S&P500 Index

Latest S&P500 Index News and Updates

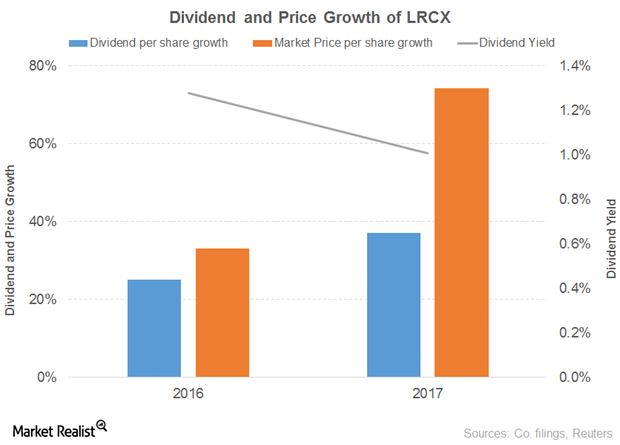

What’s Contributing to Promising Outlook for Lam Research?

Lam Research’s (LRCX) revenue rose 12% and 36% in 2016 and 2017, respectively. It rose 52% in 1Q18.

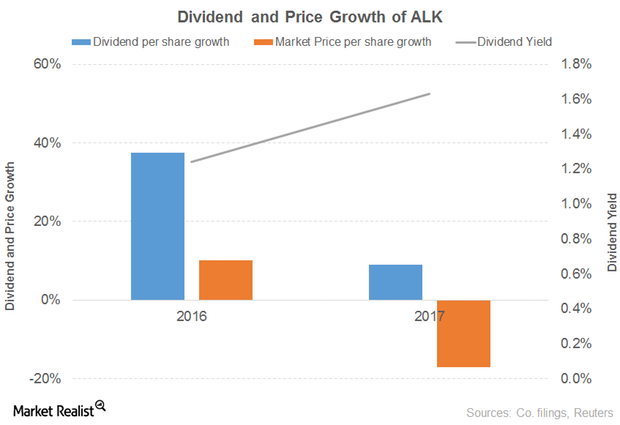

What’s the Outlook for Alaska Air Group?

Alaska Air Group’s (ALK) operating revenue rose 6% and 35% in 2016 and 9M17, respectively.

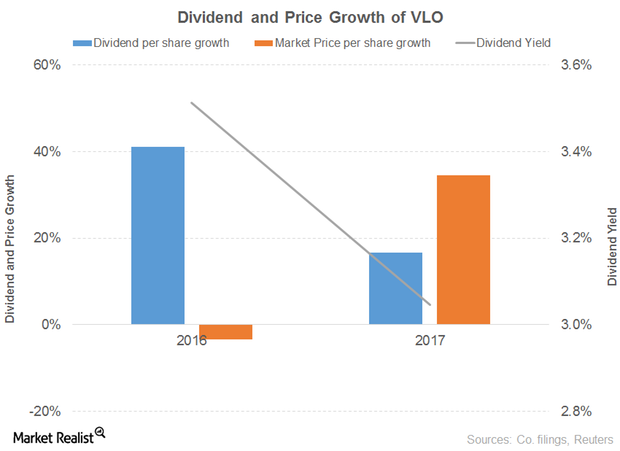

What Has Influenced the Outlook for Valero Energy?

Valero Energy’s operating revenue fell 14% in 2016 before rising 23% in 9M17. Refining revenues drove the decline in 2016, offset by ethanol revenues.

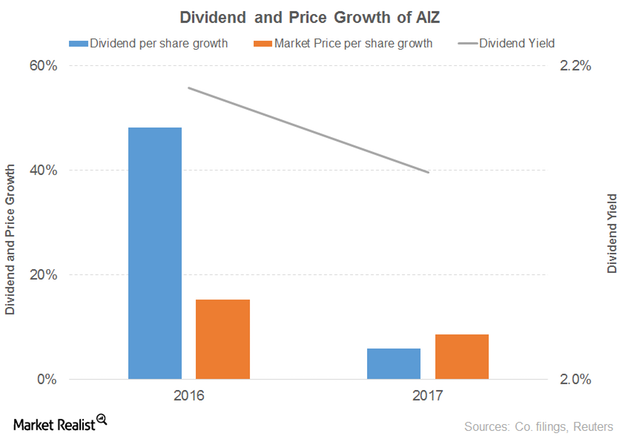

Why Assurant Has a Positive Outlook despite a Weak 2017

Assurant’s (AIZ) revenue fell 27% and 18% in 2016 and 9M17, respectively.

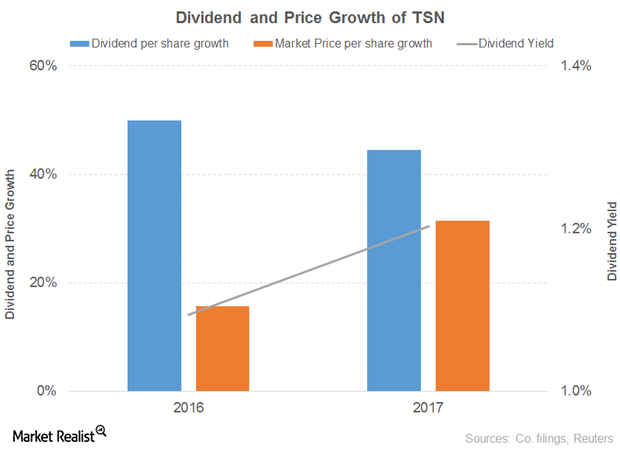

What’s the Outlook for Tyson?

Tyson Foods’ (TSN) sales dropped 11% in 2016 before gaining 4% in 2017.

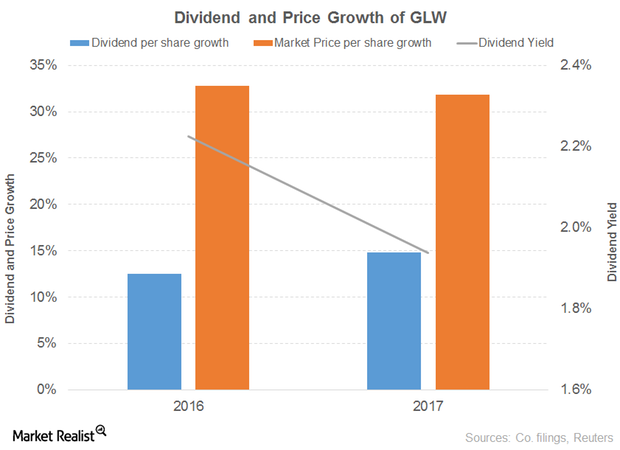

What Are Corning’s Key Growth Drivers?

Corning’s gross margin grew 3% and 9% in 2016 and 9M17, respectively.

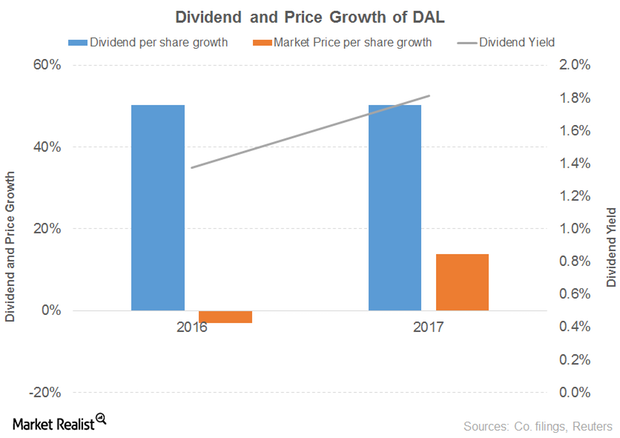

What to Expect from Delta Air Lines

Delta Air Lines’ (DAL) operating revenue fell 3% in 2016 before gaining 3% in 9M17 (or the first nine months of 2017).

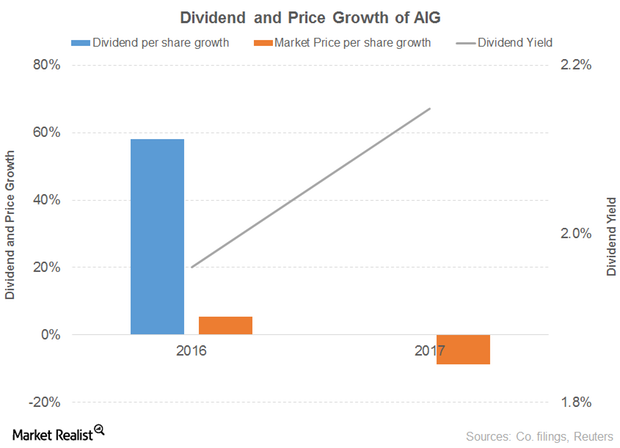

What’s the Outlook for American International Group?

American International Group’s dividend per share rose 58% in 2016 and was flat in 2017.

What Key Economic Indicators Say about the Economy

In this series, we’ll take a look at December 2017 manufacturing PMI reports for major developed regions, namely the United States (SPX-INDEX), Germany (DAX-INDEX), France, Spain, Europe, Japan, and the United Kingdom (UKX-INDEX).

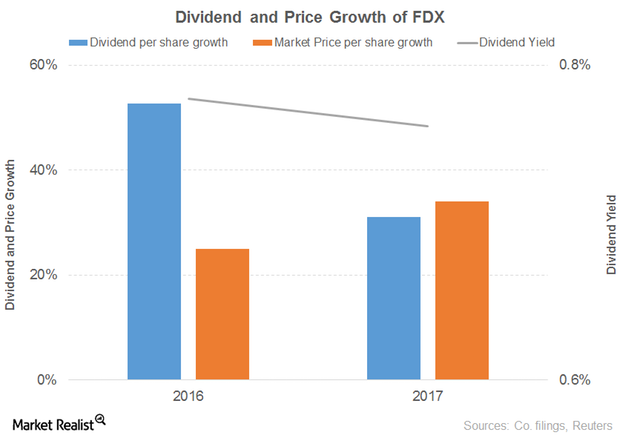

How FedEx’s Performance Influenced Its Outlook

FedEx’s (FDX) revenue grew 6% and 20% in 2016 and 2017, respectively. The FedEx Ground, FedEx Freight, and FedEx Services segments drove the 2016 growth, offset by the FedEx Express segment.

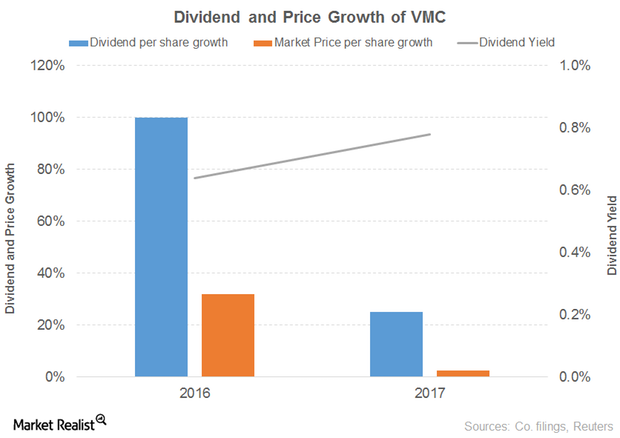

The Outlook for the Vulcan Materials Company

The Vulcan Materials Company’s (VMC) revenue grew 5% and 7% in 2016 and 9M17, respectively. Aggregates, concrete, and calcium drove the growth in 2016, offset by asphalt mix.

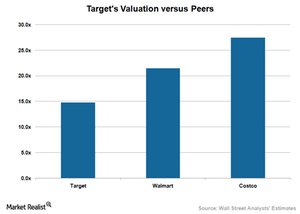

Target’s Valuation Compared to Its Peers

Target (TGT) stock was trading at a forward PE ratio of 14.8x on January 9, 2018, which seems compelling when compared to the peer group average of 24.5x.

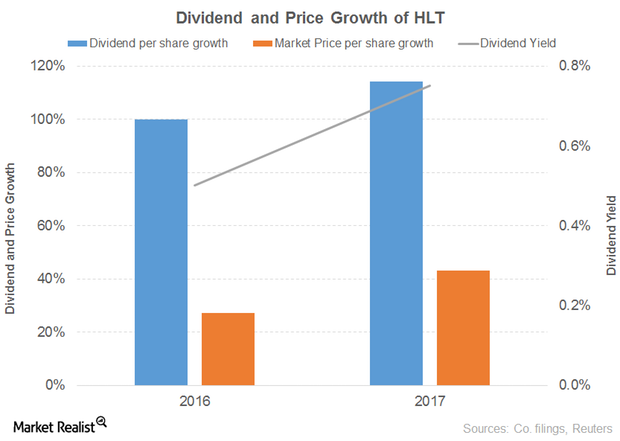

Hilton Worldwide Holdings Looks Promising despite a Tough 2017

Hilton Worldwide Holdings’ (HLT) revenue grew 3% in 2016. Management and franchise fees, timeshare, and other revenues from managed and franchised properties drove the growth in 2016, offset by owned and leased hotels.

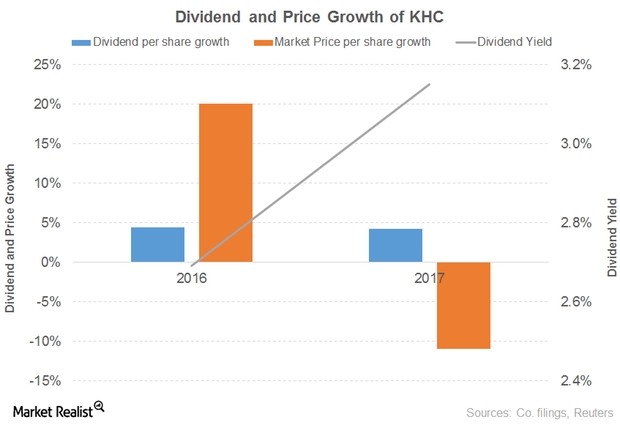

Why The Kraft Heinz Company’s Outlook Still Seems Promising

The Kraft Heinz Company’s (KHC) net sales grew 44% in 2016 before falling 1% in 9M17. Every product category drove the growth in 2016, offset by a decline in the infant and nutrition segments.

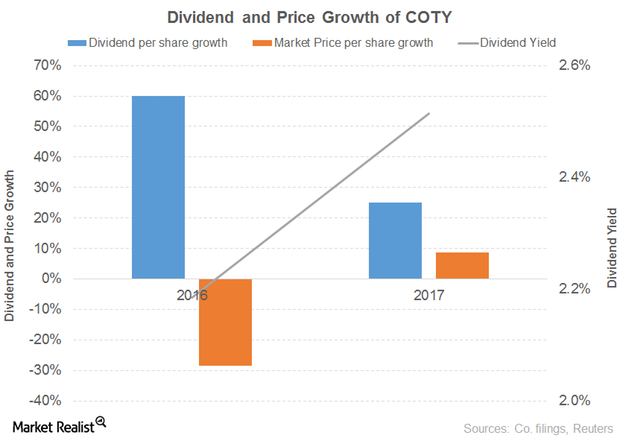

How Coty’s Performance Affected Its Outlook

Coty (COTY) net revenue fell 1% in 2016 before climbing 76% in 2017. The Consumer Beauty segment drove the growth in both years.

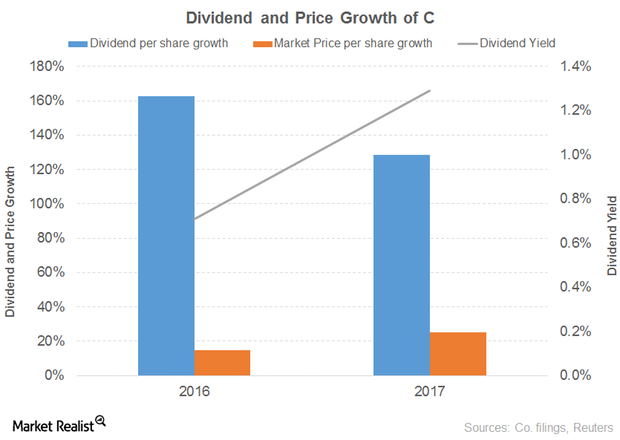

Why Citigroup’s Outlook Seems Promising

Citigroup is projected to grow its revenue 2% and 4% in 2017 and 2018, respectively. The 2017 and 2018 diluted EPS are projected to grow 12% and 14%, respectively.

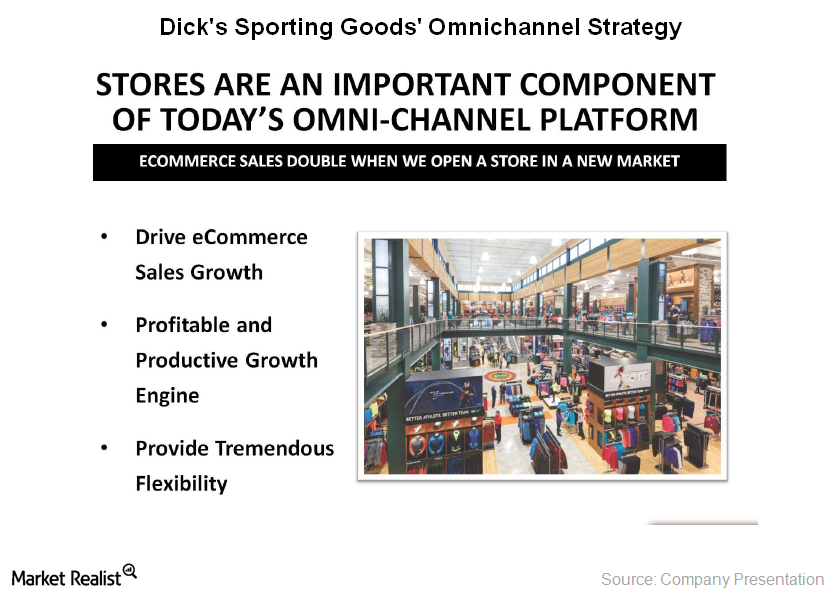

Dick’s Sporting Goods’ Growth Strategies in 2018

To thrive in such a challenging retail environment, Dick’s Sporting Goods is now investing in e-commerce and omnichannel capabilities.

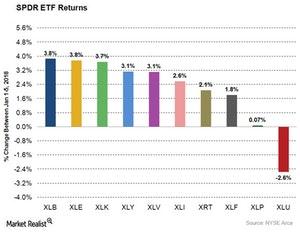

Consumer Sector Insights for the First Week of 2018

The consumer staples sector had a slight gain of 0.10% led by a stock increase in the stock price of CVS Health, Coty, Estee Lauder, and Walmart.

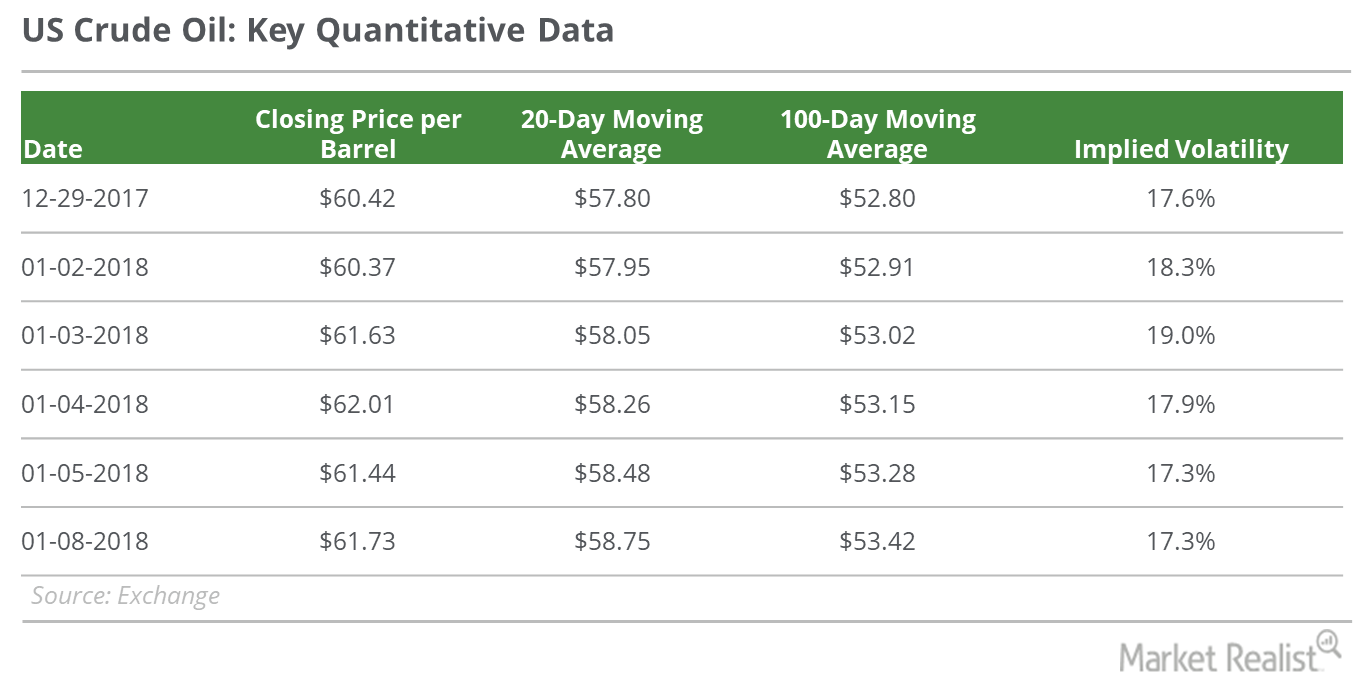

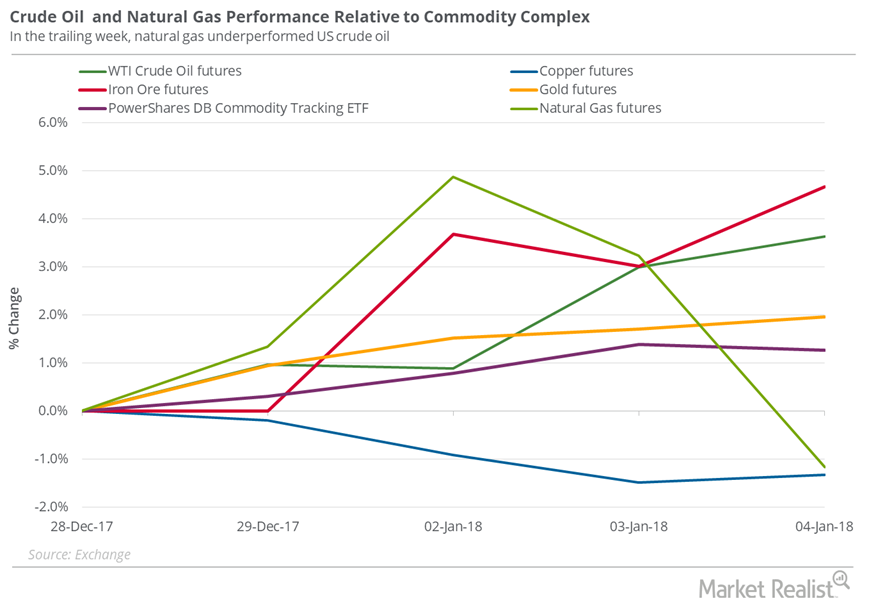

Will US Crude Oil Prices Make a New 3-Year High?

On January 8, 2018, US crude oil (USO) (USL) February 2018 futures rose 0.5% and closed at $61.73 per barrel—0.5% below the three-year high.

Why Bill Ackman’s Pershing Square Had a Rough 2017

Bill Ackman’s Pershing Square Capital Management saw negative returns in 2017 for the third consecutive year.

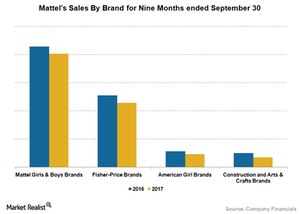

Mattel’s Year-to-Date Sales by Brand

As you can see in the graph below, Mattel’s (MAT) sales declined across all its brands for the nine-month period that ended on September 30, 2017.

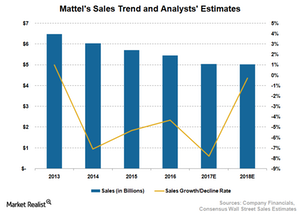

Why Mattel’s Sales Could Keep Falling in the Near Term

Toy makers in the United States (SPY) are facing near-term disruptions affecting their top-line performance. Toys “R” US, one of the leading distribution partners for US toy companies, filed for bankruptcy.

Why Oil Reached a 3-Year High

On January 4, 2018, US crude oil (USO) (USL) February 2018 futures rose 0.6% and closed at $62.01 per barrel—a three-year high.

What’s Driving Cheniere Energy’s Recent Rally?

Cheniere Energy (LNG) has risen 9.7% in the last six trading sessions. It rose 12.1% in December 2017 alone.

US Crude Oil Closed at 2017 High: Will the Ride Continue?

On December 22–29, US crude oil (USO) (USL) February futures rose 3.3%. On December 29, US crude oil February 2018 futures closed at $60.42 per barrel.

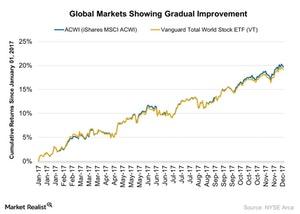

Will 2018 Be a Smooth Road for Investors?

2018 also brings with it many geopolitical events that could bring uncertainty and turn the market around.

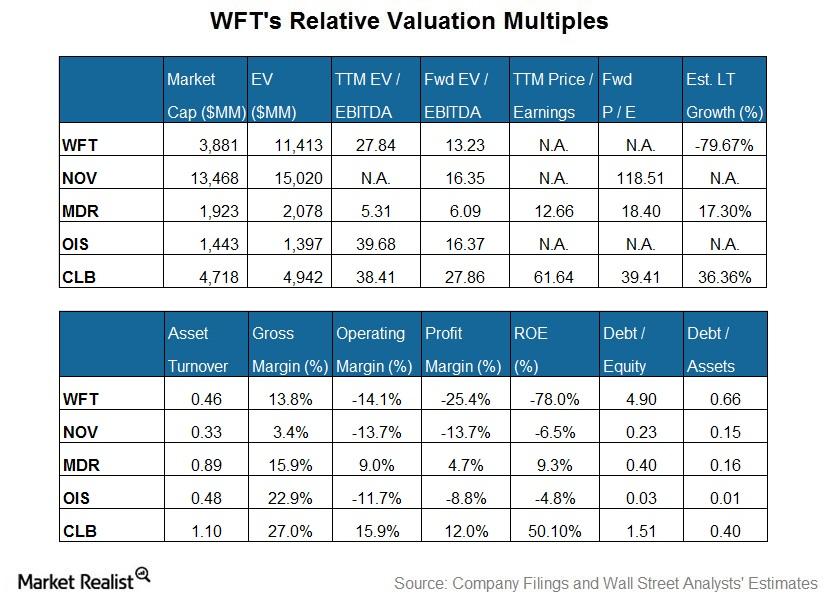

Weatherford International’s Valuation Compared to Its Peers

Weatherford International’s (WFT) EV (enterprise value) when scaled by a trailing 12-month adjusted EBITDA is close to the peer average in our group.

Why Asian Markets Grabbed Investors’ Attention in 2017

Stock markets around the world rallied in 2017. Asian equities, in particular, grabbed investors’ attention in 2017, as they have been outperforming other markets.

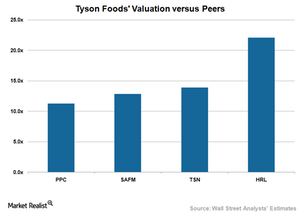

How Tyson Foods Compares with Its Peers in Valuation

As of December 22, 2017, Tyson Foods (TSN) stock was trading at a 12-month forward PE (price-to-earnings) multiple of 13.9x, which could seem attractive to investors.

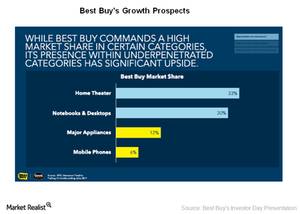

Understanding Best Buy’s Growth Strategies

Best Buy (BBY) has managed to deliver higher same-store sales for three consecutive quarters. This growth came amid tough retail market conditions and heightened competition from online retailers like Amazon (AMZN).

Key Economic Indicators Released in the Past Week

In this series, we’ll analyze inflation for three key economies and look at retail sales in the United States and China. We’ll also look at some key economic sentiment indexes.

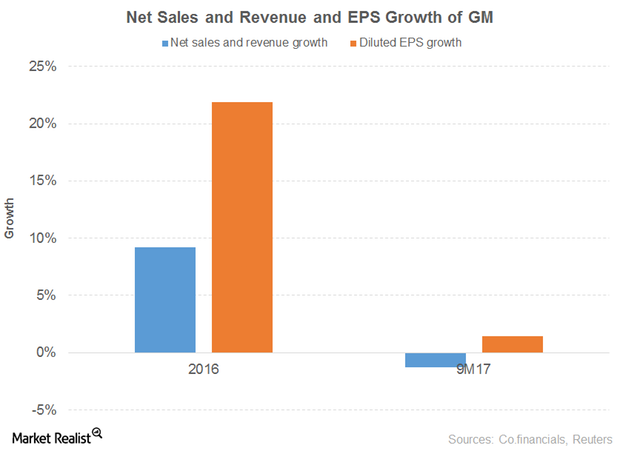

A Look at GM’s Stock Performance

In this part of our focus on the top 18 cheap S&P 500 stocks, we’ll discuss another six stocks: General Motors (GM), Ford Motor (F), Owens-Illinois (OI), The Goodyear Tire & Rubber Company (GT), Navient (NAVI), and Brighthouse Financial (BHF).

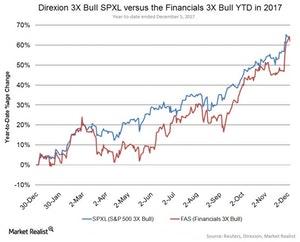

What Helped the Financial Sector in 2017?

Interestingly for all the talk about financials this year, the S&P 500 GICS Level 1 Financial Sector is only up 19% vs. 17%+ for the S&P500 as a whole.

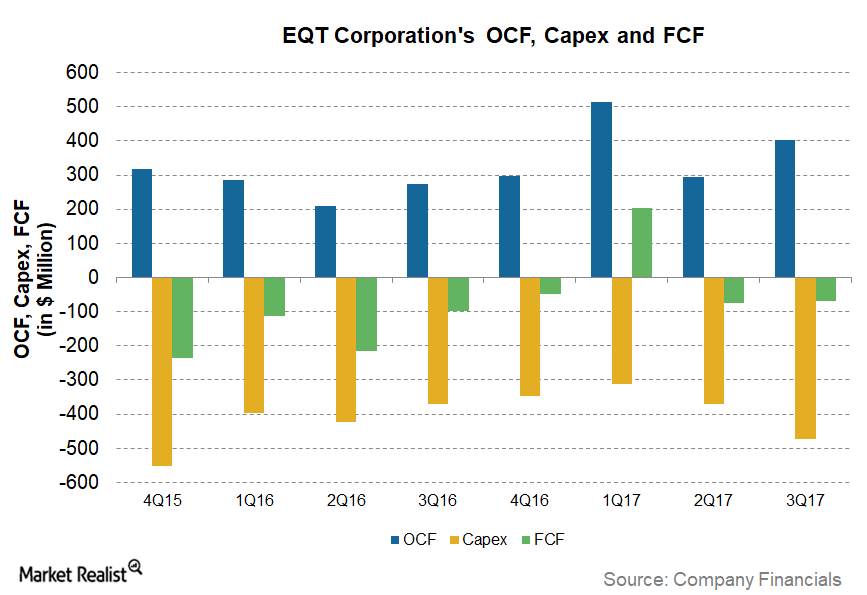

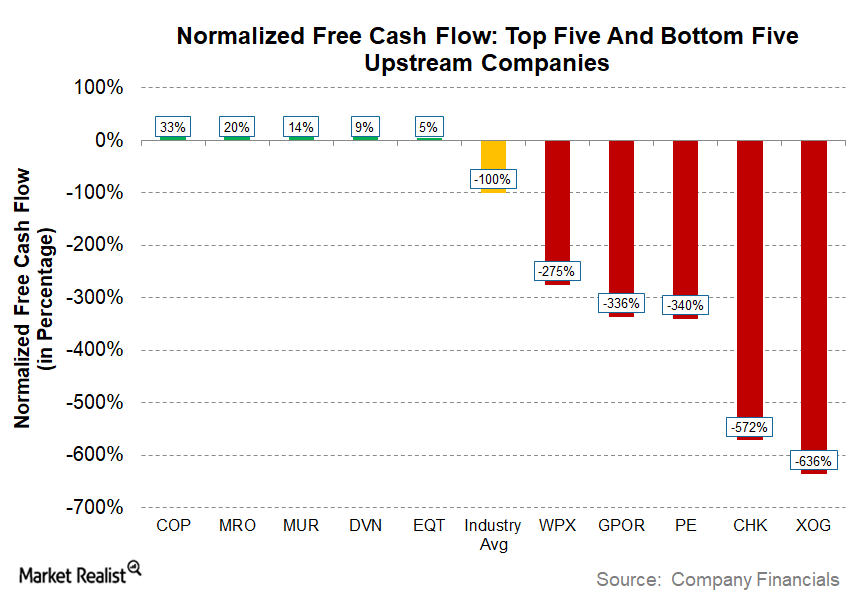

Why EQT’s Normalized Free Cash Flow Is Improving

As we saw in part one of this series, EQT (EQT) had normalized free cash flows of ~5% in the first nine months of 2017, the fifth highest among crude oil (USO) and natural gas (UNG) (UGAZ) producers we have been tracking.

Upstream Energy’s Best and Worst Free Cash Flow Companies

Free cash flow (or FCF) is an important metric for the crude oil (USO) and natural gas (UNG) production (or upstream) sector.

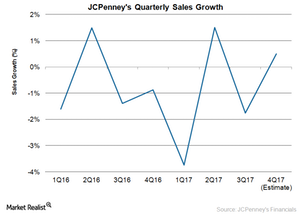

JCPenney’s Sales Growth Strategy

JCPenney (JCP) has been undertaking several strategic actions to improve its sales amid a challenging retail environment.

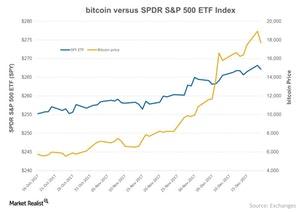

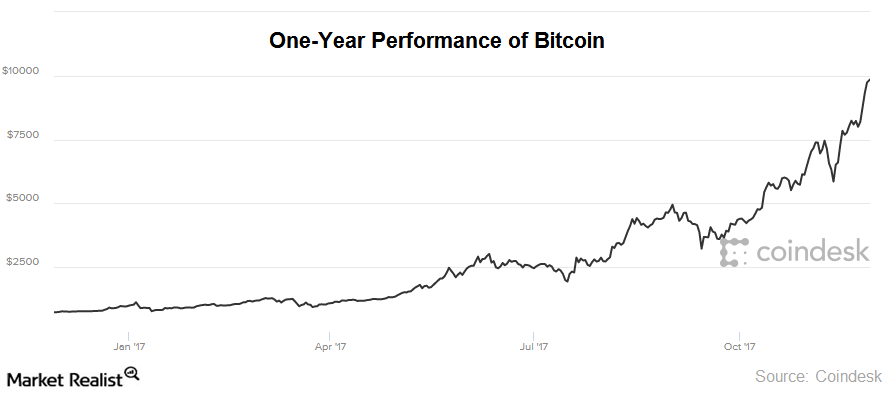

How Bitcoin Has Performed versus SPY

Bitcoin was trading at $17,000 on Wednesday, December 20, while the SPY Index was at $268.

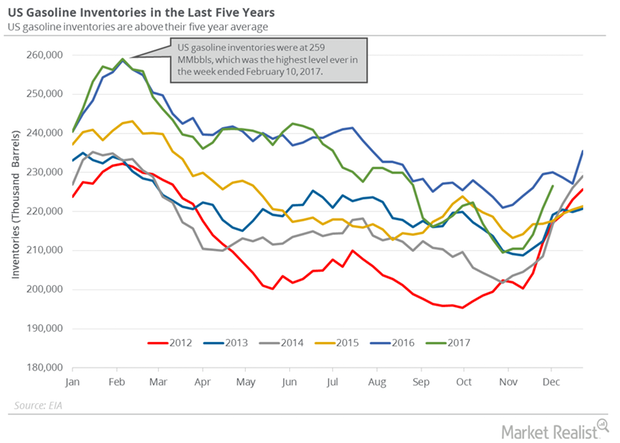

Analyzing the API’s Gasoline and Distillate Inventories

On December 19, 2017, the API released its crude oil inventory report. US gasoline inventories rose by 2 MMbbls (million barrels) on December 8–15, 2017.

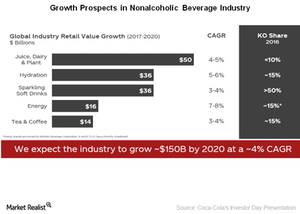

How Coca-Cola’s Innovations Could Improve Its Revenue

Coca-Cola’s (KO) revenue has declined for ten straight quarters. The decline has been due to several factors, including a weakness in soda volumes.

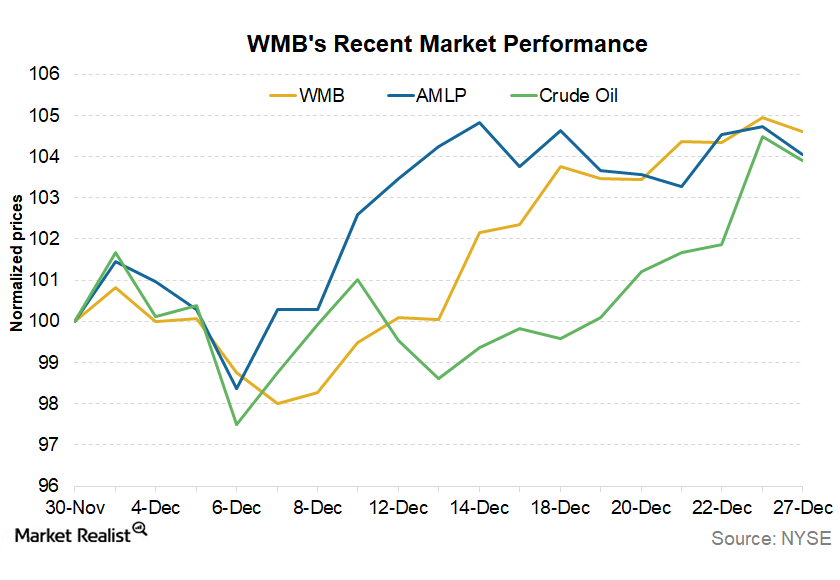

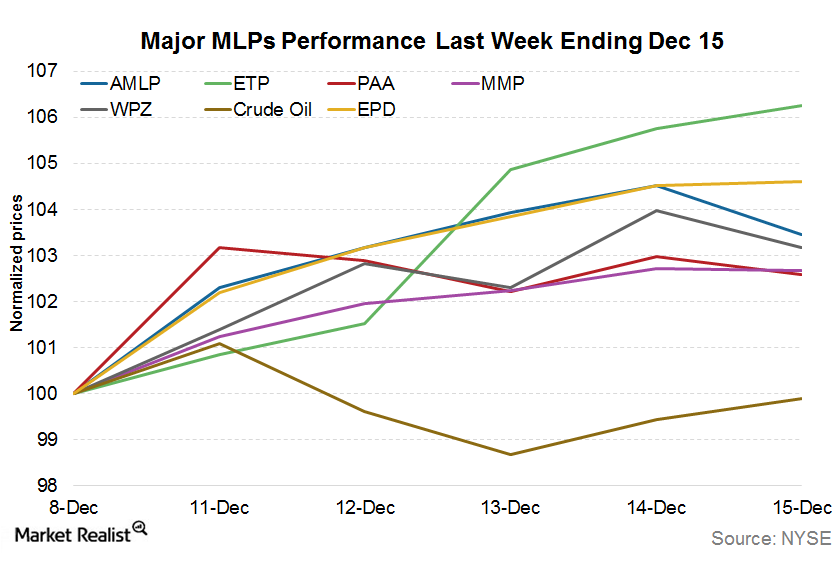

What Drove MLPs in the Week Ending December 15?

MLPs were strong in the week ending December 15, 2017. The Alerian MLP Index (^AMZ) had a strong start last week although it fell slightly on Friday.

Can US Crude Oil Break Below $57 Next Week?

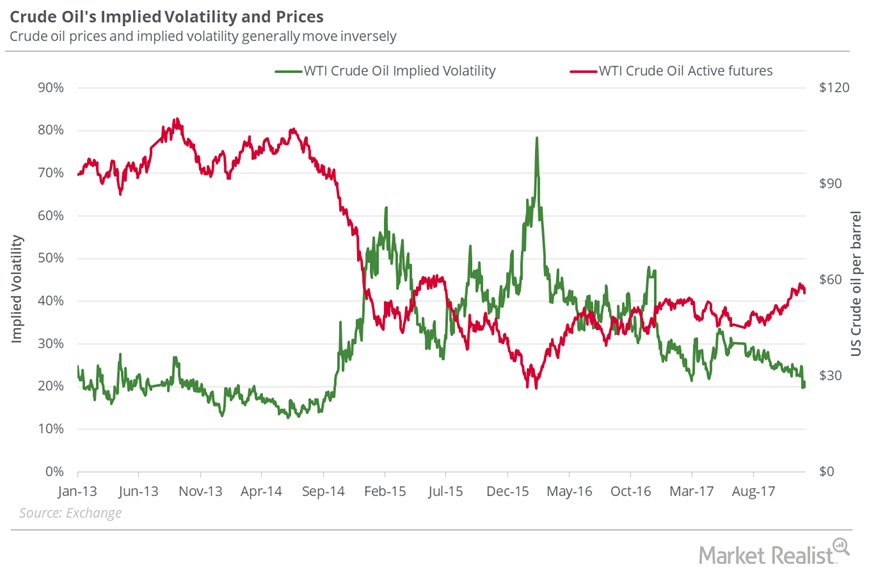

On December 14, 2017, the implied volatility of US crude oil futures was 18.1%. It was 14.8% below its 15-day average.

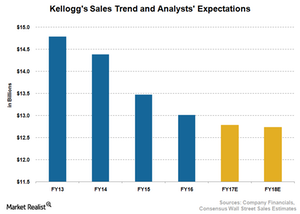

Why Analysts Expect Kellogg’s Sales to Fall

Kellogg (K) estimates a 3% decline in its top line for fiscal 2017, reflecting weakness in the cereal category and challenges in several markets.

November Services PMIs: What They Say about Developed Markets

In this series, we’ll analyze the November performances of the services PMIs for developed economies, including the United States, the United Kingdom, the Eurozone, Germany, France, Spain, and Japan.

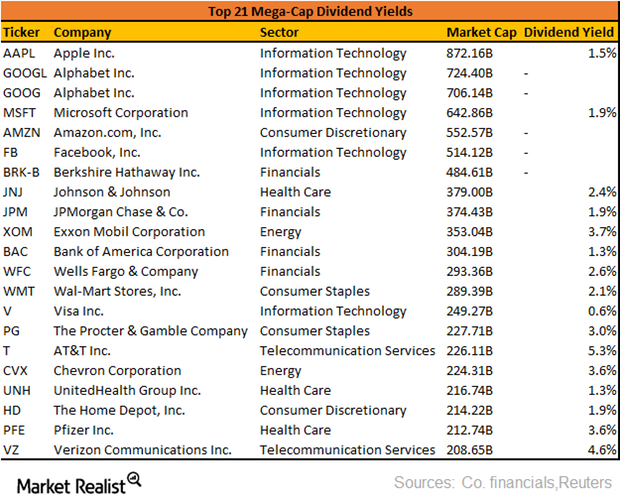

What Are the Dividend Yields of the Top 10 Mega-Cap Stocks?

Donald Trump’s promises of financial deregulation, infrastructure spending, and tax cuts played a major role in the stock market rally this year.

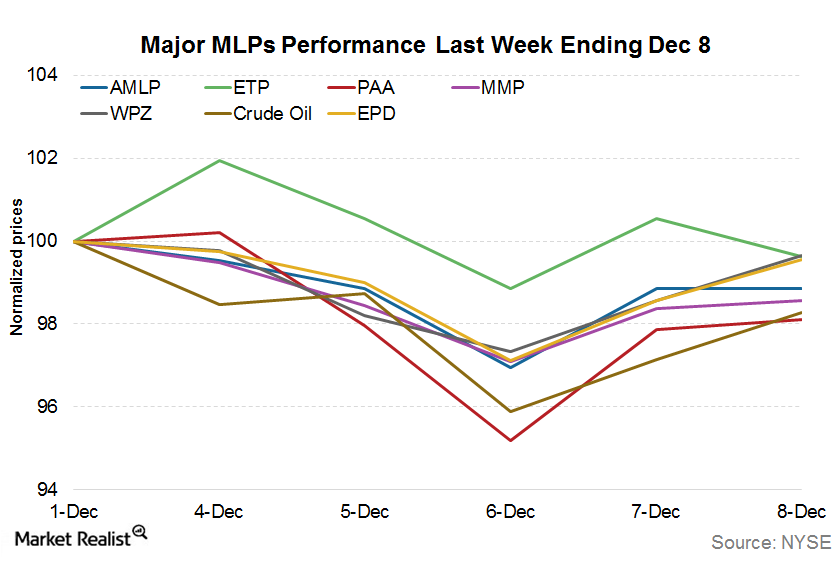

What’s Been Impacting MLP Performances as of December 8?

Most MLPs (master limited partnerships) closed the week ended December 1 in the red, after seeing some gains earlier in the week.

US Crude Oil Prices Could Remain below $58 Next Week

On December 7, 2017, US crude oil’s implied volatility was 20% or ~1.1% less than its 15-day average. On December 1, the implied volatility fell to 19.8%.

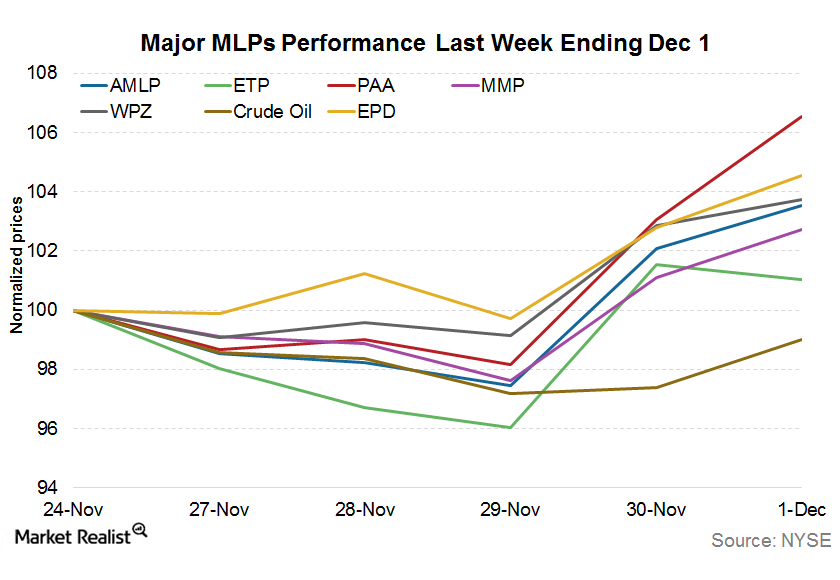

Understanding the Slight Recovery among MLPs Last Week

MLPs (master limited partnerships) recovered slightly last week (ended December 1, 2017), after three weeks of sluggishness.

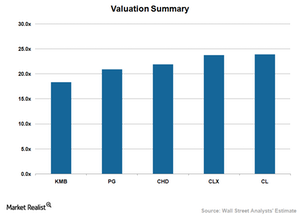

How PG, KMB, CL, CLX, and CHD Compare on Valuation

As of November 24, 2017, Colgate-Palmolive (CL) stock was trading at a forward PE multiple of 24.0x, which is higher than its peers.

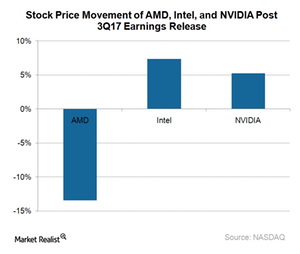

Why Did AMD’s Stock Price Fall after Its Fiscal 3Q17 Earnings?

AMD reported better-than-expected fiscal 3Q17 earnings. Despite this, its stock fell 13.5% in just one day after its earnings were released.

Why Gorman Doesn’t Think Bitcoin Deserves So Much Attention

James Gorman thinks that investment in bitcoin could be risky.