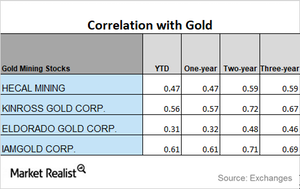

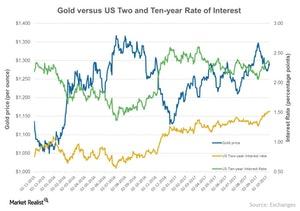

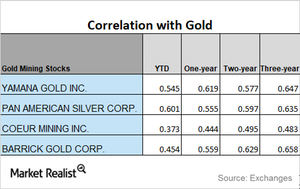

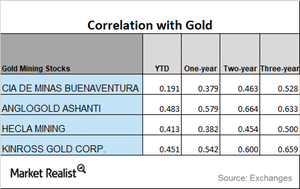

Correlation Reading of Miners and Funds in the Last 3 Years

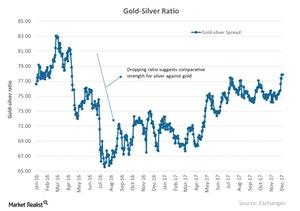

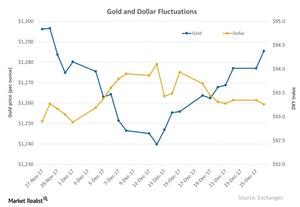

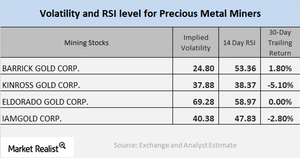

During the past year, IamGold has seen the highest correlation to gold, while Eldorado Gold has the lowest correlation.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.