Vanguard Materials ETF

Latest Vanguard Materials ETF News and Updates

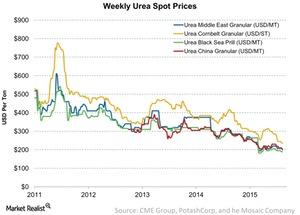

Urea Prices: The Continuing Decline Last Week

Granular urea prices in the Middle East declined 5% to $200 per metric ton in the week ended July 1. It was $210 per metric ton in the previous week.

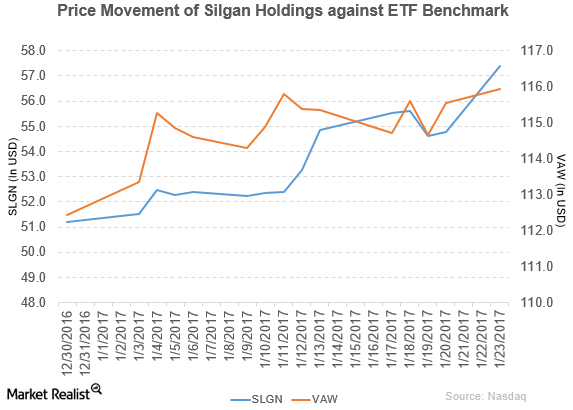

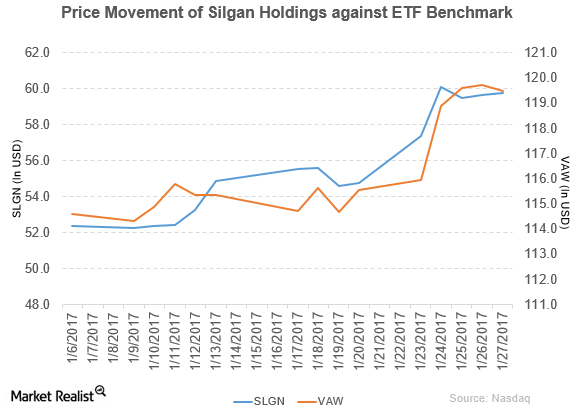

Bank of America/Merrill Lynch Upgrades Silgan Holdings to a ‘Buy’

On January 23, 2017, Bank of America/Merrill Lynch upgraded Silgan Holdings’s (SLGN) rating to a “buy” from “underperform.”

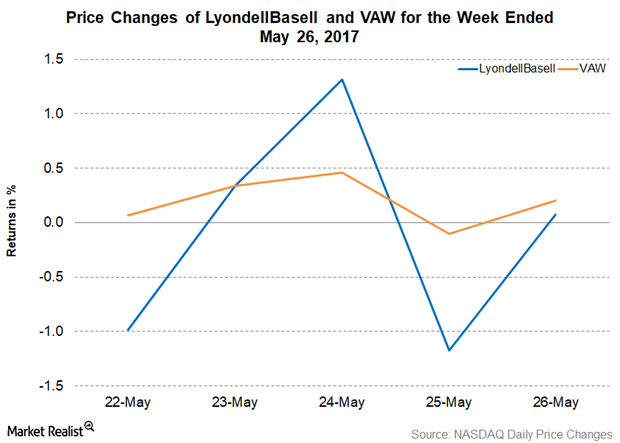

LyondellBasell Announces New Share Repurchase Program

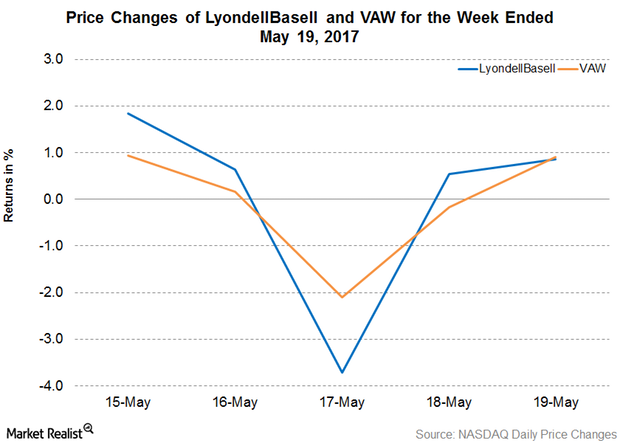

On May 24, 2017, LyondellBasell’s (LYB) board authorized a new share repurchase program. It can repurchase up to 10% of its outstanding shares over the next 18 months.

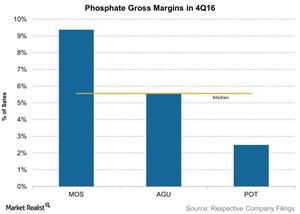

Why Phosphate Matters: Margins Among the Biggest Producers

The median gross margin for these companies’ phosphate segments was 14%, as a percentage of segment sales in 4Q15.

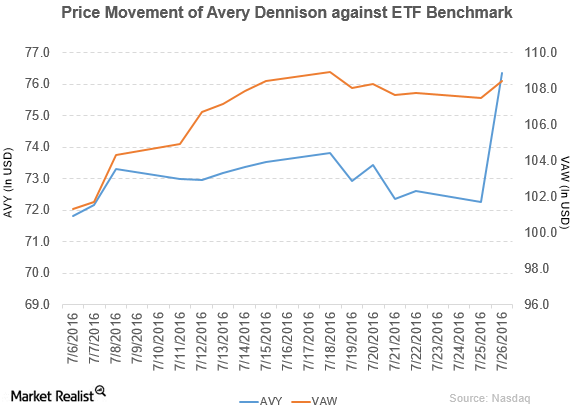

Avery Dennison’s Top and Bottom Lines Rose in 2Q16

Avery Dennison (AVY) has a market cap of $6.8 billion. It rose by 5.7% to close at $76.37 per share on July 26, 2016.

What Moody’s Thinks of Silgan Holdings’ Rating

Silgan Holdings (SLGN) rose 9.1% to close at $59.77 per share during the fourth week of January 2017.

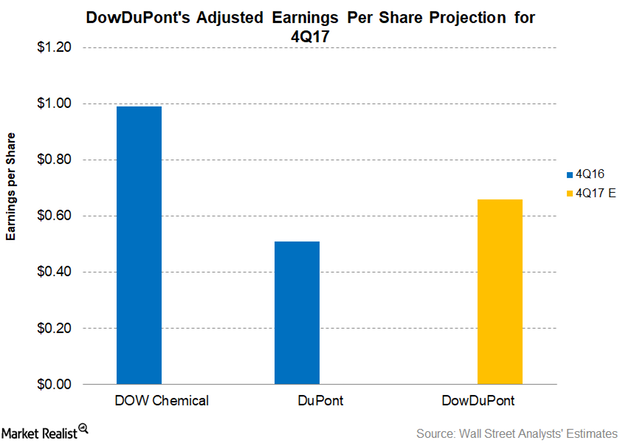

What Could Drive DowDuPont’s Adjusted Earnings in 4Q17?

DowDuPont (DWDP) is expected to post an adjusted EPS (earnings per share) of $0.66 in 4Q17. DowDuPont posted an adjusted EPS of $0.55 in 3Q17.

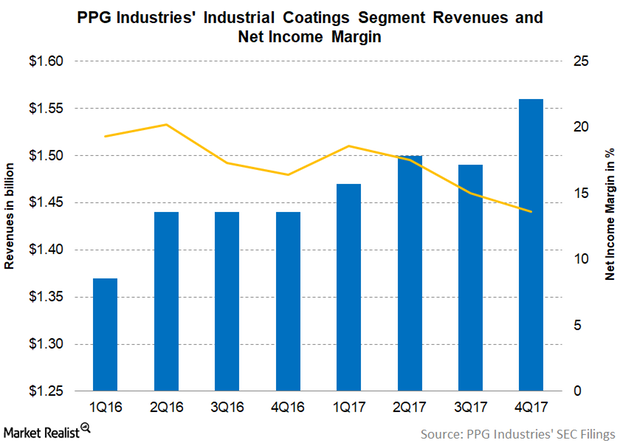

PPG’s Industrial Coatings Segment’s Margins Continue to Contract

PPG Industries’ (PPG) Industrial Coatings segment is its second reporting segment. The segment represented 42.3% of the company’s total revenue in 4Q17 compared to 42.0% in 4Q16.

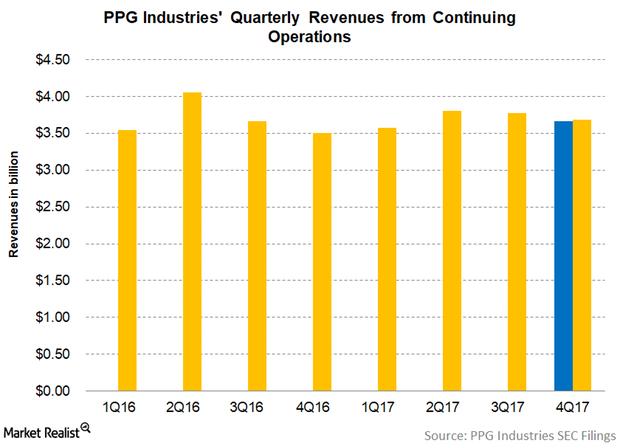

PPG Industries Stock Soars as 4Q17 Revenue Beats Estimates

PPG Industries (PPG) announced its 4Q17 earnings before the market opened on January 18, 2018. The company reported revenue of $3.68 billion, a rise of 7.9% year-over-year.

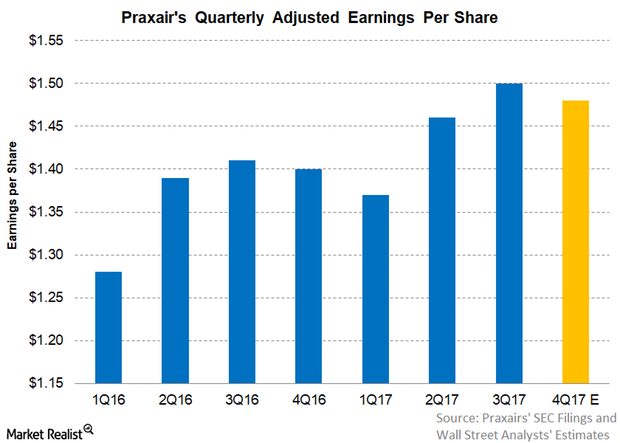

Can Praxair Meet Analysts’ Adjusted Earnings Per Share Estimate?

As of January 15, 2018, analysts are expecting Praxair (PX) to report adjusted EPS (earnings per share) of $1.48, an increase of 5.7% on a year-over-year basis.

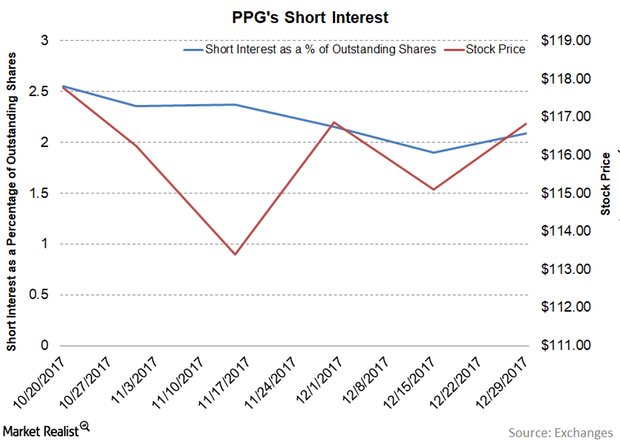

PPG Industries: Short Interest before Its 4Q17 Earnings

As of December 29, PPG Industries’ short interest as a percentage of outstanding shares stood at 2.10%. Its short interest fell from 2.55% as of October 20.

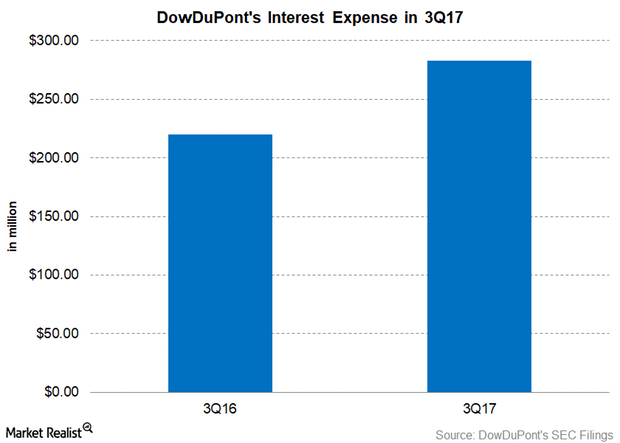

How Strong Is DowDuPont’s Interest Coverage?

In 3Q17, DWDP’s interest expense was reported at $283 million as compared to the $220 million in 3Q16 on a proforma basis.

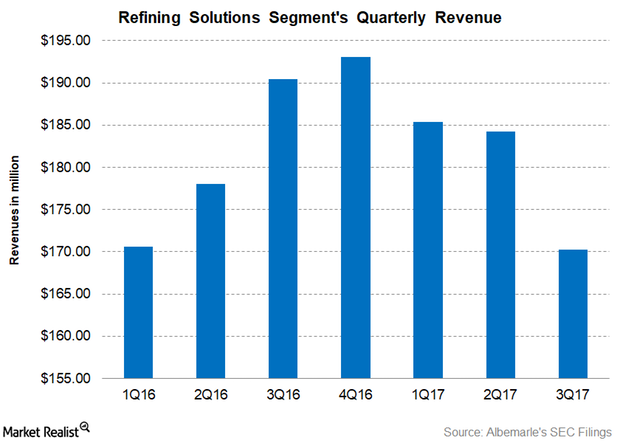

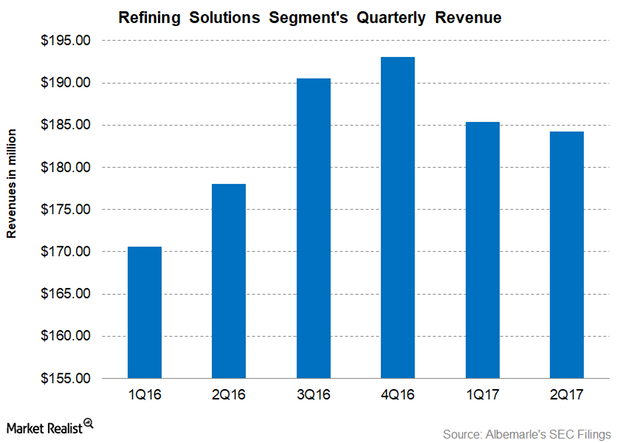

Why Albemarle’s Refining Solutions Segment Fell in 3Q17

Albemarle’s (ALB) Refining Solutions segment is the company’s lowest revenue generator, accounting for 22.6% of its total revenues in 3Q17 compared to 29.1% in 3Q16.

LyondellBasell Starts Polypropylene Production at Dalian, China

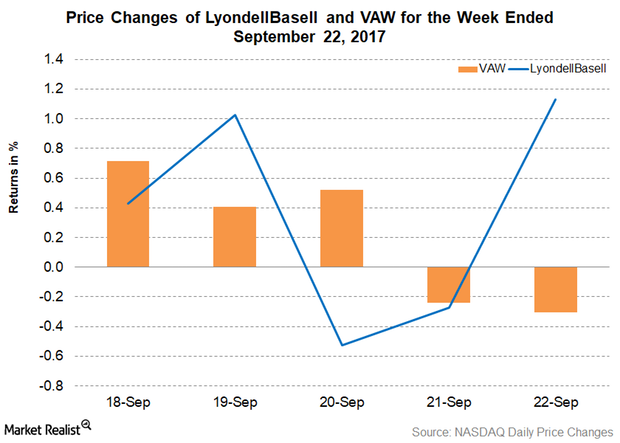

On September 21, 2017, LyondellBasell (LYB) announced that it has started manufacturing polypropylene (or PP) from its production facility in Dalian, China.

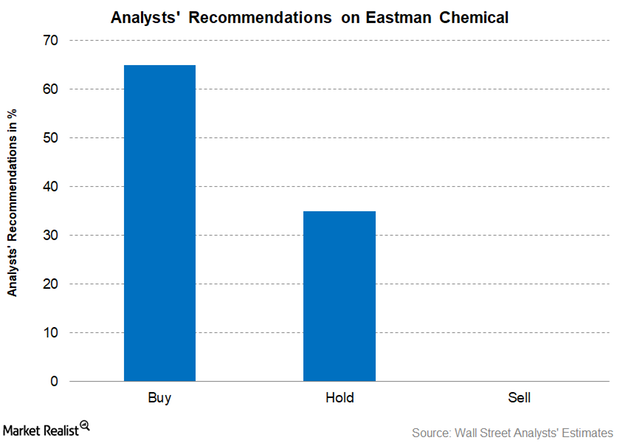

What Analysts Recommend for Eastman Chemical

Analysts’ consensus on EMN’s mean target price is on the rise from $89.92 in July to the current target price of $93.38 as of September 12, 2017.

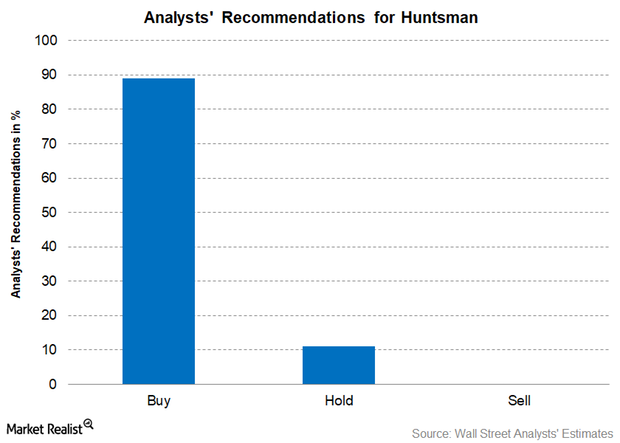

Why Most Analysts Recommend ‘Buy’ for Huntsman

Analysts’ consensus for Huntsman The number of analysts covering Huntsman (HUN) stock has increased from eight analysts to nine analysts in the last month. Among them, 89% of the analysts have recommended “buy,” and 11% have recommended “hold.” There were no “sell” recommendations. Analysts have raised Huntsman’s 12-month target price to $30.11 from $28.71, implying a potential […]

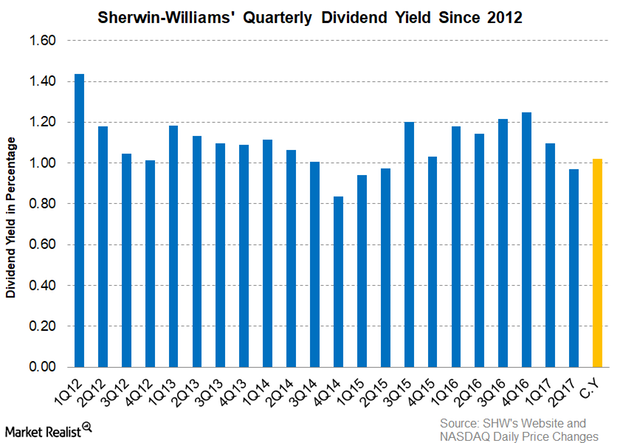

Sherwin-Williams’ Dividend Yield and Dividend Payout

Sherwin-Williams didn’t make any changes to its quarterly dividend rate. As a result, we can expect its fiscal 2017 dividend to be $3.40 per share.

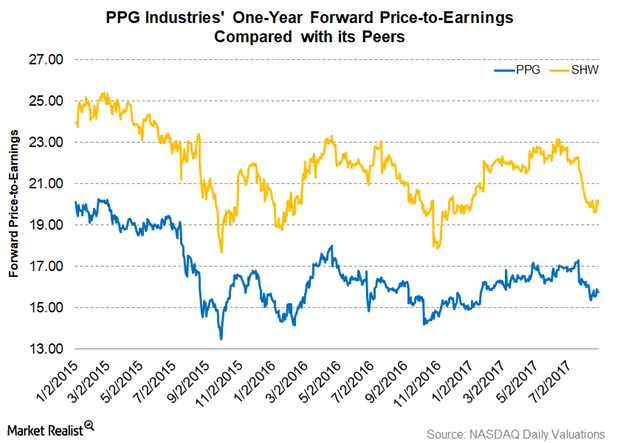

Why PPG Industries Is Trading at a Discount

As of August 25, 2017, PPG Industries’ one-year-forward PE (price-to-earnings) multiple stood at 15.80x.

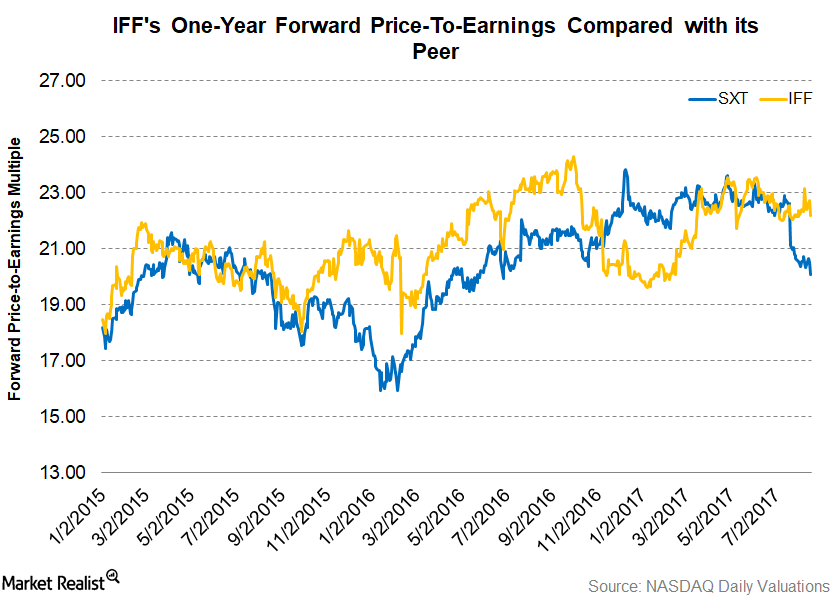

What IFF’s Valuations Suggest about the Stock

As of August 17, 2017, International Flavors and Fragrances traded at a one-year forward PE (price-to-earnings) multiple of 22.20x.

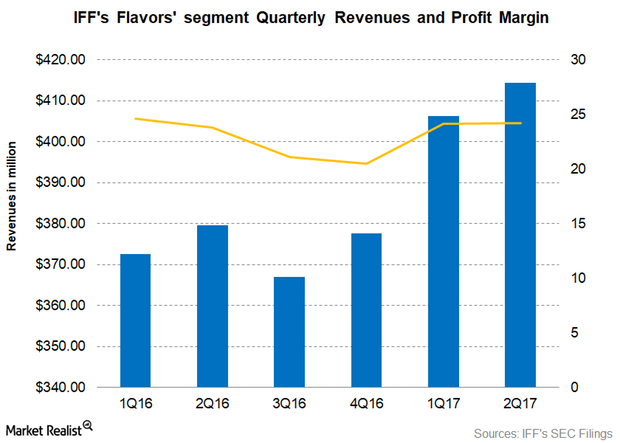

How IFF’s Flavors Segment Performed in 2Q17

The Flavors segment of International Flavors and Fragrances (IFF) has increased its revenue contribution to IFF’s overall revenue.

How Albemarle’s Refining Solutions Segment Performed in 2Q17

Albemarle’s (ALB) Refining Solutions is the company’s lowest revenue generator, accounting for 25.0% of its total revenues in 2Q17 compared to 26.6% in 2Q16.

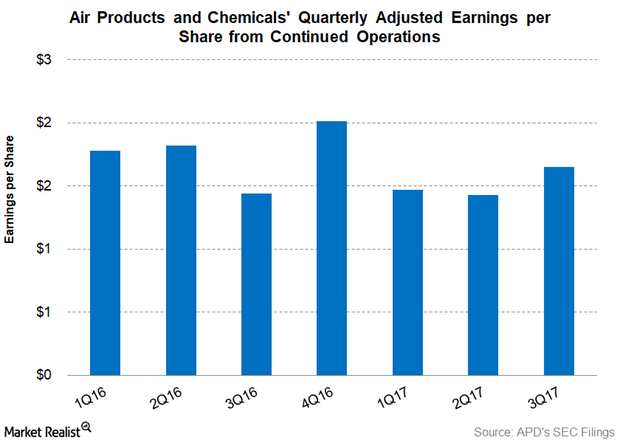

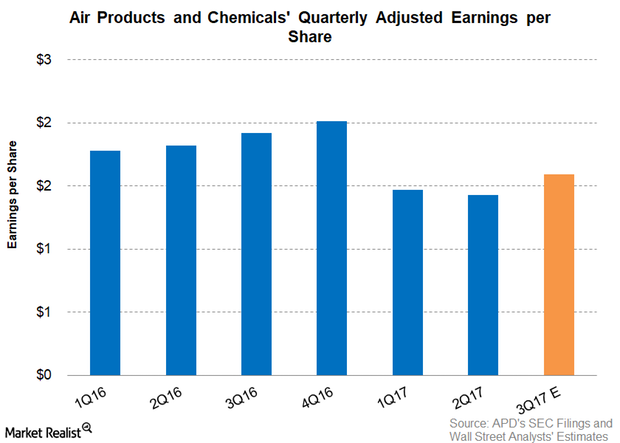

Air Products & Chemicals’ Stock Price Rose

Air Products & Chemicals (APD) announced its fiscal 3Q17 earnings on August 1, 2017. Its adjusted EPS from continuing operations was $1.65.

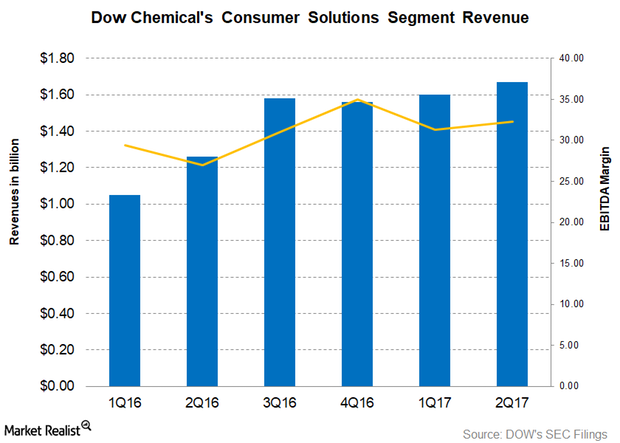

How Dow Chemical’s Consumer Solutions Segment Performed in 2Q17

Dow Chemical’s (DOW) Consumer Solutions segment is the fourth largest segment in terms of revenue.

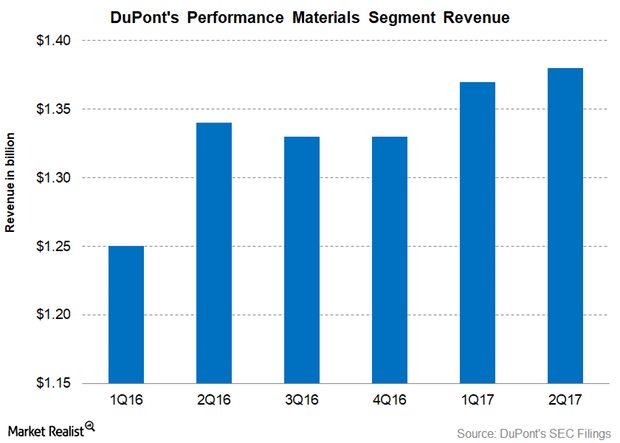

DuPont’s Performance Materials Segment’s Revenue Rose in 2Q17

In 2Q17, DuPont’s Performance Materials segment reported revenue of $1.38 billion—a increase of 3.40% on a YoY (year-over-year) basis.

How Analysts View APD’s Fiscal 3Q17 Adjusted Earnings

On March 31, 2017, APD was left with $485.3 million from its share repurchase program.

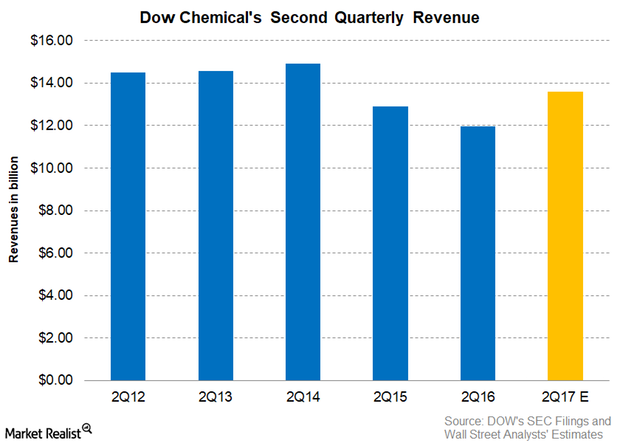

Understanding DOW’s High 2Q17 Revenue Hopes

As of July 21, 2017, analysts are expecting Dow Chemical (DOW) to post revenues of ~$13.6 billion for 2Q17, which would represent a 14.0% rise on a YoY basis.

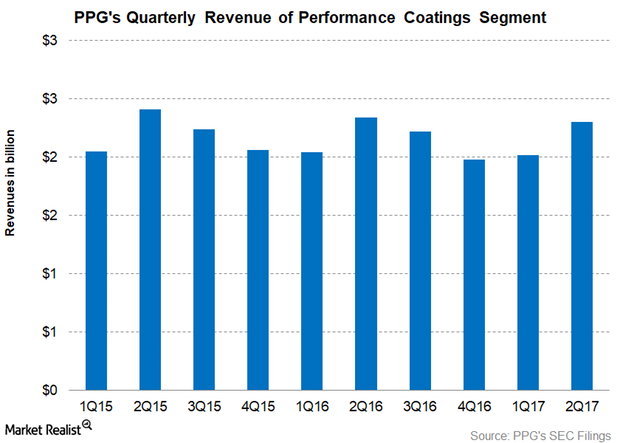

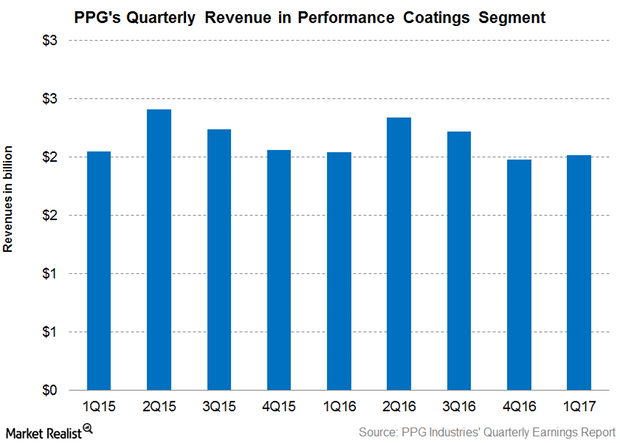

What Led to PPG’s Performance Coatings Segment’s Revenue Fall?

PPG Industries’ Performance Coatings segment is its largest revenue contributor. The segment’s contribution to PPG’s overall revenue fell from 61.8% in 2Q16 to 60.5% in 2Q17.

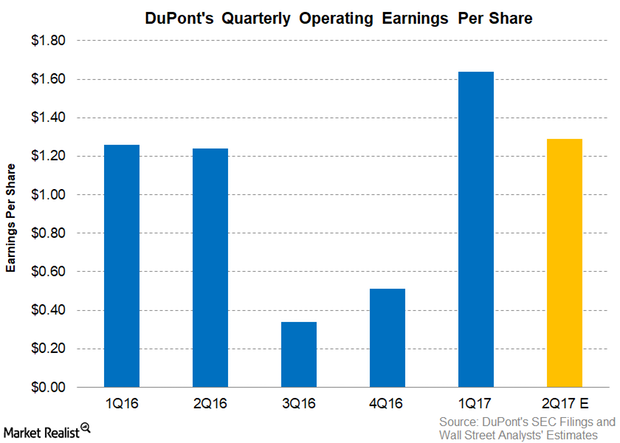

What Can We Expect for DuPont’s Earnings per Share in 2Q17?

DuPont’s earnings per share estimates for 2Q17 As of July 19, 2017, analysts expected DuPont (DDD) to post operating EPS (earnings per share) of $1.29, an increase of 4.0% YoY (year-over-year). In 2Q16, DuPont reported operating EPS of $1.24. The forecast increase in DuPont’s operating EPS is expected to be driven by improved SG&A (selling, general, […]

Who’s LyondellBasell Cooking up a License Deal with Now?

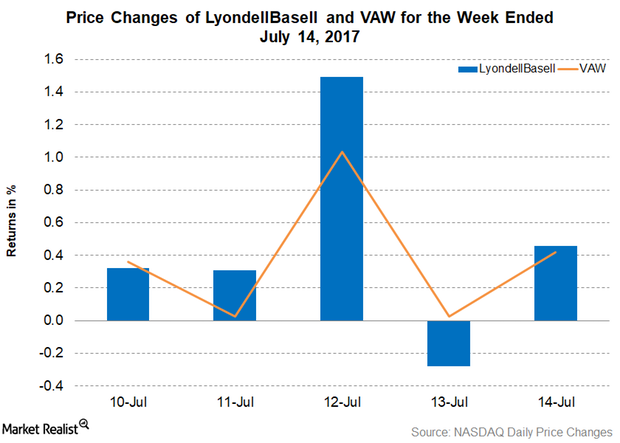

On July 12, 2017, LyondellBasell (LYB) granted its Spherizone and Lupotech T Licenses to Shaanxi Coal Yulin Energy and Chemical.

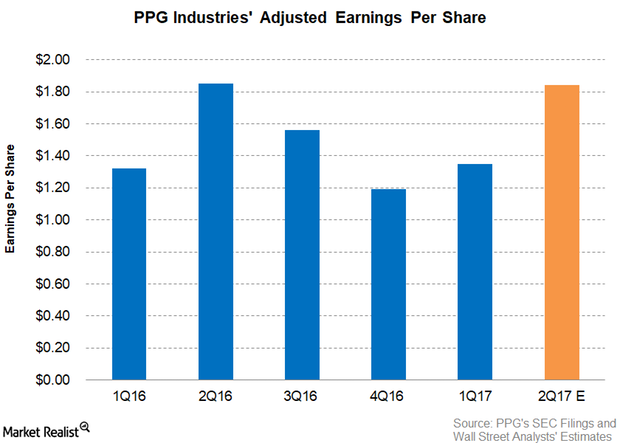

Can PPG Industries’ 2Q17 Adjusted EPS Beat Estimates?

Analysts are expecting PPG Industries (PPG) to post adjusted EPS of $1.84 in 2Q17, which implies a fall of 0.50% YoY.

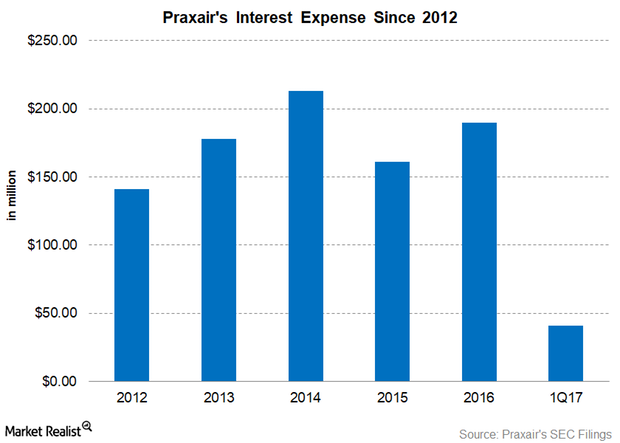

Can Praxair Manage Its Interest Expense?

Praxair’s (PX) interest expense has been on an upward trend since 2012 when its debt grew.

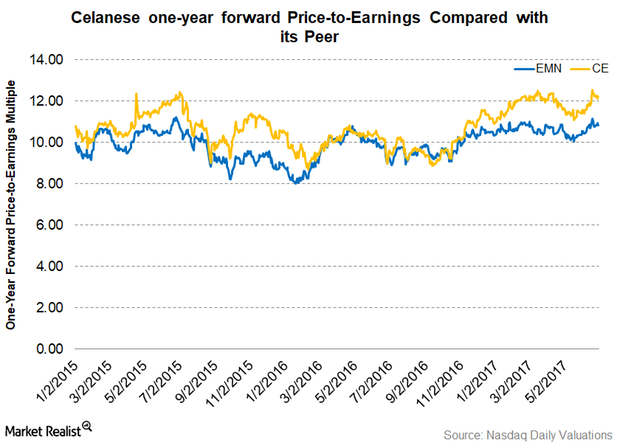

What Are Celanese’s Latest Valuations?

As of June 29, 2017, Celanese’s one-year forward PE (price-to-earnings) multiple stood at 12.20x.

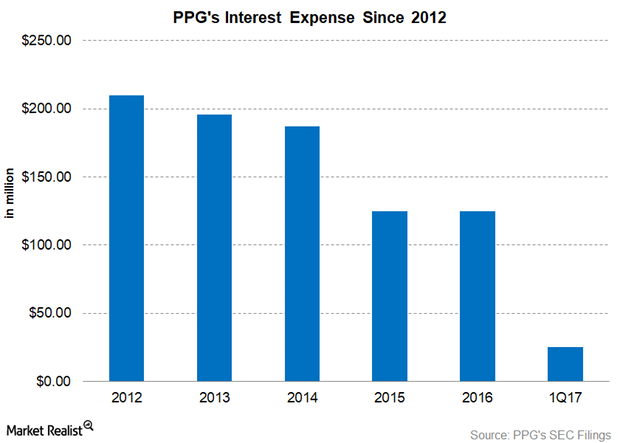

Why PPG Industries’ Interest Expense Is in a Declining Trend

In 2015, PPG’s interest expense dropped significantly. At the end of 2014, PPG refinanced $1.7 billion worth of notes that carried coupon rates of 9% and 7.7%, which reduced the interest expense.

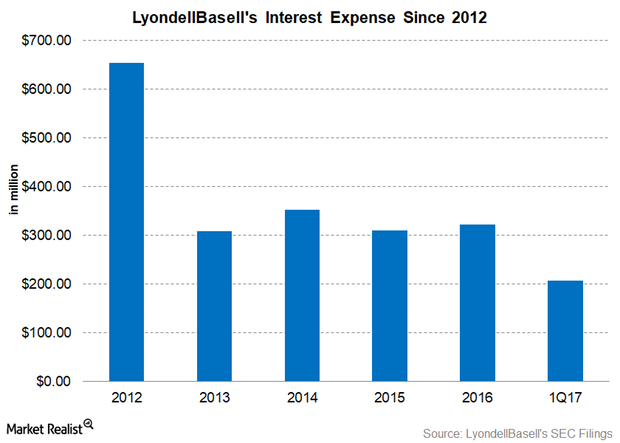

Is LyondellBasell Managing Its Interest Expenses Efficiently?

LyondellBasell’s (LYB) interest expense has been steady in the range of $309 million–$352 million since 2013, although debt has risen during the same period.

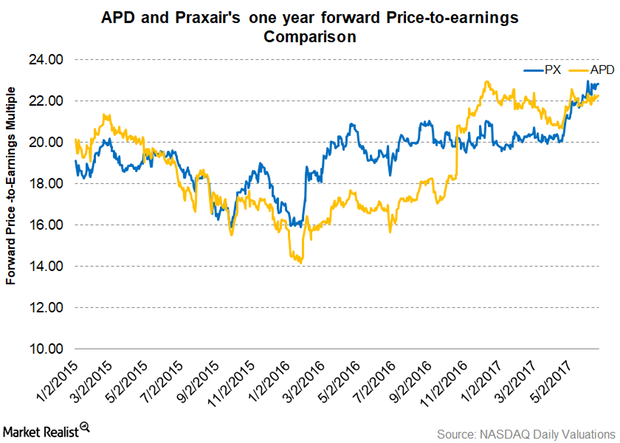

Why APD’s Latest Valuations Matter

On June 19, 2017, Air Products and Chemicals (APD) was trading at a one-year forward PE ratio of 22.3x Praxair’s one-year forward PE ratio stood at 22.8x.

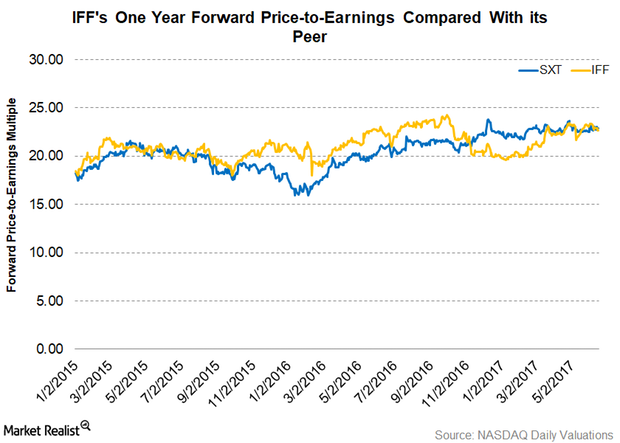

Where Does IFF’s Valuation Stand Compared to Its Peer?

As of June 15, International Flavors & Fragrances traded at a one-year forward PE ratio of 22.60x—marginally lower than Sensient Technologies.

PPG Industries Expands Coatings Capacity with New Plant in Russia

On June 16, PPG Industries (PPG) announced the completion of its 45-million-euro paint and coatings facility in Russia’s Lipetsk region.

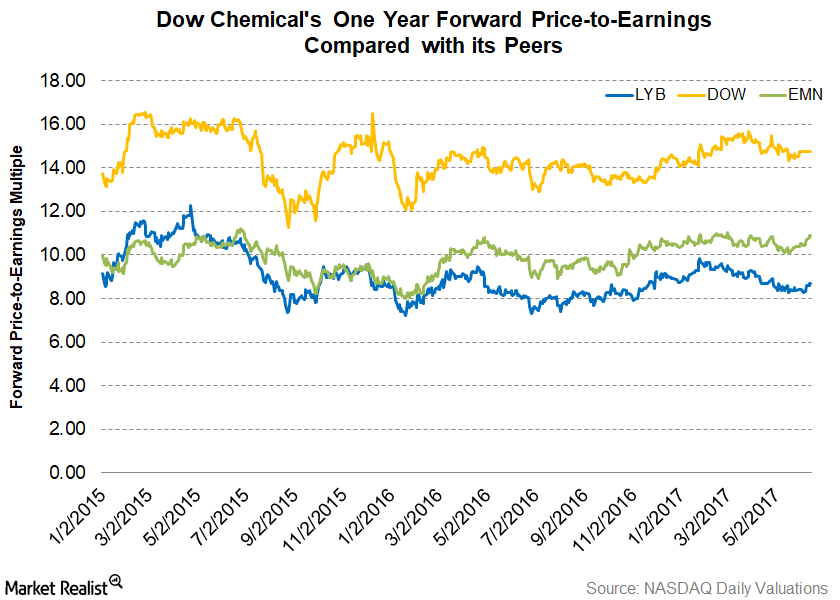

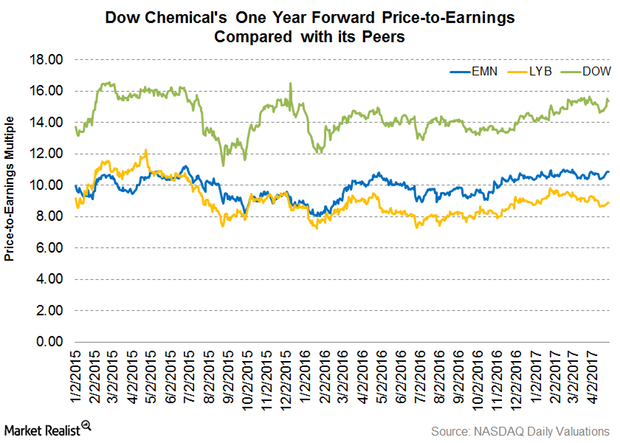

Dow Chemical’s Latest Valuations

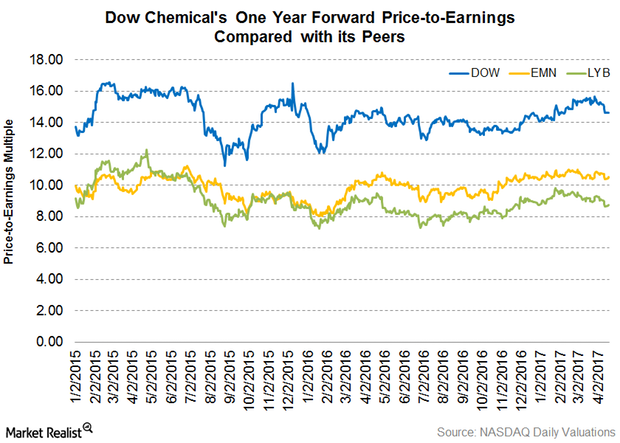

As of June 13, 2017, Dow Chemical (DOW) was trading at a one-year forward PE ratio of 14.70x, compared to 10.9x for Eastman Chemical (EMN).

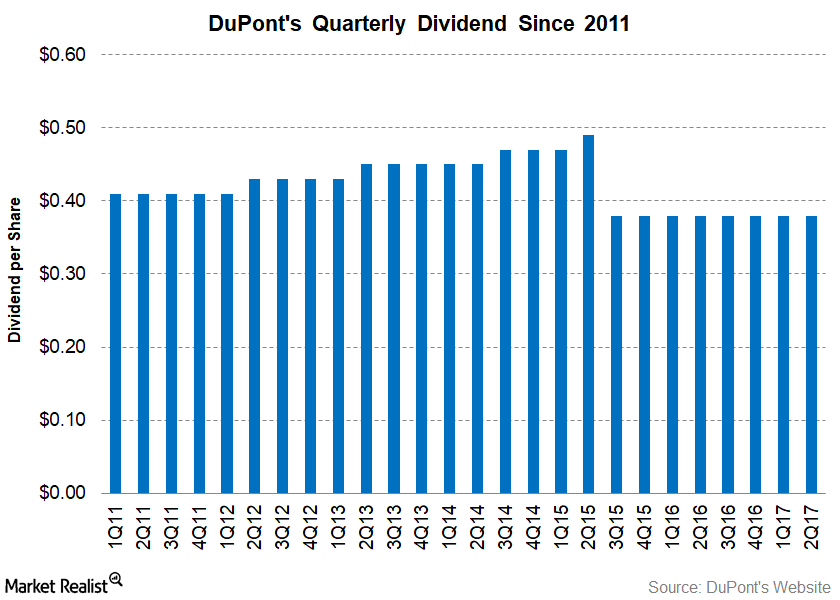

Are Investors Disappointed with DuPont’s Dividend Rate?

On April 26, 2017, DuPont (DD) declared a dividend of $0.38 per share on its outstanding common stock for fiscal 2Q17. The dividend will be payable on June 12, 2017.

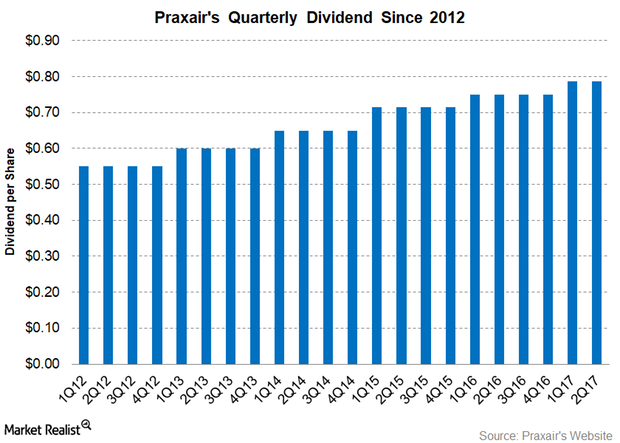

Will Praxair’s 2Q17 Dividend Inspire Investors?

On April 27, 2017, Praxair (PX) announced a dividend of ~$0.79 per share for 2Q17 on the company’s outstanding common stock.

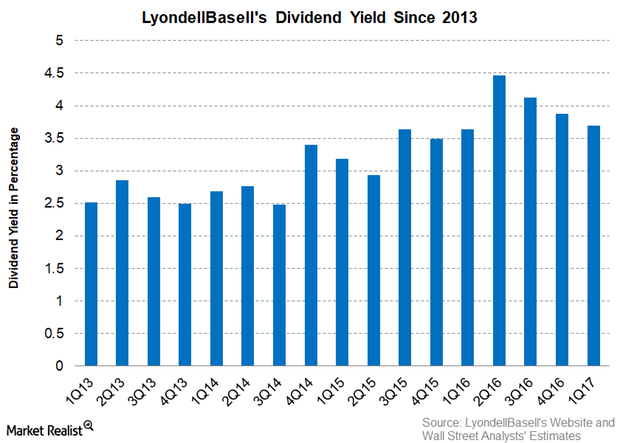

How LyondellBasell’s Dividend Yield Has Changed

On May 25, 2017, LyondellBasell (LYB) stock closed at $80.67. With LYB’s 2Q17 quarterly dividend of $0.90 per share, its current dividend yield is 4.4%.

LyondellBasell to Build Hyperzone Polyethylene Plant

On May 15, 2017, LyondellBasell Industries (LYB) said it’s set to build a polyethylene plant at its La Porte, Texas, facility.

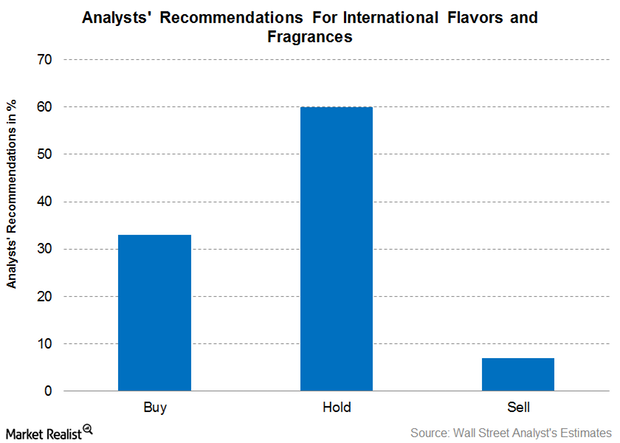

Analysts’ Recommendations for IFF after Its 1Q17 Earnings

As of May 9, about 33% of the analysts recommended a “buy” for International Flavors & Fragrances, 60% recommended a “hold,” and 7% recommended a “sell.”

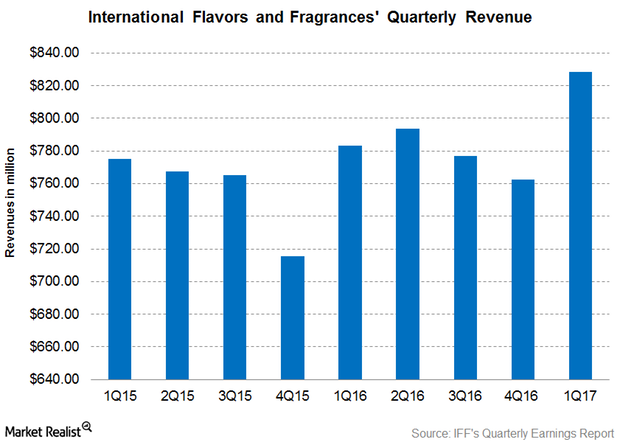

IFF’s Revenue Broke $800 Million in 1Q17, Missed Estimates

International Flavors & Fragrances (IFF) reported revenue of $828.3 million in 1Q17. For the first time, it broke $800 million in revenue during a quarter.

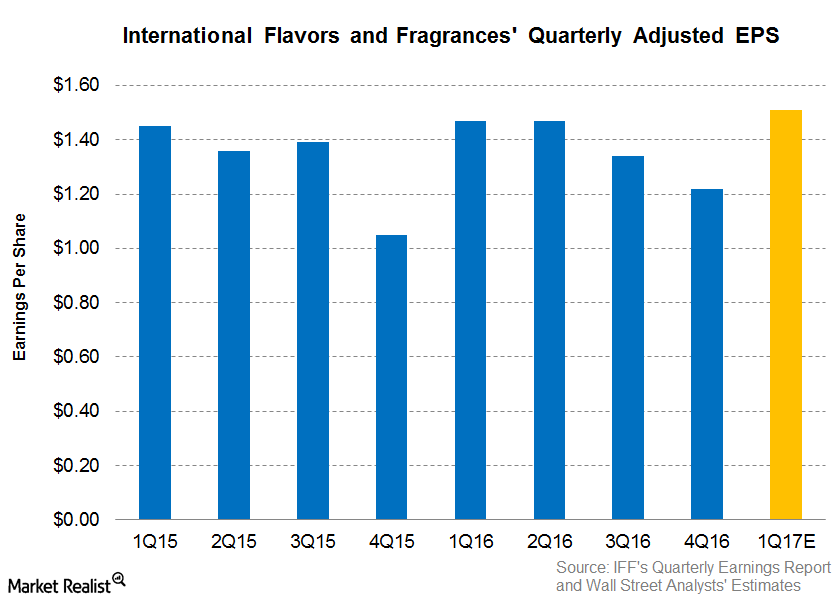

Why Analysts Expect IFF to Post Higher Adjusted EPS in 1Q17

As of May 2, 2017, Wall Street analysts expect International Flavors and Fragrances (IFF) to post adjusted EPS of $1.51, a growth of 2.7% year-over-year as compared to $1.47 in 1Q16.

Dow Chemical’s Latest Valuations Post 1Q17 Earnings

As of April 27, 2017, Dow Chemical (DOW) was trading at a one-year forward PE ratio of 15.4x, compared to Eastman Chemical (EMN) and LyondellBasell (LYB) at 10.9x and 8.9x, respectively.

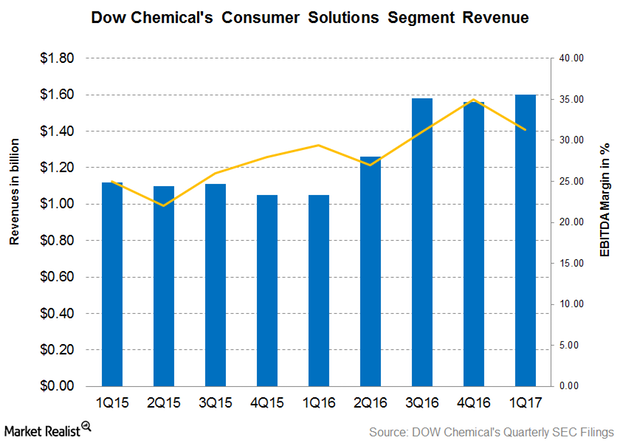

Dow Chemical’s Consumer Solutions Segment Revenue Rose in 1Q17

Dow Chemical’s (DOW) Consumer Solutions segment reported revenue of $1.6 billion in 1Q17, a 51.7% rise year-over-year compared to $1.1 billion in 1Q16.

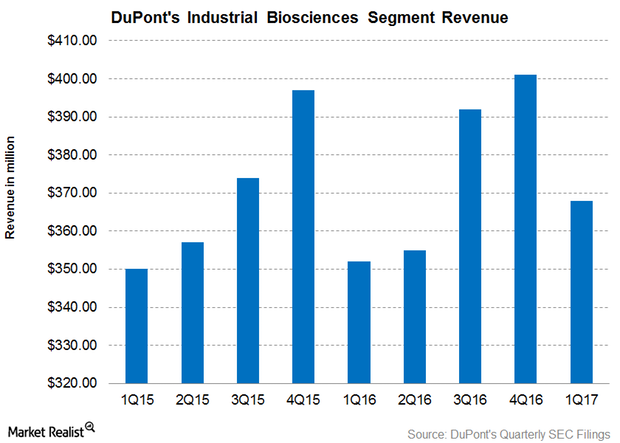

How Did DuPont’s Industrial Biosciences Segment Perform in 1Q17?

DuPont’s Industrial Biosciences segment in 1Q17 DuPont’s (DD) Industrial Biosciences segment, its smallest revenue contributor, accounted 4.8% in 1Q17. The segment reported revenue of $368 million in 1Q17, an increase of 4.5% from the $352 million seen in 1Q16. Increased demand of biomaterials for carpeting and new product launches in bioactives boosted sales volumes. However, revenue […]

What Hurt PPG’s Performance Coatings Segment in 1Q17?

PPG Industries’ (PPG) Performance Coatings segment is its largest revenue contributor. The segment accounted for 56.5% of total revenue in 1Q17.

What Are Dow Chemical’s Valuations ahead of 1Q17 Earnings?

As of April 19, 2017, Dow Chemical (DOW) traded at a one-year forward PE ratio of 14.60x.