Celgene Corp

Latest Celgene Corp News and Updates

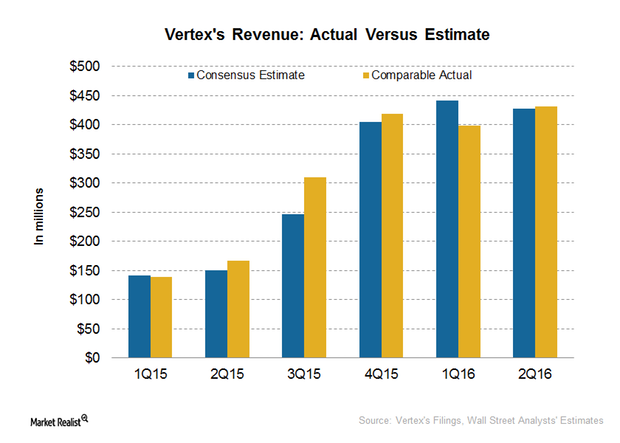

How Vertex’s Revenue and Earnings Surprised in 2Q16

Vertex Pharmaceuticals (VRTX) reported its 2Q16 earnings on July 27, 2016. VRTX surpassed Wall Street analysts’ projections and reported revenue of $431.6 million.

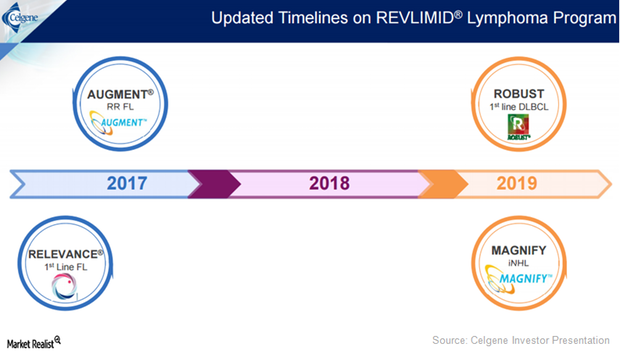

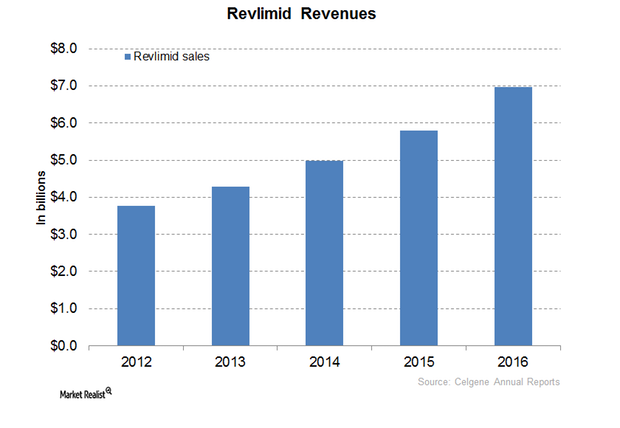

Celgene’s Revlimid Expected to Post Strong Revenue in 2017

According to unaudited financial results published by Celgene (CELG) on January 9, 2017, Revlimid sales for 2016 are about $7.0 billion, a YoY rise of about 20.0%.

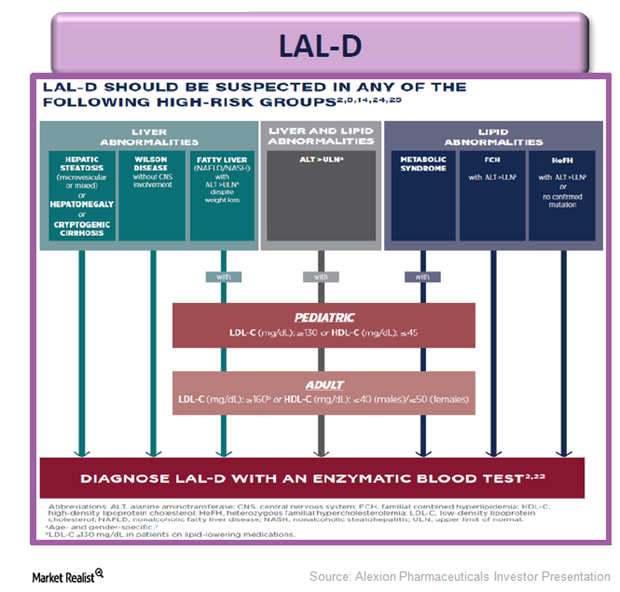

Alexion Pharmaceuticals Adds Metabolic Drug Kanuma to Portfolio

Kanuma was acquired by Alexion Pharmaceuticals on completion of the acquisition of Synageva Pharmaceuticals in June 2015.

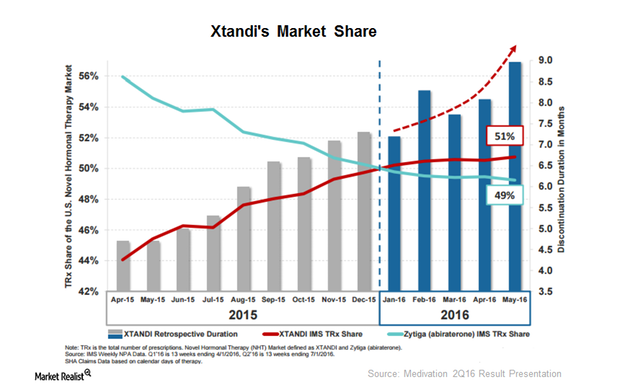

How Xtandi Fueled Big Pharmaceutical Interest in Medivation

Xtandi is the major factor behind Pfizer’s (PFE) interest in Medivation (MDVN). The drug, along with MDVN’s pipeline molecules, should strengthen Pfizer’s (PFE) oncology franchise.

What Were the Top Holdings of Citadel Advisors in Q3?

In Q3 2019, Citadel Advisors’ portfolio of publicly traded securities was worth $212.04 billion. In Q2 2019, its portfolio was worth $155.1 billion.

Revlimid Could Continue to Drive Celgene’s Revenue Growth in 2017

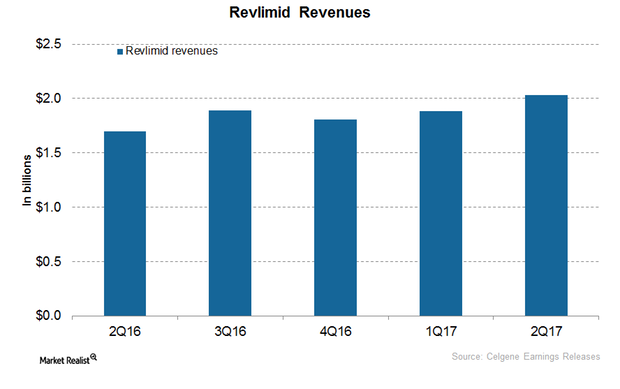

In 2016, Celgene’s (CELG) Revlimid generated revenues of around $6.9 billion, which reflected a ~20% year-over-year (or YOY) growth.

Pfizer’s Growth Rate and Estimates

Pfizer (PFE) reported an EPS of $0.74 on revenues of ~$13.5 billion during the second quarter, which beat analysts’ estimate of ~$13.3 billion.

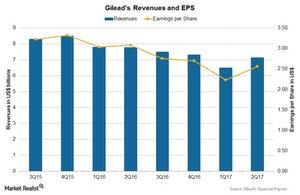

What’s Gilead Sciences’ Valuation?

Gilead’s stock price has risen ~8.9% in the last 12 months. Wall Street analysts estimate that the stock price will fall ~4.5% over the next 12 months.

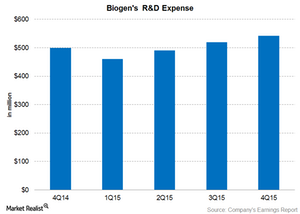

How Much Does Biogen Spend on Research and Development?

Biogen’s (BIIB) R&D expenses for 4Q15 were $542 million, or 19% of its total revenue, including a $60 million payment to Mitsubishi Tanabe.

Allergan’s 1Q18 Earnings: Analysts’ Estimates

Allergan (AGN) plans to release its 1Q18 earnings on April 30. Wall Street expect AGN’s earnings per share to reach $3.36.

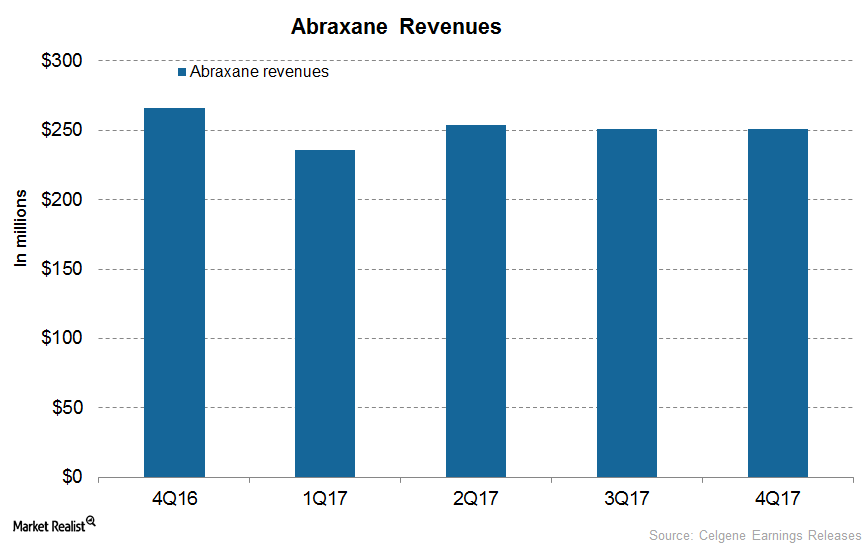

How’s Celgene’s Abraxane Positioned after 4Q17?

In 4Q17, Celgene’s (CELG) Abraxane generated revenues of $251 million, which reflected a decline of ~6% on a YoY (year-over-year) basis.

An Easier Way to Understand the Pharma Industry

In 2018, the global pharmaceutical industry stood at $1.2 trillion, and experts expect $1.5 trillion by 2023. Here’s everything investors need to know.

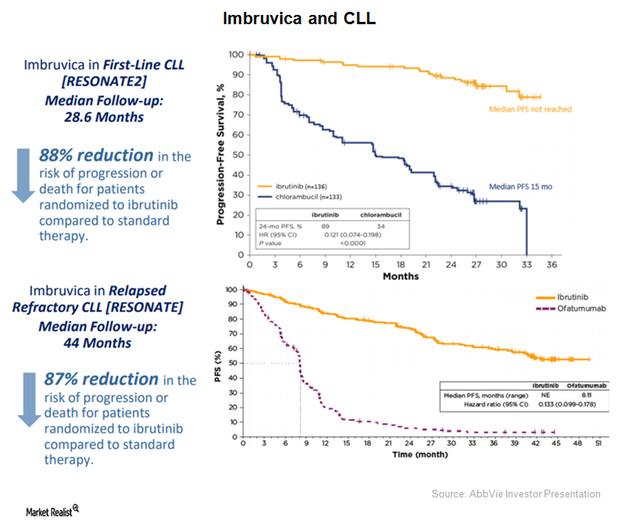

AbbVie Expects Peak Sales of $7 Billion for Imbruvica

AbbVie (ABBV) has projected Imbruvica’s annual revenues to be $5 billion by 2020. That would be driven by a rapid uptake in the first line chronic lymphocytic leukemia (or CLL) segment.

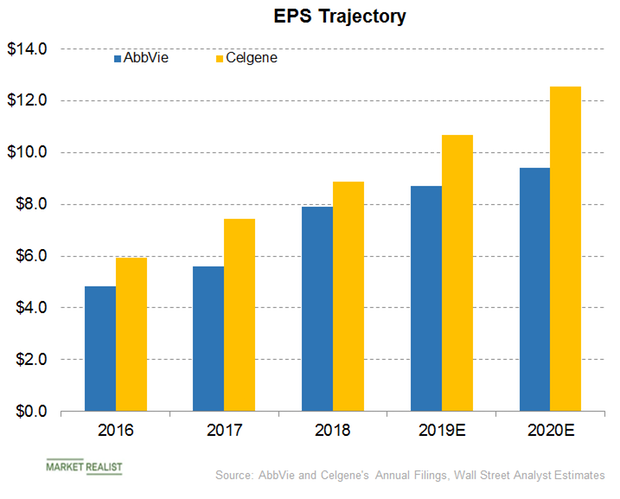

AbbVie or Celgene: Which Is Expected to Report Faster EPS Growth?

On its fourth-quarter earnings conference call, AbbVie (ABBV) guided for an adjusted gross margin of 82.5% in 2019.

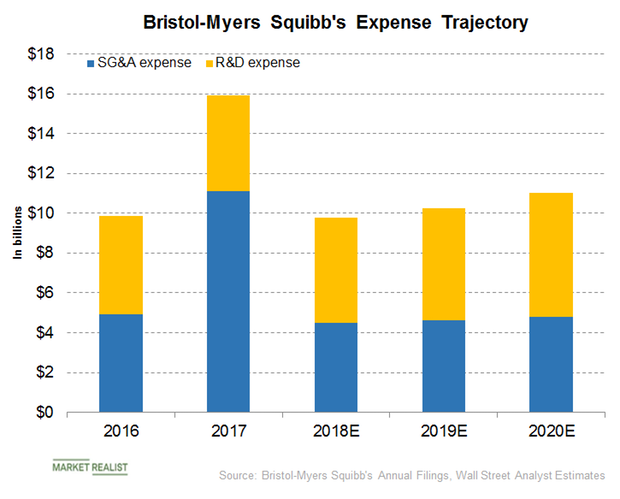

Bristol-Myers Squibbs and Celgene: Cost Synergies for Future Years

According to Bristol-Myers Squibb’s (BMY) press release, the company expects the acquisition of Celgene (CELG) to result in annual cost synergies close to $2.5 billion.

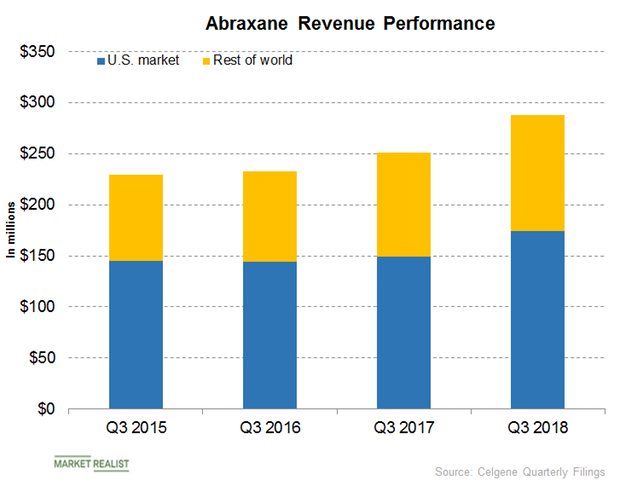

A Look at Abraxane’s Revenue Growth Trajectory in 2018

In its third-quarter earnings conference call, Celgene (CELG) reiterated its expectation for Abraxane’s fiscal 2018 net product sales of around $1.0 billion.

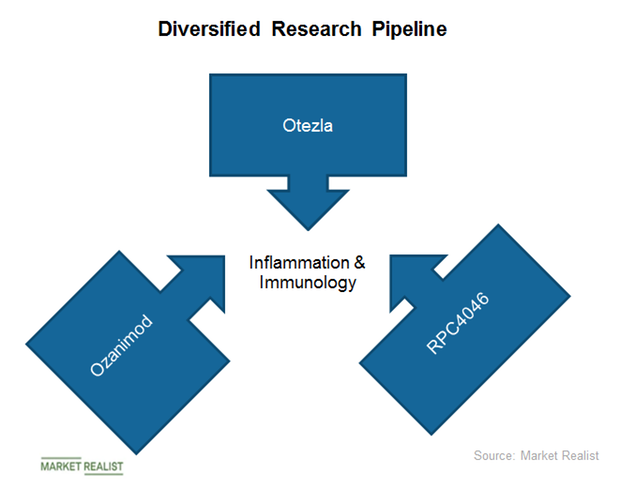

Inflammation and Immunology: Celgene’s Diversified Research Pipeline

Celgene (CELG) is focused on advancing its diversified inflammation and immunology (or I&I) research pipeline in 2018.

How Wall Street Analysts View Merck

On October 25, Merck (MRK) announced a dividend of $0.55 per share for its outstanding common stock in the fourth quarter of 2018.

How Celgene Performed in 1Q18

In 1Q18, Celgene’s (CELG) revenue grew 20% year-over-year to $3.5 billion from $3.0 billion, boosted by Revlimid, Pomalyst, and Otezla sales.

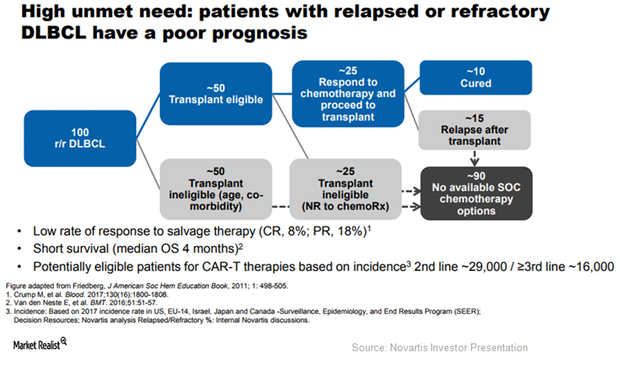

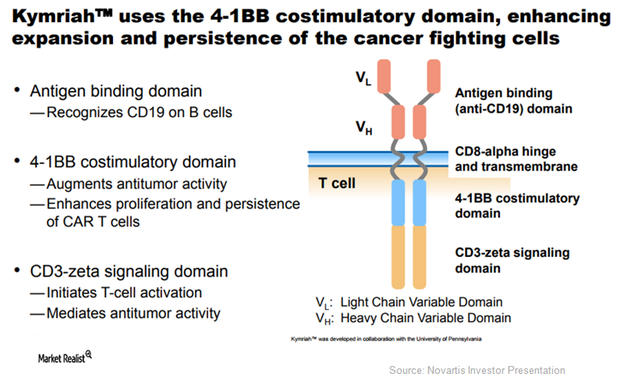

Kymriah May Emerge as a Robust Treatment Option in DLBCL Indication

Kymriah is the first FDA-approved chimeric antigen receptor T cell (or CAR-T) therapy.

Novartis’ Kymriah: The First Gene Therapy to Be Approved in the US

The National Cancer Institute estimates that the incidence of ALL in patients aged 20 or younger is ~3,100 in the US.

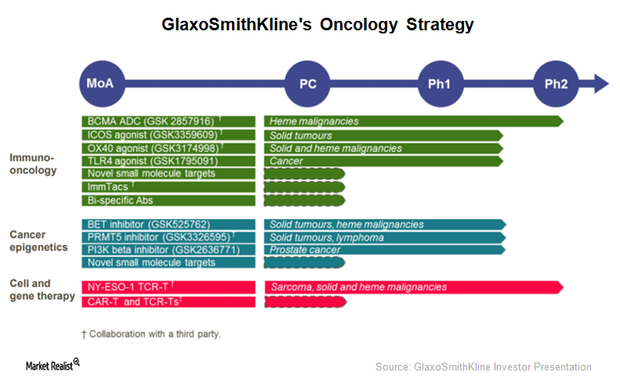

GSK Is Focused on Innovative Assets in Oncology Research Pipeline

In 2018, GlaxoSmithKline aims to initiate a pivotal phase 2 trial to evaluate GSK 916 as monotherapy Darzalex refractory population as the fourth line or the last line of multiple myeloma therapy.

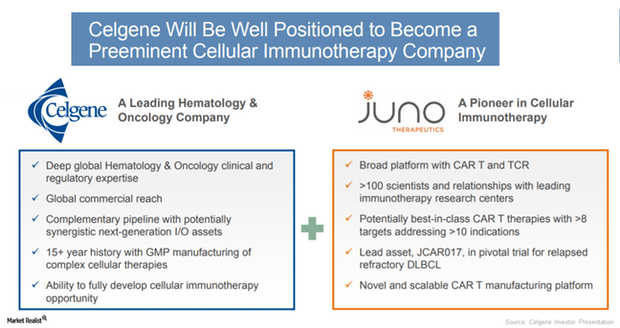

Celgene to Acquire Juno Therapeutics

On January 22, 2018, Celgene and Juno Therapeutics announced a merger agreement in which the former will acquire the latter’s business.

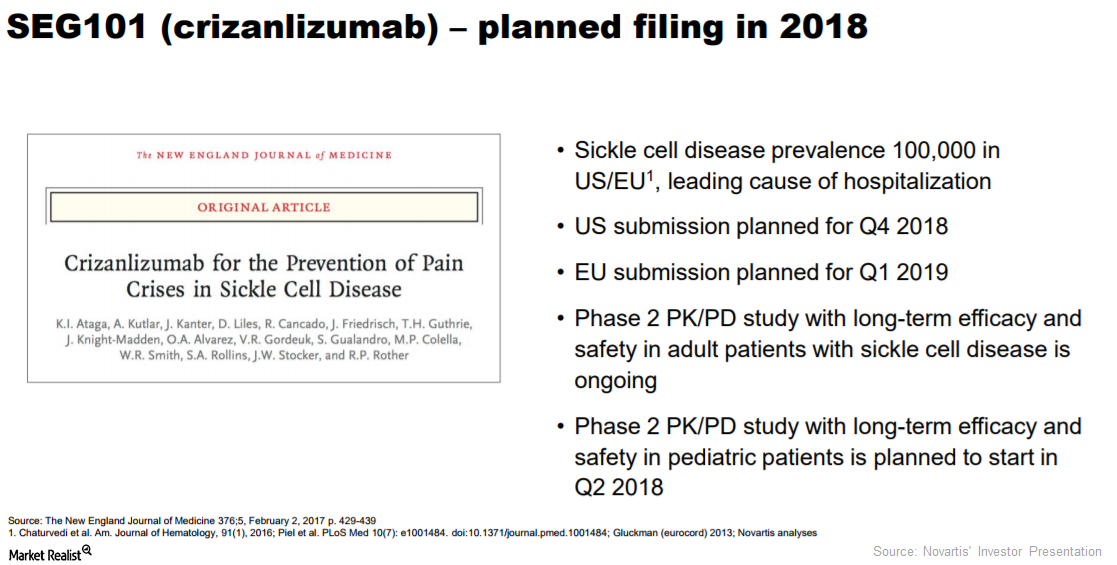

Novartis’s Crizanlizumab Demonstrates Positive Results in Trials

In December 2017, Novartis presented the results from the post-hoc subgroup analysis of the phase 2 Sustain trial.

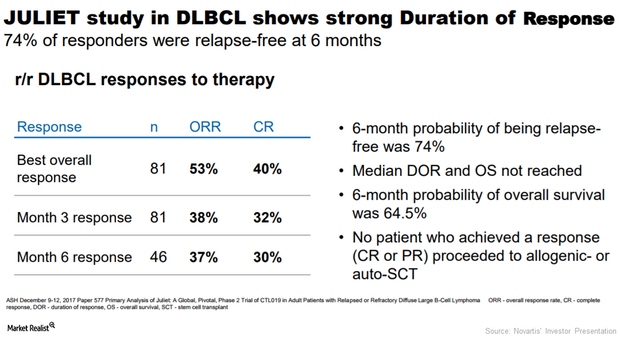

Key Updates on Novartis’s Kymriah

In December 2017, Novartis (NVS) presented updated results from the Juliet clinical trial, which demonstrated sustained responses of Kymriah (tisagenlecleucel) for the treatment of adults with relapsed or refractory diffuse large B-cell lymphoma (or DLBCL).

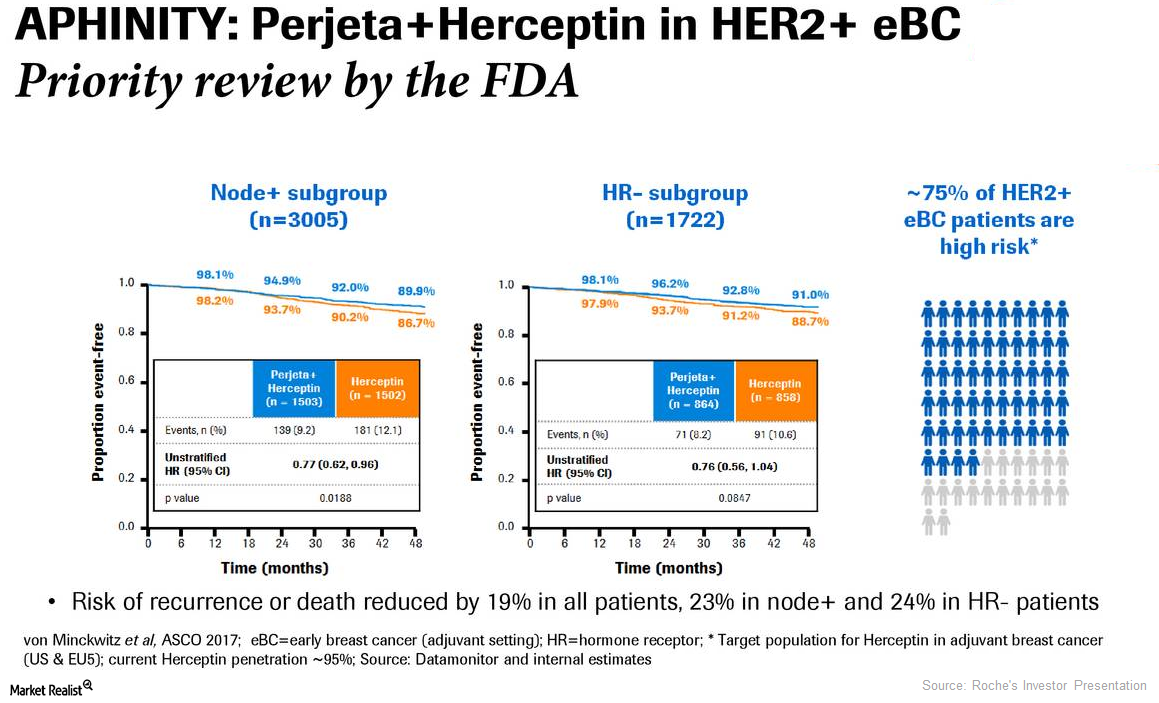

Perjeta Could Significantly Boost Roche’s Revenue Growth in 2018

In December 2017, the Food and Drug Administration approved Roche’s (RHHBY) Perjeta based on the results of its phase three Aphinity trial.

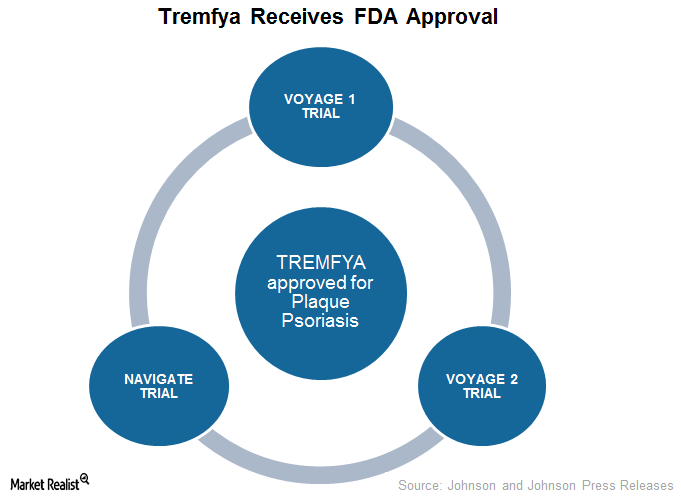

Johnson & Johnson’s Tremfya Approved to Treat Plaque Psoriasis

In July 2017, the US FDA (Food and Drug Administration) approved Johnson & Johnson’s (JNJ) Tremfya (guselkumab) for the treatment of individuals with moderate to severe plaque psoriasis.

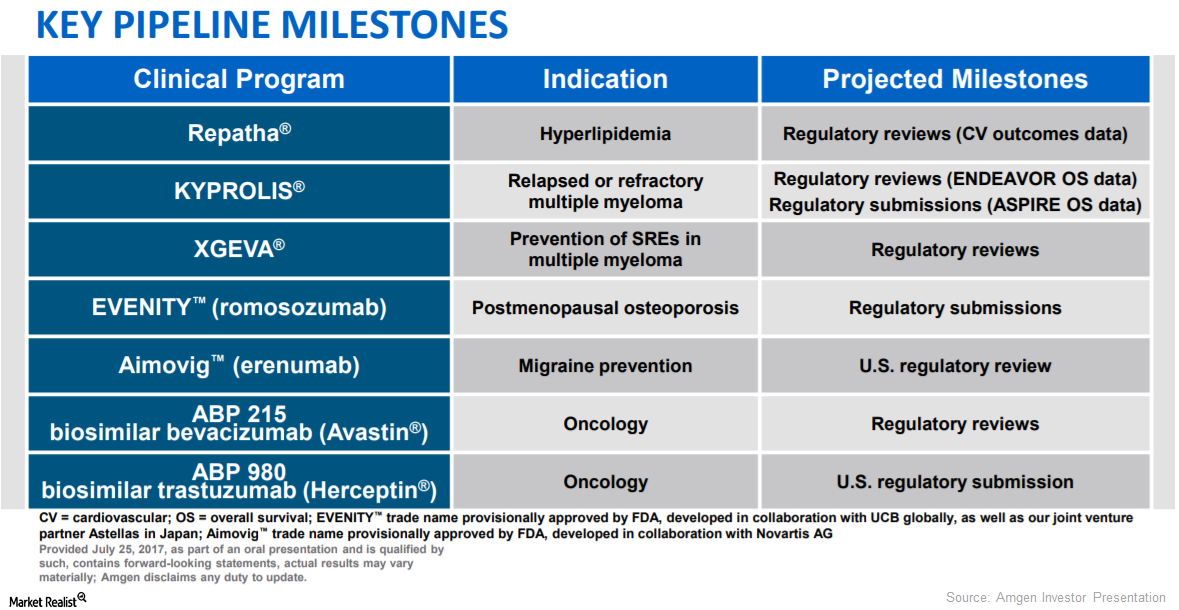

Amgen’s Pipeline Could Boost Its Long-Term Growth Opportunities

EVENITY (romosozumab) is a monoclonal antibody under investigation that acts by inhibiting the activity of sclerostin.

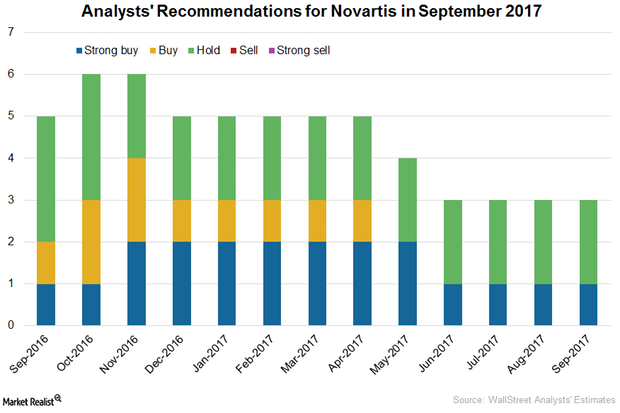

What Analysts Recommend for Novartis in September 2017

Three analysts were analyzing Novartis in September 2017. One analyst recommended a “strong buy,” while the other two recommended a “hold.”

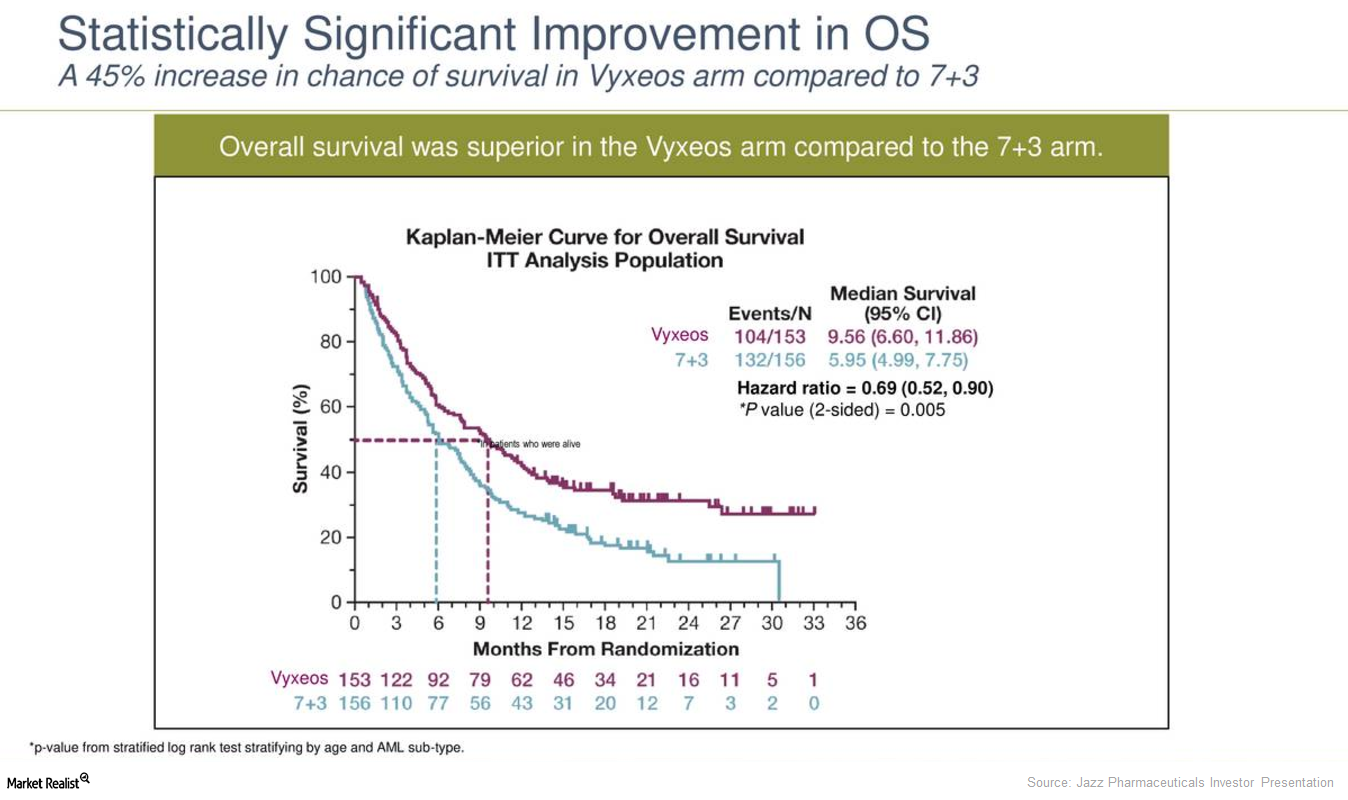

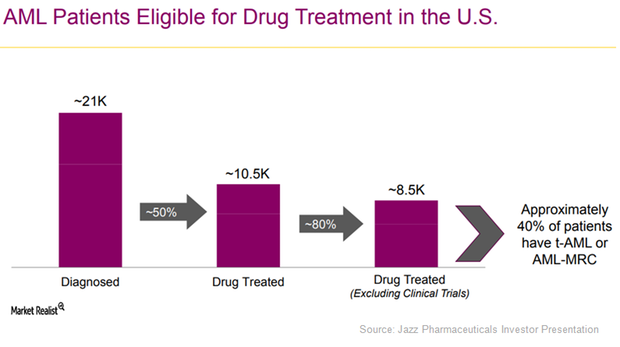

Why Jazz Pharmaceuticals’ Vyxeos Could Boost Revenue Growth in 2018

In August 2017, JAZZ’s Vyxeos liposome injection for the treatment of adult individuals with rapidly progressing or life t-AML received FDA approval.

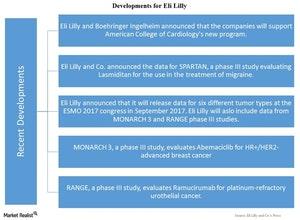

Eli Lilly & Co.’s Recent Developments after Its 2Q17 Earnings

On July 31, 2017, Eli Lilly and Boehringer Ingelheim announced that the companies would support one of the new programs by the American College of Cardiology.

Bristol-Myers Squibb’s Immunoscience Products in 2Q17

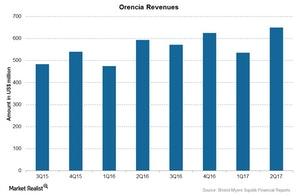

Orencia revenues rose to $650.0 million in 2Q17, a 10.0% rise compared to $593 million in 2Q16.

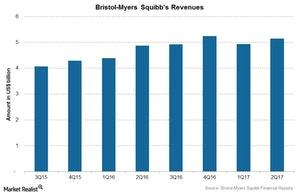

Bristol-Myers Squibb’s Revenues in 2Q17

Bristol-Myers Squibb (BMY) surpassed Wall Street analysts’ estimate for 2Q17 revenues, reporting $5.14 billion compared to the estimate of $5.09 billion.

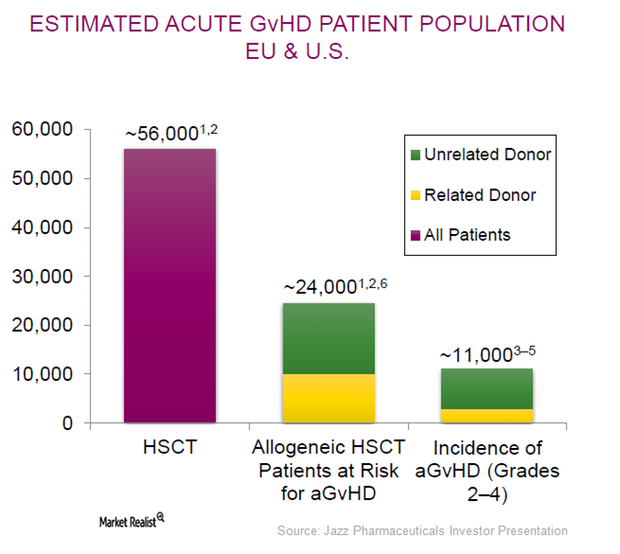

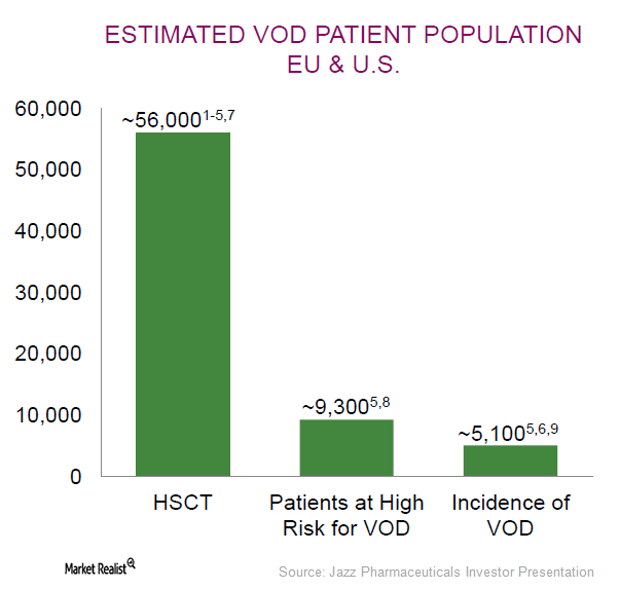

Jazz Pharmaceuticals Is Focused on Label Expansion of Defitelio

Defitelio could help Jazz Pharmaceuticals become a prominent player not only in the treatment but also in the prevention of post-HSCT complications.

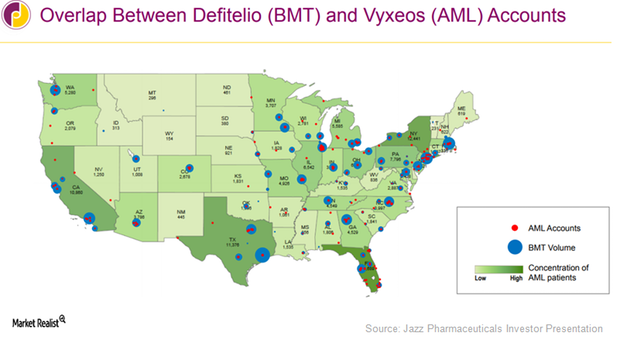

How Jazz Pharmaceuticals Aims to Boost Vyxeos Sales in 2017

In early 2017, Jazz Pharmaceuticals (JAZZ) expanded its sales force team from 35 to 55 and expanded its field reimbursement teams to support the commercial launch of Vyxeos in the US.

What Jazz Pharmaceuticals Expects for Vyxeos

If Vyxeos manages to penetrate a sizeable portion of the target market, it may have a favorable impact on Jazz Pharmaceuticals stock.

JAZZ Is Focused on Increasing Market Adoption of Defitelio

Jazz Pharmaceuticals (JAZZ) expects quarterly variability in Defitelio sales as the drug targets hepatic veno-occlusive disease (or VOD), an ultra-rare condition.

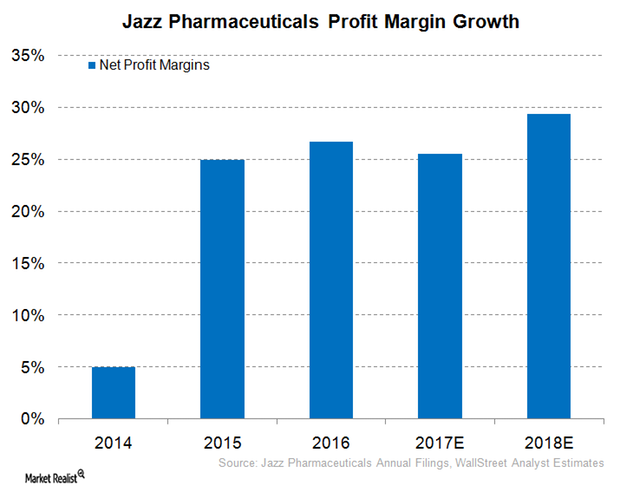

Inside Jazz’s Net Profit Margin Expectations for 2017

For 2Q17, Jazz Pharmaceuticals (JAZZ) reported revenues close to $394 million, which represented a YoY growth of ~3% and sequential growth ~5%.

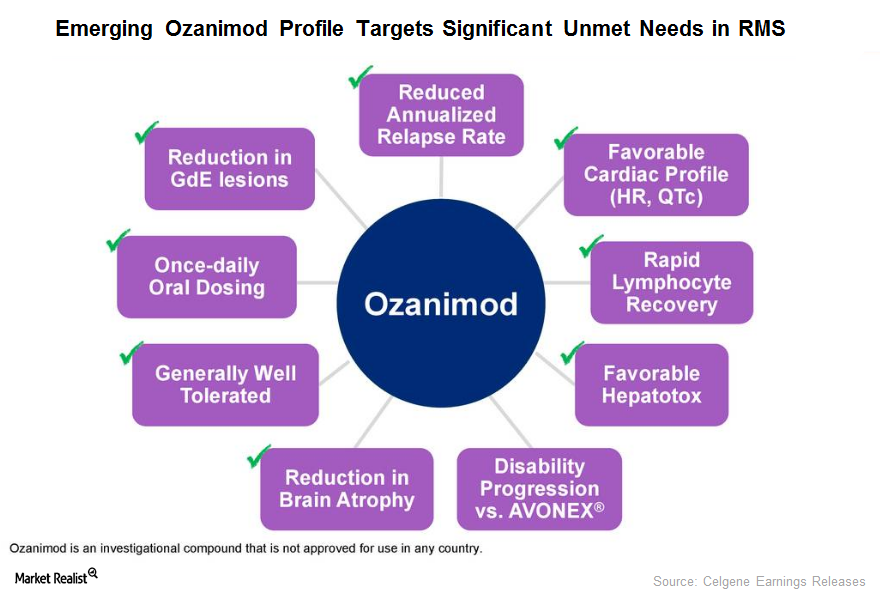

Ozanimod Could Drive Celgene’s Long-Term Growth

The Phase 3 RADIANCE trial enrolled 1,313 RMS patients and conducted the trial in 21 countries.

Celgene’s Abraxane Continued Steady Growth in 2Q17

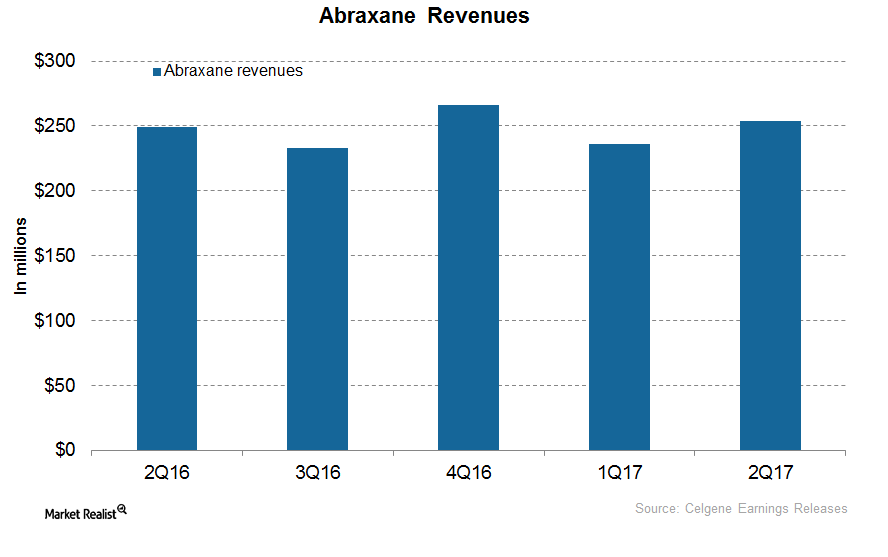

In 2Q17, Celgene’s (CELG) Abraxane generated revenues of around $254 million, which reflected ~2% growth on a year-over-year basis.

Celgene’s Revlimid Witnessed High Growth in 2Q17

In 2Q17, Celgene’s (CELG) Revlimid generated revenues of ~$2.0 billion, which reflected ~20% growth year-over-year and ~8% growth quarter-over-quarter.

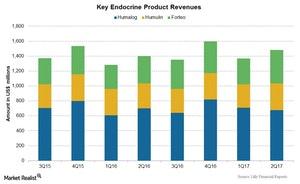

Eli Lilly in 2Q17: Humulin and Endocrine Products

Eli Lilly’’s (LLY) Human Pharmaceuticals segment reported a rise of ~11.0% to ~$5.0 billion for 2Q17 compared to ~$4.6 billion for 2Q16.

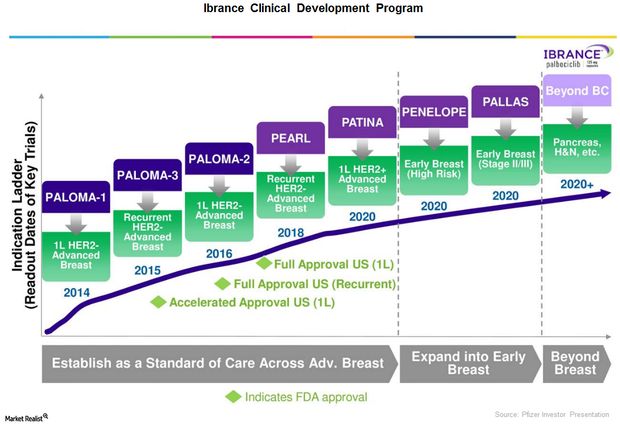

Why Ibrance Could Be Pfizer’s Long-Term Growth Driver

Pfizer (PFE) is extensively conducting clinical trials for the label expansion of Ibrance.

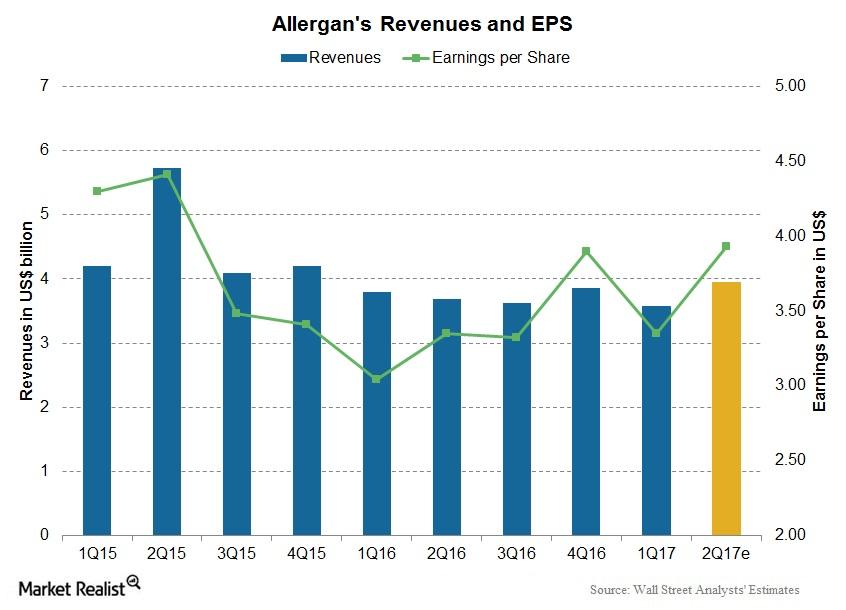

A Look at Allergan’s Performance in 2Q17

Allergan Headquartered in Dublin, Ireland, Allergan (AGN) is a leading pharmaceutical company focused on generic and specialty pharmaceutical products. The company has divided its business into three segments: US Specialized Therapeutics, US General Medicine, and International. Stock price performance Allergan’s stock price has risen ~1.4% in 2Q17, and 15.0% year-to-date as of July 7, 2017. […]

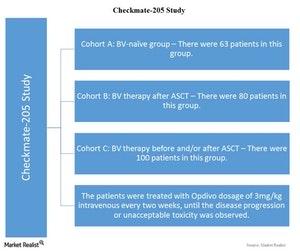

Data from the Checkmate-205 Study Evaluating Opdivo

Follow-up data were released from the Checkmate-205 study. It evaluated long-term effects of PD-1 inhibitors in patients with classical Hodgkin Lymphoma.

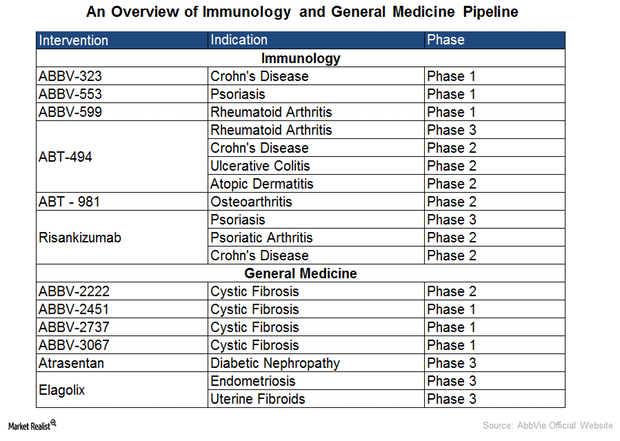

This Product Pipeline Brings Hope for AbbVie’s Future Growth

AbbVie (ABBV) has a focused immunology pipeline in order to address various dermatologic and gastrointestinal conditions.

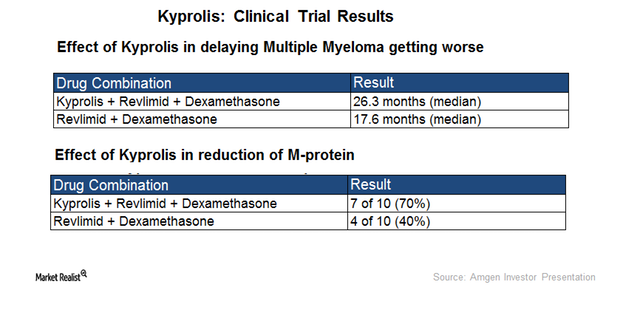

Kyprolis Could Significantly Drive Amgen’s Revenue Growth in 2017

Amgen’s (AMGN) Kyprolis has gained considerable market share in second-line multiple myeloma (or MM) indication since its launch in 2012.

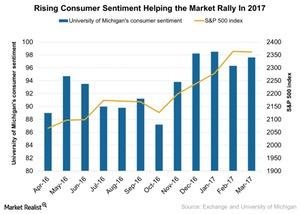

Is Rising Consumer Sentiment Helping the Market Rally in 2017?

The S&P 500 Index (SPX-INDEX) has posted a rise of ~5% since the beginning of 2017, with banks and energy stocks leading the rally as of March 29, 2017.

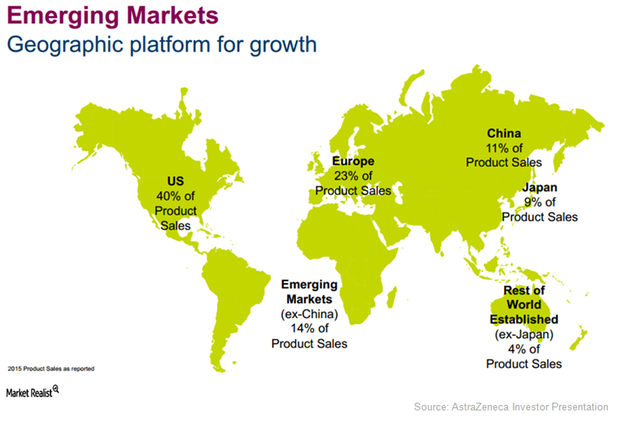

Emerging Markets Expected to Be AstraZeneca’s Key Growth Driver

For 2016, AstraZeneca (AZN) reported revenues of about $5.8 billion for its emerging markets business, which is a YoY (year-over-year) rise of about 6.0%.

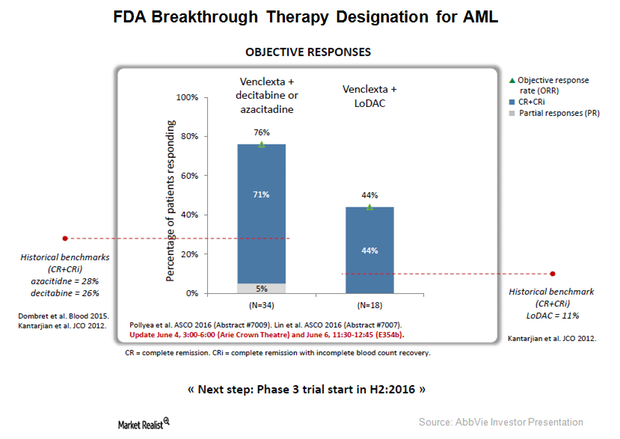

Acute Myeloid Leukemia: Growth Opportuny for AbbVie’s Venclexta?

AbbVie’s (ABBV) Venclexta has been granted FDA breakthrough therapy designation as a first line therapy for patients with acute myeloid leukemia who are ineligible for high-dose chemotherapy.