BP PLC

Latest BP PLC News and Updates

The Largest Corporation Settlements in United States History

The largest class action corporation settlements in United States history have staggering price tags. Learn about the gross negligence or harm that led to such enormous settlements.

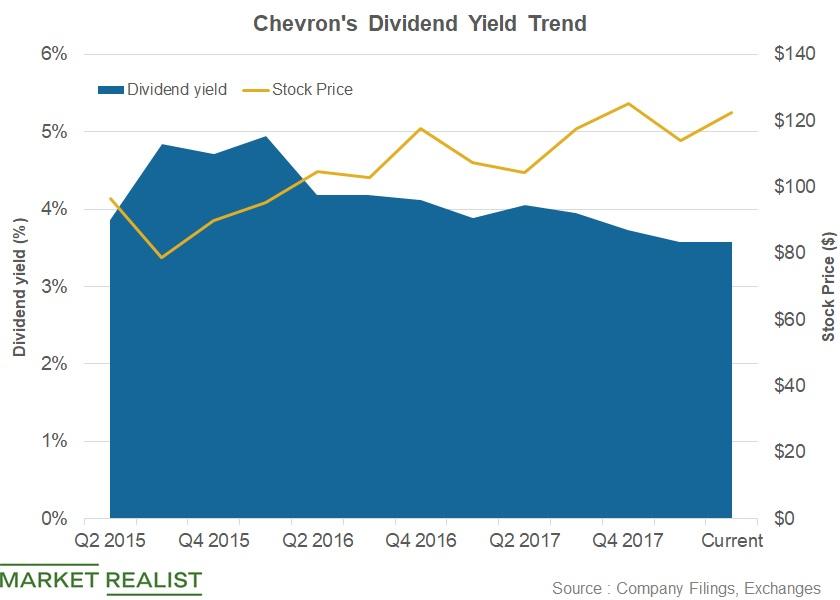

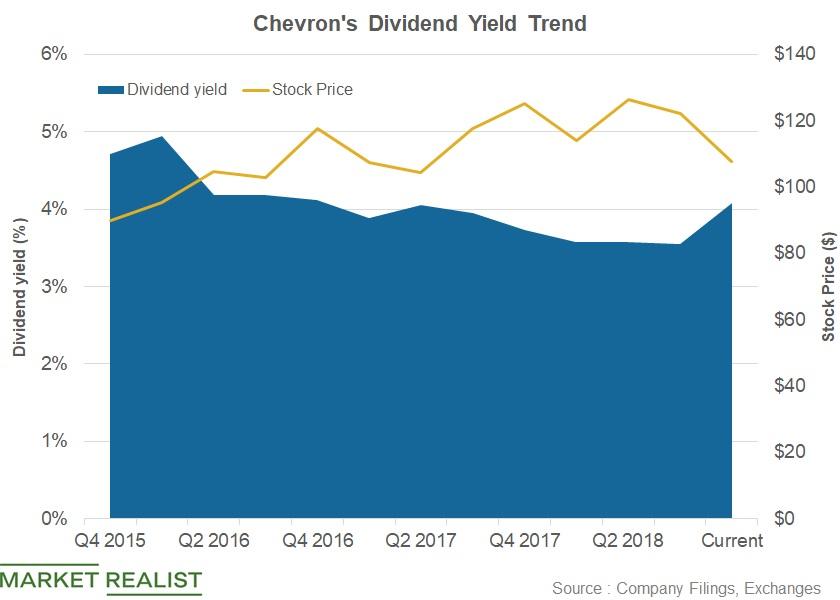

Chevron’s 3.6% Dividend Yield Ranks Sixth with High Valuations

Chevron (CVX) is the sixth stock on our list of the top eight dividend-yielding stocks.

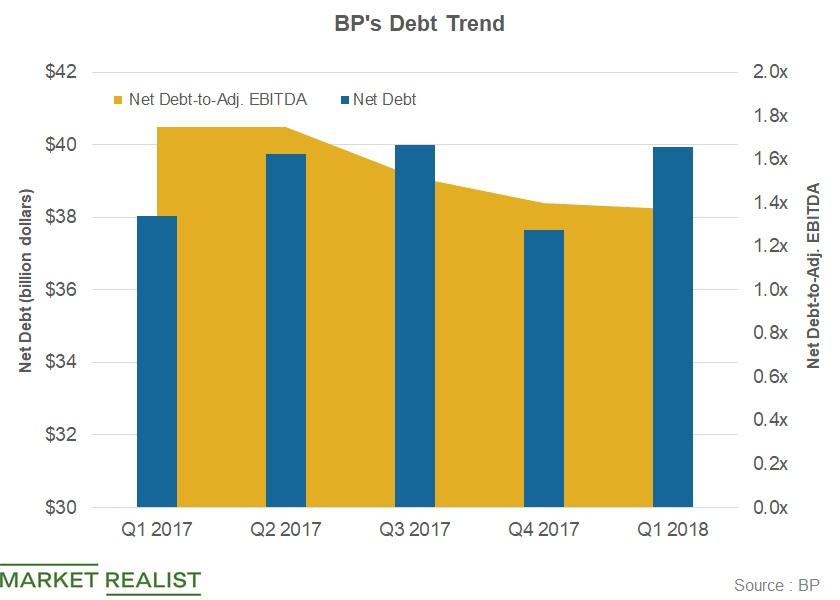

How BP’s Debt Position Compares

In this part, we’ll review whether BP’s (BP) debt position has improved. Let’s begin by comparing BP’s debt position with peers’.

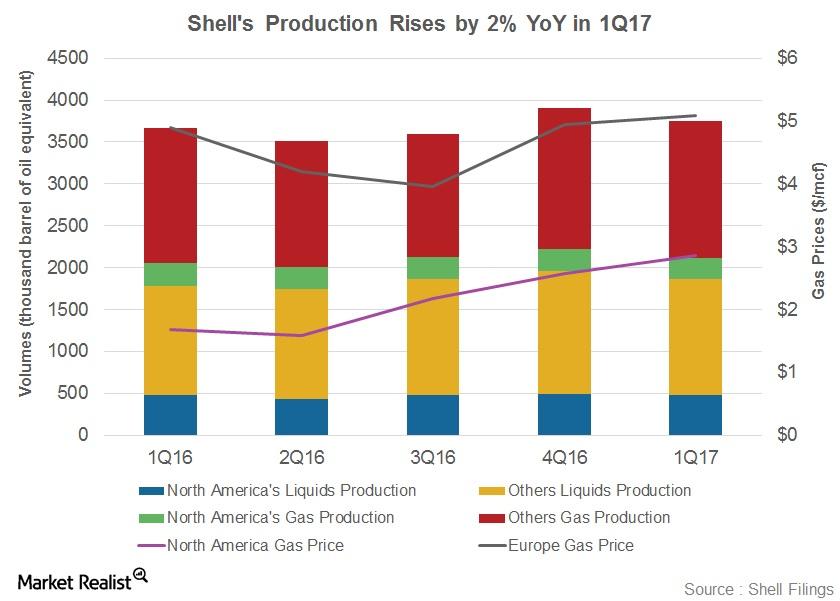

Shell’s Upstream Portfolio: Is it Poised to Grow?

Royal Dutch Shell (RDS.A) produced 3.8 MMboepd in 1Q17 from its worldwide operations, compared to 3.7 MMboepd in 1Q16.

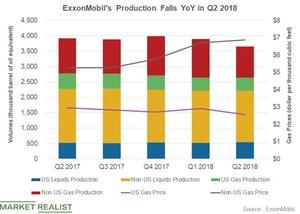

How Was ExxonMobil’s Upstream Performance in Q2 2018?

ExxonMobil (XOM) produced 3.7 MMboepd (million barrels of oil equivalent per day) from its worldwide operations in the second quarter.

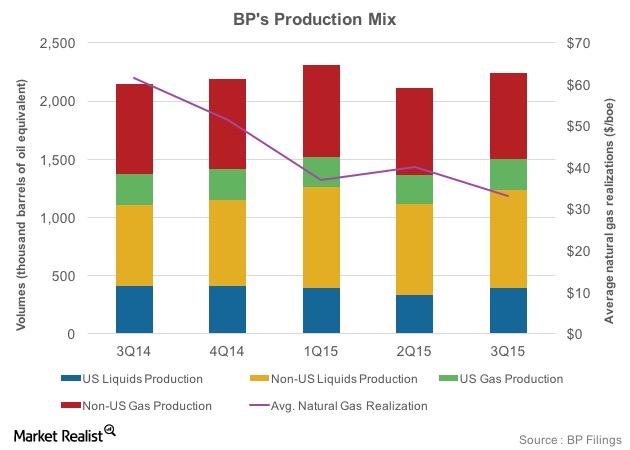

BP’s Upstream Segment: Large Upcoming Gas Projects

BP has a strong pipeline of projects in its upstream portfolio. These projects are expected to result in 800,000 barrels per day of new production by 2020.

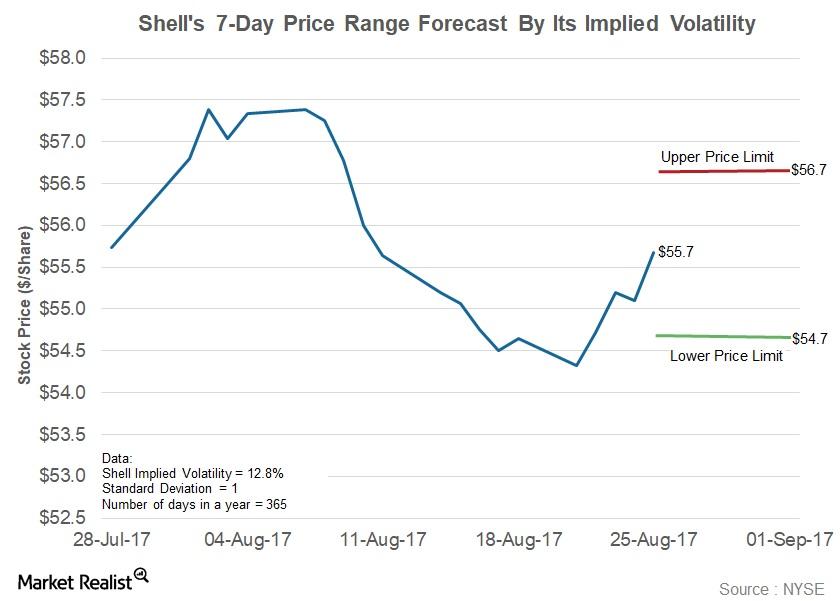

What’s the Forecast for Shell Stock for the Next 7 Days?

Implied volatility in Royal Dutch Shell (RDS.A) has fallen 4.9% since July 3, 2017, to the current level of 12.8%.

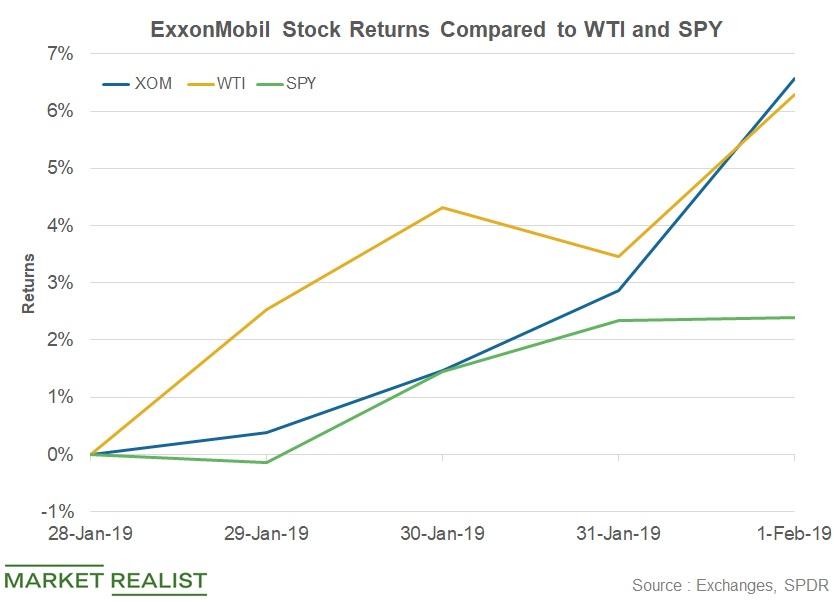

ExxonMobil Stock Rose 4% after Its Q4 Earnings

ExxonMobil (XOM) announced its fourth-quarter earnings on February 1. ExxonMobil stock opened at $74.9 per share on February 1.

Chevron Ranks Second-Last in Terms of Its Dividend Yield

In terms of its dividend yield, Chevron (CVX) is the fifth-best performer among the six stocks under review.

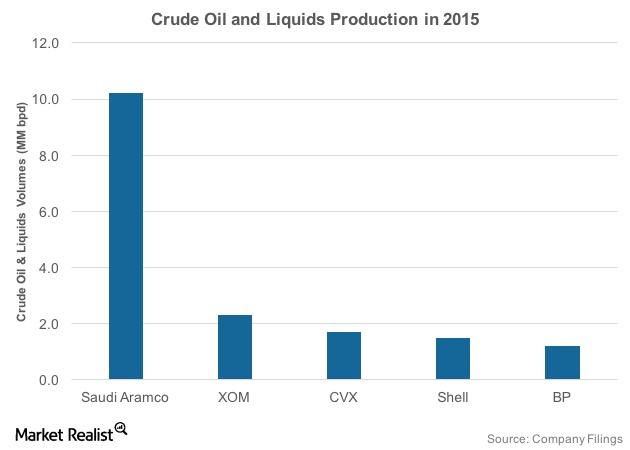

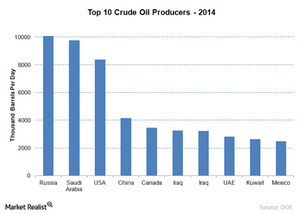

Must-Know: World’s Top Oil Companies by Production

The US, Saudi Arabia, and Russia are the world’s top three crude oil producers. Let’s take a look at the world’s top oil players by production volumes.

XOM, CVX, RDS.A, BP: Are They Underperforming the S&P 500?

So far in 1Q18, Chevron (CVX) stock fell 13.9%, the highest among its peers ExxonMobil (XOM), BP (BP), and Royal Dutch Shell (RDS.A).

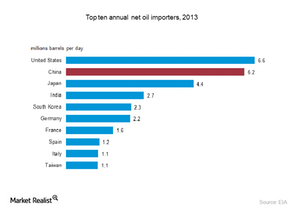

Who will drive crude oil consumption?

Current lower oil prices and growth from China, India, the United States and Asia Pacific countries will drive crude oil consumption in the long term.

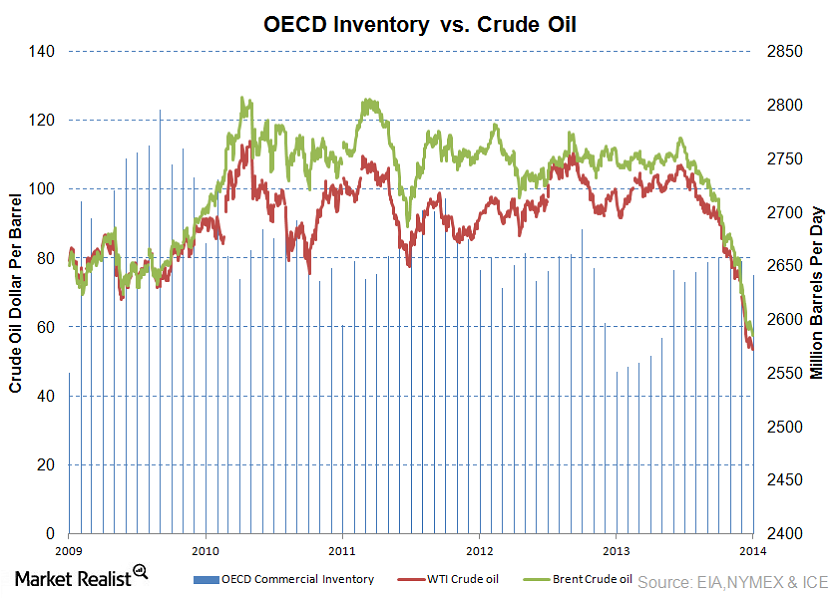

Why investors should track crude oil inventory levels

The difference between actual and expected changes in US crude oil inventory levels affects crude prices and thus revenues and earnings of major companies.

Goldman Sachs Favors Chevron Compared to ExxonMobil

Chevron and ExxonMobil stocks have provided almost flat returns in the current quarter. As a result, Goldman Sachs favors Chevron over ExxonMobil.

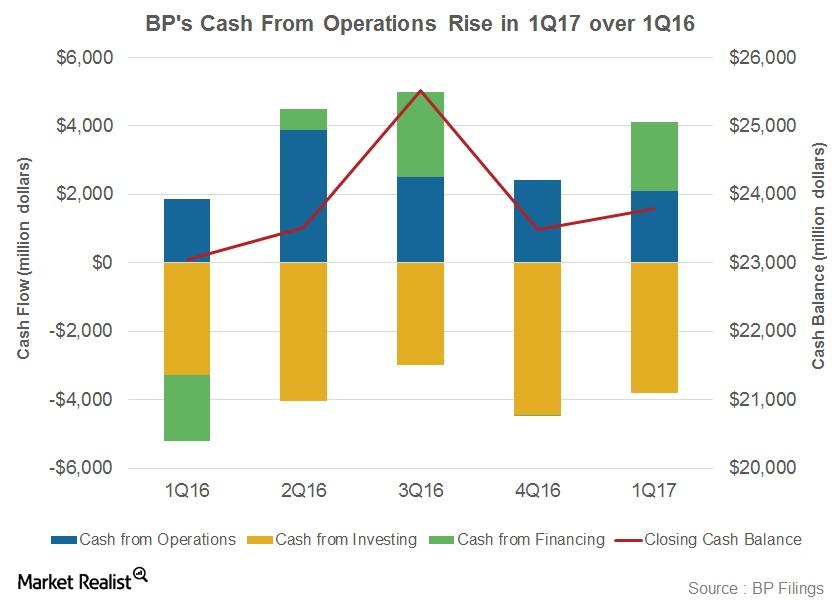

Is BP’s Cash Flow Slated for Growth?

Rising oil prices have given BP some hope that its cash flows could improve. The robust upstream project pipeline is also likely to result in higher production.

Positive and negative effects on ExxonMobil’s returns

Currently, the biggest concern affecting Exxon Mobil (XOM) and other energy companies is the falling crude price and falling oil and gas production.

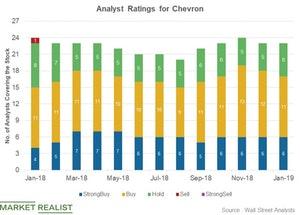

Chevron: Analysts’ Recommendations

In January, 23 analysts rated Chevron (CVX). Among the analysts, 17 (or 74%) recommended a “buy” or “strong buy.”

How Does Saudi Aramco’s Production Compare to Its Peers?

Saudi Aramco’s production accounted for 27% of OPEC’s average production in 2015. After Saudi Arabia, Iraq and Iran have the highest production in OPEC.

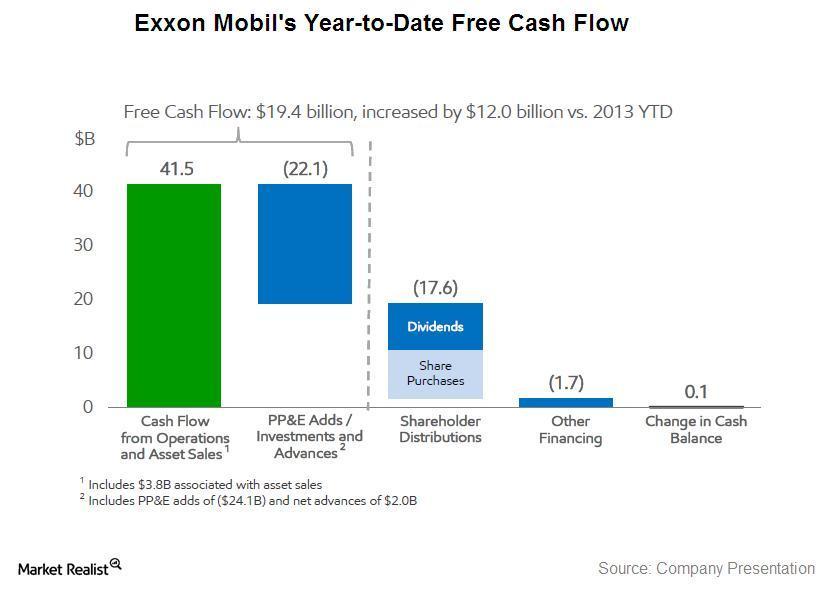

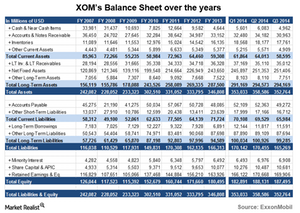

An essential analysis of ExxonMobil’s balance sheet

On a combination of several factors such as its earnings, share buybacks, and XTO acquisition, XOM’s balance sheet has grown.

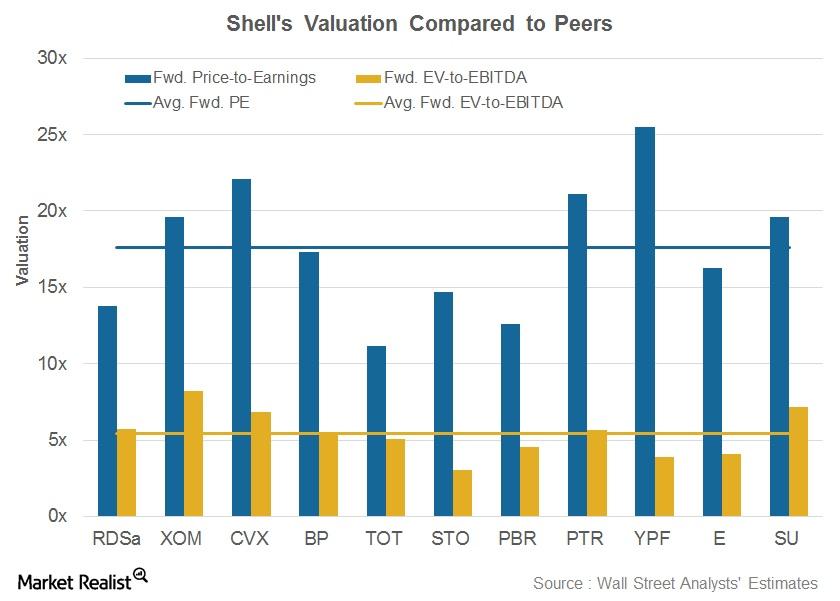

Shell’s Valuation Compared to Its Peers

Shell is trading at a forward PE of 13.8x, below its peer average of 17.6x.

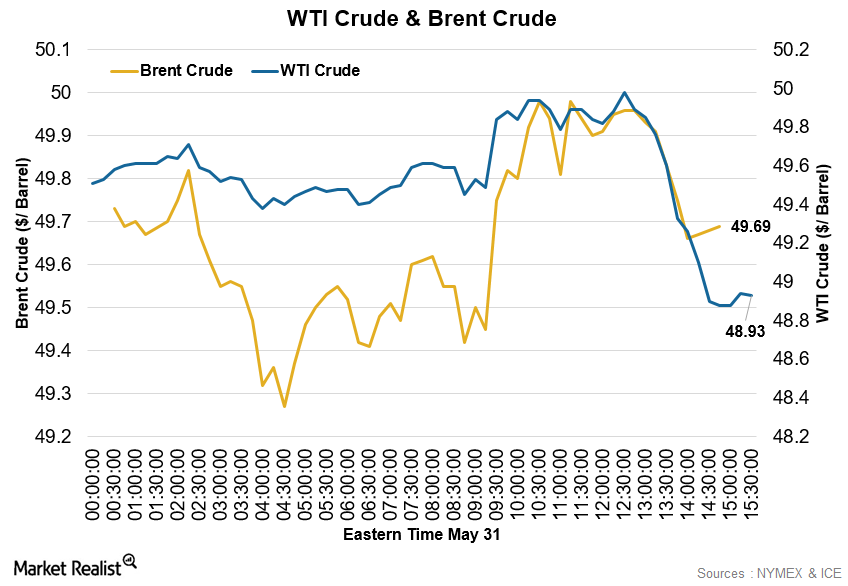

How Did Crude Oil Perform on Tuesday, May 31?

Crude oil had a volatile trading day on Tuesday, May 31, 2016. At 1:40 PM EDT, WTI crude for July delivery traded at $49.67 per barrel, a gain of 0.67%.

The World’s Top Oil-Producing Countries

These are the countries who produce the most oil in the world as well how much they produce

Top Oil-Producing Companies’ Stock Prices Fall

Looking at the top US-listed oil-producing companies’ stock prices, ExxonMobil, BP, and Chevron have fallen by 40.5%, 41.6%, and 31.5% in 2020.

Do Technical Indicators Hint at Strength for BP Stock?

BP stock has had almost flat returns in 2019, and its stock is up 0.3% year-to-date. Lower oil prices have impacted the stock’s performance.

Get Real: Breakups, Rallies, and Struggles Continue

In today’s Get Real newsletter, we looked at big tech breakup updates, another leaked Musk email, the Boeing and Airbus war, Slack’s outlook, and more.

Chevron: Is It a Good Time to Invest in the Stock?

Currently, Chevron stock trades at 18.5x its 2019 forward EPS and at 17.2x its 2020 forward EPS. The stock is higher than most of its peers.

Oil Prices and ExxonMobil Stock: What’s the Correlation?

ExxonMobil stock and oil prices have a strong correlation. The one-year correlation coefficient between the stock and WTI crude oil prices stood at 0.54.

Which Country Has the Most Oil?

Let’s take a look at the countries that own the most proven oil reserves and see why that matters for investors. You might find some surprises!

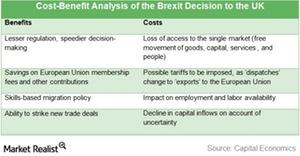

A Cost-Benefit Analysis of the Brexit Decision

To understand how the Brexit result stands to impact your portfolio or your willingness to invest in the United Kingdom, a cost-benefit analysis is pertinent.

Why is OPEC important to the price of crude oil?

High market share gives OPEC bargaining power to price oil above a competitive market. It can sway crude oil prices by increasing or decreasing production.

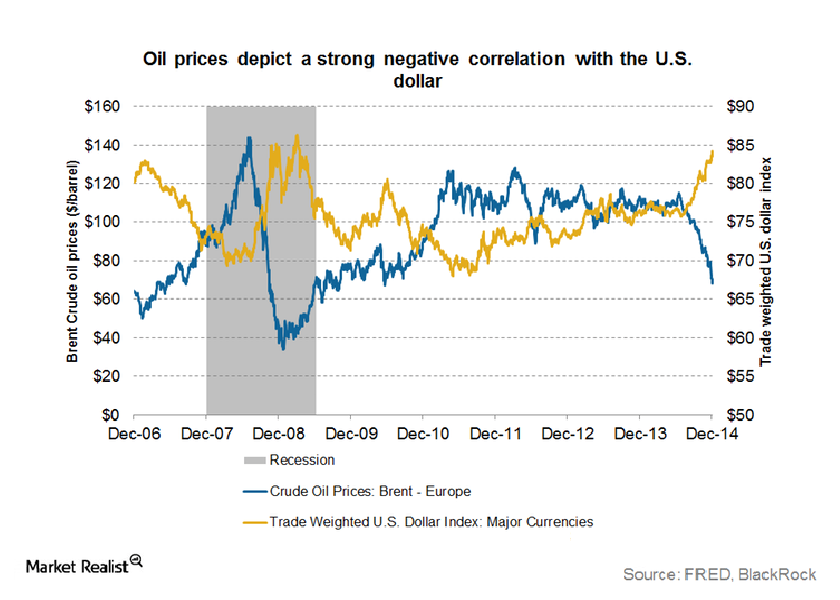

How the strengthening US dollar is impacting crude oil prices

The US dollar plays a major role in the price movements of commodities such as gold and crude oil. A strengthening US dollar is often seen as negative.

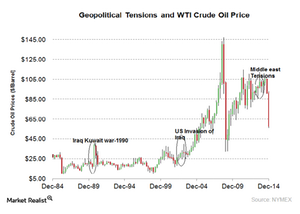

Must know: Geopolitical tensions impact oil prices

A glut in crude oil supply could mean that political tensions in the near term may not impact oil prices.

Get Real: Scandal and Opportunity in the Market

Twitter is dealing with a scandal and Airbus seems to be making the most of the Boeing crisis. Plus, Canopy Growth has a new partner.Consumer Must-know: The Baupost Group’s 2Q14 positions

The size of the fund’s U.S. long portfolio increased 48% to $6.14 billion in the second quarter from $4.14 billion in the first quarter. The fund’s top positions include Micron Technology, Idenix Pharmaceuticals, and Viasat.

Must-Know: The Top 10 Refineries in the US

US crude oil production has more than doubled since 2009 and grew by 1.1% over the last year. Currently, there are 133 operable refineries in the US.

ExxonMobil and Chevron: Do Moving Averages Show a Breakout?

Leading energy stocks like ExxonMobil (XOM) and Chevron (CVX) are facing bleak business conditions. Oil prices have been weaker in the third quarter.

ExxonMobil and Chevron: Upstream Portfolio Positioning

Integrated oil companies ExxonMobil and Chevron have strong upstream portfolios, which play a vital role in determining their profitabilities.

BP Stock: Should You Buy It Now?

BP (BP) stock rose 3.9% on Monday due to higher oil prices. The drone attack on Saudi Arabia’s oilfield increased WTI crude oil by about 13%.

Energy Stocks Fall: Right Time to Invest?

The recent slump in energy stocks provides investors with an opportunity to invest in well-placed stocks. Shell looks like an attractive investment option.

ExxonMobil Stock: JPMorgan Chase Cut Its Target Price

ExxonMobil’s (XOM) earnings fell in the second quarter. After the earnings, JPMorgan Chase cut its target price on ExxonMobil stock from $85 to $83.

BP’s Earnings Beat Analysts’ Expectations

BP (BP) reported its second-quarter results today. Its earnings per American depositary share of $0.84 beat analysts’ estimate by about 7%.

Total SA Stock Fell Marginally After Q2 Earnings

Total SA stock fell 0.9% on Thursday—its earnings release day. The stock was impacted by a 20% YoY fall in its earnings.

Suncor’s Earnings Rise but Miss Estimate in Q2

Suncor Energy (SU) posted its second-quarter earnings results on July 24. In the quarter, its revenue missed Wall Street’s estimate by 4%.

ExxonMobil Tops the Charts with Strong Financials

ExxonMobil (XOM) has the lowest percentage of debt in its capital structure compared to its peers. In the first quarter, ExxonMobil’s total debt-to-capital ratio stood at 17%.

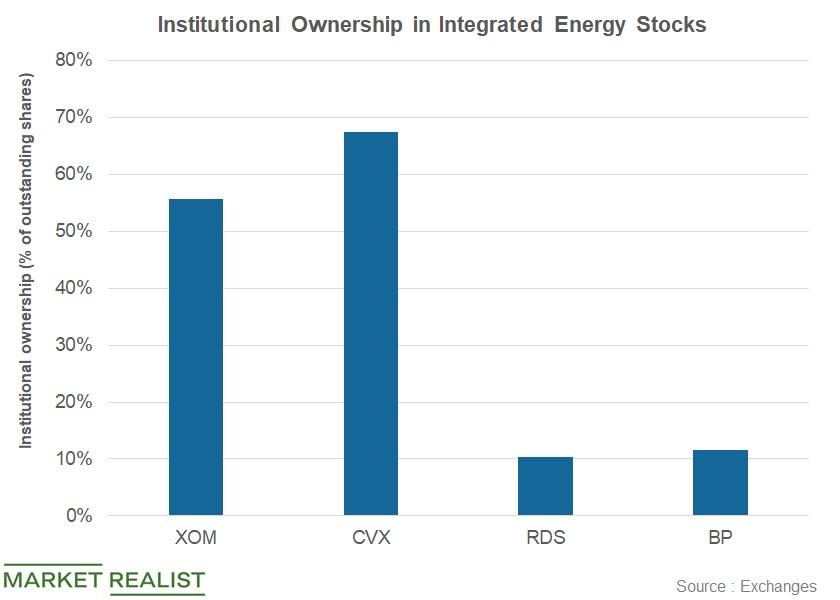

Which Institutions Raised Holdings in Integrated Stocks?

Institutional ownership in ExxonMobil and BP stands at ~56% and ~12%, respectively.

Are Analysts Gaining Confidence in BP?

Analysts seem to be gaining confidence in BP due in part to its expected upstream production growth.

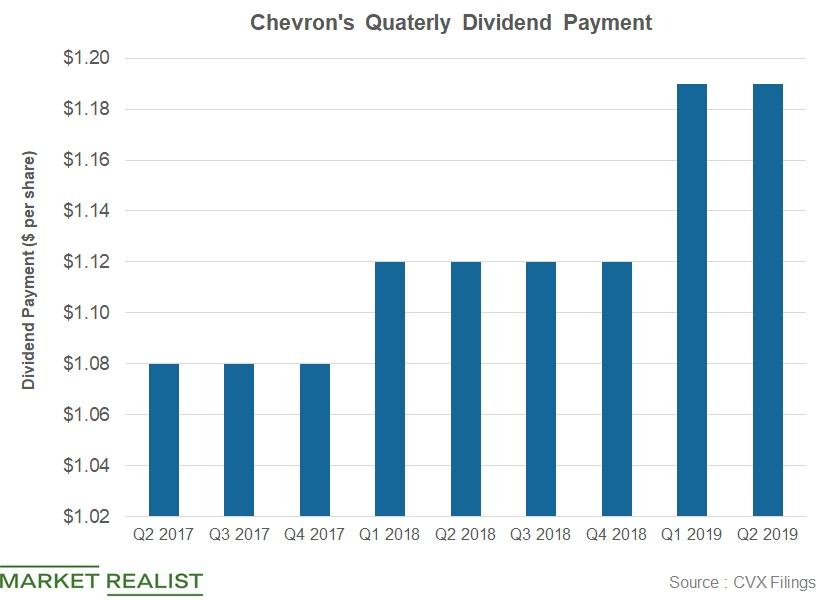

How Will Chevon’s Dividend Payment Trend in Q2?

Chevron (CVX) released its first-quarter earnings on April 26. The company paid $2.2 billion in dividends in the first quarter.

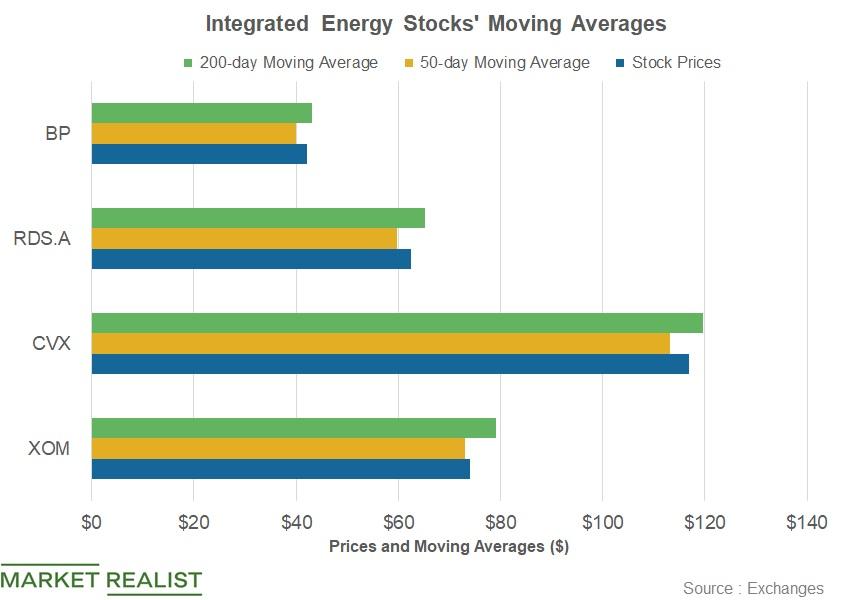

XOM, CVX, Shell, BP: What Do Moving Averages Suggest?

In the first quarter so far, integrated energy stocks ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have risen due to the rise in oil prices.

Chevron: Analysts Expect Higher Q3 Earnings

Chevron (CVX) is expected to post its third-quarter results on November 2. Chevron is expected to post an EPS of $2.1 in the third quarter.

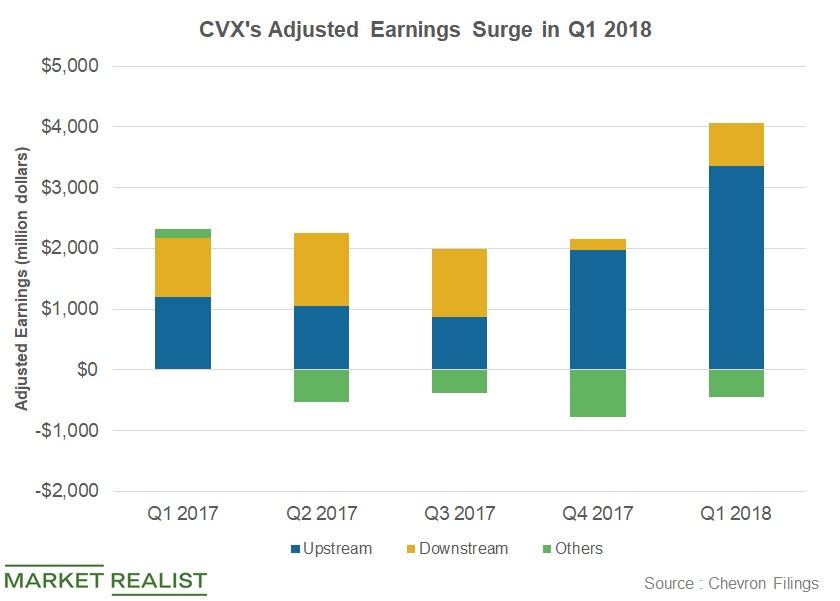

Will Chevron’s Upstream and Downstream Earnings Rise in Q2 2018?

Before we proceed with Chevron’s (CVX) second-quarter segmental outlook, let’s briefly look at its first-quarter segmental performance.