Procter & Gamble Co

Latest Procter & Gamble Co News and Updates

Procter & Gamble Beats Third-Quarter Estimates

Procter & Gamble (PG) posted stronger-than-expected third-quarter results on Tuesday, April 23.

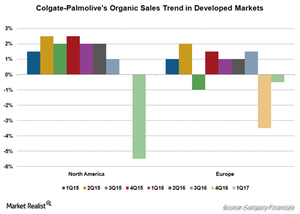

Colgate-Palmolive’s Developed Markets Remained a Drag in 1Q17

Net sales in North America fell 5.0% in 1Q17, reflecting a strong decline in volumes coupled with lower pricing.

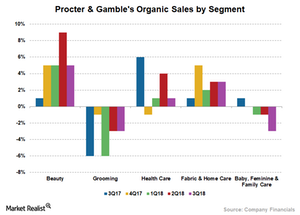

How Procter & Gamble’s Segments Performed in 3Q18

Lower pricing adversely impacted Procter & Gamble’s (PG) sales across product segments amid increased competitive activity.

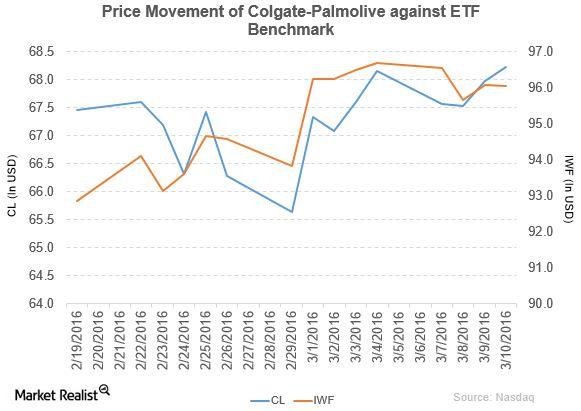

How Much Has Colgate-Palmolive Increased Its Dividend?

Colgate-Palmolive (CL) has a market capitalization of $60.9 billion. CL rose by 0.37% to close at $68.23 per share as of March 10, 2016.Financials Moore Capital lowers its stakes in JPMorgan Chase

JPMorgan’s latest 2Q14 results beat estimates. Meanwhile, net income was down to $6 billion from $6.5 billion in 2Q13. The earnings per share (or EPS) was $1.46, compared to $1.60 in 2Q13.

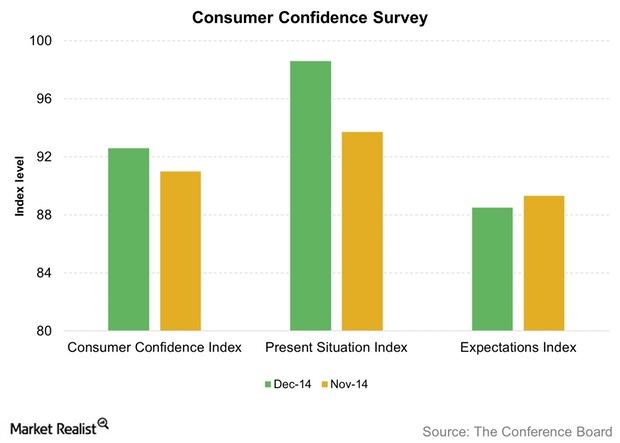

Why did consumers’ confidence rise in December?

The Board’s Consumer Confidence Index rose to 92.6 in December—compared to 91 in November. For November, the index was revised from an initially reported value of 88.7.

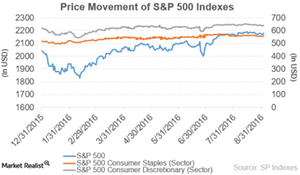

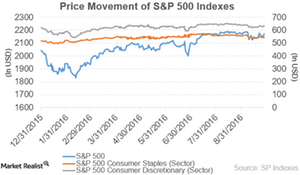

Your Outliers in the Consumer Space: 5th Week of August

By the end of August, the S&P Consumer Staples had outperformed the S&P Consumer Discretionary and SPY with respective returns of 0.89%, -0.18%, and 0.50%.

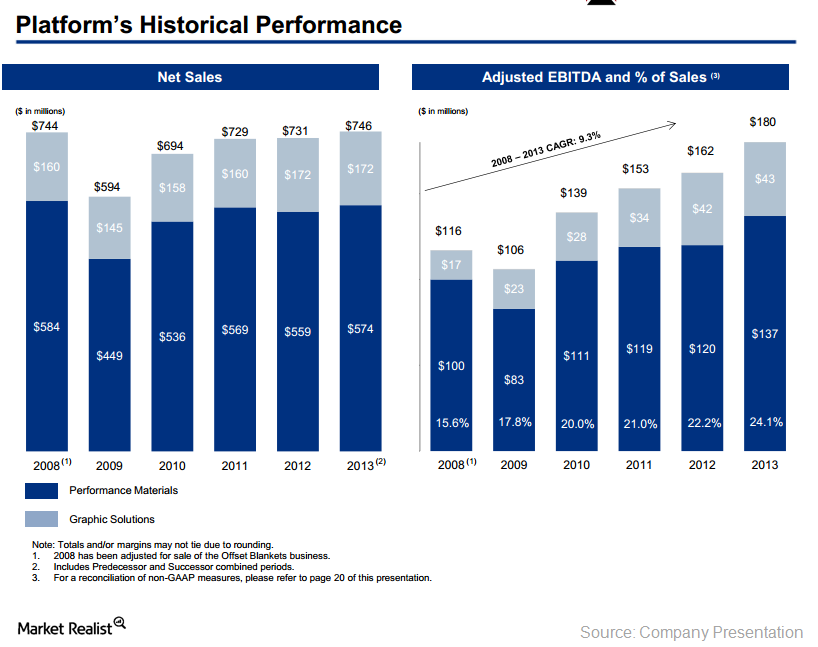

Why Pershing Square initiated a position in Platform Specialty Products

Pershing Square disclosed a new position in Platform Specialty Products (PAH) that accounts for 7.58% of Pershing Square’s 1Q14 portfolio.

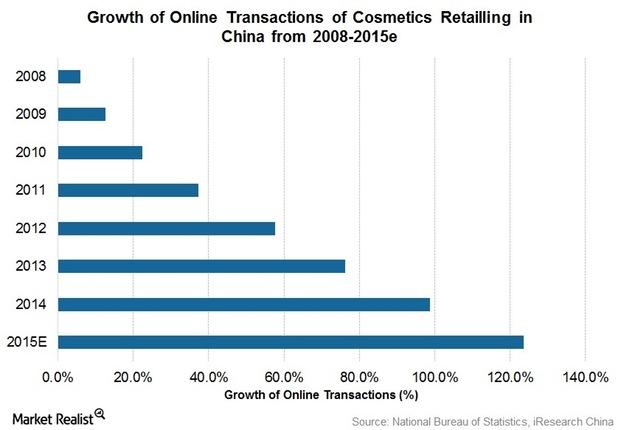

Estée Lauder Sees Positive Outlook in China

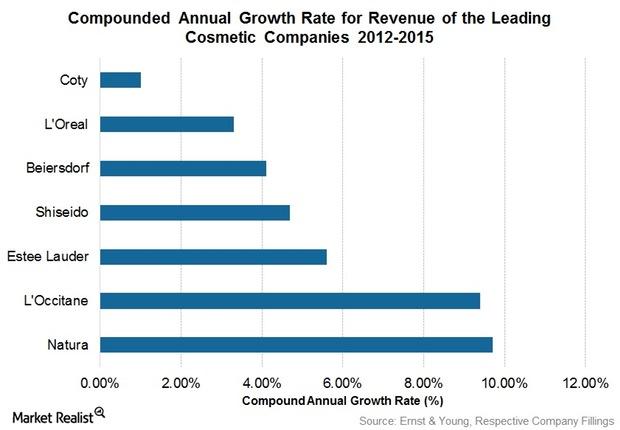

International brands such as Estée Lauder (EL), L’Oréal (LRLCY), Procter & Gamble (PG), Shiseido (SSDOY), and Nivea (BDRFF) dominate the cosmetics market in China.

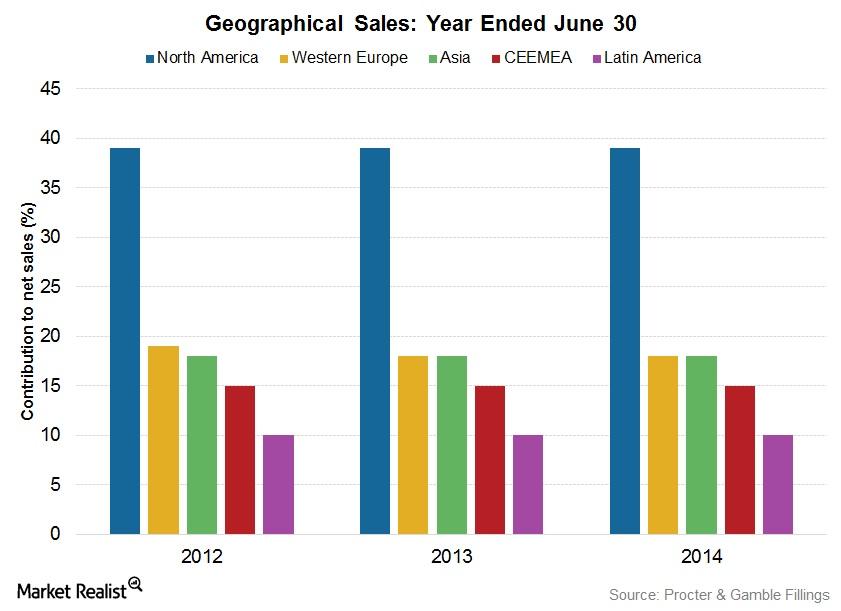

Procter & Gamble: Global Giant in Household, Personal Products

The Procter & Gamble Company, or P&G, is the largest household and personal products company in the world. It was established in 1837 by William Procter and James Gamble.

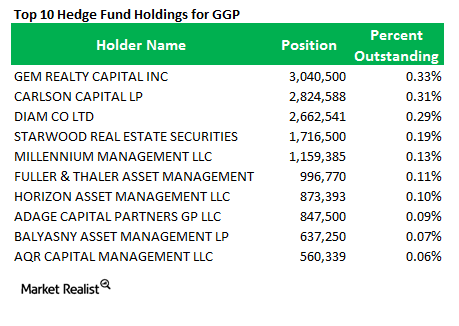

Why did Ackman’s Pershing Square exit General Growth Properties?

Last week, Pershing Square exited its entire stake in General Growth Properties.

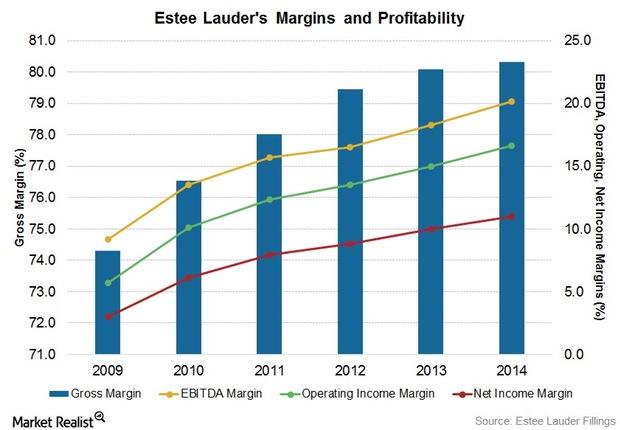

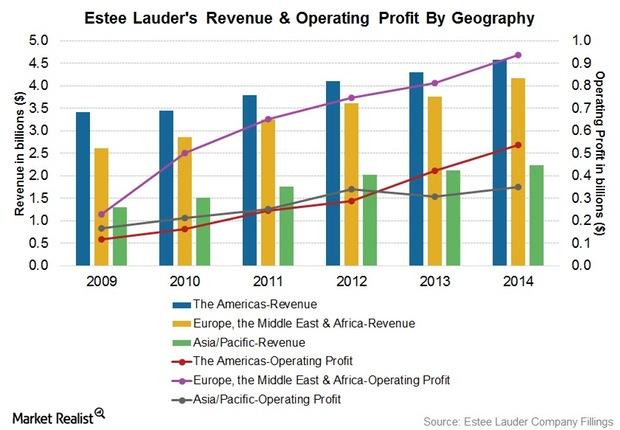

Why Estée Lauder’s Margins and Profitability Are Rising

Despite currency headwinds, Estée Lauder’s (EL) worldwide gross profit margin increased to 80.3% in fiscal 2014 from 80.1% in fiscal 2013.

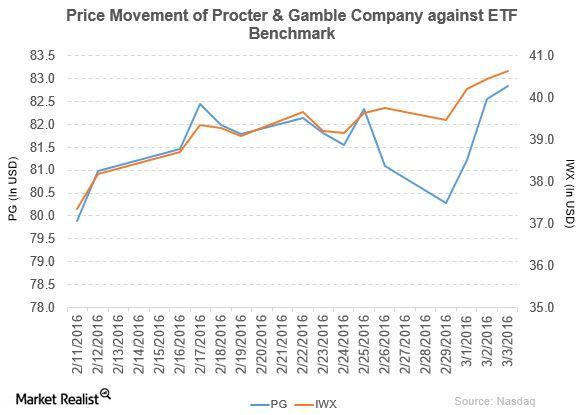

Henkel Acquired Procter & Gamble’s Haircare Brands

Procter & Gamble (PG) has a market cap of $224.1 billion. PG rose by 0.35% to close at $82.84 per share on March 3, 2016.

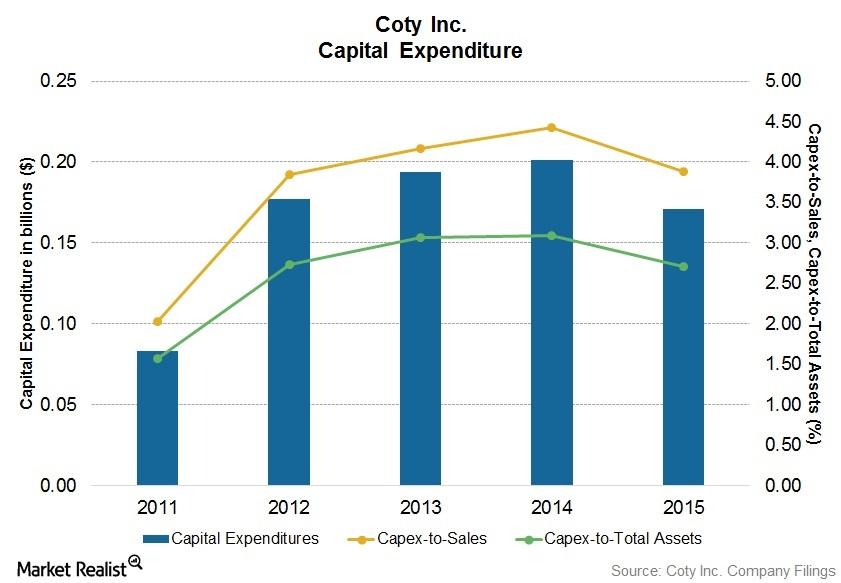

Why Coty’s Capital Expenditure Could Rise

Coty Inc.’s capital expenditure decreased 15.2% to $0.17 billion in fiscal 2015, compared to $0.20 billion in fiscal 2014.

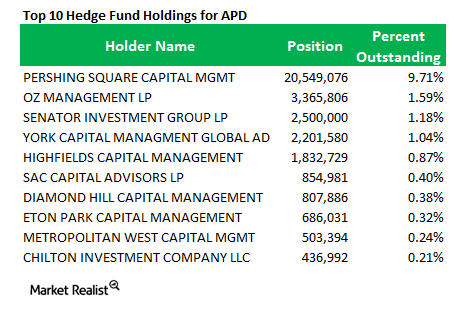

Why Pershing Square increased its stake in Air Products and Chemicals

Pershing Square increased its position in Air Products and Chemicals, Inc. from 21.31% in 3Q 2013 to 27.91% in 4Q 2013.

Business Overview of Estée Lauder

Estée Lauder’s sales growth was ranked third-highest globally among leading cosmetic companies between the years 2012 to 2015, with net revenue of $11 billion in fiscal year 2014.

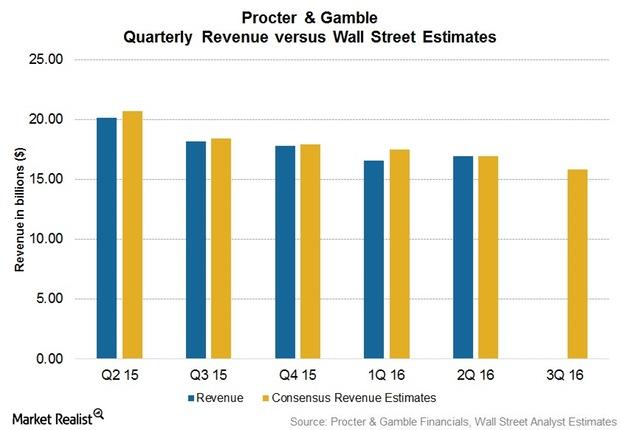

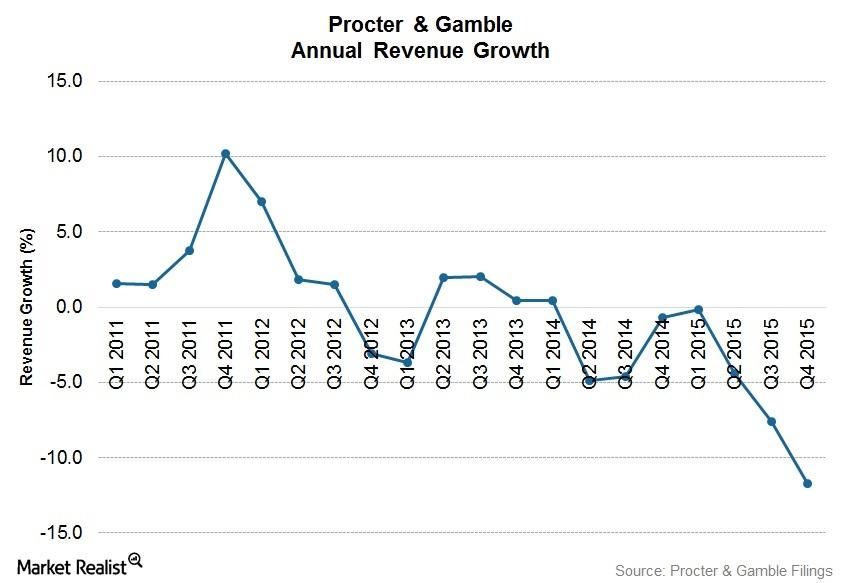

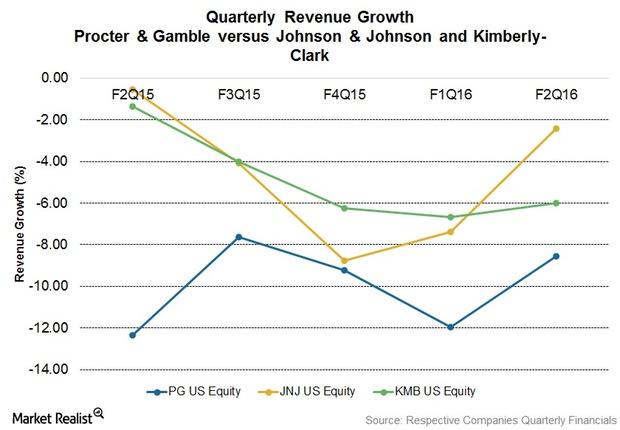

Procter & Gamble: Can Focus on 10 Product Categories Help 3Q16?

Procter & Gamble (PG) is set to release its fiscal 3Q16 earnings before the Markets open on April 26, 2016. In fiscal 2Q16, P&G missed revenue estimates for the fifth consecutive quarter.

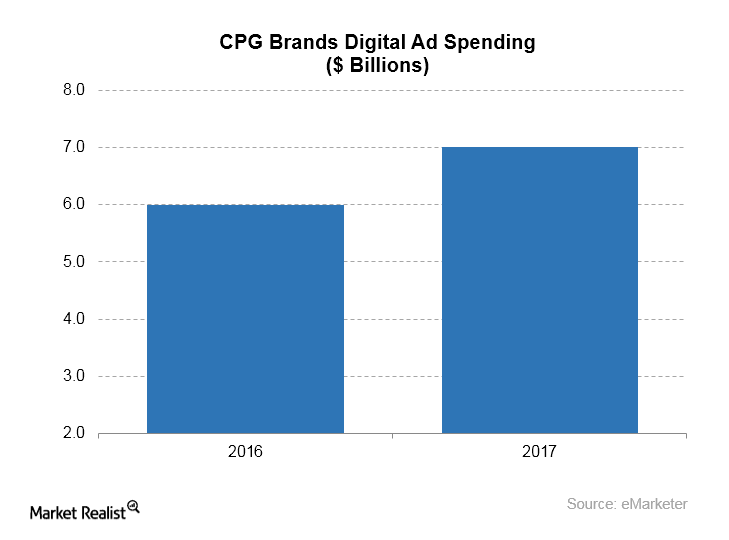

What Are the Trends in Facebook’s Largest Advertising Category?

Business intelligence firm eMarketer estimates that CPG brands spent more than $7.0 billion on digital advertising in 2017, compared with $6.0 billion in 2016.

How Is Clorox Improving Product Distribution?

For distribution in the United States, Clorox (CLX) sells or markets its products primarily through mass retail outlets, e-commerce channels, wholesale distributors, and medical supply distributors.

Mega Brands Set to Dominate in P&G’s New Product Portfolio

P&G plans to focus on superior brands in the 10 product categories in its portfolio. It expects one-third of them to surpass $1 billion in annual sales.

Estée Lauder’s Efforts to Expand Its Geographical Presence

Estée Lauder aims to expand its geographical market share in China, the Middle East, Eastern Europe, Brazil, and South Africa by focusing on consumers who purchase in travel retail channels.

Women CEOs: 5 Names You Should Know

Of all the Fortune 500 companies, only 5% have women CEOs. We rounded up five of the biggest names investors should know. Here’s why.

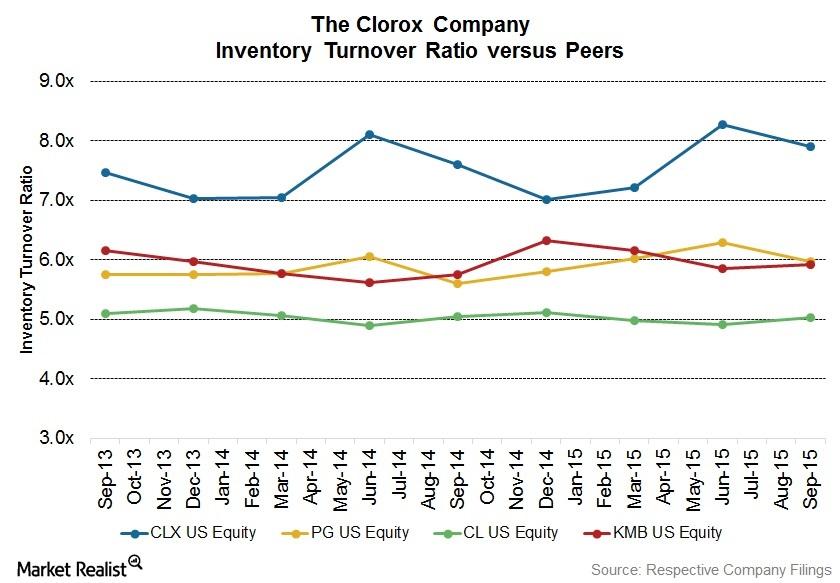

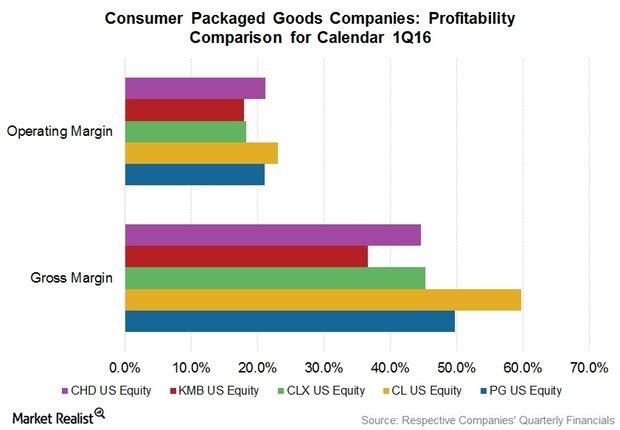

Weak Currencies, but Consumer Packaged Goods Margins Improved

The 1Q16 margins of consumer packaged goods (or CPG) companies sent strong signals. These companies have been investing heavily in innovative products and other growth initiatives.

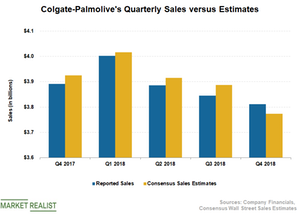

What Dragged Colgate-Palmolive’s Sales Down in Q4?

Colgate-Palmolive (CL) posted net sales of $3.8 billion, a decline of about 2% on a YoY (year-over-year) basis, as unfavorable currency rates hurt the top line by 5%.

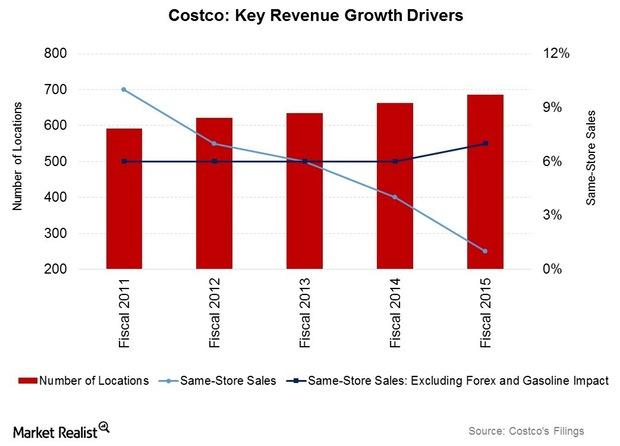

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

Why P&G Transferred Its Duracell Business to Berkshire Hathaway

On February 29, 2016, Procter & Gamble (PG) announced the completion of the transfer of its Duracell business to Berkshire Hathaway (BRK-B).

Who Were the Outliers in the Consumer Space on September 28?

On September 28, the S&P 500 outperformed the S&P Consumer Discretionary and the S&P Consumer Staples, which saw returns of 0.53%, 0.30%, and 0.11%.

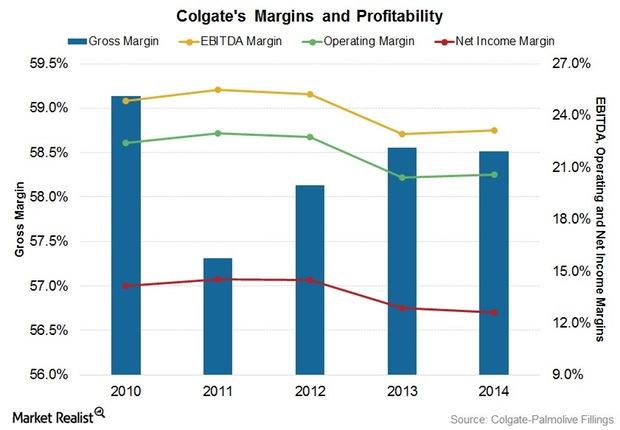

How Colgate Is Maintaining Margins in the Face of Headwinds

Colgate’s worldwide gross profit margin fell to 58.5% in 2014 from 58.6% in 2013.

Will the Rally in Clorox Stock Continue?

The COVID-19 pandemic boosted Clorox’s sales. People started paying more attention to cleaning and sanitizing.

Is Procter & Gamble a Good Bet for Investors?

The defensive nature of Procter & Gamble stock and its strong dividends make it a good buy in a challenging market environment.

Clorox Gets Rating Upgrade, Coronavirus Triggers Demand

Clorox stock rose 4.1% on March 16, even though the US stock market crashed amid the coronavirus pandemic. JPMorgan Chase upgraded its rating.

Why 2019 Wasn’t As Good As 2018 for Church & Dwight Stock

Although Church & Dwight stock is trading in the green, it has lagged its peers and the broader markets. The stock didn’t repeat its 2018 performance.

Procter & Gamble Stock: What’s Fueling the Growth?

Procter & Gamble stock has generated a significant amount of wealth for investors this year. The company boosted shareholders’ returns.

Why Colgate-Palmolive’s Q3 Earnings Failed to Impress

Colgate-Palmolive released its third-quarter earnings results today. The company’s performance was mixed, irking investors.

Procter & Gamble Stock: Valuation Limits Upside

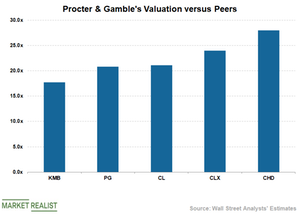

Procter & Gamble stock trades at 24.7x its fiscal 2020 estimated core EPS of $4.85. The stock trades at 23.2x its fiscal 2021 estimated core EPS of $5.17.

Church & Dwight Stock: Valuation Overshadows Growth

Church & Dwight (CHD) stock has risen 9.5% on a YTD (year-to-date) basis as of September 13. However, the stock lags its peers by a wide margin.

Procter & Gamble Stock: What’s behind Its Solid Return?

Procter & Gamble stock benefits from its strong organic sales. On average, the company’s organic sales have increased by 5% in the last four quarters.

Why Clorox Stock Is Underperforming Peers

Clorox stock (CLX) is down about 8% since the company posted its third quarter of fiscal 2019 earnings on May 1.

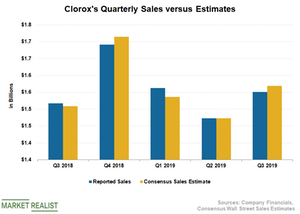

Currency and Competition Hurt Clorox’s Q3 Sales

Clorox (CLX) posted net sales of $1.55 billion, which fell short of Wall Street’s estimate of $1.57 billion.

These Consumer Staples Stocks Marked Stellar Gains in Q1

The Consumer Staples Select Sector SPDR ETF (XLP) rose 10.5% in the first quarter of 2019.

What Drove Clorox’s Q2 Sales?

Clorox (CLX) posted net sales of $1.47 billion during the second quarter.

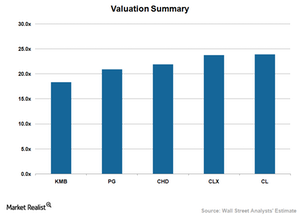

Procter & Gamble’s Valuation Compared to Its Peers

Procter & Gamble (PG) stock trades at 20.8x its estimated fiscal 2019 EPS of $4.41, which doesn’t look attractive.

Investing Defensively Can Lose You a Fortune

I bet you may have heard a lot about investing defensively while the market faded.

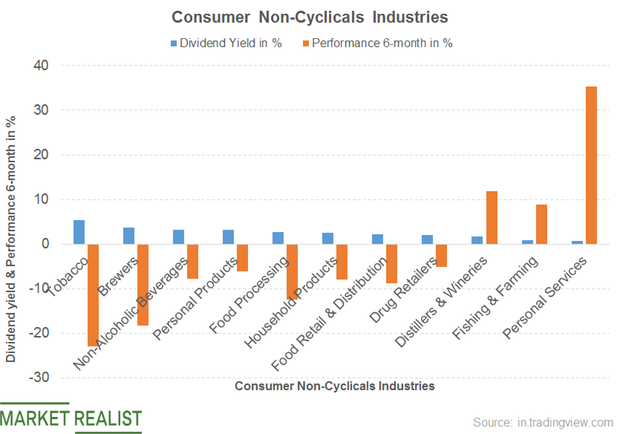

What’s the Dividend Yield of the Consumer Non-Cyclical Sector?

The consumer non-cyclical segment recorded a dividend yield of 3%.

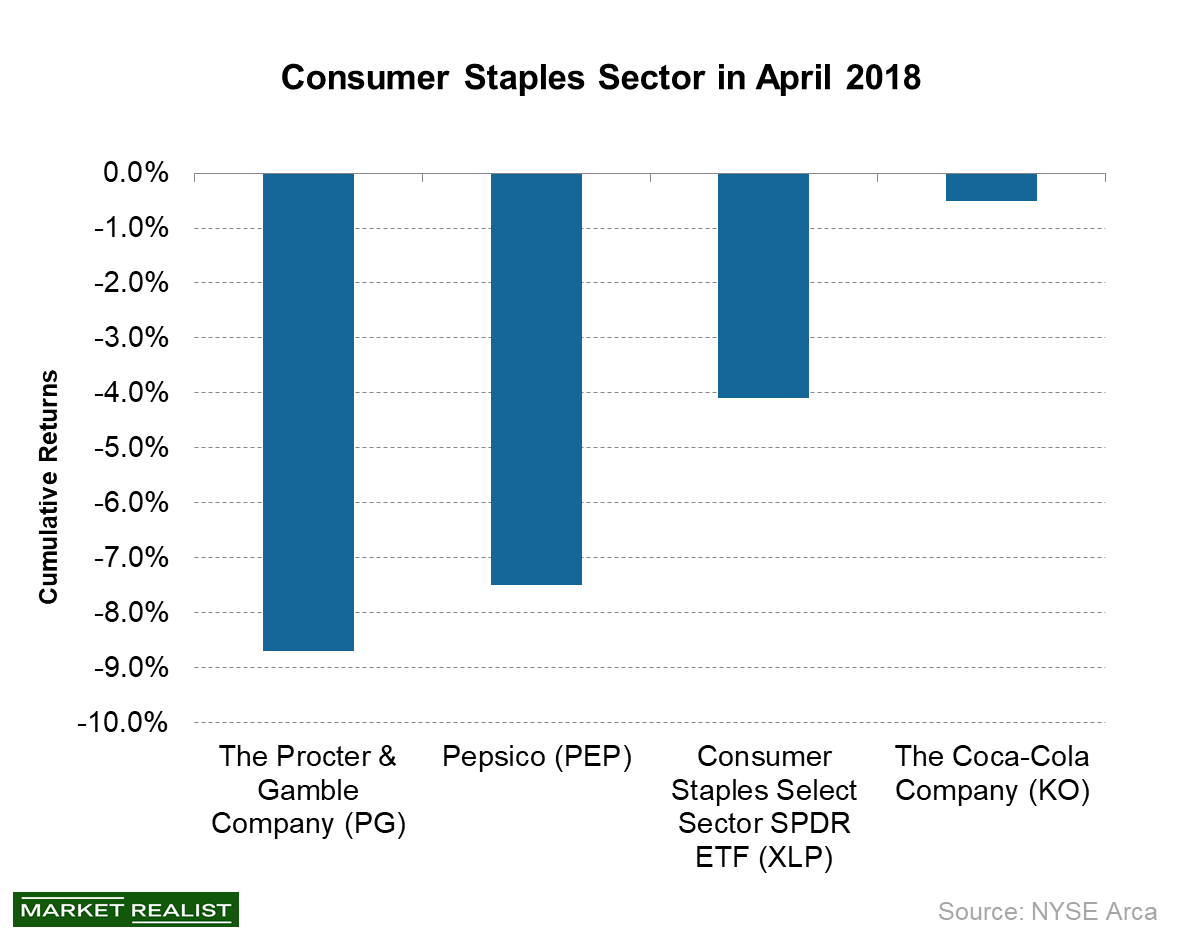

Is Higher Inflation Hurting the Consumer Staples Sector?

The consumer staples sector is an important sector in the S&P 500 Index (SPY).

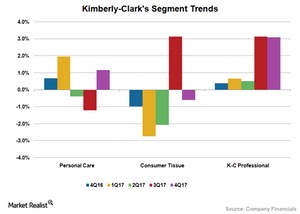

Kimberly-Clark: Segment Performances in 4Q17

Kimberly-Clark’s (KMB) Personal Care segment returned to growth in 4Q17. The segment’s top line increased 1.2% to $2.3 billion.

How PG, KMB, CL, CLX, and CHD Compare on Valuation

As of November 24, 2017, Colgate-Palmolive (CL) stock was trading at a forward PE multiple of 24.0x, which is higher than its peers.

What Do Analysts Think about Merck?

Wall Street analysts estimate Merck’s (MRK) top line will increase marginally by 0.1% to ~$10,546 million in 3Q17.

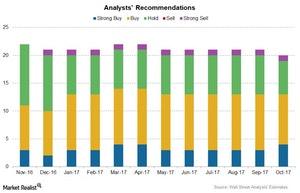

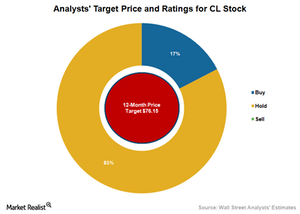

What Analysts Recommend for Colgate-Palmolive

The majority of analysts providing recommendations on Colgate-Palmolive (CL) stock maintain a neutral outlook.

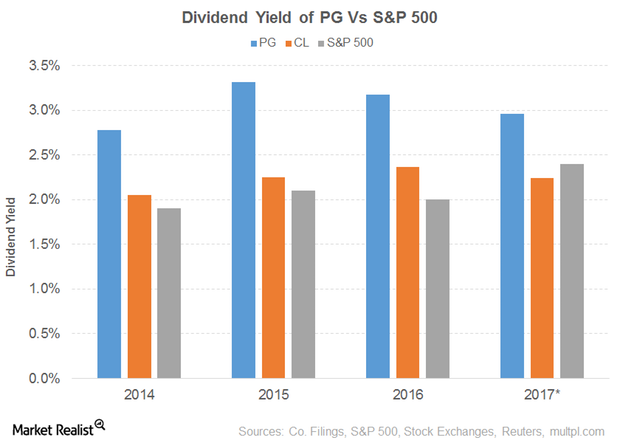

Dividend Yield of Procter & Gamble

Procter & Gamble’s (PG) PE ratio of 25.1x compares to a sector average of 23.3x. The dividend yield of 3.0% compares to a sector average of 3.8%.