Regeneron Pharmaceuticals Inc

Latest Regeneron Pharmaceuticals Inc News and Updates

Regeneron's Stock Forecast Is in Question as Omicron Variant Spreads

Regeneron stock could face more obstacles. Will the omicron variant of the COVID-19 virus redefine the pandemic's trajectory? What's the forecast for the stock?

Is Regeneron's COVID-19 Drug Better Than the Vaccine?

The FDA authorized a COVID-19 drug cocktail from Regeneron, but that doesn't mean it's better than the vaccine.

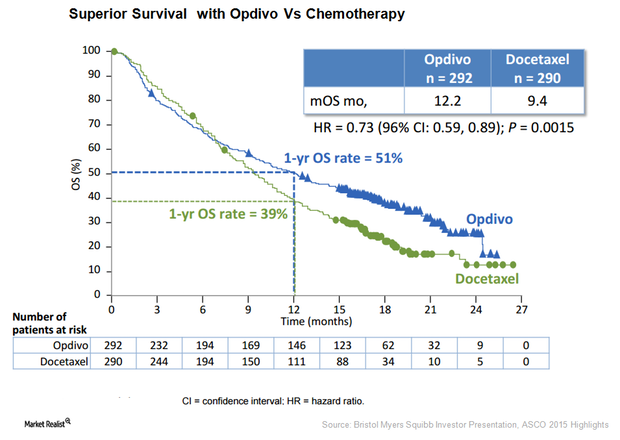

Bristol-Myer Squibb’s Opdivo Is Keytruda’s Strong Competitor

the U.S. Food and Drug Administration accepted the filing of a supplemental Biologics License Application for Bristol-Myers Squibb’s Opdivo.

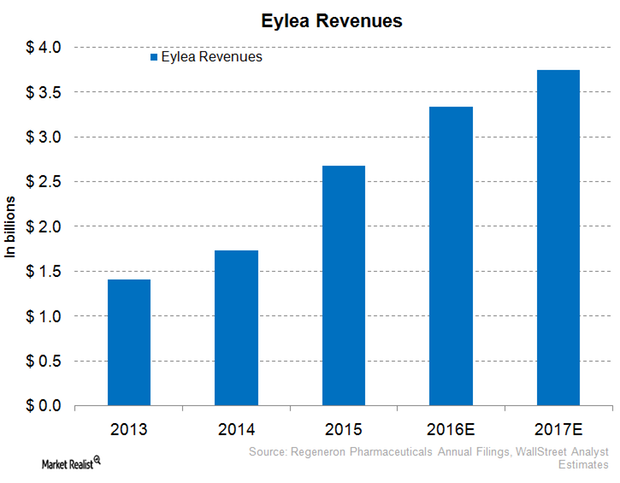

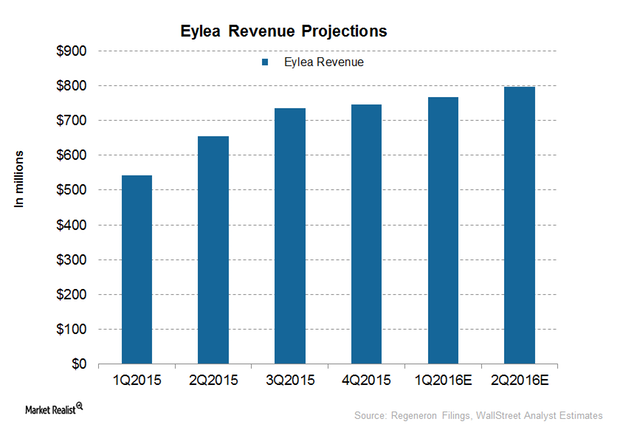

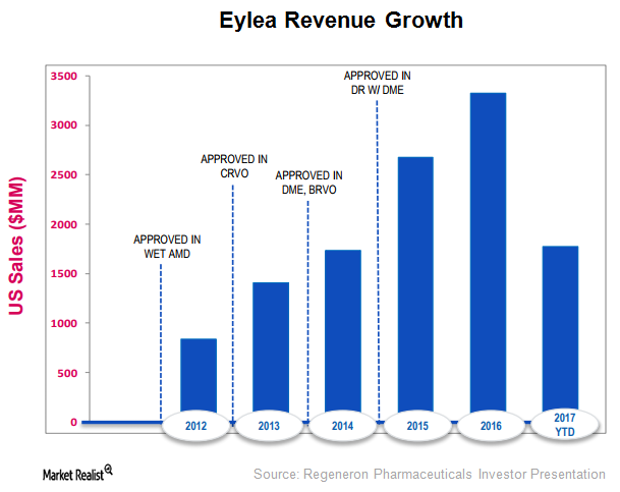

Why Eylea Could Face Tough Competition in 2016

In 2016, Regeneron expects to face increased competition from Roche Holding’s Lucentis (Ranibizumab) and Avastin (Bevacizumab) for Eylea.

Worst-Case Scenario for Regeneron: What If Eylea Sales Slow Down by 2018?

Regeneron Pharmaceuticals (REGN) depends heavily upon its key drug, Eylea, which recorded global sales of $4.1 billion during fiscal 2015.

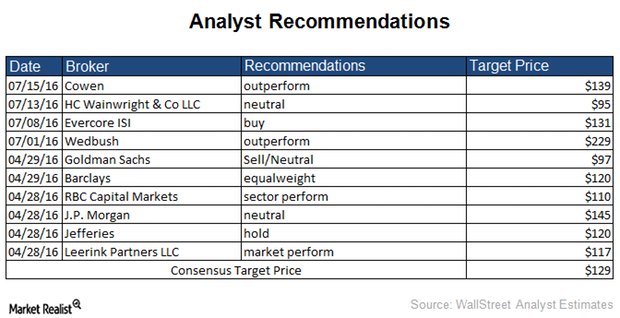

What Do Analysts Recommend for United Therapeutics?

23.1% of analysts gave United Therapeutics (UTHR) a “buy” recommendation while 69.2% of analysts rated the company a “hold.”

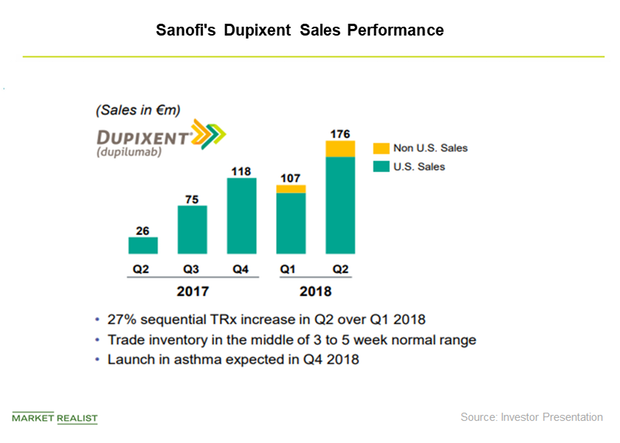

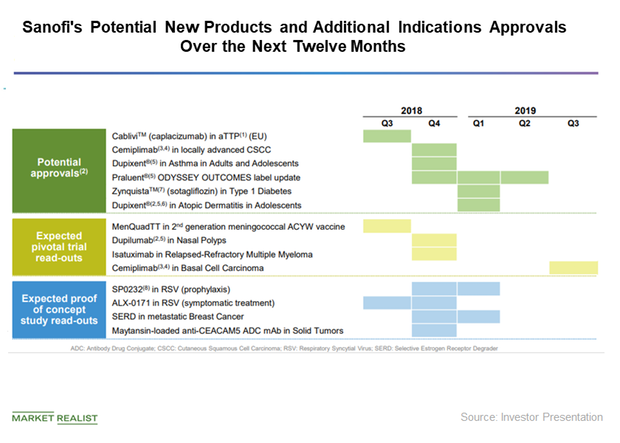

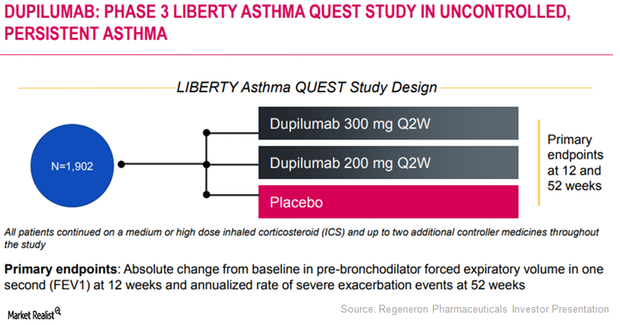

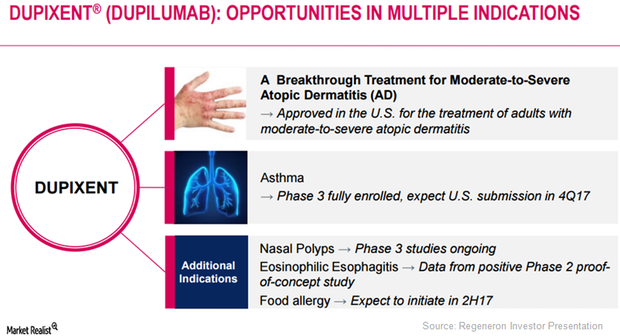

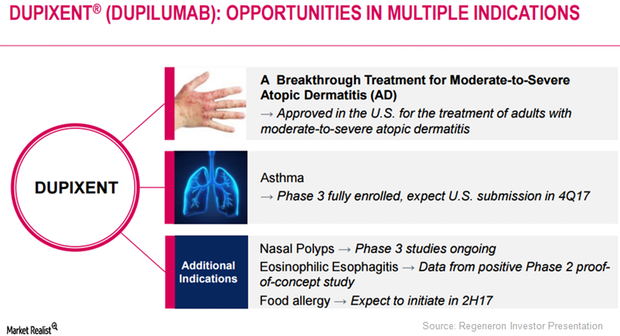

Sanofi’s Dupixent: Growth Prospects and Phase 3 Trials

Sanofi and Regeneron are conducting clinical studies for the treatment of a range of type 2 inflammation conditions with Dupixent.

Regeneron to Partner With Roche on COVID-19 Drug

Roche Holding has agreed to help develop and distribute an experimental COVID-19 drug in partnership with Regeneron Pharmaceuticals.

Analysts Raise Their Target Price for Regeneron in March

Wall Street analysts expect a potential upside of 6.79% for Regeneron Pharmaceuticals based on the company’s closing price on March 27.

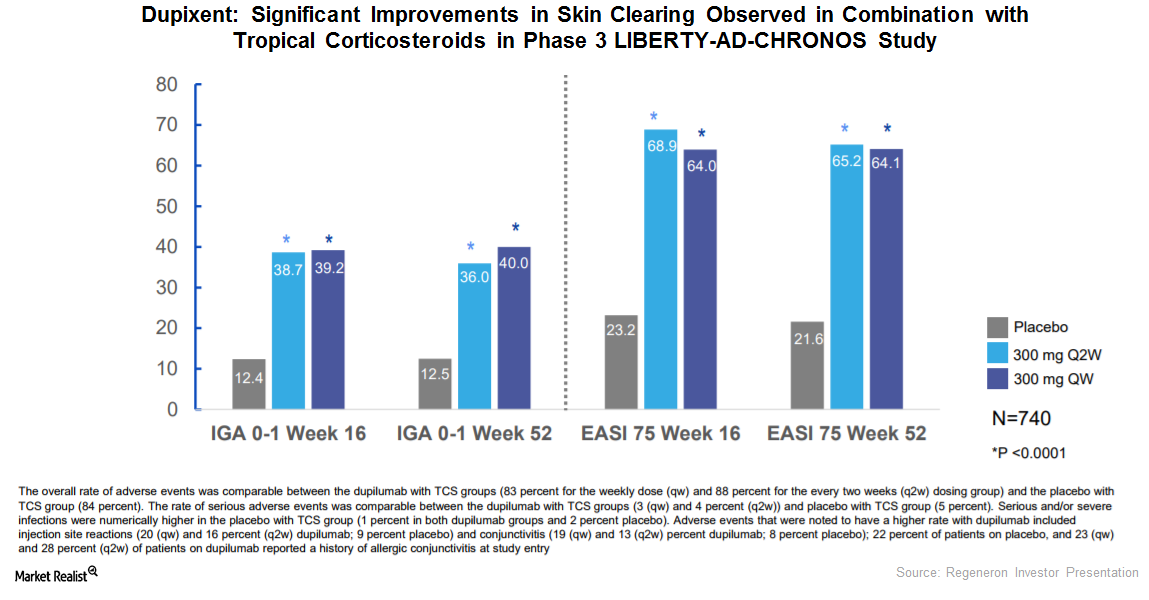

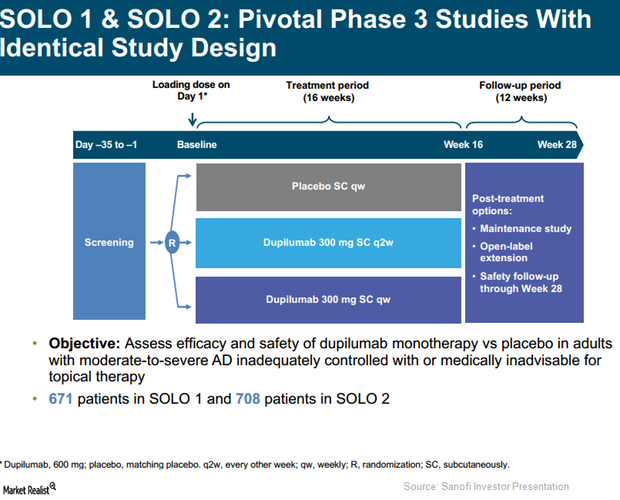

Sanofi Eyes Market Expansion with Phase 3 Data for Dupixent

On September 15, Sanofi and Regeneron announced Phase 3 data results for Dupixent for the treatment of moderate-to-severe atopic dermatitis.

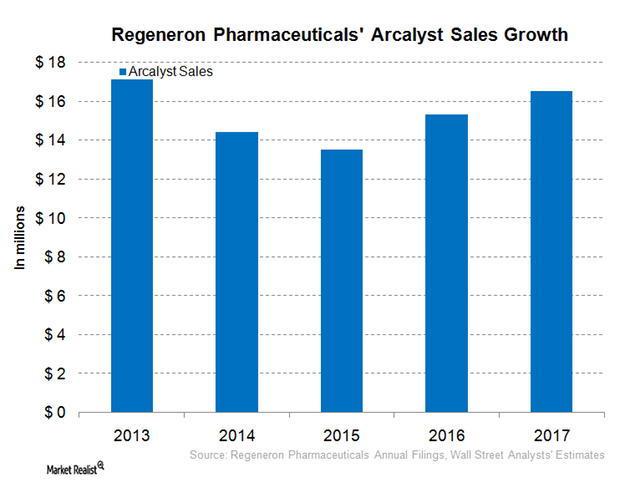

Regeneron Pharmaceuticals’ Kevzara, Arcalyst, and Zaltrap

In January 2017, Regeneron Pharmaceuticals’ (REGN) Kevzara was approved in Canada for the treatment of patients with active rheumatoid arthritis.

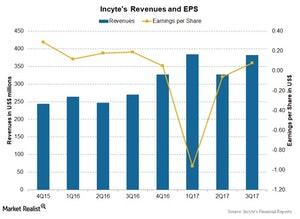

How’s Incyte’s Valuation in January 2018?

Analysts expect Incyte Corporation’s revenue to rise ~26.7% to $413.8 million in 4Q17 compared to $326.5 million in 4Q16.

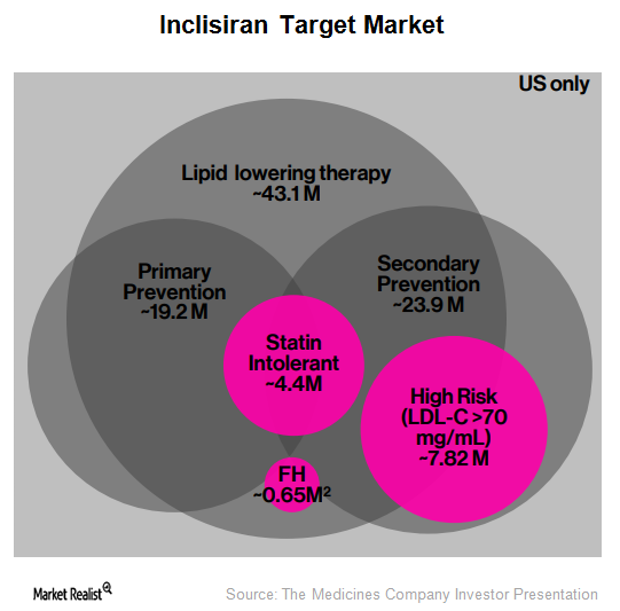

Inclisiran: Long-Term Growth Driver for The Medicines Company?

According to a Monte Carlo simulation performed at Harvard, it’s estimated that 5.0 million patients in the United States stand to benefit from PCSK9 inhibitor therapy.

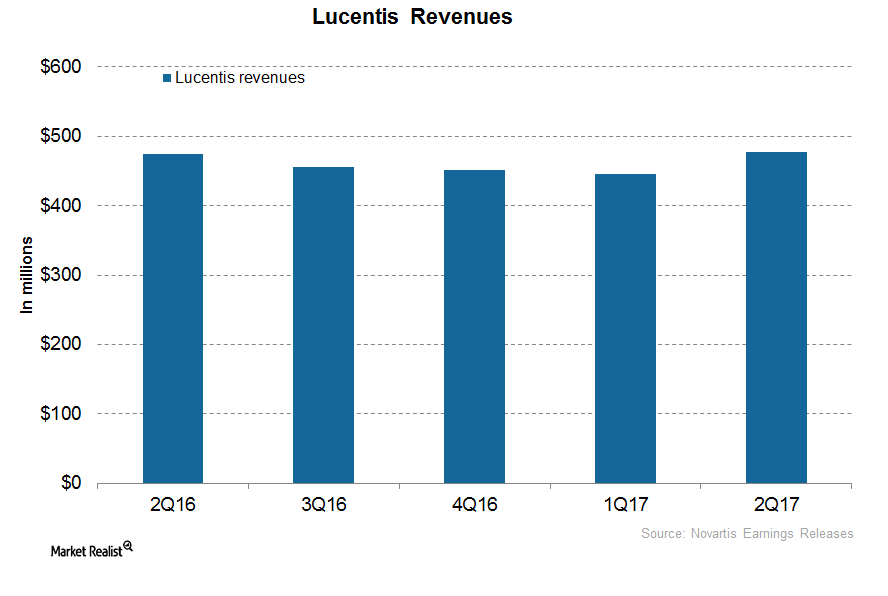

How Is Novartis’s Lucentis Positioned after 1H17?

In 1H17, Novartis’s (NVS) Lucentis reported revenues of around $922 million, which is a ~1% decline on a year-over-year (or YoY) basis.

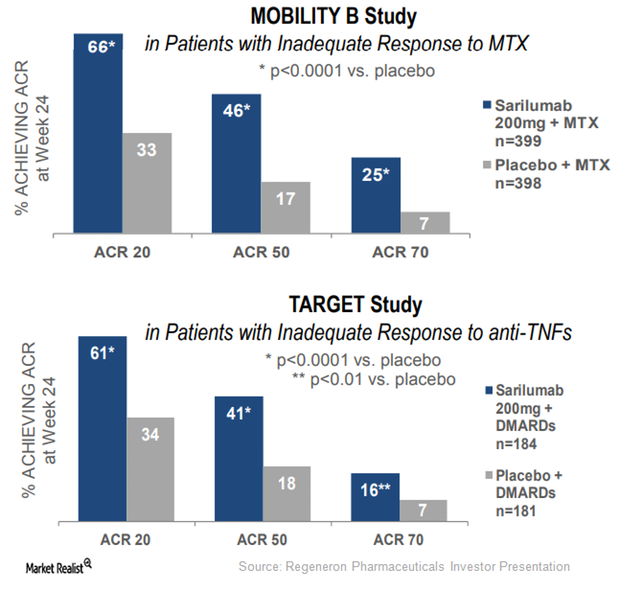

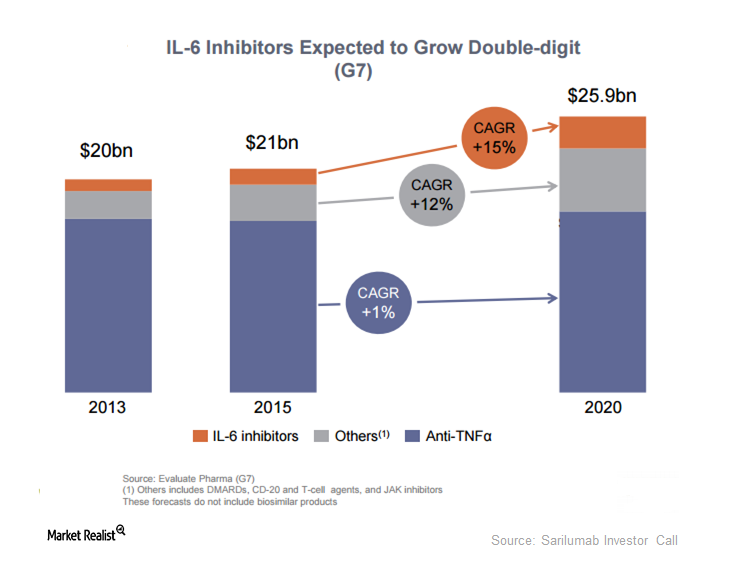

Kevzara May Emerge as a Prominent Rheumatoid Arthritis Drug in 2017

Regeneron and Sanofi have submitted an application seeking regulatory approval for Kevzara in Japan.

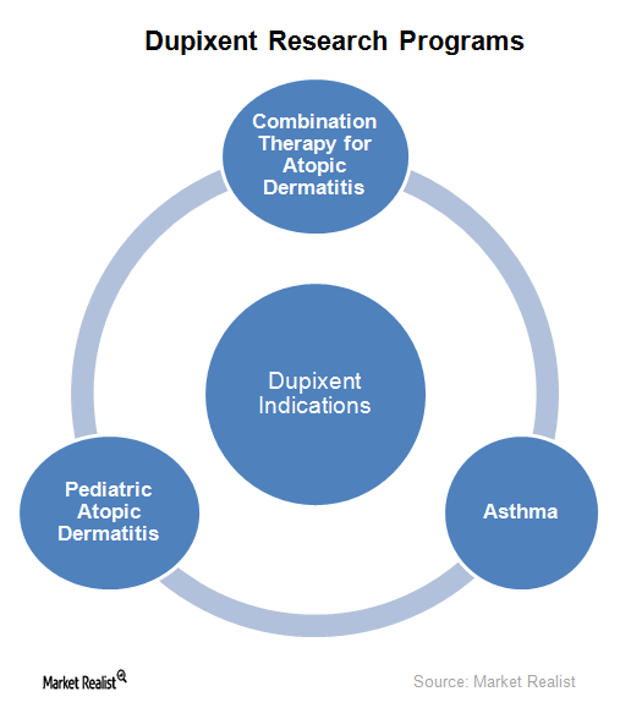

Regulatory Approval in Asthma Indication May Boost Dupixent’s Sales

In June 2017 and July 2017, healthcare providers wrote prescriptions for Regeneron (REGN) and Sanofi’s (SNY) Dupixent for 750 new patients on a weekly basis.

Eylea Leads the Retinal Diseases Sector

In 1H17, Eylea’s total sales rose 10% on a year-over-year basis.

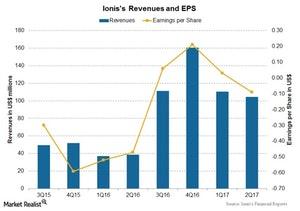

What’s Ionis Pharmaceuticals’ Valuation?

Ionis Pharmaceuticals (IONS) has been one of the leading pharmaceutical companies in the RNA-targeted therapeutic space for over 26 years.

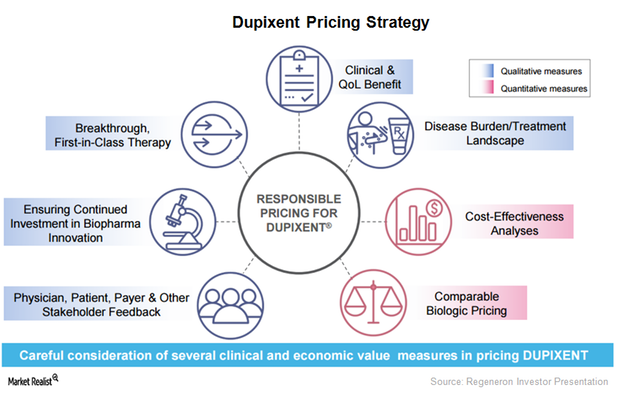

Dupixent Could Substantially Drive Regeneron’s Growth

In March 2017, the FDA approved Regeneron and Sanofi’s Dupixent injection for the treatment of adult individuals with moderate to severe atopic dermatitis.

Eosinophilic Esophagitis: Major Market Opportunity for Dupixent?

Regeneron (REGN) has obtained positive results from its Phase 2 proof-of-concept study evaluating Dupixent in eosinophilic esophagitis.

Dupixent May Prove Effective in Multiple Diseases

Regeneron plans to discuss Dupixent’s innovative mechanism-based treatment approach with regulatory authorities.

Dupixent May Be a Major Growth Driver for Regeneron in 2017

After Dupixent’s commercial launch, Regeneron has been involved in creating awareness for the drug among physicians who have been treating AD patients.

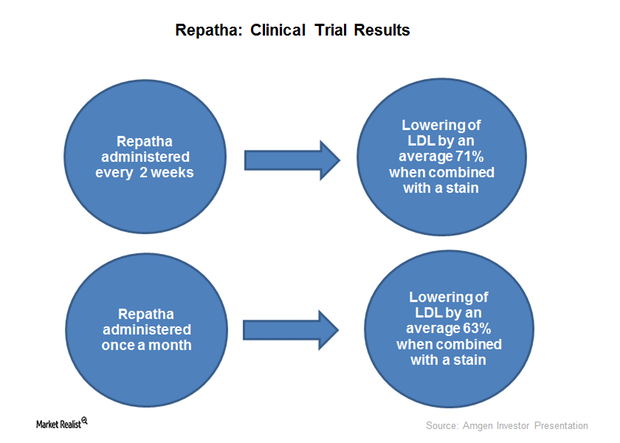

Amgen’s Repatha Could Gain Market Share in 2017

In 1Q17, Amgen’s (AMGN) Repatha witnessed quarter-over-quarter growth in sales volume of ~14% and 28% in the US and Europe, respectively.

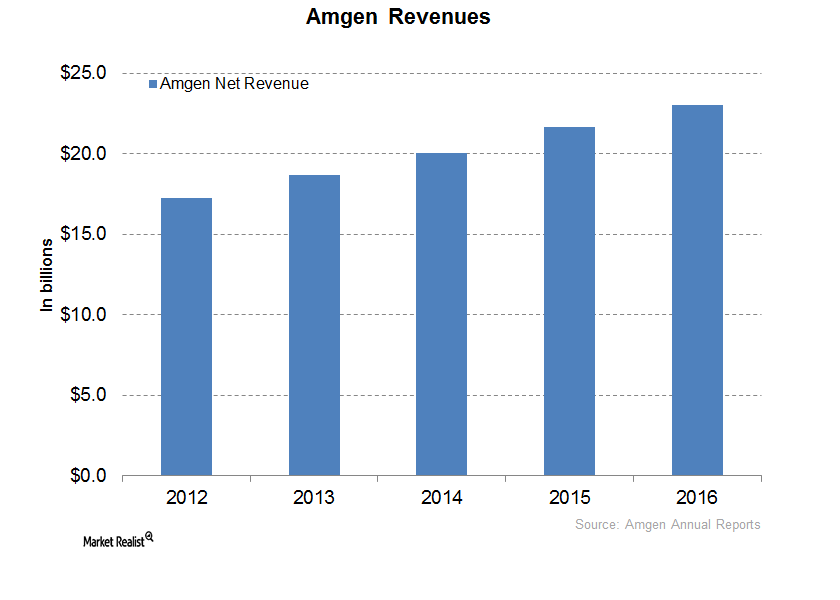

What Could Drive Amgen’s Growth in 2017?

Enbrel, Neulasta, and Epogen are among Amgen’s (AMGN) major revenue-generating drugs, each with annual sales in excess of $1 billion. Enbrel and Neulasta together accounted for ~46% of Amgen’s 2016 revenues.

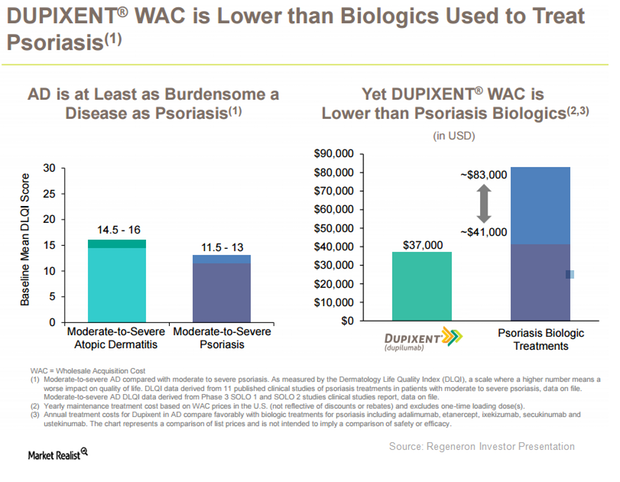

Dupixent Expected to Be a Solid Addition to Regeneron’s Portfolio

On March 28, 2017, the FDA approved Regeneron (REGN) and Sanofi’s (SNY) Dupixent for the treatment of patients with moderate-to-severe eczema or atopic dermatitis (or AD).

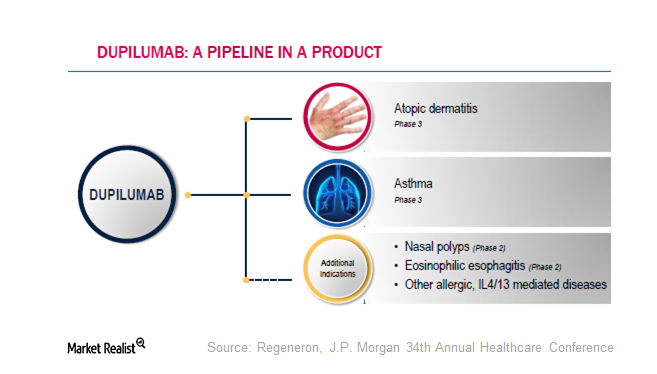

Dupixent Is Being Explored for Multiple Indications in 2016

In addition to being explored as a monotherapy for AD (atopic dermatitis), Regeneron and Sanofi are also researching Dupixent for other indications.

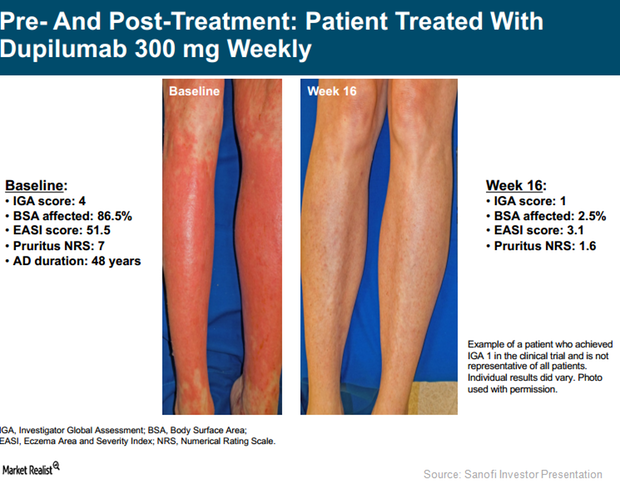

SOLO 1 and SOLO 2 Trials Could Strengthen Dupixent’s Label

In Phase 3 trials, SOLO 1 and SOLO 2, Regeneron (REGN) and Sanofi (SNY) tested the efficacy of an investigational therapy, Dupixent, compared to a placebo.

Dupixent: Leading Therapy for Atopic Dermatitis in the Future?

Existing treatment options for AD aren’t tolerated well by the entire patient population. Dupixent might become a preferred regimen in the future.

2016’s Estimated Product Launches: LixiLan, Sarilumab, Lixisenatide

LixiLan indicated for type 2 diabetes is a combination of Lantus and lixisenatide. Lantus is Sanofi’s most frequently prescribed diabetes drug.

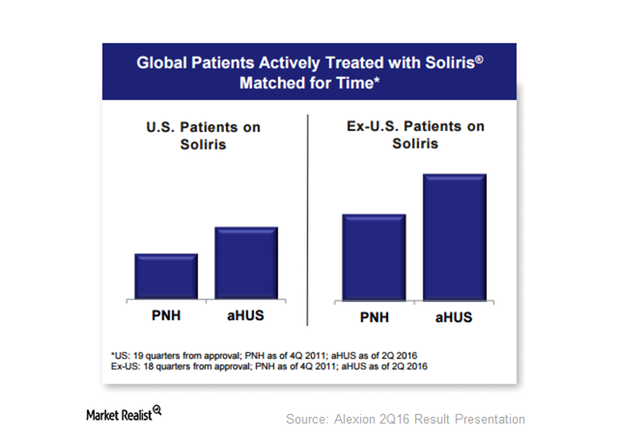

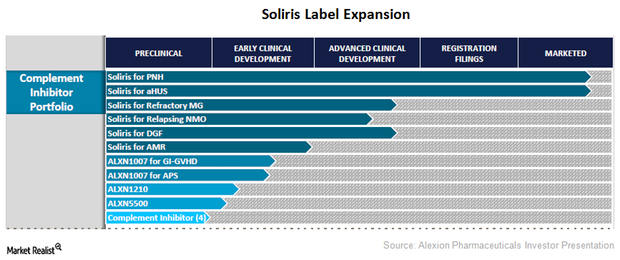

How Significant Is Alexion’s Opportunity with Soliris?

Alexion (ALXN) has been serving the atypical hemolytic uremic syndrome, or aHUS, market for the past five years.

Regeneron’s Dupilumab: How Much Potential Does It Hold?

Dupilumab has a breakthrough therapy designation from the FDA for the indication of moderate-to-severe atopic dermatitis in adults.

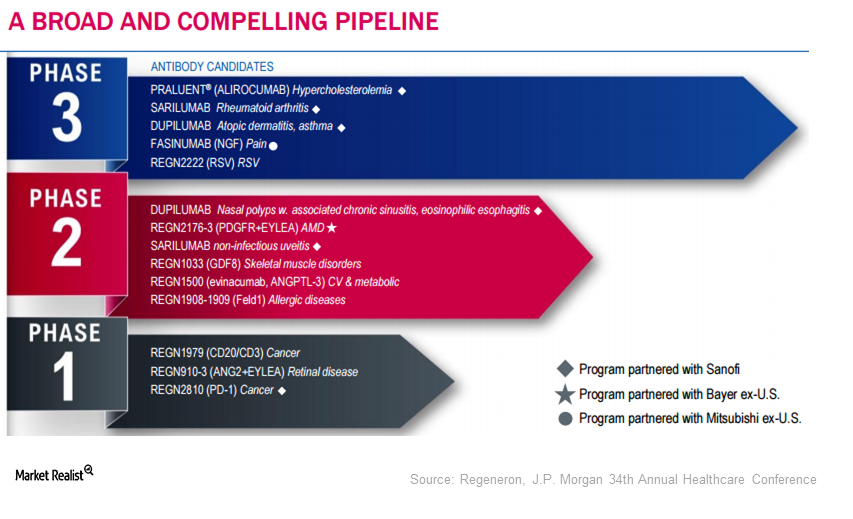

Regeneron’s Robust Pipeline

Regeneron’s (REGN) robust pipeline consists of 13 molecules in various phases of development. Sarilumab is under review with the FDA.

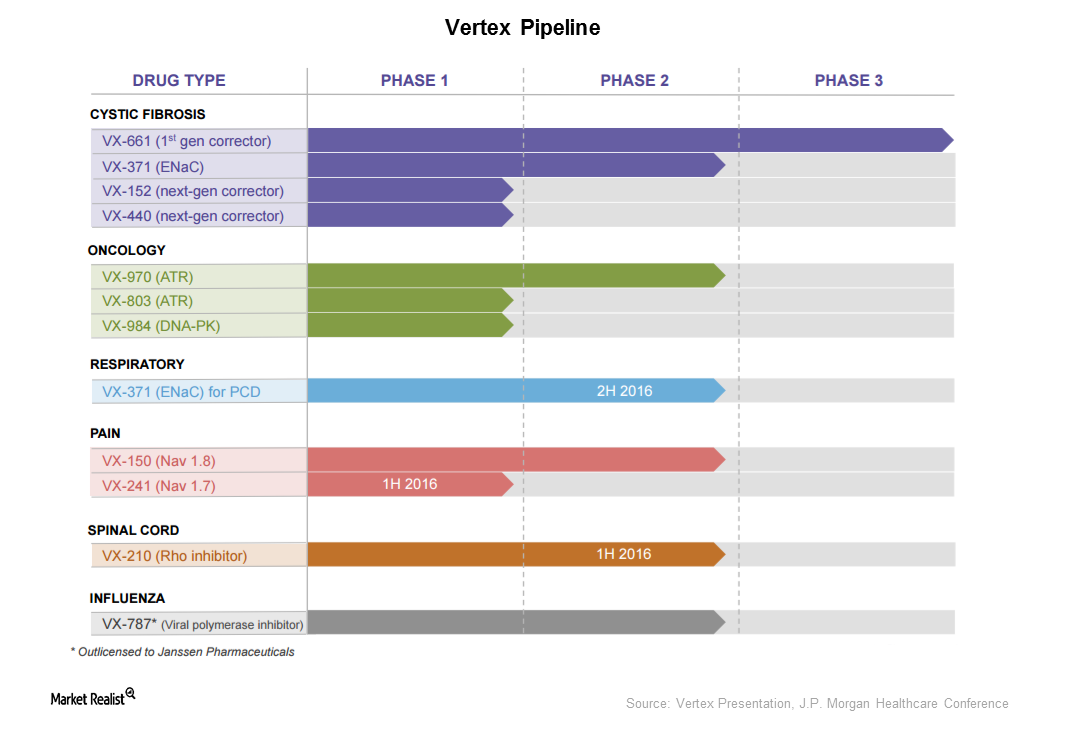

How Does Vertex Plan to Expand Beyond Cystic Fibrosis?

Vertex is trying to expand its product base beyond cystic fibrosis. It holds molecules in the oncology, respiratory, pain, spinal cord, and influenza spaces.

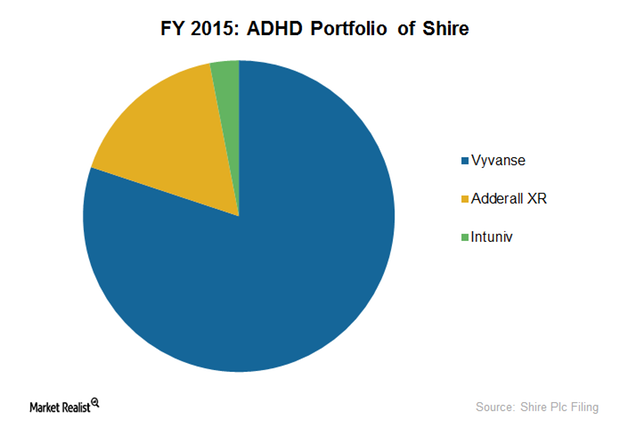

How Vyvanse Could Fuel Shire’s ADHD Portfolio Sales

Vyvanse is Shire’s leading ADHD drug, constituting 80% of the company’s ADHD portfolio. In fiscal 2015, Vyvanse earned the company $1.7 billion.

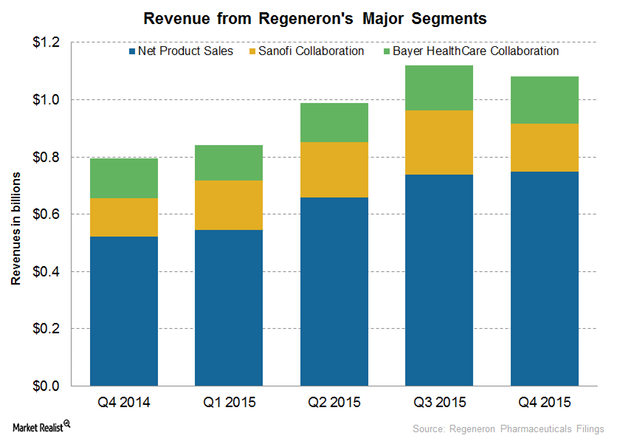

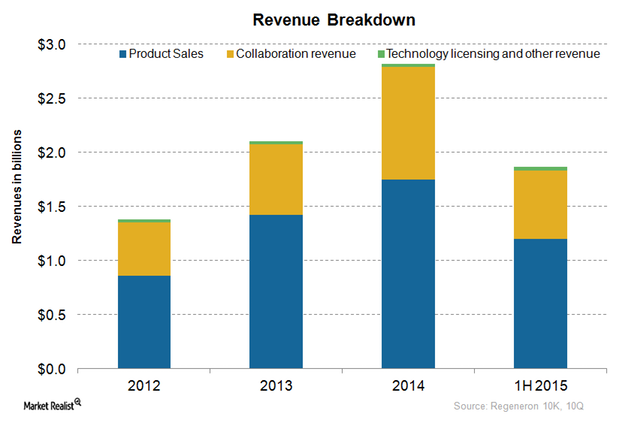

Regeneron Pharmaceuticals’ Major Revenue Sources in 4Q15

Regeneron Pharmaceuticals (REGN) earns revenue from net product sales, collaboration, and technology licenses.

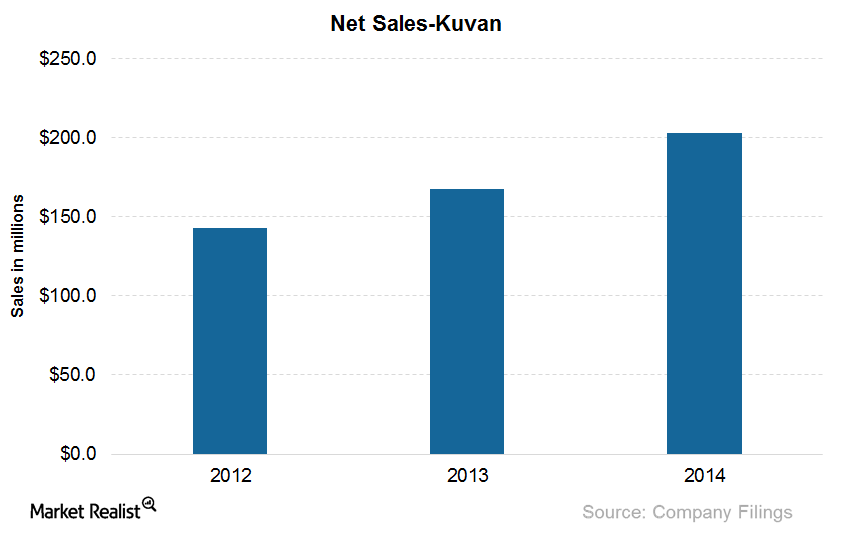

What Are BioMarin’s Products for Treating Phenylketonuria?

Kuvan, with the active ingredient sapropterin dihydrochloride, is effective in reducing blood phenylalanine levels in PKU (or phenylketonuria) patients.

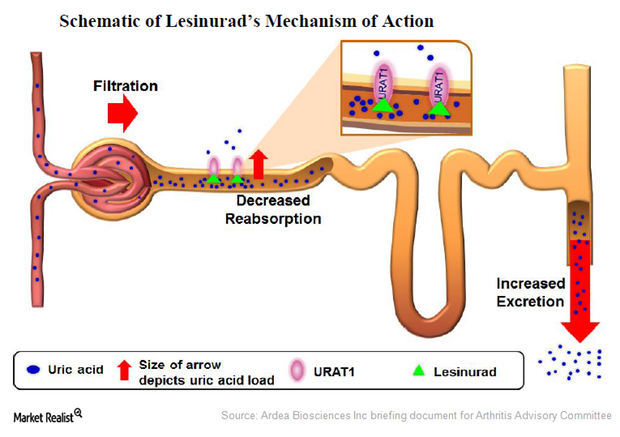

Lesinurad: A Selective Uric Acid Reabsorption Inhibitor for Gout

Lesinurad, originally developed by Ardea Biosciences, was acquired by AstraZeneca through the acquisition of Ardea in June 2012. It works to reduce the uric acid levels in gout patients.

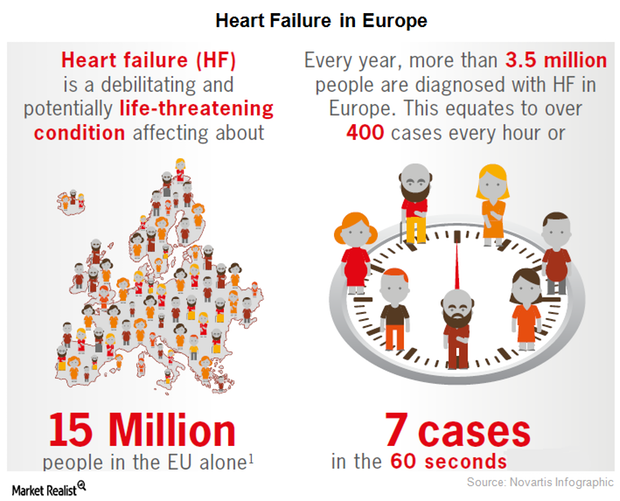

The European Commission Approved Novartis’s Entresto

On November 24, Novartis announced that the European Commission had approved Entresto as a therapy for adult patients suffering from symptomatic chronic heart failure with reduced ejection fraction.

Alexion Pharmaceuticals Expands Soliris Labels

Alexion Pharmaceuticals is actively involved in expanding the approved labels for its flagship product Soliris.

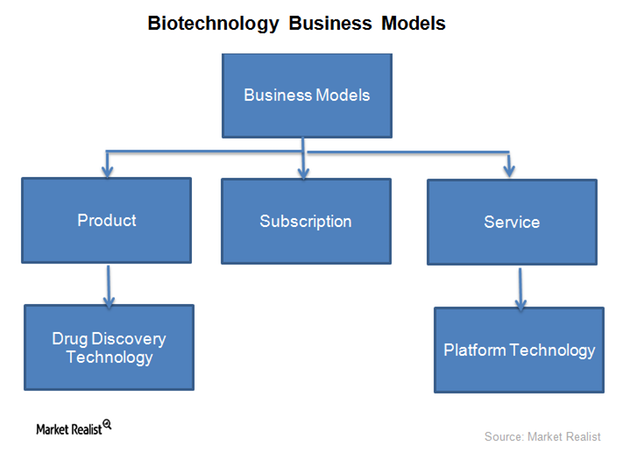

An Overview of Regeneron’s Business Model

Regeneron generates revenues in three ways: product sales, revenues earned through collaboration arrangements, and revenues earned from licensing proprietary technology.

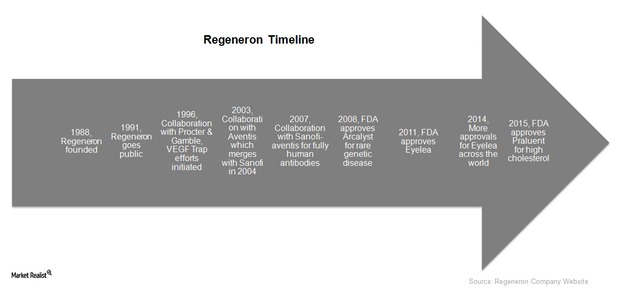

Regeneron: An Investor’s Overview to a Leading Biotech Company

With a market capitalization of $50.7 billion, Regeneron is one of the country’s major biotechnology companies. Its products and pipeline candidates focus on cancer, eye diseases, and cardiovascular diseases.

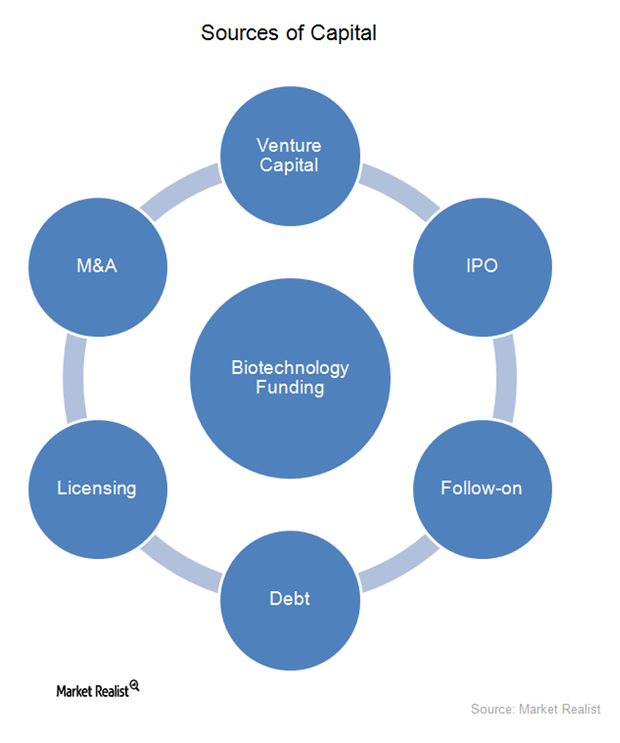

Sources of External Capital for the Biotechnology Industry

In the early stages of their life cycles, most biotechnology companies are financed by venture capital, which typically comes from wealthy investors who invest in startup companies.

Drug Approval Process in the Biotechnology Industry

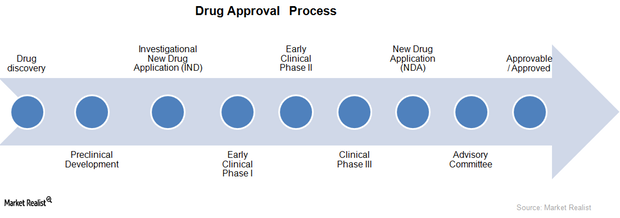

A drug approval process is required in order for a new drug to enter the market. Companies with new drugs in later stages of the approval process are more likely to earn a positive cash flow in the next few years.

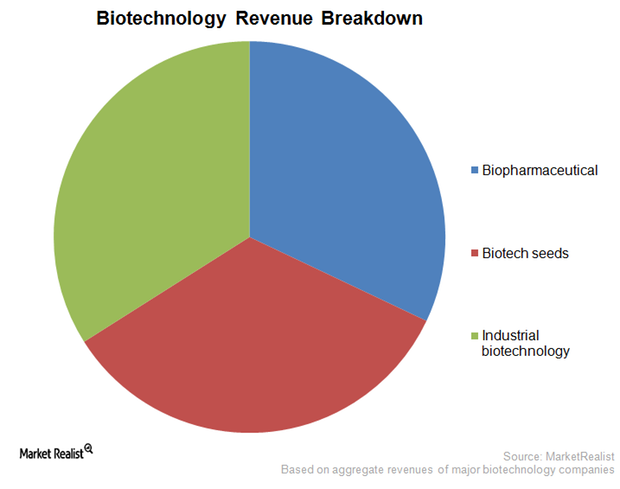

The Business Models of Biotechnology Companies

The type of business model a biotechnology company selects depends on technical capability, availability of resources, and competition in the industry.

A Must-Read Overview of the US Biotechnology Industry

Biotechnology is simply ‘technology based on biology.’ The biotechnology industry includes food technology, genetic research, healthcare, and environmental technology.