Why Analysts Are Quickly Raising Huntsman’s Target Prices

The analyst consensus target price for Huntsman is $37.55, which implies a return potential of 20.9%.

Dec. 14 2017, Updated 12:36 p.m. ET

Analyst consensus on Huntsman

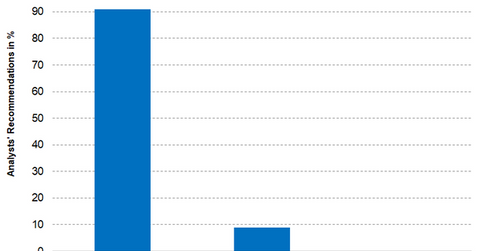

As of December 12, 2017, the number of analysts tracking Huntsman (HUN) has risen from eight analysts in July to 11 analysts at present. 91% of these analysts have recommended a “buy,” 9% have recommended a “hold,” while none of the analysts have recommended a “sell.”

The analyst consensus target price for Huntsman is $37.55, which implies a return potential of 20.9%. Analysts have been quickly raising HUN’s target price, which indicates their bullishness on the stock. The target prices have been moved from $30.10 in September to the current target price.

Most analysts lean towards a “buy”

Huntsman successfully spun off its pigments and performance additives business, which is now trading as Venator (VNTR). HUN posted strong 3Q17 earnings and reduced its debt from $4.5 billion to $2.4 billion on December 5. The company used the net proceeds from the secondary IPO to further reduce its debt by $471 million by redeeming the Term Loan B due in 2023. In total, HUN will reduce its interest expense by approximately $90 million per year. The debt repayments have helped HUN to improve its leverage ratio. Also, HUN still holds a 55% stake in VNTR. All these developments are expected to improve investor value. Thus more analysts are leaning towards a “buy” recommendation.

Individual brokerage recommendations

- Instinet has recommended a target price of $40, which implies a return potential of 28.7% based on its closing price of $31.07 on December 11, 2017.

- UBS (UBS) has given the stock a target price of $35, implying a return potential of 12.6% from the closing price as of December 11, 2017.

- Citigroup has raised its target price on Huntsman to $38.0, which implies a return potential of 22.3% from the closing price as of December 11, 2017.

Investors looking to invest in Huntsman indirectly can invest in the Vanguard Materials ETF (VAW), which has 0.70% exposure to Huntsman. The fund also provides exposure to Monsanto (MON) and LyondellBasell (LYB). These stocks have weights of 5.6% and 4.0%, respectively, as of December 11, 2017.