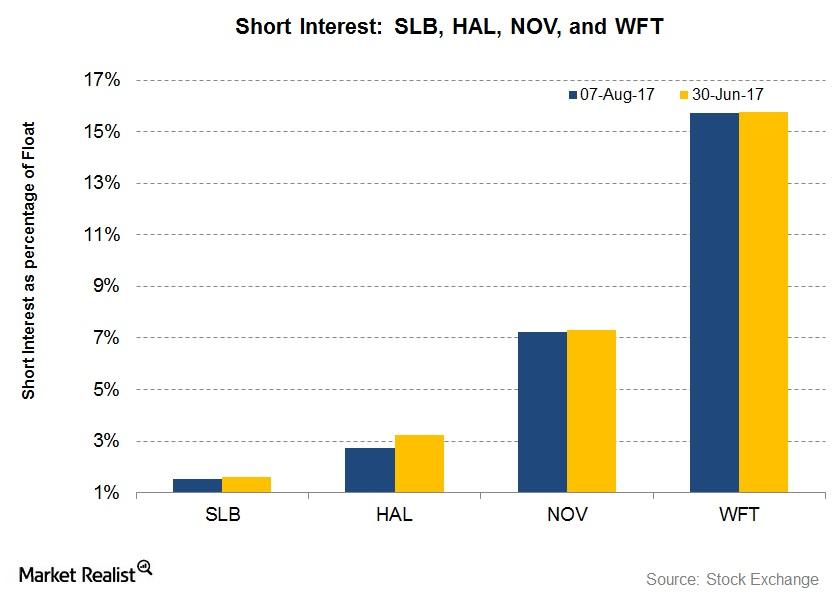

Short Interest in SLB, HAL, WFT, and NOV after 2Q17

The short interest in Schlumberger (SLB), as a percentage of its float, is 1.5% as of August 7, 2017—compared to 1.6% as of June 30, 2017.

Why Oil Prices Could Lose Momentum

On January 25, 2018, US crude oil’s (USO) (USL) March 2018 futures fell 0.2% and settled at $65.51 per barrel.

Paul Singer Increased His Holdings in NXP Semiconductor in 3Q17

Paul Singer, the CEO of Elliott Management, increased his holdings in NXP Semiconductor (NXPI) in 3Q17, according to a recent 13F filing report.

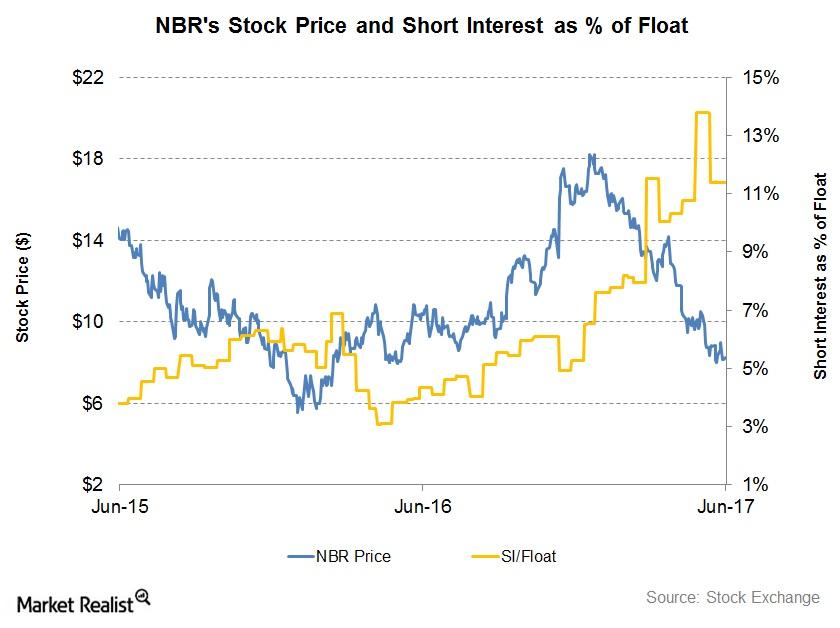

What’s Nabors Industries’ Short Interest as of June 19?

Short interest in Nabors Industries (NBR) as a percentage of its float was 11.4% as of June 19, 2017, compared to 10.1% as of March 31, 2017.

Why Is the Risk in Oil Prices Rising?

On December 5, 2017, US crude oil (USO) (USL) January 2018 futures rose 0.3%. The API’s oil inventory data might have supported oil prices on the same day.

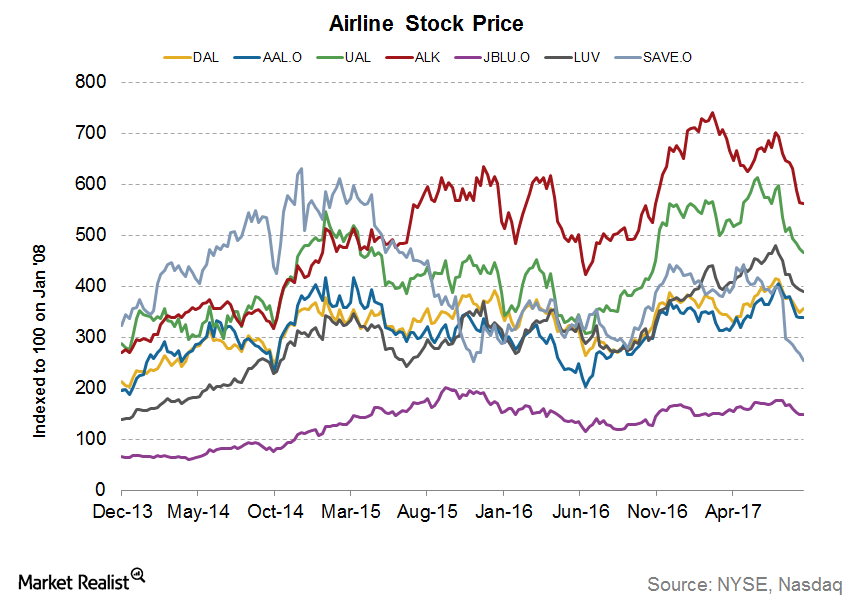

How American Airlines Stock Reacted to Its Guidance Update

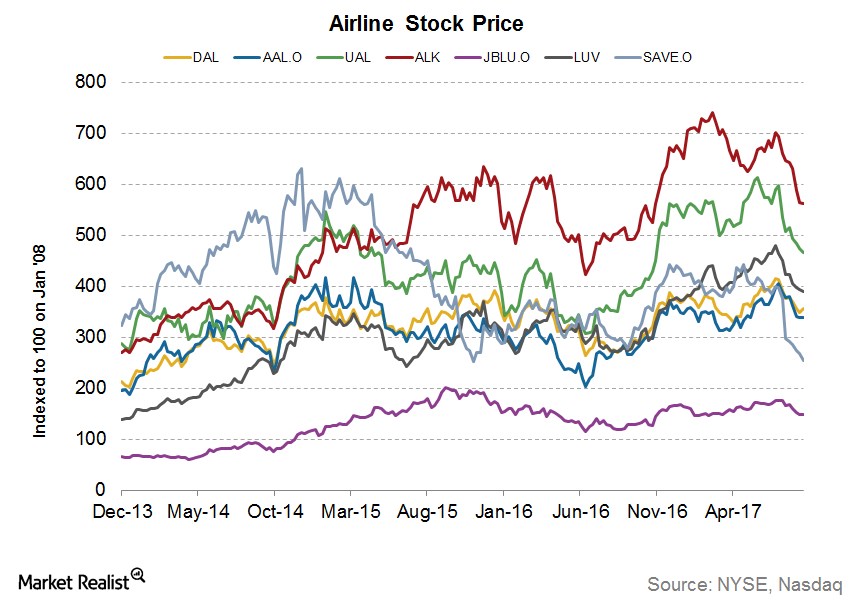

American Airlines (AAL) stock rose almost 0.94% on September 12, the day of its traffic release.

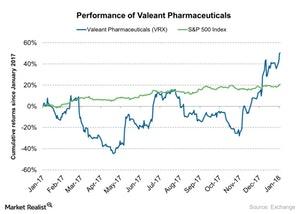

How Valeant Position Affected Pershing Square Capital Management

Valeant Pharmaceuticals is currently trading at $23.05. Its 52-week high is $23.47 and 52-week low is $8.31.

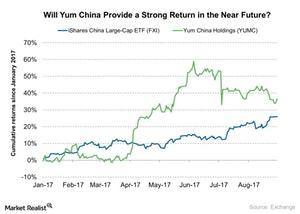

Why Druckenmiller Is Optimistic about Chinese Consumer Stocks

Druckenmiller’s firm bought 710,200 shares of Alibaba (BABA) in 2Q17. The holding accounted for nearly 5.4% of the firm’s portfolio in 2Q17.

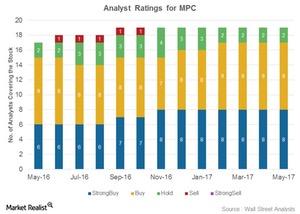

Why Most Analysts Are Calling Marathon Petroleum a ‘Buy’

Marathon Petroleum (MPC) has been rated by 19 Wall Street analysts. Seventeen analysts (or 89%) have rated it as a “buy” so far in May 2017.

Larry Fink Says Lower Rates Hampered Savings around the World

Various central banks in developed nations (EFA) have lowered their key interest rates close to the zero level to revive their economies.

Did Delta’s Guidance Cut Prompt a Losing Streak for Airlines?

Delta Air Lines (DAL) stock fell 3.5% after its traffic release on September 5, 2017. The negativity has spread to other players.

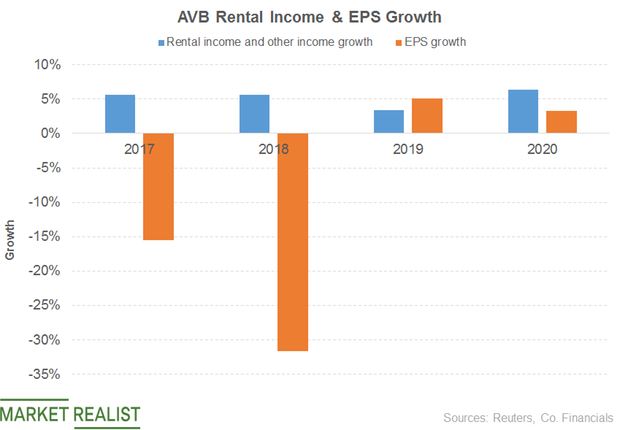

AvalonBay: What’s Driving the Dividend and Valuations?

AvalonBay’s revenue grew 7% in the first quarter, driven by rental and other income.

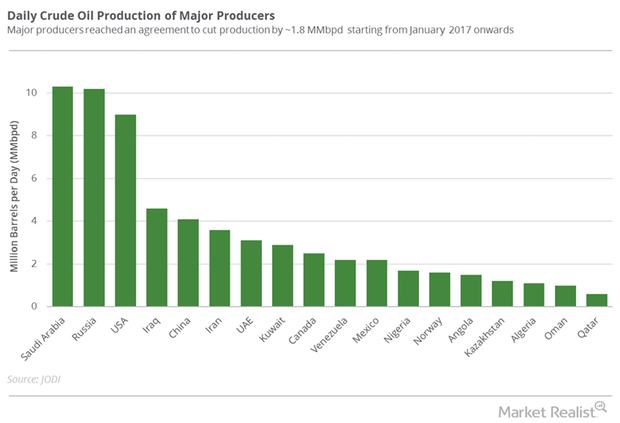

OPEC and Non-OPEC Meeting Could Drive Crude Oil Futures

August US crude oil futures contracts rose 0.4% and closed at $44.4 per barrel on July 10. Brent crude oil futures rose 0.4% to $46.8 per barrel.

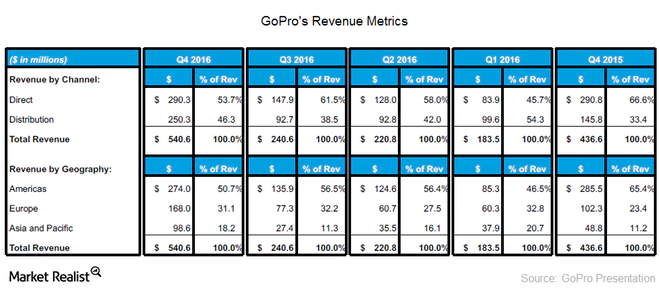

Why GoPro Is So Optimistic about Asia Sales

GoPro believes it can grow sales in developing economies such as India and China by focusing on online sales.

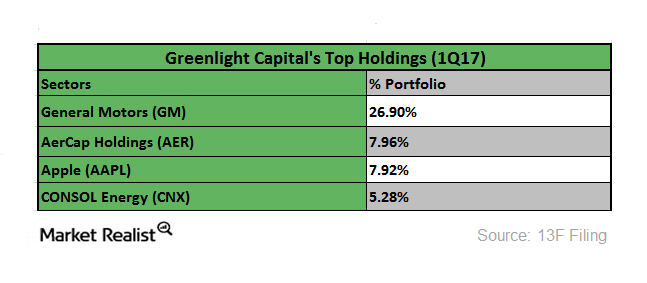

Inside Einhorn’s Greenlight Capital’s Top Holdings

Billionaire hedge fund manager David Einhorn is well known for his investment strategy, having advised long and short bets during different market scenarios.

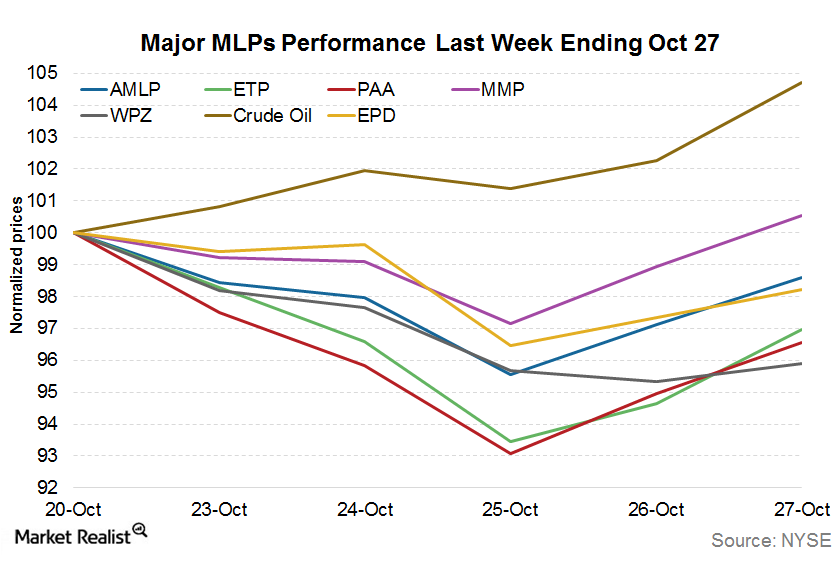

Why MLPs’ Sluggishness Continued Last Week

MLPs’ sluggishness continued last week despite strong crude oil. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, fell 1.2% last week.

Energy Calendar for Oil and Gas Traders: May 1–5

The energy sector contributed to ~6.3% of the S&P 500 (SPY) (SPX-INDEX) on April 28, 2017. Oil and gas are major parts of the energy sector.

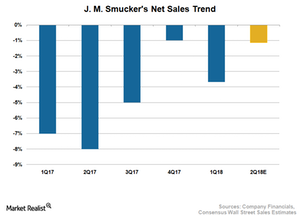

Behind J.M. Smucker’s Waning Sales

J.M. Smucker (SJM) has continued to disappoint on the sales front this year, having posted declines in sales for the past several quarters.

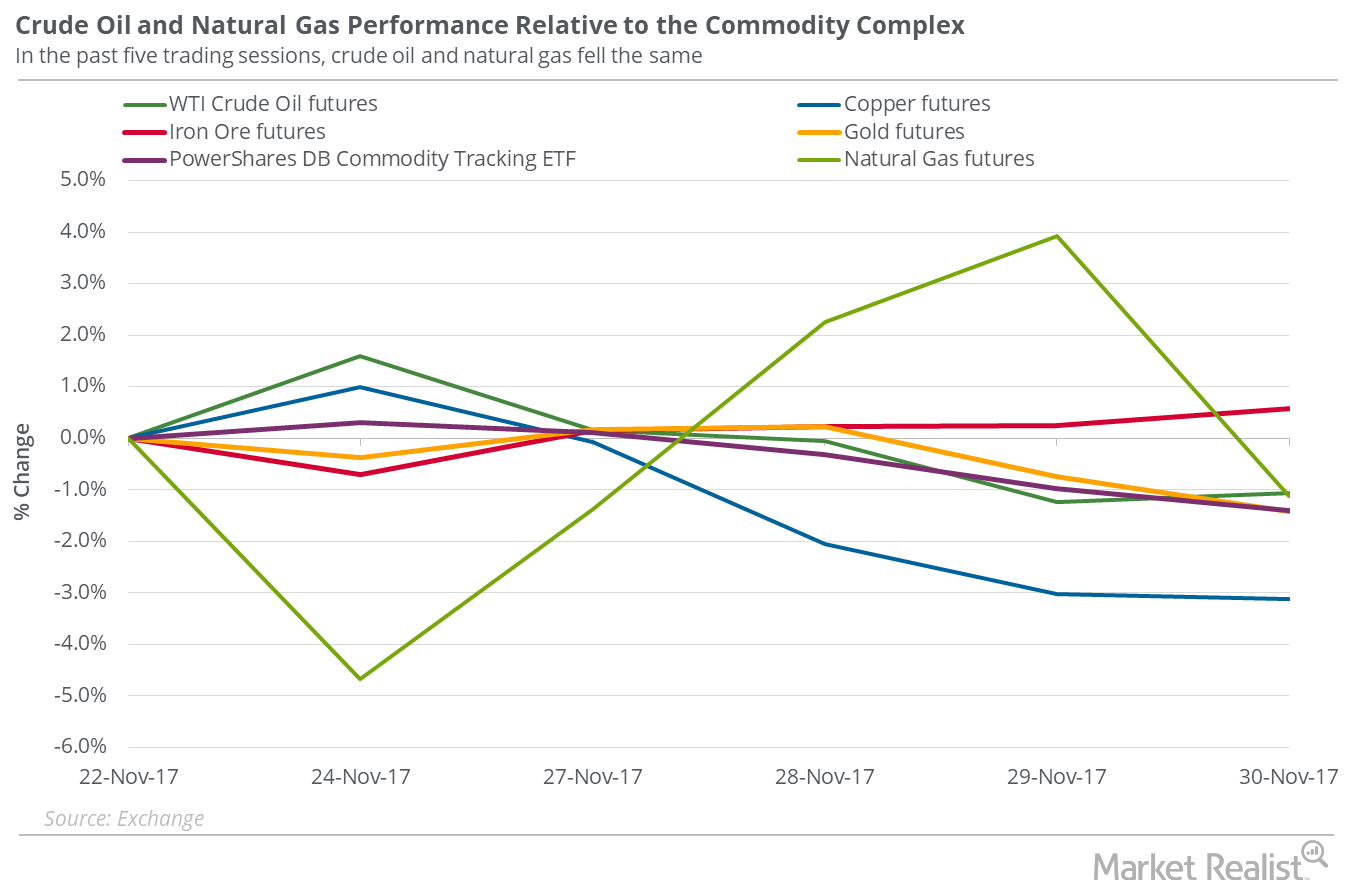

Why Oil Traders Should Stay Cautious after OPEC Meeting

On November 30, 2017, US crude oil (USO) (USL) active futures rose just 0.2% and closed at $57.4 per barrel.

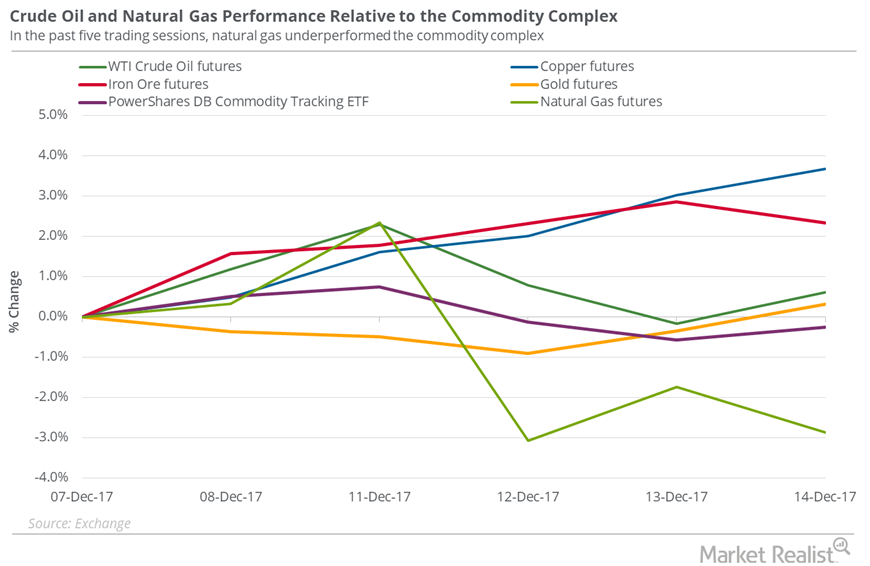

Will Non-OPEC Oil Supply Dominate Oil Prices in 2018?

On December 14, 2017, US crude oil (USO) (USL) January 2018 futures rose 0.8% and closed at $57.04 per barrel.