Which Analysts Are Bullish on Nutrien in January 2018?

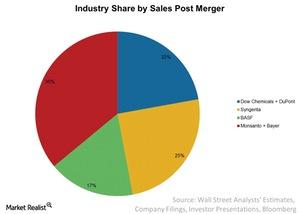

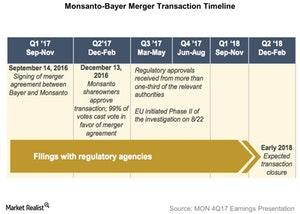

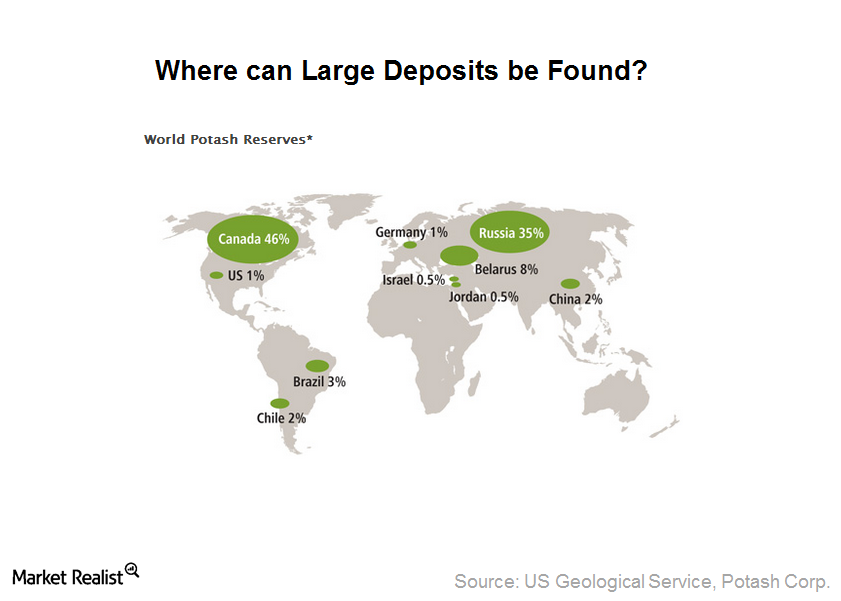

At the end of 2017, after receiving final regulatory approval for the merger, PotashCorp and Agrium combined into a new company called Nutrien (NTR).

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.