Celgene Corp

Latest Celgene Corp News and Updates

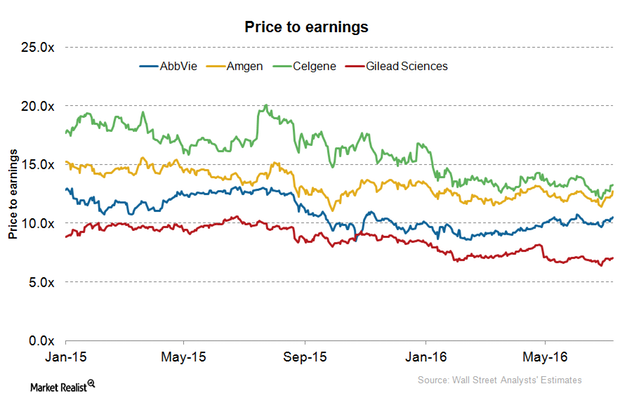

Why Is AbbVie’s Valuation Multiple Rising in July?

AbbVie believes that the Market has misunderstood the growth potential of Rova-T, which is expected to earn $1.5 billion–$2 billion in peak sales even under extremely conservative assumptions.

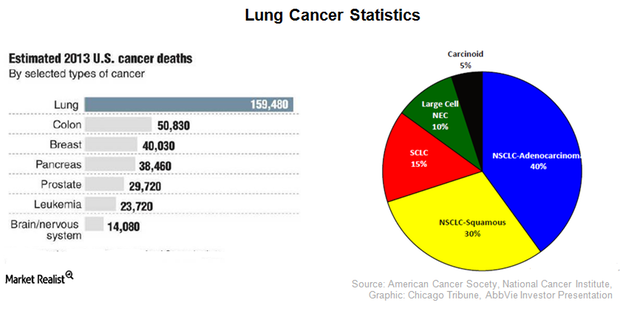

Why AbbVie Expects Rova-T to See Big Peak Sales

AbbVie project that Rova-T, a DLL3-targeted antibody conjugate acquired through the acquisition of Stemcentrx, will earn $5 billion in peak sales.

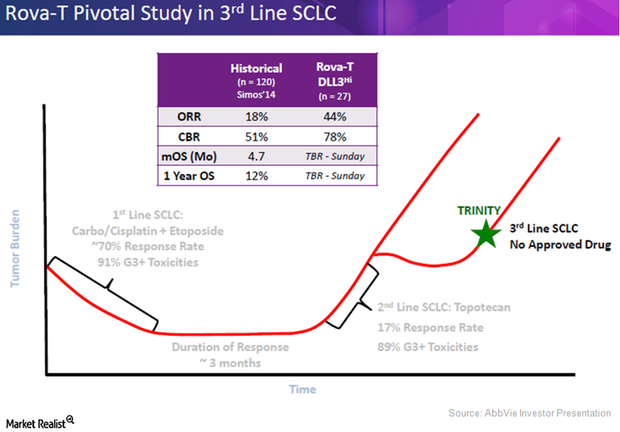

Understanding Trinity: Inside the Testing of AbbVie’s Rova-T

Trinity is a phase-2 clinical trial that tests the use of Rova-T as a third-line therapy for SCLC (small cell lung cancer).

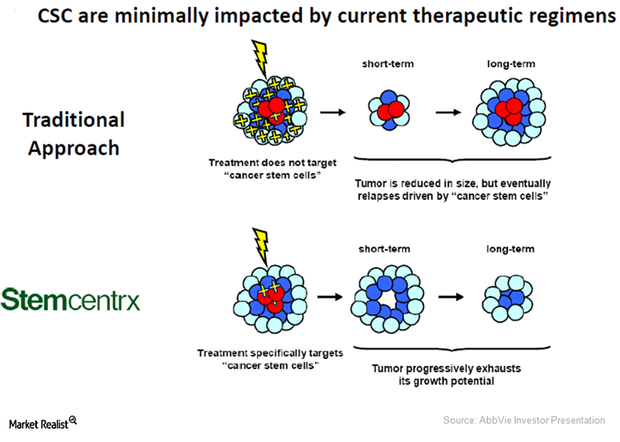

Can Stemcentrx’s Cancer Stem Cell Technology Really Accelerate Innovation for AbbVie?

The acquisition of Stemcentrx has added CSC (cancer stem cell) technology platform to AbbVie’s (ABBV) oncology portfolio.

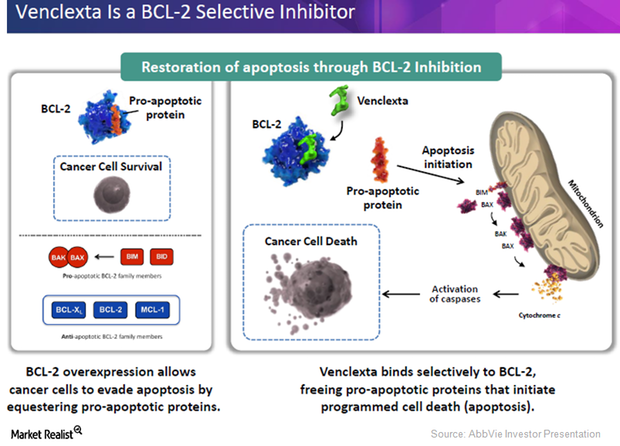

Venclexta: The First BCL-2 Inhibitor Cancer Therapy to Be Approved by the FDA

On April 11, 2016, Venclexta became the first BCL-2 inhibitor therapy to be approved by the FDA for chronic lymphocytic leukemia patients with 17p deletion.

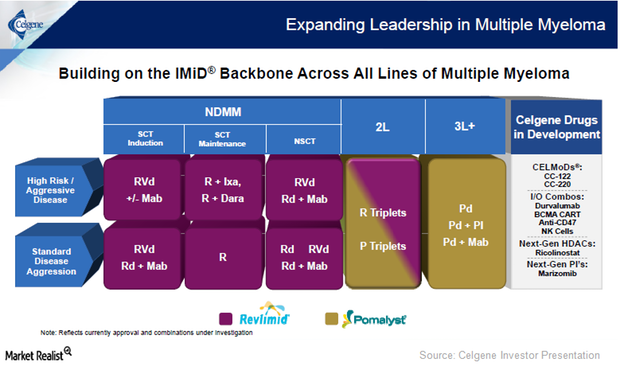

Celgene Continues to Develop New Multiple Myeloma Drugs

Celgene has been working on its immunomodulatory backbone drugs to develop combination therapies for use in treating all lines of multiple myeloma.

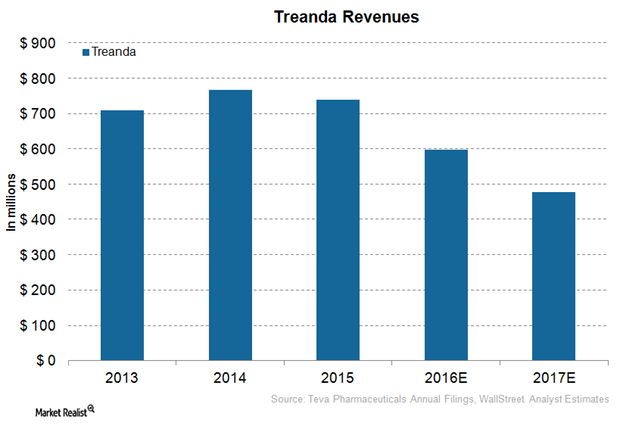

Bendeka: How Teva Plans to Safeguard Oncology Revenues

In the first quarter of 2016, Teva Pharmaceutical Industries (TEVA) launched a new drug, Bendeka, in partnership with Eagle Pharmaceuticals.

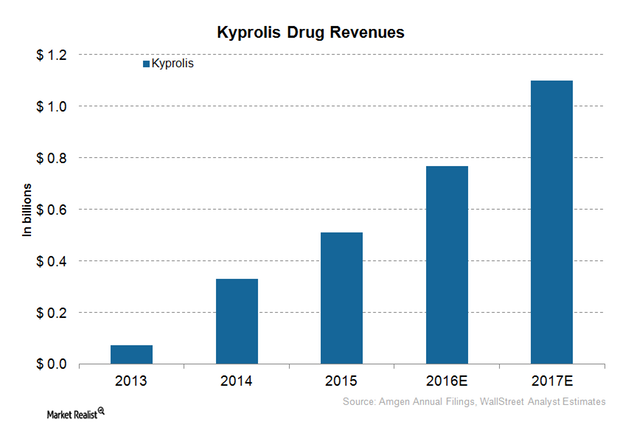

What Could Drive Amgen’s Kyprolis Sales in 2016?

Amgen expects Kyprolis to continue capturing the global multiple myeloma (or MM) market in 2016. The drug has established itself as a backbone therapy for relapsed MM.

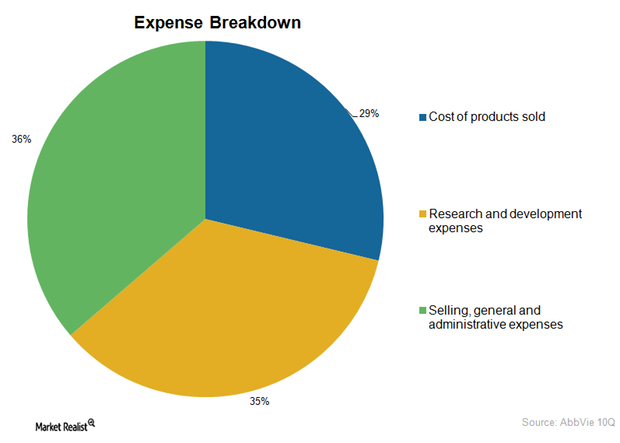

AbbVie’s Net Profit Margin Expected to Reach 29.8% in 4Q15

AbbVie (ABBV) has continued to improve its operational efficiency, which is expected to result in a net profit margin of 29.8%, a YoY increase of 6.3%. In 3Q15, AbbVie realized a net proft margin of 30.4%.

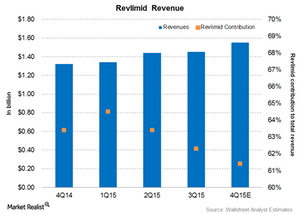

Revlimid Continues to Drive Celgene’s Revenue

Revlimid (lenalidomide) is one of Celgene’s (CELG) main revenue drivers. It had revenues of $1.4 billion in 3Q15, excluding the adverse impact of foreign exchange fluctuations.

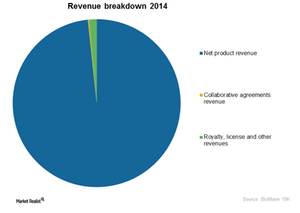

BioMarin’s Business Model and Its 3 Sources of Revenue

Let’s discuss BioMarin’s business model. It derives revenue from three sources, including product revenue. The latter accounts for ~98% of total revenue.

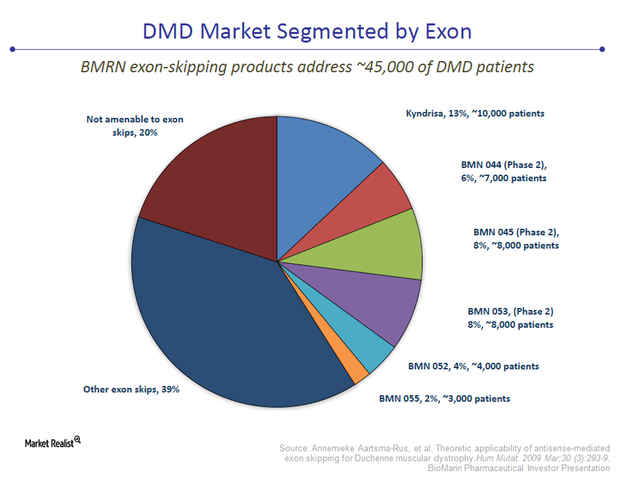

How Would Kyndrisa Treat Duchenne Muscular Dystrophy?

The FDA advisory committee has given an unfavorable opinion to Kyndrisa. But most analysts estimate the probability of FDA approval for the drug to be about 50%.

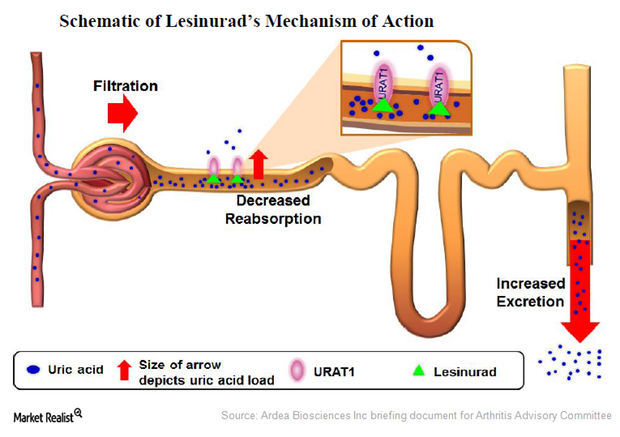

Lesinurad: A Selective Uric Acid Reabsorption Inhibitor for Gout

Lesinurad, originally developed by Ardea Biosciences, was acquired by AstraZeneca through the acquisition of Ardea in June 2012. It works to reduce the uric acid levels in gout patients.

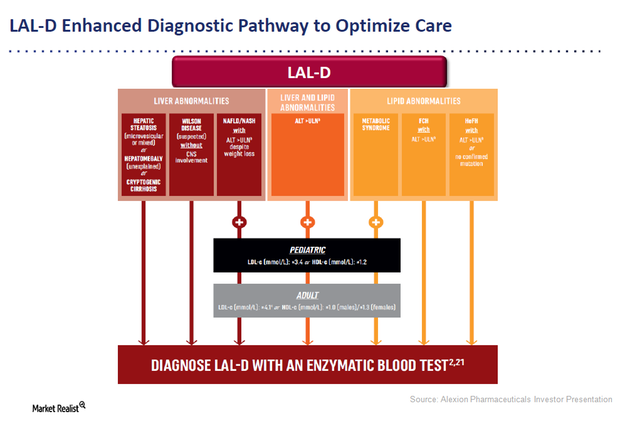

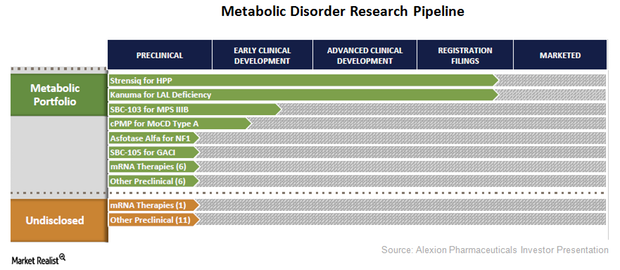

Kanuma: An Innovative Enzyme Replacement Therapy for LAL-D

Alexion Pharmaceuticals’ Kanuma is an innovative enzyme replacement therapy for patients suffering with lysosomal acid lipase deficiency (or LAL-D).

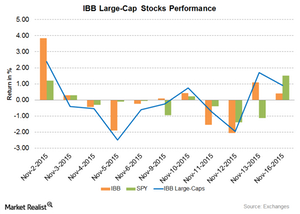

Illumina Continued to Rise, Led the Large-Cap Stocks

Illumina (ILMN) rose by 2.7% on November 16, 2015. It rose for the fourth consecutive trading session. Illumina rose 10% in the trailing five-day period.

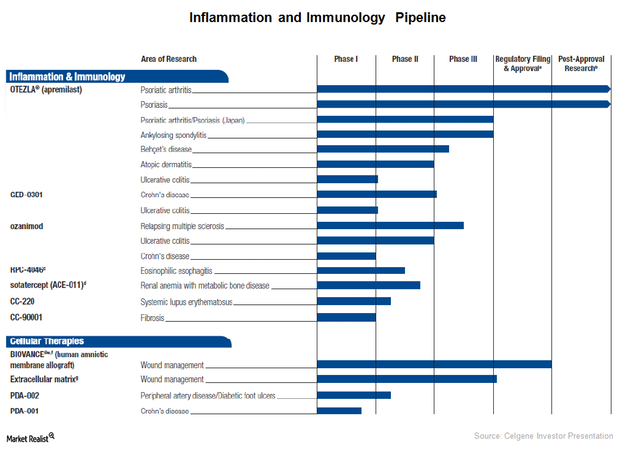

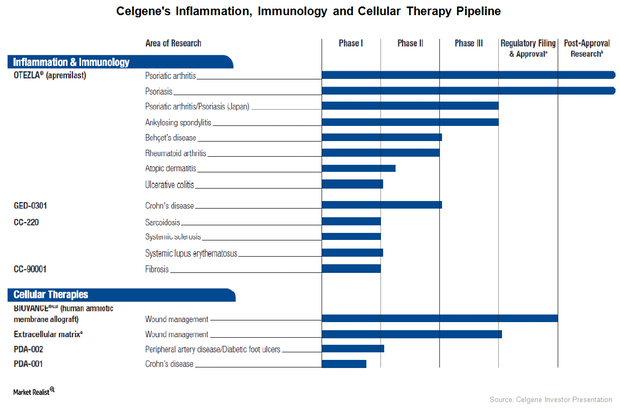

Celgene Has a Strong Inflammation and Immunology Pipeline

In 3Q15, Celgene had a strong inflammation and immunology pipeline. The company witnessed the progress of its key investigational drug GED-0301.

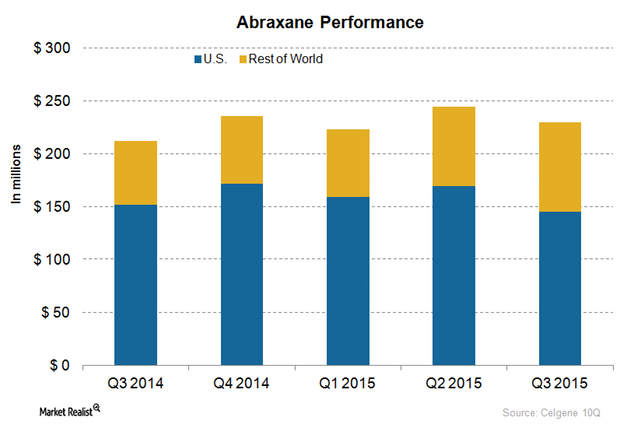

Abraxane Sales Are Lower than Expected in 3Q15

Abraxane’s sales in the US market fell by 4.2% from 3Q14 to 3Q15, while its sales in the rest of the world’s markets rose by 39.7% in the same time period.

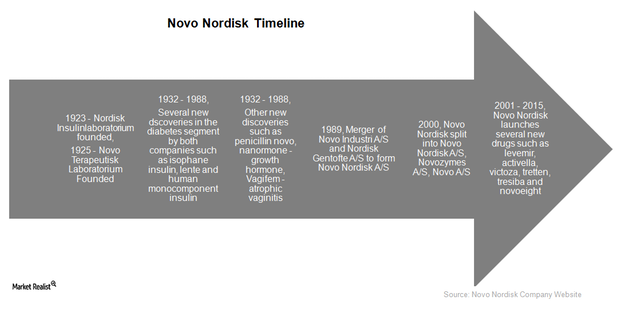

Novo Nordisk: An Investor’s Guide to a Leading Biotech Company

Novo Nordisk (NVO) is a leader in diabetes care with 90 years of experience coupled with a strong workforce of 39,700 in 75 countries around the world.

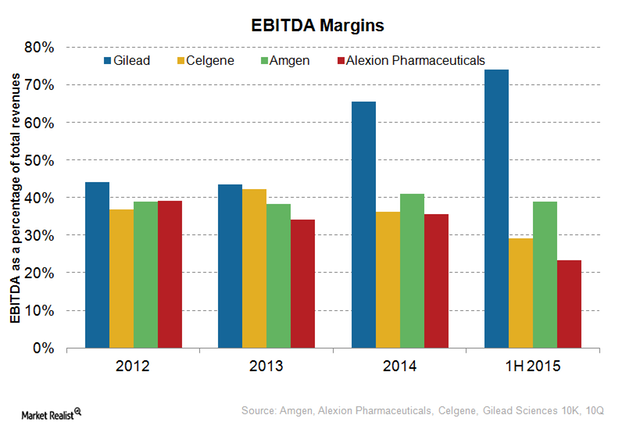

Alexion Pharmaceuticals’ Cost Structure and EBITDA Margins

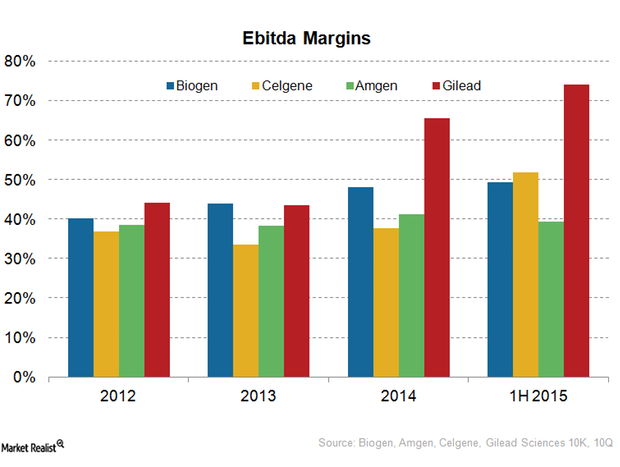

Mature biotechnology companies generally earn EBITDA margins of about 30% to 40%.

Alexion Pharmaceuticals Diversifies Its Research Pipeline

Alexion Pharmaceuticals (ALXN) has strengthened its drug pipeline by diversifying its research programs across the metabolic disorder segment.

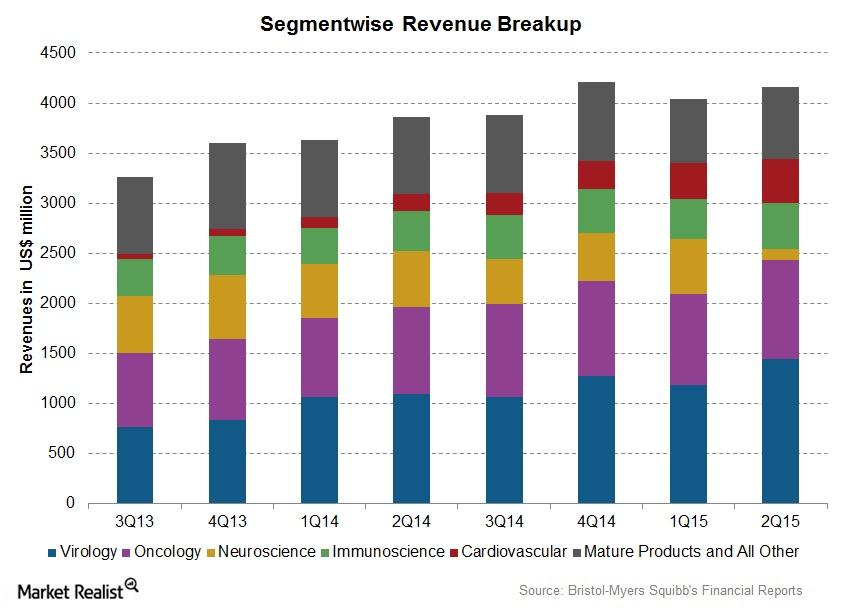

Bristol-Myers Squibb’s Business Segment Performance

Bristol-Myers Squibb (BMY) has classified its business into virology, oncology, immunoscience, cardiovascular, and neuroscience segments.

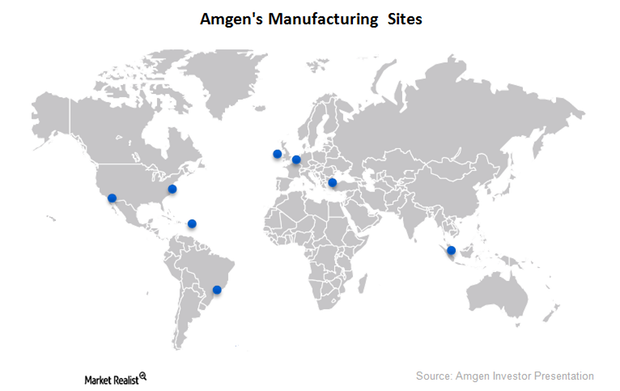

Amgen Develops World-Class Manufacturing Capability

Enhancing its manufacturing capability, Amgen has launched a next-generation bio-manufacturing facility in Singapore and plans to set up more in the coming years.

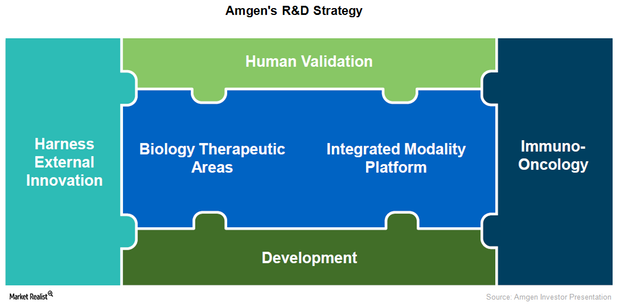

Amgen’s Research and Development Strategy

Amgen (AMGN) has adopted a well-structured research and development strategy focused on inflammation, metabolism, bone, and cardiovascular diseases.

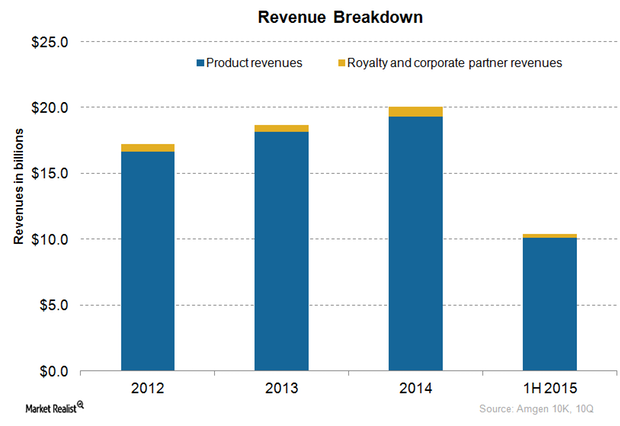

An Overview of Amgen’s Business Model

Amgen’s (AMGN) business model generates revenues in two ways: product sales and other revenues mainly comprised of royalties and corporate partner income.

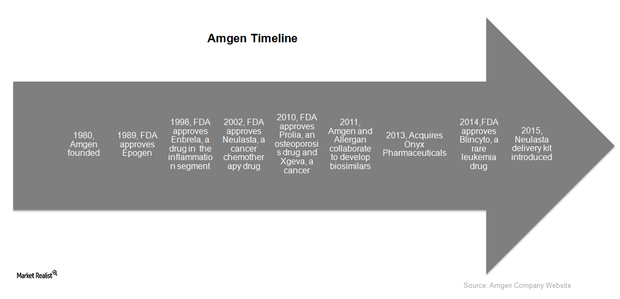

Amgen: An Investor’s Overview to a Leading Biotech Company

An overview of global biotechnology company Amgen shows a market capitalization of $127.2 billion. Headquartered in Thousand Oaks, California, Amgen has a presence in 75 countries.

Celgene’s EBITDA Margins Surpass Competitors

Celgene’s EBITDA margins were lower than those of its competitors. Its R&D investment appears to be higher than its peers, and its SG&A expenses have risen.

Celgene’s Growing Inflammation and Immunology Pipeline

Celgene has entered the inflammation and immunology drug market, as well as the cell therapies market, in order to be less dependent on MM drugs.

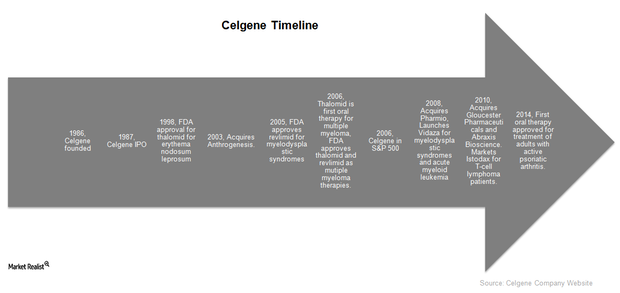

Introducing Celgene, a Leading Biotech Company

Celgene has consistently delivered breakthrough innovations in biotechnology and has as actively pursued acquisitions of companies for access to compounds.

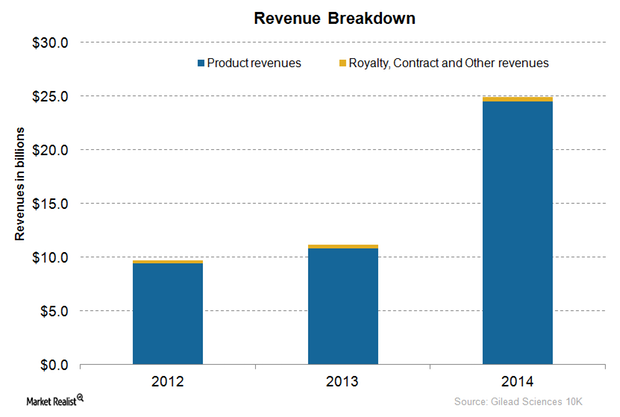

An Overview of Gilead Sciences’ Business Model

Gilead Sciences’ business model consists of product sales in the HIV and HCV markets, as well as royalty, contract, and other revenues.

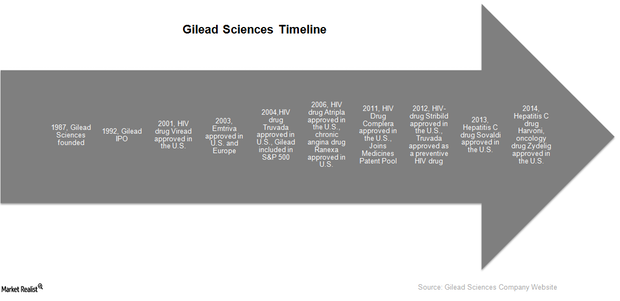

Gilead Sciences: Investor’s Overview of a Leading Biotech Company

The strong leadership of Gilead’s talented scientists has enabled the company to consistently deliver innovative therapies in the market.

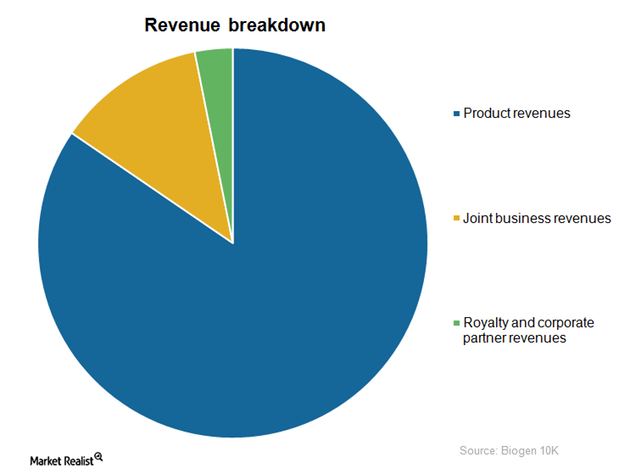

An Overview of Biogen’s Business Model

A leader in the development of multiple sclerosis treatments, Biogen earned 82.5% of its total revenues from its MS drugs in 2014.

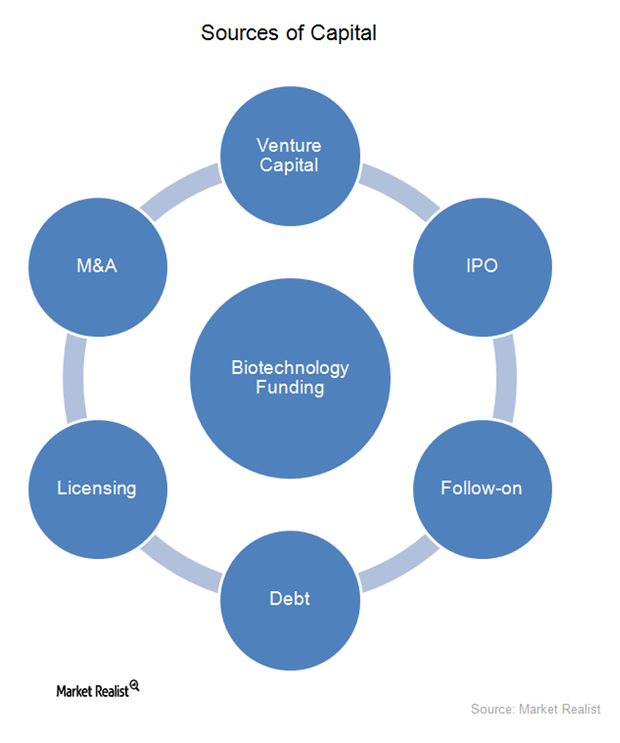

Sources of External Capital for the Biotechnology Industry

In the early stages of their life cycles, most biotechnology companies are financed by venture capital, which typically comes from wealthy investors who invest in startup companies.

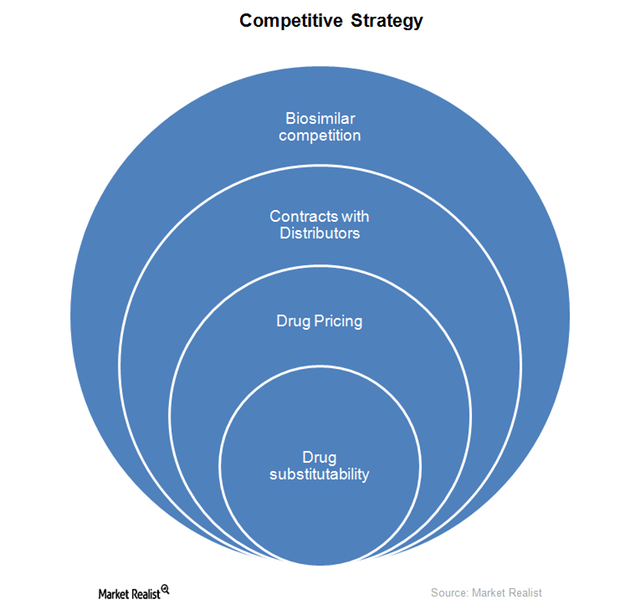

How Does Competition Impact the Biotechnology Industry?

The biotechnology sector is witnessing intense competition with big pharmaceutical companies entering into collaborations and mergers and acquisitions with biotechnology companies.

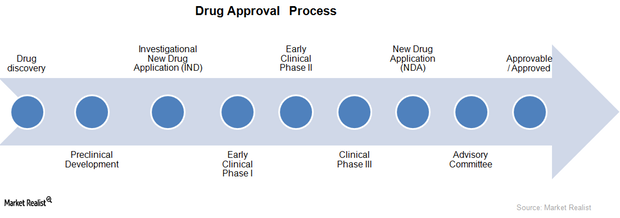

Drug Approval Process in the Biotechnology Industry

A drug approval process is required in order for a new drug to enter the market. Companies with new drugs in later stages of the approval process are more likely to earn a positive cash flow in the next few years.

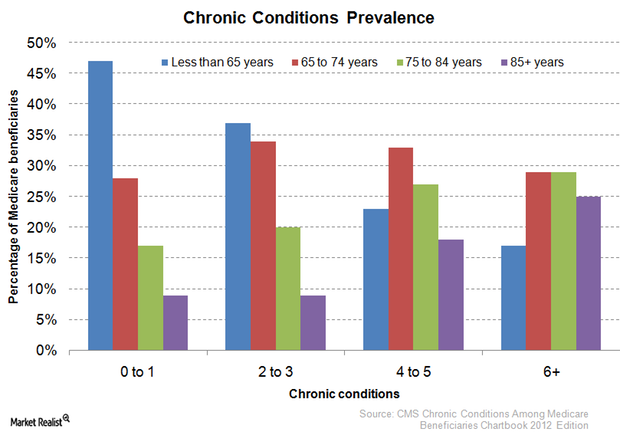

Social Factors That Impact the Biotechnology Industry

The aging Baby Boomer population in the United States is one of the social factors driving the US healthcare industry. By 2030, Americans over 55 will be 31% of the population.

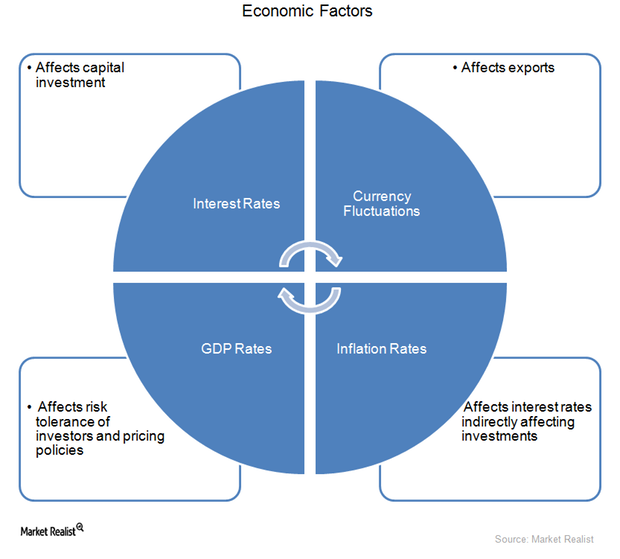

Economic Factors That Affect the Biotechnology Industry

Compared to pure-play pharmaceutical companies, the biotechnology industry is more sensitive to economic factors such as changes in GDP, interest rates, and exchange rates.

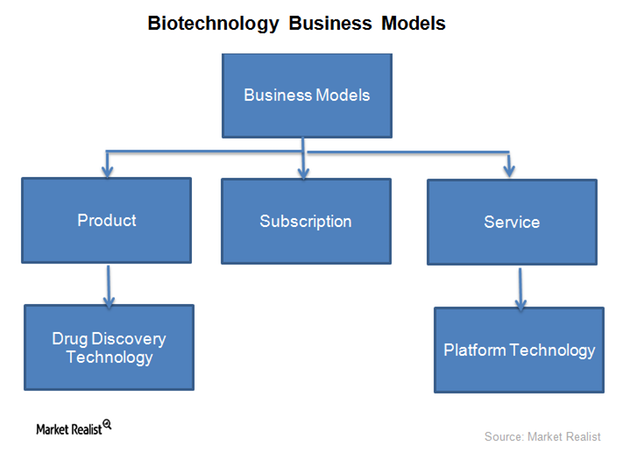

The Business Models of Biotechnology Companies

The type of business model a biotechnology company selects depends on technical capability, availability of resources, and competition in the industry.

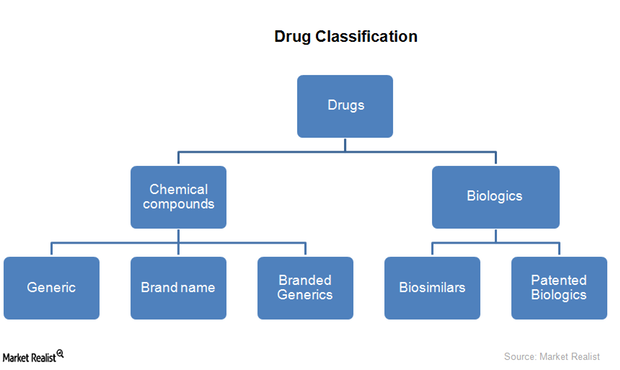

How Are Drugs Classified?

The two main classifications for drugs are chemical compound drugs and biologics. Medicinal drugs are broadly classified as prescription drugs and over-the-counter drugs.

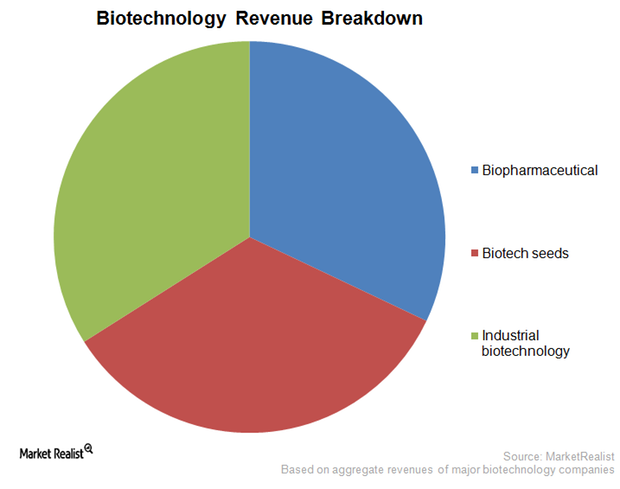

A Must-Read Overview of the US Biotechnology Industry

Biotechnology is simply ‘technology based on biology.’ The biotechnology industry includes food technology, genetic research, healthcare, and environmental technology.

As US Economy Expands, Innovation Is Tide That Lifts All Boats

As the US economy expands, innovation seems to be the tide that is lifting all boats. Innovation is being driven by technology.