S&P500 Index

Latest S&P500 Index News and Updates

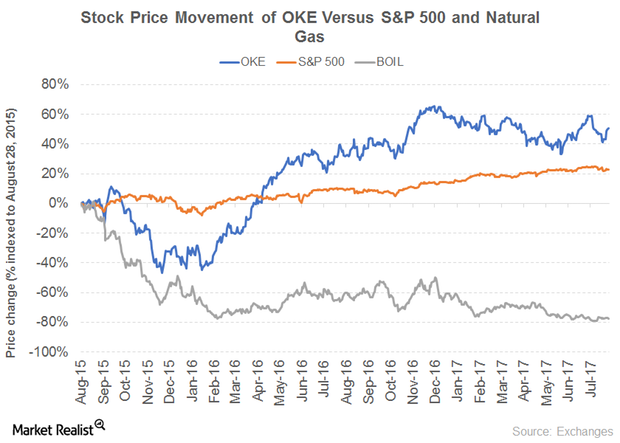

How ONEOK Has Managed Its Impressive Dividend Yield

How ONEOK has maintained a 4% yield ONEOK (OKE), the general partner and 41% owner of ONEOK Partners, owns one of the country’s premier natural gas liquid systems. The company’s revenue grew 15% in 2016 after falling 36% in 2015. The growth was driven by its Natural Gas Gathering and Processing, Natural Gas Liquids, and […]

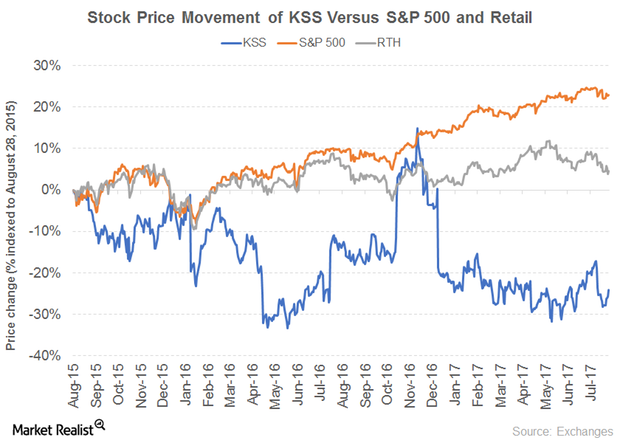

What’s Contributing to Kohl’s Dividend Yield

The story behind Kohl’s rising yield Department store retailer Kohl’s (KSS) saw its sales fall 3% in 2016, driven by lower comparable sales, after recording growth in 2015. Like Macy’s, it was impacted by online competition, store closures, discounts, and advertisements. Its operating income fell 8% in 2015 and 24% in 2016, while its operating […]

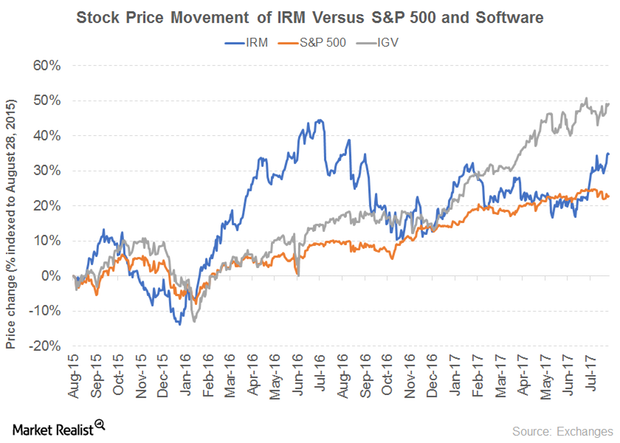

How Iron Mountain Has Maintained Its Dividend Yield

How Iron Mountain has maintained a 5% yield Iron Mountain (IRM) is an enterprise information management services company. The company’s revenue grew in 2016, supported by its North American Records and Information Management Business, North American Data Management Business, Western European Business, and Other International Business segments. Its revenue fell 4% in 2015 before rising 17% in 2016. Its operating income fell 5% in 2015 and 4% in 2016 due to […]

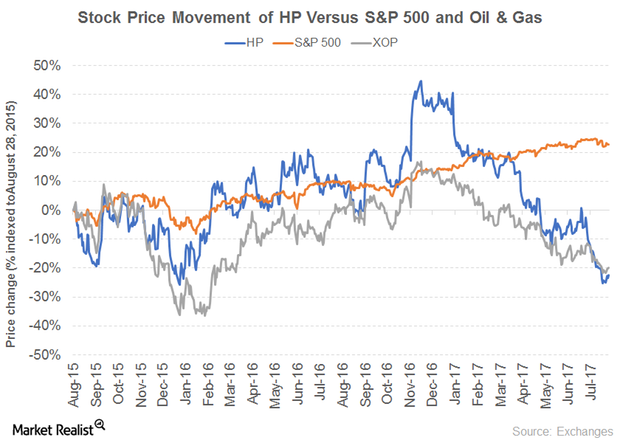

Decoding Helmerich & Payne’s Dividend Yield

What’s driving Helmerich & Payne’s high yield? Contract oil and gas well driller Helmerich & Payne (HP) recorded a sharp drop in its 2016 operating revenue due to declines in its US drilling, offshore, and international segments. Its revenue fell 19% in 2015, compared with 51% in 2016. Its operating income, as a result, ended […]

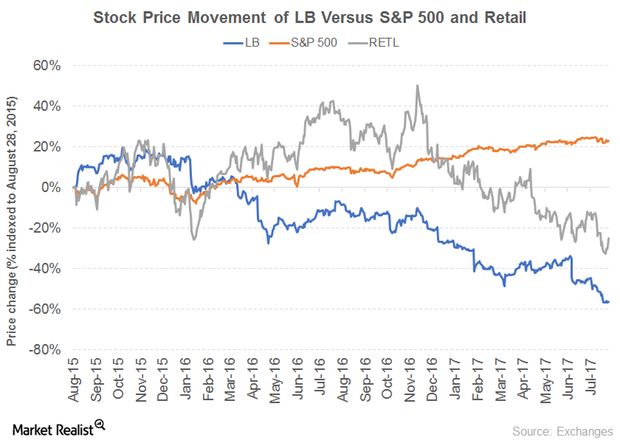

Here’s Why L Brands’ Dividend Yield Is Rising

Reasons behind L Brands’ growing yield Specialty fashion retailer L Brands (LB) saw its sales slow between 2013 and 2016. The company recorded revenue growth of 3.5% in 2016, compared with 6% in 2015. The growth was driven by the Victoria’s Secret and Bath & Body Works segments. Whereas its operating income grew 12% in 2015, it […]

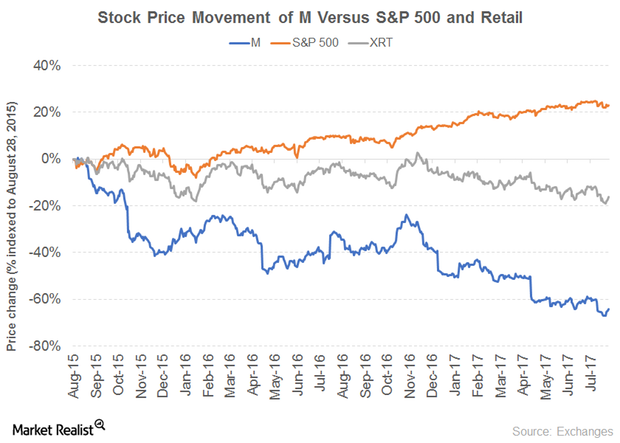

What’s behind Macy’s Rising Dividend Yield

The story behind Macy’s attractive yield Macy’s (M) operates Macy’s and Bloomingdale’s stores. The company’s sales fell between 2013 and 2016. Revenue fell 5% in 2016, compared with 4% in 2015. Online shopping and discount stores have wreaked havoc on brick-and-mortar stores, leading to store closures. Narrowing gross margins and rising impairments, store closing costs, and […]

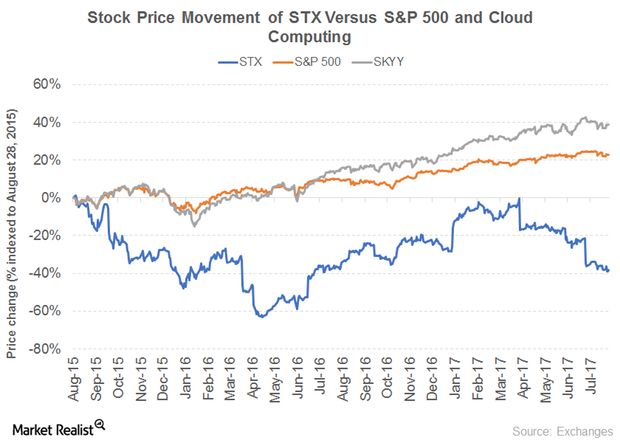

Can Seagate Sustain Its Dividend Yield?

What’s behind Seagate’s dividend yield Seagate Technology (STX) is a data storage technology and solutions provider. The company’s revenue, which has fallen over the years, seems to have recovered in 2017. Its revenue has fallen 3% in 2017, compared with a fall of 19% in 2016 due to intense competition in the data storage market. The company’s […]

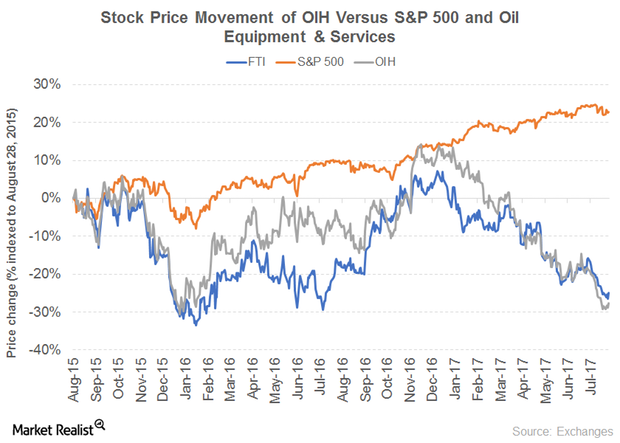

What Could Drive TechnipFMC’s Dividend Yield

How TechnipFMC intends to maintain its yield FMC Technologies and Technip merged to become TechnipFMC (FTI) in 2017, an international provider of subsea, onshore, offshore, and surface projects. The synergy aims to combat the challenges of low oil prices and a challenging outlook through cost cutting and the enhancement of efficiency. The company recorded 51% revenue […]

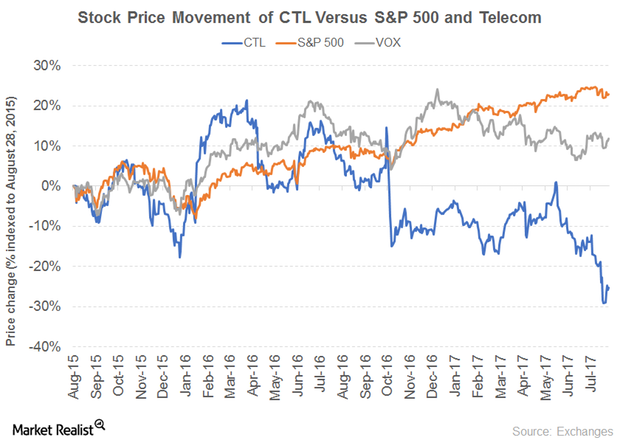

How CenturyLink is Maintaining Its Dividend Yield

The story behind CenturyLink’s 8% yield Another acquisition-driven telecom company is CenturyLink (CTL). The cohesive communications company provides a wide range of services to its residential and business customers. Like Frontier, it has been impacted by the slowing traditional phone business. The company’s operating metrics, excluding those of Prism TV, are trending downwards. This trend has […]

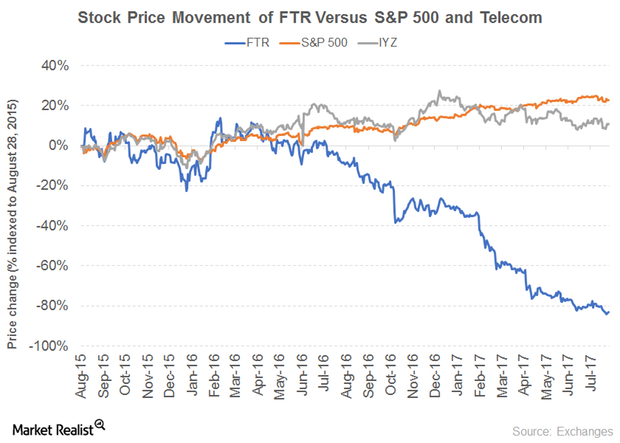

Frontier Communications: High Dividend Yield despite Dividend Cut

In this series, we’ll look some small-cap stocks with high dividend yields.

How Dish Views the Trend of Cable Companies Entering the Wireless Arena

Among the major cable companies, Comcast (CMCSA) has already ventured into the wireless industry by launching a wireless service.

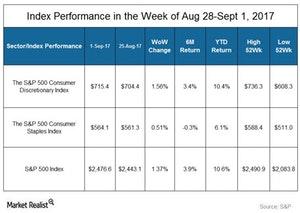

Analyzing the Consumer Sector’s Performance Last Week

On September 1, General Motors (GM) released its August sales report. In August, US retail sales recorded 275,552 vehicles—7.5% higher YoY.

These Key Economic Indicators Were Released Last Week

In this series, we’ll take a look at the flash manufacturing PMI for the US, Germany, France, and the Eurozone for August 2017.

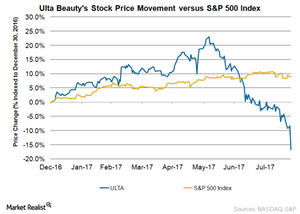

Ulta Beauty Stock: Why It Fell despite Beating 2Q17 Expectations

Ulta Beauty (ULTA) stock fell 9.1% to $212.36 on August 25, 2017, in reaction to the company’s results for fiscal 2Q17, which ended on July 29, 2017.

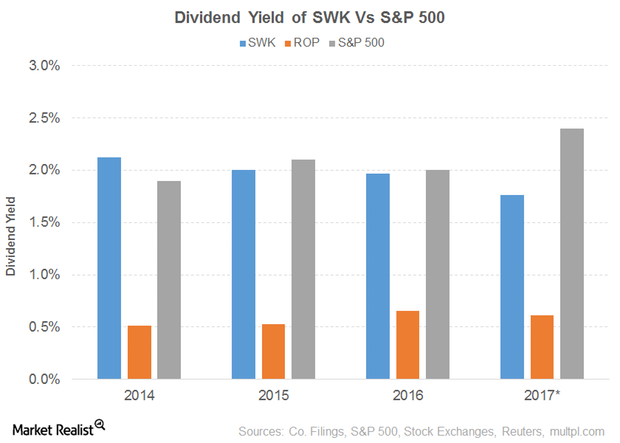

Dividend Yield of Stanley Black & Decker

Stanley Black & Decker’s (SWK) PE ratio of 21.1x is pitted against a sector average of 29.3x. The dividend yield of 1.8% is pitted against a sector average of 1.6%.

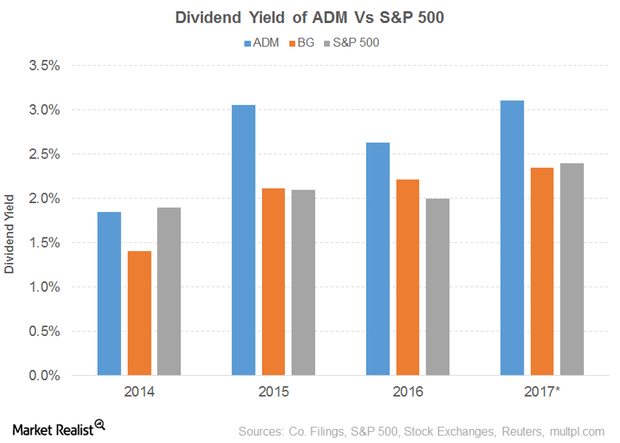

Dividend Yield of Archer-Daniels Midland

Archer-Daniels Midland’s (ADM) PE ratio of 19.1x compares to a sector average of 23.8x. The dividend yield of 3.1% compares to a sector average of 2.4%.

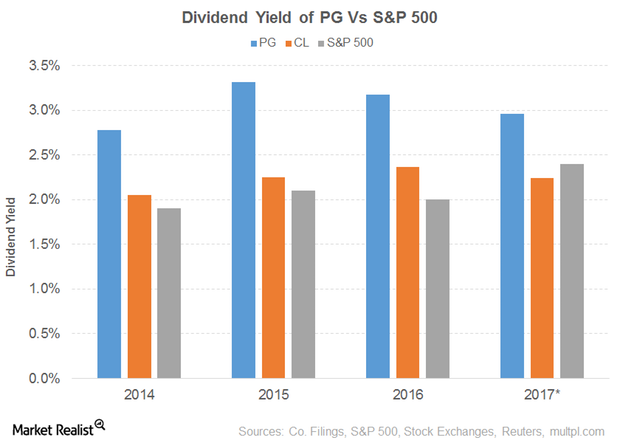

Dividend Yield of Procter & Gamble

Procter & Gamble’s (PG) PE ratio of 25.1x compares to a sector average of 23.3x. The dividend yield of 3.0% compares to a sector average of 3.8%.

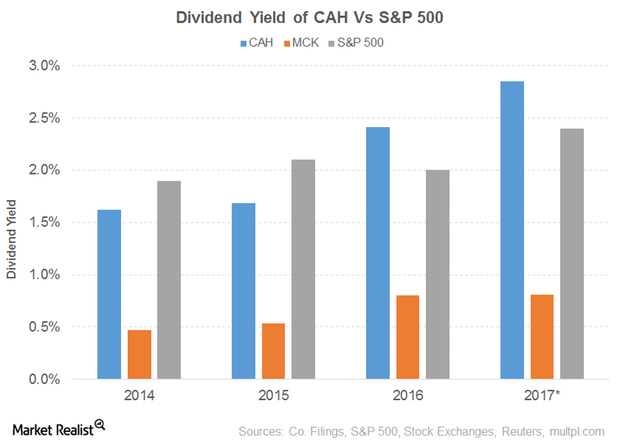

Dividend Yield of Cardinal Health

Cardinal Health’s (CAH) PE ratio of 16.0x compares to a sector average of 20.4x. The dividend yield of 2.9% compares to a sector average of 2.0%.

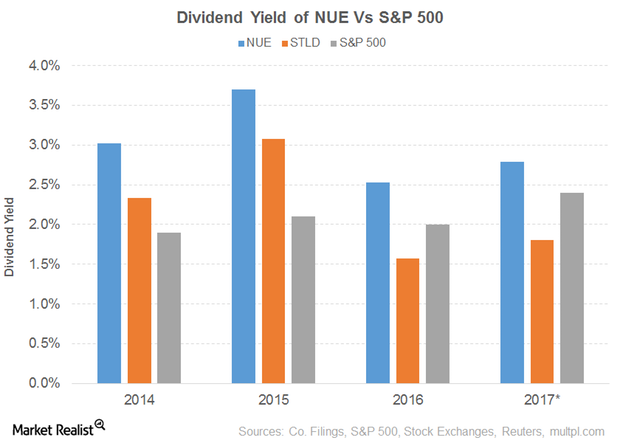

Dividend Yield of Nucor

Nucor’s (NUE) PE ratio of 21.8x is pitted against a sector average of 19.4x. The dividend yield of 1.5% is pitted against a sector average of 1.4%.

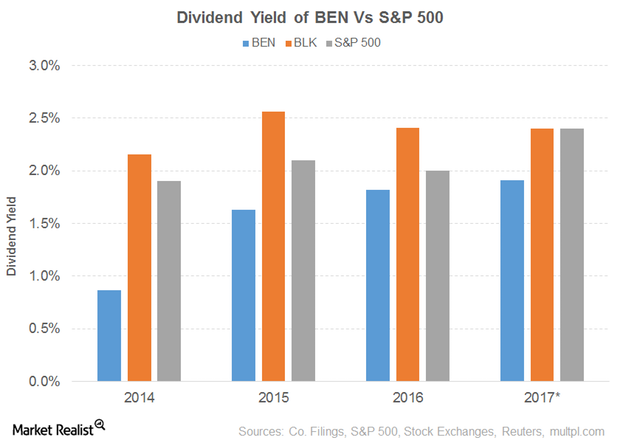

Dividend Yield of Franklin Resources

Franklin Resources (BEN) has recorded consistent growth in dividends since at least March 1982.

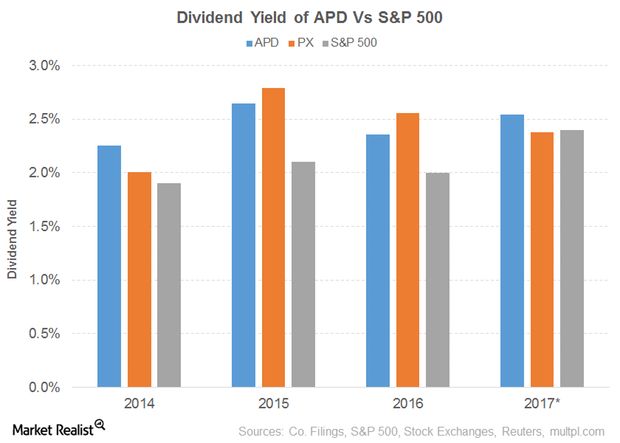

Dividend Yield of Air Products & Chemicals

In this series, we’ll be looking at ten dividend aristocrats with low PE ratios. Dividend aristocrats are S&P 500 stocks that have raised their dividend payouts for at least 25 successive years.

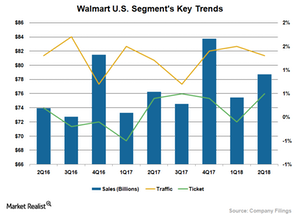

How Walmart Has an Edge Over Competition

As competition heats up in the grocery business, Walmart (WMT) is leveraging its strong retail presence, which gives the company an edge over the competition.

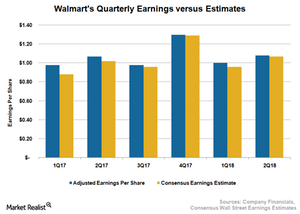

Walmart Beats Fiscal 2Q18 Bottom-Line Analyst Estimates

Walmart (WMT) reported its fiscal 2Q18 results on August 17. Walmart’s adjusted earnings per share of $1.08 beat Wall Street’s estimate and increased 1% year-over-year.

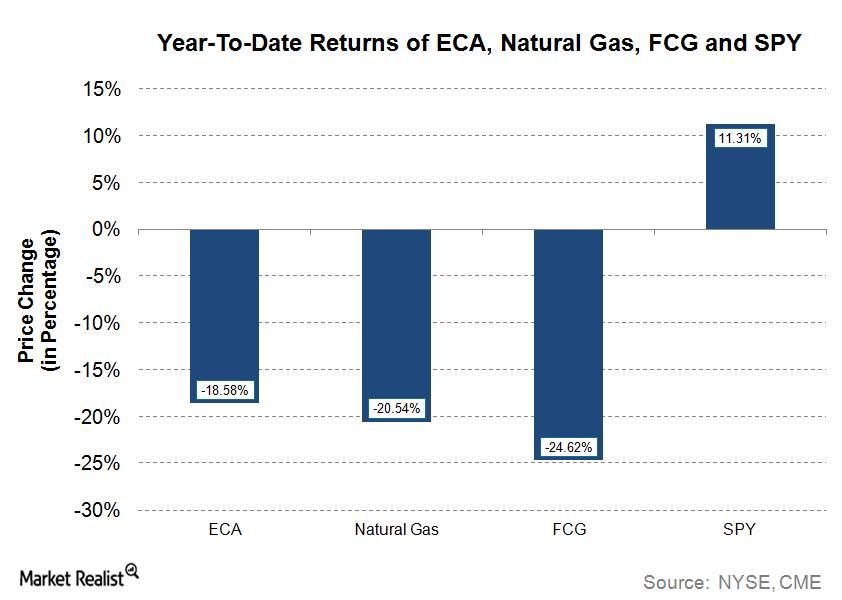

How Encana Stock Has Performed This Year

Year-to-date, Encana’s (ECA) stock has fallen ~19% to $9.53. The stock is trading below its 50-week and 200-week moving averages.

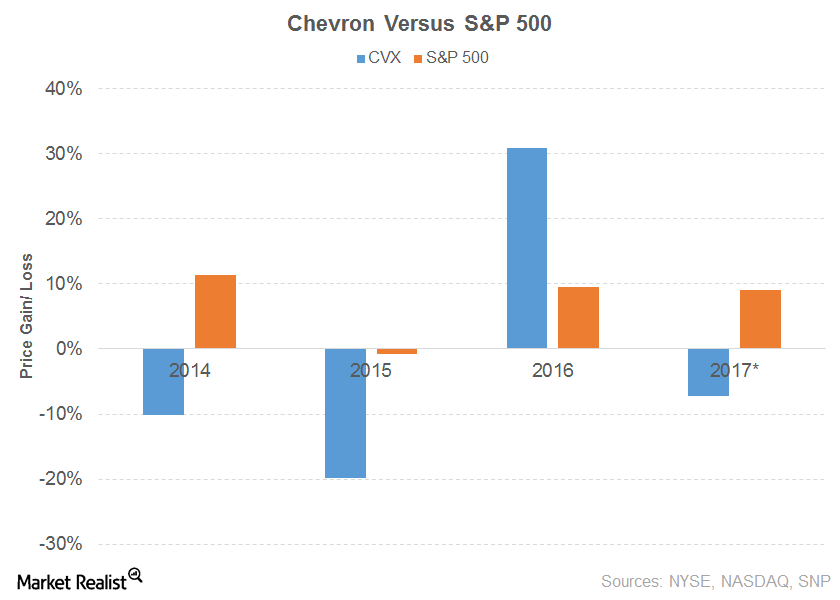

How Good Is Chevron as a Dividend Payer?

Chevron’s (CVX) total sales and other operating revenues for 2016 fell 15.0% due to volatility in commodity prices.

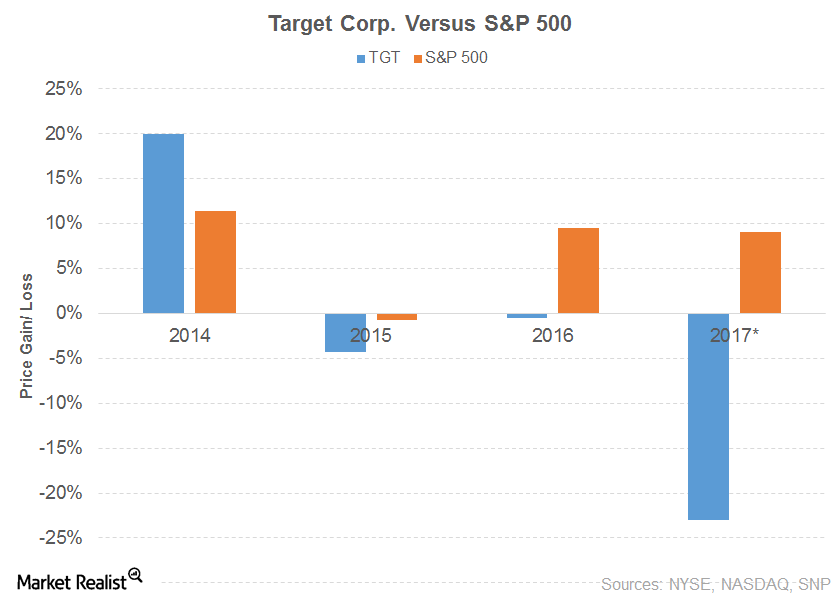

Target’ s Performance as a Dividend Aristocrat

Target’s (TGT) sales for 2016 fell 6.0% due to lower comparable store sales and weak store traffic.

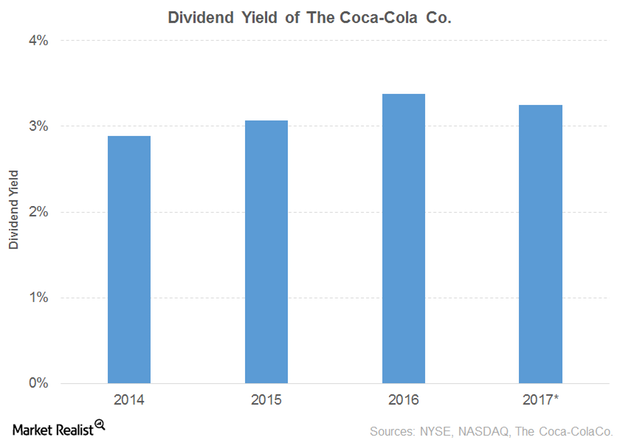

A Look at Coca-Cola’s Dividend Yield

Coca-Cola (KO) recorded a fall of 6.0% in its 2016 net operating revenues due to a decline in its Third Party and Intersegment segments.

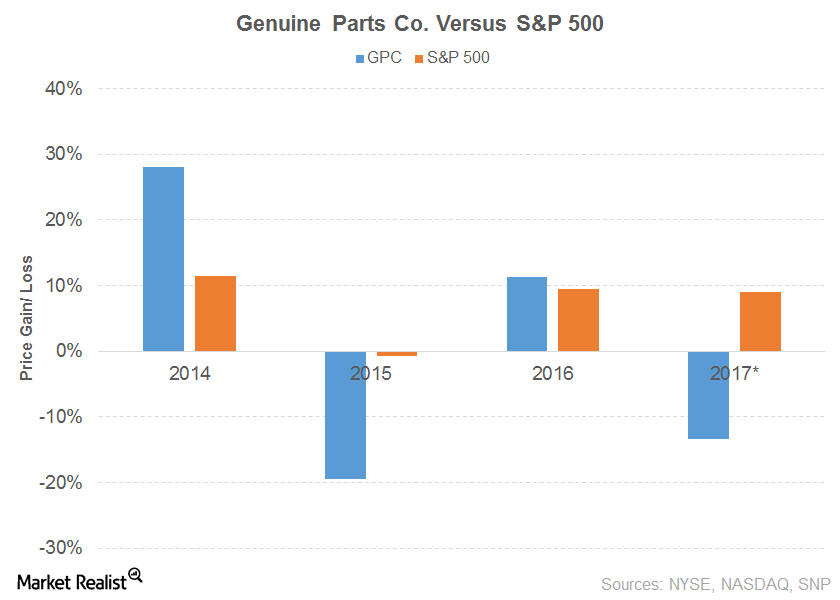

Will Genuine Parts Sustain Its Dividend Yield?

Genuine Parts (GPC) recorded a marginal growth in its 2016 net sales, driven by its Automotive and Office Products segments.

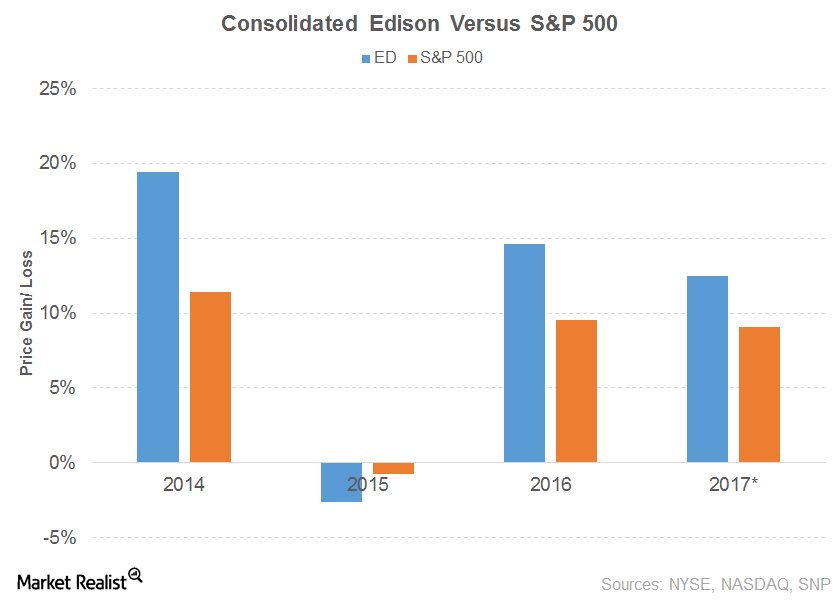

Consolidated Edison’s Dividend Trajectory

Consolidated Edison’s (ED) 2016 operating revenues fell 4.0% due to a decline in every segment; namely, electric, gas, steam, and non-utility.

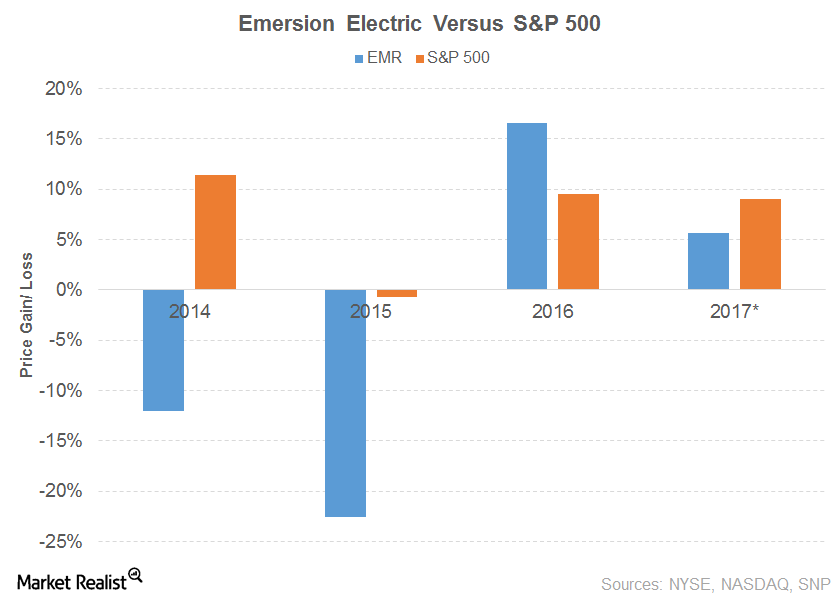

Emersion Electric’s Dividend Woes

Emersion Electric’s (EMR) 2016 net sales fell 11.0% due to a fall in every segment.

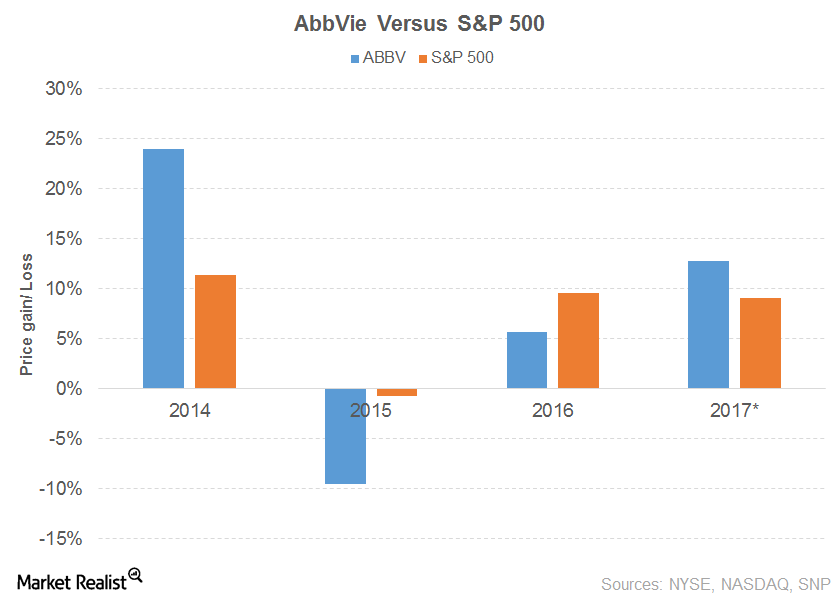

What Does AbbVie’s Dividend Curve Look Like?

AbbVie (ABBV) recorded a 12.0% rise in net revenue for 2016, mainly driven by Humira and Imbruvica.

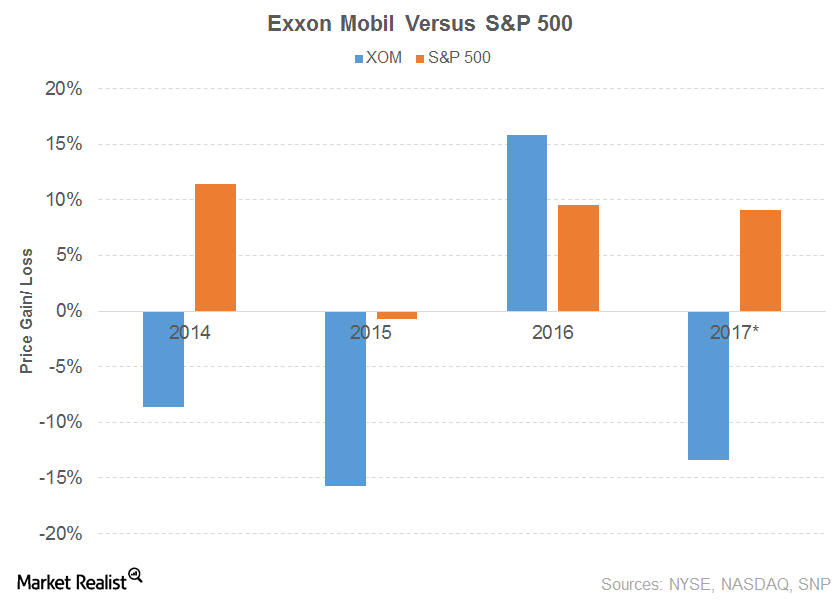

ExxonMobil’s Journey as a Dividend Aristocrat

ExxonMobil’s (XOM) story is similar to Chevron’s. The company’s sales and other operating revenue for 2016 fell 16.0%.

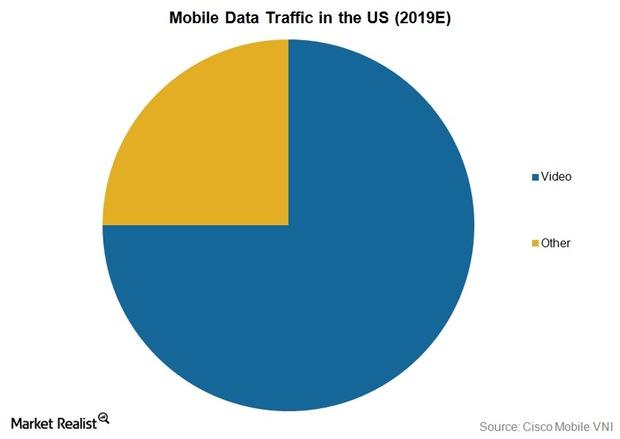

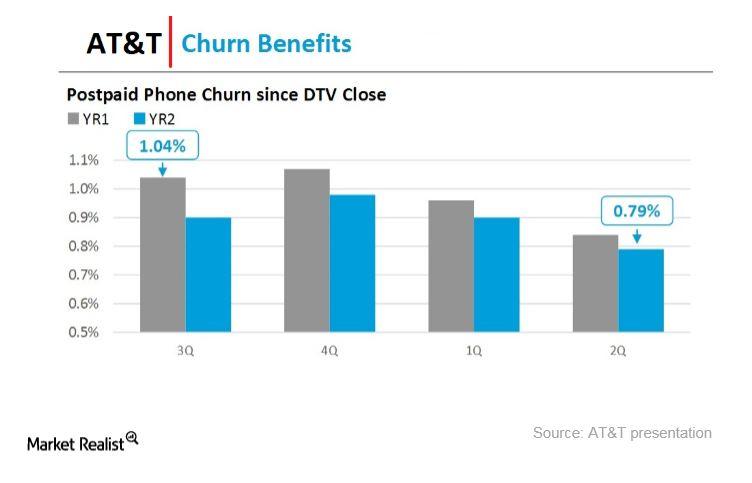

A Look at AT&T’s Customer Retention

AT&T (T) noted that it added 2.8 million net wireless subscribers in 2Q17, up from 2.7 million in 1Q17.

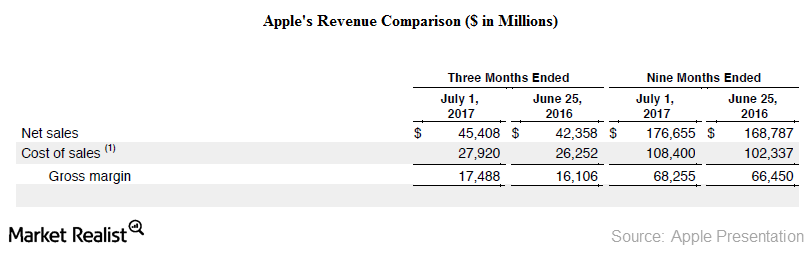

Apple Beat Revenue and Earnings Estimates in Fiscal 3Q17

Apple (AAPL) announced its fiscal 3Q17 results on August 1. Apple reported revenues of $45.4 billion in fiscal 3Q17, a rise of 7% year-over-year.

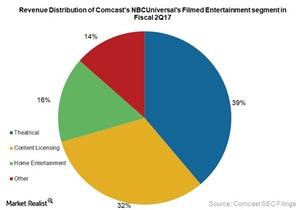

What Drives Success for Comcast’s Universal Studios

Comcast’s franchise-focused strategy In the first part of this series, we looked at how Comcast’s (CMCSA) fiscal 2Q17 results were strongly driven by the company’s filmed entertainment and theme parks businesses. In this part of the series, we’ll look at the key factors that are driving Comcast’s filmed entertainment business. Comcast’s filmed entertainment business is […]

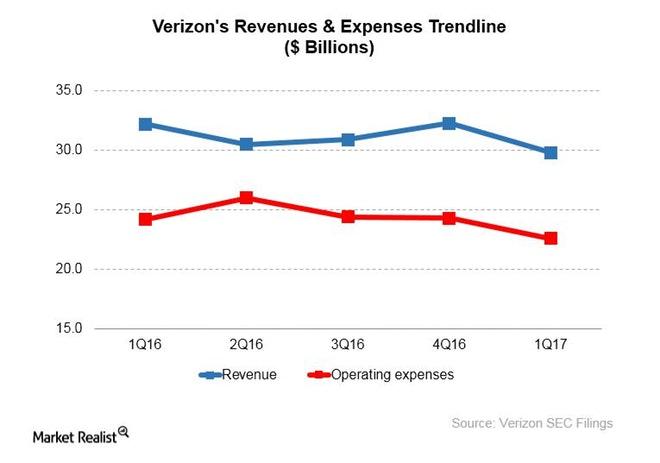

How the Yahoo Acquisition Is Starting to Affect Verizon

On June 13, 2017, Verizon (VZ) sealed the acquisition of Yahoo, marking the end of a deal that was announced in July 2016.

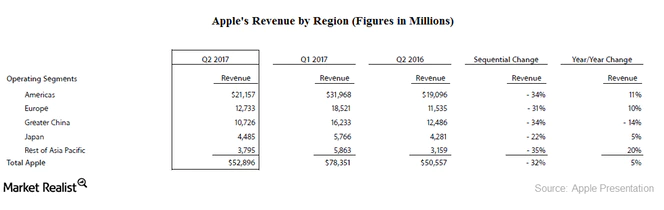

How Will Apple Perform in China in Fiscal 3Q17?

Apple’s (AAPL) revenue in Greater China fell 14% YoY (year-over-year) from $12.5 billion in fiscal 2Q16 to $10.7 billion in fiscal 2Q17.

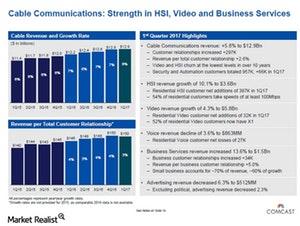

Outlook for Comcast Cable’s High-Speed Internet and Business Services

In May 2017, Comcast introduced its new Wi-Fi gateway, xFi, which offers a personalized Wi-Fi experience to its users.

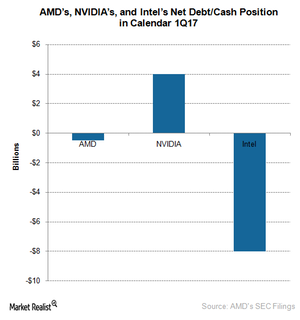

A Look at AMD’s Target Capital Structure

AMD’s target capital structure is to maintain a cash balance of up to $1.0 billion. Any amount above this figure would be used to repay debt, which currently stands at $1.5 billion.

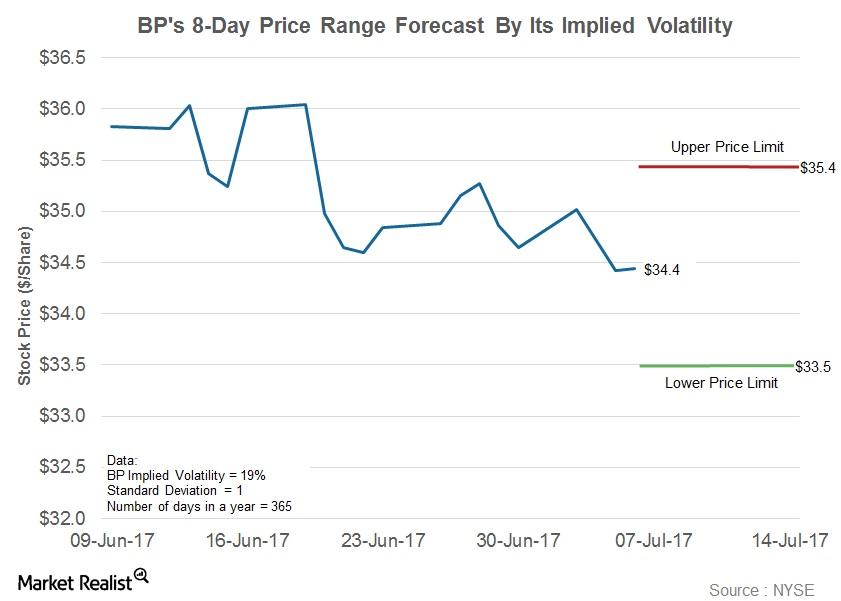

Estimating BP’s Stock Price Using Implied Volatility

What is implied volatility? Volatility gauges changes in a stock’s return over a period. When estimated based on historical stock prices, it is called historical volatility. We can estimate the future volatility, or implied volatility, of security using an option pricing model. A high implied volatility would indicate that a stock price is expected to move […]

AMD’s Ryzen Threadripper Challenges Intel in the Ultra-Premium PC Market

In response to AMD’s Threadripper, Intel announced an 18-core, 36-thread i9 processor for the very high-end market at the Computex Taipei show in Taiwan.Macroeconomic Analysis Germany’s Rising Manufacturing: A Change in Sentiment

According to data provided by Markit Economics, the final Markit Germany manufacturing PMI (purchasing managers’ index) stood at 59.6 in June 2017 compared to 59.5 in May.

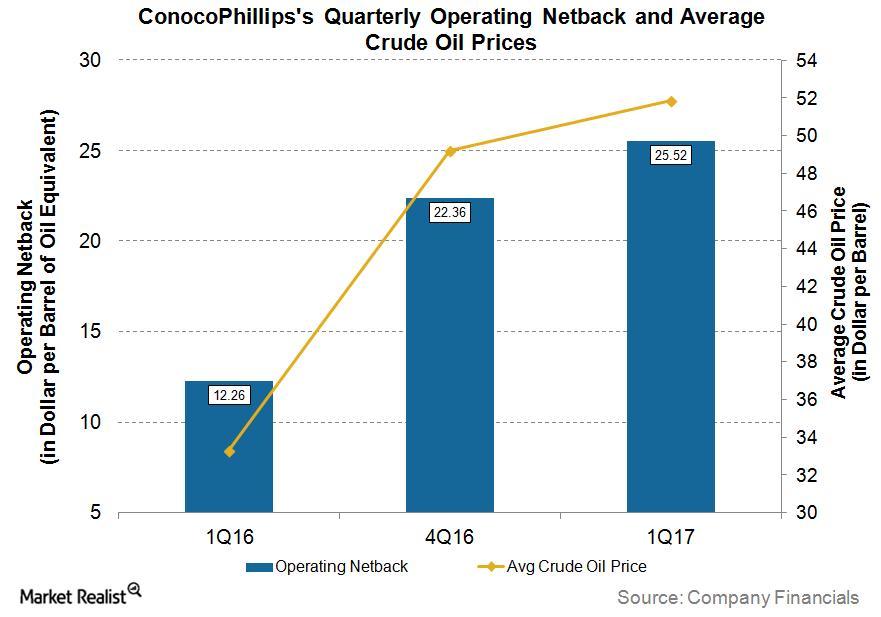

Chart in Focus: ConocoPhillips’s Operating Netback

What is the operating netback? The operating netback (also referred as production netback) is oil and gas revenue realized per boe (barrel of oil equivalent) after all costs to bring one boe to the market are subtracted from the realized price. The operating netback is derived by subtracting production expenses (or field operating expenses), production taxes, […]

Why China Is Becoming an Important Market for Disney

Popularity of English-language content in China Media companies in the United States (SPY) are increasingly looking at the Chinese (FXI) market as Hollywood movies become popular there. However, there have also been concerns about box office success in the country. On June 27, The Wall Street Journal reported, citing an unknown source, that the six […]

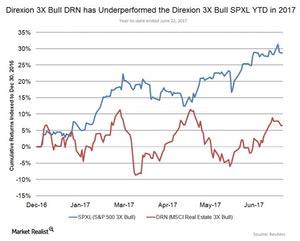

Will the Real Estate Sector Shine Thrive this Summer?

Another important summer activity is shopping for a new home. Realtors often talk of curb appeal, and there’s no better time than summer.

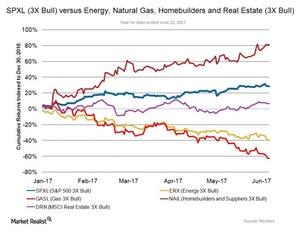

Interesting Options for Summer Investments

Summer is finally here after only nine months of waiting. Now might be a good time to look at investments that have to do with the summer months.

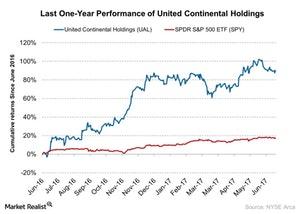

Why Barclays Thinks UAL Earnings Could Improve

UAL is currently trading at $76. Its 52-week high is $83.04, and its 52-week low is $37.64.

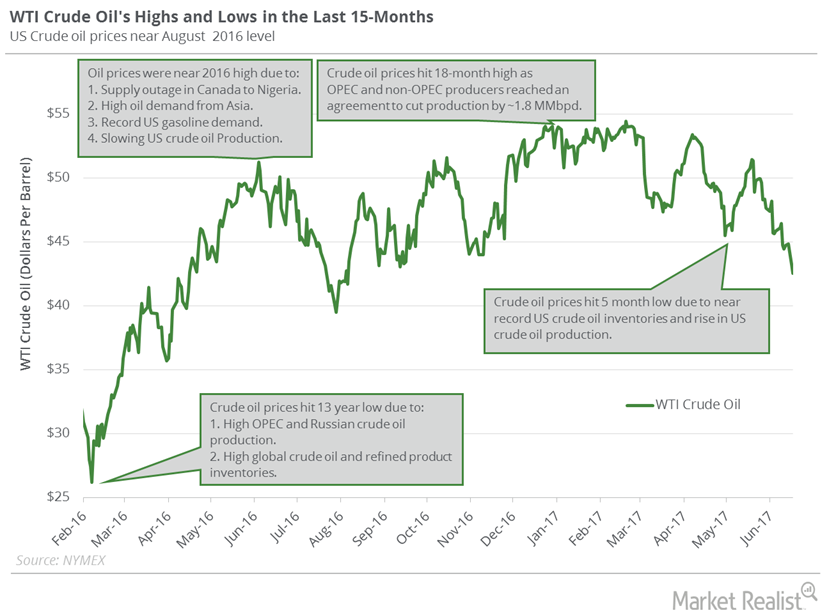

US Crude Oil Prices Could Be Range Bound Next Week

August WTI (West Texas Intermediate) crude oil (XOP) (VDE) (RYE) futures contracts rose 0.5% and closed at $42.74 per barrel on June 22, 2017.

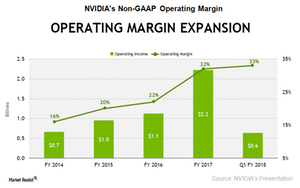

How Is Software Related to NVIDIA’s Operating Margin?

NVIDIA’s operating margin of 33% surpassed Intel’s (INTC) operating margin of 26% in 1Q17.

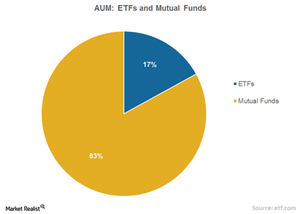

Why ETFs Are Seeing Increased Popularity

Mutual fund ownership of equities is at the lowest level in ~13 years, while ETFs (SPY) (IVV) are gradually increasing their share in the stock market.