S&P500 Index

Latest S&P500 Index News and Updates

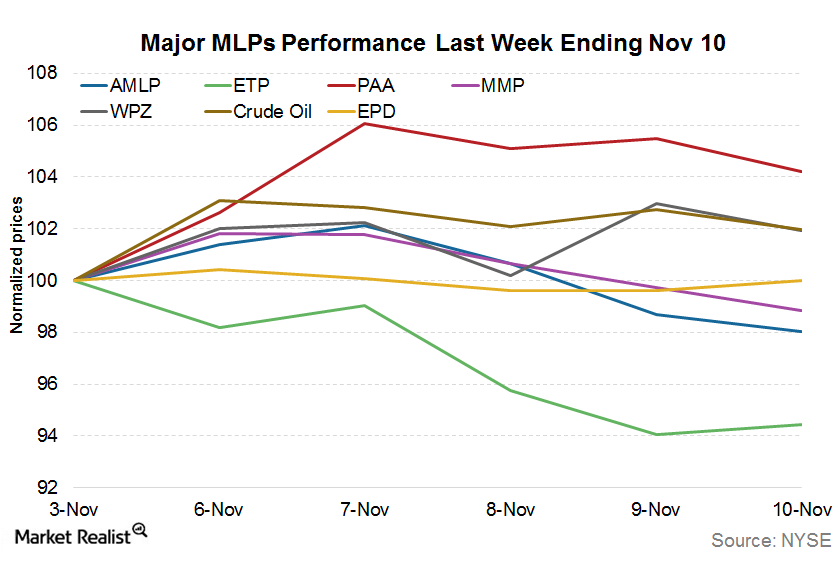

What’s behind MLP Performances for the Week Ended November 10?

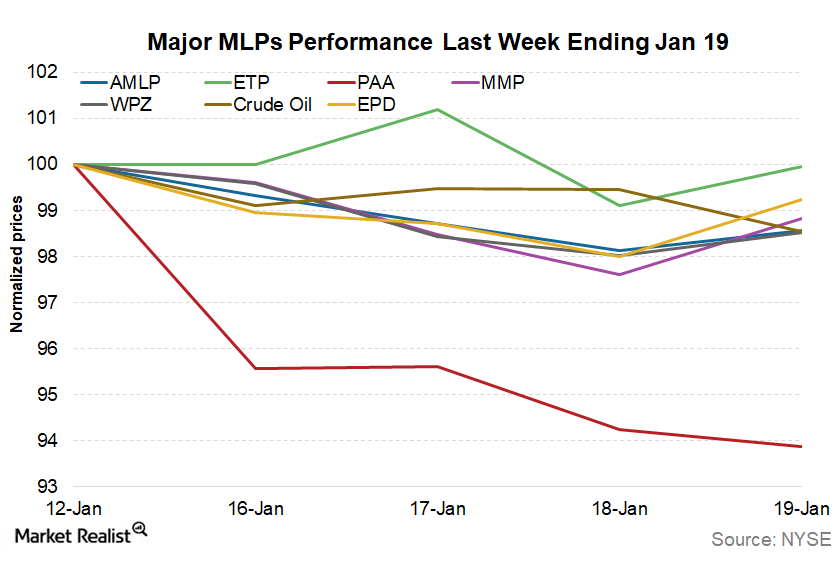

Of the total 95 MLPs, 62 ended last week in the red, 30 ended in the green, and the remaining three ended flat. Energy Transfer Partners (ETP) fell 5.5%.

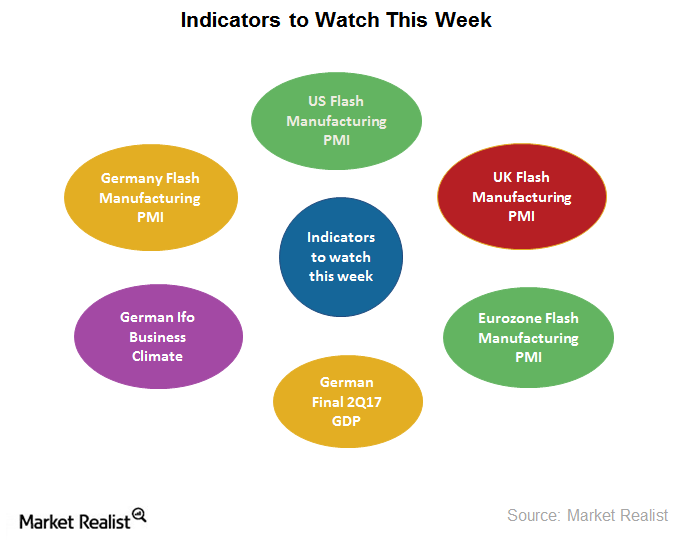

Important Economic Indicators to Watch Next Week

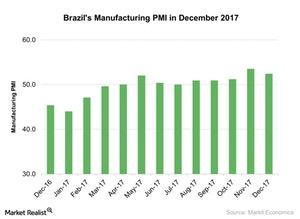

The most important indicators next week are the global flash manufacturing PMIs. Manufacturing PMIs are important indicators for the economy.

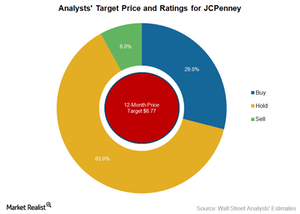

JCPenney: Analysts’ Recommendations and Target Price

As of July 13, 15 analysts covering JCPenney (JCP) stock have a “hold” rating. Seven analysts have a “buy” rating, while two analysts have a “sell” rating.

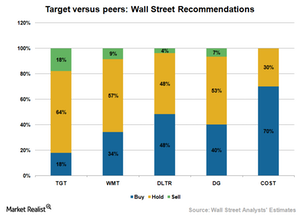

Did Analysts Change Their Views on Target after 1Q17 Results?

The majority of analysts covering Target (TGT) remain neutral on the stock.

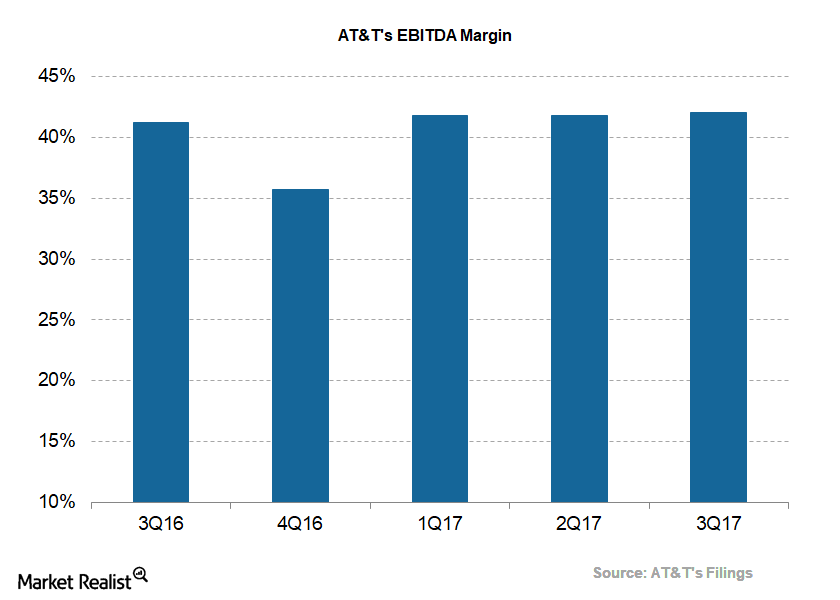

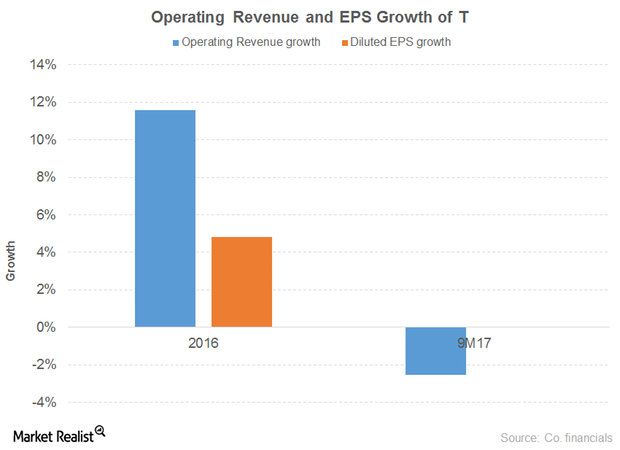

A Look at AT&T’s Earnings Margins

AT&T’s earnings growth in 4Q17 Previously, we discussed how much revenue growth we can expect from AT&T (T) in 4Q17. In this part, we’ll look at AT&T’s expected domestic wireless operations EBITDA (earnings before interest, tax, depreciation, and amortization). Wall Street analysts forecast AT&T’s combined domestic wireless operations EBITDA to rise ~3.2% YoY (year-over-year) to ~$6.9 […]

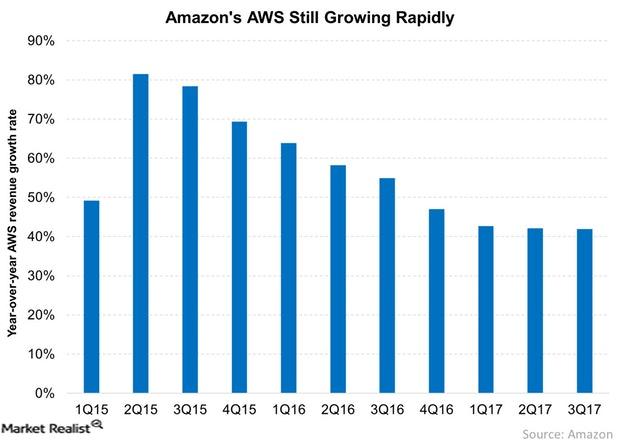

How Amazon Keeps Growing

Amazon.com (AMZN) posted its fiscal 3Q17 numbers last week, handily beating its earnings and revenue estimates.

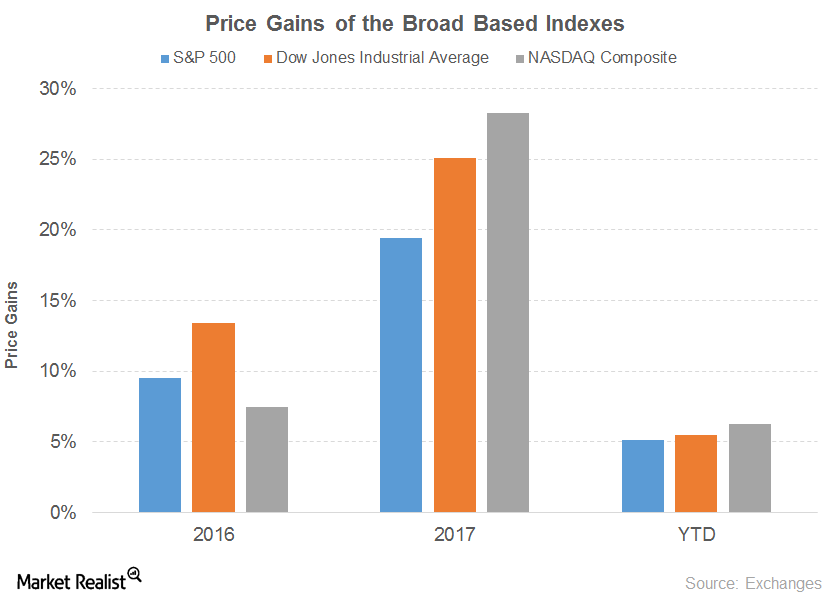

Tech Stocks Drive the S&P 500 to Record Highs

This year, the SPDR S&P 500 ETF (SPY) and Technology Select Sector SPDR ETF (XLK) have risen 19.2% and 35.5%, respectively. What’s driven this rally?

Dow Jones and SPY Trade Lower, Retail Data Disappoints

All of the major indexes and ETFs are trading lower today. The Dow Jones Industrial Average has fallen by 44 points or 0.16% at the time of this writing.

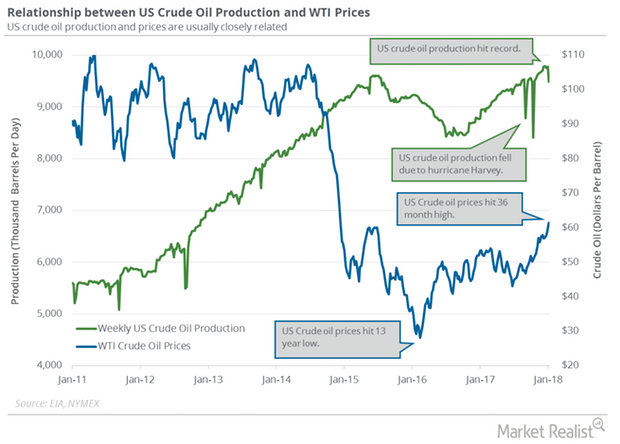

Will US Oil Production Pressure Crude Oil Futures?

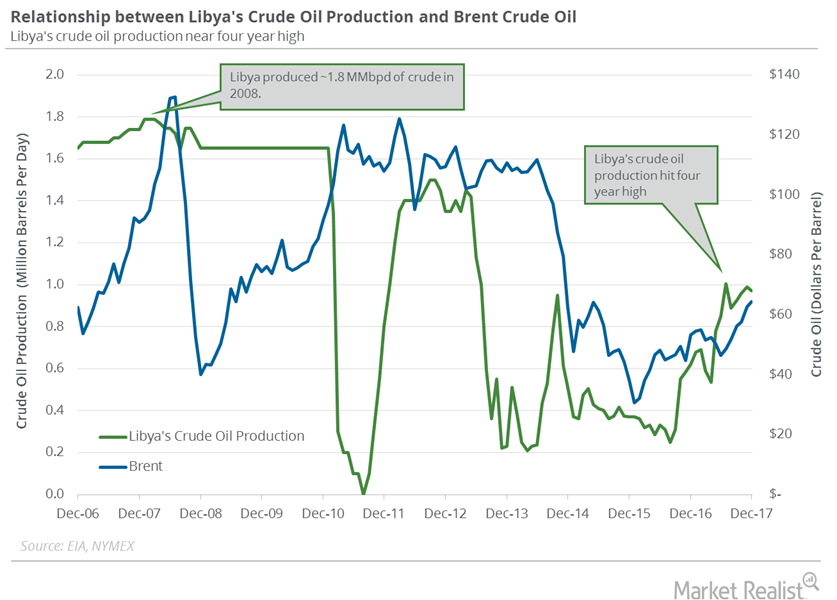

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

Weekly Update: Trade Talk Uncertainty and Gold Prices

Last week (ended September 20), gold rose 1.1% and settled at $1,507.30 per ounce. Meanwhile, the SPDR Gold Shares ETF (GLD) rose 2%.

Goldman Sachs: Expect Volatile October, Rising Gold

Yesterday, Goldman Sachs’ strategist warned of high volatility in October. Based on Goldman Sachs’ data, since 1928 volatility in October is 25% higher.

Investing Defensively Can Lose You a Fortune

I bet you may have heard a lot about investing defensively while the market faded.

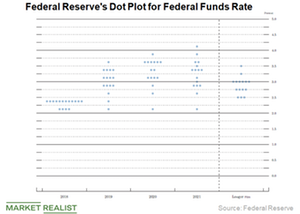

Is the Market Worried about an Overheating US Economy?

Federal Reserve Chair Jerome Powell’s speech did little to assuage investors’ concerns regarding the overheating of the US economy.

Cold War 2.0: Why It Looks Like a Real Possibility

The trade war is expected to be a long-term affair, according to several observers including Alibaba’s (BABA) Jack Ma.

PPG Industries Stock since Its Q1 2018 Earnings

PPG Industries (PPG) has announced that it will announce its second-quarter earnings on July 19 before the market opens.

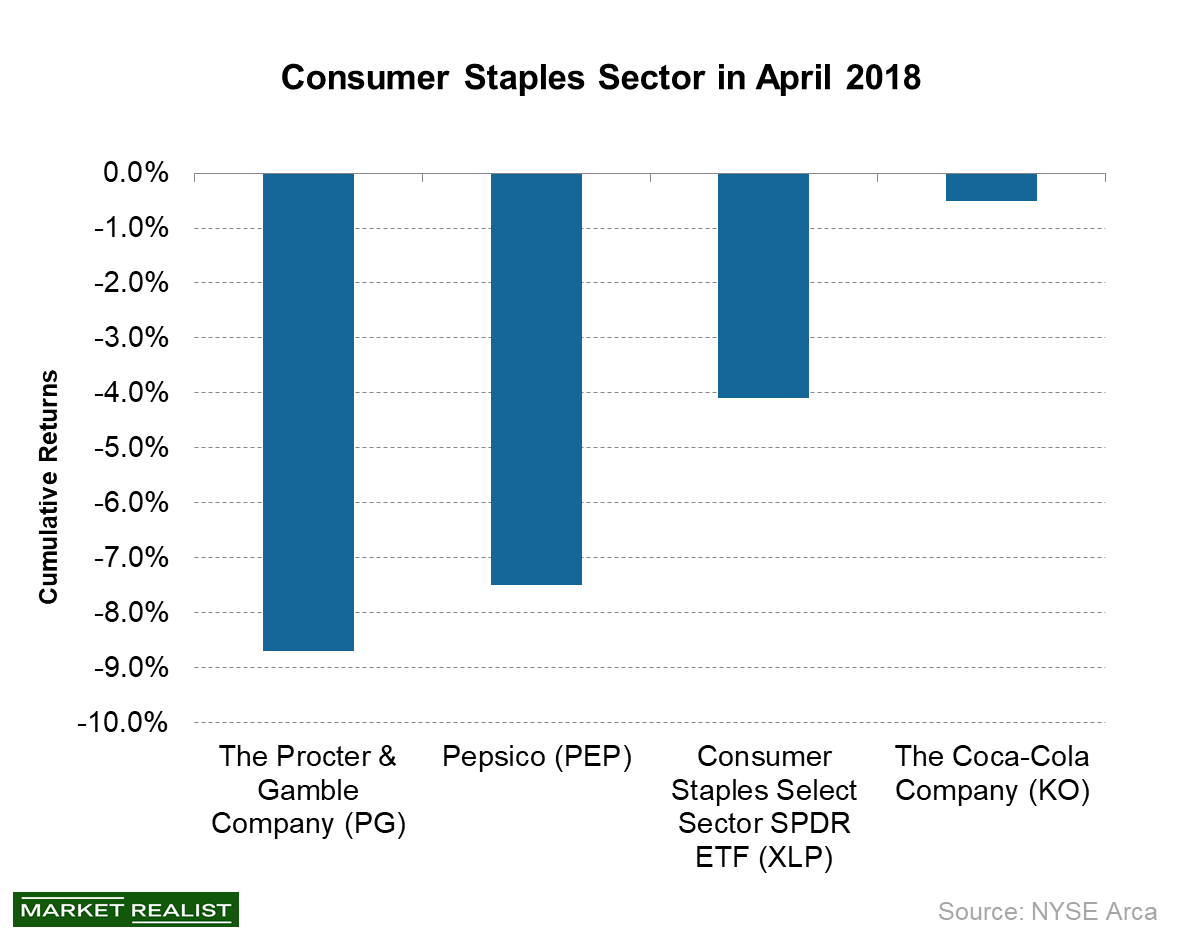

Is Higher Inflation Hurting the Consumer Staples Sector?

The consumer staples sector is an important sector in the S&P 500 Index (SPY).

Could McCormick’s Improving Fundamentals Boost Its Stock?

McCormick (MKC) has seen double-digit sales and earnings growth over the past couple of quarters.

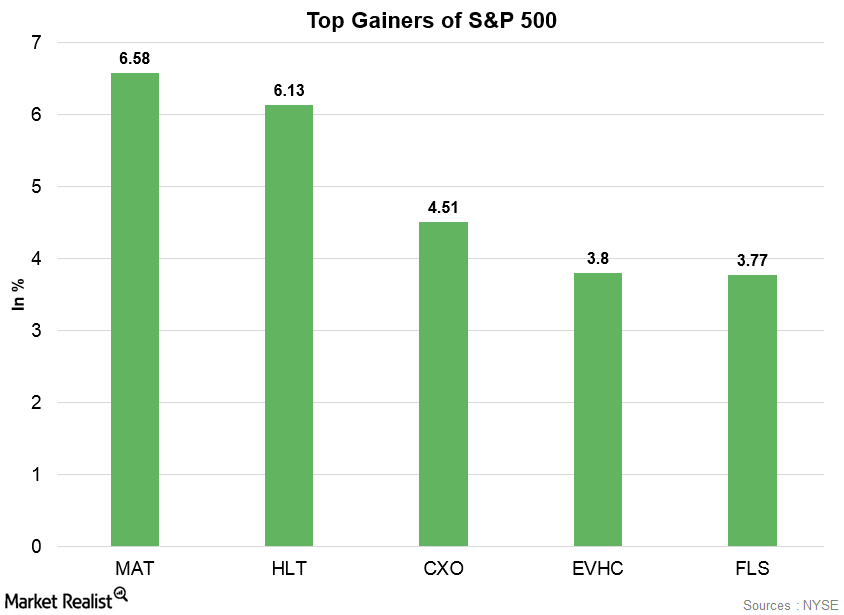

Mattel: S&P 500’s Top Gainer on April 11

Mattel, which is an American multinational toy manufacturing company, was the S&P 500’s top gainer on Wednesday.

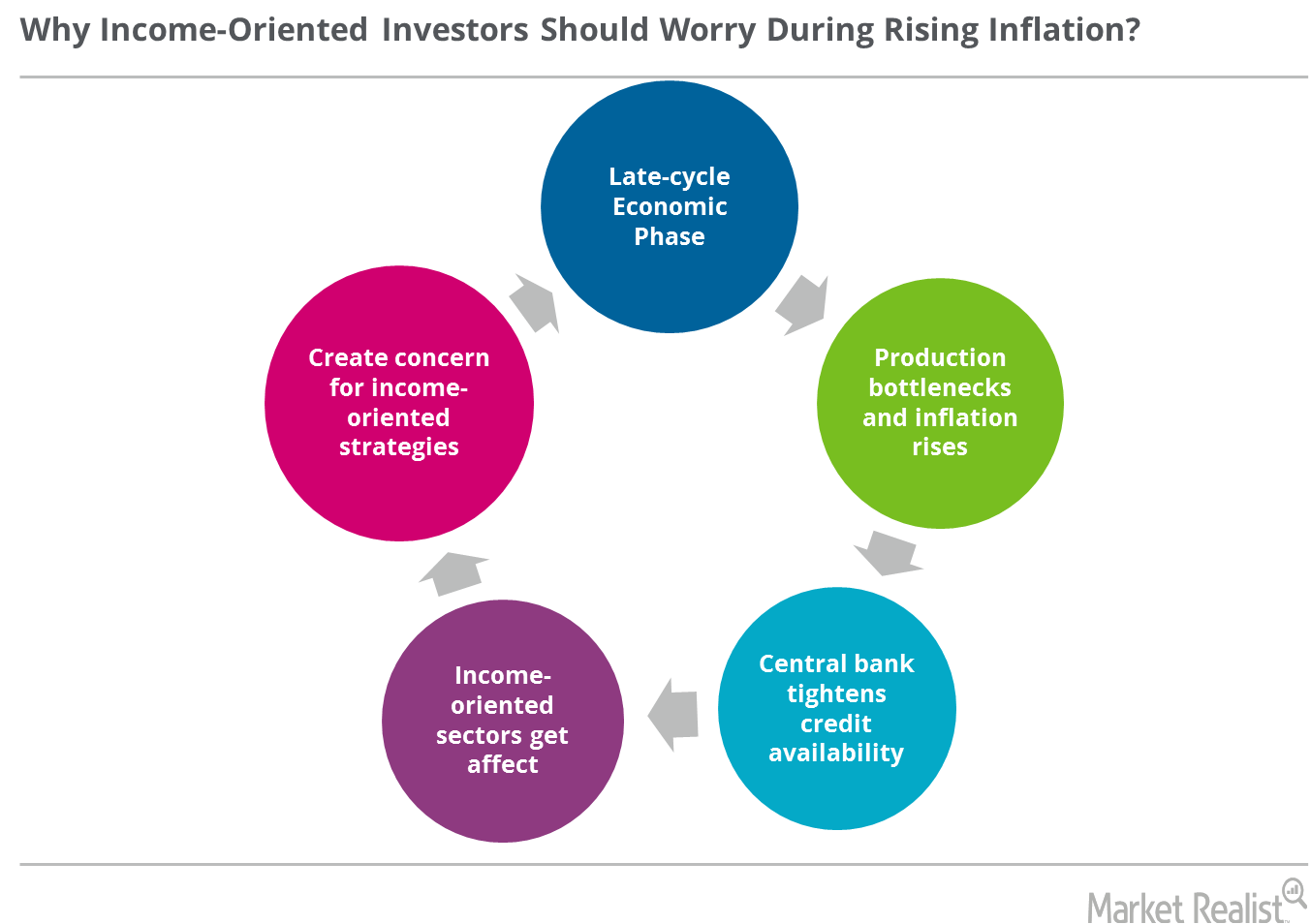

Bernstein: Income-Oriented Investors Should Worry about Inflation

In the late-cycle phase, production activity shows blockages, inflation shoots up, and the central bank tightens credit availability.

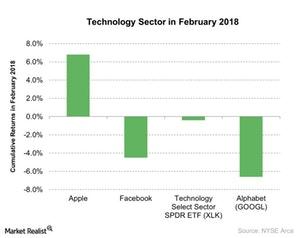

What’s the Correlation between S&P 500 and the Technology Sector?

The Technology Select Sector SPDR ETF (XLK), which tracks the performance of the US technology sector, fell marginally by 0.4% in February 2018.

Inflation and Retail Sales: Their Effect on the Economy

In this series, we’ll analyze UK inflation and US inflation for January 2018. We’ll also analyze retail sales for that month.

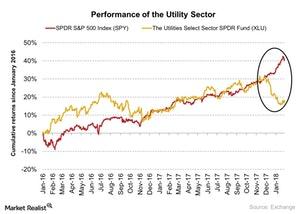

Why Utility Sector Had Inverse Correlation with S&P 500 in January

The Utilities Select Sector SPDR ETF (XLU), which tracks the performance of the utility sector, fell 3.2% in January 2018.

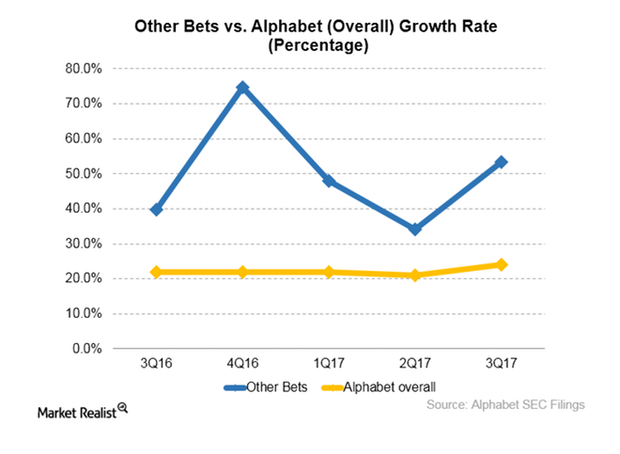

How Alphabet Is Diversifying Its Business

Alphabet (GOOG) announced on January 25, 2018, that it is launching its 13th unit—cybersecurity company Chronicle.

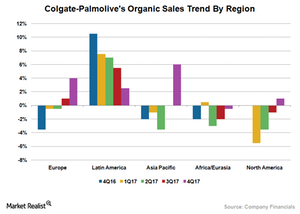

Analyzing Colgate-Palmolive’s Regional Sales in 4Q17

Colgate-Palmolive (CL) witnessed improved volumes across several regions thanks to the improvement in volumes driven by new products supported by increased advertising.

Etsy in 2017: A Year of Sweeping Changes

In March 2017, Black-and-White Capital sent a letter to Etsy’s board of directors, noting that the company had a variety of execution and corporate governance issues.

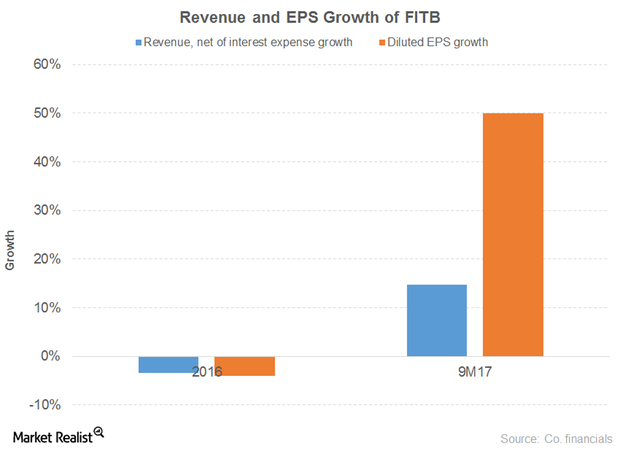

How Fifth Third Bancorp Has Performed Recently

Fifth Third Bancorp has an impressive free cash flow position.

A Look at Bank of America’s Key Growth Drivers

Bank of America’s dividend yield of 1.5% and PE of 20.6x compares to a sector average dividend yield of 2% and PE of 20.7x.

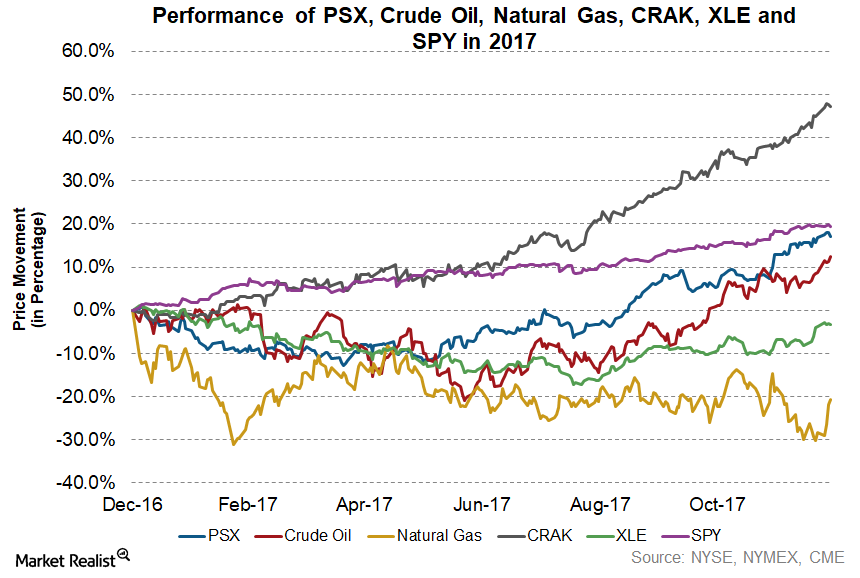

Phillips 66’s Strong Performance in 2017

In 2017, Phillips 66 (PSX) was the fifth-best-performing energy stock of the Energy Select Sector SPDR ETF (XLE).

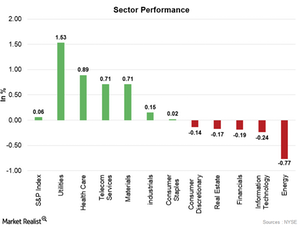

How Did the S&P 500, NASDAQ, and Dow Perform on January 25?

On January 25, six out of the S&P 500’s 11 major sectors moved higher. Strength in the utilities and health care sectors pushed the market higher.

Why Bill Miller Thinks Bond Bull Market May Be Coming to an End

Bill Miller said, “Bonds, in my opinion, have entered a bear market, but one that is likely to be benign for the next year or so.”

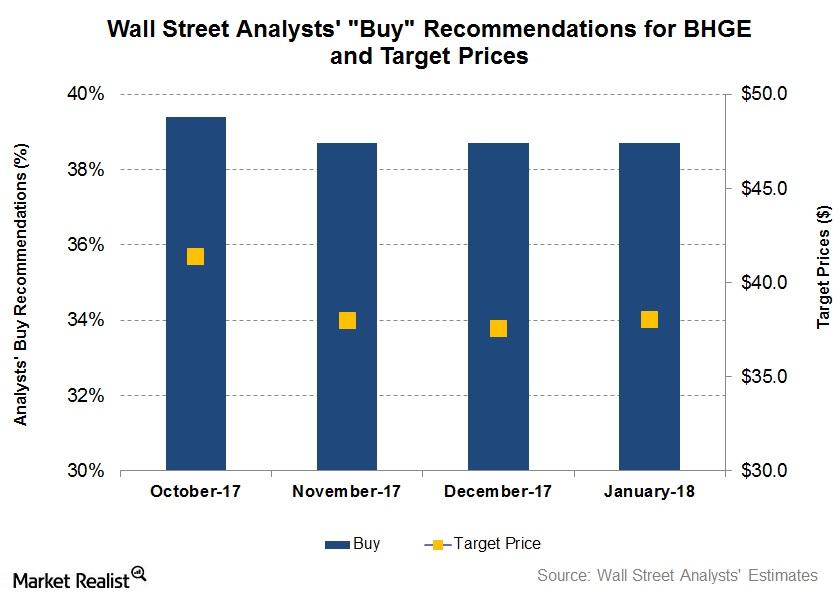

Wall Street’s Forecasts for Baker Hughes after Its 4Q17 Earnings

In this article, we’ll look at Wall Street analysts’ forecasts for shares of Baker Hughes, a GE company (BHGE) following its 4Q17 earnings release.

How AT&T Is Preparing for the Price War

AT&T’s cost of revenue rose 15% in 2016 before decreasing 1% in 9M17. That led to a 9% growth in gross profit for 2016 before falling 4% in 9M17.

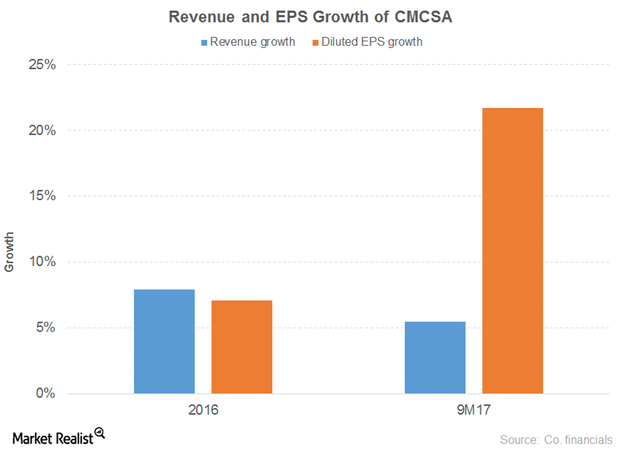

A Look at Comcast’s Strategy

Comcast’s (CMCSA) revenue grew 8% and 5% in 2016 and 9M17, respectively. The broadcast of the Rio Olympics in 3Q16 drove the 2016 numbers.

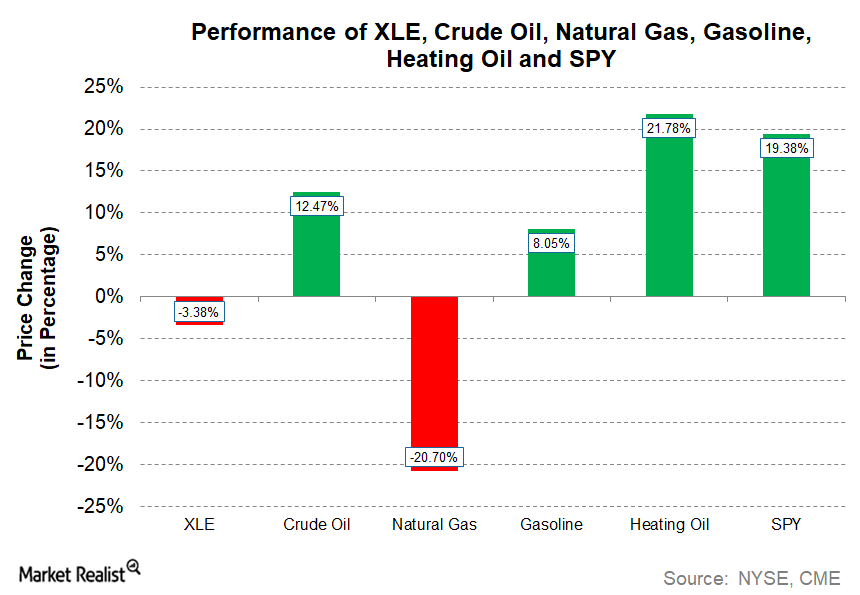

How the Energy Sector Performed in 2017

In this series, we’ll look at the best-performing and worst-performing stocks of the Energy Select Sector SPDR ETF (XLE) and analyze the earnings and developments behind the movements.

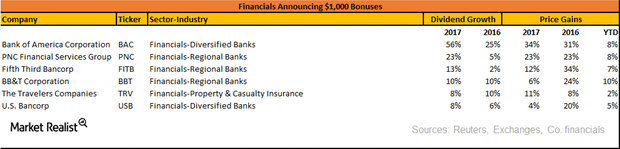

Which Stocks Have Announced $1,000 Bonuses?

In this series, we’ll be taking a look at the companies that have announced $1,000 dollar bonuses, pay raises, increased dividends, and buybacks in the last two months.

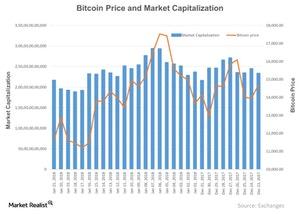

How Is Bitcoin Faring after Last Week’s Slump?

Investors (SPX-INDEX) around the world looked to gold (GLD) (IAU) for the rescue during the slump in bitcoin prices.

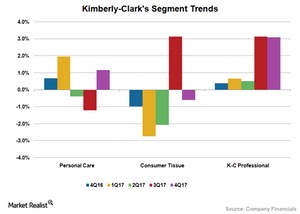

Kimberly-Clark: Segment Performances in 4Q17

Kimberly-Clark’s (KMB) Personal Care segment returned to growth in 4Q17. The segment’s top line increased 1.2% to $2.3 billion.

Analyzing Brazil’s Manufacturing PMI in December 2017

The final Markit Brazil manufacturing PMI stood at 52.4 in December compared to 53.5 in November 2017. The December PMI didn’t beat the initial estimate of 52.8.

Restarting the Wintershall Oilfields in Libya Could Impact Oil Prices

On January 21, the NOC (National Oil Corporation) of Libya said that it would restart the Wintershall AG’s Sara oilfield. NOC is a state-owned oil company.

MLPs Cool Off after a Strong 2-Week Rally

MLPs (master limited partnerships) cooled off last week, which ended on January 19, after two weeks of a strong rally.

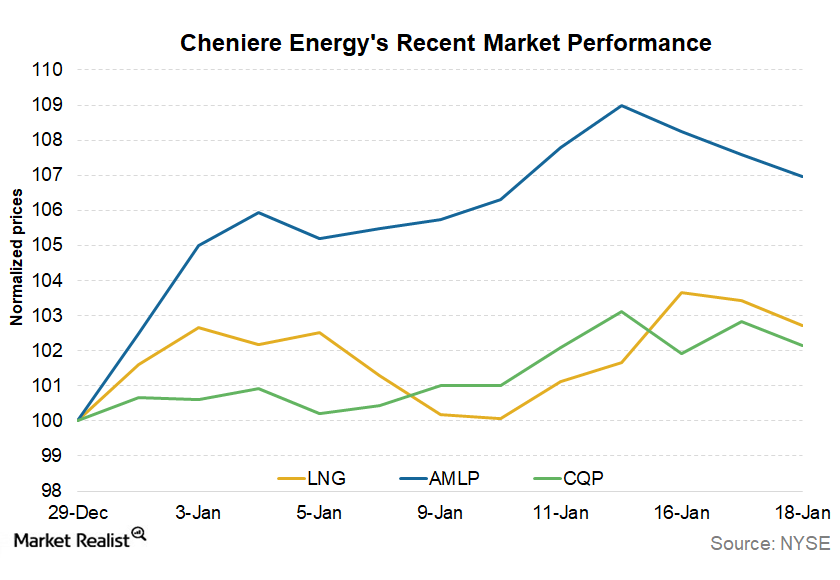

How the Recent Trafigura Deal Could Boost Cheniere Energy’s Stock

Cheniere Energy’s subsidiary, Cheniere Marketing, recently entered into a long-term SPA (sale and purchase agreement) with Trafigura.

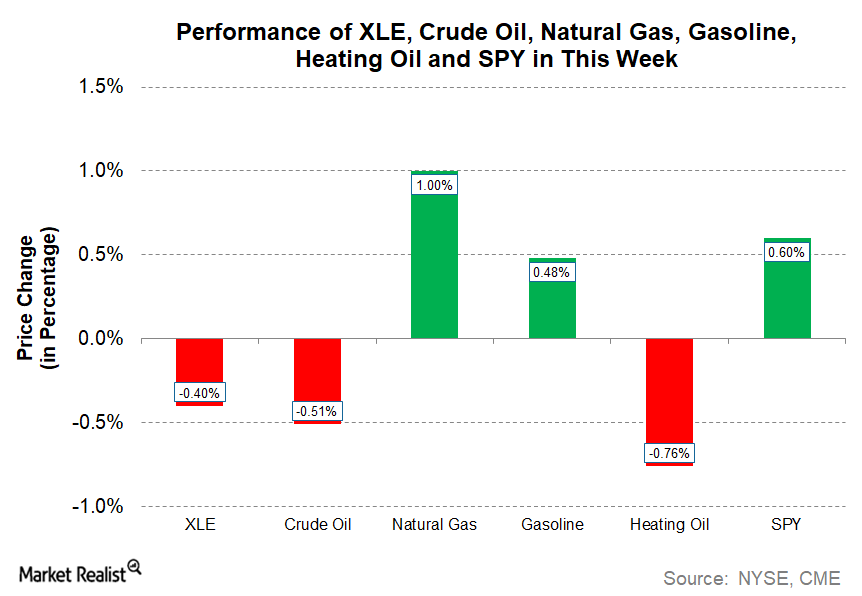

These Energy Commodities Rose This Week

With the mixed performance from energy commodities, energy stocks are down this week. As of January 17, the Energy Select Sector SPDR Fund (XLE) has fallen ~0.4% this week.

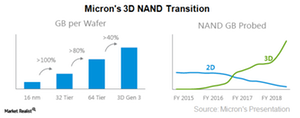

Micron’s Product Strategy for Fiscal 2018

In the DRAM market, Micron expects to achieve bit crossover on 1X DRAM by the end of 2018.

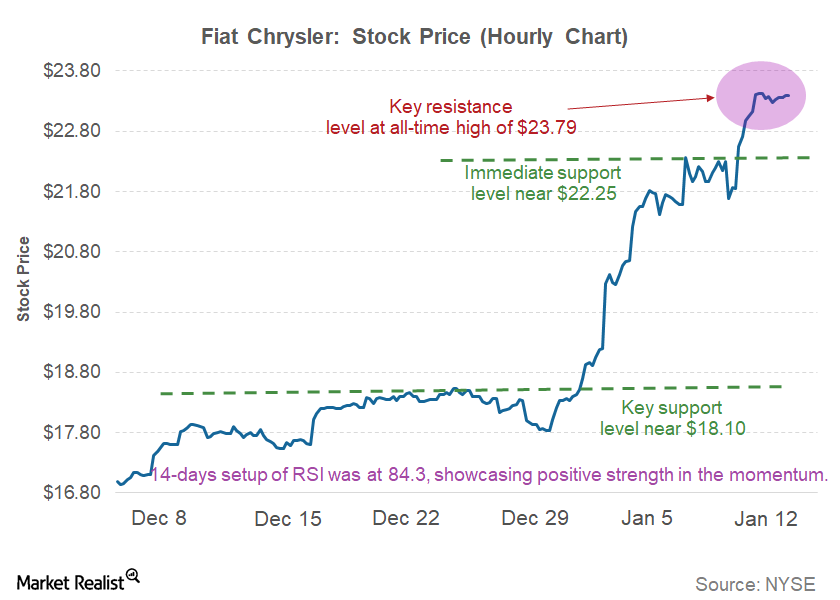

Fiat Chrysler Stock Began 2018 with a Bang after a Solid 2017

Last week, Fiat Chrysler stock (FCAU) continued to soar and posted solid weekly gains of 7.4%.

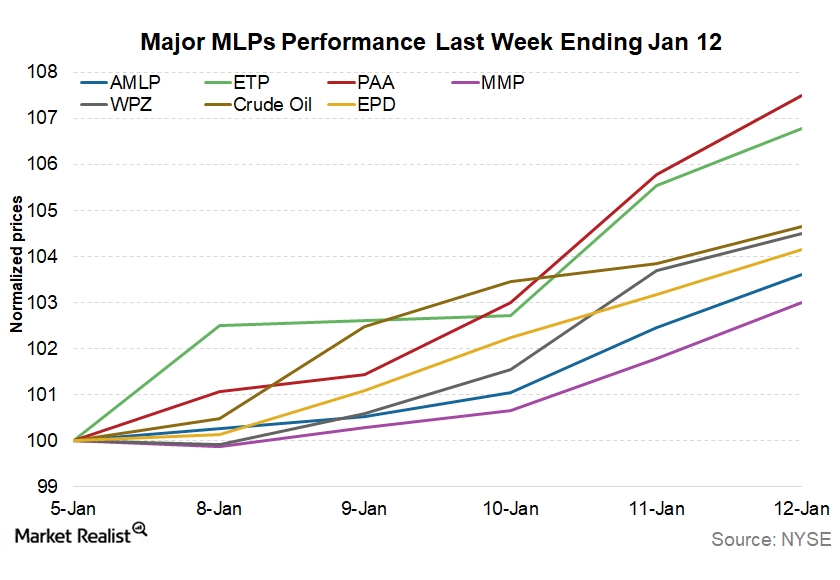

MLPs Continue to Outperform Broader US Markets in 2018

MLPs maintained their winning streak in the second week of 2018. The Alerian MLP Index (^AMZ) rose 4.6% last week and ended at 300.5.

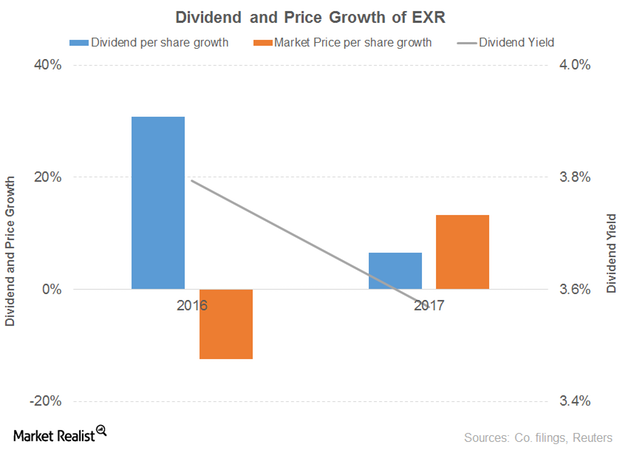

What’s the Outlook for Extra Space Storage?

Extra Space Storage’s (EXR) revenue grew 27% and 13% in 2016 and 9M17, respectively.

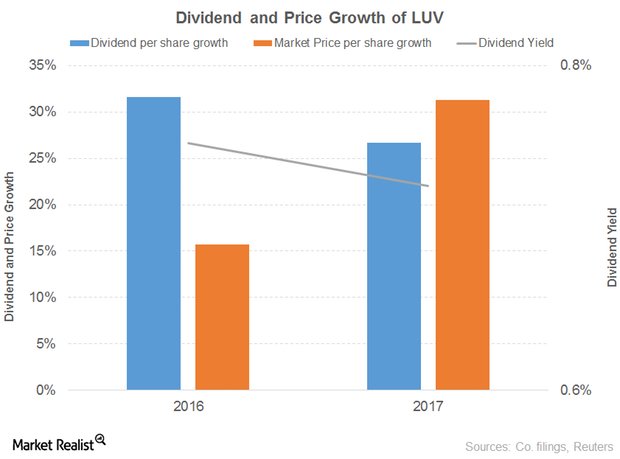

Here’s What Influenced the Outlook for Southwest Airlines

Southwest Airlines’ (LUV) operating revenue grew 3% and 4% in 2016 and 9M17, respectively.

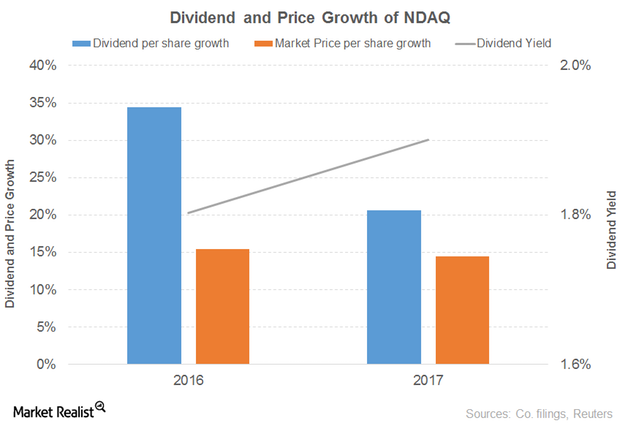

What’s behind the Outlook for Nasdaq?

Nasdaq (NDAQ) revenue rose 9% and 8% in 2016 and 9M17, respectively.

These Factors Are Contributing to Gilead Sciences’ Weak Outlook

Gilead Sciences’ (GILD) revenue fell 7% and 13% in 2016 and 9M17, respectively. The fall was due to lower product sales. Both antiviral products and other products recorded declines in both the periods.

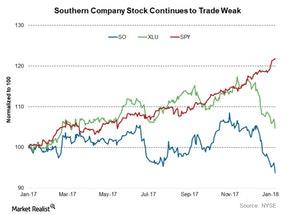

Does Southern Company Stock Have an Attractive Valuation?

Southern Company (SO), the second largest rate-regulated utility, is currently trading at an EV-to-EBITDA multiple of 10.5x.