Ubiquiti Networks Inc

Latest Ubiquiti Networks Inc News and Updates

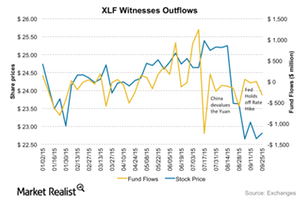

Fund Flows to XLF Have Been Declining

Exchange-traded fund investors added almost $552.6 million on average to the Financial Select Sector SPDR ETF (XLF) in the last quarter. During the week ending September 25, the ETF witnessed outflows of $318.3 million.

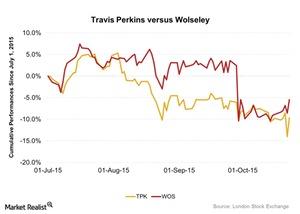

Travis Perkins Rebounded, Led EWU by 5.09%

Travis Perkins was at the top of the iShares MSCI United Kingdom ETF on October 23, 2015, as analysts showed positivity toward the construction industry.

BYND Leads Alt-Meat Market, Faces New Competitors

On Friday, investment bank UBS started coverage on Beyond Meat Stock (BYND). At 10:08 AM ET today, the stock was trading 4.4% lower at $76.5.

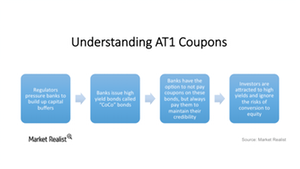

Why Are Deutsche Bank Investors So Concerned About AT1 Coupons?

Shares of Deutsche Bank (DB) have fallen nearly 10% in the last three trading sessions. Efforts to reassure investors about its ability to pay coupons on its AT1 bonds were in vain.

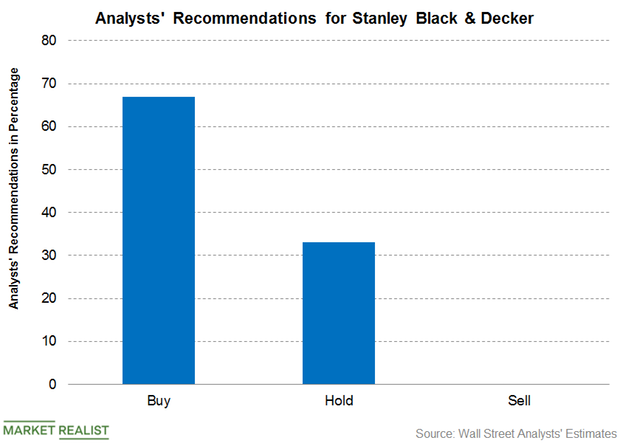

Stanley Black & Decker: Analysts’ Recommendations

Currently, 21 analysts are actively tracking Stanley Black & Decker. Among the analysts, 67% recommend a “buy,” while 33% recommend a “hold.”

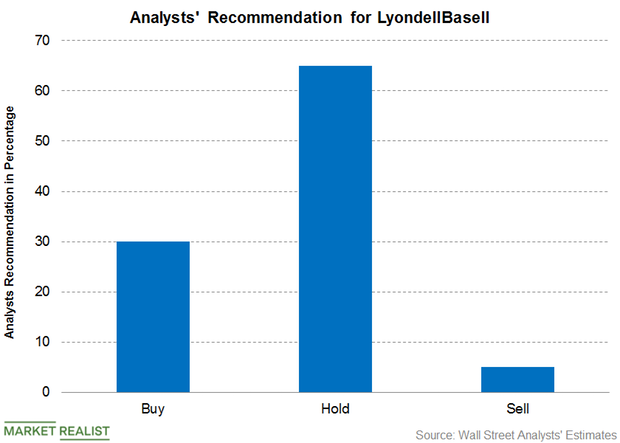

LyondellBasell: Analysts’ Views and Recommendations

For LyondellBasell, 30% of the analysts recommended a “buy,” 65% recommended a “hold,” and 5% recommended a “sell.”

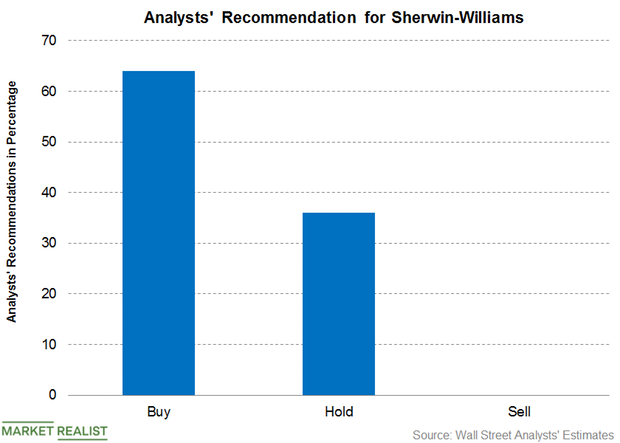

Sherwin-Williams: Analysts’ Recommendations

For Sherwin-Williams, 64% of the analysts recommended a “buy,” 36% recommended a “hold,” and none of the analysts recommended a “sell.”

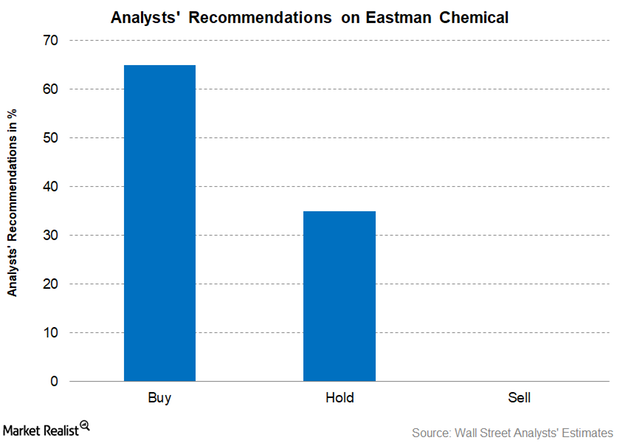

What Analysts Recommend for Eastman Chemical

Analysts’ consensus on EMN’s mean target price is on the rise from $89.92 in July to the current target price of $93.38 as of September 12, 2017.

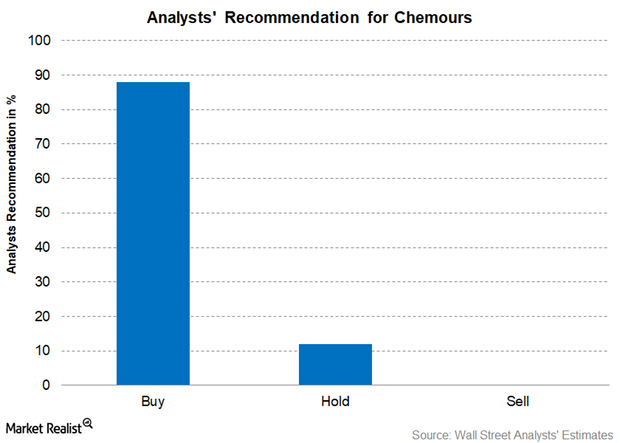

Chemours: Analysts’ Recommendations and More

For Chemours, 88% of the analysts recommended a “buy,” 12% of the analysts recommended a “hold,” and none of the analysts recommended a “sell.”

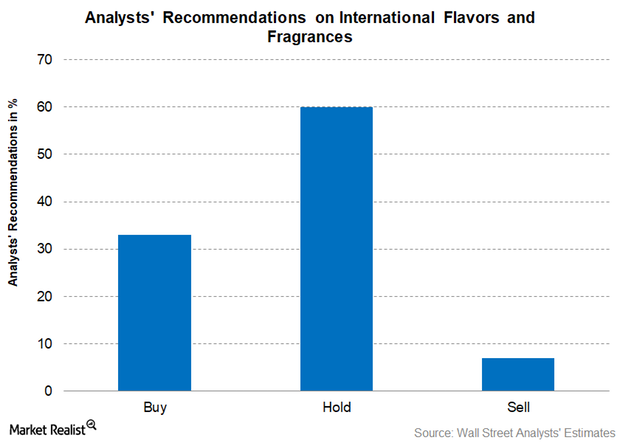

Analysts’ View on International Flavors & Fragrances

For International Flavors & Fragrances, 33% of the analysts recommended a “buy,” 60% recommended a “hold,” and 7% recommended a “sell.”

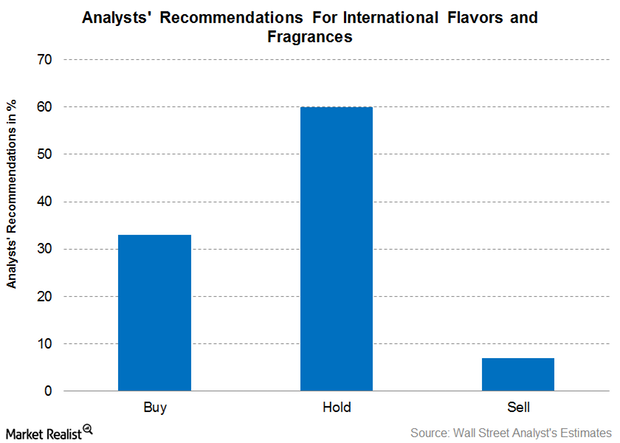

Analysts’ Recommendations for IFF after Its 1Q17 Earnings

As of May 9, about 33% of the analysts recommended a “buy” for International Flavors & Fragrances, 60% recommended a “hold,” and 7% recommended a “sell.”

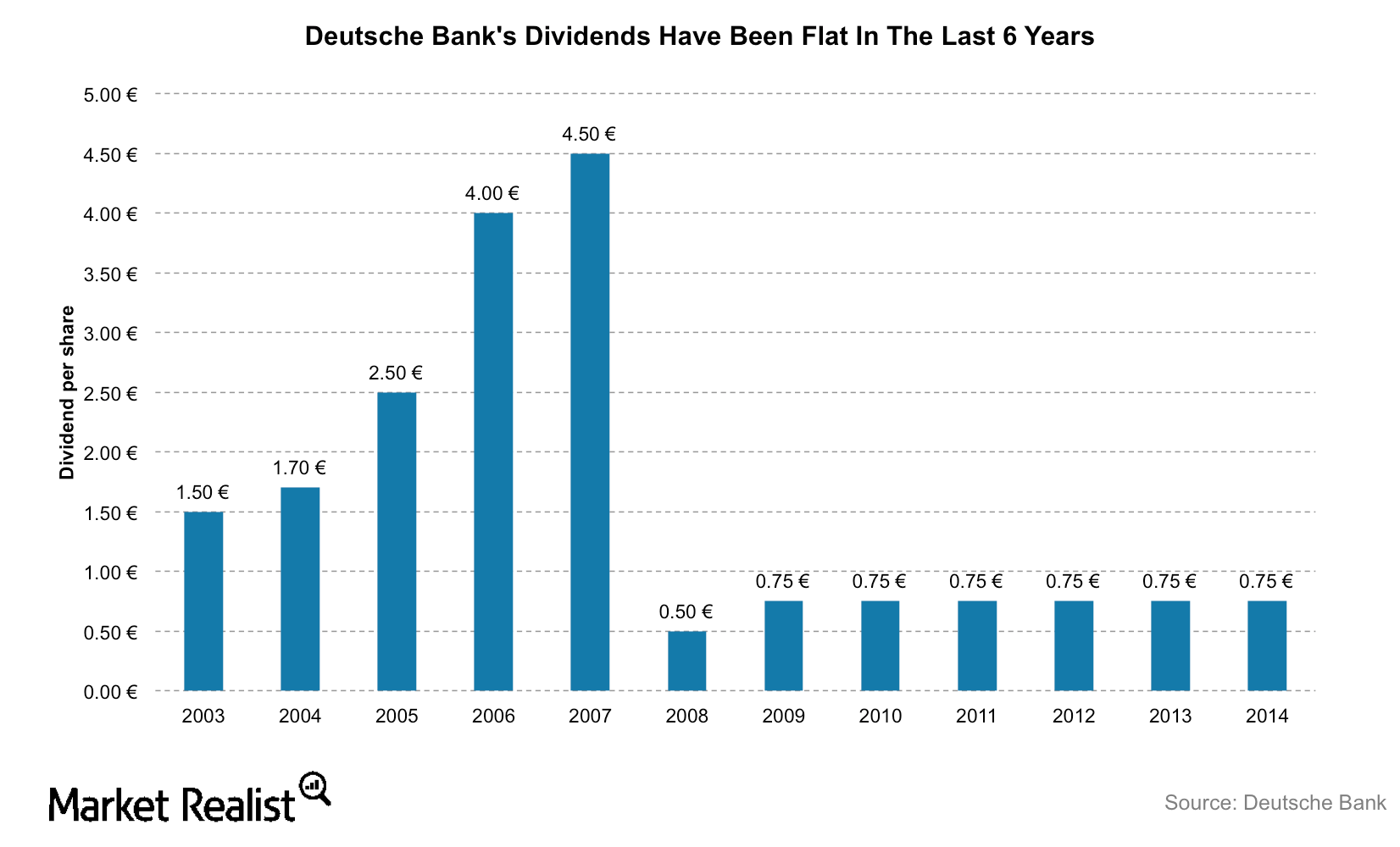

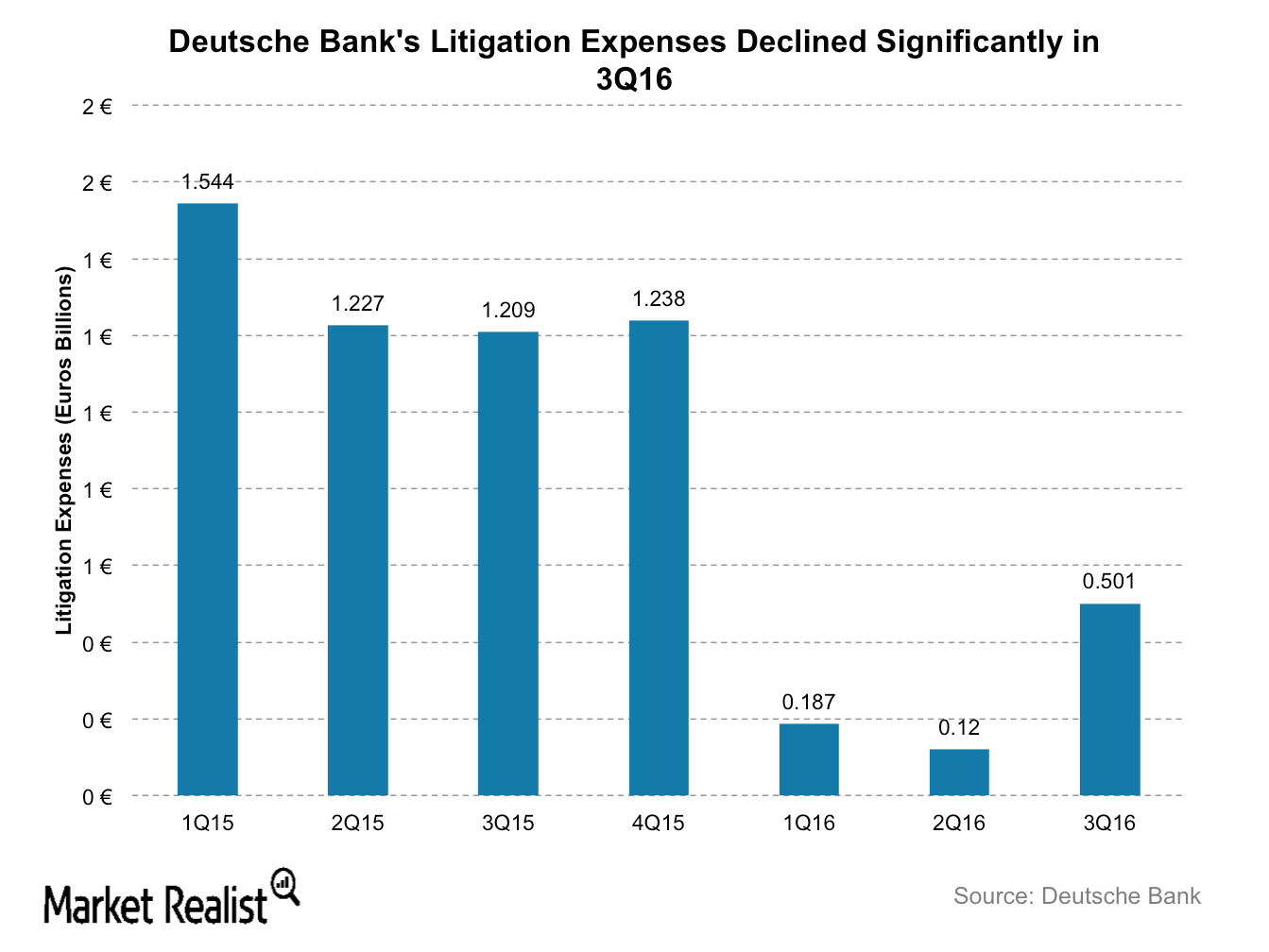

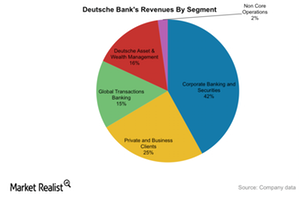

Why Deutsche Bank Scrapped Dividends in 2016

Germany-based Deutsche Bank (DB) announced plans to cut dividend payments for 2015 and 2016 as part of its plans to strengthen the bank’s capital.

Will Deutsche Bank’s Overhaul Plan Work?

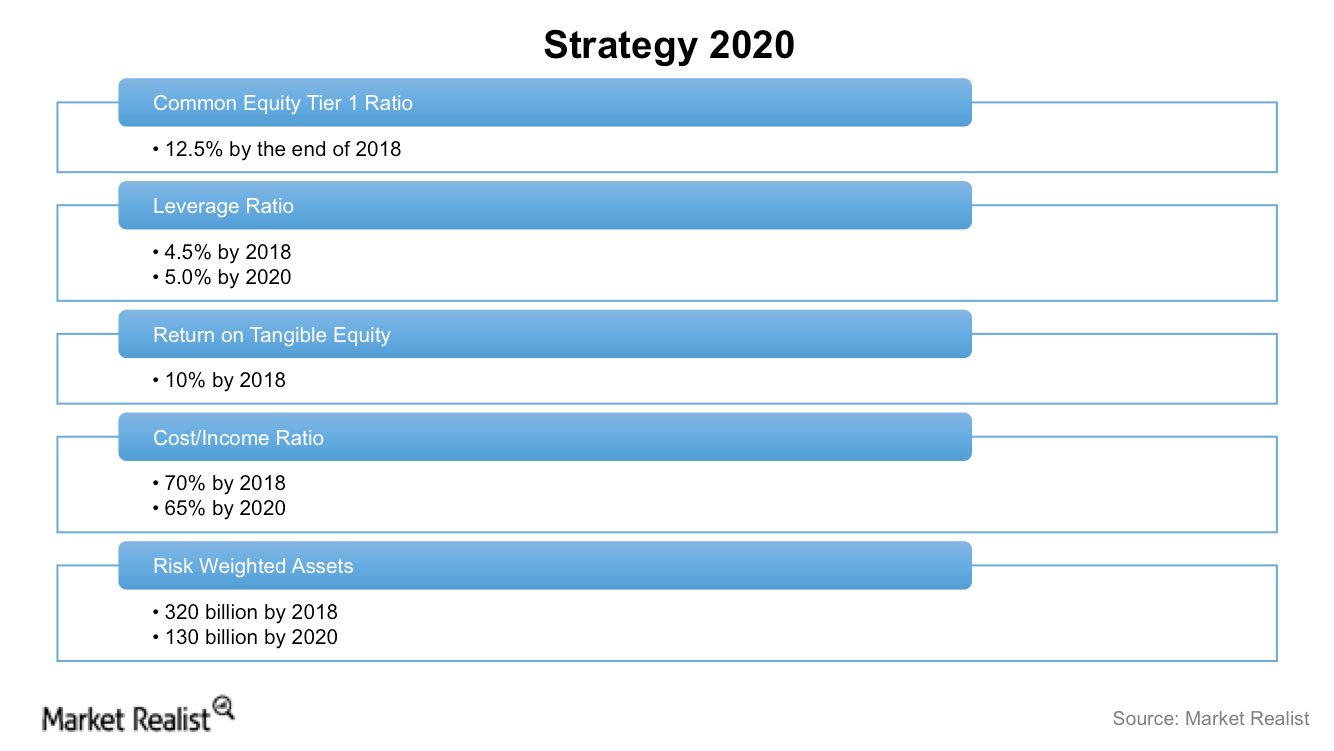

Investors who are concerned about Deutsche Bank’s bankruptcy are looking at CEO John Cryan’s plan to restructure the company’s operations.

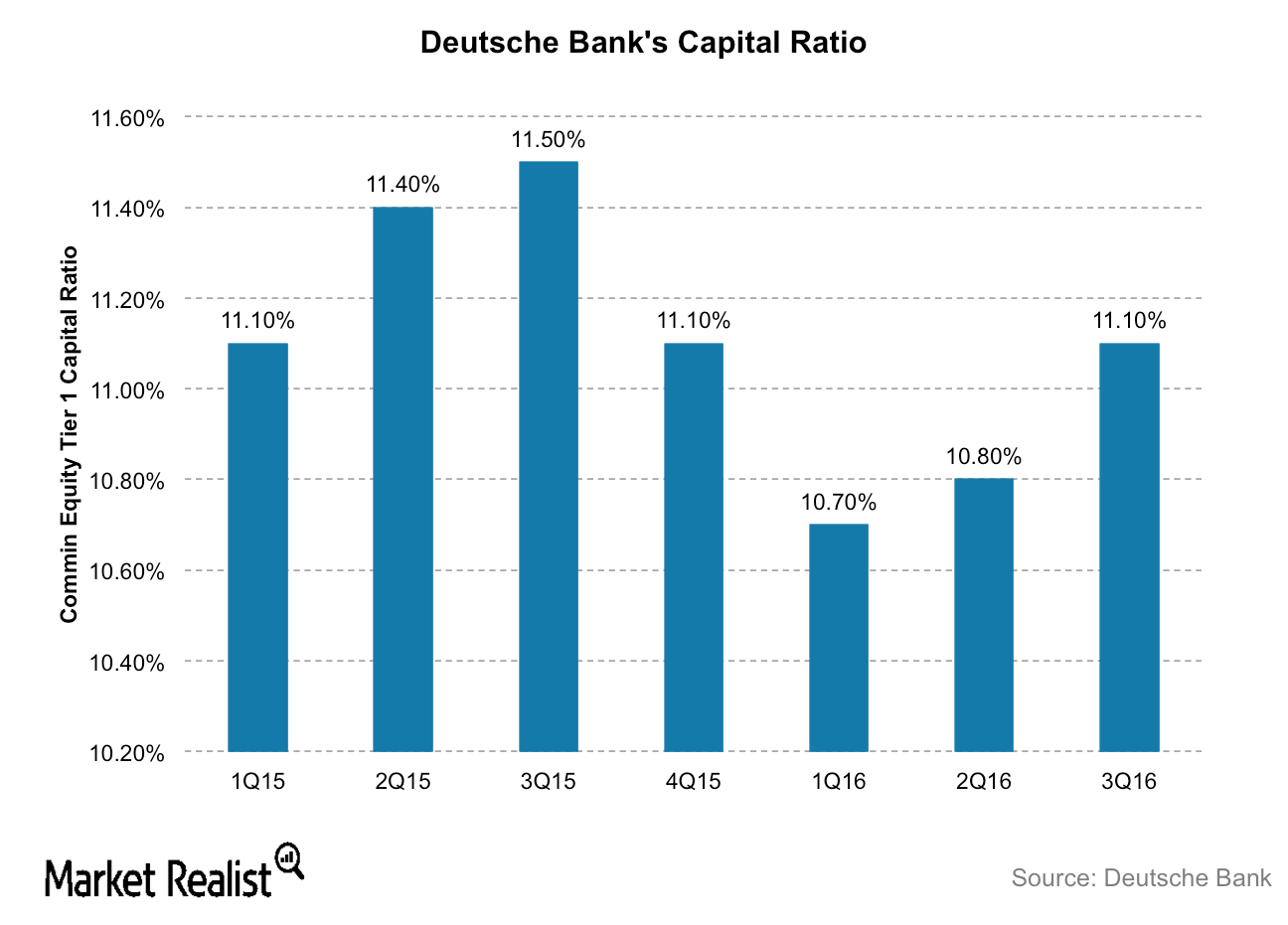

Deutsche Bank: Analyzing Its Capital Levels

Deutsche Bank is proving to be the most dangerous bank to the global economy. It failed the Fed’s 2016 stress tests in June 2016.

Can Trump Save Deutsche Bank from Bankruptcy?

Deutsche Bank could be the biggest beneficiary under Trump, having been on the brink of bankruptcy until its stock spiked nearly 20% after the election.

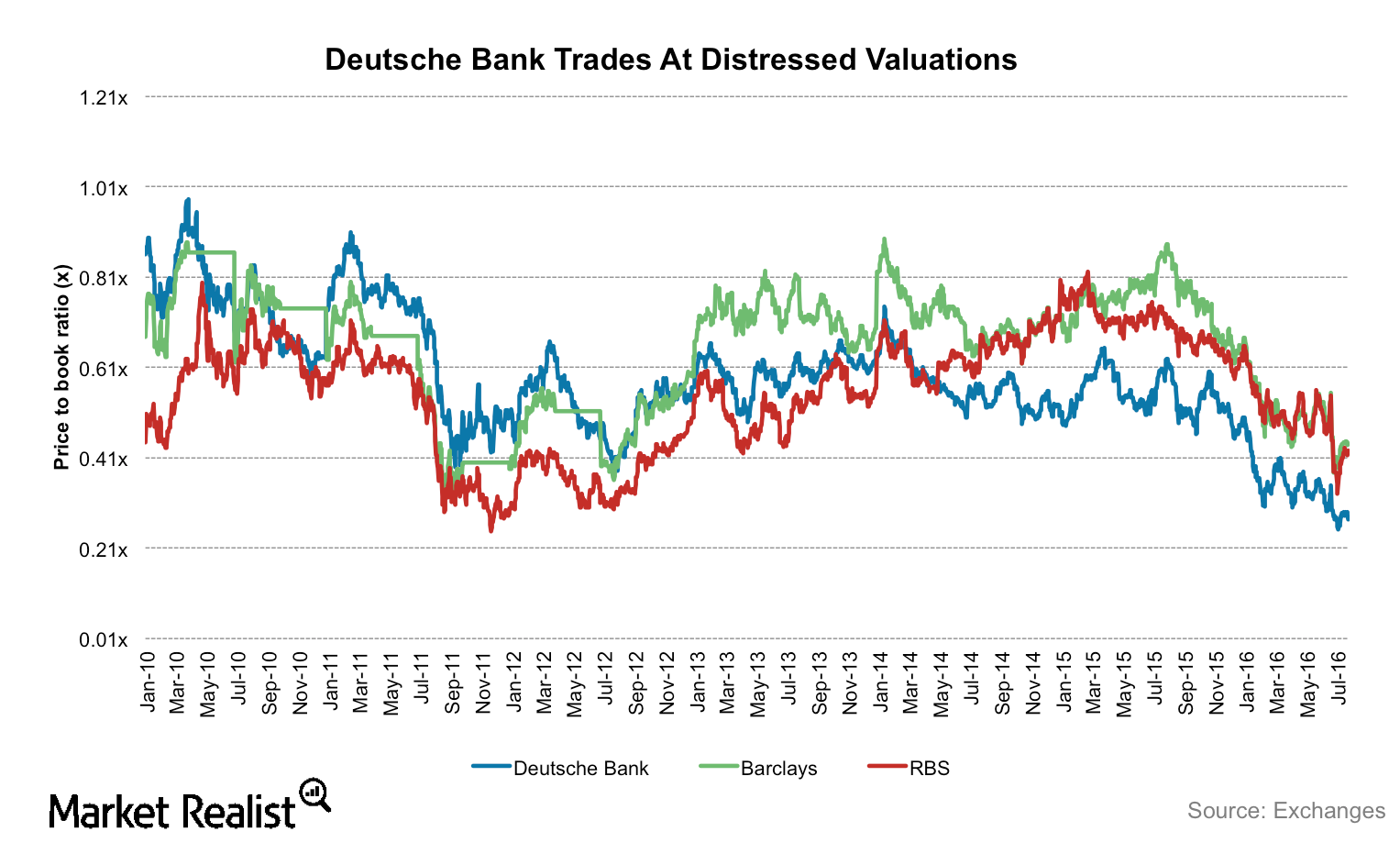

Do Distressed Valuations Offer a Good Chance to Buy Deutsche Bank?

Deutsche Bank’s (DB) shares are currently trading at distressed valuations. The bank’s shares are trading at the steepest discount to its book value, worse than the 2008 financial crisis.

Deutsche Bank’s Capital Levels Struggle to Meet Regulatory Requirements

Deutsche Bank’s stock is down nearly 40% in 2016 so far. Capital reserves are important to restore the confidence of regulators and investors.

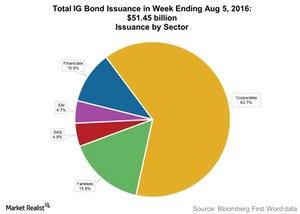

Microsoft Issued the Most High-Grade Bonds Last Week

Microsoft (MSFT) issued Aaa/AAA rated high-grade bonds worth $19.8 billion through seven parts on August 1, 2016.

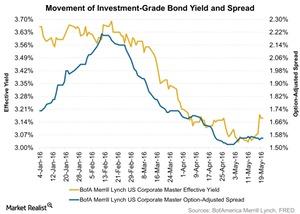

High-Grade Bond Yields Rise on Better Odds of a Rate Hike

Last week, investment-grade bond yields jumped 12 basis points and ended at 3.16%, the highest level since April 5, 2016.

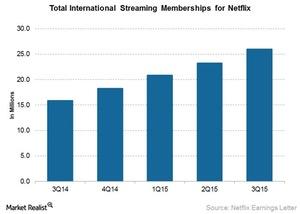

Netflix’s Challenges in Acquiring Global Streaming Rights

Netflix has had difficulty in acquiring global streaming rights for content from media companies. This is due to its status as the sole buyer of streaming rights on a global basis.

Understanding Deutsche Bank’s Segments

Deutsche Bank operates under five segments. Corporate Banking & Securities contributes 50% to Deutsche Bank’s revenues.

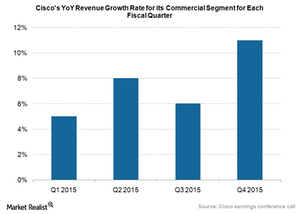

Meraki Drives Cisco’s Commercial Segment Growth in 4Q15

Cisco credits Meraki for the acceleration in revenue growth for Cisco’s commercial segment. Cisco’s year-over-year revenue growth for this segment rose to 11% in 4Q15.

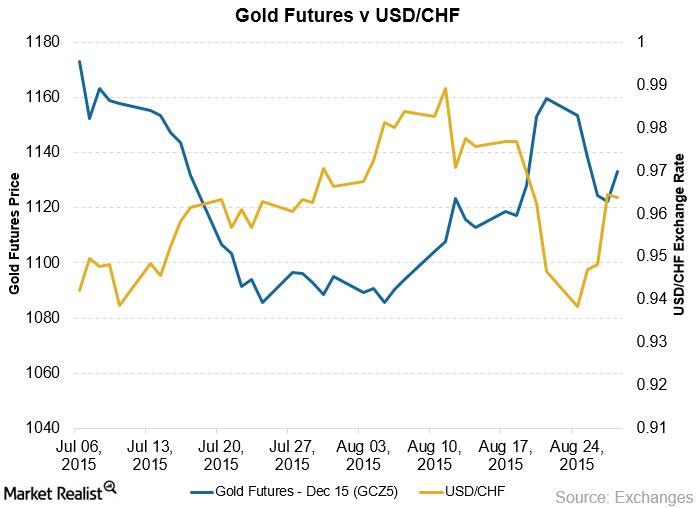

Why the Swiss Franc Is the Golden Currency

Recently, the safe haven currencies like the Swiss franc and the Japanese yen are the ones that are showing a greater correlation to gold.