S&P500 Index

Latest S&P500 Index News and Updates

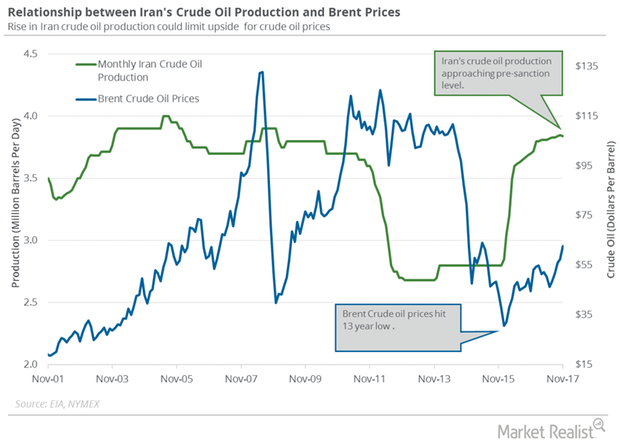

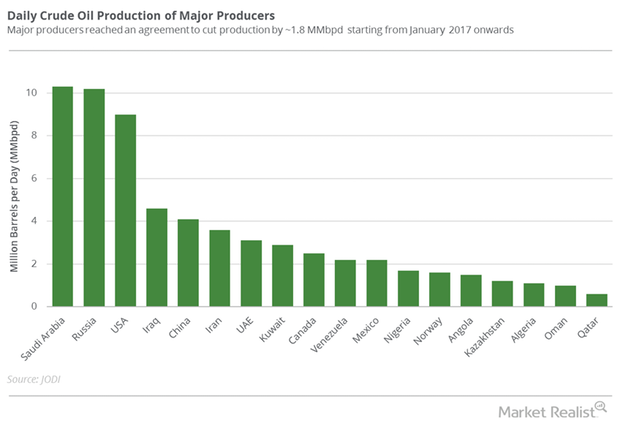

Crude Oil Prices Rise: Is It Time for a Collapse?

WTI crude oil prices have risen 9.4% since June 21, 2017. Brent and US crude oil prices are near a three-week high.

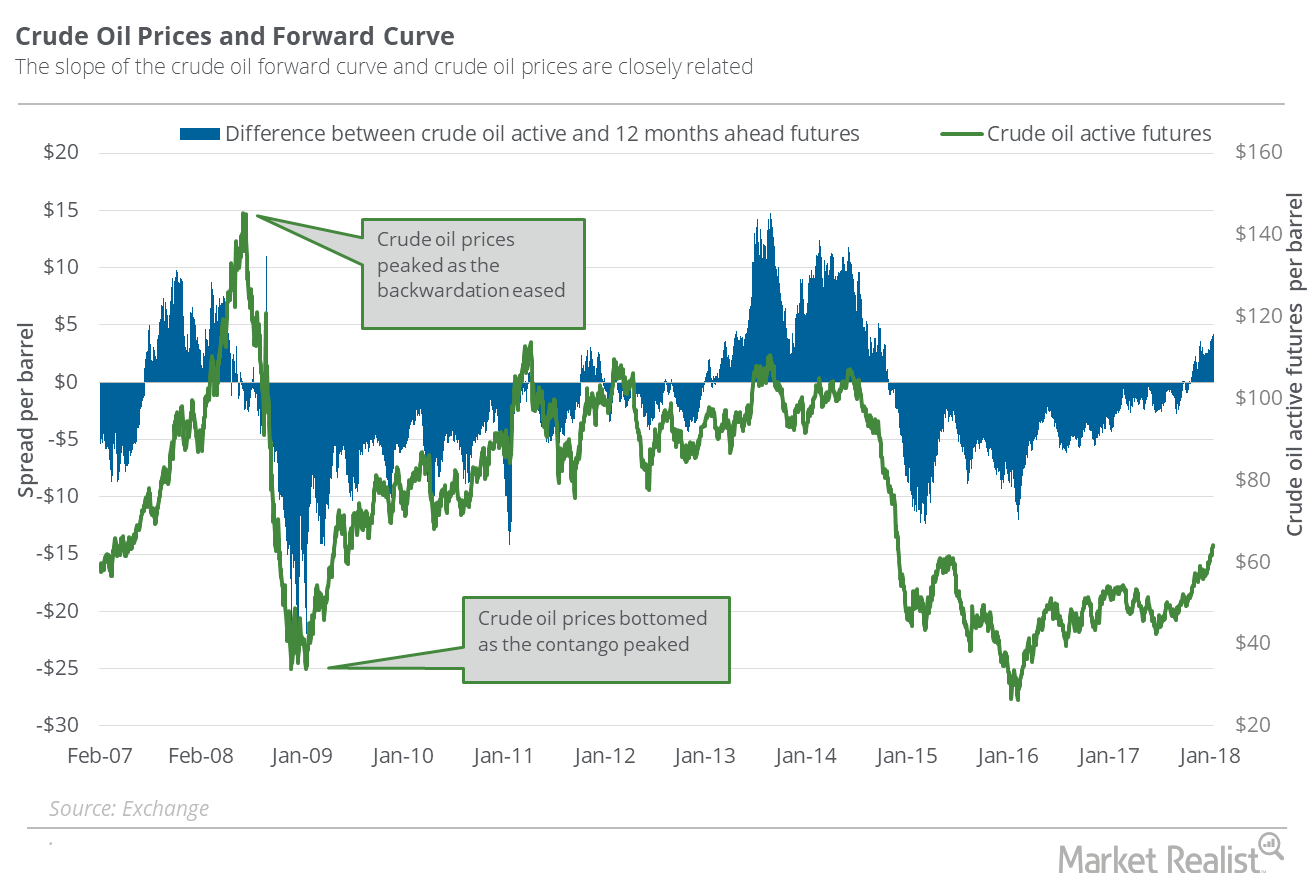

Oil Market Could Be Pricing in a Supply Deficit

The rise in the premium, along with the rise in oil prices in the trailing week, could mean that the market expects a supply deficit in the oil market.

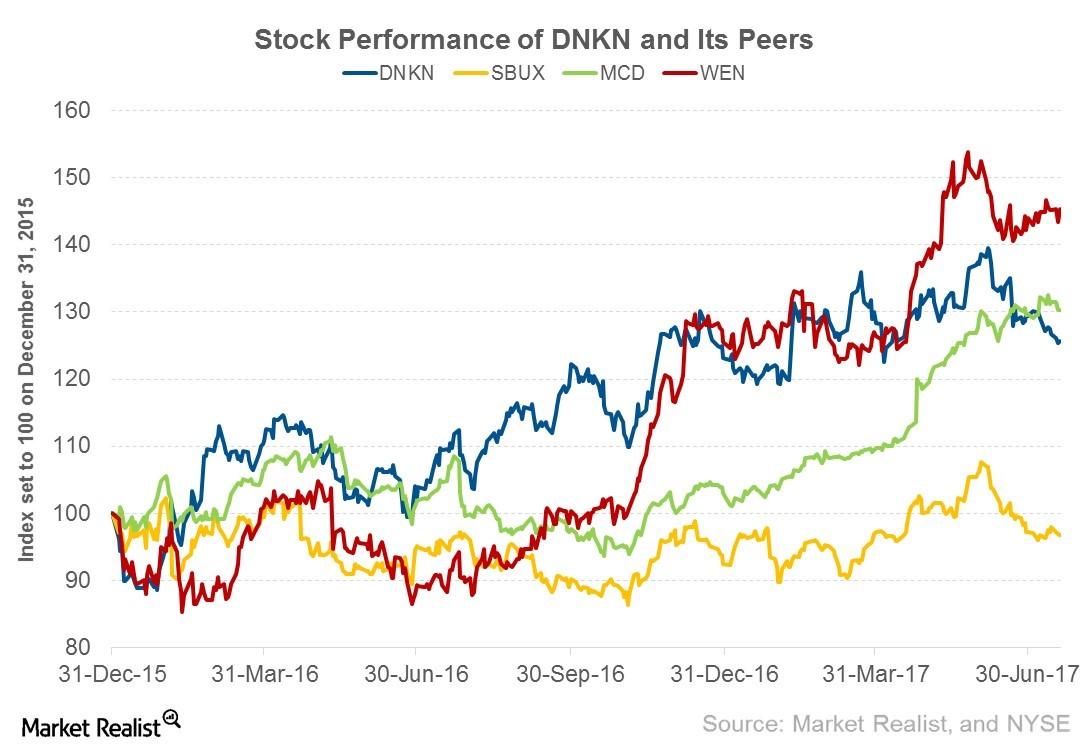

What’s Behind the Decline in Starbucks Stock Price

After posting its fiscal 2Q17 earnings on April 27, 2017, Starbucks (SBUX) stock rose 5.3% to reach $64.57 on June 2, 2017. The aggressive expansion plans in the CAP (China and Asia-Pacific) region and its implementation of technological advancements led Starbucks stock price to rise. However, since then, the stock has seen downward momentum.

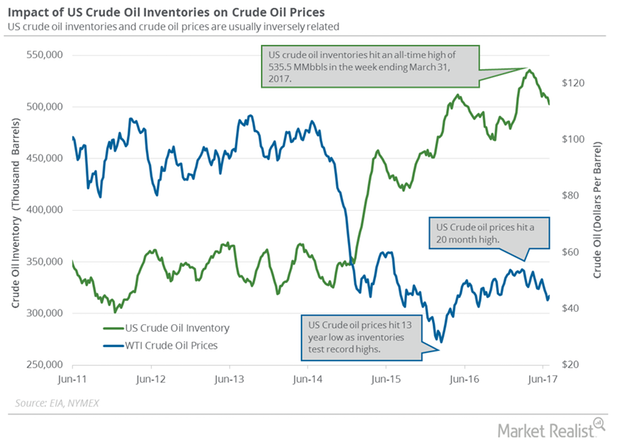

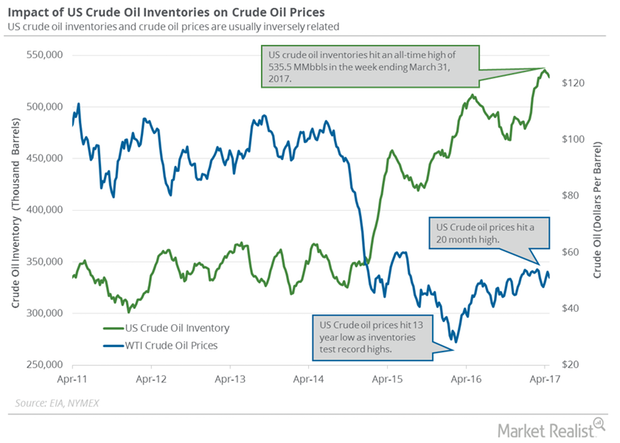

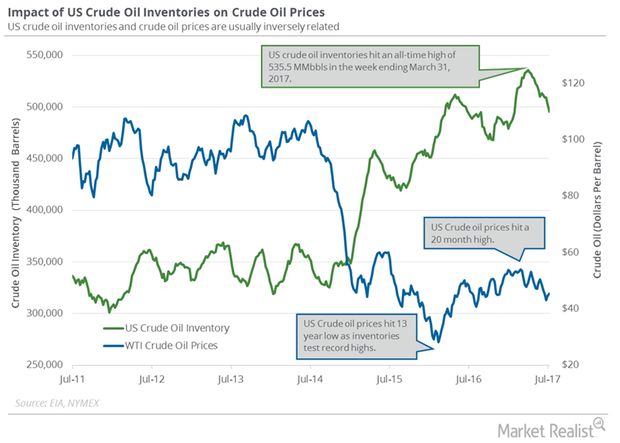

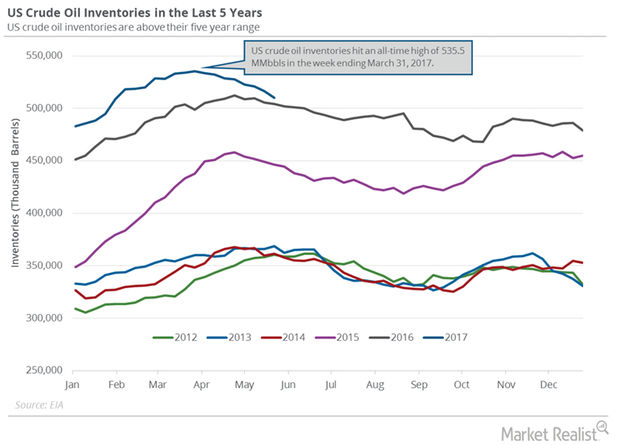

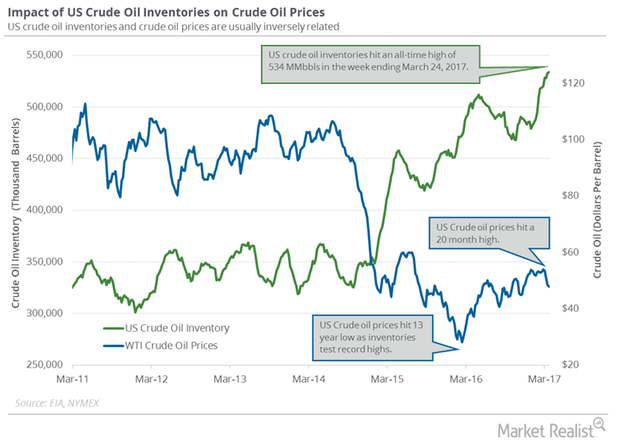

Near-Record US Crude Oil Inventory: Will Oil Blood Bath Continue?

June WTI crude oil futures contracts fell 0.40% and were trading at $48.68 per barrel in electronic trade at 2:35 AM EST on May 2, 2017.

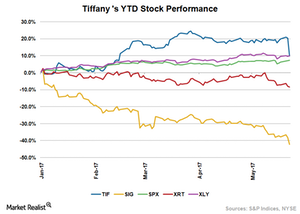

Why Tiffany Stock Plunged

Tiffany (TIF) disappointed investors with its comparable-store sales numbers in 1Q17. After results were announced, the company’s stock plunged ~9%.

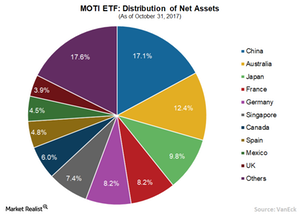

Expanding Investors’ Reach to Global Markets

Building on the success and popularity of VanEck Vectors® Morningstar Wide Moat ETF (MOAT®) and its underlying index’s approach to investing in the U.S., VanEck launched MOTI in 2015 to expand investor access to Morningstar’s core equity research in the international arena.

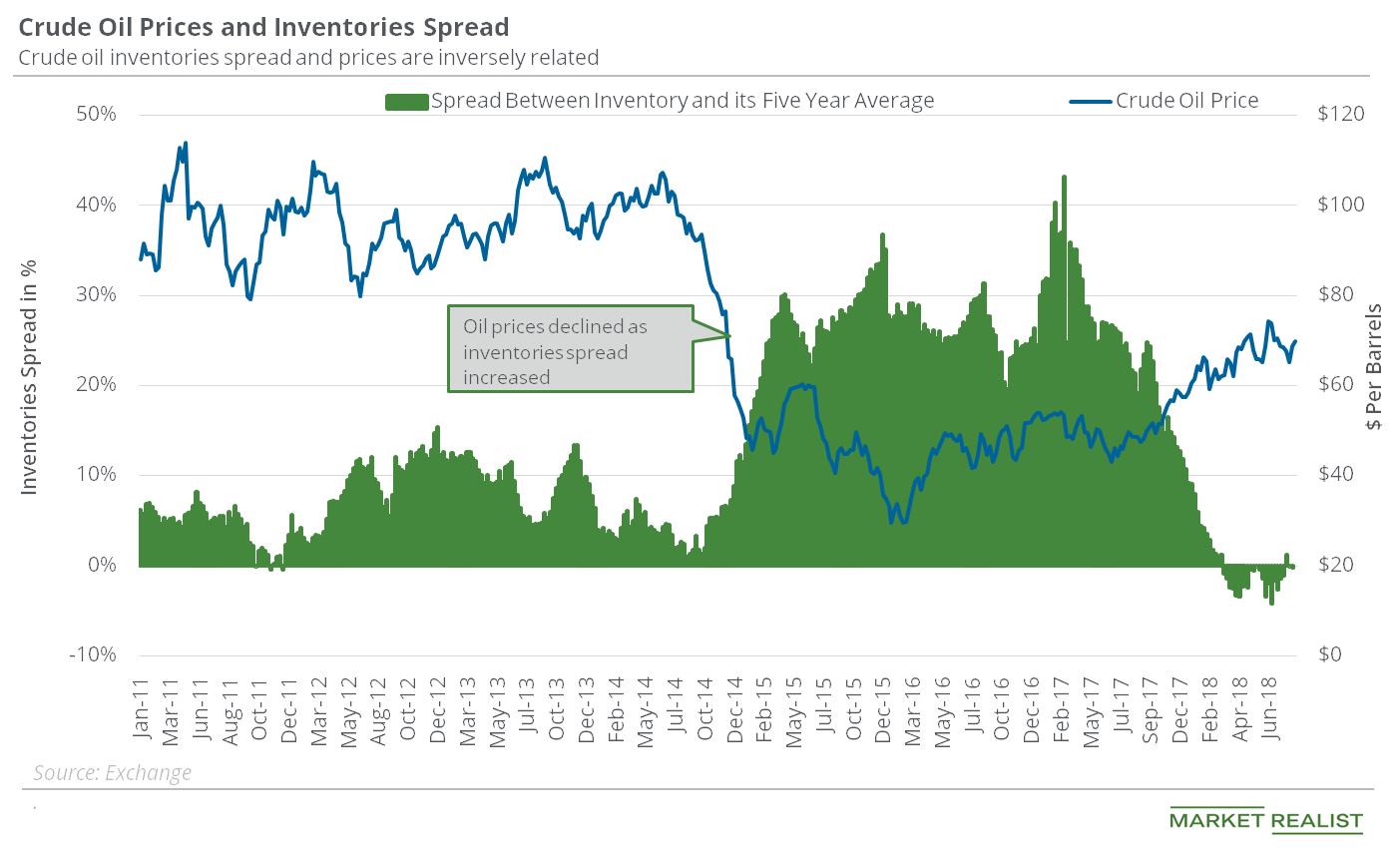

Why Inventory Data Might Boost Oil Prices

In the week ended August 31, 2018, US crude oil inventories were almost on par with their five-year average.

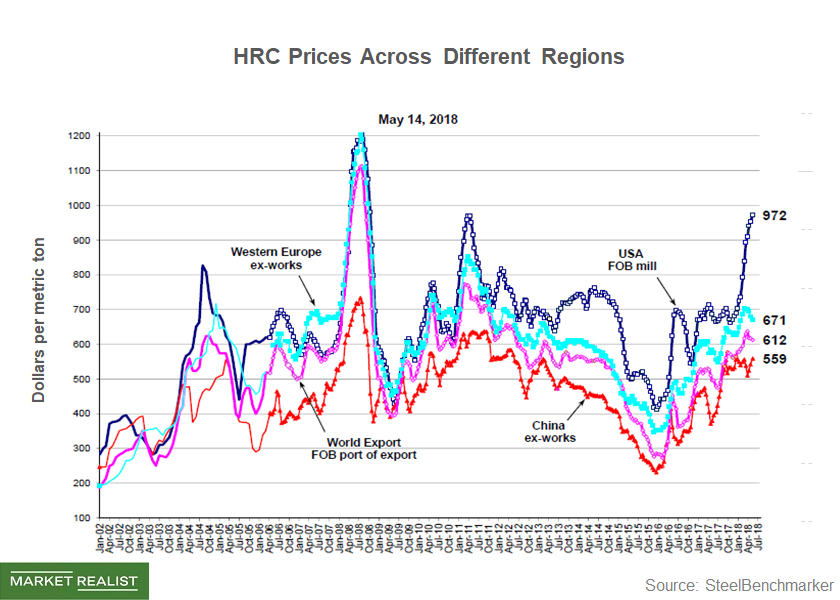

Is President Trump Robbing Peter to Pay Paul?

While higher steel prices benefit US steel producers, they raise input costs for downstream manufacturers.

Will Dunkin’ Brands’ 2Q17 Earnings Boost Its Stock Price?

Dunkin’ Brands, the owner of the Dunkin’ Donuts and Baskin-Robbins brands, is scheduled to announce its 2Q17 earnings before the market opens on July 27, 2017.

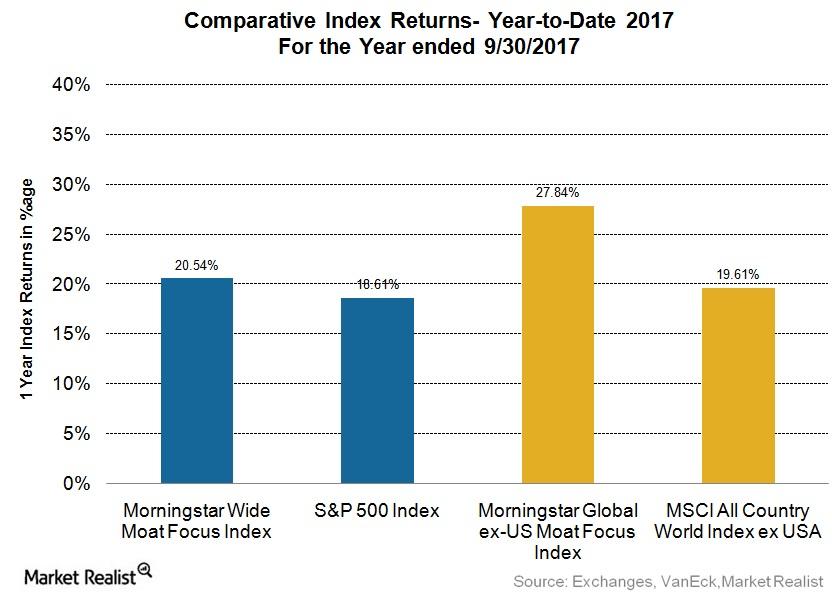

How Moat Indexes Performed in September

The US Moat Index has been performing fairly well this year. As of September 30, 2017, it has outperformed, rising 20.5% over the S&P 500 Index’s (SPY) (SPX-INDEX) rise of 18.6% YTD.

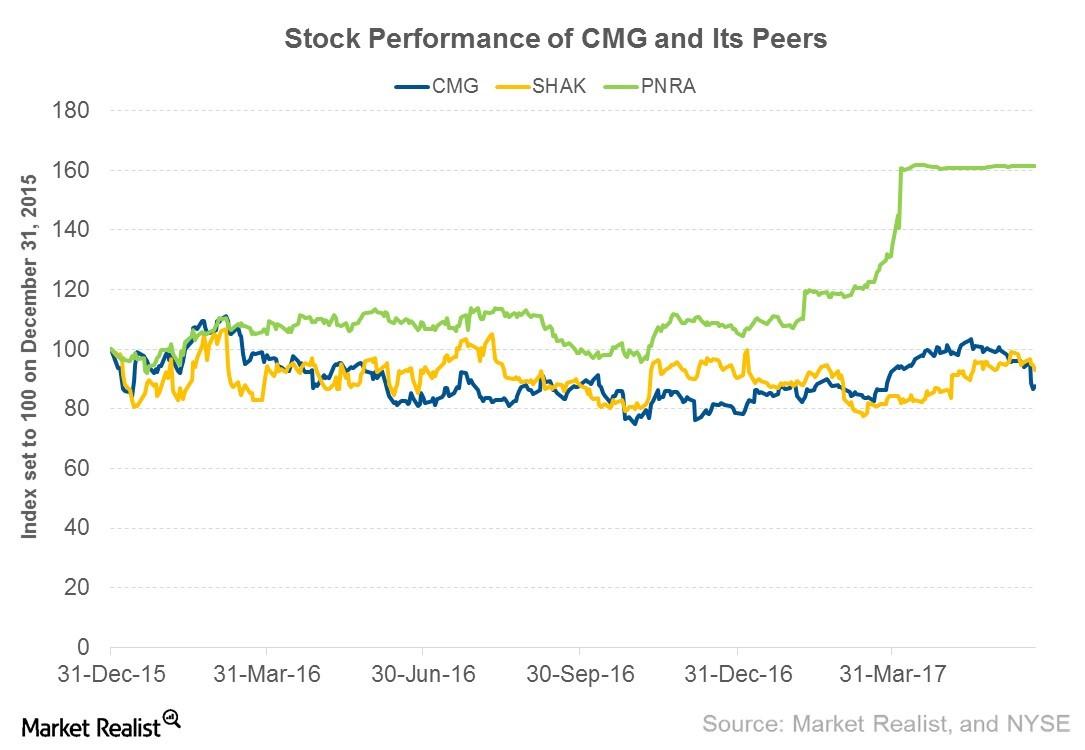

Has Chipotle’s Stock Price Bottomed Out?

After posting better 1Q17 earnings on April 25, Chipotle’s stock price rose to $496.14 by May 16, 2017. Since then, it has experienced downward momentum.

Supply, Demand: Will Crude Oil Futures Rally Be Short-Lived?

August WTI (West Texas Intermediate) crude oil futures contracts rose 1.0% and closed at $45.49 per barrel on Wednesday, July 12, 2017.

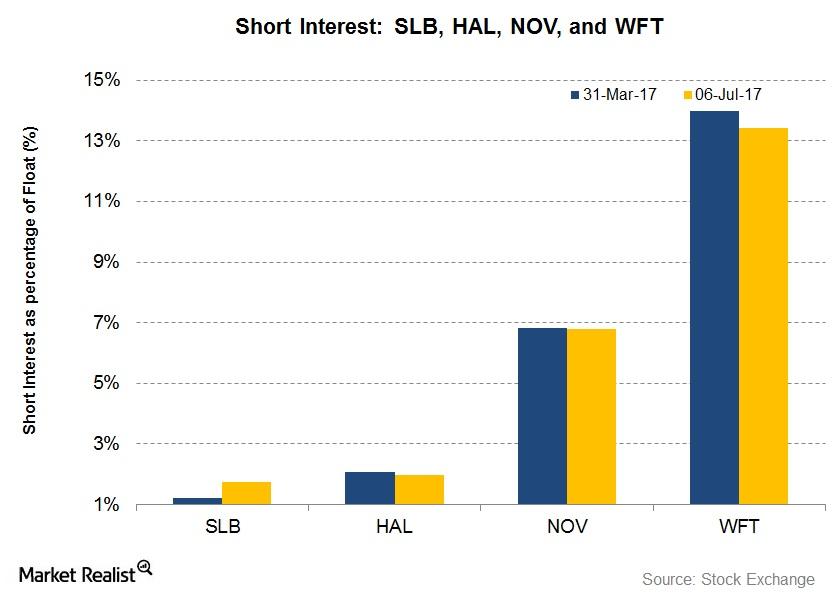

What’s the Short Interest in Large OFS Companies on July 6?

Short interest in Schlumberger (SLB) as a percentage of its float is 1.2% as of July 6, 2017, compared to 1.2% as of March 31, 2017.

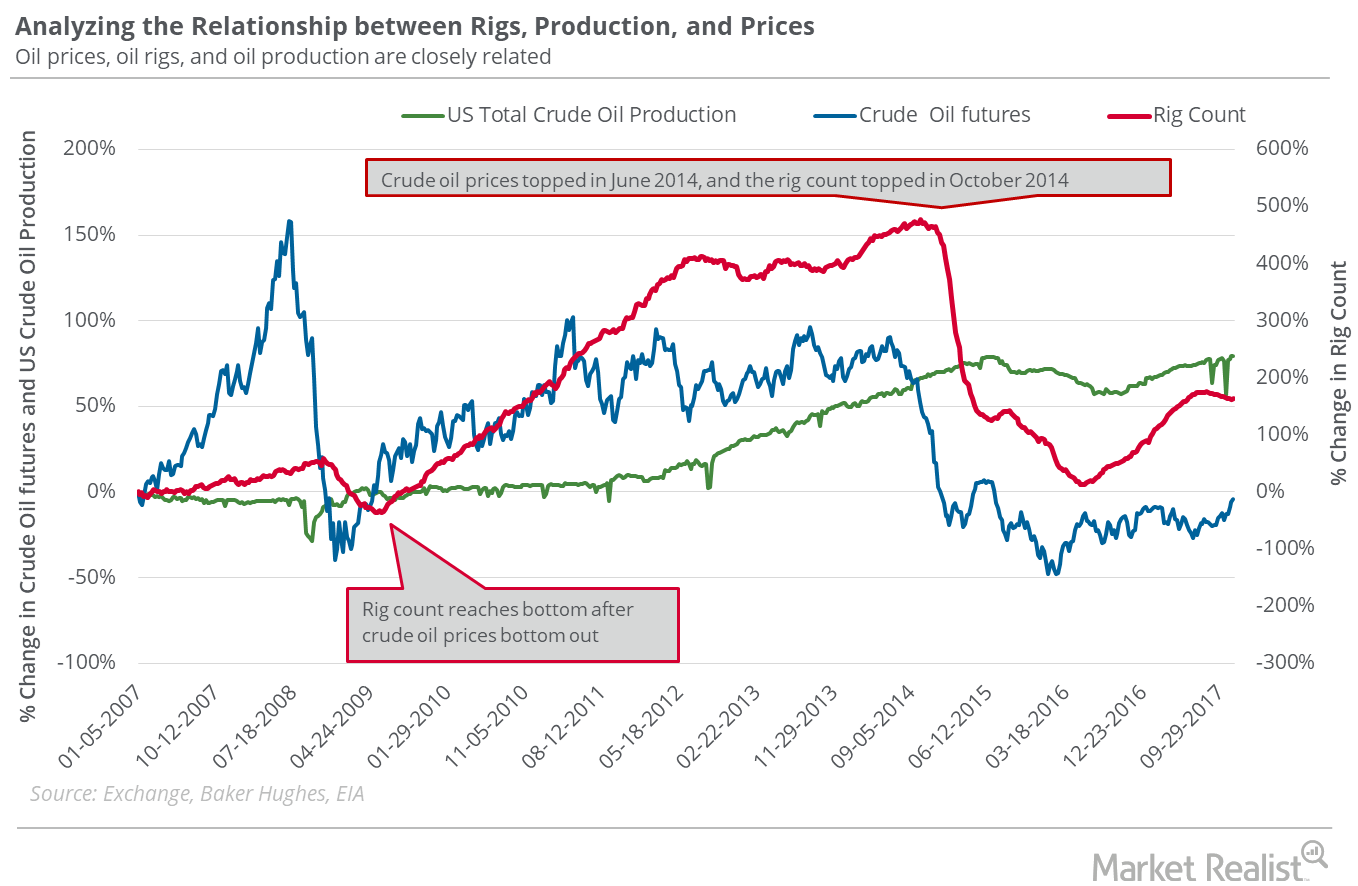

Bullish Oil Traders Must Count the Oil Rigs

On November 24, 2017, US crude oil settled at the highest closing price in 2017. The oil rig count could be at a three-year high by May 2018.

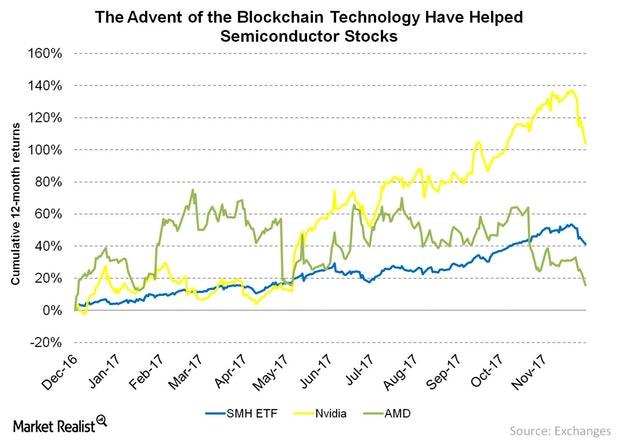

Semiconductor Stocks Have Soared on Blockchain Technology

Despite recent declines, the SMH ETF has risen over 41% in the last 12 months. Meanwhile, NVIDIA has risen a whopping 186.7% in the same period, while AMD has returned 15.5% in that period.

Is It Worth Risking Long Trades in Oil?

On November 24–December 1, 2017, US crude oil (USO) (USL) January futures fell 1%. On December 1, US crude oil January futures closed at $58.36 per barrel.

What’s Holding US Crude Oil below $60?

On December 11, US crude oil January 2018 futures rose 1.1%. The 2% rise in Brent crude oil prices could have supported the gain in US crude oil prices.

What to Watch when Oil’s at a 3-Year High

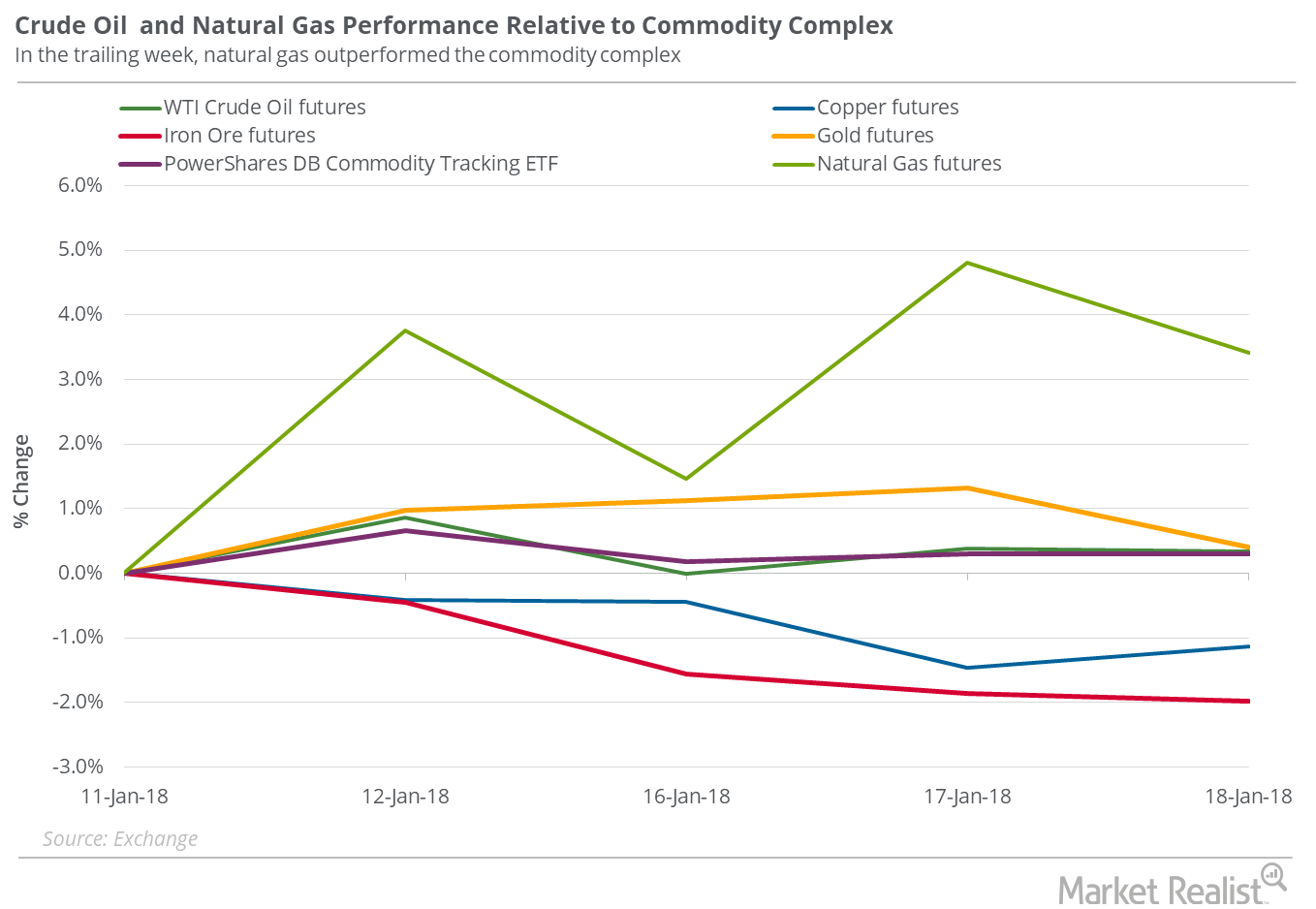

From January 5 to January 12, 2018, US crude oil February futures rose 4.7%. On January 12, US crude oil futures closed at $64.3 per barrel, their highest closing price since December 8, 2014.

Why Oil Prices Have Been Relatively Flat

On January 18, 2018, US crude oil (USO) (USL) March 2018 futures were almost unchanged at $63.89 per barrel.

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

US Crude Oil Inventories: Lower than the Market’s Expectation

The EIA reported that US crude oil inventories fell by 6.4 MMbbls (million barrels) to 509.9 MMbbls on May 19–26, 2017.

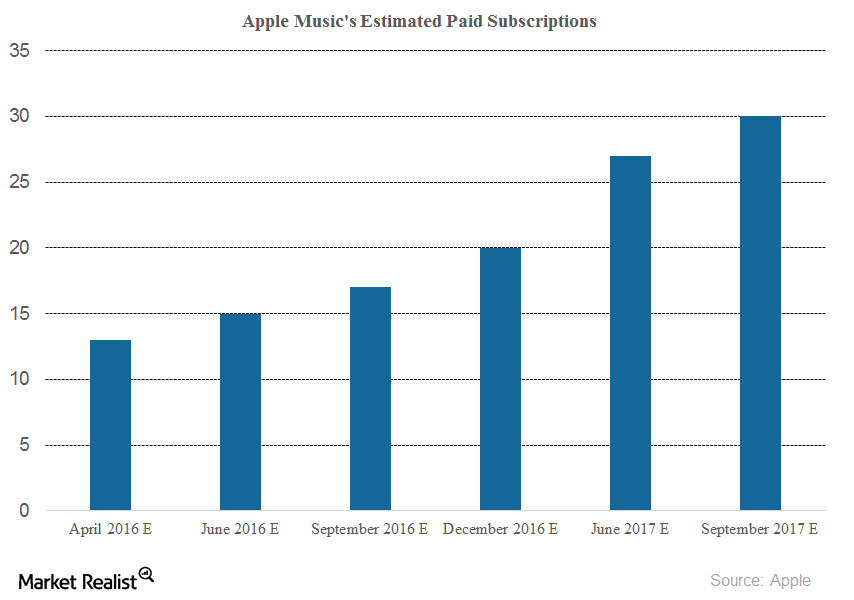

Understanding Apple Music’s Rising Subscriber Base

Last month, Apple (AAPL) announced that its music streaming service, Apple Music, now has over 30 million subscribers—up from 27 million in June 2017.

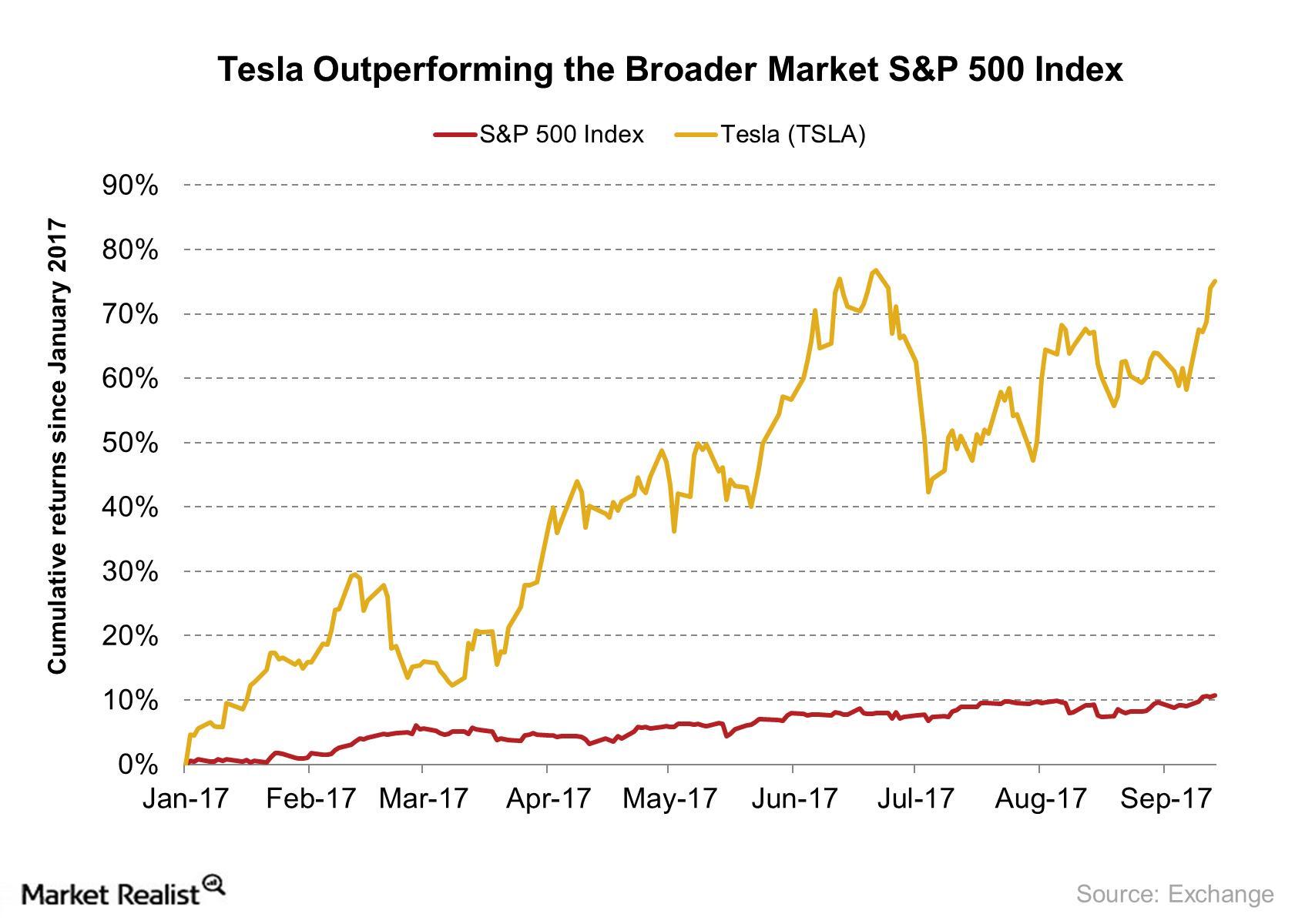

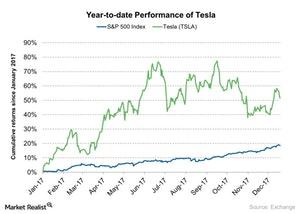

Why Jim Chanos Is Continuing His Short Position in Tesla

Jim Chanos, the billionaire investor and a well-known short seller in the hedge fund industry, said at the Delivering Alpha Conference on Tuesday, September 12, 2017, that he is continuing his short position in Tesla (TSLA).

Will Crude Oil Prices Hit a New High?

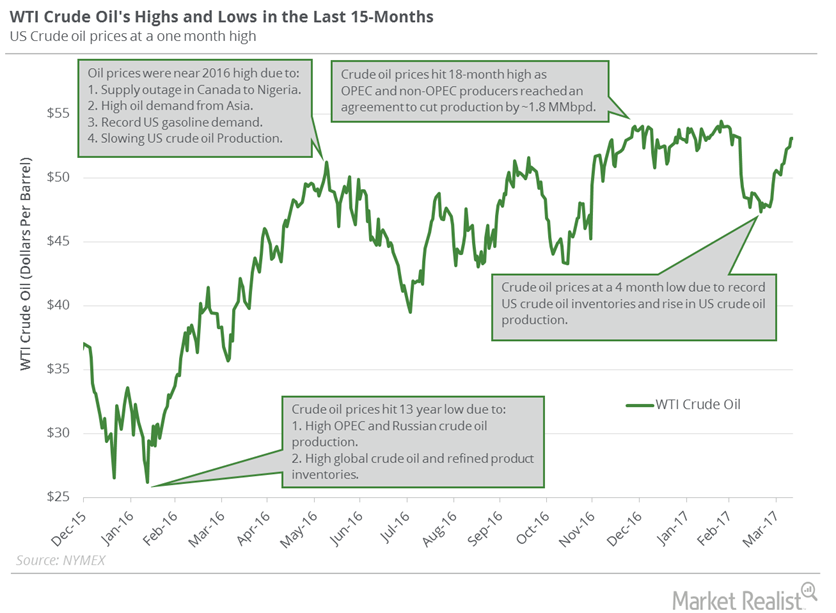

US WTI crude oil prices were at $54.45 per barrel on February 23—the highest level since June 2015. As of April 10, prices were 2.5% below their high.

Crude Oil and Product Inventories Impact Crude Oil Futures

US crude oil futures have risen 6% from the ten-month low on June 21, 2017. Futures have also risen 2% in the last month.

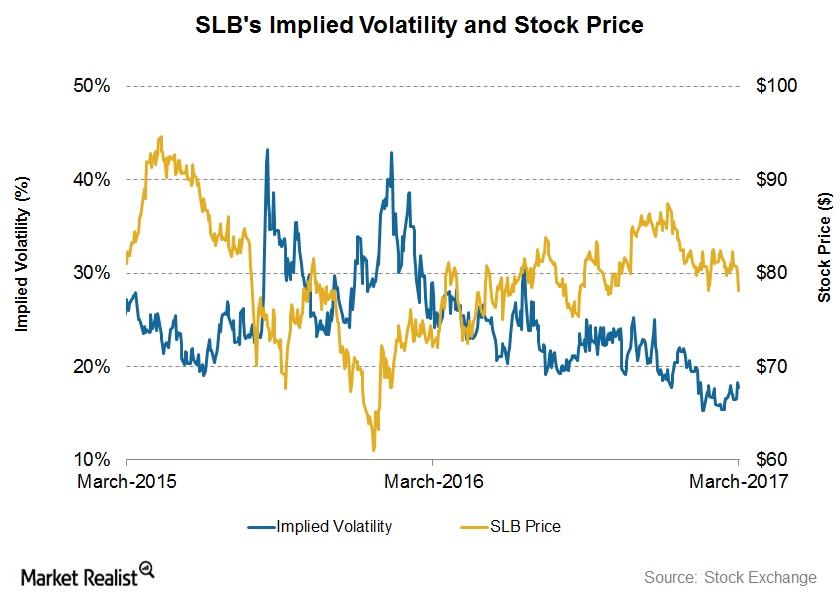

Schlumberger by Implication: Reading Implied Volatility

On March 10, 2017, Schlumberger’s (SLB) implied volatility was 17.7%, having fallen from 19% since its 4Q16 financial results were announced on January 20.

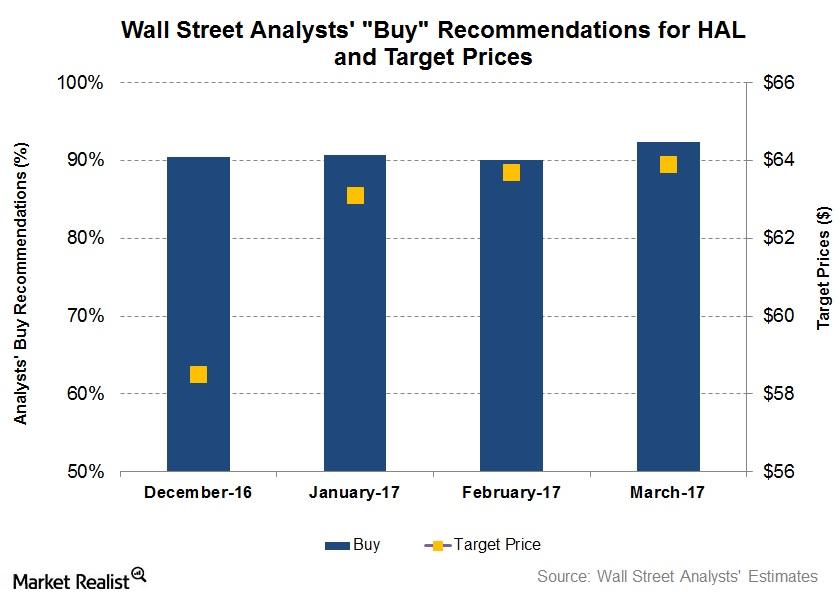

What Do Analysts Recommend for Halliburton?

On March 24, 92% of the analysts tracking Halliburton rated it as a “buy,” ~5% rated it as a “hold,” and 3% rated it as a “sell.”

Oil: Famous Recession Indicator Might Be a Concern

On January 2, US crude oil active futures settled at $46.54 per barrel—2.5% higher than the last closing level due to short covering.

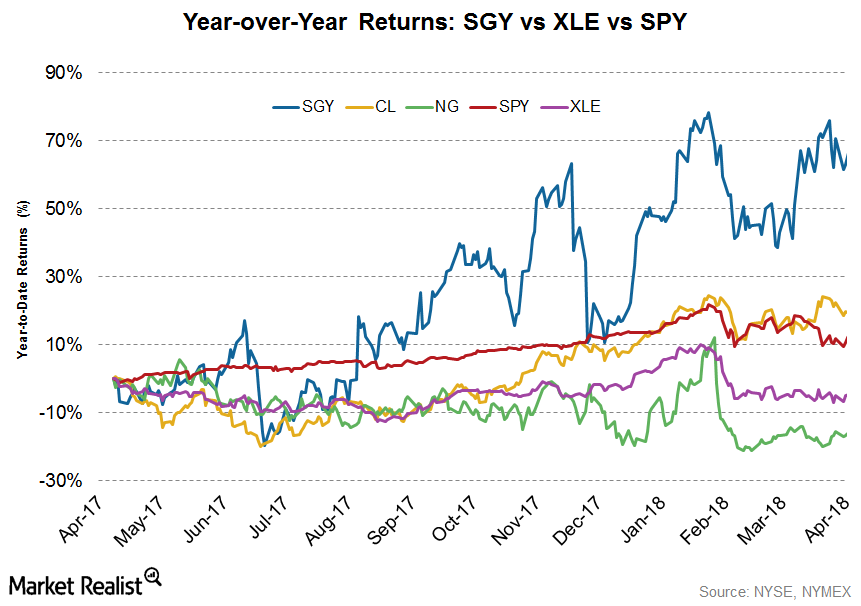

Stone Energy’s Stock Performance in 2018

Stone Energy stock has increased the most among our top five companies. Stone Energy stock has risen 60% YoY (year-over-year).

Jim Chanos on Tesla: ‘We Think the Equity Is Worthless’

Jim Chanos, a prominent short seller, discussed his view on Tesla in a recent interview with CNBC. He has a short bet on Tesla (TSLA) and said, “we think the equity is worthless.”

Why Oil Prices Could Move Higher

On January 12, 2018, US crude oil (USO) (USL) February 2018 futures gained 0.8% and settled at $64.3 per barrel—a three-year high.

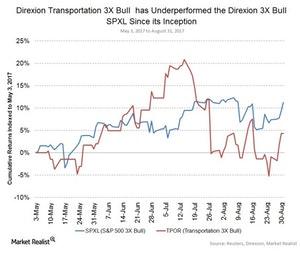

What to Expect from Transportation Stocks This Fall

The airline industry has maintained its stellar performance in the last five years.

Energy Sector and Crude Oil Prices Helped the S&P 500

The S&P 500 rose ~0.7% to 2,733.01 on May 21 due to the rise in industrial stocks and crude oil prices—the highest level in more than two months.

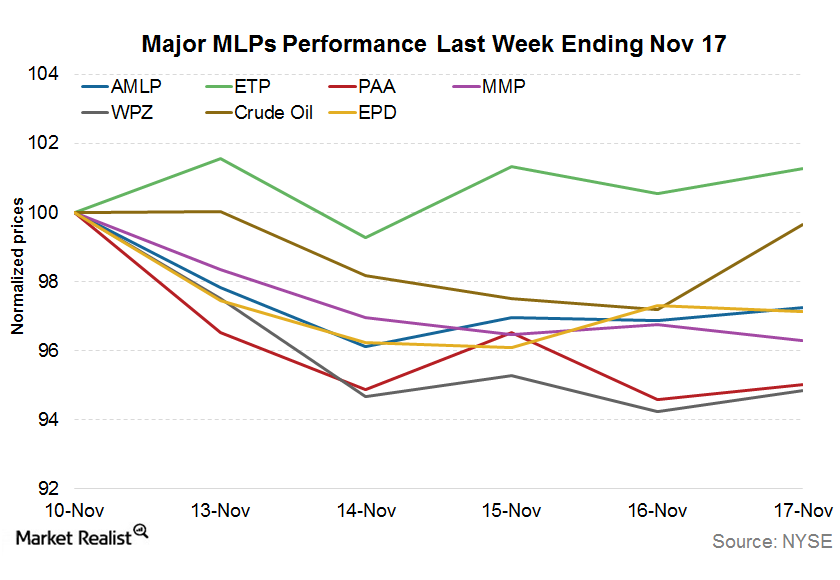

Why MLPs Saw a New 52-Week Low Last Week

MLPs went through some carnage last week. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, saw a new 52-week low of 258.45.

Will the OPEC and Non-OPEC Meeting Drive Crude Oil Futures?

September WTI (West Texas Intermediate) crude oil (RYE) (VDE) (UCO) futures contracts rose 1.1% to $49.58 per barrel on August 4, 2017.

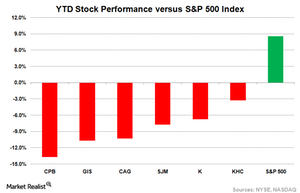

Why Food Stocks Aren’t Cooking

So far this year, food stocks have largely disappointed investors, and the outlook for the rest of the year appears no better. Stock prices for food manufacturers have been on a downtrend, underperforming the S&P 500 Index (SPX-INDEX) on a YTD (year-to-date) basis, as the graph below shows. As of July 3, Campbell Soup (CPB), General Mills (GIS), Conagra Brands (CAG), J. M. Smucker (SJM), Kellogg (K), and Kraft Heinz (KHC) have fallen 13.7%, 10.7%, 10.2%, 7.7%, 6.7%, and 3.3%, respectively, YTD. The S&P 500 Index has returned 8.5% during the same period.

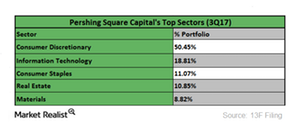

These Were Bill Ackman’s Largest Sector Holdings in 3Q17

Pershing Square Capital Management’s top sectors in 3Q17 were consumer discretionary (XLY), information technology (XLK), consumer staples (XLP), real estate (IYR), and materials (XLB).

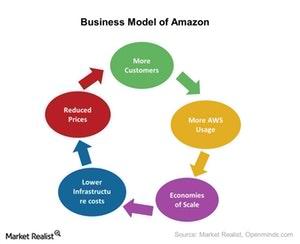

What Bill Miller Thinks about Amazon’s Business Model

Whole Foods Market (WFM) has returned nearly 40% on a year-to-date basis as of June 20, 2017.

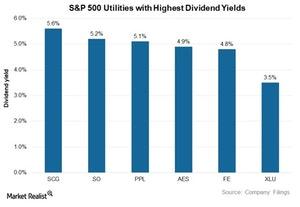

These 5 S&P 500 Utilities Offer Highest Dividend Yields

The Utilities Select Sector SPDR ETF (XLU), which tracks the S&P 500 Utilities Index, is currently trading at a dividend yield of 3.5%.

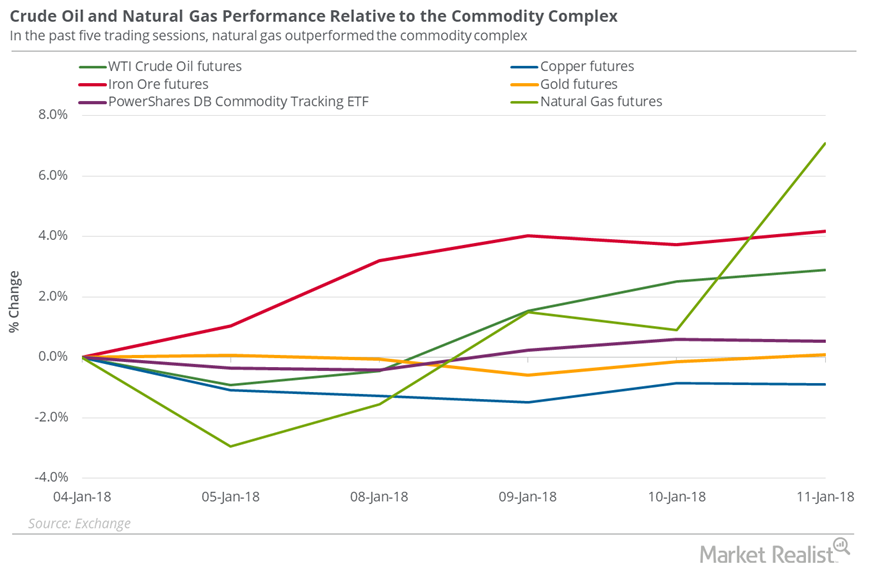

Are Supply Concerns Pushing Oil Higher?

On January 11, 2018, US crude oil’s (USO) (USL) February 2018 futures gained 0.4% and settled at $63.80 per barrel, a new three-year high.

Energy Calendar: Analyzing Key Oil and Gas Drivers

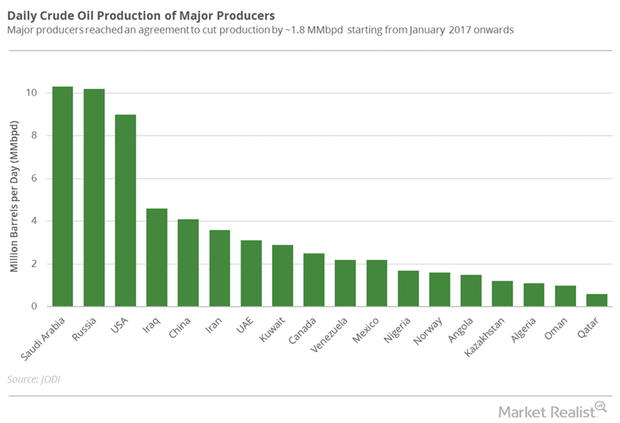

The energy sector contributed to ~6.6% of the S&P 500 on March 31, 2017. Oil and gas producers’ earnings depend on crude oil and natural gas prices.

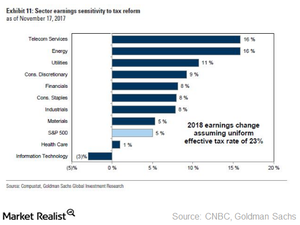

Will Tax Reform Hurt Health Care Sector?

The health care sector played an important role in the recent bull market (SPX-INDEX) rally.

Is Oil Set to Make Record Highs in 2018?

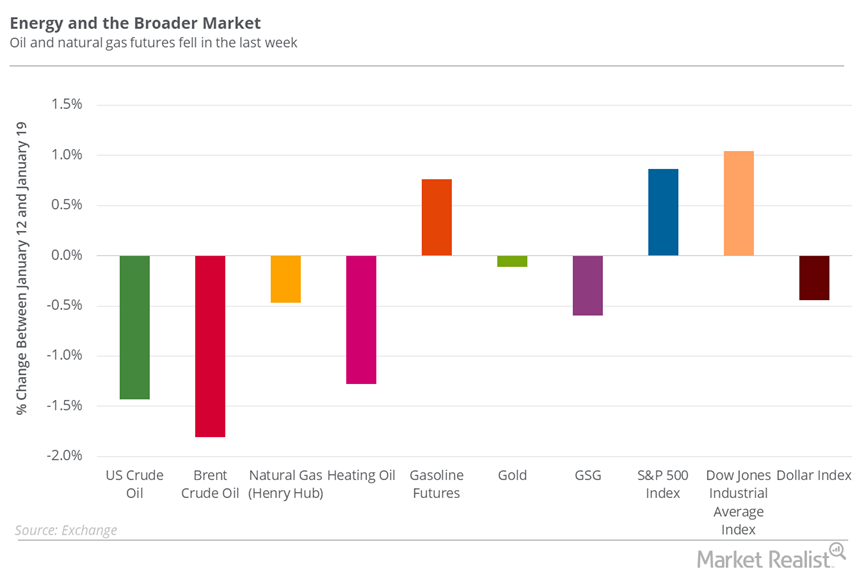

Between January 12 and January 19, 2018, US crude oil (USO) (USL) March futures fell 1.4%.

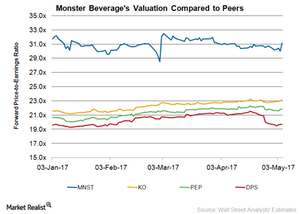

Monster Beverage’s Valuation: Impact of 1Q17 Results

On May 5, 2017, Monster Beverage (MNST) was trading at a 12-month forward PE (price-to-earnings multiple) of 31.1x, up 3.7% in reaction to its 1Q17 results.

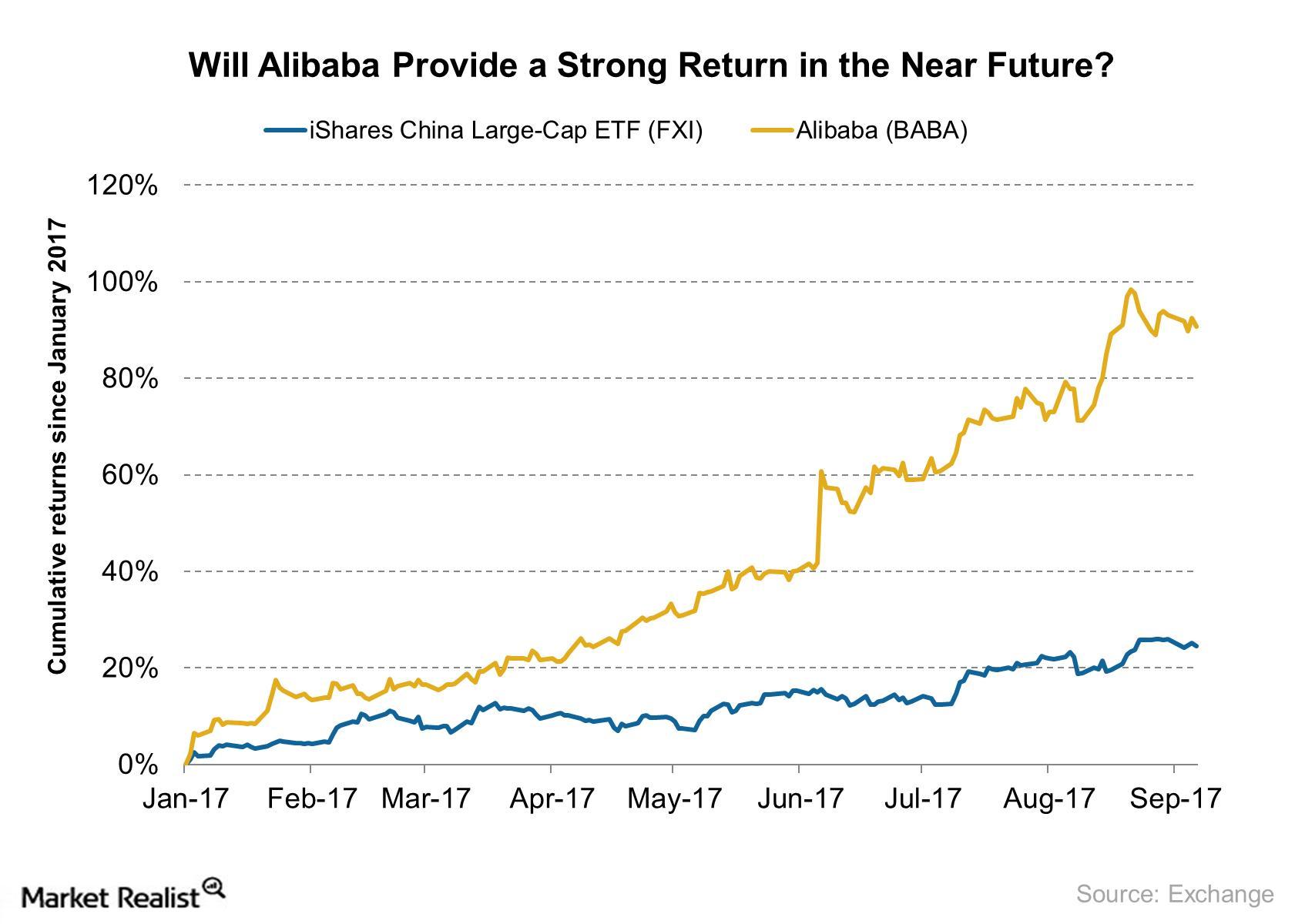

Why Goldman Sachs Is Optimistic about Alibaba

Alibaba was trading at $169 on September 8, 2017. Its 52-week high is $177 and its 52-week low is $86.01.

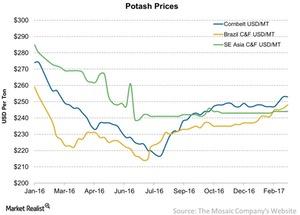

What 2017 Could Hold for Potash Producers

Potash stocks struggled for most of 2016. In 1H16, potash demand was negatively affected due to delays in potash contract settlements in China and India.

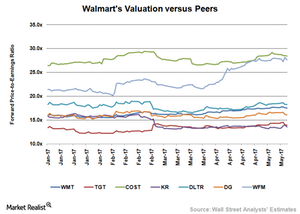

How Walmart Compares to Its Peers

On May 12, 2017, Walmart (WMT) was trading at a 12-month forward PE multiple of 17.5x.

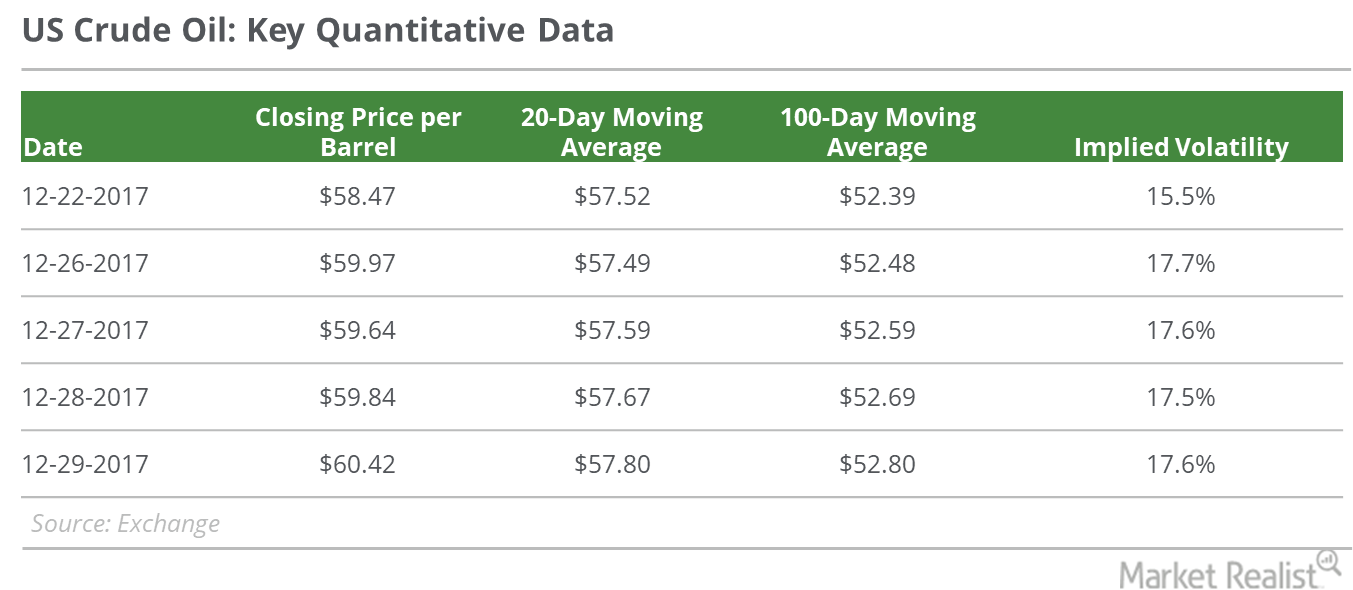

What Could Impact Oil Prices in 2018?

On December 29, 2017, US crude oil’s (USO) (USL) February 2018 futures rose 1% and closed at the 2017 highest closing price of $60.42 per barrel.

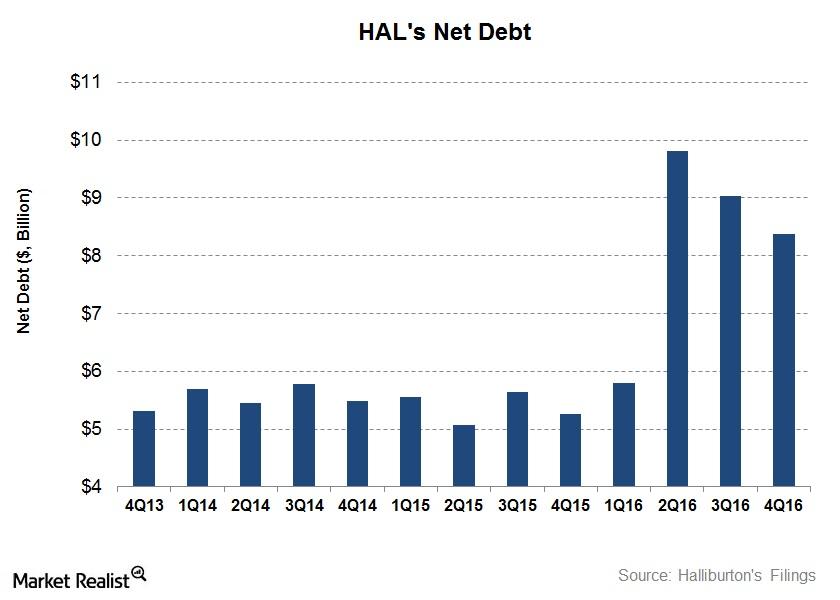

A Look at What’s Happening to Halliburton’s Debt

In 4Q16, Halliburton’s total debt fell 19% compared to a year earlier, and its cash and marketable securities fell 60%. In effect, its net debt rose 59% to ~$8.4 billion as of December 30, 2016.

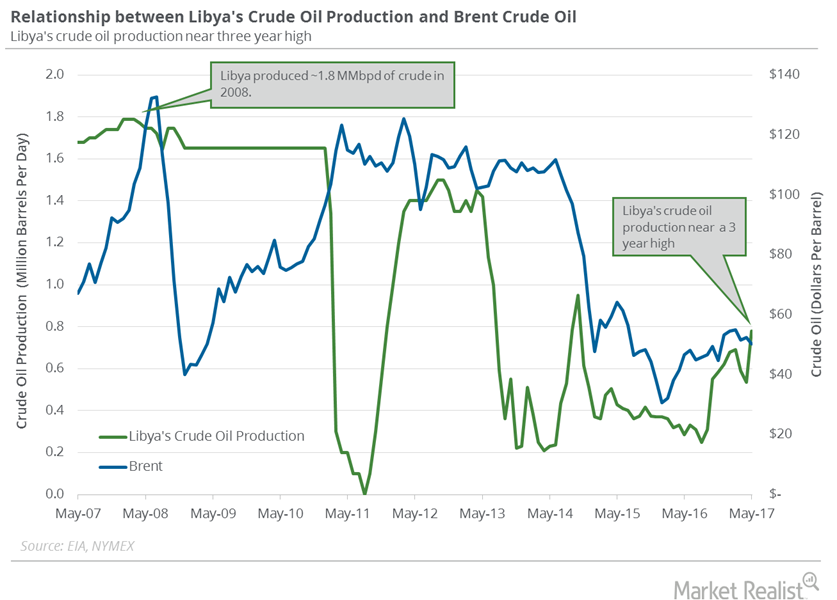

Libya’s Crude Oil Production Is at a 4-Year High

August West Texas Intermediate (or WTI) crude oil futures contracts rose $1.03 per barrel, or 2.2%, and settled at $47.07 per barrel on July 3, 2017.