JB Hunt Transport Services Inc

Latest JB Hunt Transport Services Inc News and Updates

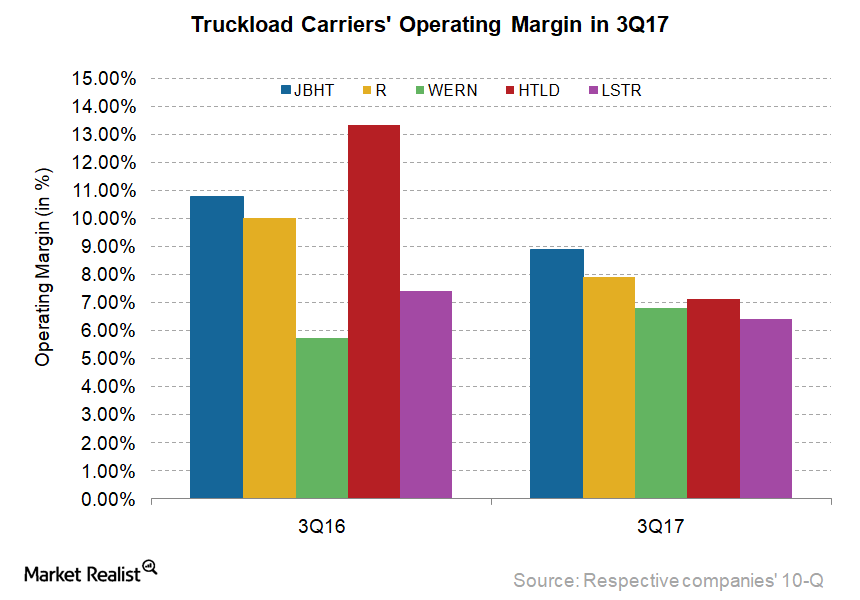

Will Rise in Crude Oil Benefit US Truckload Carriers in 2018?

The average US on-highway diesel prices in 3Q17 have risen 20% compared to the same quarter last year.

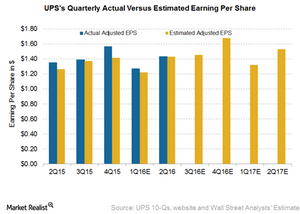

How Analysts Feel about United Parcel Service Post-2Q16

In this article, we’ll discuss what analysts are expecting for United Parcel Service (UPS) following its 2Q16 results.

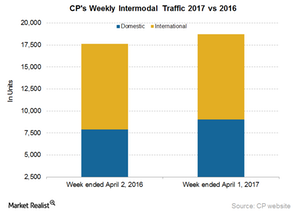

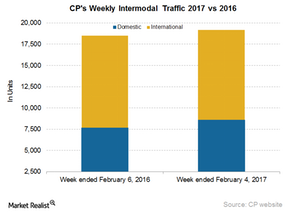

Canadian Pacific: Domestic Intermodal Growth Matters

In the week ended April 1, 2017, Canadian Pacific reported a 6.3% rise in overall intermodal traffic.

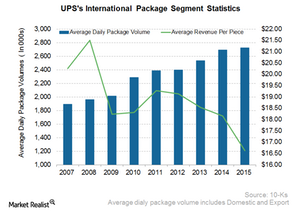

UPS’s Second-Largest Segment: International Package Segment

United Parcel Service’s international package segment includes small package operations in Europe, Asia-Pacific, Canada, Latin America, the Indian subcontinent, the Middle East, and Africa.

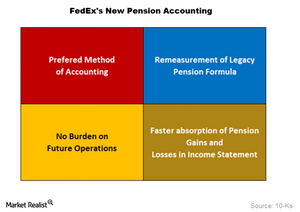

Why Did FedEx Switch to Mark-to-Market Pension Accounting?

FedEx suffered a loss of $895.0 million in connection with the shift to new pension accounting in 2015.

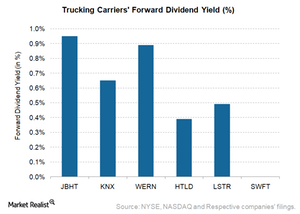

How Truckload Carriers Have Returned Cash to Investors in 2Q17

J.B. Hunt Transport Services (JBHT) raised its share repurchases by $80.0 million in 1H17 compared with 2Q16.

FedEx Delivers Strong Fourth-Quarter Earnings

FedEx (FDX) announced its fourth-quarter earnings after the market closed on June 19. FedEx surpassed analysts’ adjusted EPS estimate by 3.6%.

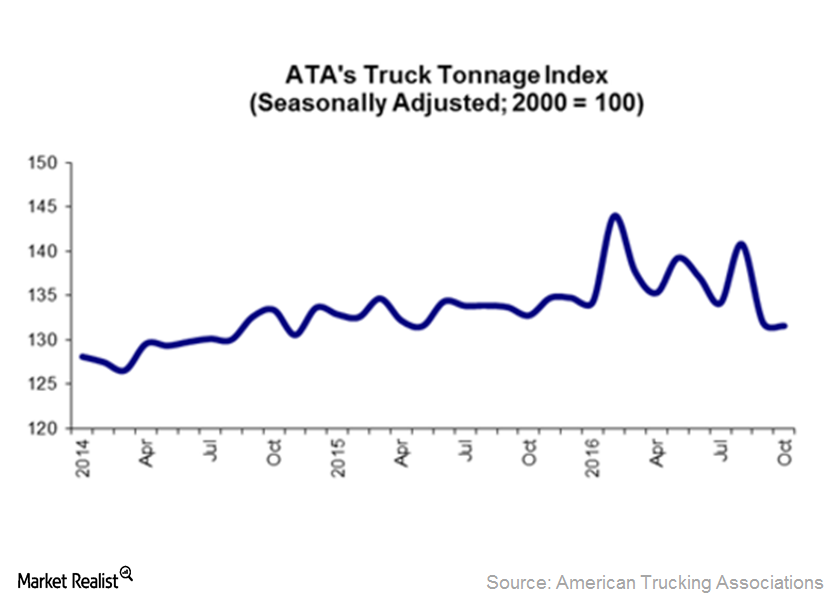

What the Direction of October’s Truck Tonnage Index Indicates

In this article, we’ll look at the direction of the Truck Tonnage Index (or TTI) in October 2016.

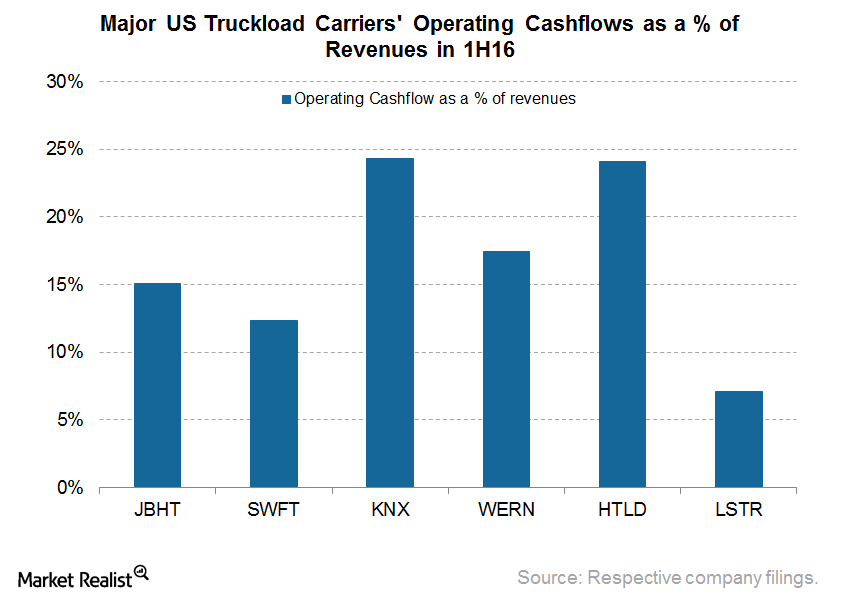

Which US Trucking Carrier Has the Best Operating Cash Flow?

Operating cash flow is a vital parameter for judging the health of a transportation company because it points to efficiency in operating assets and liabilities.

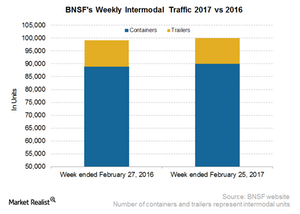

BNSF Railway’s Intermodal Volumes Matter

In the eighth week of 2017, BNSF’s overall intermodal traffic rose slightly by 0.8% YoY to ~100,000 containers and trailers.

Canadian Pacific versus Canadian National: A Key Intermodal Comparison

Canadian Pacific’s (CP) intermodal volumes have been on roll for the past few weeks. It reported a 3.6% YoY rise for the week ended February 4.

Who Are Old Dominion’s Biggest LTL Competitors Today?

Old Dominion’s peer group includes LTL companies that compete in the national and regional marketplace. The company also competes with some US railroads.

What sets J.B. Hunt apart from its competitors?

In this part of the series, we’ll discuss what sets J.B. Hunt (JBHT) apart from its competitors. The company has more than 40 years of experience.

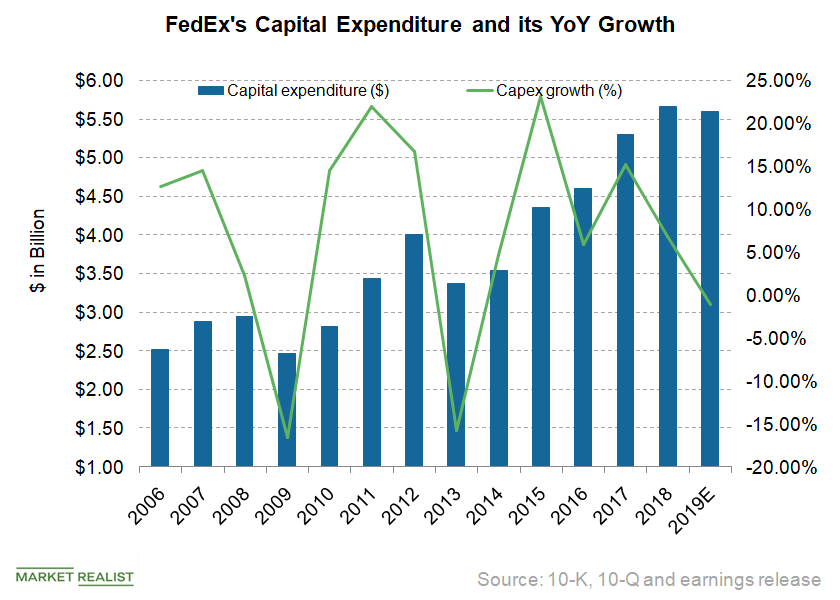

A Look at FedEx’s Capital Expenditure in Q1 2019

FedEx (FDX) incurred capital expenditure of $1.17 billion in the first quarter compared to $1.0 billion in the comparable period of fiscal 2018.

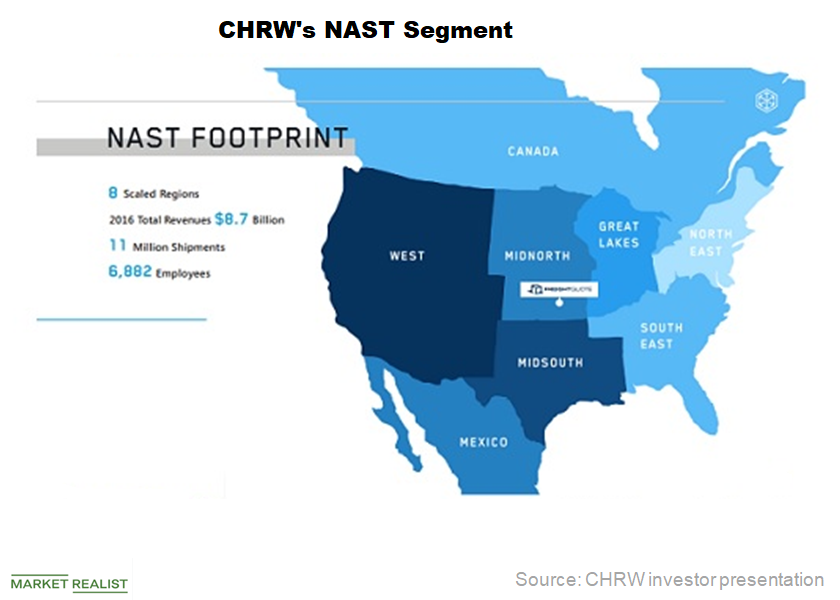

C.H. Robinson’s North American Surface Transport Segment

C.H. Robinson Worldwide’s (CHRW) NAST (North American Surface Transport) segment provides truckload, LTL (less-than-truckload), and intermodal freight transportation services across North America.

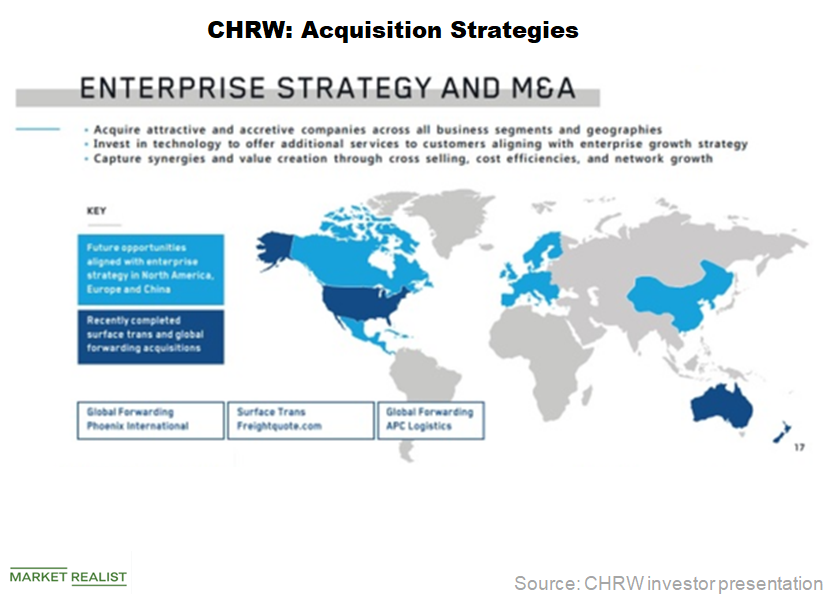

C.H. Robinson: Solid Business Growth through Acquisitions

C.H. Robinson Worldwide (CHRW) went public in 1997. Soon after, the company went on an acquisition spree to further its business interests in new geographies.

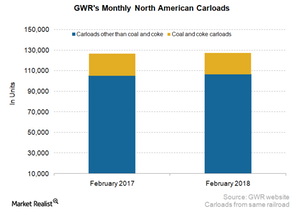

How GWR’s North American Carloads Trended in February

In February 2018, Genesee & Wyoming’s (GWR) North American carloads expanded 0.3% YoY (year-over-year) on a reported basis.

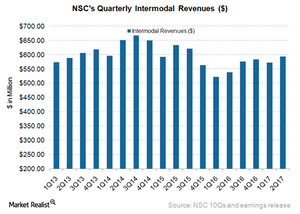

Norfolk Southern: International Pushed Intermodal Revenues in 2Q17

NSC’s Intermodal segment’s revenues rose 10% to $593.0 million from $538.0 million in 2Q16.

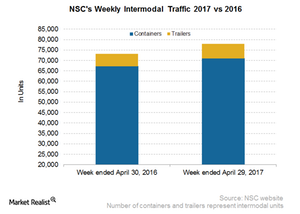

Comparing Norfolk Southern’s Intermodal Traffic with CSX’s

Norfolk Southern’s intermodal traffic Norfolk Southern’s (NSC) total intermodal traffic rose 6.5% in the week ended April 29, 2017. Its volumes reached ~78,000 containers. Norfolk’s container traffic rose 5.6%, and its trailer traffic rose 15.6% YoY (year-over-year) to nearly 6,900 units, compared with 5,900 units in the week ended April 30, 2016. Since the beginning of […]

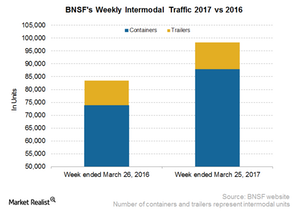

How BNSF’s Intermodal Volumes Compare in the 12th Week

In the 12th week of 2017, BNSF Railway’s (BRK-B) overall intermodal traffic rose 17.6% YoY to more than 98,000 containers and trailers.

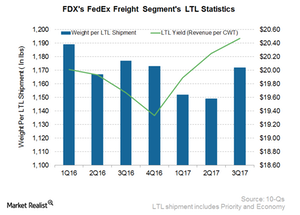

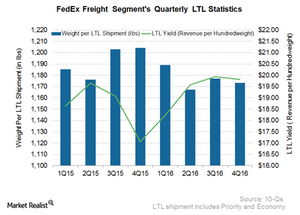

Better LTL Pricing Drove FedEx’s 3Q17 Freight Revenue

The FedEx Freight segment revenues rose 3.1% from $1.4 billion in 3Q16 to $1.5 billion in fiscal 3Q17.

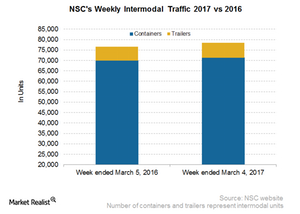

How Norfolk Southern’s Intermodal Volumes Compare to Peers

Norfolk Southern’s (NSC) total intermodal traffic rose 2.7% in the week ended March 4, 2017.

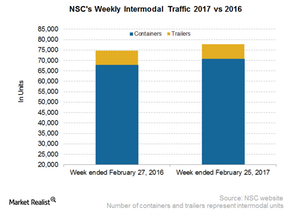

Behind Norfolk Southern’s Intermodal Volumes in the 8th Week

NSC’s total intermodal traffic rose 4.3% in the week ended February 25, 2017, reaching ~78,000 containers and trailers.

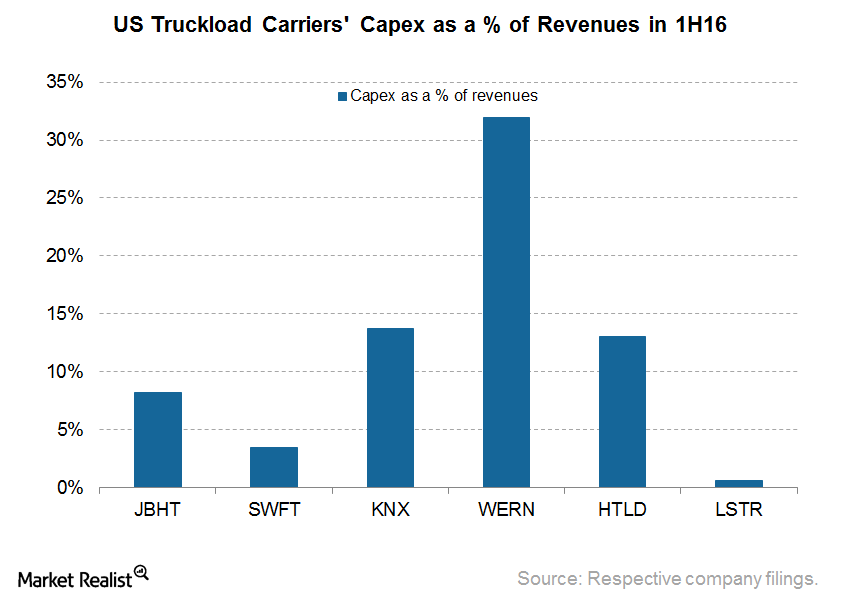

This Truckload Carrier’s Capital Expenditure Bucks the Trend

In the current weak freight regime, the extent of capital expenditure throws light on the growth prospects of these trucking carriers.

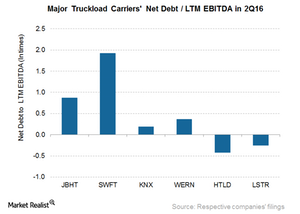

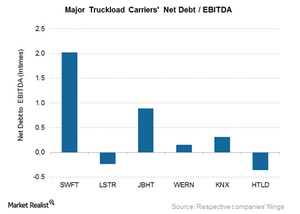

Which Truckload Carrier Posted the Most Debt in 2Q16?

Landstar System (LSTR) and Heartland Express (HTLD) have higher available cash on their balance sheets than total debt.

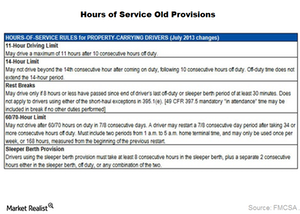

Understanding the Impact of Hours-of-Service Rules on Truckload Carriers

In July 2013, the FMCSA of the US Department of Transportation extended safety regulations regarding truckload drivers’ hours of service.

Which Is the Least Leveraged Truckload Carrier among Major Peers?

Among truckload companies, Landstar and Heartland have a lot of available cash compared to total debt. Swift and J.B. Hunt have high net debt-to-EBITDAs.

FedEx Freight: Higher Demand from Large Customers

FedEx expects FedEx Freight revenues to rise in fiscal 2017.

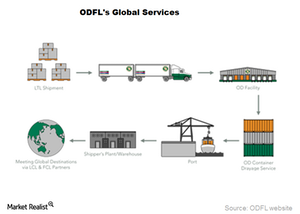

Inside Old Dominion Freight Line’s Global Services

Old Dominion unloads its less-than-truckload shipments dispatched by vendors onto an ocean container unit and onto the client’s steamship of choice.

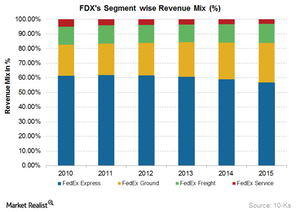

Analyzing FedEx’s Revenue Streams

In fiscal 2015, FDX increased its revenues by $1.9 billion. Its total revenue was a $47.4 billion for the year.

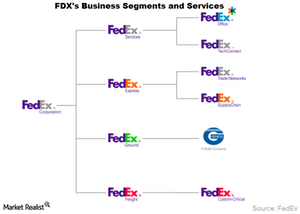

What Is FedEx’s Business Model?

FedEx provides a portfolio of transportation, e-commerce, and business services through wholly owned subsidiaries.

J.B. Hunt 360: J.B. Hunt Transport’s Technological Innovation

JHBT calls J.B. Hunt 360 an intuitive transportation management system. The company claims to realize improved workflows, tighter integration, and mobile tools.

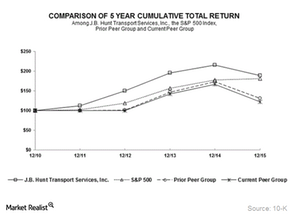

Who Competes with J.B. Hunt Transport Services?

J.B. Hunt Transport’s (JBHT) peer group includes trucking companies that compete in the national marketplace and some of the US Class I railroads. The company updates its peer group every year.

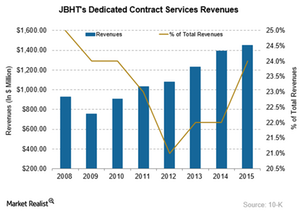

J.B. Hunt Transport’s Dedicated Contract Services Division

J.B. Hunt Transport (JBHT) has a network of roughly 89 cross-dock locations throughout the US to support the company’s final-mile, or last-mile, delivery services.

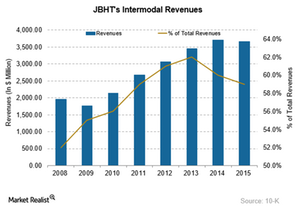

Why J.B. Hunt Transport Leads the Trucking Intermodal Space

Intermodal transportation involves the movement of freight in an intermodal container using multiple transportation modes such as rail, ship, and truck. It doesn’t involve the handling of freight when the modes are changed.

J.B. Hunt Transport Services: America’s Largest Trucking Company

One of the largest road transport companies in North America, J.B. Hunt Transport (JBHT) has transportation arrangements with all major US Class I railroads. Its operating revenues grew from $2.2 billion in 2002 to $6.1 billion in 2015.

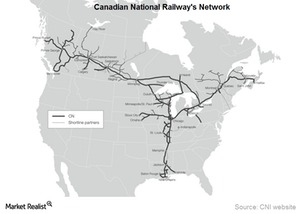

Canadian National Railway: Class I Railroad with a Robust Network

A Class I railroad in the US, or a Class I railway in Canada, is one of the largest freight railroads based on operating revenue. US Class I Railroads are line haul freight railroads with 2014 operating revenues of ~$475.75 million.

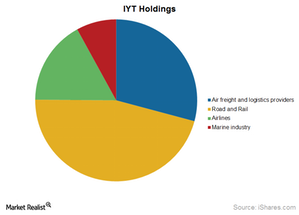

Which ETFs Give Exposure to Courier Stocks?

Smaller ETFs that provide exposure to the courier services industry include Buyback Achievers (PKW), the First Trust Capital Strength ETF (FTCS), and the MSCI Industrials Index ETF (FIDU).

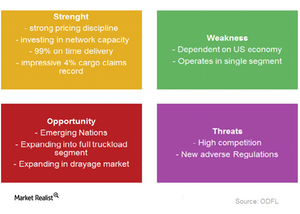

What are ODFL’s most significant strengths and weaknesses?

Old Dominion Freight Line (ODFL) has a strong pricing discipline and best-in-class service capabilities.

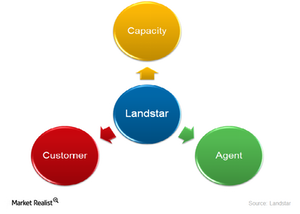

A look at Landstar’s business model

Landstar’s success is highly dependent on high revenue-generating sales reps, as well as on the volume increases by BCOs and customers.

What are Landstar’s competitive advantages?

Landstar and other 3PLs perform better during supply disruptions, when they can secure trucks among their large networks of small carriers.

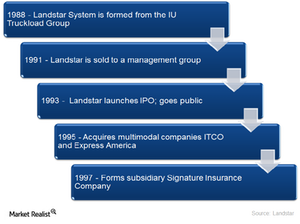

Landstar: Where it all started

Landstar invested $12 million in upgrading its IT and communications systems, making use of satellite technology and mobile equipment to track its fleet.

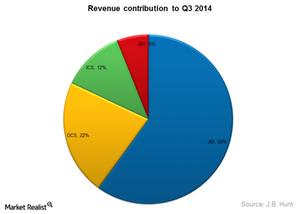

J.B. Hunt’s Integrated Capacity Solutions segment

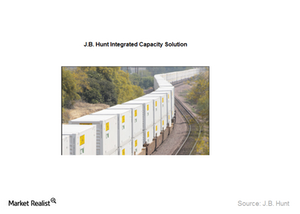

J.B. Hunt’s (JBHT) Integrated Capacity Solutions segment provides non-asset, asset-light, traditional freight brokerage and transportation logistics solutions to customers.

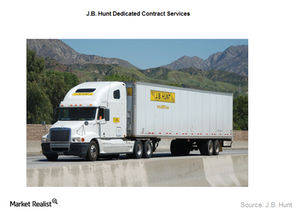

J.B. Hunt’s Dedicated Contract Services segment

J.B. Hunt’s (JBHT) Dedicated Contract Services segment supplies customers with drivers and equipment. For 2013, the segment’s revenue was $1.2 billion.

A look into J.B. Hunt’s Intermodal segment

J.B. Hunt’s (JBHT) Intermodal segment is the leader in the industry. The segment has transportation service agreements with most North American rail carriers.

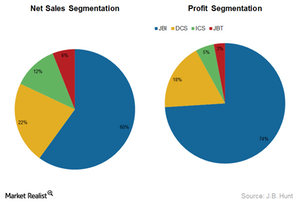

Analyzing how J.B. Hunt makes money

In this part of the series, we’ll discuss how JBHT makes money. In 2013, JBHT’s revenues increased by 500 million. Its total revenue was $5.6 billion.

An overview of J.B. Hunt Transport Services

J.B. Hunt Transport Services, Inc. (JBHT) is one of the leading transport and logistics companies in North America. The company operates a huge fleet of semi-trailer trucks.