Huntsman Corp

Latest Huntsman Corp News and Updates

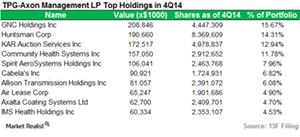

TPG-Axon Capital Management Increases Four Positions in 4Q14

In 4Q14, TPG-Axon Capital Management increased holdings in Huntsman (HUN), Allison Transmission Holdings (ALSN), KAR Auction Services (KAR), and Zynga (ZNGA).

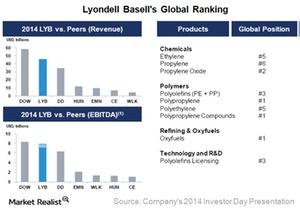

What Are LyondellBasell’s Global Rankings?

LyondellBasell (LYB) is the leading global producer of olefins and polyolefins.

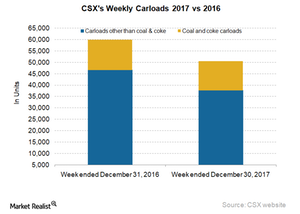

Commodities that Pulled Down CSX’s Carload Traffic in Week 52

Rail giant CSX (CSX) reported double-digit carload traffic loss in the 52nd week of 2017. The company’s carload traffic slumped 15.7% that week.

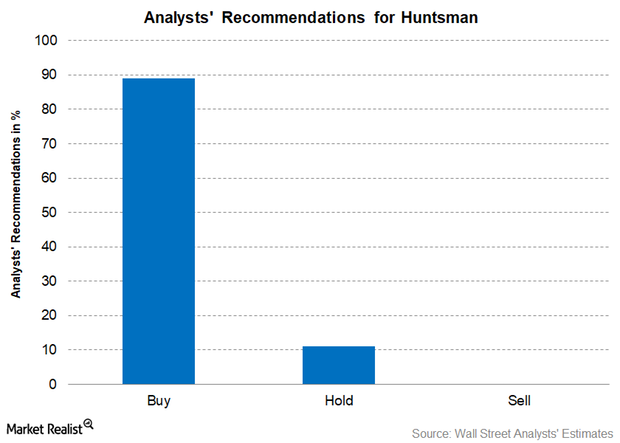

Why Most Analysts Recommend ‘Buy’ for Huntsman

Analysts’ consensus for Huntsman The number of analysts covering Huntsman (HUN) stock has increased from eight analysts to nine analysts in the last month. Among them, 89% of the analysts have recommended “buy,” and 11% have recommended “hold.” There were no “sell” recommendations. Analysts have raised Huntsman’s 12-month target price to $30.11 from $28.71, implying a potential […]

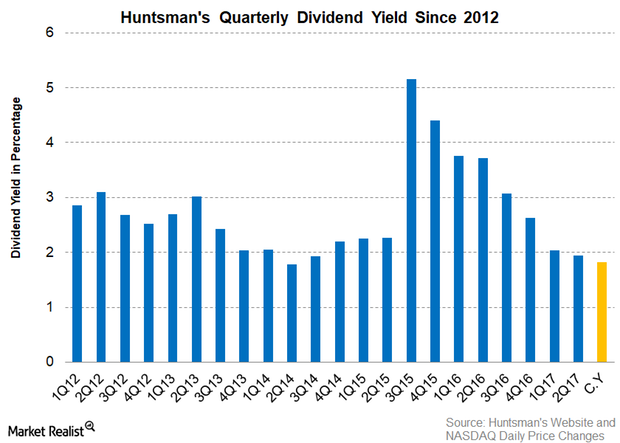

Huntsman’s Dividend Yield Falls as Its Stock Price Rises

Huntsman’s dividend yield Dividend yields are very important for long-term investors, as they fetch a steady income. Investors prefer companies with a strong dividend yield and growth. As Huntsman (HUN) has maintained its dividend rate, we can expect it to pay a fiscal 2017 dividend of $0.50 per share At this dividend rate, Huntsman’s dividend yield […]